More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

February – March 2019

Contents

- A Case for Redirection by Lincoln Rice

- Inheritances: Tax Implications

(Conversation between legal adviser Peter Goldberger and longtime WTR Larry Bassett) - Counseling Notes Lock-In Letters (Letter 2802C) • New W-4 Form • 2019 IRS Standard Deduction and Taxable Income Level • IRS Impersonation Scams • Drastic Reduction of Nonfilers Pursued by IRS

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network List Updates

- War Tax Resistance Ideas and Actions Redirection of 35,882 euros

in Spain • Turkish Cypriot Conscientious Objector Chooses Jail over Paying Fine - NWTRCC News In Memoriam: Tom Wilson • Mark your Calendars • Nominations Open for NWTRCC‘s Administrative Committee (AdComm)

- PROFILE It’s Definitely More than a Paycheck By Chrissy Kirchhoefer

Click here to download a PDF of the February/March issue

400 Years of African American History:

A Case for Redirection

By Lincoln Rice

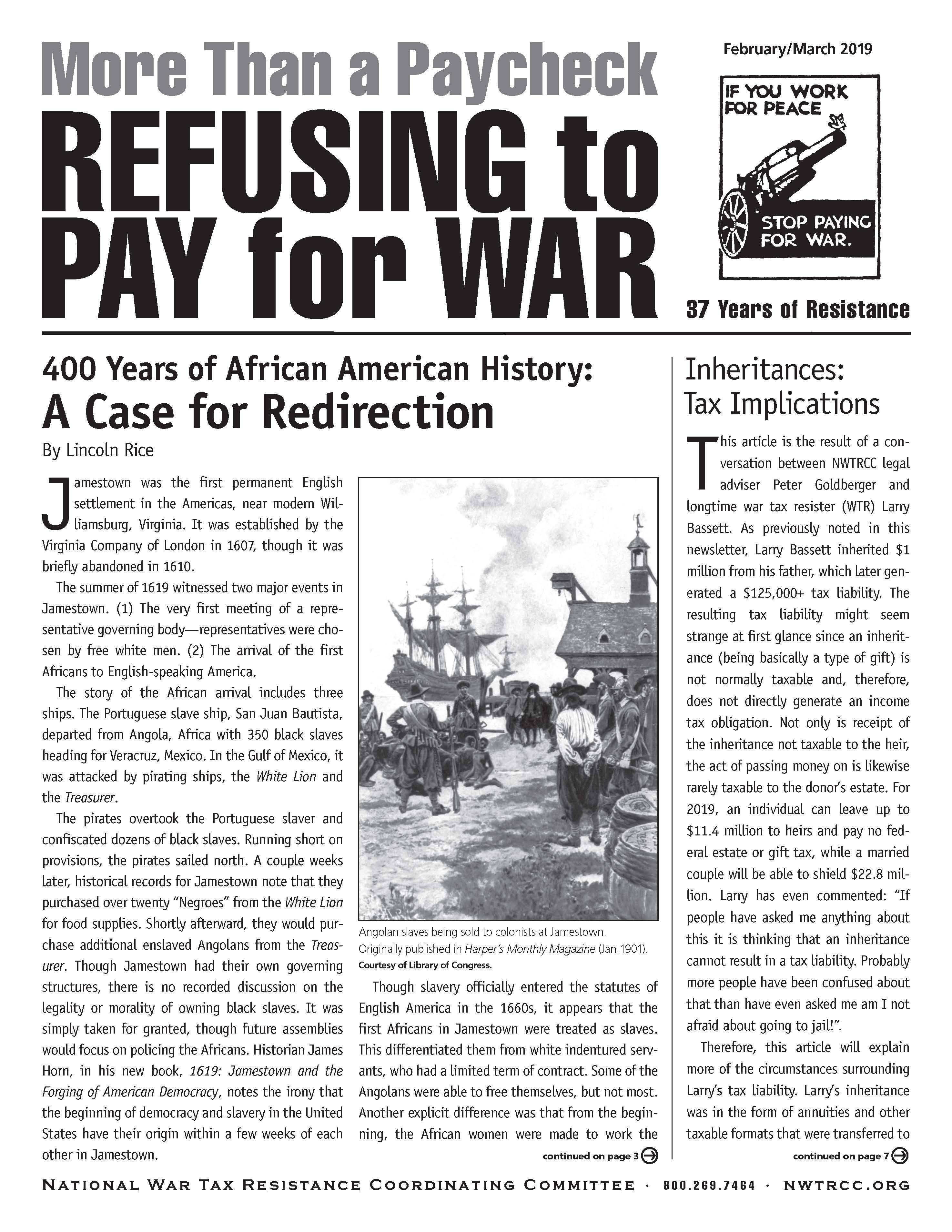

Angolan slaves being sold to colonists at Jamestown. Originally published in Harper’s Magazine (Jan 1901). Courtesy of Library of Congress.

Jamestown was the first permanent English settlement in the Americas, near modern Williamsburg, Virginia. It was established by the Virginia Company of London in 1607, though it was briefly abandoned in 1610.

The summer of 1619 witnessed two major events in Jamestown. (1) The very first meeting of a representative governing body—representatives were chosen by free white men. (2) The arrival of the first Africans to English-speaking America.

The story of the African arrival includes three ships. The Portuguese slave ship, San Juan Bautista, departed from Angola, Africa with 350 black slaves heading for Veracruz, Mexico. In the Gulf of Mexico, it was attacked by pirating ships, the White Lion and the Treasurer.

The pirates overtook the Portuguese slaver and confiscated dozens of black slaves. Running short on provisions, the pirates sailed north. A couple weeks later, historical records for Jamestown note that they purchased over twenty “Negroes” from the White Lion for food supplies. Shortly afterward, they would purchase additional enslaved Angolans from the Treasurer. Though Jamestown had their own governing structures, there is no recorded discussion on the legality or morality of owning black slaves. It was simply taken for granted, though future assemblies would focus on policing the Africans. Historian James Horn, in his new book, 1619: Jamestown and the Forging of American Democracy, notes the irony that the beginning of democracy and slavery in the United States have their origin within a few weeks of each other in Jamestown.

Though slavery officially entered the statutes of English America in the 1660s, it appears that the first Africans in Jamestown were treated as slaves. This differentiated them from white indentured servants, who had a limited term of contract. Some of the Angolans were able to free themselves, but not most. Another explicit difference was that from the beginning, the African women were made to work the fields, which white female indentured servants were excluded from because of the harsh conditions.

Over the next nearly 250 years, over 300,000 black Africans were transported to English America (and later the United States). Slavery officially ended with the passage of the 13th Amendment in 1865. For almost another 100 years, Jim Crow, segregation, and lynching were common practices across the United Sates. Since the passage of the Civil Rights Act of 1964, anti-black racism has simply changed forms once again. Racial discrimination still exists in housing, medicine, employment, education, etc. African Americans also face the most harm from the militarization of police forces.

As tax day nears, many individuals and local groups will redirect resisted federal tax dollars to underfunded groups doing wonderful work. As we enter the 400th year of institutionalized racism against African Americans, please consider redirecting your funds to black-led organizations.

During the last few years, war tax resisters from around the country have been more intentional in collectively redirecting tax money to organizing for liberation led by Black, Indigenous, and People Of Color (BIPOC). Together we will refuse to pay thousands of dollars to our oppressive government and redirect that money directly to organizations that are challenging the very foundations of oppression in our society.

Though redirection decisions will be made at the local and/or regional level, NWTRCC will help publicize the effort as well as gather information on the total amount that was redirected. This is an opportunity to build relationships by redirecting resources to those fights that directly support the BIPOC leadership in our areas. By having it be locally based, each community can shape the effort in a way that works best for them.

Consider moving this effort forward by hosting workshops and making the connections between federal spending on police, prisons, and the military; or meeting with organizations like Showing Up For Racial Justice to encourage them to resist taxes and redirect the money to Black Lives Matter organizers in their area.

Divest from War Organizing Packet

On our website and in print, NWTRCC has an organizing packet with the following sections: What do we mean when we say divest from war, invest in people? Does divestment work? How to divest? Where we reinvest? Plus, there are organizing stories and ideas, and a list or links to resources. Online you will find Powerpoint slides and an infographic that you can use on your websites or send to others. The packet comes with some resource samples.

Online, look for the link on our homepage or directly at

nwtrcc.org/programs-events/action-ideas/divest-war-invest-people.

If you would like a packet mailed to you, please call the NWTRCC office at 800-269-7464 or email nwtrcc@nwtrcc.org.

Inheritances: Tax Implications

This article is the result of a conversation between NWTRCC legal adviser Peter Goldberger and longtime war tax resister (WTR) Larry Bassett. As previously noted in this newsletter, Larry Bassett inherited $1 million from his father, which later generated a $125,000+ tax liability. The resulting tax liability might seem strange at first glance since an inheritance (being basically a type of gift) is not normally taxable and, therefore, does not directly generate an income tax obligation. Not only is receipt of the inheritance not taxable to the heir, the act of passing money on is likewise rarely taxable to the donor’s estate. For 2019, an individual can leave up to $11.4 million to heirs and pay no federal estate or gift tax, while a married couple will be able to shield $22.8 million. Larry has even commented: “If people have asked me anything about this it is thinking that an inheritance cannot result in a tax liability. Probably more people have been confused about that than have even asked me am I not afraid about going to jail!”.

Larry Bassett, Courtesy of Larry Bassett

Therefore, this article will explain more of the circumstances surrounding Larry’s tax liability. Larry’s inheritance was in the form of annuities and other taxable formats that were transferred to him on account of, and shortly after, the death of his father. Although the inheritance itself was not taxable, Larry incurred taxable income when he withdrew funds from those accounts. He could have lessened or possibly eliminated the taxable amount by gradual withdrawal, but since approximately half of the $1 million was to be passed on to other recipients at the direction of his father, Larry felt he had to cash in the investments promptly.

Larry states: “In his will he specified that I distribute that money free of any federal tax obligation. The practical result of that requirement and my decision to distribute the money immediately rather than spread it out over time was that I assumed responsibility for the federal tax obligation. My dad, of course, knew of my WTR. I wish I had had five more minutes with my dad just to be sure that he knew what would happen. But I am pretty sure that he knew exactly what he was doing and what would happen.”

Larry further states: “The amount that I actually owed in federal taxes for those two years is more than $200,000. When I file in April 2019, I will owe another pretty big chunk because I closed two retirement accounts in 2018. I was concerned about possible IRS seizure.”

Lawyer Peter Goldberger explains: “There was no estate tax imposed on the estate or on the inheritance per se (because it was less than $11.4 million), but because what you inherited was in the form of income generating assets that were not themselves tax-exempt, but were tax-deferred by your dad into retirement accounts, you had a tax liability resulting from either the withdrawals from or the cashing in of the assets, just as he would have, had he lived to use them himself. An inheritance in the form of cash, bank accounts, etc. is not normally taxable, either at the time of distribution of the estate or upon withdrawal from the bank, if the funds in those accounts were not tax-deferred. To be clear, the taxable event is not the receiving of the inheritance. But receiving an inheritance can give you an asset that generates taxable income or otherwise triggers tax consequences that you didn’t have before.”

To put it another way: The inheritance is not an event that generates a tax liability. But once the ownership of the inherited asset has been transferred to an heir, the heir may incur tax liabilities on transactions involving that asset, such as withdrawals (e.g., IRA or simplified employee pension [SEP]) or cashing in of non-cash assets (e.g., selling stock or a house).

To give an example: Someone died who was older than 70½ and left an IRA to their daughter, who is 50 years old. The IRS requires non-spouse inherited IRA owners to start taking required minimum distributions (RMDs) beginning December 31 of the year of death of the original account owner, and each year thereafter because the original owner was older than 70½. The daughter must take a RMD based on the parent’s age in the year that the parent died. And each year after, a RMD must be taken based on the daughter’s age. If not, the daughter faces a 50% penalty on the amount she should have removed. Also, since the daughter inherited the IRA from her parent, the distributions are not subject to a 10% early withdrawal penalty even though she is younger than age 59½. However, because income tax was not paid on the funds placed into the IRAs when those funds were originally earned, they are taxable when withdrawn later by an heir, just as they would have been taxable when withdrawn by the retiree during his/her lifetime.

Additionally, the basics for inheritances are explained in NWTRCC Practical #7 Health Care and Income Security for War Tax Resisters pp 22-23 (available on the NWTRCC website). But long story short, it is a good idea to consult an expert on receiving an inheritance. This stuff

is complicated.

Counseling Notes:

Lock-In Letters (Letter 2802C)

In the past three months, three war tax resisters have received notifications that their employer had received a lock-in letter. This is also known as Letter 2802C and normally begins with the following sentence: “You received this letter because we determined that your withholding doesn’t comply with our guidelines. If you do a correction now, you will avoid receiving a lock-in letter in the future that tells your employer to increase your withholding rate. You can disregard this letter if you already corrected your W-4.”

All three resisters practiced W-4 resistance by increasing the withholding allowances on their W-4 form. A lock-in letter is sent to an employer when the IRS determines that an employee does not have enough federal income tax withholding. The notice specifies the maximum number of withholding allowances permitted for the employee. Often, the IRS lock-in letter lowers the employee’s withholding to zero. Unless a resister is being claimed on another person’s tax return (e.g., by a parent), most resisters should be able to claim at least one allowance, if not more. With the lock-in letter, the employer will receive a copy of the letter to give to the employee that identifies the maximum number of withholding allowances permitted and the process by which the employee can provide additional information to the IRS for purposes of determining the appropriate number of withholding allowances. Please follow this process to appeal the number of allowances if it is too low. The employee will be given a period of time before the lock-in rate is effective to submit for approval to the IRS a new Form W-4 and a statement supporting the claims made on the Form W-4 that would decrease federal income tax withholding. The employee must send the Form W-4 and statement directly to the IRS office designated on the lock-in letter.

In the past when resisters received a lock-in letter, it was usually accompanied with a wage garnishment. Two of the recent lock-in letters did not include any wage garnishment. One person had suffered a wage garnishment a couple months earlier.

Unfortunately, unless a WTR is willing to quit their job or lower their taxable income (e.g., work less hours, increase 401k contribution, etc.), there is no magic bullet to stop a lock-in letter. It should be noted that one’s W-4 allowance can be increased if one can prove to the IRS that they qualify for more allowances to the IRS’s satisfaction: big health deductions or credits, mortgage, dependents, or other items that might bring your taxable income down.

New W-4 Form

IRS has issued the 2019 version of Form W-4 (Employee’s Withholding Allowance Certificate) and instructions. The 2019 version of the form is similar to the 2018 version of Form W-4. There was talk about substantially revising the 2019 Form W-4 to take into account changes in the Tax Cuts and Jobs Act (TCJA) that nearly doubled the standard deduction, eliminated personal exemptions, increased the child tax credit, limited deductions for state and local taxes, limited the deduction for home mortgage interest, and changed the tax rates and brackets, but it was decided to postpone any major revisions to Form W-4 until 2020.

The Form W-4 Worksheet has been updated to take into account the increase in the annual withholding allowance from $4,150 to $4,200 in 2019. Additionally, the worksheet has been updated to reflect the increase in the standard deduction for 2019 (see below).

2019 IRS Standard Deduction and Taxable Income Level

The tax overhaul bill eliminated the personal exemption. Now there is only the Standard Deduction figure that sets the taxable income level.

| Category | Standard Deduction |

|---|---|

| Single | $12,200 |

| Married, filing jointly | $24,400 |

| Married, filing separately | $12,000 |

| Head of household | $18,350 |

For each married taxpayer who is at least 65 years old or blind, an additional $1,300 standard deduction may be claimed. If the taxpayer is single, the additional standard deduction amount is $1,650.

A single person can earn up to $12,200 and owe no federal income tax. You may be able to make significantly more than the amounts indicated above and owe no income taxes. NWTRCC’s Practical #5, Low Income/Simple Living as War Tax Resistance ($1 from the NWTRCC office; read it free at nwtrcc.org), includes information on legal ways to reduce taxable income and owe no federal income taxes. We suggest that nonfilers fill out the forms and keep their receipts for reference in case their circumstances change or the IRS comes calling.

Payroll taxes, for Social Security and Medicare, apply at a lower tax rate, so beware that if you do not file or pay estimated taxes you may be liable for Social Security taxes if the payments to you are reported. If you are on salary, payroll taxes are automatically withheld as a percentage, and you cannot resist those taxes.

IRS Impersonation Scams

The Treasury Inspector for Tax Administration’s office reported that since 2013, almost 15,000 taxpayers have lost nearly $73 million to the perpetrators of IRS impersonation scams, which involve phony agency employees trying to trick taxpayers into paying money they do not owe. (Or maybe they do owe the money, but not to these tricksters!) In July, twenty-one participants in this telephone scam were sentenced to incarceration for up to 20 years. In September, fifteen individuals and five India-based call centers were indicted for their alleged involvement in the scam. As of Sept. 30, a total of 130 individuals have been charged in federal court for their participation in the scam. Over the last few months, a few WTRs have received these scam calls and contacted the office to verify they were a scam.

Drastic Reduction of Nonfilers Pursued by IRS

“Because of the repeated [budget] cuts, the IRS has drastically stopped pursuing “nonfilers” who do not submit their tax returns. The number of investigations into nonfilers fell from 2.4 million in 2011 to 362,000 in 2017. The agency has also drastically reduced its investigations of filers who do not pay their tax debts. In 2010, the IRS let $482 million in old tax debt lapse, but by 2017, that number increased to $8.3 billion.”

Quote from: https://www.salon.com/2018/12/26/ho-ho-ho-irs-cuts-audits-of-rich-steps-up-audits-of-poor-after-budget-cuts/

Many Thanks

Thanks to each of you who has responded to our November appeal!

Remember, you can also donate online through Paypal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

A special thanks to Erica Leigh, who worked as a consultant for NWTRCC for the past five years and edited this newsletter for most of 2018. She has helped Lincoln in taking over the editorial reins and helped Chrissy in adjusting to her new role as NWTRCC’s new Outreach Consultant.

We are very grateful to these alternative funds and WTR groups for their redirections and Affiliate dues:

Maine War Tax Resistance Resource Center

Milwaukee War Tax Resistance (Casa Maria Catholic Worker)

Las Vegas Catholic Worker

Boulder War Tax Info Project

Heartland Peace Tax Fund (North Newton, Kansas)

Peace Pentagon (Independence, Virginia)

Nashville Greenlands

War Resisters League New England

Southern California War Tax Alternative Fund

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is being updated this Fall. The latest list is online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC. Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

War Tax Resistance Ideas and Actions

Redirection of 35,882 euros in Spain

335 Spanish war tax resisters documented their resistance for the Antimilitarist Alternative / Conscientious Objectors’ Movement this year. Collectively, they refused and redirected 35,882.34 euros (a little over 100 euros each, on average). The organization’s report lists dozens of groups that received the redirected funds.

Turkish Cypriot Conscientious Objector Chooses Jail over Paying Fine

Conscientious objector Halil Karapasiaoglou of Turkish Cyprus was convicted of evading the military draft. He vowed to go to jail rather than pay the fine, saying “If I pay the fine there will be no meaning to what I am trying to do.” He was asking the European Union to compel Turkey to recognize the right to conscientious objection. Karapasiaoglou was initially jailed for a 20-day term in mid-January, but was released after three after his appeal was accepted by the Turkish court.

Source: https://cyprus-mail.com/2019/01/18/turkish-cypriot-conscientious-objector-released/

War Tax Resistance At a Glance

Make a donation in February of $10 or more, and receive a free copy of At a Glance! This 23-page page booklet was recently redesigned & gives concise answers to frequently asked questions. With your donation, just indicate you would like a free copy of At a Glance! (No Cost for Shipping & Handling!).

NWTRCC News

In Memoriam: Tom Wilson

Tom Wilson, 1991. Photo be Ed Hedemann

We are imparting the sad news that long-time WTR Tom Wilson from Western Massachusetts passed away on 22 December 2018. There will be a memorial service in the spring. Tom had been a WTR since 1977. Massachusetts suspended his dental license in 1987 because of his noncooperation with state tax laws after the state cooperated with IRS collection efforts. This put him in conflict with the Massachusetts law that requires compliance with all state tax laws before relicensure for any profession requiring a state license. He continued to operate as a dentist for a number of years without a state license. But in 2008, his office was forcibly closed by the state for lacking a license. He was 75 at the time. A NWTRCC newsletter article about his resistance can be found here: https://nwtrcc.org/2008/10/15/dental-office-forced-to-close/.

Mark Your Calendars

Mark your calendars for the next gathering, May 3 – 5, 2019, in Washington, DC. This will be the first time NWTRCC has met in Washington, DC. Planning for the conference is still in the early stages, but information will be posted on the web in the near future (see https://nwtrcc.org/programs-events/gatherings-and-events/schedule/). The NWTRCC business meeting is Sunday morning, May 5 (open to all). Note: Proposals for the May meeting must be submitted to the NWTRCC office by March 21, 2019.

Help keep NWTRCC Strong and Growing!

Nominations Open for NWTRCC’s Administrative Committee (AdComm)

The AdComm gives oversight to business operations, helps plan two gatherings each year, keeps in touch with consultants between meetings, and meets face-to-face at the May and November gatherings and by phone in February and August. We need to fill two seats, and new members will be selected from nominees at the May 2019 meeting. They serve as alternates for one year and full members for two years; travel to meetings is paid for full members and alternates filling in for full members who cannot attend. Each nominee will receive a nomination letter from the NWTRCC office with more details about what’s involved as a member of this important committee.

Call, email, or mail your nomination(s) to

NWTRCC, PO Box 5616, Milwaukee, WI 53205

800-269-7464 or nwtrcc@nwtrcc.org

Deadline: March 15, 2018

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. Thank you!

PROFILE

It’s Definitely More than a Paycheck

Chrissy Kirchhoefer (middle) with yurt mates from Standing Rock in Washington, DC at the Indigenous Rising march. Photo by Byron Clemens

By Chrissy Kirchhoefer

I am incredibly excited to have this opportunity to work with NWTRCC in the role of Outreach Consultant. The position involves strengthening and publicizing War Tax Resistance through social media and field organizing. I wanted to introduce myself before I start reaching out to all of you! War Tax Resistance has been more of a focal point more me since joining the Administrative Committee in 2016 and hosting the May gathering in St. Louis in May 2017. I look forward to expanding NWTRCC’s focus of anti-oppression work and collaborating with liberation oriented groups especially in our redirection efforts. In the rest of this article, I would like to share with you some of my background.

It was NWTRCC’s literature and presence at the School of the Americas in November 1998 that led me to the path of war tax resistance while I was still in college. A month after I returned from that pivotal journey, I decided to move into St Francis Catholic Worker community in Columbia, Missouri. The community had a strong tradition of direct action against militarism while also tending to those impacted by war—veterans struggling with mental health and substance abuse issues. While living in a community of shared resources, I began to learn of the many people who had been resisting systems of exploitation and were devoting their energies to life enhancing structures of mutual aid.

After a few years at St. Francis house, I returned to my hometown of St. Louis to pursue a social justice organizing position. A few days before September 11th, 2001, I began working at the Peace Economy Project, a group working on disarmament issues. That position turned into a more permanent one as we increased local peacemaking efforts with the creation of the “Instead of War” coalition. I began working more closely with Voices in the Wilderness to better understand the human impact of war and was invited to join their delegation to Iraq in conjunction with Veterans for Peace’s Iraqi water project in May 2002.

Upon my return, I helped organize many public events, spoke of my experiences in Iraq, and organized direct action campaigns at Boeing, which was operating around the clock to replenish the “smart bomb” supply that was being used in Afghanistan. I also invested more of my time and energy in creating the alternative structures by helping start the Carl Kabat Catholic Worker House to support resistance work in St. Louis. I initiated the first Midwest Catholic Worker Resistance Gathering at Boeing, which happened 3 days into the “Shock and Awe” campaign. Later that year, I traveled to Palestine and on returning to the U.S., joined the Wheels of Justice bus tour, speaking about the realities of war in the occupied territories of Iraq and Palestine. In 2004, I worked on the creation of the “Merchants of Death” speaker series, a project of the War Resisters League.

My commitment to War Tax Resistance continued to be a major influence on decisions I made of where I put my time and energy. I was inspired to invest more in life supporting structures and pursued organic farming and permaculture. In June 2014, I purchased a home to create the Dick Gregory Catholic Worker to honor the St. Louis native who incorporated humor in his approach to resistance. In August, so much dramatically changed with the killing of Michael Brown in the neighboring suburb of Ferguson. Many of us, who had been engaged in organizing work, began to understand the necessity of doing community building in a radically different way.

NWTRCC has been growing into this wider community building by making explicit that many of the ills of society are an extension of our militarized culture. I am grateful for Sam Koplinka-Loehr’s previous work to push WTR outreach for NWTRCC. I am extremely excited to be taking on this work at this time with all of you as we seek ways to collectively expand our networks with others who are creating the world in which they want to live. I look forward to working with all of you in this pursuit!

Please feel free to reach out to me at outreach@nwtrcc.org or 1.800.269.7464.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance

Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance

movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Subscriptions are $15 per year.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org