National War Tax Resistance Coordinating Committee

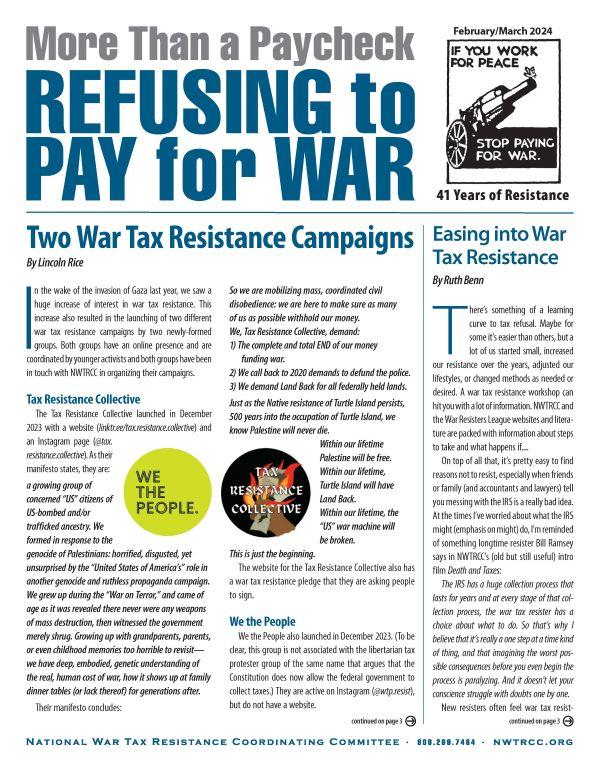

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

February – March 2024

Contents

- Two War Tax Resistance Campaigns

By Lincoln Rice - Easing into War Tax Resistance

By Ruth Benn - Counseling Notes 2024 IRS Standard Deduction and Taxable Income Level • Suspension of Failure to Pay Penalty for Tax Years 2020 and 2021 • IRS Still Recovering from Pandemic

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- NWTRCC Upcoming Events and News: Mark Your Calendars! National NWTRCC Conference on Zoom:

May 3 – 5, 2024 • Nominations Open for NWTRCC’s Administrative Committee (AdComm) • So Many WTR 101s!!! • Ask your Church to Support NWTRCC • In Memoriam: Donald Kaufman • In Memoriam: Robin Harper - War Tax Resistance News: Sojourners Magazine Recognizes Eroseanna Robinson • Nakba Day by Ruth Benn

- PERSPECTIVE: Wake Up to Find that You Are Eyes of the World

By Chrissy Kirchhoefer

Click here to download a PDF of the February/March issue

Two War Tax Resistance Campaigns

By Lincoln Rice

In the wake of the invasion of Gaza last year, we saw a huge increase of interest in war tax resistance. This increase also resulted in the launching of two different war tax resistance campaigns by two newly-formed groups. Both groups have an online presence and are coordinated by younger activists and both groups have been in touch with NWTRCC in organizing their campaigns.

Tax Resistance Collective

The Tax Resistance Collective launched in December

2023 with a website (linktr.ee/tax.resistance.collective) and

an Instagram page (@tax.resistance.collective). As their manifesto states, they are:

The Tax Resistance Collective launched in December

2023 with a website (linktr.ee/tax.resistance.collective) and

an Instagram page (@tax.resistance.collective). As their manifesto states, they are:

A growing group of concerned “US” citizens of US-bombed and/or trafficked ancestry. We formed in response to the genocide of Palestinians: horrified, disgusted, yet unsurprised by the “United States of America’s” role in another genocide and ruthless propaganda campaign. We grew up during the “War on Terror,” and came of age as it was revealed there never were any weapons of mass destruction, then witnessed the government merely shrug. Growing up with grandparents, parents, or even childhood memories too horrible to revisit—we have deep, embodied, genetic understanding of the real, human cost of war, how it shows up at family dinner tables (or lack thereof) for generations after.

Their manifesto concludes:

So we are mobilizing mass, coordinated civil disobedience: we are here to make sure as many of us as possible withhold our money.

We, Tax Resistance Collective, demand:

- The complete and total END of our money funding war.

- We call back to 2020 demands to defund the police.

- We demand Land Back for all federally held lands.

Just as the Native resistance of Turtle Island persists, 500 years into the occupation of Turtle Island, we know Palestine will never die.

Within our lifetime Palestine will be free.

Within our lifetime, Turtle Island will have Land Back.

Within our lifetime, the “US” war machine will be broken.

This is just the beginning.The website for the Tax Resistance Collective also has a war tax resistance pledge that they are asking people to sign.

We the People

We the People also launched in December 2023. (To be clear, this group is not associated with the libertarian tax protester group of the same name that argues that the Constitution does not allow the federal government to collect taxes.) They are active on Instagram (@wtp.resist), but do not have a website.

Instead of a website, they have organized a group using the online platform Geneva (app.geneva.com). This platform allows one-stop shopping. On this app, their group streams town halls, posts announcements, has a variety discussion boards organized by topic, and more.

Joining their group on Geneva is a two-step process. First, you need to download the Geneva app on your phone, tablet, or desktop. Then you need to email your request to join the group to wtp.resist@gmail.com. In your email, let them know you are part of the NWTRCC network.

Their stated goal is “to persuade 50 million Americans to participate in a Tax Blackout this April 2024 by refusing to pay at least 5% of their income taxes and donating that money to community-building organizations and emergency relief for Gaza.”

Get Involved

Both of these groups have been organized by wonderful people. Please check them out and interact with them on social media.

Easing into War Tax Resistance

By Ruth Benn

There’s something of a learning curve to tax refusal. Maybe for some it’s easier than others, but a lot of us started small, increased our resistance over the years, adjusted our lifestyles, or changed methods as needed or desired. A war tax resistance workshop can hit you with a lot of information. NWTRCC and the War Resisters League websites and literature are packed with information about steps to take and what happens if….

On top of all that, it’s pretty easy to find reasons not to resist, especially when friends or family (and accountants and lawyers) tell you messing with the IRS is a really bad idea. At the times I’ve worried about what the IRS might (emphasis on might) do, I’m reminded of something longtime resister Bill Ramsey says in NWTRCC’s (old but still useful) intro film Death and Taxes:

The IRS has a huge collection process that lasts for years and at every stage of that collection process, the war tax resister has a choice about what to do. So that’s why I believe that it’s really a one step at a time kind of thing, and that imagining the worst possible consequences before you even begin the process is paralyzing. And it doesn’t let your conscience struggle with doubts one by one.

New resisters often feel war tax resistance is an “all or nothing” choice, but many of us see the power in the protest itself as opposed to the amount of money resisted. One person refusing $10,000 all at once probably worries the government less than 1,000 people each refusing $10. At which point I’m reminded that I wrote about this “All or Nothing Syndrome” a few years ago, so I won’t repeat myself except to add another favorite quote, this one from Betty Winkler:

…with the realities of the day being what they are I would wish that everybody who marched, everybody who sent a letter of protest to their representative would just resist one fucking dollar. Just resist something.The “realities of the day” at that time, 2005, were the wars in Iraq, Afghanistan, and beyond. Even if Israel’s destruction and killing in Gaza ends tomorrow, the US war machine will still be rolling while so many other desperate needs go unmet. Preventing future wars is the bottom line for many of us and the reason to continue to resist in all ways possible for as long as it takes.

Maintaining resistance is easier if you are connected to other resisters. It will be great if a local or national war tax resistance campaign takes off and large numbers are resisting together. Short of that, encourage resistance in whatever group you are active with or seek support from them. Stay in touch with NWTRCC and contact other resisters in your area.

P.S. The graphic mentions phone tax resistance, an excise tax that’s only on land-line phones where the local and long distance plans are separate. With the onset of cell phones, this tax is less common.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2024. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org.

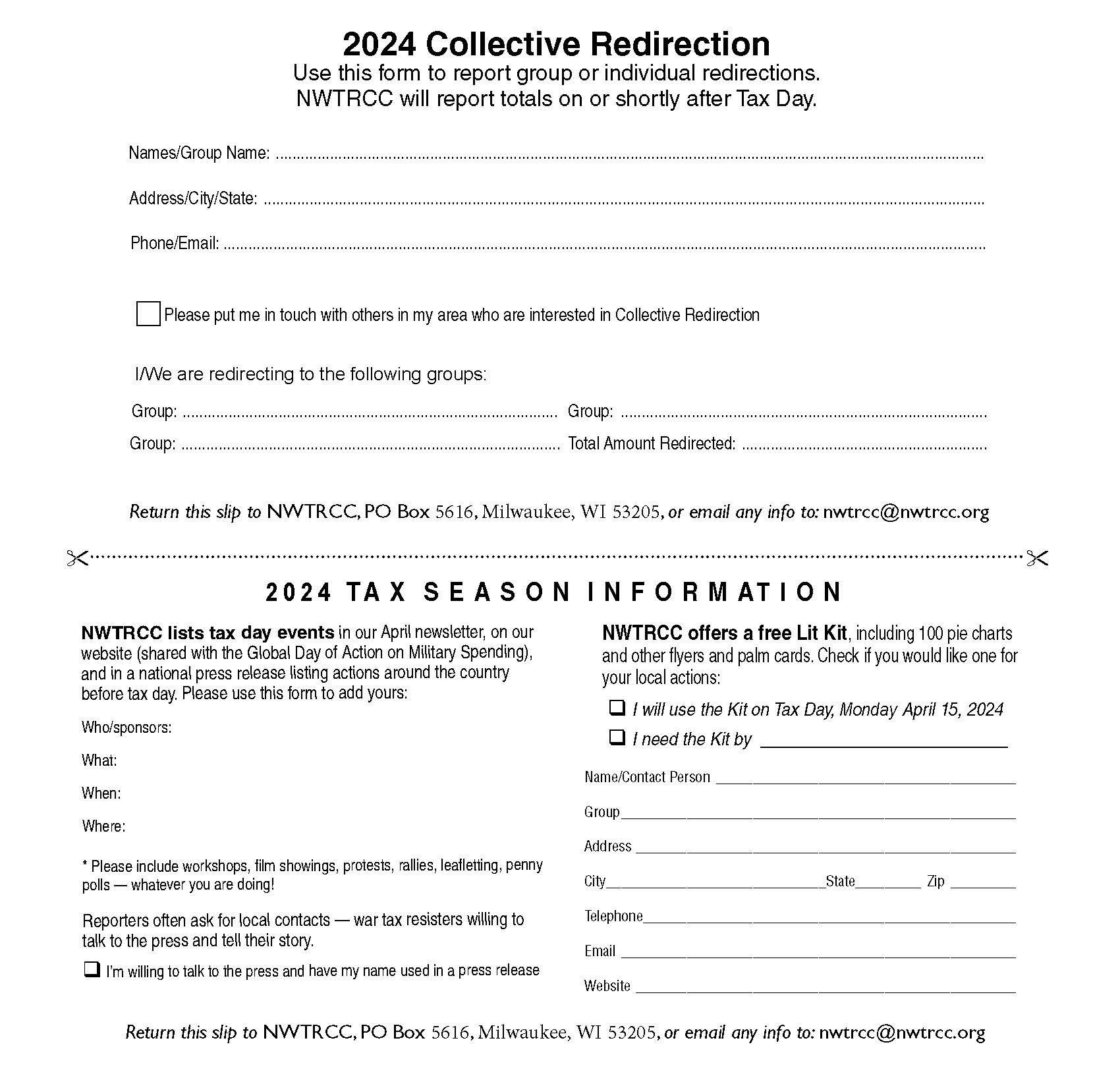

2024 IRS Standard Deduction and Taxable Income Level

As a reminder, Trump’s tax overhaul bill eliminated the personal exemption. Now there is only the Standard Deduction figure that sets the taxable income level.

Category Standard Deduction Single $14,600 Married, Filing Jointly $29,200 Married, Filing Separately $14,600 Head of Household $21,900 For each married taxpayer who is at least 65 years old or blind, an additional $1,500 standard deduction may be claimed. If the taxpayer is single, the additional standard deduction amount is $1,850.

A single person can earn up to $14,600 and owe no federal income tax. You may be able to make significantly more than the amounts indicated above and owe no income taxes. NWTRCC’s Practical #5, Low Income/Simple Living as War Tax Resistance, includes information on legal ways to reduce taxable income and owe no federal income taxes ($1 from the NWTRCC office; read it free at nwtrcc.org). We suggest that nonfilers fill out the forms and keep their receipts for reference in case their circumstances change or the IRS comes calling.

Payroll taxes for Social Security and Medicare begin to apply at a lower income level than one’s standard deduction. If you are self-employed and do not file or pay estimated taxes, you may be liable for Social Security taxes. If you are an employee, these payroll taxes are automatically withheld as a percentage and you cannot resist those taxes.

Suspension of Failure to Pay Penalty for Tax Years 2020 & 2021

In January, the IRS issued a statement that they will automatically waive failure-to-pay penalties on unpaid taxes for tax years 2020 or 2021. To qualify, you need to have filed for those years, owed a tax debt of less than $100,000, and received an initial balance due notice (typically the CP14) between Feb. 5, 2022, and Dec. 7, 2023.

This action was taken due to the IRS suspending many of their mailed notices because of the pandemic. It appears that the penalty for unpaid taxes for those years is now resuming since they are sending out notices again, but the press release did not make this explicit.

IRS Still Recovering from Pandemic

During the pandemic, the IRS fell behind with processing paper Forms 1040. At one point, they had a backlog of 17 million returns. As we stated last issue, the IRS reported that the backlog has been eliminated.

Nevertheless, it is now clear that they are still catching up in other areas. For example, there is still a large backlog of amended individual tax returns, business amended tax returns, and correspondence, which “remain at double their pre-pandemic levels.”

It appears that this backlog has continued because of the IRS focus on processing the original 1040 returns and their attempt to improve performance with answering their phones. In 2021, only 11% of phone calls were answered. This increased to 29% for 2023. The IRS also reduced the average wait time from 29 minutes in 2022 to 13 minutes in 2023.

Many Thanks

Thanks to each of you who donated to the November appeal! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

We are very grateful to these alternative funds and WTR groups for their redirections and Affiliate dues: Agape Community (Ware, Massachusetts); Boulder War Tax Info Project (Colorado); Milwaukee War Tax Resistance / Casa Maria Catholic Worker

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.orgAdvertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loopWe’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.org

NWTRCC Upcoming events and News

Mark Your Calendars!

National NWTRCC Conference on Zoom:

May 3 – 5, 2024After two hybrid meetings in 2023 that were held in Indiana and New York, we will be returning to a completely online format for our first meeting of 2024. The agenda for the meeting is still in flux, but we hope to highlight many of the wonderful young people who have taken on war tax resistance.

The NWTRCC business meeting is Sunday morning, May 5 (open to all). Note: Proposals for the May meeting must be submitted to the NWTRCC office by April 17, 2024.

Help keep NWTRCC Strong and Growing!

Nominations Open for NWTRCC’s Administrative Committee (AdComm)The AdComm provides oversight for business operations, helps plan two gatherings each year, keeps in touch with consultants between meetings, and meets face-to-face at the May and November gatherings (and by Zoom in February and August). We need to fill two seats, and new members will be selected from the nominees at the May 2024 meeting. They serve as alternates for one year and full members for two years (three years total). Travel to meetings is paid for full members and alternates filling in for full members who cannot attend. Each nominee will receive a nomination letter from the NWTRCC office with more details about what is involved as a member of this important committee.

Call, email, or mail your nomination(s) to

NWTRCC, PO Box 5616

Milwaukee, WI 53205

800-269-7464 or nwtrcc@nwtrcc.org

Deadline: March 15, 2023So Many WTR 101s!!!

In December and January, NWTRCC consultants Lincoln Rice and Chrissy Kirchhoefer offered a plethora of introductions to war tax resistance online. On Thursday December 7th, a session was offered on Zoom at 1p Central. On Thursday December 14th, a session was offered on Zoom at 7p Central. On Wednesday January 10th, we offered a session via Zoom for a local gathering of people at the Yes We Cannibal art studio in Baton Rouge, Louisiana. And on Martin Luther King Jr.’s birthday on Monday January 15th, we offered a session for We the People (see article on page 1) using the Geneva App platform. As long as interest continues to be high, we will keep offering these sessions.

Also, we saw posted online that on Wednesday January 17th at Wooden Shoe Books & Records in Philadelphia, NWTRCC area contact Stephen Gulick offered an introduction to war tax resistance. Unfortunately, we were not able to get a report on this session before this newsletter went to press.

Ask your Church to Support NWTRCC

If you are connected to a church or religious congregation that you think would be open to supporting NWTRCC financially, NWTRCC has a webpage with resources on how to reach out to your religious group. The webpage (nwtrcc.org/church) has a sample letter as well as links to NWTRCC’s annual reports, which a religious congregation might find helpful in deciding whether to make a donation to NWTRCC.

Even if your church denies the request, it is an opportunity to raise awareness about war tax resistance. If you would like any help in formulating a request to your church, feel free to contact Lincoln at the NWTRCC office.

In Memoriam: Donald Kaufman

As this newsletter was going to print, we received word of the passing of long-time war tax resister Donald Kaufman of North Newton, Kansas. We will feature a more in-depth remembrance of his life in the next newsletter.

In Memoriam: Robin Harper

[Editor’s Note: The following was the obituary written by his family, and further edited by attorney Peter Goldberger to highlight and make more accurate the information about his court cases and their relationship to the almost total failure of the IRS to collect his resisted taxes for more than 45 years.

Robin Harper speaking at a WTR workshop in Philadelphia, March 2013. Photo by Ed Hedemann

Peter Goldberger has high praise for Robin. In email correspondence with the NWTRCC office, Peter wrote that Robin was “one of the few saints I have known in my life (Marian Franz was another), that is, he lived a life of service, devoted to the good. Whenever he entered a room a kind of aura surrounded him and affected anyone nearby with positive energy.”]

Robin and Marlies raised three children and enjoyed 50 years together. They frequently traveled to Germany to maintain ties with family and 18 of her high school classmates who developed a close bond because of their experiences during WWII in Germany. After Marlies passed away in 2003 from ALS (“Lou Gehrig’s disease”), Robin traveled to Germany and met with her family and the two surviving members of this group. A relationship developed with one of the two, Eva Goldhagen, and he continued visiting with her until her death in 2013.

Peace Work and War Tax Resistance

Robin was drawn to the Quaker Peace Testimony, which inspired and invigorated him his entire life, causing him to help organize peace walks and vigils, large and small, and participate in hundreds of nonviolent demonstrations. He helped organize the Walk for Peace to the United Nations in 1958, which was a demonstration for global nuclear disarmament and in support of the Golden Rule, a sailboat heading toward the US atom bomb testing site in the Pacific Ocean.

That same year, he helped set up two war tax resistance alternative funds in the greater Philadelphia area, creating revolving funds for making loans of refused taxes to worthy social change organizations and projects. He led delegations to visit members of Congress, participated in radio and television interviews regarding his peace views and actions, and has been the subject of numerous feature newspaper articles.

Robin began his lifelong resistance to paying for war through federal income tax in 1958, inspired in part by Dorothy Day of the Catholic Worker and motivated in particular by the US government’s ongoing testing of nuclear weapons, especially in the above-ground atmosphere. He redirected his entire tax amount each year to constructive, peace-building programs and groups, meticulously documenting all of these contributions. This continued for the next 46 years, until he no longer had a tax liability as a senior and a widower. While employed at Pendle Hill, he voluntarily reduced his salary to thwart an IRS levy.

US Tax Court Cases

In 1972, he appealed to the US Tax Court to challenge the demands of the IRS to pay over refused taxes from 1958 through 1967. This was one of the first such cases in the country during the Vietnam War period. He brought two more such cases in 1974 and 1976, always fully revealing his alternative donations of resisted taxes; the government prevailed each time, giving the IRS permission to attempt collection along with penalties for “willful disregard of rules,” even while winning respectful comments from the judges about his sincerity and integrity.

In 1974-75, the IRS took him to District Court to try to force him by “summons” to provide collection information, but he prevailed on Fifth Amendment grounds, setting a judicial precedent, which the government declined to appeal. Having failed in their efforts to collect these taxes, the IRS sued Robin in federal court in 1976, and won a judgment for over $11,000.

But again, despite ten years of trying, the government was unable to collect, including an attempt in 1985 to take his deposition to reveal any assets. When he refused to answer, the IRS took him into District Court but at the last minute withdrew their case. Over all the years of his witness, the IRS was entirely unsuccessful in its collections efforts, except for a period of nine years during which it seized 15% from his monthly Social Security payments.

More Peace & Justice Work

In 1963, Robin and Marlies, along with their two older children, took part in the March on Washington with Martin Luther King, Jr. amid the hundreds of thousands gathered at the Lincoln Memorial. In 1967, Robin took part in the famous coalition action to confront the Pentagon, one of many times he joined in D.C. with thousands to confront the war-making of the government in those turbulent years.

In 1986, Robin and Marlies joined a German protest against the installation of US Pershing cruise missiles in Gorleben, West Germany. By happenstance, they were in Berlin in November 1989 and were at the Berlin Wall on the very night when it came down.

2000s to Today

From 2009 to 2016, Robin actively participated in the Transition Town Media (PA) initiative, helping to build a more resilient and ecologically-friendly community. In 2011, he threw his energies and financial support into the work of Earth Quaker Action Team (EQAT), a grassroots, nonviolent action group including Quakers and people of diverse beliefs, who join with millions of people around the world fighting for a just and sustainable economy.

In 2013, he took part in the unprecedented Climate Rally in Washington, D.C., protesting the KXL Pipeline, as well as joined the 50th anniversary March on Washington.

For his last years Robin Harper resided at Crosslands, a Quaker life-care community in Kennett Square, Pennsylvania. He is survived by his three children, his younger sister, five grandchildren, and one great grandchild. A celebration of his life is planned for February 11, 2024, 2:00-4:00pm at Crosslands, 1660 East Street Road, Kennett Square, PA 19348.

War Tax Resistance News

Sojourners Magazine Recognizes Eroseanna Robinson

Back of the Robinson trading card that NWTRCC released a few years ago

The February / March 2024 issue of Sojourners Magazine features an article on the war tax resister Eroseanna Robinson. Robinson, whose war tax resistance took a toll on her athletic career, has been receiving more attention as of late. In 2022, the Voluntown Peace Trust featured an article on her. And in 2021, the podcast Shut Up & Play dedicated their premiere episode to her, which included an in-depth interview with Karl Meyer, who was deeply inspired by her war tax resistance.

Nakba Day

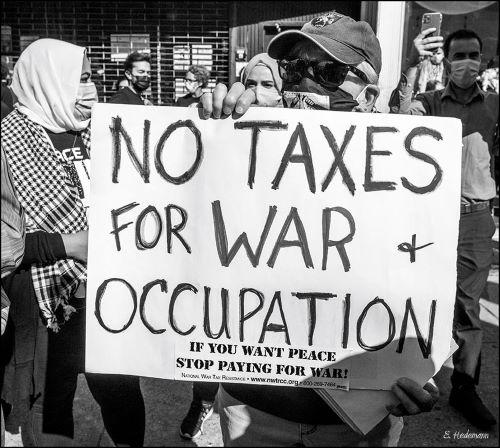

Ruth Benn on Nakba Day during protest for Palestinian Rights, Brooklyn (May 15, 2021) Photo by Ed Hedemann

By Ruth Benn

I’m working at finding hope in dark times. It helps to be in a city full of activists of one stripe or another — ceasefire, save Gaza, antiwar in one place or another, stop mass incarceration, shut down Rikers, end solitary confinement, house the unhoused, close Guantanamo, Black Lives Matter, etc. And in the midst of it all, you might get invited to a holiday party. What times we are in.

It’s not easy to see through the dark clouds looming (like the ongoing cult of personality for that former prez), but I do find hope in the constant and loud demands for a ceasefire and the range of actions one can join, from marches to vigils to petitions to calling Congress to civil disobedience. Coupled with this and encouraging for us are the constant calls for stopping the flow of US money and weapons to Israel and the impressive numbers of people joining or watching NWTRCC’s WTR 101 webinars or asking for local workshops.

The word about war tax resistance and the fact that it seems to be spreading person-by-person to their networks and then on to their contacts and then to more networks is awesome. Recently on the WTR listserve Ilene Roizman, who has been associated with NWTRCC for some years, wrote:

In an effort to contribute some small thing to the push for a ceasefire in Gaza and an end to the US’s complicity with Israel’s atrocities, I’ve been engaging on Instagram. … I posted a comment on several Instagram posts:

We don’t have to pay for war. Tax resistance is an option and would be very effective at larger scale. Yes, it’s risky, but this is a time to take big risks so we can effect big change. Learn more: National War Tax Resistance Coordinating Committee, nwtrcc.org.One person responded:

The only way it’ll work is if it’s a massive movement, but people are really afraid to not pay taxes I think.

Another replied:

People are afraid, yes, but that’s why we are putting together a coalition to educate people on their rights, risks, and recourse. The IRS isn’t as powerful as they project themselves to be.

And,

This is what I’ve been talking about and trying to comment on, but didn’t realize there was already a committee. Thank you for sharing!

In December, a reporter based in Brooklyn got in touch with NWTRCC and then me. He had heard of war tax resistance when he found a ‘zine in a Brooklyn coffee shop on the topic, and he sent images of the ‘zine, a small publication I’d never seen before. Given the content, it was obviously inspired by the current war on Gaza and included some basic information taken from NWTRCC and War Resisters League and with QR code links to those two organizations.

A third QR code took me to a slightly longer, 9-page publication called “War Tax Protest & Resistance: A Liberatory Toolkit.” The initials-only author describes it as a “toolkit with queer and Trans Black and brown folx who are distanced from generational wealth in mind.” (You can find it online at this address: shorturl.at/djswW) It’s a thought-provoking read for those of us who have been doing WTR in a certain way for a long time, and it also sparks some hope that we really can expand this form of resistance to militarism into that “massive movement” we’ve talked about for so long — maybe best led by some of these new voices.

So, a deeply felt thanks to everyone who is lighting a candle in these dark times. And as the author of the toolkit says, “Another world is possible y’all, let’s build it together.”

Perspective

Wake Up to Find that You Are Eyes of the World

By Chrissy Kirchhoefer

People are mobilizing, taking a variety of actions to call for an end to the slaughter in Gaza—making connections of how our struggles for liberation are bound together. It is encouraging that so many people are seeking out information about how to resist paying for war and then collaborating with others to learn more and share with others. As 2023 was coming to a close and 2024 began, NWTRCC was hosting almost weekly introductions to war tax resistance.

On the first day of the 2024, Israel declared that the bombing of Gaza would continue for months. Actions during the following days threatened an expansion of the war in the Middle East or as some refer to the area as West Asia / North Africa (WANA). The disruption of shipping routes by Houthis in the Southern Red Sea, the assassination of Hamas leaders in Lebanon, and the bombing in Iran on the anniversary of the US assassination of Commander Soleimani, which killed close to 100 people, are increasing tension in the area.

In addition to the bombing that is expected to continue for months, the people of Gaza are facing starvation as well as many preventable diseases related to lack of water and sanitation. Arif Husain, the chief economist at the World Food Programme, told the New York Times, “I’ve been to pretty much any conflict, whether Yemen, whether it was South Sudan, northeast Nigeria, Ethiopia, you name it. And I have never seen anything like this, both in terms of its scale, its magnitude, but also at the pace that this has unfolded.”

While much of the major news is focused on the violence and speculating what may happen next, little attention is paid to nonviolent resistance. In response to the assassinations in Lebanon, there was a call for a general strike in Palestine just weeks after a global general strike was called to demand a ceasefire to the bombing of Gaza. Not only are we often unaware of current resistance but also the long history of creative and courageous forms of resisting the oppression of the state. Beit Sahour, a little town outside of Bethlehem, has a long history of nonviolent resistance including tax resistance, economic boycotts, and other creative forms of resistance like buying eighteen cows to provide for their own needs.

It is imperative that we learn more of these stories to spark our imaginations of what is possible, to share them with others so that we can conspire together and bring forth the world that we collectively long for. With the huge influx of interest in tax resistance, we would love your support in sharing your experience with those who are navigating the waters of this powerful movement with a rich history.

We have been sharing the details for upcoming War Tax Resistance 101s in our Instagram feed (instagram.com/wartaxresister)) and NWTRCC will be hosting a Counselor’s Training on Saturday February 17 to assist others in helping others make informed decisions about WTR. (For more information on becoming a counselor, check out the counselors notes on page 2.) We would love to hear about the actions you have been involved in and ideas you have for expanding and strengthening our network.

Consider printing out a flyer with our QR code to attach to a sign or create some half sheets to share with those who have signs expressing outrage of how US taxpayer money providing ammunition to the genocide in Gaza. NWTRCC has downloadable flyers on its website. Go to the “Resources” tab and click on “Downloadable Flyers.”

More than a Paycheck

Editor Lincoln Rice

Production Rick BickhartMore Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org