National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

December 2022 – January 2023

Contents

- NWTRCC’s 40th Anniversary Conference:

A Joyous Celebration of Resistance

By Lincoln Rice-Milwaukee, Wisconsin - $80 Billion for the IRS

- Counseling Notes IRS Levies the Investments of a WTR • $5,000 Frivolous Fine Threat Retracted • Stricter Reporting Requirement Update for 1099-K

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- War Tax Resistance News WTR 101 for Midwest Catholic Workers • Tabling at National Catholic Worker Gathering • Report on the 16th International Conference on War Tax Resistance and Peace Tax Campaigns

- NWTRCC News Coordinating Committee Meeting

(6 November 2022) • NWTRCC Funding Concerns • 40th Celebration Quiz

By Lincoln Rice

Click here to download a PDF of the December/January issue

NWTRCC’s 40th Anniversary Conference:

A Joyous Celebration of Resistance

By Lincoln Rice – Milwaukee, Wisconsin

Concert with Charlie King

NWTRCC held its fortieth anniversary conference on Zoom the weekend of 4 – 6 November 2022. About 50 people attended some portion of the conference, which began the evening of Friday November 4 with a short concert with folk singer and political satirist Charlie King. He sang “More than Enough” by Robb Johnson, “Universal Soldier” by Buffy Saint Marie, and closed with a composition of his own, “Spoon of Sand.” Find the video for the concert on our YouTube page: youtube.com/nwtrcc.

Evening with Previous Coordinators

NWTRCC Conference Panel with Previous Coordinators. Top Row: Kathy Vass, Larry Bassett, Carolyn Stevens. Bottom Row: Mary Loehr and Ruth Benn.

Following the concert, NWTRCC’s previous coordinators shared some anecdotes from their time with NWTRCC. Kathy Vass, who was the coordinator from 1982 to 1987 shared about the beginnings of NWTRCC and the arduous task of spearheading the composition of a war tax resistance manual. Larry Bassett, who co-coordinated with Kathy from 1984 to 1986, spoke of the daily grind during this time and shared about the significant amount of time that he stood next to a printer making copies of the WTR manual.

Carolyn Stevens, coordinator from 1987 to 1991, spoke about creating and updating WTR literature as well as the importance of fundraising. Unfortunately, Karen Marysdaughter, coordinator from 1991 to 1999, was not able to join us.

Mary Loehr, coordinator from 1999 to 2003, shared stories from NWTRCC gatherings and the fun that happened at those meetings. She also related that at an international meeting in Washington, DC, David Zarembka shared, “I have lost a house… to divorce.” Mary believed he shared this to indicate how precarious life is.

Lastly, Ruth Benn spoke, who was coordinator from 2003 to 2018. Ruth discussed the time she was asked to visit the IRS department that investigated tax protestor organizations. Right before Ruth was called in, the IRS had shut down one of the tax protestor websites. Thankfully, the IRS decided not to take any action against NWTRCC. Their presentations and the discussion that followed have been posted to NWTRCC’s YouTube channel (youtube.com/nwtrcc).

Panel on the Living History of NWTRCC

Panel for NWTRCC’s Living History Session. Left to right: Ed Hedemann, Robert Randall, Erica Leigh, and Sue Barnhart.

On Saturday morning, four panelists each provided a concise summary of one NWTRCC decade. Ed Hedemann, who was at the first NWTRCC meeting, presented on the 1980s. Robert Randall, whose local group sent a representative to the first meeting, presented on the 1990s. Sue Barnhart, who attended her first meeting in Portland, Oregon in 1993, presented on the 2000s. And Erica Leigh, who served for several years as NWTRCC’s social media consultant, presented on the 2010s. Their presentations and the discussion that followed have been posted to NWTRCC’s YouTube channel (youtube.com/nwtrcc).

Memorial Session

For our second Saturday session, we viewed a slide show to the music of Charlie King, in which fifty individuals who have passed away during the last forty years were remembered. After the eight-minute slide show, people shared stories about those in the slide show whom they knew and called forth of the names of those who were inadvertently left out of the slide show. After the additional names with photos are integrated into the slide show, it will be posted to NWTRCC’s YouTube channel.

NWTRCC Trivia

To allow for some fun small-group interaction, we dedicated an hour-long session for trivia. Attendees were placed in groups of five, given some time to chat and catch-up, and then fifteen minutes to work together on a quiz. Lastly, everyone was then brought back to the larger group to find out the correct answers. If you were not able to participate in that session, the multiple-choice quiz from the session can be found beginning on the back page of this periodical.

The Next 40 Years

Our marathon celebration concluded with breakout sessions in which small groups discussed possible directions for NWTRCC during the next one, five, or forty years. There were numerous calls for an official statement on the war in Ukraine, which came up again at the Sunday business meeting. (See the “NWTRCC News” section for more.) Felice and Jack Cohen-Joppa shared the success they have had with placing QR codes on protest signs on college campuses. NWTRCC will provide a way for Tax Day 2023 demonstrations to do this if they wish.

Recognizing the how white our group is, there were calls to continue connecting WTR with racism and earth work. Joshua shared his belief that there would be interest for war tax resistance among several independent media outlets. The NWTRCC office will look into this more during tax season. Other ideas were also offered, which will be brought to NWTRCC’s Outreach Committee for discussion.

Overall, it was a wonderful conference and we were very pleased to see so many people who played a role in NWTRCC’s history. It would be better meeting in person, but I am glad we were able to make the best of what technology has to offer. (A report from the business meeting can be found in the “NWTRCC News” section on page 6.)

$80 Billion for the IRS

By Lincoln Rice

Almost from the moment that Biden assumed the presidency, he has been singing in unison with IRS Commissioner Charles Rettig about the need to increase funding to the IRS by $80 billion.

Originally, the proposed funding had some Republican support, but that soon soured and the future of the funding proposal seemed dead.

All that changed when Biden and congressional Democrats saw an opening to quickly pass the Inflation Reduction Act (IRA). The IRS funding would probably not have passed as a solo bill, but it found life after being added to the IRA.

What’s in the Bill?

The bill will increase the IRS budget by almost $80 billion over 10 years… so a yearly increase of about $8 billion. The current yearly IRS budget is $12.6 billion, so this is a yearly increase of over 60%. That is substantial. After decades of inadequate funding, the IRS will be flush with funds. In terms of people power, this bill will add 87,000 employees to the IRS over a ten-year period—roughly doubling their numbers.

Half of the new funding will be dedicated to enforcement. From the start, supporters emphasized that enforcement will focus on high-income individuals, but low and mid-income households will surely feel the repercussions of this beefed-up enforcement. At the end of the 2010, the IRS wrote off $14.6 billion of taxes due as it expired after reaching the 10-year-statute of limitations. At the end of 2019, $34.2 billion was written off. The IRS expects that increased enforcement will increase taxes collected by over $200 billion during the next 10 years. This means that collection efficiency should return to 2010 levels.

The remainder will be used for operations, tax-payer services, and technology. The IRS has an embarrassing back-log of paper returns to process, not enough people to answer the phone, and an antiquated computer system. These three items will be priorities for the remaining funds.

Consequences for War Tax Resisters

Nothing in the bill indicates that the IRS will increase property confiscations for items such as cars and homes. The decrease in confiscations was largely due to a change in philosophy in the late 1990s. But as the IRS slowly rebuilds its enforcement ranks, we will likely see an increase in wage garnishments, bank levies, retirement fund levies, W-4 lock-in letters, and notices of public liens filed at local courthouses.

Of course, before they can take action on recent years for WTR paper filers, they will have to actually process their returns! As always, the NWTRCC office will stay abreast of these matters and keep you up to date.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on NWTRCC’s website (go to the “About Us” tab and click on “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2023. If you would be interested in attending one of these trainings, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

IRS Levies the Investments of a WTR

Longtime WTR Kathy Labriola in California recently had an IRA retirement fund and a separate investment fund levied. The funds were kept with two different firms. Unfortunately, because they issued the levies simultaneously, they collected the entire amount that she owed the IRS from each account. In other words, the IRS now owes Kathy a refund.

In touching base with NWTRCC legal counsel Peter Goldberger, he shared that it is common for the IRS to cast a wide net to collect on a tax debt. Even though this often results in double collection, this is a legal practice. Since the IRS collected more funds than what is owed, the IRS does owe a refund. But the refund will come after they use the funds for any other tax debt. In Kathy’s case, the levy did not include tax debt amounts for 2018 and 2021. So she will receive a refund after those years have also been paid.

Before contacting the NWTRCC office, Kathy had already sent a letter to a revenue officer whose name was listed on the levy. She notified him of the over-collection. Peter Goldberger believes that the letter should be adequate to get the wheels moving and hopefully everything will resolve itself over the next few months. Unfortunately, the IRS wheels move very slowly.

The IRS has also sent simultaneous levies to PayPal and Kathy’s book publisher, but they were not able to obtain any funds from those sources.

$5,000 Frivolous Fine Threat Retracted

In late 2019, two war tax resisters in our network were threatened with $5,000 frivolous fines if they did not refile their tax returns in thirty days. Although the IRS did not state that either filer received the threat because they included a letter with their tax return, it was the one thing the filers shared in common.

The first resister called back in 2019, got ahold of an IRS employee, and the IRS had some story about how more paperwork was required to justify his charitable deductions. This explanation did not make sense because the fine should not have been threatened for that reason. Nevertheless, they sent in the additional paper and the situation was resolved.

The second resister sent a letter contesting the threatened fine and asked for clarification. In November 2022 (three years later!!!) they received notice that the IRS had reviewed his letter and determined that no action was required by the resister. In addition, they had finally processed their 2018 tax return.

Stricter Reporting Requirement Update for 1099-K

Before tax year 2022, most gig workers received a 1099-NEC if they earned more than $600 and a 1099-K if they had total sales of at least $20,000 and total transactions of 200 or more in a tax year. Gig workers who do not receive the 1099-NEC (e.g., sellers on eBay) did not have income reported to the IRS unless it hit the $20,000/200 threshold for the 1099-K. As of tax year 2022, a 1099-K will be issued for income of $600 or more.

The IRS recently released a FAQ sheet about the new rules. They stated that “transferring money between individuals (e.g., to friends, family, coworkers, etc.) for splitting costs, gifts, allowances, etc. are not payments settled through a third party payment network” and should not be reported on a 1099-K. We’ll see if this happens in practice for people using PayPal and Venmo. The IRS finished the notice by stating that if this does happen, you will need to contact the institution that issued the 1099-K and ask them to correct the error and reissue the form. Finally, the IRS states, “If they cannot get the form corrected, they may attach an explanation of the error to their tax return and report their income correctly.”

Many Thanks

Thanks to each of you who has responded to our November appeal—and in advance to each of you who is about to send that check! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

Special thanks for Affiliate dues payments from: National Campaign for a Peace Tax Fund; Community Peacemaker Teams; Episcopal Peace Fellowship; Las Vegas Catholic Worker; War Resisters League

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. (Please let the NWTRCC office know if you use Resist.) Thank you!

War Tax Resistance News

WTR 101 for Midwest Catholic Workers

NWTRCC consultants Lincoln Rice and Chrissy Kirchhoefer attended the annual Midwest Catholic Worker gathering near Preston, Iowa (16-18 September 2022). They provided NWTRCC literature at information tables and led a WTR 101 session on Saturday morning. There were about 100 folks at the gathering and 12 people attended the WTR session. Longtime war tax resister Karl Meyer was at the gathering and also brought his wisdom and stories to the WTR session.

– Lincoln Rice & Chrissy Kirchhoefer

Tabling at National Catholic Worker Gathering

The Worcester Catholic Worker community hosted a national Catholic Worker gathering the weekend of October 22. The NWTRCC office sent a packet of WTR materials for the lit table at the conference and we were told that almost all the materials were gone by the end of the weekend.

Report on the 16th International Conference on War Tax Resistance and Peace Tax Campaigns

By Cathy Deppe

Geneva, Switzerland September 17, 2022

Participants

Switzerland, United Kingdom, Germany, Italy, Colombia, Belgium, United States, attendance both in person and online. NWTRCC participants included Ruth Benn, Cathy Deppe, Eleanor Forman, and William Ruhaak.

Major Organizing for Conference

Conscience and Peace Tax International (CPTI) Board of Directors, with current leadership from Robin Brookes of Conscience UK. Conscience and Peace Tax International has NGO standing at the United Nations regarding Human Rights Council membership.

The conference focused on two campaigns: (1) the U.N. Human Rights Council, which was taking up the Conscientious Objection to Military Service quadrennial resolution submitted by CPTI and to be voted on by early October, and (2) war tax resistance.

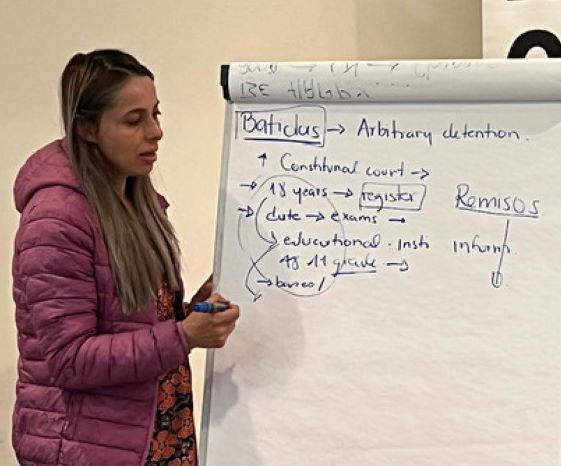

Cathy Deppe (lower left) speaking virtually at the CPTI conference. All photos courtesy of CPTI.

SESSION ONE

I tuned in for the first session at midnight to hear from Dr. Michael Wiener of the Office of the U.N. High Commissioner for Human Rights (OHCHR). Dr. Weiner gave a historical overview of the last 30 years in regard to “Freedom of Religion or Belief.” He explained that it is common practice to accept a resolution without a vote if no party objects. Also, there are no enforcement mechanisms for resolutions, while treaties carry legal obligations.

The first resolution adopted by the Human Rights Council on “Conscientious Objection to Military Service” (COMS) was adopted in 2013, the second in 2017, and it now awaits adoption in 2022. At the General Assembly, 90% of the countries have accepted it, except for Iran, Saudi Arabia, Singapore, and Cuba!

Positive results triggered by these resolutions include a change in the Republic of (South) Korea, where 18,000 had been jailed for refusing to serve in the military. Korea now provides alternatives to military service. Armenia also made a similar U-turn. But many countries still do not recognize COMS either by law or practice.

To strengthen the rights of COs, we need to consider those in territories like northern Cypress and a region of Moldavia, where there may be objectors who are not protected because they do not belong to a recognized “state,” yet may be forced to fight. In Ukraine, men 18-60 years old cannot leave the country or their residence, and the CO provision that previously existed for alternative service is no longer available.

Colombia now recognizes some COs, reported the CPTI representative for Colombia.

War Tax Resistance

Cris Barbey of Switzerland, who also represents CPTI at the U.N., spoke about three strategies for war tax resistance: (1) withhold and redirect, (2) go to court and then appeal using local and international law, and (3) pass legislation (e.g., peace tax fund legislation).

The Italian delegate said Italy has a mechanism to allow some taxpayers to direct some taxes away from or toward things.

The German delegate said Germany is experiencing a dramatic increase in military taxation. It is now 2% of GNP.

SESSION TWO

This began at 5:30am Pacific Time. First, there was a review of the U.N. structure, which I found very informative, if a bit tedious.

- Universal Periodic Reviews: These reviews must be submitted 3-4 times a year by two different bodies. CPTI has NGO status and needs to submit its report to get it into the Periodic Review.

- Special Procedures: This is the process that uses Special Rapporteurs, experts in their fields who are appointed to work on country mandates. (Not sure, but think “mandates” refer to the numbered Universal Declaration of Human Rights. Number 18 – Freedom of Religion or Belief informs CPTI’s resolutions.) CPTI works with a Special Rapporteur who is a Professor at Oxford and handles Religious Freedom and thus handles COs.

CPTI’s NGO status allows it to submit allegations to the Special Rapporteur, who has 60 days to write a letter and who can call a press conference!

When a country has a human rights crisis situation, the U.N. calls for investigation by a Special Rapporteur (SR) expert in the particular human rights issue. The SR follows a process:

- Write the government either an “Allegation Letter,” usually when there is a pattern, or an “urgent” letter often about an individual transgression (like a kidnapping), or “Other.” Experts base their analysis on human rights international law.

- Make a country visit and prepare a thematic report.

Derek Brett, also a CPTI rep at U.N. from Switzerland, explained that the U.N. website lists all these reports. He described the ten types of Human Right treaties and said it can take years to get a treaty ratified.

Country Reports

Milena Romero speaks of the military tax situation in Colombia.

Colombia: The goal is to publicize and recognize coups in Colombia. They came to Geneva to speak to the Special Rapporteur about freedom and conscience in Colombia, but their country is not open to including CO protections in military law. Military police still stop people in the streets and demand to see the “certification” they need to carry to show they have registered as available for military service.

Canada: Closing its peace tax fund but using a peace tax form letter people can send in.

United Kingdom: Conscience UK’s goal is to be more visible and to pass a peace tax bill, with a 3-stage plan of

- lobbying/surveying members of parliament about nuclear weapons and the legal right to claim CO status for the payment of war taxes

- get members of parliament to sponsor bill(s), that even if the bill fails it can prepare the way for the next attempt

- get in the news (They are offering webinars on how to protect the rights of COs, educational activities, and improvement of communications.)

400 people have signed up to write letters to members of parliament.

Germany: Pass a peace tax bill. Reaching out to work in coalition with groups like “Rethinking Security,” “Fridays for Future,” and “Green Party.” The group is shrinking, while military spending has increased, not including a new 100 billion euros only for military materials.

They also sent letters to all Protestant churches about the peace tax bill, but received a poor response — objections being that taxes are an “individual matter” that the church cannot direct.

Favorite moment for me… The Germany post office allows you to submit a requested stamp, they print it and sell it back at more than the stamp itself costs, and you use it on all your outgoing mail, sell it to your members to raise money, get your message out, etc. (My favorite stamp here would say, “Fire the Postmaster General.”)

Switzerland & Italy: Do not have organized groups, yet.

NWTRCC News

Coordinating Committee Meeting

(6 November 2022)

The Sunday business meeting began with reports from both NWTRCC consultants (Coordinator & Outreach Consultant) and the setting of our objectives for 2023. One of the few changes made to the objectives was to “develop news ways to involve the network on social media.” To make this a reality, the NWTRCC office plans to a hold a hands-on social media session for the network on Zoom this coming tax season.

Next, we discussed the upcoming budget for 2023. The most contentious issue regarded funding to hold one of our gatherings in person. One of our members felt that the COVID pandemic was so dangerous that meeting in person should not be allowed for in the budget. As background, the 2021 and 2022 budgets set aside funds for one in-person meeting, though the decision was later made to hold all meetings during those years online. To reach consensus on the budget, $700 for food and lodging was removed from the budget, but we may end up going over budget on this item before the end of 2023.

There was one proposal on the agenda to request membership in the War Industry Resisters Network, which is a coalition of groups primarily led by Veterans for Peace. Last year, they were very active with demonstrations around Tax Day and much of their work will be focused on outreach to college campuses. Outreach Consultant Chrissy Kirchhoefer regularly attends their meetings and this proposal easily passed.

The meeting finished with signing online cards for a few folks in our network, collecting some initial AdComm nominations for the May 2022 meeting, and discussing some possible meeting locations if we were to meet in person for our next meeting (5-7 May 2022). We are always looking for meeting invitations if you have a place we can meet where attendees can social distance (especially as regards sleeping arrangements) and the rental cost would be minimal.

(Minutes for this meeting are not available yet, but will be sent out to the network in the near future. The agenda and supporting documents for the meeting can be found here: https://nwtrcc.org/november-2022-business-meeting/)

NWTRCC Funding Concerns

Boston Penny Poll on Tax Day 2018.

At NWTRCC’s business meeting at the beginning of November, we passed our annual budget for 2023. This budget anticipates taking about $12,000 from our reserves during 2023. Thankfully, because of generous donations earlier in the 2022, we do not anticipate needing to dip into our reserves this year as long as donations in December mirror previous years.

We were able to build up these reserves because of a generous grant that we had been receiving from the Craigslist Charitable Fund each year from 2014 through 2018. Not only did this grant allow NWTRCC to build some reserves, but it permitted us to hire additional part-time staff.

NWTRCC did not receive the grant in 2019 and at this point it seems unlikely that NWTRCC will receive this grant again in the future. Since NWTRCC has always been very frugal, cuts to our 2023 budget were limited.

We did have a successful raffle in the spring, and combined with our regular push for pledge donations and bequests, we hope we will be able to keep shrinking the amount we need to take from our reserves each year.

That being said, if you know of funding sources willing to support NWTRCC, please contact us at nwtrcc@nwtrcc.org or call us at (800) 269-7464. In addition, any extra you can donate at this time would be appreciated. Please consider making a pledge to donate to NWTRCC on a monthly or quarterly basis. This can be done by writing checks or setting up a monthly donation via PayPal (www.nwtrcc.org/about-nwtrcc/donations/). Consider making a bequest to NWTRCC by putting us in your will. More information about making a bequest to NWTRCC can be found on our “Donations” webpage.

40th Celebration Quiz

NWTRCC Trivia

During NWTRCC’s 40th anniversary conference celebration, we had a session dedicated to team trivia using ZoomTrivia breakout rooms. If you were not able to join us, test your NWTRCC knowledge. If you can answer 12 out of the 17 questions correctly, you are a NWTRCC expert! (Answers to the quiz can found below.)

1) What was the registration cost for attending the May 1985 NWTRCC meeting in Denver?

a. Free b. $10 c. $25 d. $50

2) NWTRCC’s newsletter is currently called “More Than a Paycheck.” What was its original title?

a. More Than a Paycheck b. Network News c. War Tax Resistance News. d. Tax Rants

3) The Tax Day 1985 Press Release included how many Tax Day actions?

a. 25 b. 35 c. 75 d. 150

4) The September 1985 NWTRCC business meeting approved NWTRCC’s budget for 1986. How large was the budget?

a. $15,000 b. $26,000 c. $43,000 d. $99,000

5) How many local and national affiliates did NWTRCC have in November 1985?

a. 12 b. 25 c. 56 d. 80

6) Which of the following individuals did not represent NWTRCC in September 1986 at the first international WTR conference in Tubingen, West Germany?

a. Vicki Metcalf b. Joel Taunton c. Hanno Klassen d. Erica Leigh

7) The Peace Tax Fund bill was first introduced in 1972, what year did the House Ways and Means Subcommittee on Select Revenue Measures hold its first ever hearing on the bill?

a. 1982 b. 1992 c. 2003 d. It’s never held a hearing on the bill.

8) When did Lakeside Press (owned by longtime WTR Jerry Chernow in Madison) begin printing NWTRCC’s newsletter?

a. 1982 b. 1984 c. 1993 d. 2003

9) When did NWTRCC get an 800 number?

a. 1983 b. 1993 c. 2010 d. It’s never had an 800 number.

10) December 1995 saw the NWTRCC newsletter take on the name “More than a Paycheck.” Other names were suggested and rejected. Which of the following was not rejected?

a. NWTRCC News b. A Pax on Your Tax c. New Trek: The Next Generation

11) NWTRCC entered the future by obtaining a website in 1996. What was NWTRCC’s original web address?

a. www.nwtrcc.org b. www.wartaxresistance.org. c. www.nwtrcc.com

d. www.nonviolence.org/~nvweb/wtr

12) When did the NWTRCC office get its first answering machine?

a. September 1982 b. April 1985 c. January 1989 d. May 2003

13) NWTRCC’s Administrative Committee is responsible for overseeing the functioning of NWTRCC in between Coordinating Committee (CC) meetings. When was the AdComm first established?

a. September 1982 b. December 1982 c. May 1986 d. May 2003

14) In April 2005, the NWTRCC newsletter provided a list of alternative funds. How many funds were on that list?

a. 2 b. 10 c. 21 d. 55

15) Which person on this list did not have an interview on the topic of war tax resistance in the NWTRCC newsletter in 2006?

a. Julia butterfly Hill b. Jane Fonda c. Howard Zinn

16) What year did NWTRCC join Facebook?

a. 1982 b. 2003 c. 2009 d. Facebook is evil. NWTRCC never goes on Facebook.

17) Which war tax resister was issued an apology from the IRS in 2011 for being threatened with a $5,000 frivolous fine in error?

a. Steve Leeds b. Ruth Benn c. Joffre Stewart d. Jane Fonda

Quiz Answers:

1-C; 2-B; 3-D; 4-C; 5-D; 6-D; 7-B; 8-C; 9-B; 10-A; 11-D; 12-B; 13-C; 14-C; 15-B; 16-C; 17-A

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org