More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

August–September 2020

Contents

- The Financial Priorities of Local Governments Mirror the Federal Government

By Lincoln Rice - Examining My Good Intentions

By Ruth Benn - Counseling Notes Correction to June 2020 Note on Head of Household Filing • Increasing Expiration of Tax Debt • IRS Practices during COVID-19 • Non-Filers and the IRS • Property Seizures, Levies, and Liens

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Tax Resistance Ideas and Actions Cleveland Nonviolence Network • The People’s Life Fund (abbr title=”People’s Life Fund”>PLF of the Northern California War Tax Resisters • Chattanooga Businesses Closed on June 16 to Defund the Police

- NWTRCC News and Events NWTRCC Outreach during a Pandemic • Mark Your Calendars for Next NWTRCC Conference • NWTRCC Charity Art Auction Raised $1,100 • Rest in Peace Ed Agro • Rest in Peace Stanley McCracken

- Profile I Act Out my Prayers by Saying “NO” to Paying for War By Sylvia Shirk

Click here to download a PDF of the August/September issue

The Financial Priorities of Local Governments Mirror the Federal Government

By Lincoln Rice

In 2017, I attended a retreat at the Su Casa Catholic Worker in Chicago where the black-led #LetUsBreathe Collective guided a mostly white gathering of Catholic Workers through various anti-racism exercises and candidly related the harsh racist reality of policing in the City of Chicago. They noted that approximately 50% of Chicago’s budget was dedicated to the police department, particularly when counting the millions of dollars the city pays out in lawsuits resulting from police misconduct. (“Misconduct” seems to be a totally inadequate term!) The group has regularly called for the city to redirect its $1.4 billion police budget to programs that would better serve the community. Imagine what could be accomplished with $1.4 billion!

When I was informed that nearly 50% of Chicago’s budget was being dedicated to “security,” I had some déjà vu, since every war tax resister knows that about 50% of the discretionary federal budget is also dedicated to “security.” Additionally, this call for redirection reminded me of the war tax resistance practice of redirecting refused federal income tax dollars to individuals and groups that are underfunded.

Once I returned to Milwaukee, I examined our own city budget and discovered that the City of Milwaukee also dedicates nearly half of its operating budget for the police department. With the great needs facing our communities and the repeated instances of police harassment (and sometimes murder) of black citizens by the Milwaukee Police Department, these financial priorities are terribly misplaced.

Photo by Betty Martin from Pixabay.

In the wake of the probable recession that may follow the COVID-19 pandemic, serious budget decisions will need to be made by local governments across the United States. The obvious answer would be to greatly scale back police funding to preserve the necessary services performed by city and county governments. But I have a difficult time believing that many local governments will have the courage to do this.

Obviously, when it comes to misplaced financial priorities on the federal level, war tax resisters have methods and options to resist funding military expenditures. These same options are not available on the local level, where property taxes, rent, sales tax, parking tickets, etc. fund our local governments. In this instance, I feel more like our war tax resistance neighbors in Canada and Europe, where federal tax withholding from wage positions is mandatory and war tax refusal is much more difficult.

Nevertheless, war tax resistance does allow us to participate in the defunding of police departments to some degree. “1033 Program,” named for the section of the National Defense Authorization Act (NDAA) of 1997 that granted permanent authority to the Secretary of Defense to transfer defense “material” to federal and state agencies for use in law enforcement, has allowed the U.S. military to transfer military-grade weapons to local police departments for decades. When one refuses to pay federal income taxes, one refuses to support this heinous program.

Additionally, we have now seen President Trump wanting to invoke the Insurrection Act of 1807, which empowers the president to deploy active U.S. military and federalized National Guard troops within the United States to suppress civil disorder, insurrection, and rebellion. Thankfully, there has been some push-back to this idea even from within Trump’s own administration. But this could still happen and it would be funded by federal tax dollars.

(As this goes to press, protesters in Portland, Oregon have been forcibly taken from the streets and put in unmarked vehicles and held for a period of time by federal agents!)

Lastly, police departments across the United States benefit from federal grants that support some part their budget. (For example, the Milwaukee Police Department was just awarded a $9.7 million grant from the Department of Justice to fund 30 police officers.) Drawing these connections between war tax resistance and the funding of police departments that consistently infringe on the rights of its African American citizens deserves to be highlighted as we work toward ending government-funded killings at home and abroad.

Lincoln Rice is the Coordinator for NWTRCC and lives in Milwaukee, Wisconsin.

Examining My Good Intentions

By Ruth Benn

[Editor’s Note: Ruth wrote this article in June 2020 in anticipation of Tax Day]

Photo by Ed Hedemann

Tax day is nearly here! I do find that a funny thing to say in June as I keep reminding myself that I should sit down and fill out the forms. My motto seems to be “put off until tomorrow what you can do today.” Still, as someone who files and refuses to pay, I can’t think of any reason to file before tax day, and I like to file on paper at the last minute as just another little way to gum up the system.

But planning for redirection has been on my mind lately, reinforced by the calls to defund the police and invest in badly needed services in communities long underfunded. I’ve also gotten quite a few emails from organizations or activists encouraging donations to Black-led groups as another prod to consider my redirections.

This reminded me of NWTRCC’s 2017 call to war tax resisters for “collective redirection to Black, Brown, and Indigenous Resistance.” Sam Koplinka-Loehr, Outreach Consultant at the time, was behind the text for the call, which outlined reasons for this campaign (the full text and reports of the redirection are on the website).

- Black, Brown, and Indigenous People are directly targeted by systemic racism and state-sponsored violence.

- Black, Brown, and Indigenous organizers in our communities are leading — and have been leading for generations— fierce campaigns to end state violence, dismantle white supremacy, and eliminate all forms of oppression. (The Movement For Black Lives Policy Platform lays out how our movements are deeply connected and how black organizers are leading the charge for systemic change both in the United States and around the world.)

- There is a huge wealth gap from the ongoing legacies of white supremacy and systemic racism that impacts households and organizations. In many communities, white organizers have access to more resources than Black, Brown, and Indigenous organizers.

- War tax resisters have long recognized the interconnections between our movements. The National War Tax Resistance Coordinating Committee (NWTRCC) statement of purpose reads, “NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars NWTRCC members contribute directly to the struggle for peace and justice for all.”

That last point said to me “put your money where your mouth is.” The collective redirection campaign did cause me to examine my usual redirection list and note that I was guilty guilty guilty of supporting mostly white-led organizations. While I focused on lots of good causes like feeding the hungry, sheltering victims of war, or promoting alternative media, I was not thinking about a deeper level of redirection that involves shifting resources.

This examination is an ongoing process. I’m not patting myself on my back for changes made as there’s always more to be done. Sam still deserves a nod for pushing us along the road to examine and act on the ways that racism and structural racism inveigle their ways into even our most sincere efforts to act for peace and justice.

Ruth Benn was the previous Coordinator for NWTRCC and submits regular blog posts on the NWTRCC website. She lives in Brooklyn.

Counseling Notes:

Correction to June 2020 Note on Head of Household Filing

Last month, one of the counseling notes incorrectly stated that to qualify for the advantageous head of household filing status, one must be unmarried, claim a dependent who lives with the filer at least six months of the year, and the filer must have paid over half the living expenses for themselves and the dependent. In actuality, a person can be married and claim this status, but the filer must not have lived with their spouse for the last 6 months of the year and this situation is expected to be permanent.

Increasing Expiration of Tax Debt

ProPublica has documented the historic rise of tax debt expiration, which occurs for war tax resisters ten years after filing their taxes. In 2010, roughly $564 million expired. In 2019, $6.7 billion expired. That is an increase of almost 1200%. ProPublica believes this increase is due to the drastic cuts made to the IRS since the Tea Party wave gained influence in the House of Representatives following the November 2010 elections. They also estimate that if collection efforts in 2019 mirrored collection efforts in 2010, the IRS would have collected $20 billion more last year.

IRS Practices during COVID-19

As of this writing, the relaxation of the IRS’s collection practices during the COVID-19 pandemic concluded on July 15. During the early part of the pandemic, most liens and levies were being suspended temporarily. But there has not been any indication that this relaxation will be renewed.

Non-Filers and the IRS

A Treasury Inspector General for Tax Administration (TIGTA) audit released on June 1 concluded that high-income non-filers owing billions of dollars are not being addressed by the IRS. It is estimated that approximately $39 billion (or 9%) of federal taxes not paid on time or not paid at all for tax years 2011 through 2013 is due to non-filers. The audit also examined tax years 2014 through 2016 and identified 879,415 high-income non-filers that had not filed their taxes or filed them properly with an estimated tax due of $45.7 billion. Of these non-filers, the IRS did not address 369,180 of the cases with an estimated tax due of $20.8 billion. The remaining 510,235 high-income non-filers, with a total estimated tax due of $24.9 billion, are in the collection system, but will probably not be diligently pursued as resources decline. The report added, “Due to the policy on working single tax year cases without regard to how many returns have not been filed by a taxpayer, the IRS is missing out on opportunities to bring repeat high-income nonfilers back into compliance.” The IRS is currently considering some strategies to address non-filers.

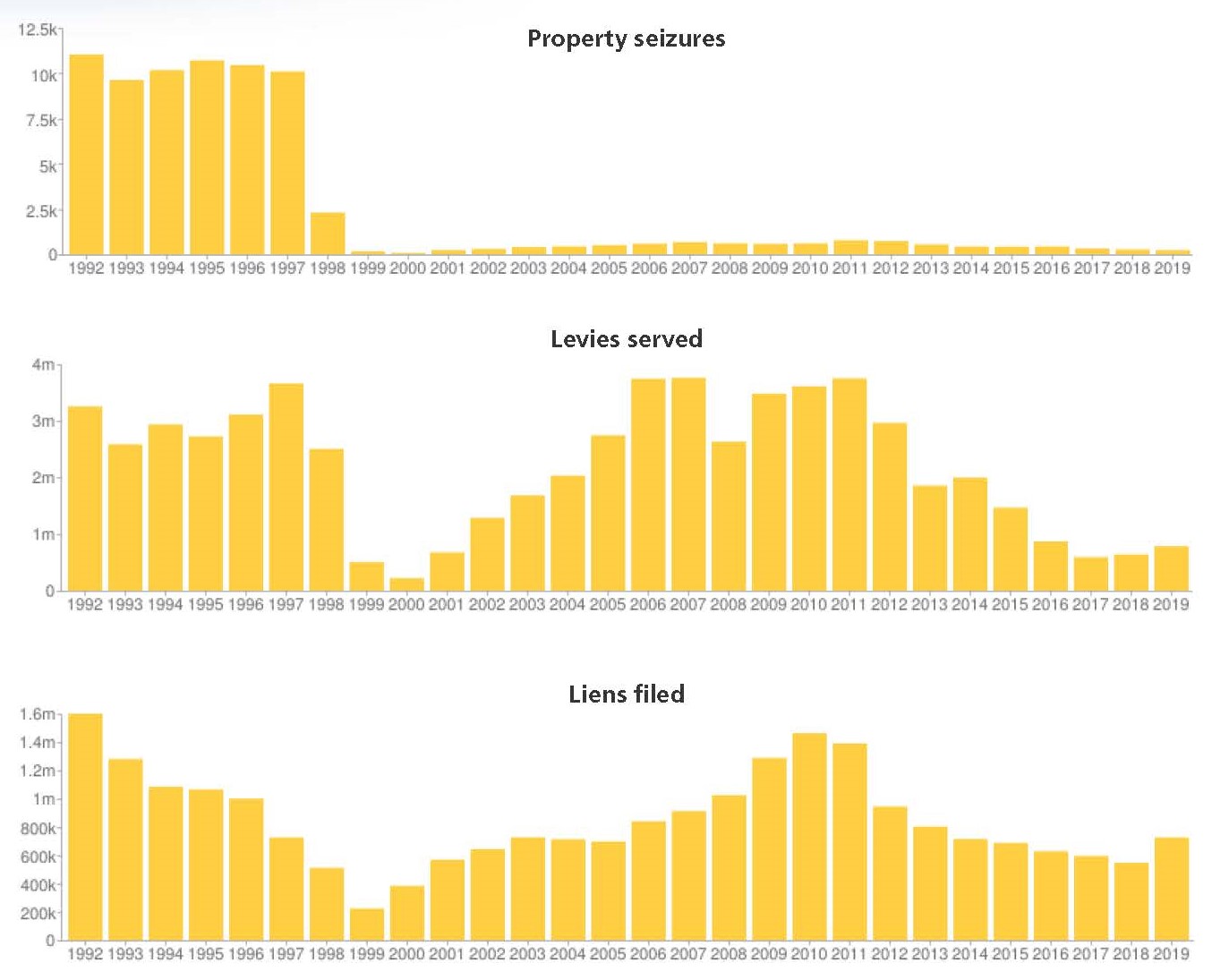

Property Seizures, Levies, and Liens

Using data recently released by the IRS, David Gross (of The Picket Line blog) has created graphs showing IRS property seizures, levies, and liens from 1992 to 2019. As you can see, property seizures collapsed in the 1990s and have remained a seldom utilized tool compared to past practice. Levies, which included wage garnishments, rose slightly, but are still down about 75% compared with 10 years ago. The number of liens increased last year to their highest number since 2014. This may account for the several folks in our network who contacted the office in 2019 to state they had received notice from the IRS that a federal tax lien had been filed with the county court house of their residence.

Thanks to David Gross for these wonderful charts.

Many Thanks

Thanks to each of you who donated for the May/June Appeal 2020! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.).

We are very grateful to these alternative funds and WTR groups for their redirections and affiliate dues:

Santa Fe Community Foundation; Peace Resource Center of San Diego;

Las Vegas Catholic Worker; Boulder War Tax Info Project; Christian Peacemaker Teams;

Heartland Peace Tax Fund (Kansas); Michiana War Tax Refusers;

War Tax Resisters Penalty Fund

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

Tax Resistance Ideas and Actions

Tax Day Part 2 (July 15, 2020)

This newsletter was being completed the week of Tax Day, so we are not able to provide a full Tax Day report at this time. Nonetheless, we would like to highlight a couple actions that took place online.

Cleveland Nonviolence Network

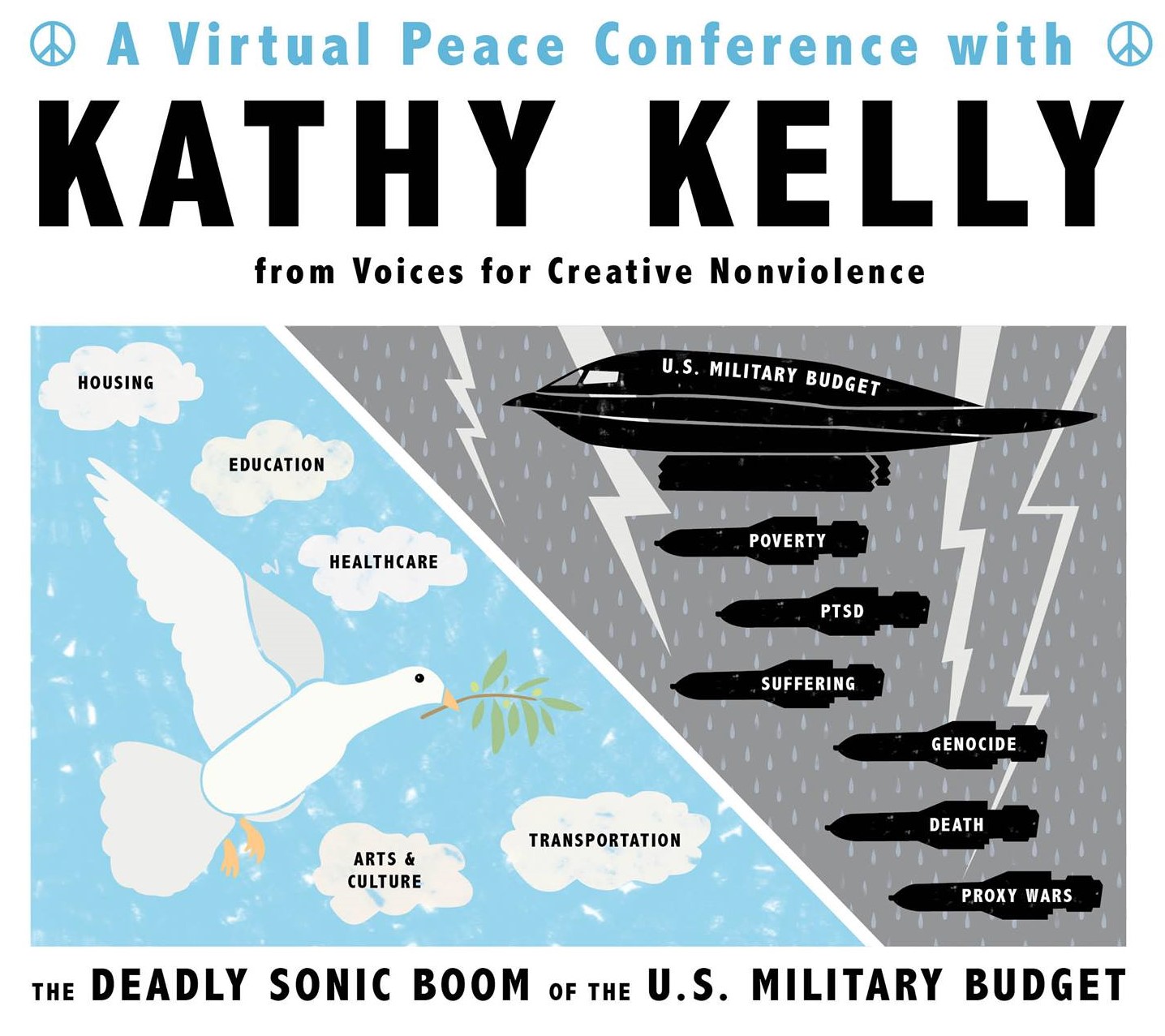

Logo for the Deadly Sonic Boom of the U.S. Military Budget Conference

NWTRCC was able to collaborate and join in two online actions the week of Tax Day 2020. While the gatherings strengthened local connections, it was also a great opportunity for all to learn and be inspired by actions taking place throughout the United States. War Tax Resister (WTR) Maria Smith with the Cleveland Nonviolence Network organized a gathering titled “The Deadly Sonic Boom of the U.S. Military Budget” to encourage actions around eliminating the military budget.

At that event, Kathy Kelly with Voices for Creative Nonviolence spoke on how U.S. military weaponry is employed on People of Color overseas and is “gifted” to police departments to target People of Color in the U.S. She shared how many people in the U.S. do not know about our Hyper-Militarization and that it does not reflect who we really are and our values. Kathy shared how militarism has become the new religion of the U.S. as evidenced in our distorted priorities and permanent warfare state. It was noted that during the pandemic, the military has been completely irrelevant. Nevertheless, 2020 has been one of the most profitable years for military contractors.

The People’s Life Fund (PLF) of the Northern California War Tax Resisters

The People’s Life Fund (PLF) embodied the work of divesting from the Pentagon with two granting ceremonies. They recognized the traditional Tax Day on April 15th with a granting ceremony which redirected $21,850 from the Pentagon to eleven community organizations. Recognizing the growing community needs during these times, the PLF conducted a second ceremony on July 15th with $12,000 granted to address vital work.

All of the recipients shared information about their inspiring work as well as emphasizing relationship building based on solidarity and not charity. Here are some of the powerful words shared: “Thanks for helping create the ecosystem for moving forward.” “It is never about a single issue, but about our humanity and dignity.” “We do what we do because it is the right thing to do.” “In helping others, it helps heal me.” “With so many calls to Defund, you (war tax resisters) are taking agency to defund the military and military industrial complex and support initiatives in the community.”

– Report by Chrissy Kirchhoefer, NWTRCC’s Outreach Consultant who lives in St. Louis.

Chattanooga Businesses Closed on June 16 to Defund the Police

Several small business in Chattanooga, Tennessee closed their doors on Tuesday June 16. By closing their businesses and not producing sales tax revenue for the city on that day, they hope to show their support for defunding the local police department. The goal is for some of the funds currently directed to the police department to be redirected to community organizations. In this way, these small businesses are showing their support for “I Can’t Breathe Cha,” which is one the groups calling for changes in policing.

[Thanks to David Gross for making NWTRCC aware of this action.]

NWTRCC News and Events

NWTRCC Outreach during a Pandemic

While the normal avenues of sharing information about WTR have shifted in 2020, I have been sharing the work of NWTRCC in Zoom meetings with people who may have never heard of WTR and sharing NWTRCC’s website in the chat box. It has been one of the simplest ways of getting information out to a wide range of people concerned about the state of the world and wanting to take action.

On Tax Day, World Beyond War hosted a course on “War and the Environment.” I took this opportunity to educate others in the course that about 50% of US taxpayer money is spent on militarization. I was able to share this in the chat room during the large group session, but also verbally with others during a small group breakout session. The two pillars of focus in the course were education and action. I would encourage others to take similar actions in this new mode of outreach!

–Report from Chrissy Kirchhoefer, NWTRCC’s Outreach Coordinator

Mark Your Calendars for Next NWTRCC Conference!!!

November 6–8, 2020 Conference will be Online!

Art Print by artist Sandy Griffin in St. Louis (This print was sold at the auction)

With a heavy heart, the Administrative Committee made the decision to have an online only conference. We believe that making this decision now will permit us to focus on creating a great online conference schedule. We would like to thank the folks in Colorado Springs for their generous invitation to meet there and hope that we might be able to do so at some future date.

For the most recent information on the gathering, including registration information, go to nwtrcc.org/programs-events/gatherings-and-events/ or call the NWTRCC office.

NWTRCC Charity Art Auction Raised $1,100

This spring, NWTRCC held its first online charity art auction. The auction was coordinated by NWTRCC’s fundraising committee, but could not have been done without the generous time and effort of Carlos Steward, director the Flood Gallery Fine Art Center in Black Mountain, North Carolina.

The COVID-19 pandemic prevented us from collecting as much artwork we had originally hoped, but we still received 63 items from eleven donors. Originally, the final night of the auction was going to feature a special event at the gallery, which would have given folks in the local area a chance to see the items up close and place bids. Again, the pandemic prevented this from happening. Nevertheless, we are happy to report that the auction raised $1,100. A special thanks to all those who donated or bid on items.

Rest in Peace Ed Agro

Ed Agro in September 1987 at a NWTRCC meeting in Boston Photo by Ed Hedemann

Ed Agro was, as he himself knew, sometimes cantankerous and sharp-tongued, and he was happy working on his own. But he loved New England War Tax Resistance (NEWTR). He helped found it, sensing the need for principle to be joined to organization. He affectionately remembered those early days and the dignity and idiosyncrasy of each founder; he was always interested in people as people, not just as holders of political views. He collected documents for telling NEWTR’s story, which with other papers of his will be housed at UMass Boston. He would have liked to write NEWTR’s history and would have been the right person to do it, but there wasn’t time. Nevertheless, he made the writing of that history possible.

I met him at an annual meeting of NEWTR in the mid-80s. He quoted the great cultural critic Edmund Wilson at that meeting—Wilson’s The Cold War and the Income Tax in particular—and that made me feel at home. The truth I got from Ed was that war tax resistance was something you could bring your whole being to—what you believed, what you’d read, what you knew. Over the years, I also got from him a truth that is maybe at odds with that but maybe in allegiance; namely, that you can be committed to the war tax resistance community but be critical, skeptical, and demanding of war tax resistance itself. (Hence his being able to ask great, challenging questions on the war tax resistance list-serve, e.g., “should WTRs vote?”) Of the resisters I’ve come to know over the years, he was among the most cosmopolitan and ironic, and among the least self-righteous.

More personally: he had immense gusto, and no self-pity at all. He moved about in his wheelchair with great daring and skill with those racing-driver leather gloves he liked. When I visited him, we had coffee. Sometimes he made it, sometimes I brought it; in any case, it had to be good and, if possible, espresso. We talked about everything under the sun: coffee itself, war tax resistance, other aspects of politics and that possibility of linking them to WTR, WTRs and other people we knew (he had a sharp tongue but a generous heart), illnesses and bodies, doctors, mortality, Italian literature and Natalia Ginzburg in particular, families, idealists, zealots, technology. When I’d leave, we’d both say how much more there was to talk about—which there was, and is.

Ed Agro’s daughter Jessica wrote a beautiful obituary for Ed, which readers can find at www.lehmanreen.com/obituary/Edward-Agro. It describes his Italian background, his time at the Massachusetts Institute of Technology (MIT) and the Bachelor of Science degree in physics he earned there, his being confined in body to a wheelchair at the age of 27, his work as an editor for the MIT Press, his crucial role in the founding and maintaining of NEWTR, his loving technical help for separated families during the Bosnian War and for the war tax resistance community for decades and decades, his accomplished paintings, his love of sailing.

“May his memory be for a blessing,” we say in the Jewish tradition. I’m sure Ed’s memory will be just that, given that his presence in life was that already.

–Larry Rosenwald (friend of Ed Agro)

Rest in Peace Stanley McCracken

We were sad to hear of the passing of Stanley McCracken in March. He is survived by his wife, Connie. He is fondly remembered as a caring, kind, and gentle man by the members of Sonoma County Taxes for Peace (SCTP) in Sonoma County, California. He and Connie had been stalwart members of the group for many years. Stanley attended every meeting, except when he was away at Quarterly or Yearly Quaker meetings. Every year he was at our Tax Day protests, handing out our educational flyers and staffing the penny poll. Some of you may remember him from his attendance at several NWTRCC gatherings between 2008 and 2011. He was the last one keeping SCTP active until he and Connie moved to Lancaster, California several years ago. Stanley will be missed.

–Larry Harper (friend of Stanley McCracken)

PROFILE

I Act Out my Prayers by Saying “NO”

to Paying for War

By Sylvia Shirk

Tax Day, April 15, has become one of my favorite annual events. It is a day of peacemaker empowerment. I smile as I write checks and send online donations to support peace and justice organizations that I care about. I hum on my way to mail the United States Treasury a payment that covers only 53% of my tax assessment, and post a letter to the President in the White House telling him what I am doing and why I choose not to pay for war. (Text of my letter is below.) I enjoy standing with other peacemakers at a sidewalk demonstration to sing prayers for peace, and voice outrage at the nearly $1,000 billion dollars allocated for the military in the U.S. national budget.

From my U.S. American father who refused military service and French mother who survived World War 2, I learned at a young age that peacemaking is important and war is horrific. My French uncle, in his nineties, retold with horror that in December 1944, the U.S. military burned down the family home. Thirty years after the fact, I heard my French grandmother cry over her adolescent son who was killed in a war accident. And then I remembered the courage of my father who as a U.S. high school student braved the taunts of his peers to choose not to fight for Uncle Sam, but to serve the nation as a Conscientious Objector. His post-war volunteer stint took him to my mother’s community in France where he participated in rebuilding what war had destroyed.

Having been nurtured in a peace church community, I was troubled for many years about my financial participation in war-making. During my college student days, my housemates and I resisted the war tax that was levied on our phone bill. I joined numerous peace groups and public demonstrations over the years. As a parent of three young children, I struggled to model peaceful resolution of conflict at home. Later, in my work as a pastor I taught peace and non-violence.

“If you pray for peace, why pay for war?” is the slogan that finally convinced me to become a war tax resister ten years ago. I wanted to follow my peace prayers with action. Earlier, I had met Marian Franz, executive director of National Campaign for a Peace Tax Fund (peacetaxfund.org), who lobbied the U.S. Congress, promoting the religious freedom of people of faith to oppose war taxes. I was also fortunate to meet up with a local group of war tax resisters with the National War Tax Resisters Coordinating Committee (NWTRCC) in New York City, who made a presentation in my church, Manhattan Mennonite Fellowship. I decided my moment for action had come. NWTRCC counselors provided expert guidance for me as I waded with some trepidation into the waters of this new venture. They answered my questions and assured me that the many experienced war tax resisters in the network would provide support along the way.

Letter after letter from the Internal Revenue Service (IRS) began to show up in my mailbox. I came to see that I would have a number of choices about how to respond. I learned that the IRS would attempt to collect money from me and that I could again decide whether I wanted to resist that collection. When they scooped out my bank account, levied my wages, and skimmed off my Social Security check, I chose to acquiesce.

My prayers for peace continue. And now more than ever, it is important to me that I act out my prayers by saying “NO” to paying for war.

Text of my letter to the White House:

Greetings President TRUMP:

Today I am sending 47% of my tax dollars to organizations that work to build peace locally and globally. As a war tax resister, I have decided to publicly register my opposition to military spending. I have chosen to redirect the amount of my tax that would have been spent on the U.S. military budget, spending it instead for peace building.

As a long-time member and a pastor of the Mennonite Church USA, I have been active in praying and working for peace for many years. Resisting war taxes is an expression of my faith in the God of love and hope and redemption.

Historically, Mennonites, Quakers, Church of the Brethren, and other people of conscience have maintained a stance of conscientious objection to participation in war in any form. This has been most evident in our refusal to join military forces. Support for the military conflicts with our Christian peace testimony.

Thank you for your part in the good things that the United States government is doing with the other 53% of my tax dollars.

Sincerely, Sylvia E. Shirk

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Subscriptions are $15 per year.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org