National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

December 2023 – January 2024

Contents

- Interest in War Tax Resistance is Growing Fast!!!

By Lincoln Rice - NWTRCC Meeting with Friends By Lincoln Rice and Chrissy Kirchhoeffer

- Counseling Notes New 1099-K Threshold Delayed… Again • Charitable Giving (Usually) Does Not Lower Taxes

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- NWTRCC News:Coordinating Committee Meeting (5 November 2023) • NWTRCC Funding Concerns • Thai Salad Dressing Recipe

- War Tax Resistance News: Call to Action: #TaxBlackout2024 • WTR 101 in Los Angeles • War Tax Resistance 101 Streamed on YouTube Live • Honor Native Land Trust

- Letter: NWTRCC Appeal Written by ChatGPT

- PROFILE: Simple Living By Don Schrader

Click here to download a PDF of the December/January issue

Interest in War Tax Resistance is Growing Fast!!!

By Lincoln Rice

Interest in war tax resistance is the highest I have ever seen it. (I will give the caveat that I was born after the Vietnam War and became a war tax resister in 1998.) I know that the NWTRCC office was bombarded with calls following the US invasion of Iraq after 9/11, but the interest in war tax resistance seems greater to me now. Perhaps the internet is playing a role in this.

Before the massacre began in Gaza a few weeks ago, NWTRCC was struggling to stand out and get its message to people who may be interested. Since then, people have been finding us through their internet searches to find ways to withdraw financial support for the massacre happening in Gaza. Not including new funding, the US provides Israel with over $3 billion every year, with almost the entire amount being used to support the Israeli military. Since World War II, the US had dedicated more foreign aid to Israel than any other country.

Normally, the week after a NWTRCC conference I take a break and relax… but not this time. When I returned home from the conference in New York on Monday November 6, I had a pile of emails and phone calls to return.

NWTRCC Joins TikTok

In mid-November, I was on a Zoom call with a couple of younger activists who are interested in launching a war tax resistance campaign (see article on page 3) and they made the comment that NWTRCC should be on TikTok.

I’ve been skeptical of TikTok as a tool for spreading war tax resistance. About a year ago, I created a TikTok account for NWTRCC, but never posted any videos after seeing that most other anti-war groups had started and given up on TikTok after posting a few videos that did not receive much of a reaction. (Code Pink is the exception. They have a very active account.) TikTok seemed more geared for sharing cat videos, dance moves, and recipes.

But after that Zoom call, I signed back into our TikTok account to see that we had 250 subscribers even though we had no content posted. In the few weeks since, the short 60-second videos that we have posted have had total views of over 130,000 and our subscribers have increased to over 5,000. Our TikTok account can be found here: tiktok.com/@wartaxresister

Increased Website Traffic

After posting the first couple videos on TikTok, traffic to our website increased so greatly that our site crashed. We had it back up after a few hours, but we’ve been told by our web host that if this new level of traffic is permanent, we would need to move to another host site because this traffic is beyond their long-term capabilities. Normally, the most unique visitors we have to the NWTRCC website in one month is 6,000 as Tax Day nears. We have had over 22,000 unique visitors for November.

Our Instagram traffic has also skyrocketed (instagram.com/wartaxresister/). Before the NWTRCC conference in early November, we had about 400 followers. Now we have over 6,200. Twitter and Facebook have seen less of an increase, but those social media platforms are used more by older people while TikTok and Instagram have a younger audience.

Shortly after the November NWTRCC gathering, I was asked by a woman connected with a Philadelphia Quaker meeting to host a WTR 101 on Zoom. That session took place on Thursday evening November 16th. Over 2,400 people registered. The problem with Zoom is that it maxes out at 300 participants. So a change was made to stream it on YouTube. There were some technical glitches that did not allow everyone to get this last minute info, but we still had an audience of around 200 and that video has now been seen by close to 1,200 people on YouTube.

Before the NWTRCC conference, I had received a call from a woman in Los Angeles who wanted to host a WTR 101 session for some people she knew… maybe a couple dozen. I put her in touch with Cathy Deppe and you can see Cathy’s report on that session on page 3 of this newsletter.

I have also received emails and phone calls from war tax resistance counselors in our network who have begun receiving calls and wanted to follow up on a piece of information that they were not sure of. If you have been receiving calls for counseling, please let the NWTRCC office know.

Time to Reach Out

This is a great time to reach out to younger activists and local activist groups. Although many of these same groups may not have been interested in having a war tax resister speak to their group six months ago, the deployment of US weapons in Gaza has changed minds.

NWTRCC Meeting with Friends

By Chrissy Kirchhoefer & Lincoln Rice

NWTRCC met for it’s twice annual conference at the Purchase Meeting House just north of New York City in West Harrison, New York. Friday evening featured a panel examining the current situation in Israel-Palestine as well as what was missing in this summer’s Oppenheimer film. Nada Khadar, Executive Director of Westchester People’s Action Coalition (WESPAC), spoke first and shared the present challenges she is facing in organizing support for Palestinians in Gaza.

Next, Vera Anderson, a musician who is active with the Nevada Desert Experience, played a couple inspiration songs and recited a poem before sharing about the Nevada Desert Experience. Then, Mari Inoue, attorney and cofounder of the Manhattan Project for a Nuclear-Free World, discussed current campaigns for nuclear abolition in the United States and Japan.

While NWTRCC was gathering at the Friends meeting house in Purchase, New York, people were gathering in the streets throughout the country as they have been since October 7 when a new wave of violence erupted in Israel and Palestine. There was a rather large demonstration in Washington, DC on that Saturday. A couple of the panelists on Friday evening were traveling the next morning to attend and emphasize the world-wide call for peace.

On Saturday morning, Brad Wolf joined us via Zoom to discuss the Merchants of Death War Crimes Tribunal (merchantsofdeath.org) that began taking place the weekend after our meeting. In addition to being one of the three principal organizers of the tribunal, Brad is a lawyer and former prosecutor. They hope that the videos created for the tribunal, which are available on their website, can be utilized by activists to teach about US militarism’s effects around the globe.

In addition to the panels that took place throughout the weekend, discussing the funding of current wars and the horrifying prospect of nuclear war, NWTRCC joined the Concerned Families of Westchester during their weekly Saturday noon vigil, which has been a weekly fixture since 2001. Lincoln Rice, Coordinator of NWTRCC, addressed the crowd that had focused on the theme of “Guns and Butter” and shared information about how people can resist paying for wars.

Bob Bady and Joanne Sheehan speaking about Juanita Nelson, Photo by Lincoln Rice

Afterward, Joanne Sheehan of the War Resisters League and Bob Bady, a longtime friend of the Nelsons, shared stories about Juanita Nelson, who would have turned 100 this year.

Saturday concluded with a War Tax Resistance 201 session. On Sunday, we had our business meeting, which is discussed on page 5. All of the events, except for the vigil, were also on Zoom.

Cover of the War Resisters League Centennial book

At the heart of NWTRCC, we are a community. Another highlight of the weekend was having the War Resisters League traveling exhibit to commemorate 100 years of peacemaking. Ruth Benn, Ed Hedemann, and Rick Bickhart, members of both NWTRCC and WRL, collaborated on creating the panels that included the history of WRL, some of their campaigns as well as photos of some of the actions over the decades. All of the content of the panels is in the book War Resisters League: 100 Years of Resistance to War and the Causes of War. If anyone is interested in hosting the exhibit, more information can be found here: warresisters.org/host-wrl-centennial-exhibit-your-community.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online on February 17, 2023 (Noon-5p Central). If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

New 1099-K Threshold Delayed… Again

For the second year in a row, the new reporting guidelines for 1099-K income have been delayed. People receive the 1099-K form for income related to business transactions on PayPal, Venmo, CashApp, etc. The new rules would have lowered the reporting threshold from those having income of at least $20,000 AND 200 transactions to business income of at least $600.

For tax year 2023, the original rule will remain in place. For tax season 2024, the threshold will lower to $5,000. Congress hopes to revise the law before tax year 2025, when the new standard would go into full effect. For more information on the 1099-K, check out this section in our previous newsletters.

Charitable Giving (Usually) Does Not Lower Taxes

This is a reminder that charitable giving is not a great way for most people to lower their taxes. First, you can only deduct charitable giving if you file Schedule A and forgo the Standard Deduction. If you file Schedule A, then I would recommend reading the following article, which further breaks down how much charitable giving can actually lower your taxes: nerdwallet.com/article/taxes/tax-deductible-donations-charity.

If you are self-employed, you can more easily deduct charitable giving. For example, people can pay to have an ad for their business in the periodical of a nonprofit (people have even done this for NWTRCC’s newsletter) or pay money to be an official sponsor for an event. Essentially, you are making a charitable donation, though it is deductible as an ad expense for one’s business.

Many Thanks

Thanks to each of you who has responded to our November appeal — and in advance to each of you who is about to send that check! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

Special Thanks for affiliate dues payments from: Casa Maria Catholic Worker (Milwaukee) Boulder War Tax Info Project

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loop

We’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.org

War Tax Resistance News

Call to Action: #TaxBlackout2024

By Nick Lancellotti & June Johnson

Now more than ever, it is clear our government has no intention of maintaining lasting peace anywhere in the world, including within its own borders. In cities, towns, and college campuses across the US we have witnessed a supposedly democratic leadership impose its will with alarming force upon our collective voice – one hand squeezing our throats, with the other hand aiming a rocket at Gaza when it’s not raiding our pockets. Despite censorship and violence, the relentless outpouring of love and revolution from all corners of the world in support for Palestine has harshly illuminated not only the ethical realities of paying for war, but even how our comfort and luxury products perpetuate genocide. The pattern we have been noticing online is that more and more people are asking the critical questions about where their money is going. We are confident that now is the time to go all in on something BIG, especially with a Presidential election just around the corner.

Our goal is to move at least 50 million Americans to participate in a Tax Blackout this April 2024 by refusing at least 5% of their income taxes and donating that money to community building organizations. We are looking to members of the NWTRCC and relying on your decades’ worth of experience to help #SpreadTheWord by being as vocal as you can online and in your circles about the Blackout and war tax resistance, engaging and educating younger voters (who have been among the most receptive to the war tax resistance messaging and are more likely to share content), and volunteering to become a Resistance Counselor. Continue to promote and share NWTRCC posts and events using the hashtags #TaxBlackout, #TaxBlackout2024, #SpreadTheWord, and #NWTRCC. Download the app Geneva and request to join the group We The People for a safe space for people to gather, discuss, host video sessions, and mobilize for action beyond the prying eyes of Meta and Big Tech.

Since learning about war tax resistance through our own curiosity and research in the wake of October 7th, we have been impressed by the impact the movement has had in shaping our nation’s history, where the People can truly make their voices heard while taking actionable steps to invest back in community. We humbly join you in the commitment to fighting for a future where peace is priceless.

[Editor’s Note: Nick and June are younger activists who contacted the NWTRCC office in early November. They also urged NWTRCC to get on TikTok, which was been a successful avenue for spreading war tax resistance among younger activists. Nick Lancellotti can be emailed at nlancellotti14@gmail.com and on Instagram @nicksclick. June Johnson can be emailed at June@junejohnson.co and on Instagram & TikTok @lovejunejohnson.]

WTR 101 in Los Angeles

Cathy Deppe speaking at the May 2023 NWTRCC gathering in Indiana. Photo by Lincoln Rice

We had scheduled an in-person War Tax Resistance 101 session for Saturday November 18th in a local park. Unfortunately, we had to change our Saturday location after weather warnings, from sitting on grass in a downtown park to being indoors at Solidarity Hall, in its large storefront meeting room/ bookstore/ community center. Solidarity Hall belongs to the Freedom Socialist Party, where I volunteer. Organizer Val Carlson made it available to us on very short notice.

We provided support, answers, and resources. Some of the resources we shared were how to fill out a W-4 form, our many practicals booklets, and “War Tax Resistance at a Glance.”

Ambrea Miller organized the session after finding a posting on TikTok of one of our pamphlets and contacting Lincoln at the NWTRCC office and then me. She also organized a webinar to be held Sunday, since so many people wanted that. We planned everything together and we want to keep working locally, probably with group meetings. Unfortunately, the Sunday webinar was cancelled as high winds disturbed reception and made Ambrea’s WIFI unreliable. She referred all who had registered (175) to NWTRCC’s YouTube webinar the following Wednesday (see next report).

We had a standing room crowd of almost 50 folks in age range of 20s and early 30s. I have a contact list with emails and phone numbers for 44. We did not record the program. I put out lots of literature from the stock I had on hand, and sold outright all four of the WTR guide books/manuals. People want more of these! We made packets of the W-4 flyer, the Peace Tax Return flyer, and passed out the WRL pie chart. We did not take up a donation, but between the two of us will donate for the hall ($50), and the photocopying. ALMOST ALL of the literature I put out was taken!!

I received the palm cards from the NWTRCC office – Lincoln, thank you.

Finally, I made a good contact with a Tom Foster one of our network allies, at the Episcopal Peace Fellowship. He is with the Palestine/Israel Network of Episcopal Peace Fellowship. He and his wife were helped by the Penalty fund in the early 2000s.

I will continue to organize with Ambrea here in L.A. I am grateful to have the opportunity to stir this pot and hopefully resurrect our Southern California WTR group. People everywhere, especially youth, are saying they don’t want to pay taxes for this genocide, and I am hearing, “Not on our Dime.”

— Report from Report from Cathy Depper

War Tax Resistance 101

Streamed on YouTube Live

As Cathy noted in her report, Chrissy and I led a WTR 101 session over YouTube on the evening of Wednesday November 22 at 8p Eastern/ 5p Pacific. I had been in contact with Joanne Sheehan of War Resister League (WRL) beforehand and WRL agreed to promote the session in their emails and on social media. We also promoted the session online and sent a special invitation to the more than 100 people who had signed up since October 1st for the NWTRCC e-newsletter and blog.

The session attracted 150 live participants and plenty of questions. The session has been posted to NWTRCC’s YouTube channel (under the ‘Live’ tab), where it has been viewed by another couple hundred people. Chrissy and I plan on hosting regular WTR 101 sessions online as long as the demand continues.

— Report from Lincoln Rice

Honor Native Land Trust

By Eric and Brenna Cussen Anglada of the St. Isidore Catholic Worker Farm

[Editor’s Note: Eric and Brenna are long-time war tax resisters, who have been working on a voluntary tax that may interest many war tax resisters who are looking for redirection opportunities that take seriously the fact that most of us are living on stolen land.]

For the last several years, since Midwest Catholic Worker communities began looking more seriously at our participation in racism as a majority-white movement, the St. Isidore CW Farm has been grappling with what it means to be a majority-white Catholic Worker Farming community living on stolen land. Our response has taken many forms, including organizing Catholic religious communities to work toward repair for their large role in the operation of Native boarding schools.

Most recently, on this Indigenous Peoples’ Day 2023, we have partnered with other non-Native and Native people from this region to launch the Honor Native Land Fund (honornativelandfund.org/) supporting Indigenous sovereignty, land return, and justice in the Midwest.

Our work has been inspired by the voluntary land tax movements (nativegov.org/news/voluntary-land-taxes/) taking off around the country, and we are excited that we can support the Indigenous-led Great Plains Action Society and their work toward regenerating Indigenous lifeways in Iowa, the most biologically altered state in the US.

We believe that an essential piece of the solution of the climate crisis and the root injustice of settler colonization on this continent is to work toward Native land return. This is an opportunity for non-Native people living across the Midwest (and beyond) to engage in a practical act of repair.

NWTRCC News:

Coordinating Committee Meeting

(5 November 2023)

Group photo of the in-person and online participants at NWTRCC’s Sunday business meeting. Photo by Lincoln Rice

The Sunday business meeting began with reports from both NWTRCC consultants (Coordinator & Outreach Consultant) and our biennial consultant review. One piece of feedback during this review process was the desire to have a better interactive experience for those online during an in-person meeting. Otherwise, the general feedback on the consultants was very good.

Next, the group approved our set of objectives for 2024 as suggested by NWTRCC’s Administrative Committee without any changes. The budget for 2024 was also passed without any changes. The budget was first composed by Lincoln, then received feedback from NWTRCC’s Fundraising Committee and Administrative Committee before being presented to the business meeting.

There was a proposal on the agenda from someone in Oregon for NWTRCC to mount a pledge campaign asking people to pledge to withhold their federal taxes when a large number—say a million—have also signed the pledge. We would have to formulate a maximum of three demands to be met by the government to prevent triggering of the tax resistance. The proposal suggested that with a million participants the risk would be relatively low and the likelihood of success would be pretty high. After a brief discussion without any clear consensus, the measure failed with three people in favor, three people blocking, and the rest standing aside.

There was also a proposal from NWTRCC’s Outreach Committee to endorse the Veterans for Peace “Peace Walk 2024,” which will feature a walk this summer from Augusta, Maine to Washington, DC. After brief discussion, the endorsement passed with full support.

The meeting finished with collecting some initial AdComm nominations for the May 2024 meeting and discussing some possible meeting locations for our next meeting the first weekend of May. We are always looking for meeting invitations if you have a place we can meet where attendees can social distance (especially as regards sleeping arrangements) and the rental cost would be minimal. At this point, it looks like the next meeting will be online.

Minutes for this meeting can be found here: nwtrcc.org/november-2023-cc-meeting-minutes/.

NWTRCC Funding Concerns

At NWTRCC’s business meeting at the beginning of November, we passed our annual budget for 2024. This budget anticipates taking about $12,000 from our reserves during 2024.

We were able to build up these reserves because of a generous grant that we had been receiving from the Craigslist Charitable Fund each year from 2014 through 2018. Not only did this grant allow NWTRCC to build some reserves, but it permitted us to hire additional part-time staff.

NWTRCC did not receive the grant in 2019 and at this point it seems unlikely that NWTRCC will receive this grant again in the future. Since NWTRCC has always been very frugal, cuts to our 2024 budget were limited.

We did have a successful raffle in the spring, and combined with our regular push for pledge donations and bequests, we hope we will be able to keep shrinking the amount we need to take from our reserves each year.

That being said, if you know of funding sources willing to support NWTRCC, please contact us at nwtrcc@nwtrcc.org or call us at (800) 269-7464. In addition, any extra you can donate at this time would be appreciated. Please consider making a pledge to donate to NWTRCC on a monthly or quarterly basis. This can be done by writing checks or setting up a monthly donation via PayPal (www.nwtrcc.org/about-nwtrcc/donations/). Consider making a bequest to NWTRCC by putting us in your will. More information about making a bequest to NWTRCC can be found on our “Donations” webpage.

Thai Salad Dressing Recipe</h3

3/4 c. organic rice vinegar

1/2 c. organic oil (1/4 c. organic sesame oil & 1/4 c. organic canola)

5 cloves garlic minced

1/8 c. organic maple syrup

1/8 c. organic soy sauce

I usually make it a day or two before using to allow flavors to marry.

[Editor’s Note: This salad dressing was offered for our salads at the November gathering to rave reviews. Lucia Z was gracious enough to share the recipe with us.]

Letter

NWTRCC Appeal Written by ChatGPT

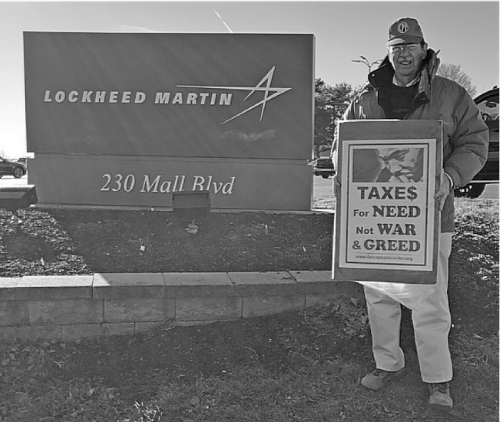

H. A. Penner Protesting outside Lockheed Martin. Photo courtesy of H.A. Penner

[Editor’s Note: H. A. Penner wrote our November appeal using ChatGPT. We’ve reprinted it here in case you missed it when the appeal was sent out. The NWTRCC office has received many compliments about the letter. Though many of those same folks are now either more interested in ChatGPT or more intimidated.]

Dear war tax resisters and friends,

When asked to write this (appeal) letter on behalf of the National War Tax Resistance Coordinating Committee (NWTRCC), I wondered what to highlight.

So, I asked ChatGPT, the Artificial Intelligence Bot, “Why should one support NWTRCC?” Here’s ChatGPT’s response:

NWTRCC is an organization that advocates for war tax resistance and promotes alternative ways to oppose war and militarism. Whether or not you should support NWTRCC depends on your personal values, beliefs, and priorities. Here are some reasons why individuals choose to support NWTRCC:

- Opposition to War: If you a.re fundamentally opposed to war and believe that military conflicts often lead to suffering, loss of life, and geopolitical instability, supporting NWTRCC can be a way to actively express your stance against war.

- Conscientious Objection: Some individuals have strong moral or ethical objections to their tax dollars being used to fund military activities. NWTRCC provides guidance and support to those who choose to resist paying a portion of their taxes as an act of conscientious objection.

- Promotion of Peace: NWTRCC promotes peaceful alternatives to war and encourages dialogue and diplomacy as means of resolving conflicts. By supporting NWTRCC, you can contribute to the promotion of peace as a viable and ethical solution.

- Social and Economic Justice: Many supporters of NWTRCC are concerned about the allocation of resources. They argue that the vast sums spent on military endeavors could be better used to address pressing social issues such as poverty, healthcare, education, and environmental concerns.

- Nonviolent Activism: NWTRCC advocates for nonviolent activism and civil disobedience as a means of challenging government policies. If you believe in the power of nonviolence and civil resistance to bring about change, supporting NWTRCC aligns with those principles.

- Legal and Ethical Guidance: NWTRCC provides resources and guidance for individuals who want to engage in war tax resistance while staying within the bounds of the law. They help taxpayers navigate the complexities of tax resistance in a responsible and ethical manner. [The A.I. is a little off here. NWTRCC is also a resource for those breaking the law in practicing their war tax resistance.]

- Community and Support: NWTRCC offers a sense of community and support for individuals who may feel isolated in their opposition to war funding. They provide a network of like-minded people who share similar concerns and values.

- Advocacy and Education: NWTRCC engages in advocacy efforts to raise awareness about the impacts of war taxes and to promote changes in government spending priorities. They also provide educational materials to inform the public about the consequences of war funding.

- Promotion of Fiscal Responsibility: NWTRCC argues that government accountability and fiscal responsibility should be paramount. They encourage citizens to question how their tax dollars are used and to demand transparency in government spending.

- Personal Integrity: For some, supporting NWTRCC is a matter of personal integrity. They believe that paying taxes should align with their deeply held beliefs and values, and supporting NWTRCC allows them to act in accordance with their conscience.

Ultimately, the decision to support NWTRCC or any organization is a personal one, driven by one’s own convictions and priorities. So, if NWTRCC’s goals and methods align with your beliefs and you affirm the impact it seeks to make, please consider supporting NWTRCC with a donation.

The above ChatGPT blog helpfully summarizes why I’ve chosen to regularly support NWTRCC financially. I hope you can too.

Sincerely,

H. A. Penner

Profile

Simple Living

By Don Schrader

Don Schrader Speaking on his TV program

I have paid no federal income tax for forty-four years. One-third to one-half of federal income taxes pay for mass murder in US wars—past, present, and future.

I did two years of community service (1969-1971) as a conscientious objector under the draft during the Vietnam War. Years later I realized that for me as a person opposed to all war, to pay federal income tax to train and equip youth—largely lower income and people of color—to become professional hired killers to murder on command with no conscience would be more evil than being a soldier myself!

Conscientious objectors and peace activists who pay federal income taxes never suffer horrific nightmares of soldier buddies beside them in combat blown to bloody bits. Heart-wrenching nightmares of a child’s or old person’s face at a window just before the hand grenade already thrown explodes the hut.

War is the worst of all crimes! I enjoy living simply below the US federal income taxable level and below the US poverty level for me as a single person. I consume no booze, no meat, no dairy, no junk food, no meals in restaurants. I eat raw plant foods. Cooking destroys most nutrients. I stopped cooking my food in 1998.

I have owned no car for forty-four years. I would not keep a car if given to me free. My home is one sunny rented room (9 ½’ x 12’) with six windows in the house of a friend. I walk. I ride the free city bus. Since a 16 May 2023 hit and run I suffered, I have accepted rides from friends.

On our streets, is the person who pays someone to kill an enemy any less guilty than the person pulling the trigger?

Would we pay local taxes if we knew any of the money went to kill neighbors on our street even if most of the money went for libraries, schools, street repairs, etc.? Are neighbors abroad less human, less precious than neighbors on our street?

I have no right to much more than I need while hundreds of millions worldwide suffer hunger, sickness, and no home on far less than they need. I have enough!

Marching and praying for peace while paying for war is like praying for health while eating sugar crap!

I am deeply indebted to the great variety of many people who have taught me, loved me, and inspired me!

My weekly TV program here on public access is also on YouTube at Don Schrader.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org