More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

June – July 2019

Contents

- Tax Day 2019 Resistance in Public by Chrissy Kirchhoefer

- NWTRCC Gathering in Washington DC by Lincoln Rice

- Counseling Notes Changes Coming to the W4 • Frivolous Correspondence Update • Frozen Bank Account

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- International: WTR is Still Not a Right, but Neither Can it be Punished

- Network Updates

- Tax Resistance Ideas and Actions State Tax Refund Pays for Peace Mission to Russia • Host a War Tax Resistance Focus Group with Younger Activists in your Area • Kurdish Farmers Pressed to Pay War Taxes by ISIS • Extorted War Taxes in Honduras

- Resources War Tax Resistance at a Glance • NWTRCC‘s Newsletter More than a Paycheck

- NWTRCC News Tom Shea – In Memoriam • Mark Your Calendars

- PROFILE Howard Waitzkin and Mi Ra Lee

Click here to download a PDF of the June/July issue

Tax Day 2019

Resistance in Public

By Chrissy Kirchhoefer

Like many, I awoke Monday April 15 with anticipation for Tax Day. My excitement was related to thinking of the many throughout the US who would be resisting taxes to pay for war and raising the issue of bloated military spending to the general public through leafleting, holding vigils, and marches. NWTRCC had been busy in the lead up to April 15, sending out copies of the War Resisters League’s annual Pie Chart and other NWTRCC literature to communities gathering on this day. Additional posts were made on social media, especially with tweets of the many ways people were refusing to pay taxes for war. Lists of communities taking action were compiled and shared on our webpage as well as through a press release.

Reports came in of Tax Day actions that took place from Belfast, Maine to San Diego, California. Rain or shine, members of NWTRCC’s network were gathering to raise awareness about the impact of military spending on our communities and environment. Many actions were collaborative to shed light on the communities most impacted by lack of tax monies. Anne Barron of San Diego spoke about war tax redirection on the Truth and Poverty Tour with the Poor People’s Campaign: A National Call for Moral Revival.

Northern California People’s Life Fund Redirection Celebration. Photo courtesy of Susan Quinlan

Redirection ceremonies were held in some communities. The Northern California People’s Life Fund celebrated Tax Day with a granting ceremony in Berkeley, California in which they distributed $16,000 in redirected tax monies to 12 organizations. The community then celebrated their time together with a potluck. Susan Quinlan, an organizer of events in the Bay Area, reported on Jim Best voluntarily distributing money to the local indigenous land trust to acknowledge living on stolen land. This was in response to a land trust started by Ohlone activists, who are asking non-indigenous residents of the East Bay area to pay a voluntary “tax,” since they are living on traditional Chochenyo and Karkin Ohlone territory.

Penny Poll in Colorado Springs. Photo by Donna Johnson.

Penny polls were conducted in Chicago, Colorado Springs, and St. Louis to engage with the public about where they would like to see their tax monies spent. The first person engaged in St. Louis with information of how federal taxes were spent asked, “Are we going to be voting on this?” He was encouraged to participate in the poll to indicate where he would like his money invested.

In a sort of marathon, Chris Nelson reported that over 400 leaflets were dispersed in almost 7 hours in Chico, California. Like many committed War Tax Resisters, she braved the elements, in this case the rain, to share information with the public. Gathered with others, Chris was happily celebrating her 39th year as a WTR. It is for this reason that many of us in NWTRCC feel that Tax Day is like a Holy Day, a day to celebrate our liberation and to gather with those who share our desire to invest more resources to support human needs, not death and destruction throughout the world. This year, Tax Day coincided with the beginning of the Christian “Holy Week” and Jewish Passover.

Members of the Chico, CA Tax Day Marathon with Pie Charts. Photo by Chris Nelson.

Tax Day was also the start of a week-long world-wide call to action from the Extinction Rebellion (XR). XR is an international movement that uses nonviolent civil disobedience to achieve radical change in order to minimize the risk of human extinction and ecological collapse. Tax Day demonstrations in both Eugene, Oregon and St. Louis included participation with XR activists.

But we in NWTRCC know that the protesting of war taxes does not end on Tax Day and that not everyone who protests paying taxes for war participates in Tax Day actions. It is fitting that Tax Day is near the start of Spring, since often the work that we do is like planting seeds; sharing information, inviting others to join us in what for many is a path of liberation and resistance. There will be a more detailed Tax Day 2019 Report with more photos on the NWTRCC website in the near future.

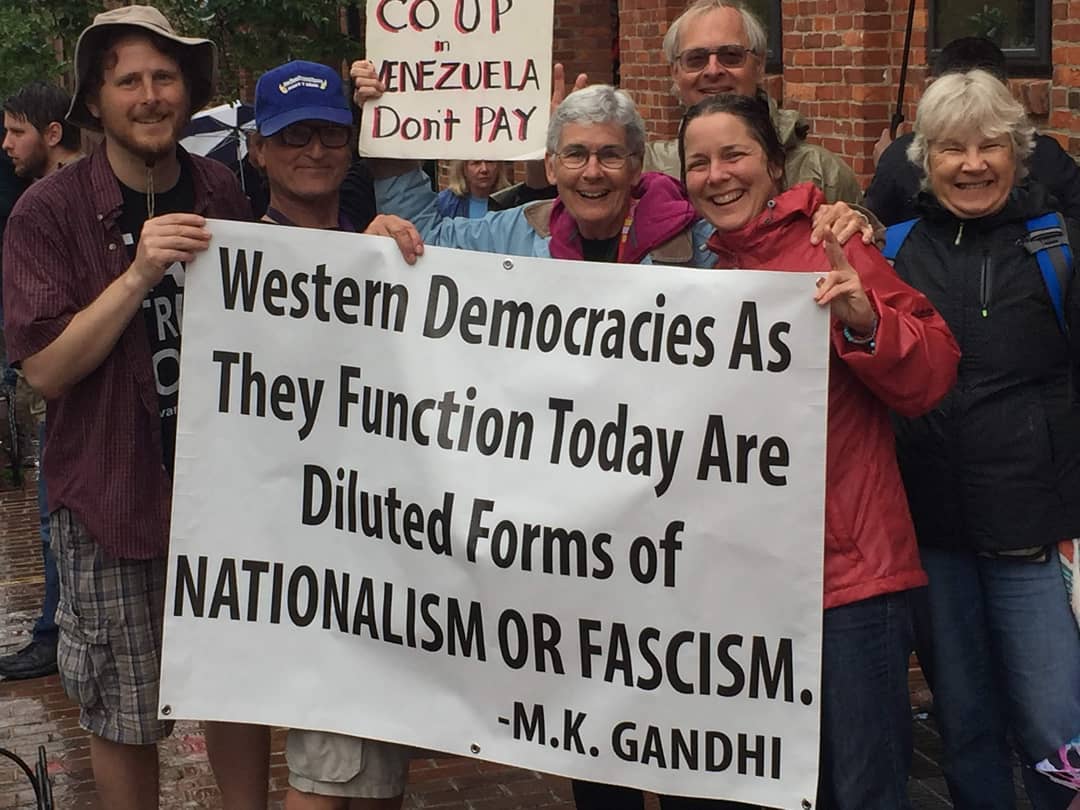

NWTRCC Gathering in Washington DC

By Lincoln Rice

We had a delightful NWTRCC gathering in Washington, DC at the beginning of May. I want to start with a HUGE thank you to the Dorothy Day Catholic Worker, who hosted folks needing beds, hosted some of our weekend activities, and helped many of us get down to the Venezuelan Embassy after our business meeting on Sunday. Thanks also to those who helped with food.

Here are some of the conference highlights, in my humble opinion:

Friday evening was supposed to begin with a report back from Code Pink activist Paki Wieland on her recent trip to I ran. Paki and other activists had been staying at the Venezuelan Embassy since it was officially turned over to them when Venezuelan diplomats who (using Code Pink’s words) “represent the legitimate government of Nicolás Maduro were forced out of the US last week.” Those who had left the embassy had not been allowed to return, so Paki decided to stay, which meant she missed our conference. In her stead, Code Pink cofounder Medea Benjamin joined us to share the latest info on Venezuela and her recent trip to Iran. This event was held at the Catholic Worker as part of their monthly clarification of thought series.

On Saturday, we met at the Emergence Community Art Collective. The morning included brainstorming to update some of our materials for Tax Day 2020. We also held our requisite War Tax Resistance 101 & 201 workshops, with a couple folks joining the 101 session.

In the afternoon, David Zarembka (who was at the founding meeting of NWTRCC in 1982, but now lives in Kenya) offered an analysis of US participation in conflicts in South Sudan, Somalia, Yemen, and Eritrea; and how this is accomplished through the military of pro-US countries—Ethiopia, Kenya, Uganda, Rwanda, and Djibouti. Though the only official US military base on the African continent is in Djibouti, there are dozens of US military outposts.

Sue Barnhart (of Eugene, Oregon) followed with details of her recent trip to the US-Mexican border. She detailed the long waits in Tijuana for folks wishing to seek asylum in the US. Many wait months for their number to be called, then are held with others in the “ice box,” with only one layer of clothing permitted and not enough space for everyone to lie down. Sue urged us to contact our federal officials, since many are not aware of these horrendous conditions.

Before supper, we heard from Malachy Kilbride, Executive Director for the National Campaign for a Peace Tax Fund & Bill Galvin, Counseling Coordinator for the Center on Conscience and War. Both shared their work experiences in DC. Malachy advocates for US federal legislation that would enable conscientious objectors to war to have their federal income taxes directed to a special fund which would be used for non-military purposes. He is currently focusing on recruiting Republican sponsors, some of whom agree with the religious freedom aspect of the bill.

Bill Galvin discussed the chaotic situation of selective service since a court recently decided that women cannot be excluded. He also shared his experience of counseling folks wishing to leave the military because of their conscientious beliefs. There are usually about 30 men and women going through the process at any given time. It takes 6-12 months for military personal to be discharged for conscientious objection and most applicants are successful in their cases.

After supper, Anne Barron of the San Diego Peace Resource Center led a peace economy workshop, in which we imagined a society with a more local focus that respected the needs of all.

NWTRCC & DC Catholic Workers at the Venezuelan Embassy after the Sunday business meeting.

Photo courtesy of Chrissy Kirchhoefer.

After our business meeting on Sunday, some of us went over to the Venezuelan Embassy to support the activists staying there. The Coup supporters in front of the embassy had been preventing food from being brought to the activists inside. I should also clarify that those NWTRCC folks who went down to support the activists inside the Embassy were not there to support the Maduro regime, but voice their opposition to US intervention in Venezuela. It is believed that if the US turns over the Maduro Embassy in DC to Guaidó supporters, that this would be a step toward US military intervention in Venezuela. Medea Benjamin also made clear that Code Pink did not want their actions to be seen as supporting the Maduro regime. I believe the Code Pink phrase “the legitimate government of Nicolás Maduro” was meant to give them a legal standing for their presence in the Embassy. Two weeks after the conference on May 16, law enforcement arrested and removed the activists at the embassy. The embassy is currently empty and whether the United States will turn over the embassy to Guaidó supporters is unclear at this point.

This conference really revealed the global impact of our federal tax dollars, from the militarization of the southern border, to the funding of pro-US regimes in eastern Africa, to the very real possibility of a U.S.-backed coup in Venezuela.

Counseling Notes:

Changes Coming to the W-4

The IRS will be releasing a major update to the W-4 form, which employees fill out for their employers so that one’s federal tax withholding can be properly determined. This draft, which will be available for public comment, is supposed to be released by the end of May 2019, but for use in 2020.

If you thought the old form was complicated, the IRS will be raising the bar sharply with the new form. The intent of the new form is to make the withholding formula more accurate so that one will neither owe taxes nor receive a refund when it comes time to file.

The new form will be similar to filling out one’s taxes. It will ask for information such as anticipated interest, dividends, tax deductions & credits, and income from other jobs. The anticipated changes to the form should not affect one’s ability to do W-4 resistance. Once the new form is finalized, we will work on updating our literature that addresses the W-4.

Frivolous Correspondence Update

NWTRCC has heard from a couple people recently who have received a letter from the IRS stating that their correspondence contains frivolous arguments. [These folks had included a separate letter with their 2018 tax forms, in which they explained their war tax resistance stance.] The IRS letter contains a warning about the potential $5,000 frivolous filing penalty, so it can be rather frightening to recipients, but you can ignore it or call the IRS 800 number to ask why you got this letter, and you should be reassured that it is merely a computer generated warning.

However, if you should receive a letter that warns you that you may receive a $5,000 penalty unless you file a corrected 1040 Form immediately, this requires your attention. This type of letter indicates that the filer submitted a tax return with some type of illegitimate deduction or credit.

If you are unsure or uneasy about a letter you receive from the IRS, please call or email Lincoln at the NWTRCC office.

Frozen Bank Account

We received a call in late April from a person whose bank account was frozen. The account was an interest-bearing account, the resister is a nonfiler, and the levy was for a year in which he received a W-2. When there is a levy on a bank account, the Internal Revenue Code (IRC) provides a 21-day waiting period for complying with the levy. The waiting period is intended to allow you time to contact the IRS and arrange to pay the tax or notify the IRS of errors in the levy. In the case of a bank levy, funds in the account are frozen as of the date and time the levy is received. Normally, the levy does not affect funds you add to your bank account after the date of the levy. On the 22nd day, the bank will transfer the owed funds to the IRS and unfreeze the account.

This case raises two main issues: (1) Bank accounts generating more than $10 of interest in one year are reported to the IRS. Though it took years for the IRS to take action on the account noted above, the IRS used the reported bank account information because of the interest earned to obtain the owed funds. If you owe the IRS money, be wary of keeping funds in an interest-bearing account. (2) The IRS probably determined the tax owed by filing a tax return on the behalf of this person at some point based on the W-2 generated from his job. When the IRS creates a substitute return, it will normally give you only one exemption, no dependents, and a standard deduction. In other words, the resister may have had more levied from his account than he should have because the IRS probably filed an inflated tax return. Especially in this situation, it would be good for the resister to fill out the old tax return and compare it to the IRS substitute version that can be obtained by requesting one’s transcripts from the IRS.

Many Thanks

Thanks to each of you who are donating for the Spring Appeal 2019. Remember, you can also donate online through Paypal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

We are very grateful to these alternative funds and WTR groups for their redirections and Affiliate dues:

Northern California People’s Life Fund

War Resisters League

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC. Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

International

WTR is Still Not a Right, But Neither Can it be Punished

Júlia Moltó and Tirs Llorens of Alcoy in Spain. Photo Courtesy of Grup Antimilitarista Tortuga.

Two residents of Alcoy in Spain, Júlia Moltó and Tirs Llorens, achieved “a partial victory” as tax resisters, in that a court rejected a fine that had been imposed on them by the Tax Agency for redirecting via their tax returns €300 each to non-profit social organizations. In 2018 in all of Spain, 335 resisters have been accounted for across 30 provinces, who redirected €35,882 with an average amount per person of €107, with Alicante being one of the provinces with the most resisters, twelve.

“Our ultimate objective is that by repeating these actions over a long period of time the administration ends up recognizing the right to conscientious objection to military taxation and reducing military spending,” explains Júlia Moltó. The government of Pedro Sánchez intends to raise the Defense budget to €8,537 million in the imbalanced budget this year.

— Dave Gross

War Tax Resistance Ideas and Actions

State Tax Refund Pays for Peace Mission to Russia

By Cathy Deppe

Cathy Deppe at November 2015 NWTRCC Conference in Las Vegas. Photo by Ruth Benn.

For retirees who file and pay state personal income taxes—be alert! I am a perfect example of someone who wasn’t.

I had been including my federal social security benefit as income on my California Resident Income Tax Return (Form 540) for three years. Misleading instructions require transferring federal 1040 income figures directly onto the state tax form. Having never itemized or claimed exemptions, I was unused to including supplemental schedules. Instructions did not clarify the need to attach the California Adjustments–Residents form CA (540) behind the Form 540. These are, by the way, the exact names of these respective forms in California. Are you confused yet? The attachment allows the filer to include and then exclude the social security benefit from California taxable income.

When I refiled three years of amended returns, California refunded me a total of $3,500. As I head for Russia this spring with Global Network Against Weapons & Nuclear Power in Space, I can say my state tax refund has paid for the trip! Here is one war tax resister who has never received a tax refund before in her life. Please look for my report back from Russia in the next issue of “More Than a Paycheck – Refusing to Pay for War.” And wish me “Bon Voyage!”

[Editor’s note: Cathy has safely returned from her trip and is writing an article for our next issue!]

Host a War Tax Resistance Focus Group with Younger Activists in your Area

During April 2019, NWTRCC hosted a virtual focus group with young women activists from the West and East Coasts. The primary purpose of the focus group was to elicit feedback about why these activists are connected with their current social justice groups and what they think about NWTRCC’s resources. An unintended consequence of these sessions was a general shift in thought about war tax resistance on the part of the participants from suspicion and fear to admiration and interest.

The focus group began as a proposal at the November 2018 NWTRCC meeting that was approved with a $1,000 budget. This permitted us to compensate each focus group participant $200. Their participation included attending two online sessions that averaged 90 minutes and some homework. The two sessions occurred two weeks apart. The homework was a 90 minute exercise completed in the interim, in which each participant examined several NWTRCC resources. Some resources they were required to examine and for others they were given options.

When asked which resources they would share with a fellow young activist that was interested in war tax resistance, the focus group recommended the introductory booklet, “War Tax Resistance at a Glance!”, the NWTRCC newsletter (yes, what you are reading!), and our podcast with new war tax resisters (which can be found here: nwtrcc.org/2017/11/01/podcast-7-new-war-tax-resisters).

The NWTRCC Outreach Committee, which meets monthly, played a pivotal role in creating the framework for the focus group. (Thank you Anne Barron, Chrissy Kirchhoefer, Daniel Woodham, Cathy Deppe, Ruth Benn, and Bill Glassmire!) If you are interested in hosting your own Focus Group, contact the NWTRCC office for more information. The affiliate support fund could also be utilized as a grant for your local group to compensate participants.

Kurdish Farmers Pressed to Pay War Taxes by ISIS

As harvest season begins in the town of Mahmour in the Kurdistan region of Iraq, farmers have been warned that their crops will be burned if they do not pay taxes to the Islamic State. Not wanting to pay this war tax, a delegation of farmers presented their dilemma to the parliament of the autonomous Kurdistan Region. One result of this meeting was to post more firefighters in the region.

Extorted War Taxes in Honduras

A war tax in Honduras is being imposed by local gangs via extortion. Extortion by gangs is so common in poor areas of the city of San Pedro Sula that it is referred to as a “war tax.” Many homes in poor parts of the city remain abandoned because the previous occupant could not afford the extortion fees and feared the repercussions. It is the inability of many to pay this war tax that has led many Hondurans to flee to America’s southern border.

RESOURCES

War Tax Resistance at a Glance!

This 23-page page booklet was recently redesigned & gives concise answers to frequently asked questions. You can download copies for free or order copies for $1.50 each from NWTRCC at www.nwtrcc.org/store or 800-269-7464.

NWTRCC’s Newsletter More than a Paycheck

As you already know, this newsletter is an excellent source for learning about war tax resistance and related news, reading personal stories, and finding out the latest technical issues facing war tax resisters.

Free email subscriptions can be easily obtained using the form on the bottom on the NWTRCC website (www.nwtrcc.org). Paper subscriptions are $15/year. Send a check to NWTRCC or use the PayPal “subscribe” button at nwtrcc.org/media/newsletters ($15 charged now with one automatic renewal for $15 after 12 months). If you would like some free copies to hand out to young activists, contact the NWTRCC office at (800) 269-7464.

NWTRCC News

Tom Shea – In Memoriam

We are deeply saddened to report the passing of Tom Shea. Below are excerpts from the testament of his friend and fellow activist, Leonard Eiger:

<strong>For Tom Shea, Peace WAS the Way</strong>

My dear friend and fellow Ground Zero member Tom Shea passed away peacefully in the early morning hours of April 3rd surrounded by his family.

Tom Shea passing out Pie Charts on Tax Day 2012. Photo by Leonard Eiger.

Tom was 47 when he left Cleveland for Traverse City, Michigan in 1977. There he met his partner Darylene, and they were inseparable from then on. Together, they participated in the Nuclear Freeze movement, and were part of the Michigan Peace Team. They traveled to New York for the second Conference on Disarmament in 1982. They protested both the first Gulf War and the war in Iraq. They also engaged in war tax resistance.

At Darylene’s suggestion, they attended a course in conflict mediation in the early ‘80s at a time when there was little written on the subject. That experience led them to a course taught by Quakers at Swarthmore College in 1986. In 1990, Tom and Darylene founded the five-county Conflict Resolution Service in Northern Michigan and trained the first group of volunteer mediators.

Tom and Darylene moved to Snoqualmie, Washington in 2007 to spend more time with Darylene’s children. Tom got involved in community issues and continued his war tax resistance work. You could find him every April 15th, in front of the local post office, offering tax resistance information.

In addition to working on media and communications for Ground Zero, and planning vigils and nonviolent direct actions at the Bangor Trident nuclear submarine base, Tom put himself on the line many times, often entering the roadway blocking traffic, symbolically closing the base and risking arrest. Tom also created street theatre scripts that have been used during vigils at the submarine base to entertain and educate people.

We will be scattering some of Tom’s ashes (per his wishes) at the Ground Zero Center during our August Hiroshima-Nagasaki weekend of remembrance and action.

I invite you to honor Tom’s memory by supporting the work of the National War Tax Resistance Coordinating Committee. There are many ways we can engage in war tax resistance in the context of a broad range of nonviolent strategies for social change.

Mark Your Calendars!!!

Our next War Tax Resistance Gathering and Coordinating Committee Meeting will be in

Corvallis, Oregon

November 1-3, 2019

Friday evening activities will probably be taking place in Portland, Oregon. So if you will be flying to the conference, please fly into Portland International Airport. More details will be forthcoming.

PROFILE

War Tax Resister Profile: Howard Waitzkin and Mi Ra Lee

Photo courtesy of Howard Waitzkin

[Editor’s Note: The following are excerpts from a letter that Howard Waitzkin and Mi Ra Lee wrote the IRS and included with their 2017 tax return. Thank you for sharing!]

Statement from Howard Waitzkin to IRS for Tax Year 2017: I am a Conscientious Objector (CO) to war, based on religious and ethical beliefs, as recognized and certified 36 years ago by the U.S. Selective Service System. My beliefs as a CO have prevented me from participating in military service. However, I have devoted my whole professional career to many forms of alternative service, trying to meet the unmet health and mental health needs of active duty military personnel and veterans, as well as those of other underserved communities in the United States and other countries. For instance, since 2005 I have directed a national network of volunteers, including health and mental health professionals and other people such as veterans and active duty military personnel, the Civilian Medical Resources Network. In this effort, we have provided free services to hundreds of active duty military personnel who have not been able to meet their needs for services within the military. Many of these clients have experienced severe problems due to their military service, including PTSD, severe depression, military sexual trauma, and substance abuse; about one half of the clients have been suicidal at the time of intake.

Due to my values as a CO, which derive from religious and ethical beliefs, I continue to experience profound ethical conflicts about paying for war through my taxes. For many years during and after the Vietnam War, I resisted half of my income taxes, leading to encounters with IRS officials who entered into dialogue with me. I contributed the money that I didn’t pay for war taxes to humanitarian projects, including various efforts to help active duty GIs and veterans. I argued and continue to argue that I and others like me who are conscientiously opposed to war should not suffer from the Constitutional contradiction of being recognized officially as a CO yet being required to pay taxes for war. Later, when the proportion of the U.S. federal budget devoted to war decreased somewhat, I decided not to resist a portion of my income taxes officially but continued to spend a substantial part of my earnings on humanitarian projects including services to current and former military personnel.

Now, our wars in various parts of the world have increased, the impacts of our military actions have created enormous devastation, including terrible effects on population health, horrible epidemics of suicide and deaths from drug abuse, adverse changes in the environment such as pollution and a substantial worsening of global warming, a rapid increase in gun violence in the United States and other countries, and a diversion of critically needed economic resources away from services like health, education, and improved infrastructure and into terribly destructive militarism. “Endless war” has become our way of life, although warfare directly affects mainly the most marginalized and disadvantaged groups in our society who see no other way to get a job or an education except through enlisting for military service. Meanwhile, despite its enormous costs, both financial and humanitarian, endless war leads to little or no apparent benefits, except large profits for a tiny portion of the world’s population. These ethically and religiously based considerations have led me to decide once again to withhold my financial support for war.

Statement from Mi Ra Lee to the IRS for Tax Year 2017: I grew up in Korea, where war has had terrible effects on living beings for centuries. My family suffered directly from the Korean War and the dictatorships that followed that War, leading to deaths and injuries among many family members and dear friends. Our society also continues to suffer from prior wars, when we were conquered by Japan, China, North Korea, and other war-making countries. As one of many examples, the women whom the Japanese military personnel used as “comfort women” have experienced deep trauma and degradation, which still has not been adequately compensated. Similar abuses affecting women have been perpetrated by military personnel from the United States and other countries that participated in the Korean War and that have maintained the military occupation of Korea. Until very recently, conscientious objection was not tolerated and the entire male population was required to serve in the military; for that reason, many COs have been required to spend long periods of their lives in prisons. If military conscription had applied to women, I am sure that I would have been a CO and probably also would have gone to prison.

Since I have been living in the United States, I have been shocked by the negative impacts of warfare on the U.S. population, as well as the many populations around the world who have been adversely affected by U.S. military policies and practices. On a daily basis, we must live in fear within the United States, as veterans and others influenced by its military culture engage in almost daily tragedies involving gun violence. The tragedies of warfare, paid for through our taxes, are ruining us and the rest of the world’s peoples. For all these reasons and others, I also can no longer ethically pay half of my income taxes for war.

Sincerely,

Howard Waitzkin & Mi Ra Lee

More than a Paycheck

Editor Lincoln Rice

Production Ruth Benn and Ed Hedemann

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance

Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance

movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Subscriptions are $15 per year.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org