National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

April – May 2023

Contents

- Tax Season 2023

By Lincoln Rice - Beauty will Save the World

By Chrissy Kirchhoefer - Counseling Notes Tax Day is Tuesday, April 18 • Poor Families the Target of Audits • IRS Running More Smoothly this Tax Season

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Tax Resistance Ideas and Actions WTR Tabling at Law Conference • Goshen College Accounting Major Speaks on his War Tax Resistance • Anti-War/Anti-War Tax Film Competition • East Jerusalem Neighborhoods Declare a Tax Strike • New Book Chapter Features War Tax Resistance

- NWTRCC News: NWTRCC National Conference: Resisting Together (5-7 May 2023) • Social Media Workshop for WTRs • Social Media Growth – Year over Year, 2018-2023

- Robert Randall Memorial By Chrissy Kirchhoefer

- Sharing War Tax Resistance with Other Activists By David Hartsough

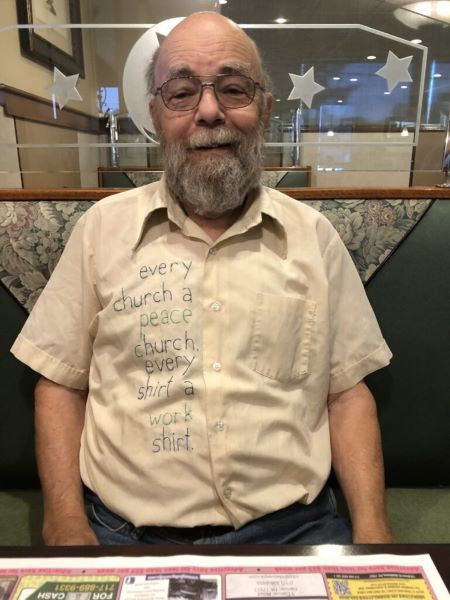

- PROFILE John Stoner Interviewed by Mennonite Church USA

Click here to download a PDF of the April/May issue

Tax Season 2023

By Lincoln Rice

For Tax Day, many local war tax resistance groups take to the streets to advocate refusal to funding a budget that is largely dedicated to past, present, and future military expenses. Although the pandemic has hampered actions in previous years, we know many folks will be going back out this year. An up-to-date list of Tax Day actions can be found on the NWTRCC website. If you plan on hosting a Tax Day event, please alert the NWTRCC office and take pictures. Find the most up-to-date list of Tax Day actions at nwtrcc.org/tax-day-actions-2023.

Current List of Tax Day Actions

Tucson, Arizona – April 18, 7:00-8:00a. Peace vigil at Raytheon Missile Systems at corners of Nogales Highway and Hermans Road. Vigil and parking is on the NORTH side of the Hermans Road entrance to the plant. Park on the gravel off northbound Nogales Highway, between railroad tracks and highway, (closer to the highway than the railroad tracks). Tax dollars for health care and education, not missiles! Recovered shrapnel confirm that a laser guided “smart” bomb made at Tucson’s Raytheon plant killed 23 people attending a wedding in northern Yemen in April 2018. Organized by the Nuclear Resister. For more information, nukeresister.org.

Northampton, Massachusetts – April 6, 10a-noon. Tabling at the Unitarian Society, 220 Main St. Sponsored by Taxes for Peace New England. For more info, email taxesforpeacenewengland@gmail.com. (Rain date is 4/7 at noon.)

Manhattan, New York – April 18, Noon-1:30pm. Vigil at IRS office and on Wall Street. Details being finalized as this goes to press. Sponsored by NYC War Resisters League and Extinction Rebellion. For more information, www.nycwarresisters.org/demonstrations or (718) 768-7306. Other sponsors will be added.

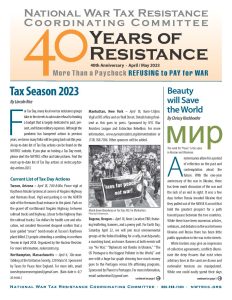

March down Broadway on Tax Day 2022 in Manhattan. Photo by Ed Hedeman

Eugene, Oregon – April 18, Noon. Location TBD; featuring leafleting, banners, and a penny poll. For Earth Day, Saturday April 22, we will join local environmental groups at the federal building for a rally, march/parade, a marching band, and more. Banners at both events will say “No War,” “Diplomats not Bombs in Ukraine,” “The US Pentagon is the biggest Polluter in the World,” and one with a huge bar graph showing how much money goes to the Pentagon versus life affirming programs. Sponsored by Planet vs Pentagon. For more information, email suebarnhart2@gmail.com.

Lancaster, Pennsylvania – April 15, 11:00a. City Center Square. Penny Poll where public can “vote” on how they would like to have their federal taxes spent. Organized by $10.40 for Peace. For more info, 1040forpeace.org.

Philadelphia, Pennsylvania – April 7, Noon. “Stations of Justice, Nonviolence, Peace, and the Love of Humanity.” At Lockheed Martin: Mall & Goddard Boulevards, King of Prussia (behind King of Prussia Mall). Sponsored by Brandywine Peace Community. For more info, call 215-843-4827.

Brattleboro, Vermont – April 18, 10am-5pm. WTR Information Tabling outside of the Brattleboro Food Coop, 2 Main Street. Sponsored by Taxes for Peace New England. For more info, contact Daniel Sicken at 802-387-2798 or dhsicken@yahoo.com.

Harrisonburg, Virginia – April 15, Noon. Shenandoah Valley Taxes for Peace has organized a War Tax Resistance/Redirection vigil at LOVE Park next to the Harrisonburg Farmer’s Market (228 S Liberty St.). The group will publicly re-direct resisted war taxes to peace and justice organizations. For more information, contact Tim Godshall, 540-908-8194, timgodshall@gmail.com.

Milwaukee, Wisconsin – April 15, Noon-1pm. Bake Sale for Military Victims and protest against federal tax dollars for war, U.S. Army Reserve, 5130 W. Silver Spring Dr. Sponsored by Milwaukee War Tax Resistance, Casa Maria Catholic Worker, & Peace Action of Wisconsin. For more info, contact Lincoln or Mikel, Casa Maria at usury_sucks@hotmail.com or (414) 344-5745.

Check out another website for Tax Day actions:

The Global Days of Action on Military Spending (GDAMS) are taking place again this year, April 13 – May 9, organized around the message, “we should drastically reduce military spending and invest in common & human security.” Find a list of all the actions at www.demilitarize.org.

Beauty will Save the World

The word for “Peace” is the same in Russian and Ukranian

By Chrissy Kirchhoefer

Anniversaries allow for a period of reflection on the past and contemplation about the future. With the one-year anniversary of the war in Ukraine, there has been much discussion of the war and the lack of an end in sight. It was a few days before Russia invaded Ukraine that they pulled out of the MINSK II accord that held the greatest prospect for a path toward peace between the two countries. While there have been numerous articles, webinars, and debates on the war between Ukraine and Russia there has been little public opposition to the war in the streets.

While borders may give an impression of collective agreements, conflicts illuminate the deep fissures that exist when arbitrary lines in the sand are drawn and nationalist tensions are manipulated. While one could easily spend their days reading the most recent headlines and following articles on the internet to have a better grasp of what is happening and the histories that have led us here, there is often a sense of disconnect or what some have identified as psychic numbing.

For the past year there has been a dark cloud of potential nuclear war hanging over the conflict. Now Russia is suspending the New START Treaty and threatening the possibility of resuming nuclear testing. While both the US and Russia have been withdrawing from nuclear arms control agreements, in January 2021 the United Nations Treaty on the Prohibition of Nuclear Weapons entered into force making nuclear weapons illegal under international law.

In The Madness of Nuclear Warfare is Alive and Well in America, the author quotes Dorothy Day, “Our problems stem from our acceptance of this filthy, rotten system,” as a testimony of the power that we have as citizens that led Dorothy and many others to war tax refusal and other tactics that promote life and strive for peace and justice.

Recently there were remembrances of the largest global anti-war day of protest to prevent the escalation of war in Iraq 20 years ago. It seems essential to take pause and mourn what was lost in not pursuing that path toward peace, including 1.5 million lives lost and $21 trillion of taxpayer dollars stolen in the War on Terror according to CODEPINK. It also seems vital to celebrate the communities that were created in coming together to dream another world into being and to broadcast those seeds throughout the lands.

Dorothy Day also wrote about the need to take a break from the daily news and suggested immersing oneself in the arts. It seems particularly important to see the issues of our day in a wider context and the universal themes of human experience. She was particularly fond of Russian authors on war and peace. Any suggestions of favorites would be welcomed. Poetry seems to be a great way to chase the headlines away.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on NWTRCC’s website (go to the “About Us” tab and click on “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2023. If you would be interested in attending one of these trainings, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

Tax Day is Tuesday April 18

As of now, it seems unlikely that the IRS will extend its deadline for filing and payment of federal income taxes.

Poor Families the Target of Audits

Nearly 50% of the IRS’ total audits were for families making less than $25,000 and claiming the Earned Income Tax Credit (EITC) according to Syracuse University’s Transactional Records Access Clearinghouse (TRAC). Dragged-out audits hurt lower-income households who depend on tax refunds to pay bills. Although the IRS recently released a new website portal to help fix issues faster, many families must amend returns during an audit, which can take up to another 16 weeks to process.

IRS Running More Smoothly this Tax Season

As of March 3, the IRS had sent out 11% more refunds than at the same point last year. Accountants have also noted a faster response time for mail correspondence. The IRS reported that their rate of responding to phone calls has improved by 13% compared to last year. This is largely due to the addition of 5,000 customer service representatives. Unfortunately, many of these new representatives are poorly trained and there have been many instances of incorrect information being given.

Many Thanks

Thanks to each of you who donated in early 2023! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

We are very grateful to these groups and affiliates for their redirection and affiliate dues: War Resisters League – New England

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. (Please let the NWTRCC office know if you use Resist.) Thank you!

Tax Resistance Ideas and Actions

WTR Tabling at Law Conference

Tabling at Law Conference. Photo Courtesy of Sue Barnhart

The first weekend in March, Planet vs. Pentagon tabled at the Public Interest Environmental Law Conference that happens every year at the University of Oregon. People come from all over the world, especially the Northwest, of course. It’s been online for the past few years due to COVID, but this year it was in person with lots of tabling by environmental groups. We shared a group of tables with XR Seattle, XR Portland, and XR Eugene. (Most of the XR Eugene folks who tabled are also in Planet vs Pentagon.)

There were lots of university students working on saving the world. Many of them wanted to know about war tax resistance. We did some great education to environmentalists about the military’s big carbon footprint and how much of our taxes support the military. We also had some great conversations about the war in Ukraine.

–Report from Sue Barnhart

Goshen College Accounting Major Speaks on his War Tax Resistance

Caleb Shenk Photo from Goshen Announcement of Event

On 21 February 2023, five Goshen College students spoke on themes of peace and justice during the 2023 C. Henry Smith Peace Oratorical Contest. [Goshen College is a Mennonite college in northwest Indiana.] One of the students, Caleb Shenk, a junior accounting major, spoke on “Protesting Taxation as a Peace-Seeking Accountant.” Shenk focused on the conflict he feels as an accountant and Mennonite. “As I started my internship this semester,” Shenk said, “I realized that I simultaneously enjoyed the work and felt personally conflicted. I’ve wrestled with the issue of taxes that go to the military before, but my internship has made it concrete.” Shenk’s presentation took second place. Watch online at tinyurl.com/yvvzundc.

Anti-War/Anti-War Tax Film Competition

The 29th Annual Twin Rivers Media Festival (TRMF) is currently accepting film entries. This year they added a category for best anti-war/anti-war tax film and they will send NWTRCC all entry fees in this category as a donation from TRMF. People can see festival information, additional categories, and rules at filmfreeway.com/trmf. The festival will be hosted at Flood Gallery Fine Art Center, which is operated by NWTRCC friend Carlos Steward.

East Jerusalem Neighborhoods Declare a Tax Strike

Four East Jerusalem neighborhoods called a general strike for a Sunday in February to protest increased Israeli police activity and harassment in that part of the city. In addition to many Palestinians refusing to go to work and Palestinian youth barricading entrances to the neighborhoods, residents stated that they would refuse to pay taxes or debts to any Israeli agency, including the Jerusalem municipality. About 350,000 Palestinians live in East Jerusalem. It is unclear how many residents are participating in the tax strike. [Thank you to David Gross for bringing this tax strike to our attention.]

New Book Chapter Features War Tax Resistance

In 2022, the University for Peace, a graduate school founded by the United Nations, published the book, A Missing Piece for Peace. Bringing Together the Right to Peace and Freedom of Conscientious Objection to Military Service. The book features a chapter by Conscience and Peace Tax International board member Derek Brett entitled, “Human Rights Advocacy and Implementation of Freedom of Conscientious Objection.”

After providing a concise history of conscientious objection to military service, Brett expands the conversation to war tax resistance: “The most obvious extension of the concept of conscientious objection to military service is however in the field of taxation.” The article then continues with a brief survey of modern war tax resistance in the West. The article concludes with a summary of the current state of conscientious objection. The book can be downloaded for free on the University for Peace website. Simply Google the title of the book. [Thank you to David Gross for bringing this chapter to our attention.]

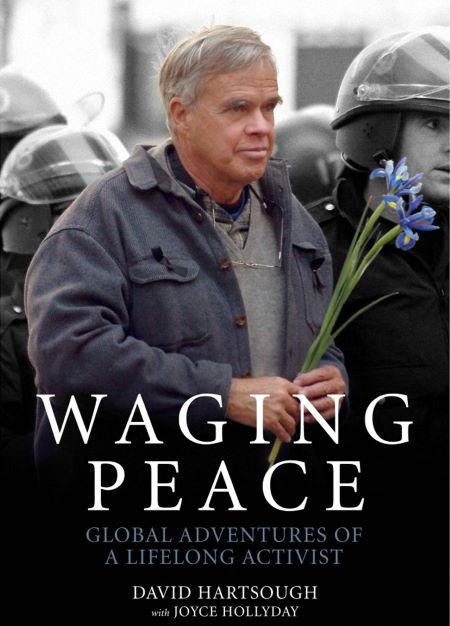

Sharing War Tax Resistance with Other Activists

By David Hartsough

[Editor’s Note: David posted the following article on the World Beyond War list-serve. We believe it is an excellent example of sharing one’s WTR with other groups with which one is involved.]

War Tax Resistance NOT Work for Peace and Pay for War!

Friends, My wife and I have been resisting/refusing to pay the 50% of our taxes which go for war and the Pentagon every year since the Vietnam War. Each year we write a letter to the IRS with copies to the local newspaper and our Congresspeople saying: We cannot in conscience work for peace and pay for war and participate in killing our brothers and sisters in other parts of the world. We write a check for 50% of what we owe to the Department of Health and Human Services and send it together with our IRS form to the IRS and write another check for the other 50% of our taxes to the Peoples Life Fund which contributes the refused taxes of many war tax refusers to local groups working for peace and justice and a livable future.

The IRS usually cashes the check to the Department of Health and Human Services and sometimes loses that year’s paperwork in their computer and in other years garnishes our Social Security checks to get the refused taxes. The Peoples Life Fund then returns to us the contribution we made in refused taxes. If millions of Americans refused to pay for the wars which are killing thousands of people and could end up with nuclear war and the deaths of most of the people in the world, they would have to end their forever wars.

If this seems a little scary, try refusing a token $10.40 or $100.40 together with your letter to the IRS. If millions of people did that, the government would certainly get the message. For wars to exist, governments need young people willing to fight the wars and the taxes of the rest of us. One of Nixon’s top staff, when he looked out the window of the White House and saw over 100,000 people protesting, said: “Let them march all they want to as long as they pay their taxes.” Wars can only continue if the people cooperate! Let’s stop our cooperation with this madness!

For more information about war tax resistance, contact the National War Tax Resistance Coordinating Committee at nwtrcc@nwtrcc.org (800) 269-7464 and the Peoples Life Fund is www.nowartax.org.

Peace, David Hartsough

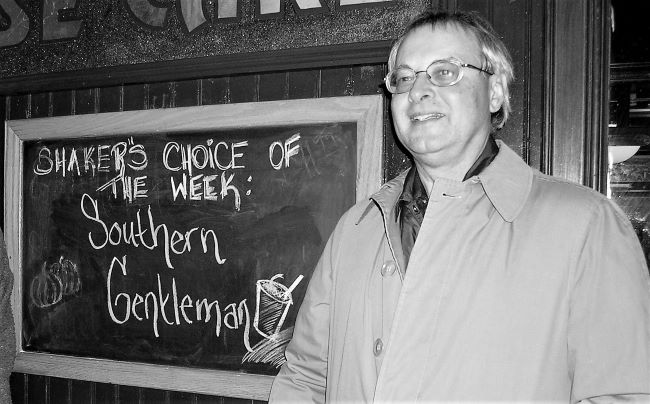

Robert Randall Memorial

By Chrissy Kirchhoefer

Robert Randall, a long time war tax resister was remembered over Zoom on Valentine’s Day by some of the communities that he was instrumental in being a part of in recent decades. The memorial was organized by members of the King’s Bay Plowshares action that took place near Robert’s home in Brunswick, Georgia. Robert rose to the occasion of supporting the nuclear disarmament action at the King’s Bay Naval Base near St. Marys, Georgia. For years, Robert had been a part of a community resisting the nuclear Trident submarines that were docked there.

Ruth Benn shared from her reflection, “Robert Randall Presente/ Always Present,” in which she spoke of how Robert identified as a “war tax converter”; how he was a Conscientious Objector at age 18, “thinking that at that age one should be thinking about going to war and also paying for war.” Ruth highlighted what many of us in the NWTRCC network experienced, Robert’s warm welcome to newcomers and old friends alike and awareness of what was happening locally; contagious energy to get involved. Ruth stated, “More than anything Robert knew that the primary reason people come together is to share stories and fears and ideas to sustain our resistance and survive the economic challenges.” [Editor’s note: Ruth entire text was printed in the last issue of this newsletter.]

The memorial was on Valentine’s Day because it was Robert’s favorite holiday. While Robert must have enjoyed celebrating love on this day, I can’t believe that his devotion to this day was removed from the history of St. Valentine, being a Conscientious Objector to war as well. In an Empire far, far away, St. Valentine resisted conscription to the Roman army by marrying men of military age. Robert was clear in his principles of not killing and not having others kill in his name.

On Valentine’s Day, the Golden Rule was docked near Kings Bay during Robert’s memorial. In 1958, the Golden Rule attempted to sail to the Marshall Islands to interrupt the atomic testing there. Four Quakers were arrested for their attempts. Veterans for Peace has restored the boat as well as the mission for nuclear

disarmament. In recent years the Golden Rule has been traveling throughout the US spreading the message of nuclear disarmament as well as the history of those in the US who have been resisting nuclear weapons since the dawn of the atomic era. Find out when the Golden Rule is coming to your community as we remember Robert’s commitment to nuclear disarmament with the Kings Bay Plowshares.

[Editor’s Note: You can watch a recording of the memorial on NWTRCC’s YouTube page: youtube.com/nwtrcc.)

NWTRCC News

NWTRCC National Conference:

Resisting Together (5-7 May 2023)

After three years of our twice yearly conferences being only on Zoom, NWTRCC will have an in-person conference the first weekend of May. As has been the case for years, there will be opportunities for people to participate in parts of the conference online.

The conference is being hosted by Joyfield Farm (4874 E 1400 N, North Manchester, Indiana 46962). Joyfield Farm is an organic farm in north-central Indiana, about an hour west of Fort Wayne. The farm has WiFi, which will allow certain sessions to be online, including our Sunday business meeting. The setting will be slightly more rustic than usual with amenities such as outhouses. There is plenty of camping space, including inside of a large barn. Some families in the area will also host folks and provide beds, but these will be limited.

The details for the sessions are still being worked out, but the Friday evening session will be hosted by the Peace Studies Institute at Manchester University, which offered the first undergraduate Peace Studies program in the world in 1948. As always, there will be concurrent WTR 101 & 201 sessions.

On Sunday morning we will hold our business meeting, which is open to all. If you have a proposal you would like discussed at the business meeting, please send it to the NWTRCC office before April 15. Go to the NWTRCC website (www.nwtrcc.org) for full schedule and registration information.

Social Media Workshop for WTRs

On Saturday March 18, Lincoln and Chrissy hosted a social media workshop for a few folks in our network. They covered the basics for Facebook, Instagram, and Twitter. There was also a discussion of #HashTags. Adding #WarTaxResistance or #NWTRCC to a social media post will help others find it and create a little more buzz for social media algorithms. Discussion also included taping QR Codes to protest signs to help people find NWTRCC’s website. Many of the ideas discussed at the session, including the QR code, can be found on the NWTRCC website. Go the “Programs” tab and click on “Action Ideas.”

Are you organizing an action, training, or gathering? Got a good photo of your war tax resister community in action? Keep us in the loop: We are all about building the community of resisters. We would love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (our Outreach Consultant): outreach@nwtrcc.org. Follow the journey + join us on all social media: Instagram + Twitter: @wartaxresister // Facebook: NWTRCC.

Social Media Growth – Year over Year, 2018-2023

| March 2018 | March 2019 | March 2020 | March 2021 | March 2022 | March 2023 | |

|---|---|---|---|---|---|---|

| Twitter followers | 1,637 | 1,680 | 1,709 | 1,797 | 1,857 | 1,848 |

| FB Page Likes | 767 | 864 | 970 | 990 | 1,044 | 1,106 |

| FB Group members | 936 | 969 | 1,005 | 1,031 | 1,033 | 1,035 |

| Instagram followers | 92 | 167 | 224 | 331 | 527 | 600 |

| E-Newsletter Subscription | 920 | 1,023 | 1,054 | 1,035 | 1,054 | 1,031 |

John Stoner Interviewed by Mennonite Church USA

[Editor’s Note: The Mennonite Church USA recently awarded John Stoner with the Bring the Peace Award. In February, Jessica Griggs, blog editor for MC USA, interviewed John. The original interview with video can be found at tinyurl.com/4v549s64. This interview is published with the permission of MC USA.]

Q: What does “bring the peace” mean to you?

John: One of the first actions of the #BringThePeace campaign was to establish the Church Peace Tax Fund. And to me, that means that the church recognizes that conscientious objection to war taxes is something that matters. I have long believed that it can’t be right for me to pay someone else to do what is wrong for me to do myself. So breaking the sixth commandment, “Thou shalt not kill,” (Exodus 20:13) is not something I can pay others to do for me. I think when #BringThePeace says that peacemaking is central, not marginal, for all Christians, it’s helping me and the church focus on priorities in Christian discipleship. #BringThePeace says it’s a priority to make peace.

Q: How are you involved in peace and justice work?

John: I believe my vocation is to live out the Sermon on the Mount—to live a life of hungering and thirsting to see justice prevail and being committed to being a peacemaker. This vocation of peacemaking means that I am willing to take risks and hold views that aren’t that popular in culture and society. One of the things my wife and I do is practice what we call symbolic war tax resistance, by underpaying the federal military tax—the federal income tax—by $10.40. 1040 is the IRS form. But to withhold a symbolic portion, the amount that goes to military uses, is a public witness to a better way to run the world. Beyond that, I’m involved in several local peacemaking groups—support groups—one of which is called $10.40 for Peace. This group strategizes ways to work for peace and focuses on the problem of military spending. I also write letters to the local paper. A letter published in a local paper communicates with your neighbors, your friends, and those who are not, perhaps, eager to be thought of as your friends. I also buy books and share books and participate in the education and encouragement of individuals in peacemaking.

Q: Where do you encounter God and your peace and justice work?

John: I’ve felt a call to peacemaking in the voice of the victims of war. And in that, I hear the voice of God. When the children of Egypt were oppressed, the Scriptures say that God heard their cry. And so, in the cry of hurting people, God is listening, and God’s voice is being heard. It’s not only that reality and threat of war that uncovers the heart and voice of God but the needs and the cry of the poor. In the faces of people in poverty, I see the face of God.

I encounter God in my own soul and conscience. Jesus never tired of reminding people that they were called to bear witness to the love of God in this world. And I think that God is visible in the lives and actions of people who do loving things. I don’t know of a better single word to describe God than love itself. And when I see love expressed, then I feel that I see God expressed. So I see the face of God in all acts of love. I see God in all expressions of truth.

Q: How do your Anabaptist faith values propel you toward peace building? Or how has your faith grounded you in the work of peace and justice?

John: The Anabaptists of the 16th century were clear that there is, in the world, a spirit of domination, of coercion; there are systems of abusive power, which need to be resisted. And their faith was that these systems of power that they saw both in the state and in church bureaucracy were not invincible. They believed that Jesus was pointing toward resources in the heart and soul of every living person to say no to the domination and propaganda of those systems, and instead, he was inviting people to say yes to their own wisdom, conscience and heart and to experience freedom and peace by doing that. So the Anabaptist faith has said to me that what Jesus called the kingship of God, the reign of God, is actually a different way to run the world, by a different form of power: compassion, forgiveness, creativity and non-violence. That is an immensely freeing experience — the experience of being able to see truth beyond the claims of domination systems, whether church or state, and the work of discovering and living in these larger truths, which resonate within us from birth. That process, to me, is faith. It’s the practice of faith to believe that things can change; they can be different. We do not have to be victimized by systems of homicide and domination.

Q: Why do you think Mennonites should embrace peace and justice work?

John: The world needs peace and justice to survive. Mennonites should do what all people should do because they are caring human beings. They should be seeking and discovering which kinds of peace and justice work can best contribute to the future of the planet. As Christians, I would expect Mennonites, and actually, all Christians, to take seriously what Jesus said about peace and justice. Peacemaking isn’t just contemplating peace, or wishing it would happen, or thinking that it would be a nice idea. Peacemaking is a vocation; it’s a task. The question really isn’t, “Why should Mennonites embrace peace and justice work?” It’s “How could they ever justify not being centrally engaged in peace and justice work?”

I would add that Mennonites should do peace and justice work as all people should because it is personally fulfilling, and it is meaningful. People struggle for meaning in life. Where can they expect to find it? Well, they could expect to find it in engaging in creative work, which includes working for justice and for peace.

Q: What would you say to encourage those who are not actively engaged in peacebuilding?

John: First, I would ask, “What would you like to do with your life?” When we get in touch with our deepest self, I believe that we want to leave the world a better place than we find it. I know the feeling of our human limitations — I do so much less than I think I should — so I try not to use my limitations as an excuse for not doing anything. We should get more deeply in touch with our own sense of personal calling. We need help to find our calling and our gifts. Mennonites are no different than other people in this. We need friends, we need community to return to time and again — to conversations and to a shared search for what our personal calling is, as well as what we should be doing.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org