More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

April – May 2019

Contents

- Tax Day Actions by Lincoln Rice

- Why I am a Cop Watcher … for the same reasons I resist war taxes by Anne Barron

- Counseling Notes Qualified Business Income Deduction • Proposed Budget Increase for IRS is Minor • Under-Reporting in the Gig Economy • New Twist on IRS Phone Scam • Tariffs for War

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

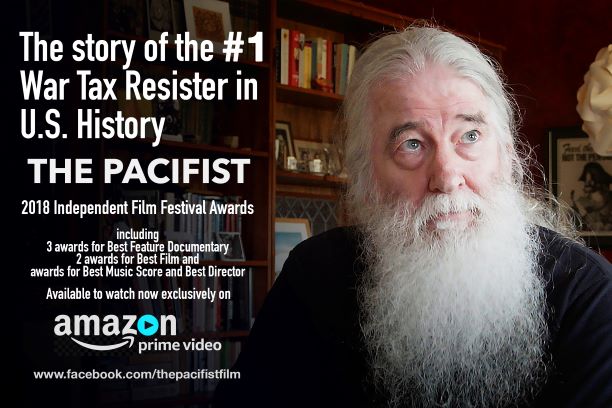

- Tax Resistance Ideas and Actions Host a viewing of The Pacifist or Death and Taxes • Keep Tax Day Positive!

- Resources New Pie Chart • Divest from War with the Peace Tax Return • Divest from War Website • Divest from War Organizing Packet

- NWTRCC News Joffre Stewart – In Memoriam • Mark your Calendars • Memorial Service for Tom Wilson • National War Tax Resistance Gathering and Coordinating Committee Meeting • Social Media Growth 2014-2019

- PROFILE Redirection Reflection By redmoonsong

Click here to download a PDF of the April/May issue

Tax Day Actions

By Lincoln Rice

As over $1.5 trillion in military-related spending is slated for fiscal year 2020, and the drums of war are beating loudly across the world, tax season is here again. Below is a sample of activities taking place across the country for the 2019 tax season, including vigils, rallies, war tax redirection ceremonies, and leafleting. Our list of Tax Day actions is growing as we go to print. For the most up-to-date list and more details, please see www.nwtrcc.org/programs-events/tax-day.

Berkeley, California – April 14, 3:00pm. Northern California People’s Life Fund will gather at the BFUU Fellowship Hall (1924 Cedar St., Berkeley—Near North Berkeley BART) and distribute $15,000 in redirected taxes to amazing peace and justice organizations! The program includes a potluck dinner and the Granting Ceremony. For more information see, www.nowartax.org or contact nowartax@riseup.net.

Kathy Kelly, left, leafletting at the penny poll in downtown Colorado Springs for Tax Day 2018. Photo by Donna Johnson

Colorado Springs, Colorado – April 12, 11:45am-1pm. A penny-poll will be hosted downtown at the southwest corner of Pikes Peak and Tejon Street. For more information, contact Mary Sprunger-Froese at firststriketheatre@hotmail.com.

South Bend, Indiana – April 15, 4:30-5:30pm. Vigil at Corner of Jefferson and Main – 204 S Main Street. Sponsored by Michiana Peace and Justice Coalition (www.michianapeacejustice.net). For more information, contact Peter Smith at psmith@saintmarys.edu or (574) 532-3720.

Manhattan, New York – April 15, Noon-1pm. Vigil and leafleting outside the IRS office, 290 Broadway at Duane Street, across from the Federal Building. War tax redirections may be announced. Sponsored by NYC War Resisters League. For more information, see or call (718) 768-7306.

Boston, Massachusetts – April 17, 4:30-8pm. Tax Day March & Rally at Uphams Corner in Dorchester. Sponsored by Massachusetts Peace Action. For more information, Massachusetts Peace Action at (617)354-2169, info@masspeaceaction.org or http://masspeaceaction.org/event/tax-day-2019-dorchester/.

Eugene, Oregon – April 15, 3pm. Taxes for Peace Not War and a coalition of climate organizations concerned about the climate crisis will rally at the old Federal Building at 211 East 7th Ave (location of IRS office). At 4pm they will deliver a signed letter to the IRS. Then they will march to the new Federal building at 405 East 8th Avenue to deliver copies of the letter to federal representative Peter DeFazio and federal Senators, Jeff Merkley and Ron Wyden. The event will include signs, chants, songs, and speeches. People interested in signing the letter, helping to organize the event, or needing more information can call Sue Barnhart at 541-731-1189 or suebarnhart2@gmail.com.

Portland, Oregon – April 15, 7:30-9am. Sign-holding on Portland bridges (Burma Shave Style). Meet at E. Burnside and MLK Jr. Blvd. Sponsored by War Resisters League — Portland. For more information, Email:

jgrueschow@comcast.net.

Brattleboro, Vermont – April 15, 10am-3pm. WTR Information Tabling outside of the Brattleboro Food Coop, 2 Main Street. Sponsored by Pioneer Valley War Tax Resistance. For more info, contact Daniel Sicken at 802-387-2798 or dhsicken@yahoo.com.

Tin Horn Uprising Band at 2018 Tax Day rally in Kingston, NY. Photo by Daniel Woodham

Milwaukee, Wisconsin – April 13, Noon-1pm. Vigil to protest federal tax dollars for war and environmental harm, U.S. Army Reserve, 5130 W. Silver Spring Dr. Sponsored by Milwaukee War Tax Resistance, Casa Maria Catholic Worker, and Peace Action of Wisconsin. For more info, contact Lincoln or Mikel, Casa Maria at usury_sucks@hotmail.com or (414) 344-5745.

Check out another website for Tax Day actions:

The Global Days of Action on Military Spending (GDAMS) are taking place again this year, April 13 – May 9, organized around the slogan, “Demilitarize: Invest in People’s Needs!” Find a list of all the actions at www.demilitarize.org.

Why I am a Cop Watcher…

for the same reasons I resist war taxes.

By Anne Barron

Sunday, Feb 24 – Since Cat was nowhere in sight, and not responding to texts, Julie and I headed over to check out the nearby AJA Project while we waited. Located in the City Heights neighborhood, the young artists at AJA Project use art as the medium for young people dealing with systemic oppression to express the inexpressible. This San Diego neighborhood is known for its diversity, large refugee populations, and tense police-community interactions. The notorious local Curfew sweeps ignited complaints about racially motivated stops as more and more young people were swept up, handcuffed, and in some cases “documented” for being brown and black.

Nov 11, 2016 – Over 50 cops, a canine unit and 35 police cars swarm Market & 30th, responding to 3 people running around the area. Photo by Anne Barron

No surprise that Cat was busy filming police in a nearby parking lot. Cat and Aaron had heard a police request for “back-up on 44th” on their scanner and grabbed their equipment. Julie and I headed over to 44th and University to learn how they do it. We saw seven police officers, three police cars surrounding the entrance, and one civilian forced to sit up against the smelly garbage dumpster while two other young men were being questioned. Cat and her partner Aaron were filming from about 10 feet away, trying to reassure the guy against the dumpster. The CopWatchers worked quietly, with a business-like attitude, in de-escalation mode. After about 30 minutes, the men were finally released–no ticket, no problem, no citation—just another cop stop for people living in black and brown communities.

The couple have been filming police in the area for about five years now, with police scanners and cameras their tools of mass education. Both have their own stories of police aggression. There are about 8,000 videos of police stops posted on their YouTube Channel. The stop we watched was posted within hours, with a title “Loitering in Parking Lot” and a musical score. The San Diego Police Department calls it “loitering”–basically an excuse to “officially” stop and detain any one, regardless of the 4th Amendment. The guys in the parking lot just call it “hanging out.”

I got into copwatching after witnessing numerous “over-policing” actions at local trolley stops and neighborhoods “south of the 8.” This is San Diego code for communities that are black and brown. The trolley stops are “Lemon Drops” (or Stop & Frisk points) where over a dozen fully-geared up officers from different agencies team up to surround and question anyone they want. I have never been questione—older white woman that I am.* I learned to keep my camera fully charged—to document what I was witnessing.

At the May 2017 NWTRCC Gathering, we had the opportunity to talk with David, one of the conveners of the St. Louis version of CopWatch, which sprang out of the Ferguson rebellion and subsequent militarized police invasion. This conversation galvanized me to reach out when I got home. Several groups in San Diego had been working around doing local cop watch; United Against Police Terror had been doing it the longest and best. They got me a police scanner and I now am listening where I live in East County.

Just how militarized is San Diego? San Diego is a military town, so much that the army thought it was a great idea to give a local high school a real MRAP (Mine-Resistant Ambush Protected) vehicle. Well, the community shut that down in no time!

Cop Watch is also having an impact in City Heights from their video posts, where officers seem to feel they are at war with the people they are “sworn to protect and serve” rather than public servants. The police now accept their presence instead of trying to intimidate them to stop. Cop Watch stood its ground and is growing the movement here.

* Full Disclosure: Ok, I was questioned once by a transit cop—I was coming back from the garden soiled, sweaty, in raggedy clothes and with my shopping cart full of garden buckets. I did get questioned for about a minute—what was my name, where was I going, etc. I simply smiled at the cop, without answering. That was my WW privilege playing out—he walked away rather than handcuffing me.

References:

www.voiceofsandiego.org/topics/news/the-curfew-police-hit-the-streets-of-city-heights/

www.youtube.com/watch?v=ewPLXH4dGzU

Counseling Notes:

Qualified Business Income Deduction

The IRS has released the corrected draft of final regulations on the Qualified Business Income (QBI) deduction, which was added by the Tax Cuts and Jobs Act. QBI is generally defined as the net amount of “qualified items of income, gain, deduction, and loss” relating to any qualified trade or business of the taxpayer. Generally for tax years beginning after Dec. 31, 2017 and before Jan. 1, 2026, the QBI deduction allows a deduction to a non-corporate taxpayer, including a trust or estate, who has qualified business income (QBI) from a partnership, S corporation, or sole proprietorship. The deduction is limited to a maximum of 20% of what would have been your taxable income without it. In other words, other income deductions (such as the standard deduction) may lower the 20% deduction.

There are several restrictions on the type of business or deduction allowed for taxpayers with taxable income greater than $315,000 for married individuals filing jointly, $157,500 for other individuals. If your income is below these amounts, you don’t have to worry about the restrictions. If it is above, get ready for your head to spin: The deduction is disallowed to anyone who has income above the threshold and operates a “specified service trade or business.” Examples of this include health, law, financial services, entertainment, and consulting. But architecture and engineering still qualify for the deduction. Essentially, if you make over the threshold, tread lightly, talk to an accountant, and look into the specifics of the law.

Proposed Budget Increase for IRS is Minor

President Trump’s 2020 budget, which was released on March 11, contains $11.5 billion in funding IRS. This is a slight increase from the current $11.3 billion funding. The $11.5 billion in base funding is meant to ensure that the IRS can fulfill its core tax filing season responsibilities, continue critical IT modernization efforts, and provide acceptable levels of taxpayer service.

Under-Reporting in the Gig Economy

A Treasury Inspector General for Tax Administration (TIGTA) audit to evaluate the self-employment tax compliance of taxpayers in the gig economy found significant income underreporting as well as problems within the IRS’s Automated UnderReporter (AUR) program. The TIGTA estimates that self-employed taxpayers underpay their taxes at a combined rate of $69 billion per year. It also noted, “Treasury Regulations do not require certain gig economy businesses to issue Form 1099-K unless workers earn at least $20,000 and engage in at least 200 transactions annually. Consequently, many taxpayers who earn income in the gig economy do not receive a Form 1099-K; therefore, their income is not reported to the IRS. When income is not reported to the IRS, taxpayers are more likely to be noncompliant.” To be clear “the gig economy is comprised of online platform companies such as Uber, Lyft, Etsy, Handy, and TaskRabbit.” The gig economy does not refer to most independent contractors, who will normally receive a 1099-Misc if they earn more than $600.

Auditors reviewed cases where taxpayers had discrepancies between what was reported on their income tax returns and payments reported to IRS via Forms 1099-K, Payment Card, and Third Party Network Transactions. “The review was limited to nine commonly recognized gig economy payer companies and identified 264,346 cases with potentially underreported payments included on Form 1099-K.” The report also noted that “AUR employees removed thousands of cases from inventory without justification or with justification that was inaccurate.”

New Twist on IRS Phone Scam

The IRS has put out another warning about phone scammers pretending to be the IRS. The new twist is that there are now documented scammer calls in which the caller ID displayed the phone number of the IRS or another local law enforcement agency. So be particularly wary of a phone call from the “IRS” without a previous mailed notice that they will call you.

Tariffs for War

The trade war with China continues to fund real wars. Back in September 24, 2018, the United States imposed tariffs on many Chinese-imported goods. These tariffs have been imposed on $250 billion worth of stuff Americans buy every day. Though the Trump income tax cuts are lowering tax revenue by $130 billion per year, Chinese tariffs could generate up to $62.5 billion per year if they are raised to 25%. Right now, most of the Chinese tariffs are at 10%, but Trump has threatened to raise them to 25% if China does not sign new trade agreement.

There are a host of ethical issues associated with tariffs, including the issues of fair-trade v. free trade, building local economies v. global economies, the harm done to small business owners, higher-priced commodities that hit poor people hardest, etc. For war tax resisters, a key concern is how purchases may unintentionally support war through consumer-subsidized tariffs. Since producers need to have someone eat these extra costs, the consumer will most likely bear the brunt of these tariffs. You can find the current list of proposed items at https://calculators.io/us-customs-list-of-tariff-impacted-items/. The 194 page list of items includes beef, fish, pork, clams, mushrooms, vegetables, fruits, nuts, flour, Epsom salts, iron, coal, sodium, iodine, pesticides, leather, paper, wool, cotton, silver, steel, iron, etc. You get the picture; stuff that most Americans (and probably most WTRs) use every single day.

Though Trump is optimistic that an agreement will be reached, he has indicated that he would like to keep some tariffs in place. As he told the New York Times, “Without the tariffs, we wouldn’t be talking.”

Many Thanks

Thanks to each of you who has donated in early 2019!

Remember, you can also donate online through Paypal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

We are very grateful to these WTR groups for their redirections and Affiliate dues:

New England Tax Resistance

War Resisters League

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC. Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

War Tax Resistance Ideas and Actions

Host a viewing of The Pacifist or Death & Taxes

In 2018, Rise Up Hudson Valley hosted a viewing Death & Taxes with a discussion on war tax resistance. The program included the 30-minute introductory film Death and Taxes, WTR methods, short talk on the risks of refusing to pay for war with an experienced war tax resister, followed by discussion, Q & A, and action planning. Death & Taxes can be ordered from NWTRCC for $1 or streamed online for free. The Pacifist, is a 1 hour film about Larry Bassett’s redirection of taxes due on over $1 million of income. It can be streamed on Amazon. See ad on this page for more information.

Keep Tax Day Positive!

Austin Tax Dax 2018. Photo by Susan van Haitsma

For Tax Day 2018, Susan Van Haitsma reported that WTRs in Austin held a long poster banner reading, “I’d rather buy ___ than war!” on a pedestrian bridge downtown where many folks walk or bike. They offered markers to folks and invited them to write in the blank, and many did. It was a positive, interactive event, and they really appreciated the responses, most of which centered on education, health care, food, pets, and the environment. A favorite moment was when a couple walked by saying that, just a few minutes before, had become engaged—they wrote “our wedding” on the banner.

RESOURCES

New Pie Chart

War Resisters League has released their fiscal year 2020 pie chart, “Where Your Income Tax Really Goes.” A copy is included in this newsletter. You can order amounts of 200 or less from NWTRCC at www.nwtrcc.org/ store or 800-269-7464, or larger amounts from WRL (www.warresisters.org/store/).

Divest From War With the Peace Tax Return

A recently redesigned Peace Tax Return is available, with updated language and colors to align it more closely with NWTRCC’s Divest From War, Invest In People campaign. Download it from www.nwtrcc.org/resources/downloadable-flyers or order from www.nwtrcc.org/ store.

Divest From War Website

The Divest From War, Invest In People website (www.wartaxdivestment.org) is a great resource to reach out to folks familiar with divestment through other campaign work! People can also sign up as resisters and/or to get more information about war tax resistance on this site.

Divest from War Organizing Packet

On our website and in print, NWTRCC has an organizing packet with the following sections:

- What do we mean when we say divest from war, invest in people? Does divestment work?

- How to divest? Where we reinvest?

Plus, there are organizing stories and ideas, and a list of links to resources.

Online you will find Powerpoint slides and an infographic that you can use on your

websites or send to others. The packet comes with some resource samples.

Online, look for the link on our homepage or directly at

nwtrcc.org/programs-events/action-ideas/divest-war-invest-people</em<.

If you would like a packet mailed to you, please call the NWTRCC office at

800-269-7464 or email nwtrcc@nwtrcc.org.

NWTRCC News

Joffre Stewart – In Memoriam

Joffre Stewart (right) with Marj at May 2011 NWTRCC Gathering. Photo by Ed Hedemann

Poet, activist, and long-time war tax resister Joffre Stewart has died.

Stewart’s war tax resistance went all the way back to the Peacemakers movement in the 1950s. He was a thorough anarcho-pacifist and an eager political debater (“anti-political” he would say, to correct me) with little patience for half-way measures.

During World War II, he was imprisoned for being AWOL, and

subsequently was jailed repeatedly for refusing to cooperate with draft registration or with racial segregation. Once, turning up at a poetry reading at a Barnes & Noble bookstore, he was thrown out as an undesirable.

He is among “the best minds of my generation” immortalized in Allen Ginsberg’s poem Howl, in which Stewart is depicted as having …

“reappeared on the West Coast investigating the FBI in beards and shorts with big pacifist eyes sexy in their dark skin passing out incomprehensible leaflets …”

Fifty years later he would turn up in much the same way at NWTRCC national gatherings—usually having gotten there by Greyhound bus from Chicago, however long that took — with leaflets as incomprehensible as ever.

–David Gross

Memorial Service for Tom Wilson

As mentioned in our previous newsletter, long time WTR Tom Wilson passed away in December. There will be a Memorial Service for him at Shelburne Falls Community Center, 53 Main St. Shelburne Falls, Massachusetts on 18 May 2019, 4-7pm. This will be a potluck if anyone wants to bring something. For more information, contact Randee Laikind at liev@comcast.net.

Divest the Pentagon – Invest in People

National War Tax Resistance Gathering & Coordinating

Committee Meeting

May 3–5, 2019, Washington, DC

St. Stephen & the Incarnation Episcopal Church, 1525 Newton Street NW, Washington, DC 20010

Join us the first weekend in May for our next NWTRCC conference. The program will include a report back from a recent Code Pink Delegation to Iran, a session on Building a Peace Economy, an Introductory War Tax Resistance Workshop, and an update session for current resisters; Program details are still in flux. Check the NWTRCC website for more details.

All are welcome to NWTRCC’s business meeting on Sunday morning. Please register soon. See www.nwtrcc.org/programs-events/gatherings-and-events for more information and the online registration form or call the NWTRCC office, 800-269-7464, to receive a brochure in the mail.

Social Media Growth – Year over Year, 2014-2019

| 14-Apr-14 | 9-Apr-15 | 1-Apr-16 | 1-Apr-17 | 6-Mar-18 | 3-Mar-19 | |

|---|---|---|---|---|---|---|

| Twitter followers |

388 | 648 | 800 | 1,178 | 1,637 | 1,680 |

| FB Page Likes | 96 | 170 | 274 | 571 | 767 | 864 |

| FB Group members |

512 | 619 | 711 | 895 | 936 | 969 |

| Instagram followers |

n/a | n/a | n/a | n/a | 92 | 167 |

| E-Newsletter Subscription |

n/a | n/a | n/a | n/a | 920 | 1,023 |

Are you organizing an action, training or gathering? Got a good photo of your war tax resister community in action? Keep us in the loop: We’re all about building the community of resisters. We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (our new Outreach Consultant): outreach@nwtrcc.org // Follow the journey + join us on all social media Instagram + Twitter: @wartaxresister // Facebook: National War Tax Resistance Coordinating Committee (NWTRCC)

PROFILE

Redirection Reflection

Redmoonsong left on a panel at Action South nonviolence training. Photo by Clare Hanrahan

By redmoonsong

I call myself redmoonsong (having chosen that name 22 years ago). Not supporting the fed with my money has been a way of life for 50 years or so. Back in the 80s, I began to realize that as a European-American, I was a thief. I lived on indigenous land which had been developed with stolen African labor. So, what is my responsibility to all those who have been denied justice in my name (both past and present)? Seems like Native land rights and civil rights are two of the most important areas for me to begin to acknowledge my part in the injustice we call “American society.” By reading books about African peoples and Indigenous peoples, and supporting their actions for liberation, I have been able to realize just where my redirection monies could be most useful. In 2016, I started to form a bibliography of books in which I had read about black, brown, and red peoples (any people of color, really). When one considers just how much time and energy we put into white folks’ affairs at every level and then realize that there’s at least that much going on with people of color, we begin to see what we’re missing. The thing about these bibliographies is that even if you don’t read the books, just reading the titles is eye opening. And let’s face it, us white people need our eyes opened!

[Here is an excerpt from redmoonsong’s reading list. The order is based on the order in which she read the books, not importance.] The Other Slavery: The Uncovered Story of Indian Enslavement in America (2016), Witness to the Revolution: Radicals, Resisters, Vets, Hippies, and the Year America Lost Its Mind and Found Its Soul (2017), Slavery by Another Name: The Re-Enslavement of Black Americans from the Civil War to World War II (2009), Thomas Jefferson Dreams of Sally Hemings (2016), Faces At The Bottom Of The Well: The Permanence Of Racism (1992), My Own Country: A Doctor’s Story (1995), Cutting for Stone (2009), The New Jim Crow: Mass Incarceration in the Age of Colorblindness (2010), The Known World (2006), Between the World and Me (2015), The Fire This Time: A New Generation Speaks about Race (2016), The Warmth of Other Suns: The Epic Story of America’s Great Migration (2010), The Defender: How the Legendary Black Newspaper Changed America (2016), An Indigenous Peoples’ History of the United States (2014), Our Black Sons Matter: Mothers Talk about Fears, Sorrows, and Hopes (2016), The New Odyssey: The Story of the Twenty-First Century Refugee Crisis (2017), Stand Your Ground: A History of America’s Love Affair with Lethal Self-Defense (2017), Empire of Cotton: A Global History (2014), Why the Vote Wasn’t Enough for Selma (2017), The Thin Light of Freedom: The Civil War and Emancipation in the Heart of America (2017), Killers of the Flower Moon: The Osage Murders and the Birth of the FBI (2017), At the Dark End of the Street: Black Women, Rape, and Resistance–A New History of the Civil Rights Movement from Rosa Parks to the Rise of Black Power (2010), The American Slave Coast: A History of the Slave-Breeding Industry (2015), Stamped from the Beginning: The Definitive History of Racist Ideas in America (2016), When They Call You a Terrorist: A Black Lives Matter Memoir (2018), My Grandmother’s Hands: Racialized Trauma and the Pathway to Mending Our Hearts and Bodies (2017), A More Beautiful and Terrible History: The Uses and Misuses of Civil Rights History (2018), This Little Light of Mine: The Life of Fannie Lou Hamer (1993).

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance

Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance

movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Subscriptions are $15 per year.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org