More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

October – November 2021

Contents

- NWTRCC Website Receives a “Refresh”

By Lincoln Rice - IRS Circumvents “Statute of Limitations” By Ruth Benn

- Counseling Notes: IRS Clarifies Bank Levies • Levies on Social Security Can Continue Past 10-Year Statute of Limitations • Appellate Court Upholds Passport Rule • IRS Contracts with 3 Private Debt Collection Agencies

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- NWTRCC Online Charity Art Auction Ends November 6!

- Moral Injury: It’s not just for Soldiers by Chrissy Kirchhoefer

- Tax Resistance Events Individual Resistance & Collective Power

- Network News & Outreach Reports: Taxes for Peace New England Desires to Educate on War Tax Resistance • Peace Tax Fund Legislation Reintroduced • Peace Week WTR 101 Session • WTR 101 at Midwest Catholic Worker Gathering

- Profile: Starting to Live by My Own Rules

By Angie Morben

Click here to download a PDF of the October/November issue

NWTRCC Website Receives a “Refresh”

A couple summers ago, we held focus groups with younger activists to explore ways in which NWTRCC could perform better outreach to younger people. Based on their feedback, we have already adapted how we use social media—particularly Twitter and Instagram. Another piece of feedback from that group was that our website looked dated, which may cause some younger people to question the legitimacy of what we are promoting.

After talking to some of our tech support people, we decided the best option was to “refresh” our website. The information on the website and how one navigates the website is unchanged, but we have updated the color scheme and given the site a modern look.

I am very thankful to some of the younger war tax resisters in our network who provided ideas and feedback for the website refresh. We are also very thankful to our financial donors, who made this upgrade possible.

Our website contains an abundance of resources, which makes it larger than the websites of most other groups. Each year, over 40,000 people visit our website and the average person looks at nine of the pages on our website. This indicates that there are a lot of people using our website as a resource for their war tax resistance. Refreshing a website with so much information on it will inevitably result in a few glitches. If you notice any, please contact the office. And thank you in advance for your patience.

IRS Circumvents “Statute of Limitations”

By Ruth Benn

Three letters arrived from the IRS within a week of each other. On the one hand this is rather exciting since the IRS has been quiet for the last few years, and I haven’t had much to report as far as consequences of refusal to pay. At the same time, it could take months of correspondence to sort out what they’ve done.

I am self-employed and file and refuse to pay the federal income tax to the feds although I redirect it to good causes. But I have been paying the Social Security/self-employment tax. (For the 2019 form 1040, the federal tax was line 12 and the self-employment tax was line 15. For the 2020 form 1040, the federal tax was line 16 and the self-employment tax was line 23.)

The Notice CP23 that arrived at my door was titled “Changes to your 2019 Form 1040,” and the IRS made some income adjustments but the bottom line for any tax due didn’t change. The part that was annoying about this letter was the $435 “Failure-to-file” penalty, which seemed a bit odd since they were correcting the form that they had obviously received. I have never sent my forms by certified mail, so I have no proof of the date I filed but I am contesting this penalty.

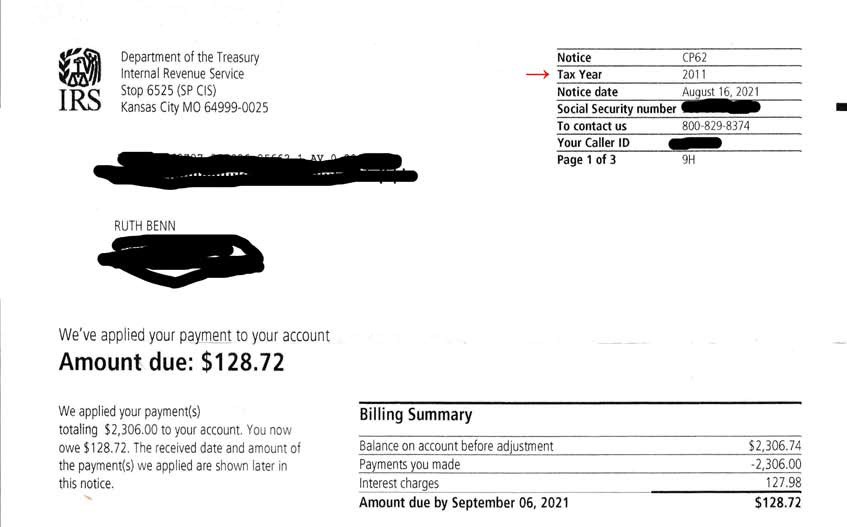

The next two letters arrived together a few days later and were somewhat more mysterious. It took me a while to sort out what the IRS had done. These were both Notice CP62, one for Tax Year 2011 and one for Tax Year 2012. The title on the letters says, “We’ve applied your payment to your account.” Each letter showed a new amount due for that tax year. On the back was a list of “payments credited to your account.”

What the IRS did was take my estimated or final payments for Social Security/self-employment tax for Tax Year 2020 and apply those payments to 2011 and 2012 debts they say I owe.

This seems to be an improper (perhaps illegal?) effort by the IRS to circumvent the 10-year statute of limitations on collecting debt for those of us who file and refuse to pay.

I asked Lincoln at the NWTRCC office if he had seen anything about this, and he helpfully replied:

My understanding from court cases I’ve seen over the last few years (via Checkpoint Newsstand) is that the IRS can choose to apply funds to any tax year they want IF they collect the funds from you involuntarily. But if you are making a voluntary payment, which you were doing, then it’s your choice to choose which year you want a payment applied. The cases I have seen were always rich people bringing the IRS to court over how the IRS applied involuntarily collected funds, so the plaintiffs always lost, but that’s how I heard about this issue.

And then he followed up with this find regarding “payment designation”:

Rev. Rul. 73-305, 1973-2 C.B. 43, holds that partial payments of assessed tax, penalty, and interest are to be applied as the taxpayer designates. If the taxpayer fails to give specific instructions as to the application of the partial payment voluntarily tendered, the amount of such payment will be applied by the [Internal Revenue] Service to tax, penalty, and interest, in that order, for the earliest period, then to tax, penalty, and interest, in that order, for the next succeeding period, until the payment is absorbed.

The Supreme Court has stated: “IRS policy permits taxpayers who ‘voluntarily’ submit payments to the IRS to designate the tax liability to which the payment will apply.” United States v. Energy Res. Co., 495 U.S. 545, 548 (1990); see Slodov v. United States, 436 U.S. 238, 252 n.15 (1978) (noting exception where payment “results from enforced collection methods”).

I have written a letter to the IRS at the Kansas City office that generated these notices asking for the late filing penalty to be removed and then listing the payments that they misapplied and asking them to be correctly applied to 2020.

It might take ages to sort this out, so stay tuned for future reports, but if any readers have had this experience, feel free email me at rbenn@nwtrcc.org.

Despite the potential hassles dealing with this, I am reminded of a pair of war tax resisters from years back who got a notice from the IRS and were thrilled. They had not heard anything for the first couple years of their resistance and felt they were being ignored. When I get nervous about seeing that distinctive envelope in the mailbox I remember them and it makes me smile. Resistance comes with consequences; we just hope that someday one of the consequences will be total redirection of the Pentagon budget to life, not death.

Counseling Notes:

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click on “Local Contacts & Counselors”).This training is usually offered once a year and the next training will be online in early 2022. If you would be interested in attending one of these trainings, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

IRS Clarifies Bank Levies

As Ruth Benn noted her article on page 1, the IRS wrongly applied estimated Social Security tax payments for Tax Year 2020 and applied them to Ruth’s 2011 and 2012 tax debt, which was set to expire shortly due to the 10-year statute of limitations that begins once one’s taxes are filed.

Please alert the NWTRCC office if this happens to you. As stated in that article, Revenue Ruling 73-305, 1973-2 C.B. 43 clearly states that payments of assessed tax, penalty, and interest are to be applied as the taxpayer designates. If the taxpayer fails to give specific instructions as to the application of a payment voluntarily tendered, the amount of such payment will be applied by the IRS to tax, penalty, and interest, in that order, for the earliest period, then to tax, penalty, and interest, in that order, for the next succeeding period, until the payment is absorbed.

Additionally, the Supreme Court has stated: “IRS policy permits taxpayers who ‘voluntarily’ submit payments to the IRS to designate the tax liability to which the payment will apply.” United States v. Energy Res. Co., 495 U.S. 545, 548 (1990); see Slodov v. United States, 436 U.S. 238, 252 n.15 (1978) (noting exception where payment “results from enforced collection methods”).

Levies on Social Security Can Continue Past 10-Year Statute of Limitations

In July 2021, the IRS released Chief Counsel Advice 202129006, which explained the effect of the 10-year statute of limitations on collection on various levies. The report confirmed that a levy on salary or wages payable to or received by a taxpayer continues from the date of the levy until either the debt is paid or the 10-year statute of limitations is reached.

Under the Federal Payment Levy Program, the IRS can collect overdue taxes through a continuous levy on certain federal payments disbursed by U.S. Bureau of Fiscal Service.

However, in the case of a levy specifically on Social Security income under Code Sec. 6331(a), the levy can continue after the 10-year statute of limitations because the taxpayer has a fixed and determinable right to future payments of Social Security income at the time the levy arose.

To be clear, the IRS must place the levy for a certain tax year on one’s Social Security before the end of the 10-year statute of limitations for the garnishment to continue past the statute of limitations. Please let the NWTRCC office know if you are having your Social Security garnished for a tax year that has reached the 10-year statute of limitations.

Appellate Court Upholds Passport Rule

In 2018, a law went into effect that states that the IRS should alert the State Department of anyone with a seriously delinquent tax debt ($54,000 in 2021). And that the State Department will no longer permit these individuals to receive a new passport or renew an old one.

In July 2021, the first appellate court to review the law upheld it as Constitutional, although on limited grounds. In its opinion in Maehr v. Department of State, the 10th Circuit Court of Appeals upheld a decision by a U.S. District Court judge in Colorado dismissing a lawsuit by Jeffrey T. Maehr, one of almost half a million people who have been deemed subject to non-issuance of U.S. passports, and thus prohibited from legally leaving the U.S. once their passports expire because of a tax debt.

Two judges wrote opinions in support of the decision, each joined in different parts by the third member of the three-judge panel. All three judges found that although there is a “right” to international travel by U.S. citizens, it is not a “fundamental” right.

Two of the three judges stated that restrictions on the right to travel should be permitted as long as the government agency imposing the restrictions can show any “rational basis” for the restriction. Although the government made no attempt to argue that there was any particular relationship between tax delinquency and fitness to travel, the government stated that the law is meant to serve as an incentive for tax compliance.

Two of the three members of the 10th Circuit panel found that providing this incentive for paying taxes was a sufficient “rational basis” for imposing this collateral consequence.

The third member of the panel scrutinized this argument, but concurred in the decision because the plaintiff had not made a sufficient argument against the law. It should be noted that the plaintiff only had court-appointed lawyers. [Much of the above information was from an article in Papers, Please! The Identity Project.]

IRS Contracts with 3 Private Debt Collection Agencies

When the IRS began contracting again with private debt collection agencies in 2018, it contracted with four agencies to harass those with a federal tax debt. As of 23 September 2021, they ended their contracts with Performant (Pleasanton, CA) and Pioneer (Horseheads, NY). As of now, the IRS only contracts with three collection agencies: CBE (Waterloo, IA), ConServe (Fairport, NY), and Coast Professional (Albion, NY).

The IRS will always send you a letter informing you if your tax debt has been assigned to one of these three agencies. Private firms are not authorized to take enforcement actions against taxpayers. Only IRS employees can take these actions, such as filing a notice of Federal Tax Lien, garnishing wages, or issuing a bank account levy.

The private firms are authorized to discuss payment options, including setting up payment agreements with taxpayers. But as with cases assigned to IRS employees, any tax payment must be made directly to the IRS. A payment should never be sent to the private firm or anyone besides the IRS or the U.S. Treasury. Anyone suggesting otherwise is a scammer.

Many Thanks

Thanks to everyone who donate to NWTRCC! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

We are very grateful to these WTR groups and alternative funds for their redirections

and Affiliate dues: Episcopal Peace Fellowship; Christian Peacemaker Teams; War Resisters League

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. Thank you!

Tax Resistance Events

Individual Resistance & Collective Power

In an Era of Endless War & Climate Crisis

National War Tax Resistance Conference

November 5-7, 2021 · Online

Climate Change Image by MasterTux from Pixabay

Due to the pandemic, the fall NWTRCC National Gathering will be online once again. Our first Saturday session will feature panelists from two very active and creative tax resistance groups: Money Rebellion and Grup Antimilitarista Tortuga. Money Rebellion, an arm of Extinction Rebellion UK, is working to disrupt the economic rules and institutions driving us toward societal collapse during this time of climate and ecological emergency. This panel will also include a representative from Grup Antimilitarista Tortuga, a very active war tax resistance group that formed in Alicante, Spain in 1999. They are fiercely dedicated to creative nonviolence and also coordinate with War Resisters’ International.

The second session on Saturday will feature Peter Goldberger, an attorney in Ardmore, Pennsylvania, and a longtime legal consultant to NWTRCC. He previously spoke at NWTRCC’s 2014 conference on “What Does the Supreme Court’s Hobby Lobby Decision Mean for War Tax Resisters?” The subject of his talk has yet to be determined, but will be topical.

Logos for Money Rebellion & Grup Antimilitarista Tortuga.

For the most recent information on the gathering, including registration information, go to nwtrcc.org/programs-events/gatherings-and-events/ or call the NWTRCC office.

NWTRCC Online Charity Art Auction Ends November 6!

NWTRCC is holding its second online charity art auction. The auction is being coordinated by NWTRCC’s fundraising committee, along with the generous time and effort of Carlos Steward, director the Flood Gallery Fine Art Center in Black Mountain, North Carolina.

The auction is taking place online and at the Flood Gallery Fine Art Center, giving folks in the local area a chance to see the items up close and place bids. The auction ends on November 6, 2021 at 11:59pm.

A link to the auction website can be found on the NWTRCC homepage. New auction items were recently added to the site. Please share links to the auction on your social media accounts (if you use social media).

Network News & Outreach Reports

Taxes for Peace New England Desires to Educate on War Tax Resistance

War tax resisters—some who began their resistance just in the past couple years and others who have been doing it for decades—came together on August 4th and September 2nd in virtual meetings to start a discussion on forming a new regional group to serve people in western Massachusetts, Vermont, and beyond. The group settled on the name Taxes for Peace New England (TPNE) after considering a dozen possibilities; those present appreciated the aspirational and positive qualities of the name (i.e. saying what the group desires—peace) and the geographic inclusiveness.

TPNE members have indicated a strong desire to educate their communities about war tax resistance, to be in solidarity with other peace and justice movements, and to offer in person connections to resisters and allies. To that end, group members are looking for opportunities to collaborate with other organizations, particularly around the International Day of Peace. TPNE is encouraging people to fill out its interest form at http://tinyurl.com/yzufcv2b. Their new website is located at www.taxesforpeacenewengland.weebly.com/ and a list-serve is currently being created. An October meeting is also in the works!

Report from Lindsey Britt

Peace Tax Fund Legislation Reintroduced

I am happy to inform you that our bill, now H.R. 4529, “The Religious Freedom Peace Tax Fund” was introduced in July. Our new sponsor, following in the footsteps of the late Congressman John Lewis, is Representative Jim McGovern of Massachusetts. We are thankful for his leadership supporting the constitutional rights of conscientious objectors to war via our income taxes.

One of our most important tools in advocating for the passage of H.R. 4529 is our online petition (peacetaxfund.org/petition/). Please sign our petition and share it with others! Our petition can be found on our web site. In the coming days we will be sending out more information on engaging your member of congress regarding H.R. 4529.

I am under no illusion that one party wears a white hat when it comes to military spending and war. However, we are presently in a rare place as both the U.S. Senate and House of Representatives, in addition to the White House, are controlled by the Democrats. I believe this is a window of opportunity and a reason for hope for the creation of a peace tax fund. So, please sign our petition and share it with others. I also ask you to contact your member of congress and please let us know about your efforts so that we will know what members are being contacted. You can email us at info@peacetaxfund.org

Report from Malachy Kilbride

Peace Week WTR 101 Session

21 September 2021 – As we did last year, NWTRCC consultants Lincoln Rice and Chrissy Kirchhoefer offered a WTR 101 workshop on Zoom as part of Pace e Bene’s Peace Week, which coincides with International Peace Day. There were seven of us who met and went over the basics of war tax resistance. It was a mixture of younger wage workers and retirees.

Report from Lincoln Rice

WTR 101 at Midwest Catholic Worker Gathering

18 September 2021 – NWTRCC Coordinator Lincoln Rice led a WTR 101 session at the Midwest Catholic Worker Gathering in Preston, Iowa. It was the first time that NWTRCC has held a 101 session in person since before the pandemic. Six folks joined the session, but many others asked questions throughout the weekend. Most of the participants were low-income, but wanted to be more informed about WTR methods and consequences if their annual wages increased.

Report from Lincoln Rice

Moral Injury: It’s not just for Soldiers

By Chrissy Kirchhoefer

“It’s been a hard week for Afghanistan veterans,” began an article on the front page of the local newspaper. Although there has been a dizzying amount of every person turned pundit about the war, many of them are on the defense industry dole and would like to see the war continue into a third decade. It seemed like an afterthought to mention those who keep the war machine well oiled—barreling across whatever terrain it wants to travel. It also centered the nationalism required to keep the U.S. empire going.

The cessation of the U.S. occupation of Afghanistan has brought to light the obvious futility of war. We are all responsible for the harm done as U.S. taxpayers. The tension that has been brewing for 20 years has shifted from “boots on the ground” to drones in the air; and from U.S. military evacuations to economic sanctions in a matter of days.

World War III Countryballs from Wikimedia Commons

While there are many reasons I have not signed up for a job that has as a requirement of training to kill or maim others, I would be deceiving myself if I did not acknowledge the role that we all have had in the harm done by the United States the world over. Perhaps we can learn to relate to the moral injury caused by our war on terrorism as it expands and scorches our collective home, Earth.

While there are many reasons to engage in war tax resistance, for me it weaves both the personal and collective together to bind what is disconnected. I can acknowledge that I am still complicit in the harms committed in my name. Although it may seem like a drop in the bucket, I refuse to freely put into the pot that goes against life. It is also an act of empowerment to remember that the majority of people share in this desire to invest our resources into that which supports life.

A few years ago, Pope Francis stated at a World War I memorial that World War III had begun “spread out in small pockets everywhere… fought piecemeal, with crimes, massacres and destruction.” He continued: “these plotters of terrorism, these schemers of conflicts just like arms dealers, have engraved in their hearts, ‘What does it matter to me?’”

The climate emergency and the new generation of nuclear weapons puts an Albert Einstein quote in perspective: “I know not with what weapons World War III will be fought, but World War IV will be fought with sticks and stones.” When I approached the CEO of Boeing’s weapons production that has been producing the “smart bombs” which had been raining down upon the people of Afghanistan, Iraq, Yemen and told him of a tale of the devastation that one of the bombs caused a whole community, he replied, “I sleep well at night.”

It seems important to remind one another that as we observe those who pass through the revolving door of politicians, lobbyists, and military officials, that though they may be loud, they are still the minority. If the main language they speak is money, then we need to stop paying them. As we collectively take stock of the role of the U.S. military, we need to point out the reality that the majority of people are sick of war. We can choose to stop paying for it and encourage others to do the same.

Mark Twain brought to light the questioning of war in the Mysterious Stranger over a century ago:

There has never been a just [war], never an honorable one—on the part of the instigator of the war. I can see a million years ahead, and this rule will never change in so many as half a dozen instances. The loud little handful—as usual—will shout for the war. The pulpit will—warily and cautiously—object—at first; the great, big, dull bulk of the nation will rub its sleepy eyes and try to make out why there should be a war, and will say, earnestly and indignantly, “It is unjust and dishonorable, and there is no necessity for it.” Then the handful will shout louder. A few fair men on the other side will argue and reason against the war with speech and pen, and at first will have a hearing and be applauded; but it will not last long; those others will outshout them, and presently the anti-war audiences will thin out and lose popularity. Before long you will see this curious thing: the speakers stoned from the platform, and free speech strangled by hordes of furious men who in their secret hearts are still at one with those stoned speakers—as earlier—but do not dare say so. And now the whole nation—pulpit and all—will take up the war-cry, and shout itself hoarse, and mob any honest man who ventures to open his mouth; and presently such mouths will cease to open. Next the statesmen will invent cheap lies, putting the blame upon the nation that is attacked, and every man will be glad of those conscience-soothing falsities, and will diligently study them, and refuse to examine any refutations of them; and thus he will by and by convince himself the war is just, and will thank God for the better sleep he enjoys after this process of grotesque self-deception.

PROFILE

Starting to Live by My Own Rules

By Angie Morben

I’ve always been such a rule-follower. As I look back on life, I realize how much I blindly followed the rules simply because they had been established by some higher “authority.” I was that way throughout childhood and all the way into adulthood. This rule-following behavior included unquestionably paying my taxes without the full knowledge of what I was paying for.

I’m now learning that many aspects of our government have always been a little (or a lot) crazy throughout history. Until recently I’d been in somewhat of a bubble, really not aware of the intricacies of politics and many world issues. However, the absolute insanity of the past few years has really forced me to take a good look at how our government is run, who the key players are, how our history has shaped us as a country, and — importantly — where my tax dollars are going.

The more I learned, the more uneasy I became. In particular, I started to think of war in terms that were no longer just abstract—I started to think about how my actual physical dollars are helping to train someone to kill someone else, or to develop/buy weapons that will kill someone. I also learned how U.S. military endeavors are contributing to environmental destruction—it’s horrifying. I truly started to see human beings all over the world as something more than just statistics on paper, and I started to feel ill. These are human lives, just like mine. Every last one of them. For years, I’ve been playing a part in funding war with my tax dollars. Not anymore. About a year and a half ago, I started the process of figuring out my best strategy as a war tax resister, and I’m still pondering all the details. There’s a lot to learn, but it’s an exciting movement, and one I’m proud to be part of.

I can’t predict the consequences of my tax resistance, but I’m finding that the consequences scare me less as time goes on. I find a lot of courage in the words and writings of well-established resisters. I consistently remind myself these days that despite my past rule-following behavior, I can now start making my own rules on how to live my life based on what’s really important to me. In fact, it feels like my responsibility to ensure that my actions are consistent with what I believe to be morally right without, as Juanita Nelson said, “waiting for 150 million others to concur.”

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org