National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

April – May 2024

Contents

- Tax Season 2024

By Lincoln Rice & Chrissy Kirchhoefer - Living Simply in a New Way: An Interview with Robin Greenfield – Part 1 By Erica Leigh

- Counseling Notes Large Income Nonfilers Given Notice • Suspension of Failure to Pay Penalty for Tax Years 2020 and 2021 • 1099-K Reporting & Zelle Exception

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- War Tax Resistance Ideas and Actions: Divest from genocide! Healthcare Workers War Tax Resistance Webinar • WTRCounselors in NYC are Busy • WTR Campaign in the UK over Gaza “Genocide” • Are We Reaching the Tipping Point? • I Won’t Pay for Genocide • War Tax Resistance/Redirection at Community Mennonite Church

- NWTRCC News: NWTRCC National Conference: Resisting Together (May 3-5, 2024) • Peace Walk 2024 • In Memoriam: Donald D. Kaufman

- PERSPECTIVE: My Letter to the IRS

By Murtaza Nek

Click here to download a PDF of the April/May issue

Tax Season 2024

By Lincoln Rice & Chrissy Kirchhoefer

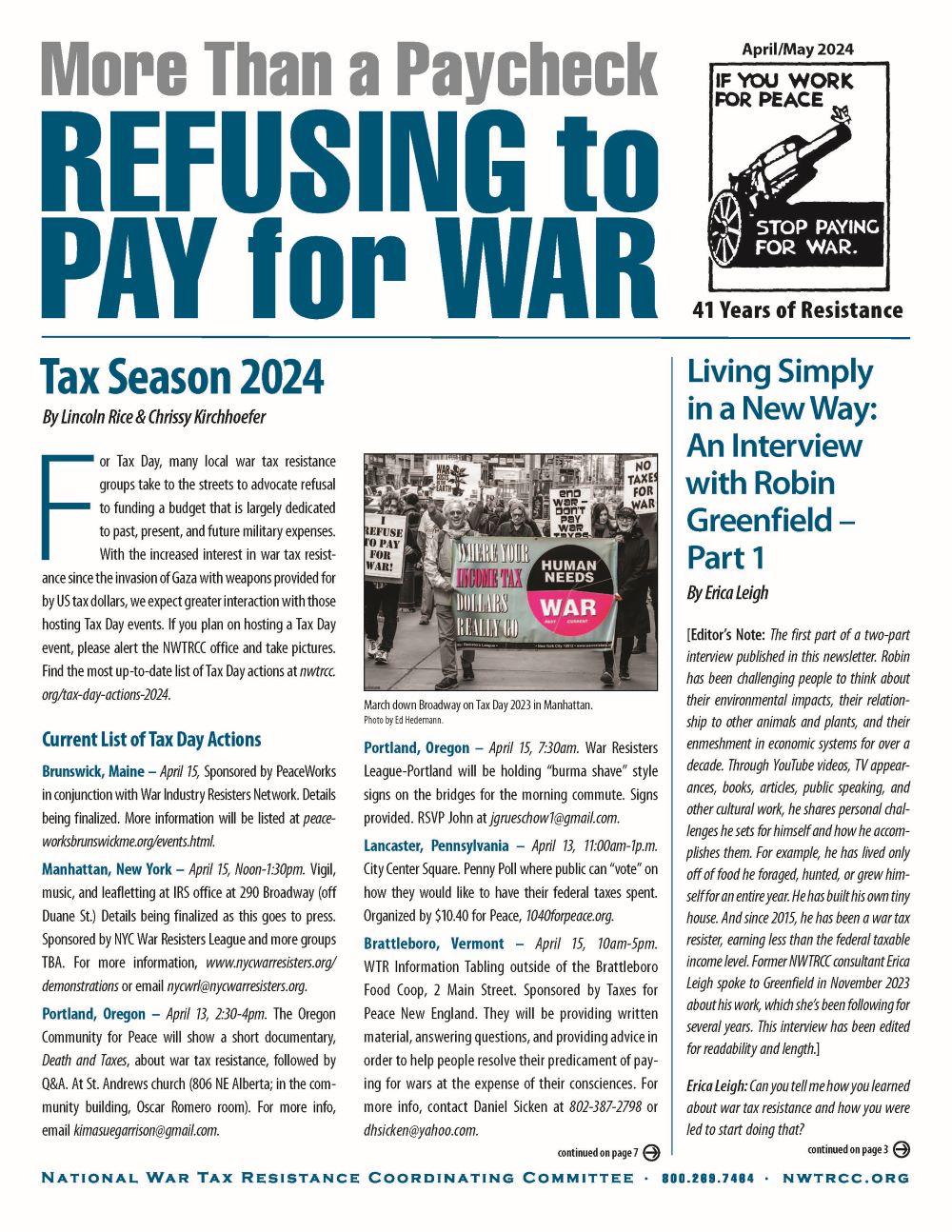

For Tax Day, many local war tax resistance groups take to the streets to advocate refusal to funding a budget that is largely dedicated to past, present, and future military expenses. With the increased interest in war tax resistance since the invasion of Gaza with weapons provided for by US tax dollars, we expect greater interaction with those hosting Tax Day events. If you plan on hosting a Tax Day event, please alert the NWTRCC office and take pictures. Find the most up-to-date list of Tax Day actions at nwtrcc.org/tax-day-actions-2024.

Current List of Tax Day Actions

Brunswick, Maine – April 15, Sponsored by PeaceWorks in conjunction with War Industry Resisters Network. Details being finalized. More information will be listed at peaceworksbrunswickme.org/events.html.

Manhattan, New York – April 15, Noon-1:30pm. Vigil, music, and leafletting at IRS office at 290 Broadway (off Duane St.) Details being finalized as this goes to press. Sponsored by NYC War Resisters League and more groups TBA. For more information, www.nycwarresisters.org/demonstrations or email nycwrl@nycwarresisters.org.

Portland, Oregon – April 13, 2:30-4pm. The Oregon Community for Peace will show a short documentary, Death and Taxes, about war tax resistance, followed by Q&A. At St. Andrews church (806 NE Alberta; in the community building, Oscar Romero room). For more info, email kimasuegarrison@gmail.com.

Portland, Oregon – . War Resisters League-Portland will be holding “burma shave” style signs on the bridges for the morning commute. Signs provided. RSVP John at jgrueschow1@gmail.com.

Lancaster, Pennsylvania – April 13, 11:00am-1p.m. City Center Square. Penny Poll where public can “vote” on how they would like to have their federal taxes spent. Organized by $10.40 for Peace, 1040forpeace.org.

Brattleboro, Vermont – April 15, 10am-5pm. WTR Information Tabling outside of the Brattleboro Food Coop, 2 Main Street. Sponsored by Taxes for Peace New England. They will be providing written material, answering questions, and providing advice in order to help people resolve their predicament of paying for wars at the expense of their consciences. For more info, contact Daniel Sicken at 802-387-2798 or dhsicken@yahoo.com.

Harrisonburg, Virginia – April 13, Noon. Shenandoah Valley Taxes for Peace has organized a War Tax Resistance/Redirection vigil at LOVE Park next to the Harrisonburg Farmer’s Market (228 S Liberty St.). The group will publicly redirect resisted war taxes to peace and justice organizations. For more info, contact Tim Godshall, 540-908-8194, timgodshall@gmail.com.

Milwaukee, Wisconsin – April 13, Noon-1pm. Protest against federal tax dollars for war, US Army Reserve, 5130 W. Silver Spring Dr. Sponsored by Milwaukee War Tax Resistance, Casa Maria Catholic Worker, & Peace Action Wisconsin. For more info, contact Lincoln or Mikel, Casa Maria at usury_sucks@hotmail.com or (414) 344-5745.

Check out another website for Tax Day actions:

The Global Days of Action on Military Spending (GDAMS) are taking place again this year, April 12 to May 15. This year, they “are witnessing the dramatic consequences of escalating global militarization.” Find a list of all the actions at demilitarize.org.

Living Simply in a New Way: An Interview with Robin Greenfield – Part 1

By Erica Leigh

Rob Greenfield in New York City (2016) during Trash Me Campaign. Courtesy of JJRam86 on WikiCommons.

[Editor’s Note: The first part of a two-part interview published in this newsletter. Robin has been challenging people to think about their environmental impacts, their relationship to other animals and plants, and their enmeshment in economic systems for over a decade. Through YouTube videos, TV appearances, books, articles, public speaking, and other cultural work, he shares personal challenges he sets for himself and how he accomplishes them. For example, he has lived only off of food he foraged, hunted, or grew himself for an entire year. He has built his own tiny house. And since 2015, he has been a war tax resister, earning less than the federal taxable income level. Former NWTRCC consultant Erica Leigh spoke to Greenfield in November 2023 about his work, which she’s been following for several years. This interview has been edited for readability and length.]

Erica Leigh: Can you tell me how you learned about war tax resistance and how you were led to start doing that?

Robin Greenfield: 2015 is when I officially committed to not paying federal taxes for the rest of my life, for however many decades that is, which is eight years ago now. And as far as where the idea came from, it was numerous things, but it was part of the overall decision to no longer support oppressive and exploitative systems. That includes government, corporations, the military-industrial complex, the prison-industrial complex.

It was 2011, so four years prior to that, that I had started to wake up to the truth of what we call the United States of America. It’s when I realized that what we call the American dream is actually the world’s nightmare. And I just learned that almost everything I was doing was causing destruction and was part of oppression and exploitation of people, of the planet, and of the plant and animal relatives that we share this Earth with…

And then I made over the next years, hundreds of changes in my life, including money… I was running a marketing company, I saw money as actually a way to have my freedom, and also to prove my self-worth. So my actions did not catch up with my moral values immediately. It takes time to unravel the web of consumerism and materialism that we’re in.

Erica:: Are there people in your life, like mentors or people who inspired you in that practice of not paying for things that you oppose?

Robin: Many inspirations in the long line of standing up to oppression and exploitation and resistance to oppressive governments. One of my earliest inspirations was Mahatma Gandhi. I know he did multiple things to resist taxes to the British government on a very large level, including the salt tax for example. Martin Luther King was one of my early inspirations and influences as far as just standing up to these exploitative systems.

Today some of my inspirations are Alice Walker, Angela Davis, and Vandana Shiva, and a lot of people that would be considered radical by our mainstream society. I mostly gravitate towards people who are quite radical, and the reason why is cause we need radical change – we don’t need just a little bit of change.

But as far as the exact [influence for] war tax resistance, I have nobody in my life. My contact with people who discuss war tax resistance has been so little, and that’s one reason I was excited for this interview is just to talk about it! Probably about eight years [ago], a guy reached out to me through email and we exchanged emails back and forth. He had been a war tax resister for decades. I don’t remember his name, but I remember having that communication with him. I’m not tied into any of the organizations…

For most people it’s a pretty big step… Now the way that I manage it is through voluntary simplicity. I don’t know what most war tax resisters do, but mine is done without any risk because I have committed for life to earning less than the federal poverty threshold. So I don’t owe any taxes. And I’m not under any risk by not paying them.

Erica: Have you ever heard anything from the IRS?

Robin: No, I’ve had no communication with them whatsoever to my recollection.

And I’m quite sure that to the uneducated eye, it could very much appear that I am hiding money from the government. You know, as a public figure who’s had TV programs and books, it’s very likely that people would assume that I have a whole bunch of money. And in fact if you type in “Robin Greenfield net worth” into Google or any web browser, most of the websites that talk about my net worth say that I’m a millionaire…

But my net worth right now is nine thousand dollars. I have five thousand dollars cash, and all of my possessions are valued at about four thousand dollars. And that’s literally everything. I have no life savings, financial savings. I have an incredible amount of life savings: relationships with the earth, with people, with plants and animals. I have no retirement fund, nothing of that sort. And so I’m sure there’s people that assume I am hiding money. My five thousand dollars is not very hidden. If someone came to find it, they would find it. And that’s all of it.

…I know that technically if you exchange resources that you’re supposed to report that and even pay taxes on it. Now that, I will outwardly say, is just absolutely unreasonable and absurd for you to say that I grow apples on my tree that are a gift from the earth, that have never been monetized prior to a very recent time in human history, and I simply eat that apple or simply give it to my neighbor, and then they give me some sochan, some leafy greens that they grew, and we are required to report that to the government as taxable income? That is absolute absurdity.

The only way I would do that is if I was willing to live in a state of delusion and oppression and exploitation, which I’m not. And so I do a lot of exchanging, and I’m willing to have that be publicly stated even though that would be technically something the government could come after me for. If the government ever comes after me for sharing my apples with my neighbors, I will be happy for them to knock on my door, because that is a conversation I would love to have and I would to love to take that publicly.

[Editor’s Note: Learn more about Robin Greenfield at robingreenfield.org. He recently wrote a piece about his war tax resistance at robingreenfield.org/tax. This interview will be continued in our next newsletter in June.]

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2024. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org.

Large Income Nonfilers Given Notice

When the IRS was given extra cash as part of the Inflation Reduction Act of 2022, they stated that the funds for enforcement would be primarily used for those with incomes above $400,000. In late February, IRS Commissioner Danny Werfel stated that the IRS will begin issuing notices to those high-income taxpayers that have not filed federal tax returns in recent years despite ample financial activity based on third-party reporting information. According to the commissioner, 125,000 cases have been identified where taxpayers making above $400,000 have not filed their taxes since 2017. We do not expect this to affect war tax resisters in our network, but if you do receive such a notice, please contact the NWTRCC office.

Passports and Seriously Delinquent Tax Debts

As has been previously noted in this column, those who have a “seriously delinquent tax debt” in the eyes of the IRS will receive a notice from the IRS that they cannot obtain a new passport or renew a current passport. If you currently have a passport, you can use it until it expires. When this law went into effect in 2018, a seriously delinquent tax debt was defined as one that was at least $50,000, but this number increases yearly with inflation. For tax year 2024, a seriously delinquent tax debt is one that is at least $62,000.

1099-K Reporting & Zelle Exception

You may receive a 1099-K as a gig worker selling goods on Ebay or driving for Uber. As a traditional self-employed person, you may receive this form if you receive credit card payments or payments from third-party processors like PayPal, Venmo, Cash App, etc. The sole purpose of the 1099-K form is to report third-party business financial transactions. The reporting threshold for the 1099-K in 2024 is $5,000. In 2025, it will drop to $600.

There are two notable exceptions to what is reported as 1099-K income. First, if when making a payment, the payer pays you as “family or friend” (with no fee charged), these types of payments are not supposed to be reported. The 1099-K is for reporting third-party business transactions. Second, Zelle is not subject to 1099-K reporting. Zelle is exempt is because it acts a mechanism for transferring money from one account to another. They never hold the money. In this sense, Zelle is similar to writing a check or a wire transfer. It simply transfers money between accounts without it ever being held by a third-party.

Many Thanks

Thanks to each of you who has donated in early 2024! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

We are very grateful to these alternative funds and WTR groups for their redirections and Affiliate dues: Birmingham War Tax Objectors; War Resister League; War Resisters League New England

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loop

We’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.org

Tax Resistance Ideas and Actions

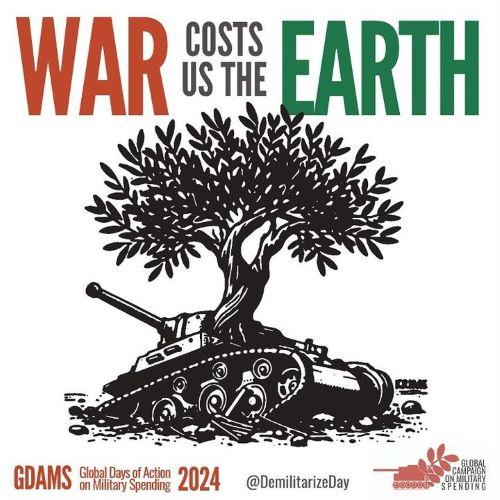

Divest from genocide!

Healthcare Workers War Tax Resistance Webinar

Healthcare workers have taken an oath to do no harm, yet through income tax, their labor funds genocides, dictatorships, and repression. For this session, health care workers promoted war tax resistance as a means by which they can divest their capital from the US war machine causing harm globally. The session was held on Zoom on Sunday March 17 and attracted about 75 attendees. The session was organized by Healthcare Workers for Palestine Bay Area, Do No Harm Coalition, and DisruptOT. The session featured two war tax resisters: Howard Waitzkin, MD and Lincoln Rice of NWTRCC. The session can be viewed at youtube.com/nwtrcc</em.

WTR Counselors in NYC are Busy

The latest interest in war tax resistance has brought emails and phone calls to NYC area counselors, and we are also excited to have the newly trained counselors with We the People active in the city. I have been contacted to answer questions on the W-4, freelancers with inconsistent income, and someone concerned about managing salary levies down the line.

A fellow activist arranged a presentation for an anarchist group at a very cool bookstore/meeting space (propertyistheft.org). Lida and I talked through NWTRCC’s basic 101 slideshow and answered questions for an attentive audience who were mostly new to WTR. Another friend arranged a house meeting where Ed Hedemann and I met six enthusiastic young women who met out in the streets for Palestine. They had many questions and a commitment to getting started with this form of resistance. One arranged a space for a more public workshop at the end of March. After tax day we’ll set up some meet-ups for support, encouragement, and hopefully a more visible presence for WTR in NYC again.

– Report by Ruth Benn

WTR Campaign in the UK over Gaza “Genocide”

In mid-March, several media outlets began reporting a new “No Tax for Genocide” campaign urging British citizens to stop paying taxes in protest of the government’s support for Israel’s war on Gaza. The campaign organizers claim that under international law, paying taxes to a government that aids and abets genocide is illegal. The campaign is currently collecting signatures. The signers agree to withhold their income and council taxes if at least 100,000 sign. [Editor’s aside: US courts have not recognized international law arguments by anti-war activists, citing national security.]

Are We Reaching the Tipping Point?

By Kima Garrison

There is a growing interest in war tax resistance. This became glaringly obvious when Paul Stretch and I recently led a WTR 101 workshop. We chose a community center, Alder Commons, which helped to organize and register people for the workshop. Online registration was capped at sixteen, but to our surprise, around thirty-five people showed up in addition to a dozen people online! I started by asking how many people were there because of what is happening in Gaza. Every hand went up. This really struck me, as it shows how much this is really affecting (the psyche of) our country (not to mention the world).

The workshop proved to be educational, not just for the participants, but for me as well (learning how the W-4 forms changed in 2020). 30+ people signed up for future workshops and meetings. We had a lively Q&A session and the conversations continued as we were leaving.

We now have a meeting set to be held in the Hollywood library’s community room, which holds 42 people. My guess is that the room will be standing room only! Maybe this is the tipping point where we can stand up as a nation and say, “WE’RE NOT BUYING IT!” As we know, there is strength in numbers and the numbers are growing. This country is founded on resistance, and now is the time to show that we are still a country with morals and a conscience and we are proud to stand up and say, “If you work for peace, stop paying for war!”

I Won’t Pay for Genocide

By Liam Crannell

Liam Crannell. Photo courtesy of Liam Crannell.

[Trigger Warning: The following letter by Liam Crannell to the IRS contains graphic descriptions of the horrors of war.]

The United States is currently funding a genocide. Since October 7th, 2023, at least 31,700 Palestinian people have been killed by the Israeli military. Of those 31,700 people, at least 12,400 were children. In 2023 and early 2024, the United States has allotted approximately $18 billion for Israel.

Hany Bsaiso amputated the leg of his teenage niece without anesthetic while she lay in agony on the kitchen table. Insects crawled on the chests of infants decomposing in the pediatric intensive care unit at Al-Nasr Children’s Hospital after being forcibly abandoned and left to wither away. Starving families gather to receive food aid; instead gunfire rains down. Over 100 are killed. We bear witness to depravity and despair beyond description. The blood of the Palestinian people is on our hands.

As a member of the Religious Society of Friends, I firmly believe in the centrality of peace and nonviolence. In this regard, the use of my tax dollars to fund violence infringes on my religious freedom. We are far beyond that. The torture and annihilation of the Palestinian people infringes upon our humanity.

I am engaging in war tax resistance because of the US-funded Genocide of the Palestinian People. Of the $81 I owe in federal taxes, 0.4% is allotted to the Israeli government for the killing of innocent civilians and children. I am refusing to pay that 0.4%, which amounts to 32 cents. One penny for every one thousand murdered Palestinians. We cannot measure the value of the lives lost, or the horror of the atrocities committed by the Israeli government with our tax dollars.

In solidarity with the Palestinian People, I have donated $81 to the Palestine Children’s Relief Fund. Despite this act of war tax resistance, I am still complicit in genocide. While I may be complicit, I will not be complacent. And I will not be silent.

“Many of us like to ask ourselves, ‘What would I do if I was alive during slavery? Or the Jim Crow South? Or apartheid? What would I do if my country was committing genocide?’ The answer is, you’re doing it. Right now.” – Aaron Bushnell

With Peace, Liam Crannell

Northeast Kingdom Quaker Meeting, Barton, Vermont

War Tax Resistance/Redirection at Community Mennonite Church

By Rick Yoder

In early March, Community Mennonite Church in Harrisonburg, Virginia devoted two Sundays to War Tax Resistance / Redirection. During the first Sunday worship service, scripture readings and hymns were selected to reflect resistance to the empire as well as express our vision of living out the historic Mennonite Peace witness. Many of the hymns were the same as those sung in and around the Canon House Rotunda during the Mennonite Action event of January 16, where 132 were arrested and a Gaza ceasefire petition signed by over 7,000 people was delivered to our members of Congress.

In place of the sermon, three people practicing WTR/R spoke about what they are doing and why. Each one was very moving. You can find the recording at youtube.com/watch?v=UZHGficy6Mc&t=2050s. During the adult education hour, attended by some sixty or seventy people, we used a circle process, giving people opportunity to briefly give any response to the three talks. This was followed by conversation and distribution of resources related to WTR/R.

During the second Sunday adult education hour, two people shared why they do not practice WTR/R and one person shared why they do. This led to a particularly rich conversation on various aspects of WTR/R. We also included some explanation and resources on WTR, especially the W-4 form. NWTRCC resources were particularly helpful in all this. Lastly, we invited people to participate in the annual Shenandoah Valley Taxes for Peace vigil that takes place downtown. [See details in the Tax Day article.]

NWTRCC News

NWTRCC National Conference: Resisting Together (May 3-5, 2024)

Our spring conference will be completely on Zoom. The details for the sessions are still being worked out, but the Friday evening session will begin at 8p Eastern with a social hour, in which participants will be randomly placed in small breakout rooms.

Saturday will begin at 11a Eastern. The sessions on Saturday will include simple living, retirement & saving, and a panel with newer war tax resisters who have been promoting war tax resistance. For the last panel, we have confirmed the two founders of We the People and the two founders of the Tax Resistance Collective. As always, there will be concurrent WTR 101 & 201 sessions.

On Sunday morning we will hold our business meeting, which is open to all. If you have a proposal you would like discussed at the business meeting, please send it to the NWTRCC office before April 15. Go to the NWTRCC website (nwtrcc.org) for full schedule and registration information.

Peace Walk 2024

In the tradition of the many wonderful long-distance walks for peace, Veterans for Peace has initiated a National Project to begin May 7, 2024, and walk from Maine to arrive in Washington, DC, in July. They’ll be walking for the wellbeing of all people, for peace and an end to the threat of nuclear war and all wars, and for an environment that supports all life. Folks can join the walk for as little or as long as they wish. NWTRCC endorsed this walk at its November meeting. For more info, go to peacewalk2024.org.

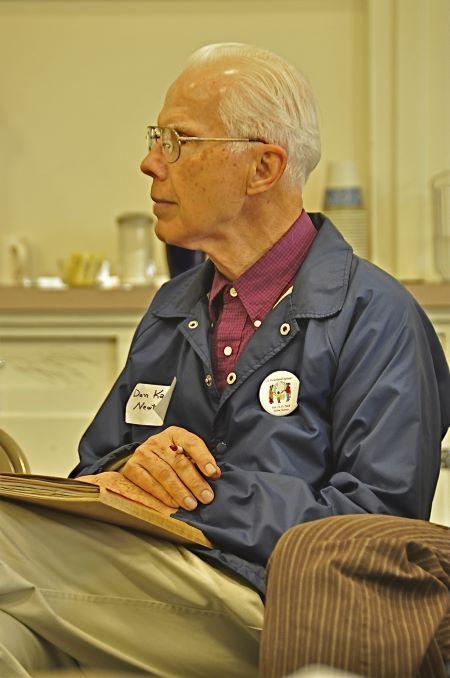

In Memoriam: Donald D. Kaufman

Don Kaufman at a NWTRCC meeting in 2009. Photo by Ray Gingrich

By Susan Miller

Don Kaufman was a humble leader who urged peacemakers to be consistent in their conscientious objection to war by not only refusing to serve in the military with their bodies, but also by not paying for war with their taxes. He pricked the consciences of those who believed that they must obey all laws of their country even if such laws contradicted God’s higher law. At times, his was a lonely stance.

Don died on Dec. 18, 2023, less than a month before his 91st birthday, in North Newton, Kansas. He was born on Jan. 10, 1933 and grew up on a farm in Marion, South Dakota. He graduated from Bethel College, North Newton, Kansas and Mennonite Biblical Seminary which was then in Chicago, where he met Eleanor Wismer. Don and Eleanor were married nearly 61 years before her death in 2019.

Don served as pastor in two churches in Minnesota and at Bethel College Mennonite Church. He worked a variety of secular jobs after that, including managing HUD housing for disabled persons at Wheatland Homes in North Newton. He was a gardener and he planted more than fifty trees around Sunset Elementary School near his home in Newton.

He will be remembered for his biblical and philosophical study and promotion of Conscientious Objection to Military Taxation. He supported peace tax legislation that would provide an alternative fund for taxes assessed to conscientious objectors. He critiqued Mennonite institutions for their reluctance to break civil law that ordered them to collect the income taxes from employees who felt compelled to resist and redirect war taxes.

He wrote two books, What Belongs to Ceasar and The Tax Dilemma. He delivered twenty-five boxes of his collections from life in Indonesia and his unique studies to the Mennonite Archives in the Bethel College Library and began the task of sorting them while he was able.

Don was a founding member of the Heartland Peace Tax Fund group and continued sharing with the group until it closed a few years ago as members aged out. The Heartland group affiliated with National War Tax Resistance Coordinating Committee (NWTRCC) in the 1990s and Don helped plan and host two of the national meetings in Kansas and served on NWTRCC’s Administrative Committee for one term.

A memorial service will be held on April 13, 2024 at 11 a.m. at Bethel College Mennonite Church in North Newton. The service will be livestreamed from the church. (bethelcollegemennonitechurch.org/live-stream/)

[Editor’s note: Some of the details of Don’s life were taken from his obituary in the Newton Kansan. Also, a very similar article penned by Susan Miller is being printed in the Anabaptist World.]

Perspective

My Letter to the IRS

Murtaza Nek (center) at May 2023 NWTRCC conference in Indiana. Photo by Lincoln Rice

By Murtaza Nek

Hi! I hope all’s well on your end. My name’s Murtaza Nek, I’m a math and science tutor at Henry Ford College in Dearborn, Michigan. I usually file my taxes using online e-filing software, but this time felt the need to communicate a message which wasn’t possible using said software. I’ve thus put in much extra effort to make sure this return was filed as accurately as possible.

I wanted to write to express a nuanced opinion regarding tax collection. First and foremost, I am not opposed to it at all in principle. I appreciate the essential role that collecting funds from a nation plays in helping run the organizational aspects of the nation: ensuring social programs are funded, ensuring there is a social safety net for the less fortunate (as I myself have benefited from), paying for roads and infrastructure, and even for providing international aid and ensuring national defense, when it is needed or warranted.

But to this last point, my lifelong experience as a reasonably well-informed taxpaying American citizen has been that there is a huge gap between what would be considered reasonable use of taxes and federal funds towards international affairs, and how taxes and federal funds are actually used in international affairs. The US uses an inordinate fraction of its federal budget on military spending, about 1/6 of it over the past decade for example, and about half of discretionary spending goes towards the military. The US spends about as much or more on its military than the next 10 countries combined, when listed in order of military spending.

Furthermore, this spending, while seemingly done for the purposes of (a) lining the pockets of military vendors and contractors who lobby Congress aggressively, (b) securing oil, natural gas, and other resources the US seems addicted to, and (c) ensuring economic dominance, e.g. by normalization of the US dollar as a de facto international currency, is not making the US safer in the long run, and I believe is increasingly alienating and isolating the US in the world stage.

What’s worse is that this military dominance is costing countless innocent lives. Examples in US history are abundant, but just one among many things going on now seems particularly egregious. The US government, in “emergency” and without Congressional approval or oversight, is rushing money and munitions, weapons of war, to a nation (Israel) found by the International Court of Justice to be plausibly engaged in acts of genocide.

By estimates found by the Israeli military itself to be reliable, Israel’s indiscriminate bombing and slaughter campaign has killed over 29,000 Palestinians in Gaza since October 7th, and hundreds more in the West Bank. Most of these deaths are of women and children, most of these deaths are of innocent civilians. The Israeli military has even killed their own hostages waving white flags. Israel’s military has repeatedly targeted journalists, healthcare workers, civilians waving white flags, injured hospital patients, and in a particularly egregious incident among far too many to count, assassinated a 5-year-old girl, Hind Rajab, waiting to be rescued by a pair of Palestinian Red Crescent paramedics who communicated and coordinated with the Israeli military their whereabouts and intentions, and who themselves were also assassinated. Of course the Israeli military subsequently claimed to not be aware of that situation, as they are known to lie repeatedly and then sometimes concede the truth after the heat is off them.

In short, the US has become possibly irrevocably isolated from the rest of the world for supplying a genocidal military with countless billions of dollars in funding for weapons of war (crimes), used indiscriminately to kill innocent children, women and men. Even President Biden himself has been recently reported to have described the Israeli prime minister Netanyahu as being a “bad f***ing guy,” and younger Israeli military members are regularly bragging about their war crimes on TikTok and social media. The vengeance of the Israeli military is unfathomable, and I believe the consequences of their actions are isolating both Israel and the US from the rest of the world.

In an ideal world, I’d be a proud taxpayer. But I cannot be proud of even a penny of my tax dollars going towards rogue nations which are known to be committing war crimes and crimes against humanity. I am thus writing to express opposition to my tax dollars being used for military purposes of any kind. I know this is not in your jurisdiction as an IRS worker, but I needed to write this letter to speak my peace. I feel the world would be a better place if the federal government spent our tax dollars in ways that did not cost the lives of innocents, and prioritized the needs of its own citizens first.

Anyway, I hope this letter had some kind of positive effect, even if just one IRS worker looks at it. I wrap up by reiterating that my 1040 filing is a complete, accurate filing to the best of my knowledge, and there’s nothing frivolous about it, despite this very serious letter. Thank you for reading!

Sincerely, Murtaza Nek

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org