National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

June – July 2023

Contents

- Tax Day 2023 Reports

By Lincoln Rice and Chrissy Kirchhoefer - War Tax Resistance Gathering in Indiana

By Lincoln Rice - Counseling Notes Debt Ceiling Deal would Cut First Year of IRS Funding Increase • Bipartisan Bill Would Raise 1099-K Reporting Threshold • Clarification on Passports

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Change Is Hard, Change Is Possible By Ruth Benn

- NWTRCC and WTR News: Our Next National War Tax Resistance Gathering & Coordinating Committee Meeting • Juanita Nelson’s 100th Birthday Celebration • Mennonite Church USA War Tax Redirection Seminar • Building Cultural Topsoil as Resistance • Raffle Fundraiser for NWTRCC

- In Memoriam — Geoffrey Huggins (1940 – 2023)

Click here to download a PDF of the June/July issue

Tax Day 2023 Reports

By Lincoln Rice and Chrissy Kirchhoefer

Tax Day was Tuesday April 18, 2023 and folks throughout the US gathered around this date to raise awareness that nearly half of federal income taxes are directed toward war. They also encouraged others to resist paying taxes and redirect money to community needs.

Here is a slightly abbreviated account of Tax Day 2023 actions from our network. A link to the complete account with plenty of photos can be found at nwtrcc.org. If you would like to see media coverage for some of the events around Tax Day, go to nwtrcc.org, go to the “Media” tab, and click on “Articles” and “TV and Radio Interviews.”

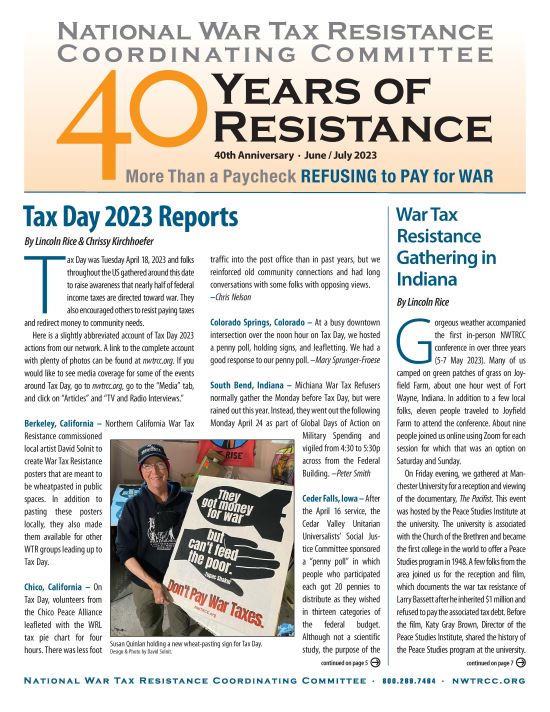

Susan Quinlan holding a new wheat pasting sign for Tax Day. Design and Photo by David Solnit

Berkeley, California – Northern California War Tax Resistance commissioned local artist David Solnit to create War Tax Resistance posters that are meant to be wheatpasted in public spaces. In addition to pasting these posters locally, they also made them available for other WTR groups leading up to Tax Day.

Chico, California – On Tax Day, volunteers from the Chico Peace Alliance leafleted with the WRL tax pie chart for four hours. There was less foot traffic into the post office than in past years, but we reinforced old community connections and had long conversations with some folks with opposing views.

–Chris Nelson

Colorado Springs, Colorado – At a busy downtown intersection over the noon hour on Tax Day, we hosted a penny poll, holding signs, and leafletting. We had a good response to our penny poll.

–Mary Sprunger-Froese

South Bend, Indiana – Michiana War Tax Refusers normally gather the Monday before Tax Day, but were rained out this year. Instead, they went out the following Monday April 24 as part of Global Days of Action against Military Spending and vigiled from 4:30 to 5:30p across from the Federal Building.

–Peter Smith

Shirley Whiteside conducting a penny poll at Cedar Valley Unitarian Universalists. Photo Courtesy of Shirley Whiteside

Cedar Falls, Iowa – After the April 16 service, the Cedar Valley Unitarian Universalists’ Social Justice Committee sponsored a “penny poll” in which people who participated each got 20 pennies to distribute as they wished in thirteen categories of the federal budget. Although not a scientific study, the purpose of the exercise was to raise consciousness about how spending and budgeting are complicated in a way that makes household budgeting look like a breeze. The War Resisters League pie chart was available in the fellowship hall for anyone interested. All seven of the Unitarian Universalist Principals present challenges to making war.

–Shirley Whiteside

Portland, Maine – Peace Action Maine held a tax day vigil on Tuesday April 18 at 10a at the local post office on Forest Avenue with handouts speaking to federal budget priorities.

blockquote>–Peace Action Maine

Boston, Massachusetts – Massachusetts Peace Action sponsored a “Tax Day Rally for Peace and our Future” on Saturday April 15 at noon in Downtown Crossing and on Greenfield Common. Speakers included State Representative Mike Connolly; Rev. Savina Martin, co-chair of the Massachusetts Poor People’s Campaign; Michael Kane, Massachusetts Alliance of HUD Tenants; Lady Lawrence Carty, Housing=Health, and music from singer/songwriter Ben Grosscup.

–Massachusetts Peace Action

Northampton, Massachusetts – Taxes for Peace New England tabled at the Unitarian Society on April 6. We had a very blustery day, which sent a few flyers down the street and hopefully into the hands of interested folks. The wind also inspired a future project to create a fabric banner to replace the paper one which was torn by the wind–silver lining!

–Lindsey Britt

St. Louis, Missouri – Tax Day began with leafleting on Saturday April 15th at a farmers market. We were able to engage with those present to share the War Resisters League’s pie chart as well as sharing information about how much taxpayer money could be invested in local needs as opposed to spending on the Israeli military. On Tuesday April 18th, we held signs at a post office in a business district around lunchtime. People were really appreciative of the information that we shared and engaged in lively conversation. Later that day during rush hour we shared information at the same location and distributed information at the nearby park.

–Chrissy Kirchhoefer

Albuquerque, New Mexico – Ginny Schneider reserved a tabling space outside the University of New Mexico Student Union for the Wednesday before War Tax Resistance Day (10am- 3:30pm). She spoke with over 200 students, faculty, and staff about their support for war. Most of the day, the majority of people who passed the table did not support war. During the last hour, about 10 people said they supported war.

Three people provided their contact information, which was the same number as last year when she tabled with another WTR at the Santa Fe food co-op. One graduate student was interested in working on further outreach. She will contact him about tabling with her in the future.

–Ginny Schneider

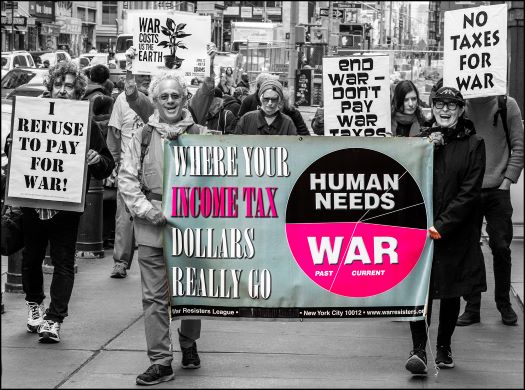

Tax Day protesters marching in Manhattan. Photo by Ed Hedeman

Manhattan, New York – Tax Day (April 18th) – the last day for rushing taxes to the Pentagon – meant the NYC War Resisters League with other peace and justice groups appeared, once again, in front of the IRS to call attention to the huge percentage of the budget allocated to U.S. wars and militarism.

Rising Together Guerrilla Theater further dramatized that crime against humanity with a short skit highlighting the effects such spending has on society and the world.

Meanwhile, the rest of us were “singing songs and carrying signs” – particularly NYC Metro Raging Grannies who lyrically converted popular tunes into antiwar ditties – and “handing out flyers” (sadly, not part of the song) with WRL‘s annual “pie chart” analysis of the budget. Many were accepted, a few were ignored.

–Ed Hedemann

Cleveland, Ohio – Three members of the Cleveland Nonviolence Network (Michael Fiala, Michael Melamphy, and Maria Smith) spoke to the Cleveland City Council concerning a “Resolution to Eliminate U.S. Militarism and the U.S. Pentagon Budget.” It was an hour or so after a public reading of Dr. King’s “A Time to Break Silence” speech. It is a national project that Cleveland Peace Action ordered locally.

This event is the culmination of two years of monthly meetings (and sometimes more). CNVN isn’t done, yet. It will continue to urge our friends, neighbors, and representatives to have a local conversation about the gargantuan military budget and local needs and aspirations. The event was covered by the local media.

–Maria Smith

Eugene, Oregon – Planet vs Pentagon and Taxes for Peace Not War tabled at the Eugene Public Library this year. It didn’t rain, which was unusual, but it was cold and windy. Forty-two people participated in the penny poll and one passerby thanked us profusely for being there and gave us a $50 donation. A few new people signed up to get emails from us and we had some good conversations. If Eugene folks were running the country the amount of money going to the military would be far less than the $2,297 billion (at least 43% of the Federal budget) currently being spent. Our penny poll results were also published in the local paper.

–Sue Barnhart

Portland, Oregon – On April 18th, nine of us held signs on two bridges on a chilly day for the morning commuters, including lots of bicyclists! LOTS of thumbs up and supportive honks! The messages were about bloated military spending and the runaway military budget.

–Kima Garrison

Lancaster, Pennsylvania – Over the noon hour on Saturday April 15 in Lancaster’s square, I operated a penny poll with a couple Peace Action Network of Lancaster colleagues. In anticipation of Tuesday’s Tax Day, we gave passersby opportunities to vote on how they would like their federal tax dollars spent by putting 10 pennies into any of ten categories. Eighty-four passersby participated.

–H. A. Penner

Brattleboro, Vermont – On Tax Day members of Taxes for Peace New England tabled at the Brattleboro Food Co-op (10am-5pm). We gave out cookies, talked with people about war tax resistance, and shared that NWTRCC is a great resource for more information and assistance. A lot of people were supportive and, unrelated to WTR, seemed hungry for connection with other people and just happy to share a conversation.

–Lindsey Britt

Harrisonburg, Virginia – We had a group of about 40 people show up by the downtown farmer’s market on Saturday April 15 for a public re-direction of $700 in resisted war taxes, plus an additional $2,100 in solidarity donations to six organizations (three local nonprofits as well as Mennonite Central Committee, the National Campaign for a Peace Tax Fund, and an alternative fund organized by the Mennonite Church USA).

There were thirteen households that donated money, four of which were resisting and re-directing a portion of their federal income tax. I also presented on WTR at the local Mennonite High School on Friday the 14th. The event was covered on the local WHSV television station for the Sunday evening news.

–Tim Godshall

Milwaukee, Wisconsin – Casa Maria Catholic Worker and Milwaukee War Tax Resistance held a vigil to protest federal tax dollars for war and environmental harm the Saturday before Tax Day. We vigiled outside the U.S. Army Reserve over the noon hour. We also organized a “Bake Sale for Military Victims,” with baked goods being sold at the protest, which raised $200 for the Ukrainian Red Cross.

–Lincoln Rice

War Tax Resistance Gathering in Indiana

By Lincoln Rice

Gorgeous weather accompanied the first in-person NWTRCC conference in over three years (5-7 May 2023). Many of us camped on green patches of grass on Joyfield Farm, about one hour west of Fort Wayne, Indiana. In addition to a few local folks, eleven people traveled to Joyfield Farm to attend the conference. About nine people joined us online using Zoom for each session for which that was an option on Saturday and Sunday.

Katy Gray Brown of Manchester University discusses the Peace Studies Institute on Friday evening. Photo by Lincoln Rice

On Friday evening, we gathered at Manchester University for a reception and viewing of the documentary, The Pacifist. This event was hosted by the Peace Studies Institute at the university. The university is associated with the Church of the Brethren and became the first college in the world to offer a Peace Studies program in 1948. A few folks from the area joined us for the reception and film, which documents the war tax resistance of Larry Bassett after he inherited $1 million and refused to pay the associated tax debt. Before the film, Katy Gray Brown, Director of the Peace Studies Institute, shared the history of the Peace Studies program at the university. The discussion after the film focused on the basics of war tax resistance and the inability of resisters with a tax debt of $55,000 (or more) to renew their passports.

Simultaneously, former NWTRCC consultant Erica Leigh graciously hosted an online social hour on Zoom for people who were not able to attend the conference in person. She reports: “I was glad to host an online Friday night social hour. I believe we had seven people joining us—less than we’ve had for the social hours during our all-online conferences. However, due to the group size, we didn’t need to split into small groups, and we could all easily talk about our lives, various political issues, and of course war tax resistance. It was great to see all your faces!”

Saturday Sessions

The remainder of the conference took place at Joyfield Farm. After breakfast and some brief introductions on Saturday morning, Joyfield Farm cofounder Cliff Kindy provided a tour of the farm. This tour was also streamed over Facebook Live so that people could participate no matter where they were. The video has since been uploaded to our YouTube page (youtube.com/nwtrcc).

Joyfield farm, in addition to being a beautiful location, is also an example of resistance in action. The founding couples (Arlene and Cliff Kindy & Rachel and Bob Gross) of Joyfield Farm are also longtime war tax resisters who have lived simply on the land for the past forty years. In a session entitled, “Simple Lives of Resistance on the Land,” they shared their journeys to war tax resistance and how that eventually led them to the land. The couples originally met owing to both Cliff and Bob being conscientious objectors during the Vietnam War. They met during the orientation program for the Brethren Volunteer Service. People off-site were able to participate on Zoom and the recorded session can be found on our YouTube page.

Cliff Kindy of Joyfield Farm and Cathy Deppe of Southern California War Tax Resistance discuss peace work happening in Ukraine. Photo by Lincoln Rice

After lunch, there were concurrent WTR 101 and 201 sessions. After a short break, we reconvened along with people on Zoom for a discussion on “Promoting Peace in Ukraine.” To set the tone, we first heard from Cliff Kindy, who is a founding member of Community Peacemaker Teams (formerly Christian Peacemaker Teams) and discussed their involvement with a proposal for a thirty kilometer de-militarized zone around the Zaporizhzhia Nuclear Plant.

Then, we heard from Cathy Deppe, who shared her interactions with conscientious objectors in Ukraine and Russia and the troubles they have faced. Afterward, others shared their own concerns about the U.S.-supported war in Ukraine. After supper on Saturday, those of us in Indiana enjoyed the sunset and hunkered down for a stormy night. Most who had been camping moved to the barn for the night.

Sunday Business Meeting

On Sunday morning, we had our obligatory Sunday business meeting, which also included participants on Zoom. There was a proposal for NWTRCC to become a member organization of Conscience and Peace Tax International (CPTI), but it was decided to table this decision for six months. Many attendees wanted more information to understand the obligations that come with membership and whether we actually qualify for membership. Some attendees also questioned whether becoming a member was worthwhile, as we already participate in their meetings, which normally occur every two years.

The meeting also included reports from NWTRCC’s consultants, a financial update, and a heated discussion about how best to share opinions with each other between meetings. With the conclusion of that meeting, Lida Shao and Joshua Wrolstad finished their three-year terms on NWTRCC’s Administrative Committee and we welcomed Greg Reagle and Paula Rogge to that committee. The minutes for the meeting can be found at nwtrcc.org/may-2023-cc-meeting-minutes.

Even though this was a smaller gathering as regards in-person attendance, everyone who made the journey to north-central Indiana agreed that it was worthwhile.

Counseling Notes

Debt Ceiling Deal would Cut First Year of IRS Funding Increase

As this goes to press, an agreement was announced in the debt ceiling bill for the U.S. to avoid default. If the proposed deal becomes law, $2 billion would be removed from the current IRS budget. This represents the first year’s budgeted amount for the IRS from their $80 billion increase over ten years that was passed last year as part of the Inflation Reduction Act.

Bipartisan Bill Would Raise 1099-K Reporting Threshold

It has been regularly reported in this newsletter that the reporting threshold for the 1099-K form was dropped from $20,000 and 200 transactions to $600. The 1099-K is used to report transactions in the gig economy, such as sellers on E-Bay. It would also lower the reporting requirement for business transactions that use applications such as PayPal, Venmo, Cash App, etc. Currently, these new reporting requirements are supposed to go into effect for the current tax year. A bipartisan bill in Congress would raise the threshold to $10,000. We’ll keep you posted.

Clarification on Passports

As has been regularly reported in this column, a resister may have the ability to renew their passport suspended if they have a “seriously delinquent tax debt.” Currently a seriously delinquent tax debt is $55,000 or more. (The amount increases by $1,000 every year.)

The part of the law that we have not focused on is that before the IRS alerts that State Department that they cannot renew (or issue a new) passport for someone, the IRS must have first filed a Notice of Federal Tax Lien with your local county courthouse or previously levied the person (e.g., an attempt to collect funds from wages, Social Security, bank accounts, etc.)

This came to my attention with a recent court case where a non-WTR challenged in tax court that the IRS had failed to levy him pursuant to Code Sec. 6331. This code requires that before levy is made a Notice of Intent to Levy be sent to the individual. Oddly enough, not only had the notice been issued, but the challenger had even signed for it as it had come certified. For clarification, if the IRS does not know where you currently live and sends a Notice of Intent to Levy to your last known address, this fulfills the requirement for the IRS even if you never receive the notice. Then, five years ago, the IRS issued a levy. After the IRS brought this information forward, the judge decided that the IRS had acted appropriately.

The reason for sharing this information is to clarify that two actions need to be taken by the IRS before they send notice to the State Department that you cannot renew your passport. First, you must have a $55,000 tax debt. Second, the IRS needs to have issued a levy or a Notice of Federal Tax Lien. For most in our network, one of the latter two actions occurs well in advance of owing $55,000.

At this point, the NWTRCC office is only aware of four individuals in our network who can no longer renew their passports. If you received notice of this, but have not notified the NWTRCC office, please let us know.

Many Thanks

Thanks to each of you who donated in early 2023! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

We are very grateful to these alternative funds and WTR groups for their redirection and affiliate dues: People’s Life Fund of Northern California; New England War Tax Resistance

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. (Please let the NWTRCC office know if you use Resist.) Thank you!

Change Is Hard, Change Is Possible

By Ruth Benn

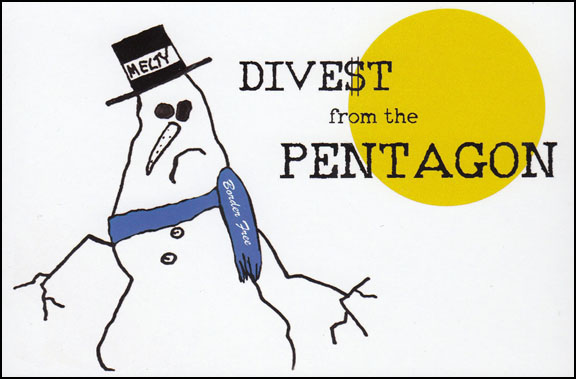

Postcard created by Jason Rawn

An article about how climate change is going to impact federal spending caught my eye. Mostly it got me vaguely thinking about how difficult it is to change — especially on the national scale. The article is about the Biden administration’s warning that climate change is going to cost the federal government a lot of money and planners and elected officials are not preparing for it.

Of course, this has already been true for decades, and the article does not talk about shifting to emergency mode and doing everything possible to stop the climate crisis from getting worse. Plus, the administration recently presented another federal budget proposal that bulks up the Pentagon (the only part of Biden’s budget that is likely to pass), which can only makes things worse, both politically and for the climate. Change at that level seems pretty far off.

So I was also thinking about change on the personal level. In a city surrounded by luxury this and luxury that, Ed and I live a pretty modest lifestyle, although there is too much plastic still coming into the house, those out-of-season blueberries are hard to pass up, and well, the car… So in my mind I balance it off with being active working for fundamental change, but I do credit the war tax resistance network with saving me from a more luxurious lifestyle, too. Meeting so many refusers who have chosen to live on very low incomes and learning about how they do it has been enlightening and challenging.

So all this kind of reminds me of the NWTRCC meeting 20 years ago where I started my 15 years as NWTRCC Coordinator. It was a wonderful conference in Santa Rosa, California, in May 2003. Sonoma County Taxpayers for Peace outdid themselves with a packed schedule, great food, an evening of music and entertainment, and a good crowd to fill the auditorium.

For some reason I was on a panel to talk about living below the taxable level in order to avoid supporting the military. This is not my method of resistance but I went over the basics of finding the taxable level and the various ways to manage life on a low income — living in community, bartering, keeping pay off the books as much as possible, living on cash. At the Q ∧ A there was this annoying guy in the crowd who pretty much disagreed with everything I said and argued that people could live above the taxable level if they made use of tax credits and other options to bring their income down legally.

That was my introduction to David Gross, who handed out a paper on his “Don’t Owe Nothin’ Method.” So today, as I was thinking about how hard change is, I noticed the link to David’s recent blog post with a detailed summary of how 20 years ago the invasion of Iraq changed his life. He threw himself into war tax resistance — and NWTRCC for many years (despite being somewhat frustrated at the inability of many of us to break some old habits).

So I end this with kudos to Dave for his ability to change and for his contributions to this eclectic network of individuals brought together to find ways to put their money where their mouth is. Be sure to read his blog and follow his Picket Line posts ()sniggle.net/TPL/index5.php.

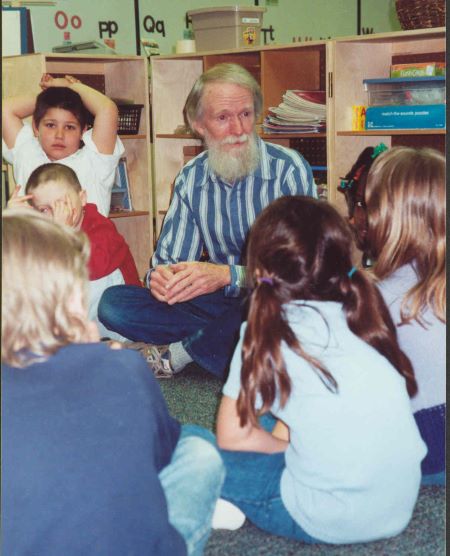

In Memoriam — Geoffrey Huggins (1940 – 2023)

Geoffrey Huggins

[Editor’s Note: This is excerpted from his obituary.]

Geoffrey Huggins, 82, of Frederick County died March 12, 2023, at his home. He was born November 25, 1940, in Elmira, New York and grew up in Flint, Michigan. He earned a Bachelor of Science in Electrical Engineering at Michigan Tech and Master of Science in Engineering at the University of Michigan. His professional career was in acoustic research. After retiring and moving to Frederick County in 1984, he taught physics and musical acoustics at Shenandoah University.

His interest in nonviolence and social justice led him to many volunteer activities including Caretakers Special Tutoring and The Peaceable Classroom program at Virginia Avenue Charlotte De Hart Elementary School in Winchester.

He is survived by his wife of 42 years, Louisa Poulin, his three children, five grandchildren, and one great-grandchild.

NWTRCC and WTR News

Mark your Calendars!!!

Our Next National War Tax Resistance Gathering & Coordinating Committee Meeting

November 3-5, 2023

As of this printing, it has not been decided if our next meeting will be online or in person. We are currently considering an invitation for a meeting a little north of New York City, but details still need to be worked out. We hope to solidify these plans soon! If you are interested in hosting a future NWTRCC meeting, let us know!

Juanita Nelson’s 100th Birthday Celebration

Juanita Nelson 1923-2015. Photo by Ed Hedeman

To remember Juanita Nelson, on what would have been her 100th birthday, the Nelson Legacy Project is planning three days of workshops, theater, trainings, music, and dancing. The event will be August 17-20, 2023 at the Woolman Hill Conference Center in Deerfield, Massachusetts. Go to the Nelson Legacy Project website (nelsonhomestead.org) for more information.

Mennonite Church USA

War Tax Redirection Seminar

There will be session entitled “Enabling the Church to do War Tax Redirection” at the Mennonite Church USA convention (MENNOCON23) in Kansas City, Missouri on January 6, 2024 (9-10a). The session will promote active nonviolence via the redirection of taxable funds away from militarism and toward church-sponsored programs of social uplift.

Mennonite Church USA Peace Tax Fund logo. Illustration by Jesse Graber

The event will also promote the Mennonite Church USA Peace Tax Fund, which recognizes youth and adults who are actively engaged in resisting war and encouraging peace, provides resources to support war tax redirectors, underwrites Mennonite Church USA justice programs such as the emerging Peaceful Options for Training and Careers (POTC), and provides resources for the peace education of future generations.

The presenters for the session will be H. A. Penner, lifelong war tax redirector who was instrumental in the renewal of the MC USAace Tax Fund and Chrissy Kirchhoefer, Outreach Consultant for NWTRCC. For more information, go to target=”_blank”>mennoniteusa.org.

Building Cultural Topsoil as Resistance

The May issue of Friends Journal featured an article with several Quaker farmers, including war tax resister Jim Stockwell, who resides in North Carolina and has been a regular fixture at NWTRCC gatherings. In the article, he states, “One of the main reasons I chose to be a farmer was to have more control over how I share resources with my community. I am against our income taxes being used to fund war-making, and as a self-employed farmer, I can be a war tax resister as well.” You can find the article online at friendsjournal.org/building-cultural-topsoil.

Raffle Fundraiser for NWTRCC

We received a very positive response to our first raffle that was combined with last year’s May appeal. Therefore, NWTRCC’s Fundraising Committee has organized another raffle. No donation is required to participate in the raffle, but we would appreciate your financial support. NWTRCC is only able to continue because of every donation it receives—both large and small.

To be entered in the raffle, simply fill out the raffle tickets and mail them back to NWTRCC… hopefully with a donation. If you normally donate online using PayPal or Resist, simply print out a sheet of tickets (nwtrcc.org/raffle), fill them out, and mail them in. A sheet of raffle tickets with a full list of prizes can be found at nwtrcc.org/raffle. Feel free to make copies of the tickets and hand them out to friends. Tickets need to be received by the time the drawing occurs on June 30.

We are very thankful to all those folks who donated something for the raffle. Our top prize is a 2-night stay in a cabin at Woolman Hill, which hosts the Nelson Homestead. Even if you do not win the top prize, making a pilgrimage to the Nelson Homestead might be something to consider at some point. (See the article about Juanita’s 100 birthday party on page 4!) The powerful peacemaking witness of Wally and Juanita—cofounders of the modern war tax resistance movement—is wonderfully displayed at their homestead. You can also take a virtual tour at nelsonhomestead.org. Other prizes include a 2-night stay at the Celo Inn in the Blue Ridge Mountains of North Carolina, NWTRCC swag, an integrative body work session, art, a brand-new hammock, and more.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org