More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

August – September 2019

Contents

- On the Streets with Extinction Rebellion by Ruth Benn

- Mennonite Church USA Re-Creating Church Peace Tax Fund by Chrissy Kirchhoefer

- Counseling Notes IRS Followed Up on Promissory Note • Public Lien Filed on War Tax Resister • IRS Notice of Third Party Contact

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- International: 2019 Russian Study Tour with Global Network Against Weapons and Nuclear Arms in Space by Cathy Deppe • Conscience and Peace Tax International (CPTI) Meeting • Nicaraguan Tax Resistance Leader Released from Prison

- Tax Resistance Ideas and Actions Announcing 2019 Grants from Southern California

War Tax Resistance List Serve • Bitter Sweet Redirection - War Tax Resistance News and Events Persistence Prevails

Or How I Am Dealing With The Loss Of My Professional License by Joseph Olejak • School of the Americas Watch Gathering • Yes to the Earth! No to War Taxes! - PROFILE Loving Life on the Margins: An Interview with Suzanne Belote Shanley and Brayton Shanley

Click here to download a PDF of the August/September issue

On the Streets with Extinction Rebellion

By Ruth Benn

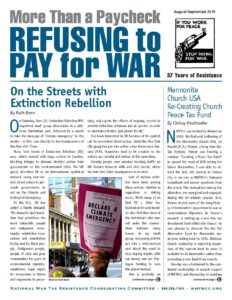

Photo by Ruth Benn

On Saturday, June 22, Extinction Rebellion NYC organized small group discussions in a midtown Manhattan park, followed by a march to take the message of “climate emergency” to the media – in this case directly to the headquarters of the New York Times.

Many have heard of Extinction Rebellion (XR) now, which started with large actions in London, blocking bridges to demand decisive action from governments on the environmental crisis. The UK group describes XR as an international apolitical network using non-violent direct action to persuade governments to act on the Climate and Ecological Emergency.

In the U.S., XR has added a fourth demand: “We demand a just transition that prioritizes the most vulnerable people and indigenous sovereignty; establishes reparations and remediation led by and for Black people, Indigenous people, people of color and poor communities for years of environmental injustice, establishes legal rights for ecosystems to thrive and regenerate in perpetuity, and repairs the effects of ongoing ecocide to prevent extinction of human and all species, in order to maintain a livable, just planet for all.”

I’ve been interested in XR because of its explicit call for nonviolent direct action, which the New York City group has put into action a few times since January 2019. Organizers tend to be creative so the actions are colorful and serious at the same time.

Seventy people were arrested blocking traffic on 8th Avenue between 40th and 41st streets, where the New York Times’ headquarters is located.

Lots of antiwar activists have been joining these actions, whether as supporters or risking arrest. While many of us find XR a little too focused on its own brand, we also find that most of the individuals who turn out make the connections between many issues. In my small group, one young activist got into a well-received rant about the need to stop buying bombs with our money and use Pentagon funding to save the planet instead.

This is probably an appropriate moment to remind readers to mark their calendars for the November NWTRCC gathering, which is being planned with a focus on collaboration between war tax resisters and environmental activists. There should be a lot to share!

Editor’s Note: WTRs in both St. Louis and Eugene, Oregon planned Tax Day actions in 2019 with local XR groups. And it is our hope to have some XR members at our November gathering as we explore ways to collaborate with environmentalists in ending militarism with its horrendous repercussions for the planet. XR’s London branch is launching a tax strike to protest the city’s funding of projects that exacerbate climate change. They intend to begin withholding 20% of their council tax once they have a critical mass of signers-on to their strike proposal. The withheld funds will be redirected to a project to create a new city plan with a focus on ecological sustainability. They have created a London Tax Rebellion Information Booklet to support the campaign. They were inspired by XR activist Imogen May, who refused to pay council tax as part of her protest. Thanks to David Gross for this last bit of news, whose blog The Picket Line (sniggle.net/TPL) includes more on war tax resistance topics.

Ruth Benn was the previous Coordinator for NWTRCC and submits regular blog posts on the NWTRCC website. She lives in Brooklyn.

Mennonite Church USA Re-Creating Church Peace Tax Fund

By Chrissy Kirchhoefer

NWTRCC was invited to MennoCon 2019, the National Gathering of the Mennonite Church USA, by Harold (H.A.) Penner, a long time War Tax Resister. Penner was hosting a seminar, “Creating a Peace Tax Fund” to spread the word of WTR among his fellow Mennonites. I was able to attend the July 4th session in Kansas City in my role as NWTRCC’s Outreach Consultant and answer questions from the crowd. The atmosphere among the attendees was energized and engaged. During the 90 minute session, H.A. Penner shared some of the long history of Mennonites’ opposition to war as Conscientious Objectors. In Penner’s research of setting up a new War Tax divestment fund within the Church, he was pleased to discover the War Tax Alternative Fund for Mennonite employees dating back to 1983. National Church leadership is exploring expansion of the current fund to make it available to all Mennonites rather than recreating a new fund from scratch.

Chrissy Kirchhoefer and H.A. Penner at Mennocon 2019. Photo courtesy of Chrissy Kirchhoefer

The day was a testament to the continued relationship of mutual support of NWTRCC and Mennonites in resisting militarism. NWTRCC Coordinator Lincoln Rice facilitated preparation for the event through research and providing NWTRCC resources. Much of the printed material was eagerly received by the participants. Discussion continued long after the official end of the session. The controller of the Mennonite Church, who was in attendance, informed the group that the Church leadership was still working out some of the details of the renamed Church Peace Tax Fund. The prospect of making this national model available for other groups is quite exciting. NWTRCC will keep you posted as the Fund develops.

Editor’s note: Chrissy Kirchhoefer became NWTRCC’s Outreach Consultant in January 2019 and has been a war tax resister for the past twenty years. She will also be attending the School of Americas Watch Gathering in Fort Benning, Georgia (Nov 15-17, 2019). If you would like to touch base with Chrissy about outreach ideas or invite her to speak in your area, email her at outreach@nwtrcc.org.

Counseling Notes:

IRS Followed up on Promissory Note

Back in 2011, war tax resister Steve Leeds and his sister inherited a condo after their mother passed away. They put the home up for sale and a school teacher expressed interest in purchasing it. In the wake of the Great Recession, the teacher could not obtain a bank loan, so she made an agreement with the siblings to pay them directly and they had a lawyer draw up a seven-year promissory note. This note was a legally binding document that contained everyone’s names and social security numbers. It also allowed the school teacher to deduct the home loan interest on her taxes, but in the process of doing this she submitted Steve’s name and social security number to the IRS.

Fast forward to early July 2019. The school teacher received a letter from the IRS stating that future proceeds from the loan that would normally be sent to Steve should be sent to the IRS. If you already worked through the math, you will notice that the “seven year” promissory note was paid off in 2018. So thankfully, no funds were sent to the IRS. The school teacher just had to return a form to the IRS stating that the account was closed.

Though promissory notes are probably a rare tool for war tax resisters, this episode reveals that the IRS will try to intercept reported payments. This episode also alerts us to the fact that the IRS if often very slow. They had seven years to intercept the promissory note payments, but it took them eight years to do it.

Public Lien Filed on War Tax Resister

The IRS has filed a public notice of lien with the clerk of the local circuit court against Larry Bassett. It is for the tax years 2016 and 2017 for a total of $193,959.46. His final amount due for the tax year 2018 is still pending. And for the first time in many years, Larry has the name of an actual IRS revenue officer to communicate with.

Courthouse Notice of Lien filings used to be very common for war tax resisters, but have been very rare lately. The large sum of Larry’s resistance is probably the reason for the filing. Traditionally, the IRS has been good about removing lien notices once the “debt” is no longer owed (after the 10 year statute of limitations on collections expires), but it is always a good idea to confirm that the IRS has done this.

IRS Notice of Third Party Contact

In June, Congress passed the Taxpayer First Act of 2019, and it was signed into law by Trump on July 1. Among other things, the Act provides some new safeguards to taxpayers in their interactions with the IRS. Effective after Aug. 15, 2019, the Act states that the IRS may not contact any person other than the taxpayer regarding the determination or collection of the tax liability of the taxpayer without providing the taxpayer with notice at least 45 days before the beginning of the period of the contact (and no greater than one year before).

Many Thanks

Thanks to each of you who are donating for the Spring Appeal 2019. Remember, you can also donate online through Paypal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

We are very grateful to these alternative funds and WTR groups for their redirections and Affiliate dues:

Michiana War Tax Refusers

Boulder Wax Tax Info Project

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC. Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

International

2019 Russian Study Tour with Global Network Against Weapons and Nuclear Arms in Space

By Cathy Deppe

As Global Network members of an international delegation to the Russian Federation in May 2019, Alex Walker and I visited Moscow, St. Petersburg, and three cities in Crimea. We came to learn, to listen, and to build a bridge of friendship through citizen diplomacy. We had daily meetings with Russian journalists, activists, academics, and ordinary citizens. We gained first-hand information and historical perspective. The Russian people met us with warmth, openness, and generosity.

Cathy with May Day Marchers in Simferopol, Crimea. Photo courtesy of Cathy Deppe

We came because we are alarmed by the U.S. demonization of Russia and by the NATO provocations which have created a world of increasing military confrontation, with the U.S. even threatening the first-use of nuclear weapons. Since the collapse of the USSR in 1991, U.S./NATO has encircled Russia with bases, so-called ‘missile defense’ systems, and escalated “war games” right on its borders.

Russia is a country of just 144 million people, with an average income of $400 a month, or $13 a day. Their annual military budget is $60 billion and decreasing. The U.S. military budget is $800 billion and increasing. The U.S. has more than 800 bases encircling the world.

Our message is a call to end the demonization of Russia, remove U.S./NATO warships from the Black Sea, end the escalating war maneuvers on Russia’s borders, and build bridges of diplomacy and friendship.

Russian and US Veterans for Peace Chapters Meeting together. Photo Courtesy of Cathy Deppe

One highlight of the trip was to hear from Alexander Pasechnik, the Chair of Russia Veterans for Peace in Komi, Russia. Afterward, we witnessed the signing of a Statement of Solidarity between the Maine, USA VFP Chapter and the Komi, Russia VFP chapter. Our “citizen diplomacy” efforts at peace building had begun. In his presentation, Pasechnik focused on the “No First Strike” policy as rejected by U.S. Congress but implemented by Russia, and agreed on between Russia and China for years. Russia requires three persons to agree to push the nuclear button, but only one person, the U.S. President, is needed in the USA. He said the U.S. President just signed a U.S. military budget approaching one trillion dollars, while the Russian military budget is only 47 billion, and that Russia’s percent of the total global GNP is only 2%, with an economy still suffering from past wars, with pensions and wages very low. For example, a Russian doctor earns only between $574.00 and $771.00 per month. Given their history and the current provocations of NATO on their borders, it seems clear that Russia will not hesitate to respond with the nuclear option in defense of the Motherland. I now realize how, given its long traumatic history of suffering wars, invasions, and occupations, the Russian people have an unbroken fierce determination to defend their homeland to the last breath.

The preceding is an excerpt from my personal report. It is quite long for this newsletter; therefore please follow this link to see my full report (nwtrcc.org/PDFs/Russian_Study_Tour.pdf). Thank you!

Cathy Deppe is a member of the Southern California War Tax Resistance Alternative Fund & just finished her term as a member of NWTRCC’s Administrative Committee. She lives near Los Angeles.

Conscience and Peace Tax International (CPTI) Meeting

The 15th Annual Conference on War Tax Resistance & Peace Tax Campaigns will be held in Edinburgh, Scotland on November 28 through December 1, 2019. The theme for this conference is “Paying for Peace not Paying for War.” NWTRCC will be sending a representative, but the conference is open to all. (Applications for the NWTRCC representative were due July 15 & the representative is being chosen by the NWTRCC Administrative Committee as this newsletter goes to press). The expected cost is under £100, though accommodation is extra. The hosts will assist with options for hostel and hotel accommodation. More information can be found on the Conscience UK website (http://www.conscienceonline.org.uk/international-conference-2019/).

The first International Conference on War Tax Resistance and Peace Tax Campaigns was held in Tübingen, Germany, in 1986. Conferences were held every-other-year, most often in Europe with a few exceptions: India in 1998; U.S. in 2000; and Colombia in 2013. While the conferences are organized by the local groups, Conscience and Peace Tax International (CPTI) was founded at the conference in Hondarribia, Spain, in 1994, to connect the groups working on legislative campaigns and to track legal issues internationally. The CPTI website (www.cpti.ws) includes reports from earlier conferences, links to groups, court documents, and more. After the 2013 conference, CPTI moved from Belgium to England, and the reorganization put conference organizing on hold until this year.

Nicaraguan Tax Resistance Leader Released from Prison

Nicaraguan tax resistance leader Irlanda Jerez was released from prison as part of a government amnesty of political prisoners in the run up to negotiations with the opposition. Beginning on June 4, 2018, Jerez and other shop owners refused to pay taxes to the government to protest its disregard for human rights. She was originally detained on July 18, 2018. Jerez says she was drugged, tortured, and sexually assaulted while in prison, and that her home was sacked and her family attacked by government-aligned paramilitary forces soon after her release. Her children are now refugees. Torture, arbitrary arrests, and repressive brutality are frequently relied upon by the Ortega regime, amounting to “crimes against humanity,” according to Amnesty International. She has renewed her call for mass civil disobedience. “We’re ready to pay any price necessary to free Nicaragua.”

Thanks to David Gross for this last bit of news, whose blog The Picket Line (sniggle.net/TPL), includes more on war tax resistance topics.

War Tax Resistance Ideas and Actions

Announcing 2019 Grants from Southern California

War Tax Resistance Alternative Fund

Last year, Southern California WTR decided to forgo the grant making process. Instead, we held a “redistribution” of refused taxes from our alternative fund at NWTRCC’s semi-annual gathering held here in Los Angeles. We made public donations to local movement allies like Black Lives Matter and Food not Bombs, who participated in that amazing conference. This year, we requested grant applications and in June distributed $9,000 in resisted taxes to the following groups:

9to5 California, Alternatives to Violence L.A., Global Network, Jewish Voice for Peace-L.A.. Nevada Desert Experience, Northern Spirit Radio, Project Yano, Regis Tremblay (filmmaker), San Diego Peace Resource Center, Oakland Street Academy, and Tri-Valley CAREs.

We are not planning a public distribution ceremony, but will be making a public announcement on our website at scwtr.net and posting on social media. Our post will include links to each of the groups. Please repost—and encourage others who say there is nothing they can do about militarism and war to consider the value of this resistance.

– Report from Cathy Deppe

War Tax Resistance Listserv

The war tax resisters’ online listserv is a place for discussion and mutual support for persons who redirect or otherwise do not pay taxes for war, those who support the resisters, and the curious. Once one is signed up for the listserv, they can easily send emails to everyone else on the list and will receive emails from other members. This tool hopes to partially bridge the geographical distances between us, offering one another support, encouragement, understanding, and information. It also provides an opportunity to do some war tax resistance organizing and outreach.

Back in January, Ed Agro did a census of the current group. The list currently has 67 subscribers—meaning 67 active email accounts. In the three months prior, there were postings from 28 subscribers, or 42% of the list. We are assuming that the other 39 subscribers who rarely post find the listserv useful for counseling, support, organizing, and outreach.

The listserv was started in the early 1990s, with Ed Agro playing a large role in it from the beginning. In 2017, Ed stepped down from his oversight role as WTR and tech expert David Gross agreed to step up. The list operates independently of NWTRCC and we are happy that it has continued to thrive for around 25 years.

If you would like to subscribe to the listserv, go to lists.riseup.net/www/info/wtr-s

Bitter Sweet Redirection

Kima Garrison of Oregon Community of War Tax Resisters and Pat Schwiebert of Peace House. Photo courtesy of Kima Garrison

As the Oregon Community of War Tax Resisters (OCWTR) in Portland has dwindled over the years, we decided to close our account at the credit union and give the money away. One deciding “push” was the fact that the credit union started charging us $5 a month to have a checking account and we prefer to help people over credit unions. Of course, choosing a group or groups to redirect money to is not always easy. There are so many worthwhile groups that are constantly underfunded. We decided to give the money to a local community church that is working with the houseless and food insecure communities. Pat Schwiebert of the 18th Avenue Peace House heads up the kitchen and other programs at Sunnyside Community Church, which includes beds for those who need to rest, free clothes, a place to shower, and also washer and dryer to do laundry. Pat and I commented how we see an ever-increasing divide between the wealthy and the houseless population, especially under this administration. And how it’s more important than ever to help out when we can. And so it’s bittersweet to close our account and yet be able to provide a small amount of support to those who need it!

– Report from Kima Garrison

WTR News & Events

Persistence Prevails

Or How I Am Dealing With The Loss Of My Professional License

By Joseph Olejak

“War will exist until that distant day when the conscientious objector enjoys the same reputation and prestige that the warrior does today.”

– John F. Kennedy

Dr. Joseph Olejak Photo courtesy of Joseph Olejak

In November 2013, I pled guilty to willful failure to file income tax forms. They called it tax evasion, but before I took the step to stop filing I put all government agencies on notice. Evasion requires, at minimum, hiding and I was open and vocal about my dislike for how the government was spending my money.

Fast forward to 2014. I’ve spent 26 weekends in the Columbia County Jail, paid monthly restitution payments, and did 200 hours of community service—BUT—New York State decided that with a felony tax conviction they were going to pull my professional chiropractic license.

I can accept a one-year suspension for my “misdeeds” or I can ask for a hearing. Believing in due process and the power of speaking the truth, I ask for the hearing. I get one, but two of the three hearing examiners are dozing off while the process moves forward. Because I ask for the hearing and put them “through the trouble” of due process they take the option of suspension off the table and revoke my license. Don’t ask for justice in a courtroom, you won’t find any.

Fast forward to 2016. I request that New York State Department of Corrections and Community Supervision (NYS DOCCS) give me a certificate of good conduct so I can re-apply for my license and they decline my request because “it is not in the public interest.” I assume my five years of probation is not complete so I accept that and wait two years until I can apply again.

Move ahead to June 2018. I apply again and get the same boilerplate denial: “not in the public interest.” This time I’m off probation and have completed all the conditions the court demanded of me with the exception of paying the full amount of restitution ($100/month) because I’m broke and can only afford $40/month.

Now, I’m fed up and decide to challenge the system. I send a Freedom of Information Law (FOIL) request to demand the records that led to the denial decision and get stonewalled. They won’t release the records or give a reason for the denial.

Then I get mad. I march myself down the Albany Law Library and ask the librarian for every book he has on Article 78 law. That’s the law that is used in NY to sue a state agency.

In November 2018, I file my case, serve the state, and wait.

In November 2018, January 2019, and February 2019 the state asks for three continuances. I complain on the third one and demand justice from the court stating that justice delayed is justice denied.

In March 2019, the state issued a reply affidavit to my petition. It stated, in part, that my case had no merit, that I had no right to the documents I was requesting (and that they relied upon for my denial) and that the affidavit of a state employee at NYS DOCCS was enough to substantiate my denial.

In April 2019, I asked the court for a continuance of three weeks to prepare a reply affidavit. In that reply affidavit, I impeached the assistant attorney general and NYS DOCCS and gave my own arguments as why it was in the public interest to grant me the certificate.

In May 2019, the Judge presiding over the Article 78 found that NYS DOCCS should reconsider their denial and orders it.

In June 2019, I was granted the certificate of good conduct which allows me to apply for my chiropractic license among other things (drive a truck, tend bar, etc.). It still denies firearm possession or the ability to hold public office. I may request a change in the public office status, but who needs a gun when you have a pen!

The moral of this story can be summed up in one word: PERSIST.

In my case, the state worker who issued the affidavit and then finally the certificate chose to perjure himself by saying I had not made restitution payments to the court and that he’d done a complete review of records in my case. In short, he did not do complete work before making a decision on the certificate. In Quaker parlance—he lacked integrity.

Anyone can challenge authority. All you need to be able to do is read and write. If everyone stopped accepting the status quo and buried the government in paper the nonsense would end rather quickly.

For those interested in expanding their peace witness, Joseph Olejak will teach a course at Powell House, November 15-17, 2019, titled, “Turning Quaker Testimony into Action.” To learn more, contact Powell House at 518-794-8811. Additional information can be found at https://powellhouse.org/site-map/articles/adult-family-programs/peace-witness-turning-quaker-testimony-into-action

If anyone wants to see the pleadings in my case feel free to email me at drjoseph.olejak@gmail.com or just call me 518-301-5717.

School of the Americas Watch Gathering

November 15-17, at Fort Benning, Georgia. This is a Commemorative Gathering to remember the 30th Anniversary of the Central American University Massacre. NWTRCC expects to have an active presence there. Please let us know if you plan to attend. More information about the event can be found at soaw.org.

Yes to the Earth! No to War Taxes!

November 1-3, 2019

Portland and Corvallis, Oregon

We are excited to announce that the fall NWTRCC National Gathering will be in Portland and Corvallis, Oregon. The primary focus of the weekend will be on collaboration between war tax resisters and environmental activists. The Friday evening session will begin in Portland at 5:00pm. After the session ends at 8:00pm, we will carpool down to Corvallis. The Saturday & Sunday portions of the program will be in Corvallis.

For the most recent information on the gathering, including registration information, go to https://nwtrcc.org/programs-events/gatherings-and-events/ or call the NWTRCC office.

PROFILE

Loving Life on the Margins:

An Interview with Suzanne Belote Shanley & Brayton Shanley

Brayton and Suzanne coming from Brigid House. Photo by Claudia McNeil.

Earlier this year, Suzanne Belote Shanley & Brayton Shanley published a book about the history of the Agape Community, which they cofounded in 1982 in Ware, Massachusetts. The community is dedicated to prayer, voluntary simplicity, and gospel-centered nonviolent witness. War tax resistance has been a core aspect of the community from its founding. The book, Loving Life on the Margins, is not only a history of the community, but also the autobiography of Suzanne and Brayton. They were kind enough to be interviewed by More Than a Paycheck to discuss their lives and the Agape Community.

What was your initial motivation for becoming war tax resisters?

We were becoming an active part of the peace movement of the late 1970’s which was focused on abolition of nuclear weapons. Through the witness of Quakers from the Cambridge Friends Meeting, where we were regular attenders, we became inspired to tax resist. Tax resistance became axiomatic morally and spiritually if we were to consider ourselves disciples of a nonviolent love of life, rooted in the gospel truth of Jesus and an authentic nonviolent way of life. We could not, in conscience, pay for killing of any kind, but primarily the killing in war. We hold the belief that all life is sacred. Meeting Hibakusha, survivors of the American bombing of Hiroshima and Nagasaki, in Boston during the 70’s gave a human face to the ravages of nuclear war and the tax money allocated for MAD, Mutually Assured Destruction, of which we refused to be a part.

In the book, you mention meeting longtime civil rights activists and war tax resisters Wally & Juanita Nelson. Can you speak about meeting them and the influence they had on you?

Wally & Juanita Nelson, 1991. Photo by Ed Hedemann.

Wally and Juanita were leading the tax resistance movement in the Pioneer Valley in Western Massachusetts when we moved Agape to that region. Wally and Juanita were frequent visitors to Agape, Juanita often speaking at our annual gathering, Francis Day, named after St. Francis of Assisi, where she spoke her truth with incisive eloquence and never wavered on any topic dealing with tax refusal. They were both good and loving people, nonviolent mentors to the core. Their commitment to the truth of nonviolence, to the refusal to pay war taxes, and their residence in a tiny cabin called The Bean Patch, without electricity or running water, were motivational in our sustainable, simple life style at Agape. They were unwavering, resilient, authentic leaders by example. They often supported us financially, with their widow’s mite, sending 30 dollars they felt they did not “earn” for giving a talk. We treasure them always.

In what ways does the Agape Community promote and support war tax resistance?

Suzanne and I, as Agape co-founders, have refused all payment of taxes since our inception as a community in 1982 by living on donations which are not taxable. All who come to Agape and who support us in a myriad number of ways, are made aware of our witness. We join with the Pioneer Valley War Tax Resistance group when they have retreats and have, on one occasion, hosted a PVWTR retreat here at Agape.

In the book, you share how a lien was placed on a house that you owned, which the IRS collected on when you sold the house. Having a lien put on your house is a common fear among war tax resisters, what was the experience like for you?

The lien was an unknown for us. I believe we had a $5,000 debt to the IRS. We met with a revenue officer who said that he respected our convictions, but that we had broken the law and we had to pay for this. The officer also said that he was going to file our case under “uncollectible” until such time as we made a taxable income, when the debt would then be enforced. No further fines were to be levied on the initial $5,000.

When we sold our house, the IRS collected our debt of $5,000, plus $1,000 in fines. It was not the cleanest and clearest of refusal stands, and it wasn’t a catastrophic loss, as we did not lose the house itself. The IRS did get our money, but we carried the witness to its conclusion without blood on our hands, so to speak.

In what ways has war tax resistance positively and negatively affected your life?

As Juanita Nelson said: “Tax refusal will change everything you do and every way you live.” And so, we soon learned that simplicity is a requirement, doing without luxuries, and not having a great amount of discretionary income. This nonconformity, however, and the changes it requires are a blessing and a necessity of this age that we are living in. Our association with tax resisters has meant that we have met and been inspired by some of the most creative and courageous people on earth!

We feel morally and spiritually centered in our decision to refuse paying for taxes for humans to kill humans while destroying the earth’s ability to support life. There are really no negative moral and theological effects; there is sometimes a financial struggle. However, we would say that the major negative may be that we haven’t spread the message of tax refusal as far and wide as this form of witness deserves.

To purchase a copy of Loving Life on the Margins, go to agapecommunity.org/loving-life-on-the-margins-the-story-of-the-agape-community/. If you would like Suzanne and Brayton to come and speak in your area about their new book and war tax resistance, feel free to contact Suzanne and Brayton at peace@agapecommunity.org.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Subscriptions are $15 per year.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org