More Than a Paycheck,

REFUSING to PAY for WAR

October-November 2016

Contents

- Don’t Lament: Resist and Redirect By Ruth Benn

- Speaking of Conscience By Joel Mathis

- Counseling Notes Private Debt Collection Approaches (Again) • Busted! Two Sides to Tax Scams

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network List Updates

- International Inspiration for a Better World • Taxes for Peace Bill by Cathy Deppe – UK Update

- War Tax Resistance Ideas and Actions Wonderful Viet Nam Era Tax Resist Story! • New England WTR Gathering • Report from the Border By Erica Weiland

- Resources New Organizing Packet • War Tax Resistance Stuff – See our CafePress Store! • Watch on YouTube

- NWTRCC News Warm Hospitality Greets WTRs • Business Matters • Nominations Needed

- PERSPECTIVE Water is the Foundation

By Chrissy Kirchhoefer

Click here to download a PDF of the December/January issue

Don’t Lament: Resist and Redirect

By Ruth Benn

Some months ago a review copy of a book by one of NWTRCC’s founders, Bill Durland, arrived in the office. Since it’s not about war tax resistance, I poked into it but hadn’t gotten to reading it for review. Then the book’s title caught my eye recently, The Demise of American Democracy: Explaining the Crisis and What To Do About It. It was published last spring during an election campaign that presumably only strengthened Durland’s premise: that the disintegration of representative government began between 1963 and 1980 and has turned the evolution of democracy away from justice.

5th Avenue, New York City, November 12, 2016. Photo by Grace Hedemann

The book draws together many factors that play into this disintegration and empower a conservative agenda with the “intention to relocate public governmental power to wealthy, private corporations and religious organizations.” Replacing voting and representation “will be an elite and much overpaid CEO and a Board of Directors.” Well, that’s rather prescient.

Maybe it makes me feel a fraction better to be reminded that this whole democracy thing is a process, and we’ve always been in it for the long haul. Still, there is no denying our work is cut out for us, and war tax resisters are well placed to help strengthen the movement for peace, justice, and something closer to true democracy.

- It seems we are about to have a President who does not pay taxes, so we should be able to explain the difference between conscientious tax refusal and gaming the system for personal benefit. Will many counseling calls be from people who just feel they shouldn’t have to pay if the president doesn’t pay? Maybe, but there is already new interest from people who are newly or re- activated after the election.

- Redirection of taxes is one way to differentiate ourselves. Those of us who do refuse to pay the IRS can emphasize what we do with the money instead. Those who live below taxable income can talk about all the ways they use their resources to work for peace and justice. NWTRCC’s meeting in Florida produced a call for a coordinated redirection effort in 2017. See the insert in this issue and plan to participate.

- Love trumps hate. NWTRCC’s last gathering came just before election day, but as we talked about the deep divide in this country, many spoke about making more effort to reach out to people who seem to be “on the other side.” As Robert Randall said, “No group is monolithic. Trump people do agree that the system is fucked up. Some don’t think we should be in foreign military operations. I should try to find the people who don’t want to be in wars of aggression, who believe some of the things I do. They might want to join in not paying for that crap.”

- Work with as broad a coalition as possible, connecting issues and adding your expertise in war tax refusal and redirection to the tactics of others. Tell NWTRCC what you are doing, especially what successes you have in working with groups you haven’t connected with before.

Ruth Benn is NWTRCC’s Coordinator.

William Durland’s book, with a forward by Loring Wirbel, is published by The Edwin Mellen Press, PO Box 450, Lewiston, New York 14092, (716) 754-2788, mellenpress.com.

Speaking of Conscience

By Joel Mathis

Peace Mennonite Church Pastor Jim Russo requested a speaker from NWTRCC’s Speakers Bureau using the online form, which you can find under “Resources” at nwtrcc.org.

Two members of the war tax resistance movement shared their stories at Peace Mennonite Church in Lawrence, Kansas, in early November.

Beth Seberger and Charles Carney spoke during services on November 13, the first Sunday after the 2016 election.

They also stayed to answer questions during a brown bag lunch.

“It’s really formed my life in a good way,” Seberger said of her participation in the movement. Seberger became a tax resister in the early 1970s. It was an unexpected choice for the young woman, who had two older brothers in the military.

Beth Seberger speaking at Peace Mennonite Church in Lawrence Kansas, November 13, 2016. Photo by Whitney Baker.

“It wasn’t in my upbringing to become a pacifist or war tax resister,” she said, but added, “It was easy in those years to be very aware of the cost of war.”

Even now, she said, the title=”United States”>U.S. spends more on the military than the next seven countries combined. So when it came time to pay her first ever federal taxes — a bill amounting to just $18 — Seberger refused. “It was like $18, but I just didn’t feel right — and that’s the call of conscience.” Seberger avoided taxes during her career by keeping her income below a taxable level. “It results in living simply, and that’s been very good for me,” she said.

Carney joined the movement in the early 1980s, inspired by Anabaptists and the Catholic Worker Movement —“I sometimes jokingly refer to myself as Ana-catholic,” he said — during the height of the nuclear freeze campaign of the era.

In 1981, he said, “I finally decided I had to stop praying for peace while paying for war.”

Charles Carney speaking at Peace Mennonite Church in Lawrence Kansas, November 13, 2016. Photo by Whitney Baker.

Like Seberger, he worked to keep his income below taxable levels. Over 35 years, he’s been able to live cheaply by living with roommates and by bartering services and goods instead of exchanging money.

Such activities might still draw the attention of authorities. At one point, Carney said, the IRS sent him a letter saying he owed $54,000 in unpaid taxes. Carney said he didn’t respond, instead inquiring with the agency a few years later about the status of his bill.

It no longer existed. “We deemed you uncollectible,” Carney said he was told. The money saved in unpaid taxes didn’t just undermine any warmaking efforts, he said.

“In following my conscience and refusing to pay for war, I’ve been freed up to give $100,000 to causes in need,” he said. “Call me kooky, but I’d rather buy bikes for poor people than subsidize violence.”

A member of the Peace Mennonite congregation pointed out that the federal government does good things with taxes, too. Seberger said she still paid payroll taxes, which directly fund Social Security.

She acknowledged, too, that she’d been helped by friends and family along the way — getting assistance in obtaining both a car and mortgage. Such generosity, she said, has compelled her to look for ways to be generous to others in need. “I know I need to pay it back,” she said.

Joel Mathis is a freelance writer in Lawrence, Kansas. He attends Peace Mennonite Church.

Counseling Notes:

Private Debt Collection Approaches (Again)

The on-again/off-again IRS policy of farming out some underworked tax cases to quasi-private debt collection companies is on again. Four companies — CBE Group, Conserve, Performant, and Pioneer — will begin during the spring of 2017. They will work on cases in which the taxpayer has years-old unpaid taxes that the IRS has stopped trying to actively collect for whatever reason.

These private debt collection agencies have no flexibility with which to negotiate the tax debt (they can’t negotiate an offer-in-compromise or adjudicate a dispute over the amount of the debt) and no real power to enforce sanctions (they can’t initiate liens, levies, and seizures). So for the tax resister, having your account handed off to a private debt collection agency is mostly just an opportunity to stonewall. The agencies are required to follow the Fair Debt Collection Practices Act. If you find your case assigned to one of these agencies, you may want to familiarize yourself with the provisions of this act so you can strike back if they try any funny stuff. Be sure to notice those four company names; any other contacts might be from a scam company.

— David Gross

Busted! Two Sides to Tax Scams

In early October 2016, police in India arrested 70 people at a call center where employees impersonated IRS agents. Such centers blast out frightening messages to thousands of U.S. phone numbers. When there’s a live call back, the employees demand immediate payment of a tax debt or threaten legal action. The busted call center made as much as $150,000 a day over the past year.

We learned through a friend of one person who fell for the scam and is out $1,000. She told us some of her story, despite the continued distress that it causes to think about it:

The caller left a very disturbing message. I returned the call and was literally scared. I was then directed to call another number, which I did. Looking back on it now, it sounded like the same person. This whole process lasted over 3 hours. They played me perfectly! They told me that I had not paid my taxes from 2009 to 2014, and there were some problems with my owing back taxes. They told me that my taxes were filed incorrectly and asked me who did my taxes or did I do them myself. There actually was a problem one year with H & R Block during that time frame, but looking back I guess they can start guessing and my reaction “cinched” it. He was very persistent and I was very gullible and upset. I am really ashamed of myself. And out $1,000!

This happened on a late Thursday afternoon, but the person kept calling. I went to the police on Friday. There was nothing they could really do. On Monday I called the Oregon Attorney General for consumer fraud. There was nothing they could do, but they gave me some information.

One key in the story above is her own question about a certain tax year — a foot in the door for the caller. Don’t give them an opening! Hang up. If you want to know your tax status with the IRS, call the IRS directly. Don’t give any information — or money — to an “IRS agent” who calls you.

Many Thanks

We are very grateful to each of you who has donated in response to our fall fund appeal — and each of you who is giving it serious consideration!

Special thanks for Affiliate dues payments from these groups:

Boulder War Tax Information Project

Casa Maria Catholic Worker/Milwaukee WTR

Michiana War Tax Refusers, South Bend, Indiana

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464) if you would like a printed list by mail.

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

INTERNATIONAL

Inspiration for A Better World

By Cathy Deppe

Editor’s Note: This is a shortened version of Cathy’s report. You can read the longer version on the NWTRCC blog .

“Something there is that doesn’t love a wall” is a favorite Robert Frost line I mused over on my first trip to Berlin for the International Peace Bureau World Peace Congress as a representative for NWTRCC. Germany was readying for Unity Day October 3, a national holiday celebrating the day “the wall” came down and the people of Germany were once again united. I could hardly wait to take my first walk in this bustling, rebuilt city, east through the Tiergarten to the famous Brandenburg Gate that anchored the Berlin Wall for 27 years.

Cathy Deppe (right) holds a Ban Uranium Weapons banner in front of the Reichstag, Berlin, Germany, September 2016 on Unity Day. Photo by Alex Walker

The urgent need to transform our militarized societies would be at the heart of the Peace Congress. At the Technical University Berlin where we gathered, university president Christian Thomsen gave a welcoming speech and shared the history of this respected institution, first misused and militarized by the Third Reich, then pulverized by the Allies, then reborn and transformed with a mission to never again support war efforts.

Our coalition partner in Berlin was Conscience and Peace Tax International (CPTI), a collection of war tax resisters and peace tax campaigners with a conscientious objection to paying for war. CPTI has special consultative status at the United Nations and promotes the aim that “no person shall be compelled to participate in military violence, directly or indirectly through military taxation.”

Most European governments do not provide an option to control withholding (W-4 resistance) but simply remove estimated taxes directly from employee paychecks. Only self-employed persons can maintain control over their earnings. Twelve countries have peace tax legislative campaigns similar to the one in the title=”United States”>U.S.

Peace Tax workshop leaders in Berlin, Germany, October 2016. Cathy Deppe is third from left in the back. At the table is Conscience UK staff Shaughan Dolan (center) and Peace Tax Seven member Robin Brookes. Photo by Alex Walker

Our CPTI workshop attracted several newcomers and gave me an opportunity to describe our work in the U.S. People were completely shocked at the high percentage of U.S. taxes that go to war and war preparations. They especially liked the WRL pie chart and the NWTRCC brochure “Praying for Peace but Paying for War.” Our session ended fittingly with a comic skit topped off by a wonderful rendition of Bob Marley’s “Redemption Song” by memberMerikukka Kiviharju from Performers and Artists for Nuclear Disarmament.

While over 1,000 registered to attend the conference, over 250 from countries like Ghana, Nigeria, Bangladesh and Pakistan could not get visas, another wall faced by the global peace movement. For those attending, there was a smorgasbord of plenaries, youth gatherings, 13 panel discussions and 63 workshops to choose from. My husband Alex travelled with me, and we found a great spot for the NWTRCC/Peace Tax Fund/CPTI table and had steady interest from both conference participants and students from the institute. Though we had arrived with two roll-on bags of materials weighing a total of 43 pounds, most was gone before we returned home.

Cathy Deppe is a member of NWTRCC’s Administrative Committee and active with Southern California WTR and Alternative Fund.

Taxes for Peace Bill – UK Update

The previous edition of this newsletter reported that a Taxes for Peace Bill promoted by the group Conscience had a first reading in Parliament in July. Ruth Cadbury MP presented the bill, and it was scheduled for a second reading on December 2. Recently the group reported that the second reading was dropped because the bill “doesn’t enjoy the support of the government.” However, the campaign continues. Conscience held an alternative event asking the public to record a statement on why military spending is an issue of conscience. The statements will be sent to all MPs. For more information see conscienceonline.org.uk.

War Tax Resistance Ideas and Actions

Wonderful Viet Nam Era Tax Resist Story!

Friend and fellow resister Ellen Barfield sent in a story under that title from her friend Steve Norris, in Asheville, North Carolina:

In 1974 in Boston I had to go to federal tax court to defend my claiming a “war crimes deduction” on my 1040 IRS tax return during the Vietnam War. The IRS had actually given me a refund of about $500 on my taxes (which I donated to a free health clinic) before they realized that the deduction I claimed was illegal. So here I was in court, defending myself, claiming that under Nuremburg statutes I had a duty to resist a law that caused death and destruction to others. I lost the case. But the attorney for the IRS came up to me afterward and said, “You know, I agree with you.”

The IRS never was able to get the $500 back. And the Vietnam war ended not long after that.

New England WTR Gathering

A fish bowl exercise at the New Englanf GAthering. Pictured are NWTRCC field organizer Sam Koplinka-Loehr speaking, and (clockwise) Mandy Carter, Mary Regan, and Joanne Sheehan with backs to camera. Photo by Ruth Benn

The 31st annual New England Gathering of War Tax Resisters and Supporters was held over the October 14-16 weekend in Western Massachusetts. Saturday’s special program brought together a variety of activists for discussions under the title “Dialogue Among Resistance Movements.” The featured speaker was Mandy Carter, a long-time community organizer and war resister from North Carolina. Her presentation led to questions for discussion: What does a truly intersectional organizing model look like? How do we recognize shared issues and work together across lines of race, class, gender, sexuality, immigration status, and ability? A recording from the weekend will be linked on the NWTRCC website soon. The Agape Community in Ware hosted Friday evening and Sunday morning sessions. Agape founders Suzanne and Brayton Shanley told us their story of leaving well-paid jobs to head back-to-the-land and create a home for gospel-centered nonviolent action.

Report from the Border

By Erica Weiland

Our outreach at the October 7-10 School of the Americas Watch (SOAW) Border Convergence at ambos Nogales (both Nogales, on the U.S. and Mexico sides) went very well! Myself, Anne Barron, Rachel Soltis, and Coleman Smith were present at each activity throughout the weekend, including the vigil at the Eloy Detention Center and the march to the border on Saturday.

Between the towns of Nogales the border wall consists of 30 foot metal posts with a flat panel at the top. You can reach your arm through; one group even brought folding chairs to sit while they talked through the wall.

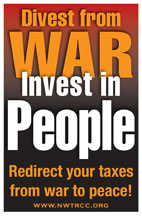

A steady stream of people passed by our table Saturday, and I spoke with many curious about war tax resistance, as well as about half a dozen who are already resisters. On Saturday evening about 20 people attended our workshop, “How to Refuse to Pay for War.” Throughout the weekend we passed out a lot of pie charts, including many of the Spanish-language ones. I was also very glad to have the translated Spanish-language flyer with our “Divest from War, Invest in People” message.

I attended a workshop given by a Tohono O’odham tribal member who is also a lawyer. She described the intense militarism and surveillance Tohono O’odham people endure on a daily basis, just for living close to the border. Mysterious deaths at the hands of the heavily armed Border Patrol, the use of surveillance towers that can see into people’s backyards and the desert around the community, and Border Patrol checkpoints on tribal land are part of regular life in this militarized zone.

I hope this new energy stays with SOAW, and that NWTRCC continues to prioritize outreach at the annual convergences. I strongly believe that connecting militarism to other issues is the future of a revitalized movement against war.

Erica Weiland lives in Seattle and is NWTRCC’s Social Media Consultant. A longer version of her report is on the NWTRCC blog.

****Advertisement****

Long time friend and neighbor of Juanita Nelson seeking outstanding correspondence and other published or unpublished manuscripts of hers for possible inclusion in an anthology of her work. Also accepting editorial assistance, pre-orders, and financial support for this collaborative project. For details, preliminary pamphlet, or volunteer/contribution form: Louis Battalen, Apple Valley, Ashfield, Massachusetts 01330.

Resources

New Organizing Packet

Get ready for tax season with our new Divest from War, Invest in People Organizing Packet. Sections include: What do we mean when we say, “Divest from War, Invest in People;” how much of our taxes are invested in war; Does divestment work; How can we divest from the Pentagon; What do war tax resisters reinvest in; Organizing stories; Other divestment campaigns; Organizing ideas; and Organizing Resources. To order a free print copy with sample resources, contact the NWTRCC office (800) 269-7464 or nwtrcc.org

War Tax Resistance Stuff — See our CafePress Store!

NWTRCC has a store on CafePress where you can order tee shirts, mugs, and other items. We’re posting various designs to choose from, and we’ll take your suggestions and keep adding more. Go to http://www.cafepress.com/nwtrcc.

Watch on youtube.com/user/nwtrcc

The Militarized South, a slideshow and talk by Clare Hanrahan and Coleman Smith of the New South Network of War Tax Resisters, recorded at the NWTRCC national gathering in Florida on November 5, 2016. To arrange a presentation, email them at newsouthnetwork@gmail.com.

The Militarized South, a slideshow and talk by Clare Hanrahan and Coleman Smith of the New South Network of War Tax Resisters, recorded at the NWTRCC national gathering in Florida on November 5, 2016. To arrange a presentation, email them at newsouthnetwork@gmail.com.

Webinar: Refusing to Pay for Oppression with Sam Koplinka-Loehr. War Tax Resistance organizers from around the country were invited to join this webinar to meet Sam, NWTRCC‘s new field organizer and outreach consultant. He introduces himself, shares ideas, and other participants join in to share their local issues and ideas.

Iraq Tribunal, sponsored by CodePink, with testimonials on the costs of war from activists and thinkers in the movement for peace and justice. NWTRCC‘s Field Organizer, Sam Koplinka-Loehr, gave live testimony on the second day. Watch online at codepink.org/iraqtribunal. You can also hear an interview about the Tribunal and war tax resistance with Sam on the podcast Clearing the Fog.

NWTRCC News

Warm Hospitality Greets WTRS

The fall war tax resistance gathering and NWTRCC’s business meeting were held November 4-6 at the Sustainable Living Center (SLC) of North Florida. Along with workshops and business, we had a little time to sit on John X and Martina Linnehan’s porch and relax. They live on the SLC property in a house built with care for the earth, from the materials to the water catchment and sewage systems. Our host for the weekend, Garrett Llopiz, an SLC board member, has impressive plans for creating a sustainable food forest and a community to caretake the land, along with making it available to groups for events and meetings.

On the Linnehan’s porch. Photo by Ed Kale.

We heard reports from the International Peace Bureau’s World Congress in Berlin (see p. 3) and the School of the Americas Watch Border Convergence (p. 5). NWTRCC helped fund travel for these events and reaffirmed the need to keep such financing in our budgets.

This was our first gathering with new Field Organizer/Outreach Consultant Sam Koplinka-Loehr, who started off Saturday morning by explaining through personal experience why the focus on intersectional organizing is so important now. Experience protesting the Iraq war, prisons, and working for environmental justice drew together many issues and led Sam to question “What is effective action? What is power?” So many longtime WTRs got involved because of a specific war, but Sam noted that young people now react to the injustice around them. WTRs need to learn to speak to a new generation of activists.

NWTRCC is continuing to build toward tax season actions under the “Divest from War/Invest in People” theme (see resources on the website). Part of the campaign will include a coordinated, but locally based redirections of taxes to Black-led organizing. Redirection decisions will be made by local groups, and NWTRCC will promote the effort through our publications, social media, and press releases before and at the end of the effort around tax day.

Clare Hanrahan and Coleman Smith from Asheville, North Carolina, have put together an impressive Powerpoint presentation detailing the militarization of the South, which they presented Saturday night. You can watch it online.

Business Matters

The Coordinating Committee meets on Sunday morning at each gathering. It is the highest decision-making body of NWTRCC. Proposals, a new budget, and objectives for the coming year are circulated in advance to the Network, made up of affiliate groups, area contacts, WTR counselors, and alternative funds, and final decisions are made at the meeting. Anyone in attendance (in person or virtually) joins in the consensus decision-making process. The group also hears reports from the consultants and committees, reviews finances and fundraising, chooses next gathering locations, etc.

NWTRCC’s budget has grown in the last couple years from around $45,000 to a proposed $77,600 for 2017, thanks to grants we have received from craigslist Charitable Fund. However, we don’t know if that funding will continue, so we need to ramp up our fundraising and find new sources in 2017 in order to maintain our current level of activity.

Key proposals at this meeting were requests for financial support from Maine and San Diego affiliates, linking to and promoting the Thoreau bicentennial in 2017, creating a committee to plan how to cut military spending, and endorsing the Code Pink Iraq War Tribunal (Dec. 1-2, 2016). Thoreau’s 200th birthday (July 12) will be commemorated by a number of groups, and we agreed that NWTRCC should take advantage of the occasion too. We would like a special banner for our website and passed $200 for a design; if you have an idea, contact the NWTRCC office. The group agreed to endorse and promote the Tribunal, codepink.org/iraqtribunal. The committee proposal evolved into an Outreach Committee that will support Sam’s work, develop new alliances, and include a focus on how to cut military spending.

Financial support for local groups has strong support but the specific proposals at this meeting did not pass while we develop a policy that outlines criteria for such support and how to apply. Being a granter is new to NWTRCC, but we continue to support local groups with as much free literature as possible, financial support for tax season campaigns, paying tabling and conference fees, and such. We also hope that our fall appeal will do well and put us in good shape heading into 2017 so that we can afford some additional support in the next year.

NWTRCC objectives cover many things that you expect from this organization — this newsletter, information about IRS activity, technical updates, a website, etc. — and we added a few for 2017, such as translating more literature into Spanish, emphasizing fundraising work, and creating new literature that speaks to a wider audience.

Our next gathering is planned for St. Louis over the weekend of May 5-7. Please mark your calendars and plan to join us!

Photos from the weekend and other notes

Nominations Needed

NWTRCC’s Administrative Committee gives oversight to business operations, helps plan two gatherings each year, keeps in touch with consultants, and meets face-to-face or by phone four times a year. New members will be selected from nominees at the May 2017 meeting and serve as alternates for one year and full members for two years. For more information, contact the NWTRCC office (800-269-7464) or nwtrcc@nwtrcc.org. Deadline for nominations is March 17, 2017.

PERSPECTIVE

Water Is The Foundation

By Chrissy Kirchhoefer

A solidarity message sent from the NWTRCC gathering in Florida, November 6. Chrissy Kirchhoefer is holding the banner at the corner above the W. Photo by Jackie Betz.

A few days after returning from the biannual NWTRCC gathering in balmy Gainesville, Florida, I traveled north into the bitter cold to Standing Rock Sioux reservation in North Dakota where thousands have gathered in opposition to the Dakota Access Pipeline (DAPL). I went to Standing Rock from St. Louis as a legal observer with a National Lawyers Guild delegation and Copwatch to document police abuses. We utilized our experiences during the Ferguson uprising to coordinate trainings and work with the Water Protectors Legal Collective.

Since April, members of over 300 Native American tribes have come to Standing Rock to establish a community of water protectors resisting Dallas-based Energy Transfer Partner’s DAPL. The issue, that water is life, has brought together an unprecedented collaboration of tribes behind this simple truth, creating a community at times up to 15,000 water protectors.

Our introduction as Legal Observers was at a DAPL construction site where an angry employee began waving a gun and threatening the crowd, then slammed the gun onto a woman’s hand followed by several rounds of fire into the air. There were daily actions at construction sites, at banks that are supporting DAPL, at the state capital, at the Army Corp of Engineers, and at other sites that were “protected” from the nonviolent water protectors by numerous County Sheriff’s departments, state troopers, local police departments, correctional officers and even animal control.

While we often think of U.S. military spending going towards equipment to fight foreign wars, we are becoming increasingly aware of the use of military equipment on unarmed citizens throughout the U.S. Unfortunately, people of color have known this reality for a long time. It seems as though many domestic policing agencies are rapidly becoming the top recipients of U.S. military aid. As with foreign military aid packages, it is not just the military hardware that is given but also the militarized training.

Scene at Standing Rock. Photo by Jacob Crawford/Copwatch.

Our delegation returned home only to learn from friends in Standing Rock of the strong armed response by the Morton County Sheriff’s department upon unarmed people on the Backwater Bridge. The people had intended to clear the highway for emergency vehicles and so that in the light of day they could attempt to witness the construction occurring with DAPL down the road. For over six hours the nonviolent water protectors were met with water cannons spraying this sacred symbol on them in subfreezing temperatures. Additional weapons were deployed causing severe injuries to over 200 people including a man whose head was fractured, an elder who went into cardiac arrest, and a woman who nearly had her arm severed from a concussion grenade.

As of November 26, construction of the 1,172 mile pipeline was 87% completed. What remains is placing the pipeline under Lake Oahe, the largest reservoir of the Missouri River. Many from the Standing Rock tribe were displaced when the Oahe dam was constructed in 1948 by the Army Corp of Engineers, who used eminent domain claims with the assistance of the Bureau of Reclamation. Almost 56,000 acres of prime agricultural land was taken from the Standing Rock reservation and submerged, destroying their way of life. When a visitor came to Standing Rock and noticed there were so few elders they were informed that the elders had died of heartache after the construction of the dam and the loss of land.

It is an increasingly critical time to do all we can before January 1, 2017, when the DAPL contract is set to expire and financial backers will be able to withdrawal their support, especially in light of decreased oil prices and the increased costs of the pipeline. I have read that it will take 90-120 days to drill under the waters if permission is granted by the Army Corp of Engineers.

Oahe is a Sioux word meaning “foundation” or “place to stand on.” The people will continue standing firm to prevent the black snake from entering the sacred waters and disrupting the sacred grounds of their ancestors. They hold deep traditions connecting them to the Earth and all its resources like an umbilical cord. We all benefit from learning of these traditions as a way back to fully understanding what it means to be human here in this piece of America.

As an elder stated after talking about the slaughter of hundreds of thousands of Native Americans and the displacement from their lands by the European colonizers, “We forgave you. The people have welcomed you as Americans. We can’t walk backwards.” Your warrior spirit is needed to help create a better world for the generations to come!

WHAT YOU CAN DO:

- Many readers are already refusing to pay war taxes that have been increasingly trickling down to arm local police forces. Hold trainings to encourage others to refuse to pay taxes for war and redirect that money to organizations whose work you support.

- Donate or redirect war taxes to sacredstonecamp.org, waterprotectorlegal.org, wecopwatch.org, or any number of other organizations. Even better do a local fundraiser to build community.

- Withdraw your money from banks investing in DAPL; do so in a public way if possible. Find the list at nodaplsolidarity.org.

- Educate yourself and others about the impact and scope of oppression experienced in the U.S. especially by Native Americans. Two websites with great articles are: wagingnonviolence.org and poconlineclassroom.com.

Chrissy Kirchhoefer is a member of NWTRCC’s Administrative Committee from St. Louis. She has traveled internationally on delegations promoting justice to Iraq, the Occupied Palestinian Territories and Jeju, South Korea. She is working on establishing the Dick Gregory Catholic Worker House to promote racial justice in the fertile ground created by the Ferguson Uprising.