National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

February – March 2023

Contents

- Robert Randall: Presente / Always Present

By Ruth Benn - NWTRCC Continues its Online Workshops and Trainings

By Lincoln Rice - Counseling Notes 2023 IRS Standard Deduction and Taxable Income Level • WTR Investment Fund Levy is Resolved • Breaking News! 1099-K Reporting Rules Delayed until Tax Year 2023 • IRS has Stopped the Bleeding on their Backlog of Unprocessed Paper Returns

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- War Tax Resistance News Connecting the U.S. Military with Environmental Harm in Eugene, Oregon • WTR Message Brought to Lockheed Martin on MLK Day • WTR John Stoner Honored by Mennonite Church USA • Climate Tax Resistance in the Netherlands

- NWTRCC Upcoming Events and News Nominations Open for NWTRCC’s Administrative Committee (AdComm) • National NWTRCC Conference in Indiana: May 5 – 7, 2023 • Ask your Church to Support NWTRCC • Robert Randall and his Quirky-Fun-Serious-Committed-Larger-than-Life Personality

- Christmas Truce Redux

By Cathy Deppe

Click here to download a PDF of the February/March issue

Robert Randall: Presente / Always Present

By Ruth Benn

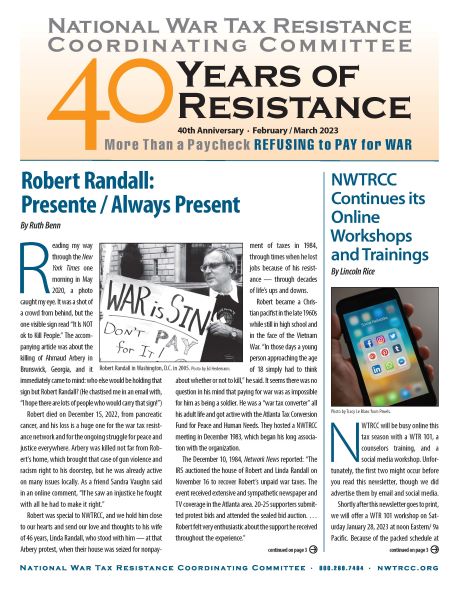

In front of IRS headquarters in Washington, DC during an antiwar protest. Photo by Ed Hedemann, DC 2003.

Reading my way through the New York Times one morning in May 2020, a photo caught my eye. It was a shot of a crowd from behind, but the one visible sign read “It Is NOT ok to Kill People.” The accompanying article was about the killing of Ahmaud Arbery in Brunswick, Georgia, and it immediately came to mind: who else would be holding that sign but Robert Randall? (He chastised me in an email with, “I hope there are lots of people who would carry that sign!”)

Robert died on December 15, 2022, from pancreatic cancer, and his loss is a huge one for the war tax resistance network and for the ongoing struggle for peace and justice everywhere. Arbery was killed not far from Robert’s home, which brought that case of gun violence and racism right to his doorstep, but he was already active on many issues locally. As a friend Sandra Vaughn said in an online comment, “If he saw an injustice he fought with all he had to make it right.”

Robert was special to NWTRCC, and we hold him close to our hearts and send our love and thoughts to his wife of 46 years, Linda Randall, who stood with him — at that Arbery protest, when their house was seized for nonpayment of taxes in 1984, through times when he lost jobs because of his resistance — through decades of life’s ups and downs.

Robert became a Christian pacifist in the late 1960s while still in high school and in the face of the Vietnam War. “In those days a young person approaching the age of 18 simply had to think about whether or not to kill,” he said. It seems there was no question in his mind that paying for war was as impossible for him as being a soldier. He was a “war tax converter” all his adult life and got active with the Atlanta Tax Conversion Fund for Peace and Human Needs. They hosted a NWTRCC meeting in December 1983, which began his long association with the organization.

The December 10, 1984, Network News reported: “The IRS auctioned the house of Robert and Linda Randall on November 16 to recover Robert’s unpaid war taxes. The event received extensive and sympathetic newspaper and TV coverage in the Atlanta area. 20-25 supporters submitted protest bids and attended the sealed bid auction. …Robert felt very enthusiastic about the support he received throughout the experience.”

Being supported and being supportive were what drew Robert to NWTRCC, which is why we honored him at our 30th anniversary conference in 2013. Robert held the record for attendance at the network’s meetings and gatherings around the country. Sometimes he was on a committee and had his travel paid, but mostly he used his own resources because he appreciated being in a group where “everyone has shown what it means to live according to your conscience,” as he said in response to the award. Robert came to see friends, but was also the one most welcoming to all newcomers, as evidenced by comments on the war tax resistance listserve at news of his death. (As a matter of fact, one of Robert’s key contributions was starting and hosting that listserve, which has been valuable for conversation and support among resisters, refusers, and converters since 1999.)

Most recently, many peace activists met Robert through his support for the Kings Bay Plowshares, who entered the Georgia naval base on April 4, 2018, and “beat swords into plowshares” at the Trident submarine base until arrested. Their trials, sentencing dates, and incarcerations in Robert’s hometown, Brunswick, involved more than four years of support actions and events with which Robert was fully engaged. But he had long been active around the Kings Bay naval base. In 1988, he helped host a NWTRCC meeting with John X and Martina Linnehan at their Metanoia House in St. Marys, Georgia, and took us to the gates of Kings Bay, a focus of their antinuclear protests. (He was so pleased to see John and Martina again in 2016 when they were living on land at the Sustainable Living Center of North Florida, which hosted a NWTRCC gathering.)

In May 1989, Robert helped host again at the Marywood Conference Center outside of Jacksonville. That gathering lasted nearly a week and included WTR events in Jacksonville, St. Marys, and Brunswick. Chrissy’s blog post from 2019 about her trip to Brunswick for the Kings Bay Plowshares 7 trial is another tale of Robert’s hospitality, but most of us who have attended NWTRCC meetings probably think of him as something of a host for every meeting no matter where it was. He was always the best prepared for the business meeting; he carried decades of institutional memory and was fun to be around. His enthusiasm for post-meeting outings, protests, or local tours was contagious. More than anything Robert knew that the primary reason people come together is to share stories and fears and ideas to sustain our resistance and survive the economic challenges.

There is so much more to say about Robert… But it would be unfair to conclude without emphasizing Robert’s deep religious faith, even though it was possible to spend a good deal of time with him and not realize how central it was to his life choices. This is exemplified in his 2006 tax day letter to the IRS:

Once again this year I am unable to pay any federal income tax which you might deem “due” from me. As I have stated to you in years past, I am a Christian. …The Holy Spirit will not let me sin in this way. I am completely and utterly constrained by God from voluntarily paying for war.

Robert (far left) enjoying a donut with others at the meeting in Milwaukee (Nov, 1999). Photo by Nancy Rice

Robert was not a proselytizer. He was more concerned that we act on conscience than join a religion. He did, however, mean it when he wrote at the beginning of his “An Ethic for the 21st Century”:

Let us all agree on this one simple thing:

It is not OK to kill people.

[Editor’s Note: Ruth Benn originally wrote this piece for the NWTRCC blog, which contains more pictures of Robert as well as links to his “Ethic” and his IRS letter. You can find this blog post by going to nwtrcc.org and scrolling to the bottom of the page.]

NWTRCC Continues its Online Workshops and Trainings

Photo by Tracy Le Blanc from Pexels

By Lincoln Rice

NWTRCC will be busy online this tax season with a WTR 101, a counselors training, and a social media workshop. Unfortunately, the first two might occur before you read this newsletter, though we did advertise them by email and social media.

Shortly after this newsletter goes to print, we will offer a WTR 101 workshop on Saturday January 28, 2023 at noon Eastern/ 9a Pacific. Because of the packed schedule at our November meeting, we did not have a 101 session that weekend. A few of the attendees at that conference indicated that they would like to attend our next WTR 101 session, so we chose the date and time after reaching out to them.

Each year, NWTRCC hosts a war tax resistance counselors training. Before COVID, these trainings normally occurred on Sunday afternoon after the November business meeting. Our session this year will be Saturday February 4 beginning at 11a Eastern/ 8a Pacific. This will be the fourth time that the session has been held online. If you are interested in becoming a counselor, taking a deeper dive into the war tax resistance, or you are a counselor who would like a refresher, contact the NWTRCC office.

Social Media Workshop

NWTRCC will host an online Social Media Workshop on Saturday March 18 at 2p Eastern/11a Pacific. This workshop will aid our group in utilizing Facebook, Twitter, Instagram and other social media platforms with an eye toward Tax Day. You did not need to be tech savvy to participate, you only have to be able to join us on Zoom. Registration information for the session will go out in early March by email and on our social media platforms. But if you want to make sure you do not miss that email, simply contact the NWTRCC office and let us know you want to join the session.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on NWTRCC’s website (go to the “About Us” tab and click on “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2023. If you would be interested in attending one of these trainings, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

2023 IRS Standard Deduction and Taxable Income Level

Trump’s tax overhaul bill eliminated the personal exemption. Now there is only the Standard Deduction figure that sets the taxable income level.

| Category | Standard Deduction |

|---|---|

| Single | $13,850 |

| Married, filing jointly | $27,700 |

| Married, filing separately | $13,850 |

| Head of Household | $20,800 |

| Qualifying Surviving Spouse | $27,700 |

For each married taxpayer who is at least 65 years old or blind, an additional $1,500 standard deduction may be claimed. If the taxpayer is single, the additional standard deduction amount is $1,850.

A single person can earn up to $13,850 and owe no federal income tax. You may be able to make significantly more than the amounts indicated above and owe no income taxes. NWTRCC’s Practical #5, Low Income/Simple Living as War Tax Resistance, includes information on legal ways to reduce taxable income and owe no federal income taxes ($1 from the NWTRCC office; read it free at nwtrcc.org/PDFs/practical5.pdf). We suggest that nonfilers fill out the forms and keep their receipts for reference in case their circumstances change or the IRS comes calling.

Payroll taxes for Social Security and Medicare begin to apply at a lower income level than one’s standard deduction. If you are self-employed and do not file or pay estimated taxes, you may be liable for Social Security taxes. If you are an employee, these payroll taxes are automatically withheld as a percentage and you cannot resist those taxes.

WTR Investment Fund Levy is Resolved

Last issue, we reported that longtime WTR Kathy Labriola in California had an IRA retirement fund and a separate investment fund levied. The funds were kept with different firms. Unfortunately, because the IRS issued the levies simultaneously, the IRS collected the entire levy amount from each account. In other words, the IRS owed Kathy a refund.

But the refund would come after the IRS used the funds for any other tax debt. In Kathy’s case, the levy did not include tax debt amounts for 2018 and 2021. So she would receive a refund after those years had been paid.

Kathy had sent a letter to the IRS and was waiting for this situation to slowly resolve itself. Surprisingly, one of the fund companies then contacted her to ask why the IRS had not cashed the check they sent. The fund had already tried calling the IRS, but no one answered the phone or returned their calls. After Kathy submitted proof of IRS over-collection, the fund decided to stop-payment on the check. Normally, a fund could face penalties for cancelling a check to the IRS, but it is also very strange for the IRS not to cash checks in a timely manner. Perhaps the check was lost in the mail. In any case, the situation is resolved for now.

Breaking News! 1099-K Reporting Rules Delayed until Tax Year 2023

This column has provided regular updates that about the change for Tax Year 2022 that third-party organizations (like PayPal, Venmo, Ebay) would be required to report transactions of $600 and above to the IRS using the 1099-K Form. Previously, the 1099-K would only be issued when there were at least 200 transactions and at least $20,000 transacted.

In late December, the IRS announced that the new rules would be delayed until tax year 2023. Even though companies are not required to follow the new rules, we could see some follow the new rules for tax year 2022 or even be stricter than the new rules require. One person in our network had Ebay send them a 1099-K for tax year 2021 on earnings of less than $600.

IRS has Stopped the Bleeding on their Backlog of Unprocessed Paper Returns

Though the IRS had dreams earlier in 2022 of eliminating their backlog of unprocessed paper returns, the backlog continues. For those of us waiting to have our paper returns processed, they are making some progress and the problem is not worsening. According to the IRS’s latest report on the issue, they still had 9.6 million paper returns to process as of 28 October 2022. That is down from 10.8 million returns on the same date the year before.

Many Thanks

Thanks to each of you who has responded to our November appeal. Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

Special thanks for Affiliate dues payments from: Agape Community (Ware, Massachusetts); Boulder War Tax Info Project (Colorado); Milwaukee War Tax Resistance / Casa Maria Catholic Worker; Michiana War Tax Refusers; War Tax Resisters Penalty Fund; Birmingham War Tax Objectors

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. (Please let the NWTRCC office know if you use Resist.) Thank you!

War Tax Resistance News

Connecting the U.S. Military with Environmental Harm in Eugene, Oregon

Planet vs Pentagon, a peace and environmental group in Eugene, Oregon and Taxes for Peace Not War!, a NWTRCC affiliate, haven’t really done much since the pandemic started. On Martin Luther King Jr. Day we walked with a large coalition of progressive organizations in the NAACP march and then tabled with many of those groups. We were able to talk to quite a few young people about war tax resistance. We also got out the messages that the U.S. military is the biggest polluter in the world, that the U.S. spends more taxes on the military than any other country or on any other part of the government, and that negotiations and diplomacy instead of bombs are needed in the Russian/Ukraine war.

The next day, Tuesday, we held up signs saying “No War!” and “Diplomacy, Not Bombs” at the U.S. federal courthouse where our federal representative and senators have offices from noon to 1pm. We received many friendly honks from passing motorists. We will be doing this for at least the next four Tuesdays at noon. It sure was fun to spend time with so many like-minded people and to get out the message of peace.

– Report from Sue Barnhart

Martin Luther King, Jr. Day in Eugene, Oregon. Photo by Steve Dear

WTR Message Brought to Lockheed Martin on MLK Day

On Martin Luther King, Jr. Day 2023, war tax redirector and NWTRCC Outreach Committee member H.A. Penner of Akron, Pennsylvania joined some 15 others from the Brandywine Peace Community of Philadelphia in a nonviolent demonstration at the entrance of the Lockheed Martin facility in King of Prussia, Pennsylvania, opposing their war profiteering activities. This was the 43rd anniversary of the Plowshares 8 action, in which the Berrigan brothers participated.

– Report from H. A. Penner

H.A. Penner at the entrance of Lockheed Martin

WTR John Stoner Honored by Mennonite Church USA

John Stoner

Longtime WTR John Stoner received the Legacy Peacemaker award from the Mennonite Church USA. A recent article in Anabaptist World announced the award and noted John’s war tax resistance and his involvement with $10.40 for Peace, a war tax resistance group in Pennsylvania. In addition to this war tax resistance, they recognized John’s role as the executive secretary of Mennonite Central Committee’s Peace Section for 12 years. In this position, he supported conscientious objectors and draft nonregistrants as well as overseeing women’s concerns and the Mennonite Conciliation Service. Lastly, the article noted his role in helping to found Community Peacemaker Teams (formerly Christian Peacemaker Teams).

Climate Tax Resistance in the Netherlands

A group in the Netherlands called “Belastingstaking voor Klimaat” (“Tax Strike for Climate”) have decided to no longer “silently pay for global warming” via government subsidies for fossil fuels. They are refusing to pay 5% of their income tax – the rough estimate of how much of central government spends (or provides in tax breaks) to subsidize CO2-generating companies: about €17.5 billion per year. They are also using the official tax adjustment and appeals process to press their claims. [Thanks to David Gross for making NWTRCC aware of this campaign.]

NWTRCC Upcoming Events and News

Help keep NWTRCC Strong and Growing!

Nominations Open for NWTRCC’s Administrative Committee (AdComm)

The AdComm provides oversight for business operations, helps plan two gatherings each year, keeps in touch with consultants between meetings, and meets face-to-face at the May and November gatherings (and by Zoom in February and August). We need to fill two seats, and new members will be selected from the nominees at the May 2023 meeting. They serve as alternates for one year and full members for two years (three years total). Travel to meetings is paid for full members and alternates filling in for full members who cannot attend. Each nominee will receive a nomination letter from the NWTRCC office with more details about what is involved as a member of this important committee.

Call, email, or mail your nomination(s) to

NWTRCC, PO Box 5616

Milwaukee, WI 53205

800-269-7464 or nwtrcc@nwtrcc.org

Deadline: March 15, 2023

Mark Your Calendars!

National NWTRCC Conference in Indiana: May 5 – 7, 2023

We will finally be meeting in person again for our May meeting. We are very thankful to Joyfield Farm in North Manchester, Indiana for extending us an invitation. Joyfield Farm is an organic farm in north-central Indiana, about an hour west of Fort Wayne. The farm has WiFi, so portions of the conference will also be online. The setting will be slightly more rustic than usual with amenities such as outhouses. There is plenty of camping space, including inside of a large barn. Some families in the area will also host folks and provide beds, but these will be limited.

In our pandemic world, this farm provides one of the safest environments for meeting and sleeping. Unfortunately, the farm is not near any airports, train terminals, or bus terminals. Therefore, we ask that anyone planning to attend who would need a ride from one of these locations to please contact the NWTRCC office to arrange a ride before purchasing a ticket. The farm’s address is 4874 E 1400 N, North Manchester, Indiana 46962. Registration will go up on the website in late-February. You can also call the office and register over the phone.

The NWTRCC business meeting is Sunday morning, May 7 (open to all). Note: Proposals for the May meeting must be submitted to the NWTRCC office by April 15, 2023.

Ask your Church to Support NWTRCC

If you are connected to a church or religious congregation that you think would be open to supporting NWTRCC financially, NWTRCC has a webpage with resources on how to reach out to your religious group. The webpage (nwtrcc.org/church) has a sample letter as well as links to NWTRCC’s annual reports, which a religious congregation might find helpful in deciding whether to make a donation to NWTRCC. Even if your church denies the request, it is an opportunity to raise awareness about war tax resistance. If you would like any help in formulating a request to your church, feel free to contact Lincoln at the NWTRCC office.

Robert Randall and his Quirky-Fun-Serious-Committed-Larger-than-Life Personality

By Andy in Texas

How unlucky that one can be exuberant and full of life one month and gone the next. Even with a diagnosis he had beaten for a time. It’s so surreal and bizarre I don’t quite believe it. I had the pleasure of knowing Robert a little because he was at every NWTRCC meeting, and I’ve attended maybe half a dozen going back to Birmingham, Asheville, Colorado Springs, Amherst and this past November 2022 on Zoom. He was just there.

Robert stayed for the Sunday business meetings. He was at the SOA protests. And many other protests over many years. He was a committed peacemaker for sure. Whoever said showing up is 90% of life (Jack Nicklaus the golfer, I think), well, he sure got that memo.

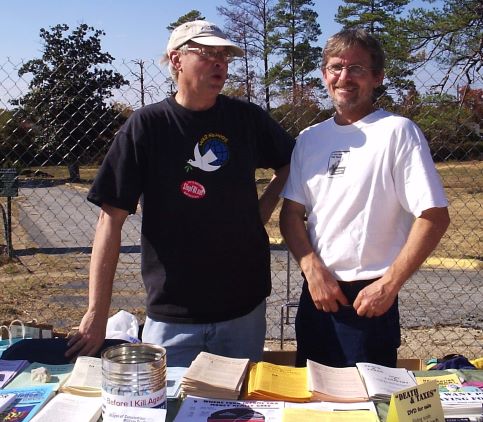

Robert Randall and Daniel Woodham at a School of the Americas demonstration with NWTRCC materials in 2010. Photo by Coleman Smith

When I realized I needed health care a few years ago after losing my job, Robert convinced me that using the marketplace for insurance was a valid form of resistance because the money was going for health care, not war. He took the time to listen and talk to me about it. I was skeptical but given the amount of tax credits I have gained he was proven right in the fiscal sense. (I did have a refund seized, though.)

Still, over Zoom during the conference, I shared that I had some lingering doubt about whether I could still call myself a resister. Robert had no such doubt, about this and many things. His reply was simple and steadfast: “You’re still a resister.” He knew that, even if the form of it has taken a different shape than my non-filing for over two decades. Something about him saying this removed any doubt. He could be a persuasive lad.

I come from a different religious tradition that is less sure of itself – if not having outright disbelief – regarding things like the afterlife. One can certainly find fault with sureness about such matters. As others have noted regarding one part of his “An Ethic for the 21st Century” statement, the idea of when life begins is different for different people, including myself. But I never experienced Robert as not being ok with difference, mine or others.

From what I saw, he lived out his faith confidently without having to insult his deep intelligence or ours with a sense of superiority or a need to proselytize. I’m sure he wasn’t a saint and had his faults as we all do, not knowing him all that well. But I knew enough to say that I haven’t met many people who call themselves Christian who I felt lived out that ideal better than Robert Randall.

His clear (sometimes loud!) voice, contagious laugh, voluminous knowledge of NWTRCC history, and quirky-fun-serious-committed-larger-than-life personality will be dearly missed by many. I’m so glad to be able to say I’m one of those many, even as I’m so very sad he’s gone far too soon. Or to quote a line in a eulogy from the Sex and The City sequel, And Just Like That… talking about having known him: “How lucky.”

Love you, brother Robert. Presente indeed.

P.S. I’m not crying, you’re crying.

Christmas Truce Redux

By Cathy Deppe

[Editor’s Note: This article was published on the NWTRCC blog on 20 December 2022. Russian President Putin had announced a cease-fire for Orthodox Christmas on January 7. While the cease-fire was limited, anti-war activists hope it will inform broader efforts to a negotiated and lasting truce.]

There has been a recent push advocating for a truce in the war between Ukraine and Russia. Advocates are asking for a cessation of violence from December 25 through January 7. NWTRCC has previously blogged about the history of the Truce during World War I as well as other holiday traditions that celebrate peace at this time of the year, including John McCutcheon’s song about the Truce and a not so traditional holiday song, “War Pigs.”

There is an immediacy this year to call for cessation of the war that has been ravaging Ukraine and Russia for the past 11 months. It draws the attention of those seeking light in these dark days. Advocacy for peace is not limited to religious preference. NWTRCC encourages atheists, agnostics, Buddhists, Hindus, Christians, Muslims, Jews (believers and non-believers) to consider backing this effort.

At NWTRCC’s conference at the beginning of November 2022, a group war tax resisters attending the conference decided to start meeting to discuss how we could address the war in Ukraine. This blog post is one way our group plans to address that war. Acknowledging that there is no good war, and no possibility of a lasting military solution in Ukraine, we urge everyone to press for an immediate truce — a ceasefire that is a precondition for peace talks to begin.

We support a proposed Christmas Truce based on the model of the Christmas Truce held in the Belgian trenches of the German and Allied armies more than 100 years ago. Some 100,000 soldiers on both sides of that conflict laid down their arms and spontaneously suspended their warmaking.

They moved toward one another into the “no-mans-land” between them, and sang “Silent Night” and other hymns together. They shared food and they prayed. They even shared a game of football (soccer) as well as drinks. They engaged with each other as fellow humans with families and dreams for the future.

Today, the U.S. peace movement is responding to this call for a Christmas Truce, as spear-headed by Massachusetts Peace Action as part of large peace coalition at www.peaceinukraine.org. The call is also supported internationally by the International Peace Bureau in Berlin.

Please contact one or both of these organizations to sign on to this action for peace. Or write your own legislators to call for a ceasefire from December 25th through January 7th. This is the first and vital step toward opening the way to negotiations and ending the carnage.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org