More Than a Paycheck,

REFUSING to PAY for WAR

April-May 2018

Contents

2018 Tax Day Actions by Erica Leigh

2018 Tax Day Actions by Erica Leigh- “Bond Slackers” Refused War Loans By David Gross

- Counseling Notes Traveling Resisters • Glitches with the Tax Overhaul Bill • Interest Adds Up — But How Much? • Estate and Gift Tax Exempt Amounts • Health Care Mandate and 2017 Tax Returns

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network List Updates

- War Tax Resistance Ideas and Actions Starting a War Tax Resistance Support Group • Send Greetings to the IRS • Review: Walden, The Game

- Resources New Pie Chart • Divest From War With The Peace Tax Return • Divest From War Website

- NWTRCC News Divest from War · Invest in People • craigslist Charitable Fund Comes Through Again • Social Media • NWTRCC Coordinator Hiring Update

- PROFILE Reflections on War Tax Resistance Actions By Michael McCarthy

Click here to download a PDF of the April/May issue

2018 Tax Day Actions

The group Filthy Rotten System kept things lively during the 2017 NYC tax day vigil. Photo by Ed Hedemann.

By Erica Leigh

As $1.5 trillion in military-related spending is slated for fiscal year 2019, and the drums of war are beating loudly across the world, tax season is here again. Below is a sample of activities taking place across the country for the 2018 tax season, including vigils, rallies, war tax redirection ceremonies, and leafleting. Our list of Tax Day actions is growing as we go to print. For the most up-to-date list and more details, please see nwtrcc.org/programs-events/tax-day.

“Bond Slackers” Refused War Loans

By David Gross

The United States funded its participation in World War I through the sale of “Liberty Bonds” to citizens. Refusal to buy these bonds was the primary tactic of war tax resisters in the U.S. at that time. It was ostensibly not obligatory to buy such bonds, but the government and vigilante groups frequently used coercive tactics to try to force people into purchases or to retaliate against people who had not contributed. A signature tactic of these vigilante groups was to paint the vehicles, homes, businesses, and bodies of “bond slackers” yellow. The persecution of Americans who refused to buy war bonds mostly took place in 1918, and to commemorate these resisters, NWTRCC is printing our newsletter on yellow paper throughout 2018.

The third Liberty Loan drive, in April 1918, prompted many attacks on bond slackers. In one case, five coal workers were suspended by their feet and dunked head-first in hot oil by their co-workers until they agreed to buy Liberty Bonds. A vigilante mob cut the telephone wires at Mennonite George Cooprider’s house, then tarred and feathered him and two other Mennonite resisters. Other refusers lost their jobs, or had to leave their homes or seek refuge to avoid murderous mobs.

In April 1918, Herman Bausch was convicted under Montana’s sedition laws for refusing to buy Liberty Bonds. He served 28 months in state prison. In May, a vigilante mob seized and sold over a thousand head of livestock from a Mennonite colony, using the proceeds to purchase Liberty Bonds.

David Gross, author of 99 Tactics of Successful Tax Resistance Campaigns among other books, will be adding historical notes in this column through the year. For more you can also see his blog at sniggle.net/TPL.

Counseling Notes:

Traveling Resisters

A U.S.. citizen living in South America asked NWTRCC about travel and passport issues for a nonfiler with some reported income in the U.S.. He had read about the possibility of passports being revoked for tax debt, but that debt has to be over $50,000. He did not have a debt at that level, but he had other worries related to living abroad and applying for citizenship in another country. We asked a few WTRs who are frequent travelers, and none have ever been questioned about taxes when coming or going from the U.S. or on entry to other countries. One mentioned the Peace Tax Seven, who were prominent resisters from Britain because of a court case they initiated. All travel with no problems. Another WTR travels with his wife who is not a U.S. citizen but has a green card. He has had a tax debt, but taxes have never come up at the border. And another WTR noted that he’s never had a problem and thinks that if tax issues come up it might have more to do with U.S. money leaving the U.S. than the human. But he also said,

“Upon returning and reentering the U.S., Immigration, can, of course, hassle anyone they want to. They can interrogate, search, search computers and phones (even though the legality of that is an open question — they still routinely do it), and delay you long enough to force an expensive rewrite of a person’s travel itinerary. The U.S. government has its lists, and most of us have heard of people being hassled that are not on any known list, so they can be unpredictable. But regarding foreign countries — allowing entry and/or issuing entrance visas — they can do whatever their laws allow… in the case of Canada our governments completely share information, so if the Federal government has a record of on you, so does Canadian Immigration — best not to be caught in a lie with them.) Bottom line: travel and freedom of movement is a Human Right. Use and enjoy it. Support others who are being infringed upon.

“Oh, one more thing, there are a number of countries on planet Earth where being an activist against insane U.S. military spending would not be looked down upon, if the question were ever asked of you by a government official.”

Glitches with the Tax Overhaul Bill

The IRS is scrambling to make many detailed changes as a result of the rushed tax bill passed at the end of 2017. We’ve written about withholding calculations in the previous issue and online, and the IRS has now updated their W-4 for 2018 and has a withholding calculator on their website that might be useful for some resisters. Find it at irs.gov.

One glitch, reported in tax information emails from Thomson Reuters “Checkpoint Newsstand,” points to problems in withholding calculations for nonresident alien employees, who are not entitled to the standard deduction built into withholding tables. Employers must add an amount (add-back amount) to the wages of this group of employees before determining withholding in order to offset the standard deduction. Because the tax bill substantially increased the standard deduction, the add-back amount for a nonresident alien employee paid on a weekly basis went from $44.20 to $151.00 in 2018. For some employees that meant that their withholding was greater than their wages. The IRS is looking into this problem.

If you are interested in other esoterica from the tax bill, some of which may have real impact on some resisters, the IRS has a resource page at irs.gov/newsroom/tax-reform.

Interest Adds Up — But How Much?

Resisters with a tax debt notice that their debt increases significantly over time and often ask about projections to help them prepare. The IRS recently announced an increase in the interest rate for both underpayments and overpayments from 4% to 5%. However, this line might indicate why it’s still hard to calculate interest compounding daily: “…in determining the rate on estimated underpayments for an individual, the federal short-term rate that applies during the third month following the taxable year also applies during the first 15 days of the 4th month following the taxable year.” (Checkpoint Newsstand, 3/12/18).

Estate and Gift Tax Exempt Amounts

The new tax law temporarily doubles the amount exempt from federal estate taxes. For decedents dying and gifts made from 2018 through 2025, taxes apply to estates over $11.2 million for 2018, and $22.4 million per married couple.

In 2018, the first $15,000 of gifts given by one person to another individual is not taxable and does not have to be shown as income by the recipient. So mom can give her child $15,000 and dad can give $15,000 to that same child for a total of $30,000 per year. If that child is married, then the same gifts can be given to the spouse.

Health Care Mandate and 2017 Tax Returns

Trump has not killed the Affordable Care Act yet. The IRS says that 2017 returns won’t be treated as complete and accurate unless the taxpayer reports full-year coverage, claims a coverage exemption, or reports a shared responsibility payment on the tax return.

Many Thanks

Thanks to each of you who has responded to our November appeal or gave a year-end donation. Remember, you can also donate online through Paypal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

Special thanks for Affiliate dues payments from:

- Center on Conscience and War

- CMTC Escrow Account

- New England War Tax Resistance

- War Resisters League National Office

And, we were grateful to get a check from Sonoma County Taxes for Peace, but it also represented the closing of their account and the decision to fold the organization. Individuals in the group will maintain their war tax resistance and meet up maybe once a year or when support is needed, but this longtime NWTRCC affiliate has ended their group status. Thanks so much to all of you who kept the group going for so many years!

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or 1-800-269-7464), if you would like a printed list by mail.

Click on the icons at nwtrcc.org to find us on

Facebook • Twitter • YouTube • Instagram

and to join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC. Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

War Tax Resistance Ideas and Actions

Starting a War Tax Resistance Support Group

Hudson Valley war tax resistance gathering. Courtesy of Daniel Woodham.

Daniel Woodham and Katherine Betts organized an introductory war tax resistance gathering in the Hudson Valley of New York in February. Here’s part of Daniel’s report on the organizing and implementation of their meeting. For more, see the full report on the NWTRCC blog (nwtrcc.org/media/blog).

The actual program included welcoming people, giving them logistical info, and a brief outline of how we were going to run the 2-hour program. I included a 5-minute version of my personal ‘how did I get into WTR‘ story before the video, as I’ve found that this is one of the most poignant things to include in a WTR workshop. We then viewed the video, talked about low-to-high levels of refusal and associated risks, and did Q & A. At the end of the program people were encouraged to check out the literature table at the back of the hall. We also mentioned NWTRCC’s website, the WTR practical series, the WTR handbook, MTAP, area counselors, the national and international WTR movements, and the importance of having a local support group.

When at the end of the program we proposed starting a local support group for WTR and social justice activism, there was general enthusiasm and an agreement to set up a second meeting. With the sign-up sheet from the meeting we are now contacting people to set up our next program fixed for one month from the initial get-together. We have also sent out a reminder about upcoming social justice actions in the region people can attend.

Send Greetings to the IRS

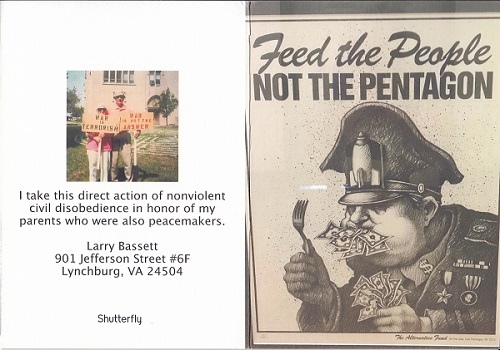

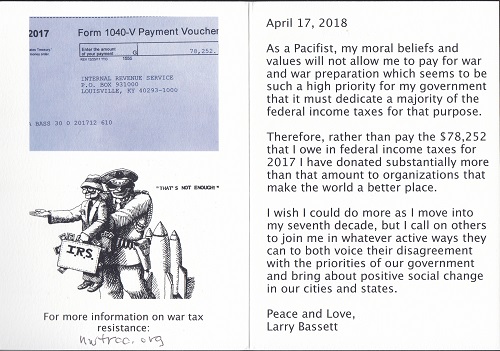

Outside of the Greeting Card

War tax resister Larry Bassett writes, “I am just stumped that the IRS in response to $130,000 resisted so far has just sent out their normal half dozen letters and lien notice.” He decided to announce this year’s resistance differently — with a greeting card. Larry wrote on the war tax resistance discussion listserve (lists.riseup.net/wtr-s),

“Using the online photo service Shutterfly, I have created a card with words and pictures. I will send a card this week to my local IRS friend Jeffrey and will enclose a one dollar bill with it. Ultimately it will be interesting to see if they credit my account with this payment. I assume this is a idea that has been tried in the past but I have no recollection of hearing about it.

Inside of the Greeting Card

My goal in this case is just to try to force them out of their normal bureaucratic response. Jeffrey has told me he just passes my letters up the chain of command. Presumably the dollar bill will go with it.

“If you would like me to mail you a copy of my greeting card, send me your mailing address by email to lhbassett@ntelos.net.”

(You can see more on the upcoming documentary about Larry, called The Pacifist, at facebook.com/thepacifistfilm.)

Review: Walden, The Game

Reviewed by Ed Hedemann

“A long way from ‘Grand Theft Auto’… the challenge is stillness.”

— New York Times, Feb. 24, 2017

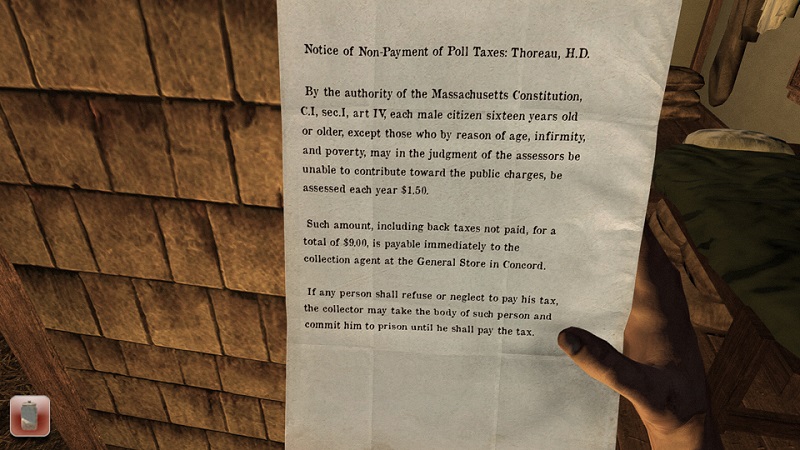

Unlike most video games, there is no score-keeping, different skill levels, or competition. There are no cars, guns, violence, aliens, or, some might feel, action. It’s a first-person 3D game that stresses solitude while you try to stay alive by building Henry David Thoreau’s cabin, mending clothes, chopping wood, gardening, observing wildlife, walking through the woods, fishing, gathering food, visiting friends in Concord (such as Emerson), pausing for contemplation or reading The Iliad, Thoreau’s journal, personal letters, etc.

At times there is a sense of urgency because days do turn to night, so best not to be too far from home late afternoons. Also, if you haven’t eaten recently, it’s possible you’ll faint as happened to “me” two or three times during my first foray into the game.

Initially I spent a couple hours getting familiar with the game and its controls (CTRL-J especially valuable), and my quest to see if there was any mention of tax resistance, which did appear once in the form of a “notice of non-payment of poll taxes” — complete with the threat of prison — tacked to the front door. There could be other adventures I missed because I didn’t play all the way through.

But since I don’t do video games any more, it seemed the opinion of a real gamer would provide valuable insight. Fortunately, Ruth Benn’s 16-year-old nephew, Tyler Benn from Indiana, offered the following (lightly edited) comments:

“I think the game is very creative and haven’t really seen anything like it before. I was fairly surprised as it looked quite decent for a game made on Unity.

“I normally play strategy games but I’ll give this game credit, the amount of stuff to do seems a little overwhelming. However, a large portion of the game is devoted to performing tasks and surviving, and has the player traveling around the map searching for things like arrowheads to contribute to the story but I find it more of a negative. Overall, I think this game is best suited for those that have a very genuine interest in Thoreau and not so much for people who just enjoy video games as the gameplay might be a bit slow for them.

“My biggest complaint about the game are the controls. They are pre-mapped for an Xbox controller. Also, I found the house-building very clunky, albeit amusing. It was quite entertaining when I first figured out how to do it, but after a while it became very repetitive and, at times, frustrating.

Screenshot of “Notice of Non-Payment of Poll Taxes: Thoreau, H.D.” from Walden, the game.

“One of the big positives was the ambiance. The minimalistic music combined with the occasional crackling of a fire or buzzing of a bee hive gave the game a relaxing feeling that I don’t find with many other games. The game definitely captures the essence of what Thoreau was seeking.”

“Walden, a game,” a 3D game for PCs or MACs on desktop or laptop by USCGame Innovation Lab, 2017, produced with NEH and NEA funding. $18.45 download or $39.95 box set with flash drive encased in wood. High resolution monitor and graphics card important. To move during the game use W, A, S, D keys and the mouse, but CTRL-J is very handy as it pulls up a map to show your location. Trailer: https://www.waldengame.com/#about-section.

Ed Hedemann is a longtime war tax resister from Brooklyn, NY. He claims some familiarity with Pong, Pac-Man, Space Invaders, and the like.

Resources

New Pie Chart

War Resisters League has released their fiscal year 2019 pie chart, “Where Your Income Tax Really Goes.” A copy is included in the print version of this newsletter. You can order amounts of 200 or less from NWTRCC at nwtrcc.org/store or 800-269-7464, or larger amounts from WRL (warresisters.org/store).

Divest From War With The Peace Tax Return

A redesigned Peace Tax Return is now available, with updated language and colors to align it more closely with NWTRCC’s Divest From War, Invest In People campaign. Download it from

nwtrcc.org/war-tax-resistance-resources/flyers or order from nwtrcc.org/store.

Divest From War Website

The Divest From War, Invest In People website is now live at wartaxdivestment.org. This is a great resource to reach out to folks familiar with divestment through other campaign work! People can also sign up as resisters and/or to get more information about war tax resistance on this site. This registration replaces the old War Tax Boycott sign-on.

NWTRCC News

Divest from War · Invest in People

War Tax Resistance Gathering and Coordinating Committee Meeting

May 4-6, 2018 · CPUSA Worker Center, 1251 South St. Andrews Place, 90019

Hosted by members of Southern California War Tax Resistance and Alternative Fund and co-sponsored by Veterans for Peace LA Chapter, LA Catholic Worker, and NWTRCC

- Panels and workshops Friday evening and Saturday

- Link up with other divestment campaigns

- WTR 101 workshop for those new to war tax resistance

- Share stories and strategies for sustaining resistance

- Celebrate Cinco de Mayo Saturday evening in Los Angeles

- Meet NWTRCC’s new coordinator and say farewell to Ruth Benn after 15 years as coordinator

Plus, enjoy great meals from Food Not Bombs, and stay if you can on Sunday afternoon to visit Arlington West on the beach at Santa Monica. All are welcome to NWTRCC’s business meeting on Sunday morning. Please register soon so that housing can be arranged in host homes and shared space.

See nwtrcc.org/programs-events/gatherings-and-events for more information and the online registration form or call the NWTRCC office, 800-269-7464, to receive a brochure in the mail.

craigslist Charitable Fund Comes Through Again

NWTRCC is pleased to acknowledge another $25,000 grant from the craigslist Charitable Fund, which makes outright grants to organizations without applications, preconditions, or expectations of specific use of the money. We have used this money to fund consultant work outside the NWTRCC coordinator position (such as social media, field organizing, and now communications), as well as to fill fundraising gaps over the years. Again, this grant will help us sustain our work this year and into the future. Thank you!

Social Media

Erica Leigh has passed the social media work to Sarah Mueller, and is taking up other communications work for NWTRCC, including this newsletter, as well as the website, blog, and literature. Here’s a table that shows how NWTRCC’s social media presence has grown over the past five years — we’re looking forward to many more years of growth! You can continue to reach Erica in her new role at wartaxresister@nwtrcc.org.

Are you organizing an action, training or gathering? Got a good photo of your war tax resister community in action? Keep us in the loop: We’re all about building the community of resisters. We’d love to celebrate you + help spread the word. Email Sarah Mueller (our new Philadelphia-based social media coordinator): socialmedia@nwtrcc.org // Follow the journey + join us on all social media Instagram + Twitter: @wartaxresister // Facebook: National War Tax Resistance Coordinating Committee (NWTRCC).

Social Media Growth – Year Over Year, 2013–2018

| 11-Apr-13 | 14-Apr-14 | 9-Apr-15 | 1-Apr-16 | 1-Apr-17 | 6-Mar-18 | |

|---|---|---|---|---|---|---|

| Twitter followers | 31 | 388 | 648 | ~800 | 1,178 | 1,637 |

| FB Page Likes | 34 | 96 | 170 | 274 | 571 | 767 |

| FB Group members | 466 | 512 | 619 | 711 | 895 | 936 |

| Instagram followers | n/a | n/a | n/a | n/a | n/a | 92 |

NWTRCC Coordinator Hiring Update

After months of work, the Hiring Committee and Administrative Committee are excited to report that we have offered the NWTRCC Coordinator position to a well-qualified applicant: Lincoln Rice of Milwaukee, Wisconsin. Lincoln is a long-time war tax resister, an area contact for Milwaukee War Tax Resistance, and a WTR counselor. He also helped organize the May 2015 NWTRCC gathering in Milwaukee.

Lincoln will attend the May 2018 gathering in Los Angeles and train with Ruth in New York during the week after, taking over the coordinator role completely in mid-May. Welcome, Lincoln!

The Hiring Committee consists of: Bill Glassmire and Cathy Deppe, co-chairs; Rick Bickhart, Kima Garrison, Jason Rawn, Carolyn Stevens; and Ruth Benn and Erica Weiland, consultants.

PROFILE

Reflections on War Tax Resistance Actions

Michael McCarthy and Ande Gaines McCarthy cantoring at their church. Courtesy of Michael McCarthy.

By Michael McCarthy

In May 2007, I wrote an article (pictured below) for the Port Huron, Michigan Times Herald called “Protesters want to pay taxes, but don’t want immoral war” about our project, “Iraq Peace Bonds.” We’d formed a local community to openly redirect some of the federal income tax money going to the Iraq war, in doable amounts — increments of $100 to meet human needs. Easier said than done, but worth the effort.

The check we presented to our local library in 2007 was from 10 of us: seven paying forward what they planned to resist, and three of us already owing and therefore actually refusing payment to the IRS. We were a loose group of friends who’d worked together for peace for years. The one of us three who has not been filing, and works for herself as a housekeeper, has yet to be docked for the money. But within a year, the amount my wife Ande Gaines McCarthy and I had redirected was deducted automatically from President G.W. Bush’s special “Economic Stimulus 2008” tax rebate. IRS computers have gotten smarter since we began war tax resistance/redirection, each before we got married in 1978. But we had used almost a thousand dollars for peace prior to our “rebate.”

IRS collection does not invalidate one’s efforts, but does often “double bill” us — yet new dollars have already gone for peace. In our first 15 years of marriage we in this way preemptively redirected a cumulative over $13,000 refused, paid for peace, and not collected on, all those years. Eventually we bought a house in town, after 2 simple country homes built in Kentucky and Michigan with funds direct from our paychecks and the sweat labor of ourselves and community church friends. Needing a mortgage now we had to establish credit for the first time, and settle with IRS. It was our initiative because of needed family changes, not IRS demands. That’s not the case for every tax resister though, and IRS computer cleverness does seem to be improving.

To make peace-not-war tax a more accessible movement for more working- and middle-class people, one must start at the beginning, preventing withholding. To not prepay the IRS should be an important initial focus. Keep as much as possible of job or retirement disbursement income out of IRS hands. Redirect it to your own or a collective peace fund. NWTRCC has the expertise, and we all can become better at this in our local areas. You have to owe the IRS on April 15th in order to refuse and redirect your money. Few refuse an IRS refund.

When we started our efforts at peace tax in 1978, we were both embarking on medical professions (registered nurse and physician assistant) that had potential for lucrative incomes. Over the years we tried to limit our war tax liability, by both working as much part-time as possible (sharing care of our four children with the time gained), sometimes bargaining down salary in favor of benefits, and contributing forgone salary amounts to the cause of the community clinics we worked in. We are both retirement age now and have some significant savings as a result of putting (at times) 25-50% of our combined income into IRAs and 401(k)s.

Now we’re in a situation, as are many of our friends, of beginning to get required minimum distributions (RMDs) from these retirement funds —which means confronting the war tax liability. To be able to be war tax re-directors, we have to tell the fund managers not to deduct federal tax from each RMD, so that no income tax is withheld. This income is reported on a Form 1099-R.

In 2013 we gathered another group, and demonstrated against prepayment for war, and enabling peace tax redirection. We burned our 1099-Rs and W-2s and dropped the ashes into a crystal bowl of blue water (we’re the Blue Water city — Port Huron) with songs and protest signs. Out of the war ashes would come the phoenix of peace investment. There were six or seven of us on the boulevard between the courthouse and the public library, flanked a little further down at the river by the municipal police station. No authorities objected, but little notice was taken, except by some of the pedestrians who stopped to talk.

Most recently we held a meeting of our local peace group, Blue Water Pax Christi. In these times of increasingly ominous inequality, racism, and military expenditure, we were sounding out our own members on their willingness to make WTR a focus of our activities. There was heartfelt honest discussion, but none of the 10 present could at this point commit to this as a collective direction for the group. They did affirm and support our intention to resist and redirect this year.

And this is the central importance to all our efforts we believe — sharing openly with family, church, and community the desire to pay responsibly for cooperation with the good, and a noncooperation with evil. There is more discussion and discernment going on than in the past. God bless us with inspiration, courage, and growing solidarity.