National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

October – November 2023

Contents

- NWTRCC Gathering in West Harrison, New York

By Lincoln Rice - Juanita Nelson Celebration in Happy Valley By Lindsey Britt

- Counseling Notes IRS Wrongly Applies Estimated Tax Payments to Earlier Tax Debt…Again • IRS Will Utilize Artificial Intelligence for Audit Targets

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Network News and Update Reports: NWTRCC & Pace e Bene Collaborate for Peace Week • Report Back from Conscience UK Meeting • Conscience Taxes for Peace not War • WTR 101 at Midwest Catholic Worker Gathering • WTR Office Hours at the Library • NWTRCC Poll for Online Event

- War Tax Resistance News: Lawyer Advocates Tax Resistance as a Tool in Israel

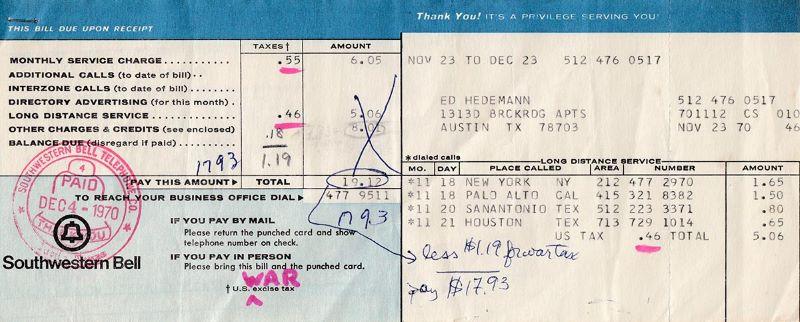

- It All Began with the Telephone by Ed Hedemann

- PROFILE: Brief History of the War Tax Resistance Penalty Fund by Peter Smith

Click here to download a PDF of the October/November issue

NWTRCC Gathering in West Harrison, New York

November 3-5, 2023

By Lincoln Rice

NWTRCC’s May 2023 in-person conference in Indiana was not NWTRCC’s most well-attended gathering, but it was very energizing. Lucia van Diepen travelled from Connecticut to attend the conference and witnessed this energy in person. On returning home, she reached out the Purchase Friends Meeting in West Harrison, New York and we soon had a place to eat, sleep, and meet this coming November.

Friday Night

On Friday evening, we will have supper followed by a session that will examine what was missing in this summer’s Oppenheimer film. We have confirmed Mari Inoue, attorney and cofounder of the Manhattan Project for a Nuclear-Free World, as one of the speakers and we are currently working to confirm one more.

Saturday Sessions

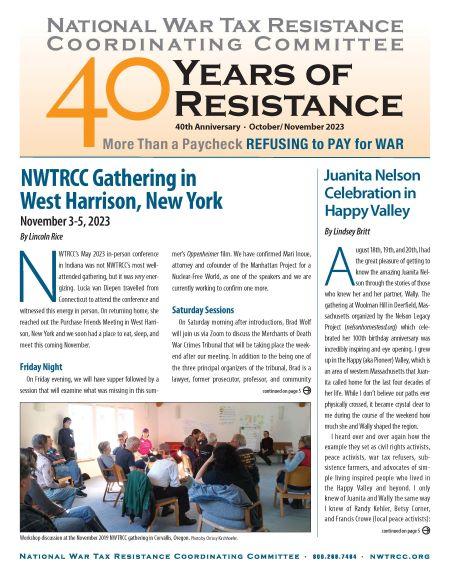

Workshop discussion at the November 2019 NWTRCC gathering in Corvallis, Oregon. Photo by Chrissy Kirchhoefer

On Saturday morning after introductions, Brad Wolf will join us via Zoom to discuss the Merchants of Death War Crimes Tribunal that will be taking place the weekend after our meeting. In addition to being one of the three principal organizers of the tribunal, Brad is a lawyer, former prosecutor, professor, and community college dean. He also cofounded the Peace Action Network of Lancaster, Pennsylvania.

After an early lunch, we will join the Concerned Families of Westchester for their weekly vigil. They have been vigiling every weekend since 2001 and plan on matching that Saturday’s theme to NWTRCC’s mission against federal taxes for militarism. Right now the working title for the demo is “Guns and Butter.”

After lunch, we will host a session celebrating what would have been Juanita Nelson’s 100th birthday. Juanita Nelson was one of the founding members of the modern war tax resistance movement in the U.S. During a previous weekend in August, her life was celebrated near her home in Massachusetts (see other article on page 1) and we plan on continuing that celebration. Joanne Sheehan of the War Resisters League and Bob Bady, a longtime friend of the Nelsons, will get us started. Before finishing with supper on Saturday, we will host concurrent WTR 101 and 201 sessions.

Sunday Business Meeting

Photo from Purchase Meeting House website

As always, we will hold our business meeting on Sunday morning from 9am until noon Eastern. At this meeting, NWTRCC will discuss and reach consensus on its objectives and budget for 2024. We will also discuss any proposals from the larger network. If you have a proposal that you would like have considered at this meeting, please send it to the NWTRCC office before October 15th. This will give ample time for the proposal to be discussed online by people that may not be able to attend in person.

Logistics

The meeting house is quite large and can easily accommodate fifteen folks with sleeping bags. If you are traveling to the conference, please register ASAP on the NWTRCC website (nwtrcc.org). We can pick people up who either arrive at the Westchester County airport or take a train either to the White Plains stop or the Westchester County Airport. It is relatively easy to catch a train to these locations from LaGuardia or Newark Liberty airport, but we would recommend avoiding JFK. As always, most of our conference will also be online. There is a link to register for the online component on the same page as the in-person registration.

Juanita Nelson Celebration in Happy Valley

By Lindsey Britt

Cutouts of Juanita & Wally Nelson. Photo by Lindsey Britt.

August 18th, 19th, and 20th, I had the great pleasure of getting to know the amazing Juanita Nelson through the stories of those who knew her and her partner, Wally. The gathering at Woolman Hill in Deerfield, Massachusetts organized by the Nelson Legacy Project (nelsonhomestead.org) which celebrated her 100th birthday anniversary was incredibly inspiring and eye opening. I grew up in the Happy (aka Pioneer) Valley, which is an area of western Massachusetts that Juanita called home for the last four decades of her life. While I don’t believe our paths ever physically crossed, it became crystal clear to me during the course of the weekend how much she and Wally shaped the region.

I heard over and over again how the example they set as civil rights activists, peace activists, war tax refusers, subsistence farmers, and advocates of simple living inspired people who lived in the Happy Valley and beyond. I only knew of Juanita and Wally the same way I knew of Randy Kehler, Betsy Corner, and Francis Crowe (local peace activists): I heard their names spoken by my family and teachers, saw newspaper articles mentioning them, and the like. They were all part of the fabric of the region. But until Juanita’s birthday anniversary gathering I never fully comprehended how much I owed her and these other folks for cultivating the soil (sometimes literally!) in which my life took shape. Juanita and Wally lived out their values and the ripple effect of their example shaped institutions, individuals, and systems both near and far.

It was so lovely to hear the personal stories of their friends and to understand how so many of us have incorporated the Nelsons’ ways of being into our lives in an effort to make the world a more compassionate, honest, and peaceful place. Being a war tax resister as well as a proponent and practitioner of simple living, I felt less alone after the weekend: I’m walking in the footsteps of so many wonderful people who believe like I do—and like Juanita and Wally did—that it is a worthwhile pursuit to examine our complicity with the causes of violence and to do better. A quote from Juanita is especially apt: “I am concerned to strive for a coherent, integrated life.”

I left the weekend with lots of ideas (some of which I’m already putting into action) and two questions:

1. How can I strive to be less complicit with violence in all its forms?

2. What am I capable of? What are we (my family) capable of? What is my community capable of? And on and outwards, because the Nelsons made it clear that we are capable of so much, especially when we join together.

Over the coming weeks I’ll return to those questions for inspiration and, whenever I’m feeling a bit lonely in my pursuit of peace, I will revisit the memories of my time spent with new friends at the gathering. I heard from her friends that Juanita and Wally wouldn’t like being put up on a pedestal, but I think she would have approved of the gathering as a way to meet new friends, feel renewed, and recommit oneself to constructive nonviolence. I will do my best not worship them as heroes, but add them to the list of inspiring people who have graced my corner of the world with their presence and reached far beyond it.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2024. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org.

IRS Wrongly Applies Estimated Tax Payments to Earlier Tax Year Debt…Again

Two years ago, the IRS wrongly applied one of Ruth Benn’s estimated Social Security / Medicare tax payments—also known as FICA. She intended the payment for Tax Year 2020, but the IRS redirected it to her 2011 and 2012 tax debts, which were set to expire shortly due to the 10-year statute of limitations that begins after one’s taxes are filed and processed. This issue has also happened to Ruth a couple times since.

With the IRS touting shorter wait times on the phone—she decided to call and actually got to a person in collection in ten minutes, though at one point she just began hitting zero over and over again to make this happen. Once she got through, Ruth had to be clear she was disputing a recent letter with penalties for an estimated underpayment. “It took a long time for her to get what I was talking about.”

For this phone call Ruth only focused on her most recent estimated FICA payment in January 2023 for tax year 2022, which was wrongly applied to taxes for 2012 and 2013. “For the next hour she would ask me questions then put me on hold. Of course the account must be a tangle. She asked if I was going to set up a payment plan, so I explained my refusal to pay voluntarily for war though that didn’t seem to phase her one way or the other.”

The IRS person finally saw what Ruth was talking about and would “come back from hold every few minutes to say she’s working on it.” But then the call dropped. Since the IRS person never called back, Ruth is not sure if the payment was correctly applied in the end. In addition, “I didn’t even ask about the estimated payments from last year or the year before that were applied wrong as just doing this one payment was clearly all she could handle.”

Please alert the NWTRCC office if this happens to you. Also, you would probably want to contact the IRS about it ASAP. Revenue Ruling 73-305, 1973-2 C.B. 43 clearly states that voluntary payments of assessed tax, penalty, and interest are to be applied as the taxpayer designates. If the taxpayer fails to give specific instructions as to the application of a payment voluntarily tendered, the amount of such payment will be applied by the IRS to tax, penalty, and interest, in that order, for the earliest period, then to tax, penalty, and interest, in that order, for the next succeeding period, until the payment is absorbed.

Additionally, the Supreme Court has stated: “IRS policy permits taxpayers who ‘voluntarily’ submit payments to the IRS to designate the tax liability to which the payment will apply.” United States v. Energy Res. Co., 495 U.S. 545, 548 (1990); see Slodov v. United States, 436 U.S. 238, 252 n.15 (1978) (noting exception where payment “results from enforced collection methods”).

IRS will Utilize Artificial Intelligence for Audit Targets

In early September, IRS Commissioner Daniel Werfel announced that the IRS will be employing artificial intelligence (or A.I.) as early as this month to target large earners for audits. A 2021 study by economists and IRS researchers discovered that the top 1% of U.S. income earners fail to report more than 20% of their earnings to the IRS.

I do believe the IRS when they state this is for folks making $400,000 a year or more. The IRS has been criticized in recent years for how often they audit impoverished people because of the IRS focus on critiquing the Earned Income Credit and how little they audit rich folks. Biden and the IRS have a good relationship. If they use this program to audit more folks making less than $400,000, that would harm Biden’s re-election bid.

Although A.I. could be used in different ways that may affect WTRs in the future, I don’t see this program affecting WTRs at the moment. Since most WTRs who file are honest on their forms, they are not the subject of audits. Audits are for people who the IRS believes are understating their income.

Many Thanks

Thanks to each of you who donate to NWTRCC! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

We are very grateful to these alternative funds and WTR groups for their redirections and Affiliate dues: Community Peacemaker Teams; St. Lawrence Catholic Worker (Kansas City, Kansas)

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loop

We’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.org

Network News & Outreach Reports

NWTRCC & Pace e Bene Collaborate for Peace Week

On Saturday, September 23, NWTRCC co-hosted an introduction to war tax resistance with Pace e Bene’s war tax resistance affinity group as part of Pace e Bene’s Campaign Nonviolence Days of Action. Chrissy Kirchhoefer and Cathy Deppe started with a PowerPoint presentation and then opened the floor to people’s personal experiences and questions.

We provided support, answers, and resources. Some of the resources we shared were how to fill out a W-4 form, our many practicals booklets, and “War Tax Resistance at a Glance.”

The session was called “Resist Through Redirection: Choose Your Own Adventure.” There were twelve of us for the session, with quite a few people from Oregon who are creating a statewide peace network. The next steps we encouraged were for people to join Pace e Bene affinity group to bring their questions and their visions for the world we envision creating!

Report from Chrissy Kirchhoefer

Report Back from Conscience UK Meeting

Conscience UK, which is NWTRCC’s British counterpart, had their business meeting Saturday September 23. For the first hour of that meeting, they welcomed general information on WTR from NWTRCC Coordinator Lincoln Rice, representatives from WTR organizations from Canada and Germany, as well as a representative from Conscience and Peace Tax International (CPTI).

Derek Brett from CPTI shared that they are continuing to work with the United Nations on expanding the rights of conscientious objector status to include war tax resistance, but have not had any success thus far with the cases they have presented from Canada and Germany. Derek also shared that in his native Switzerland, they have a voluntary tax system where the taxes of employees are not automatically withheld, but workers are supposed to pay them by March 31 for the previous year. This is also the situation in the United States, though it is less common in other European nations.

Jan Birk of the German group Netzwerk Friedenssteuer, shared that they are few and aging. They are putting less emphasis on promoting war tax resistance and more emphasis on rethinking the term “security.”

Lastly, Doug Hewitt-White of Conscience Canada spoke of the discernment process that their organization had recently concluded. This two-year process, in which dissolving the group was strongly considered, resolved to close their Peace Tax Trust Fund and work to expand the notion of conscientious objector to include not just objection to war, but also to abuse of the earth and native peoples, as well as other justice issues.

Report from Lincoln Rice

WTR 101 at Midwest Catholic Worker Gathering

WTR Session at Sugar Creek. Photo from St Louis CW Web

9 September 2023 – NWTRCC consultants Lincoln Rice and Chrissy Kirchhoefer led a WTR session at the Midwest Catholic Worker Gathering outside Preston, Iowa. There were seven of us at the session. Most of the attendees had previously attended a WTR session at the yearly gathering, but had follow-up questions and concerns as their individual situations had changed. We were very happy to have Charles Carney join us again, who is long time war tax resister and a local contact for NWTRCC in Kansas City, Kansas.

Report from Lincoln Rice & Chrissy Kirchhoefer

Lindsey Britt at her local library

WTR Office Hours at the Library

For International Peace Day on Thursday September 21, Lindsey Britt of Taxes for Peace New England held office hours in the community room of the Brooks Memorial Library in Brattleboro, Vermont—sharing info about #wartaxresistance.

Report from Lindsey Britt

NWTRCC Poll for Online Event

Image by John Mounsey from Pixabay

At the end of August, NWTRCC posted a poll on social media and also emailed it to those who have recently registered for NWTRCC gatherings. The main reason for this poll was to see what kind of online event our network would be interested in. Our previous May conference in Indiana was in person, but it had an online component and this will also be the case with our upcoming November conference in New York.

During the pandemic, we regularly had sixty households register for our online-only conferences and over forty actually attended. The number of online registrants dropped to twenty-three for our in-person Indiana conference. And about half of those online registrants attended some part of the conference.

Obviously, people are more interested in an online event when it is completely online. This permits greater and easier interaction among the online participants. Therefore, NWTRCC will plan an online-only event based on the results of this poll.

I am happy to report that our poll garnered thirty-six responses. Here is the breakdown of those responses.

Have you Previously Attended a NWTRCC Conference?

Only one of the respondents had not previously attended a NWTRCC conference. 80.6% had previously attended one of our conferences online and 86.1% had attended a conference in person.

What Type of Online Event would you Attend?

For this question, participants could check multiple boxes or add their own.

I will list those options that received more than one response:

83.3% – Panel Event with Speakers on a Timely Topic

55.6% – Social Hour Event

44.4% – War Tax Resistance 201

44.4% – Tax Day Organizing Session

33.3% – Social Media Workshop

19.4% – War Tax Resistance 101

Additional Comments

There were thirteen additional comments. Here are few: “If it’s online, I’m interested!” “I have a really unpredictable schedule and hope to be able to attend a future online event.” “Timing is everything. i.e. time zones! Seems I’m working or sleeping during much of what I’m interested in attending. And realize now, I’ve not watched/listened to recordings from May gathering yet! They get lost amongst the daily barrage…” “We need a talk about where do we go from here. What do we have to offer the peace movement, the climate movement, the movement against militarized policing. We need a concrete goal and a strategy to achieve it.” “I wish I had funds for travel!”

Plan of Action

There was a clear winner with the desire to attend an online event featuring a panel with speakers on a timely topic. At this point, Lincoln and Chrissy will work with the Outreach Committee to plan an event for mid-January. We will probably start planning in earnest after the November gathering. To make the event as interactive as possible, we will also make sure to take advantage of Zoom’s breakout room function.

A huge thank you to all who responded!!!

War Tax Resistance News: Lawyer Advocates Tax Resistance as a Tool in Israel

Lawyer Doron Levy. Image from his website

In August, Israeli international taxation lawyer Doron Levy publicly promoted tax resistance as a tool for societal transformation. He believes tax resistance can be a powerful resistance tool against governments that are transitioning from democracies to dictatorships. It’s a moral stance. He states:

“Tax resistance is not just about financial dissent; it’s a moral stance against supporting governments that engage in objectionable actions. It’s a way for citizens to voice their opposition and to withhold financial support from regimes they disagree with.”

Levy notes that his stance is inspired by American war tax resisters like Henry David Thoreau and William Lloyd Garrison. Levy’s stance was reported widely in the press and is also featured on his company website.

It All Began with a Telephone

Ed Hedemann’s first telephone bill. Photo by Ed Hedemann

By Ed Hedemann

Fifty-three years ago, as a cash-strapped University of Texas graduate student, I relied on my office phone at the astronomy department to save money. Consequently, I didn’t also need a telephone at home. But I got one anyway. It was my gateway to resisting taxes for war.

The year before, I had refused induction into the U.S. Army, but that felt a bit hollow to then just turn around and pay the taxes that funded the war in Vietnam. Fortunately, in 1970 I learned of a nonviolence weekend in San Antonio, sponsored by the American Friends Service Committee (AFSC), which featured veteran war tax resisters, including Wally Nelson among others. I learned that refusing the federal excise tax on telephone service was an effective way to protest the war since in those days, it really irritated the IRS that lots of people were blatantly refusing these small amounts of money and getting away with it. Mostly. The IRS tried to make an example of a tiny number of people by seizing bank accounts, salaries, and even bicycles, cars, and houses for nonpayment.

I was among those selected when the IRS twice had my entire $250-a-month teaching assistant salary seized for a measly $5 in tax. Nevertheless, both times—many months later—they eventually refunded almost all of what had been seized because of the interest they gave me on the $245 excess amount seized, virtually wiping out the $5 excise tax!

Those were the only times they recovered my telephone taxes. Over all the years of nonpayment, I’ve accumulated $999.99 in telephone taxes diverted from the IRS. In addition, my total resisted income taxes has accumulated to $85,000.

Now decades later, as my income has diminished, so has my ability to owe—thus resist—taxes. Am I celebrating? No. I didn’t start resisting just so I could claim I wasn’t paying for war but also to register a protest. Consequently, I’ll hang on to my landline to make sure I never lose that special opportunity to emphatically say, “No!” to the IRS,* no to war, not with my taxes you don’t and, at the same time, conduct an action the government cannot easily ignore.

*It’s possible the telephone provider swallows my unpaid federal excise tax rather than hassle with reporting such small amounts to the IRS, despite my telling them every month to be sure to report my nonpayment to the IRS.

Brief History of the War Tax Resistance Penalty Fund

By Peter Smith

[Editor’s Note: In the latest letter from the War Tax Resistance Penalty Fund, Peter Smith provided a brief history of the fund, which began the same year as NWTRCC. More information about the Penalty Fund can be found at wtrpf.org].

The last NWTRCC gathering was at Joyfield Farm in North Manchester, Indiana. This is the home of Cliff and Arlene Kindy and Bob and Rachel Gross, who, following the inspiration of Professor Ken Brown of Manchester College, founded the fund in 1982. According to the archived records at Swarthmore College,

“The War Tax Resisters Penalty Fund began in 1982 as a volunteer project of the North Manchester, Indiana Fellowship of Reconciliation. It supported and encouraged conscientious war tax resisters in the U.S. As of 1994, the group had worked with about 1000 tax resisters and supporters, and numbered 500 members nationally. Originally the group was called Tax Resisters Penalty Fund.”

In 1982, a core group of 83 people across the country decided they could easily share $463.14 in penalties and interest incurred by a few military tax resisters who appealed to the war tax resistance community for help. The more people they could recruit to shoulder the penalties and interest of resisters, the lighter the burden for everyone.

The base list of supporters has been as high as 600 people sharing the weight. After 1994, the frequency of appeals was greatly reduced and the North Manchester folks turned the operation of the fund over to Julie Garber—originally from North Manchester but living in Chicago. In 2013, the current steering committee from NWTRCC offered to take over the fund and Julie was happy to agree.

We sent our first appeal letter in the summer of 2014. By that time, the list of supporters had fallen to 200 since many of those in the North Manchester support group did not respond to our request to rejoin the fund. In nearly every appeal, at least 130 people respond, usually more. In all, we’ve paid out about $250,000 to help resisters stay in the struggle.

Before 2014, a share was determined by dividing the total requested by the number of members who had responded to the previous appeal. Whatever was collected was divided among those who had submitted an appeal. The current steering committee decided to not make a share greater than $30, but to continue quarterly appeals until all the requested funds have been collected. We welcome your comments and any ideas for improving the operation of the fund.

To find out more about the fund go to wtrpf.org, To add your name to our list of supporters, please send your name, address, and email to Peter Smith, 1036 N. Niles Ave, South Bend, IN 46617, or email him at psmith@saintmarys.edu.

WTRPF Steering Committee: Peter Smith (Indiana), Shulamith Eagle (Pennsylvania), Bill Ramsey (Pennsylvania), Shirley Whiteside (Iowa), Steve Leeds (California)

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org