More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

October–November 2020

Contents

- The Financial State of NWTRCC & Bequest Campaign

By Lincoln Rice - Loving the Hell out of People

By Marian Franz - Counseling Notes: IRS Working to Reduce Undeliverable Mail • IRS Rejects an Installment Plan • Stimulus Letters Sent to Non-Filers Who may be Eligible

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Outreach Reports and National News: 4 Years Probation for American Anti-Abortion Activist • We’re All Field Organizers

- Can You Keep War Bonds Out of Your Socially-Responsible Investments?

By David Gross - War Tax Resistance Events: National War Tax Resistance Conference

- Profile: Taxes, Relationships, and Competing Priorities

By Lindsey Britt

Click here to download a PDF of the October/November issue

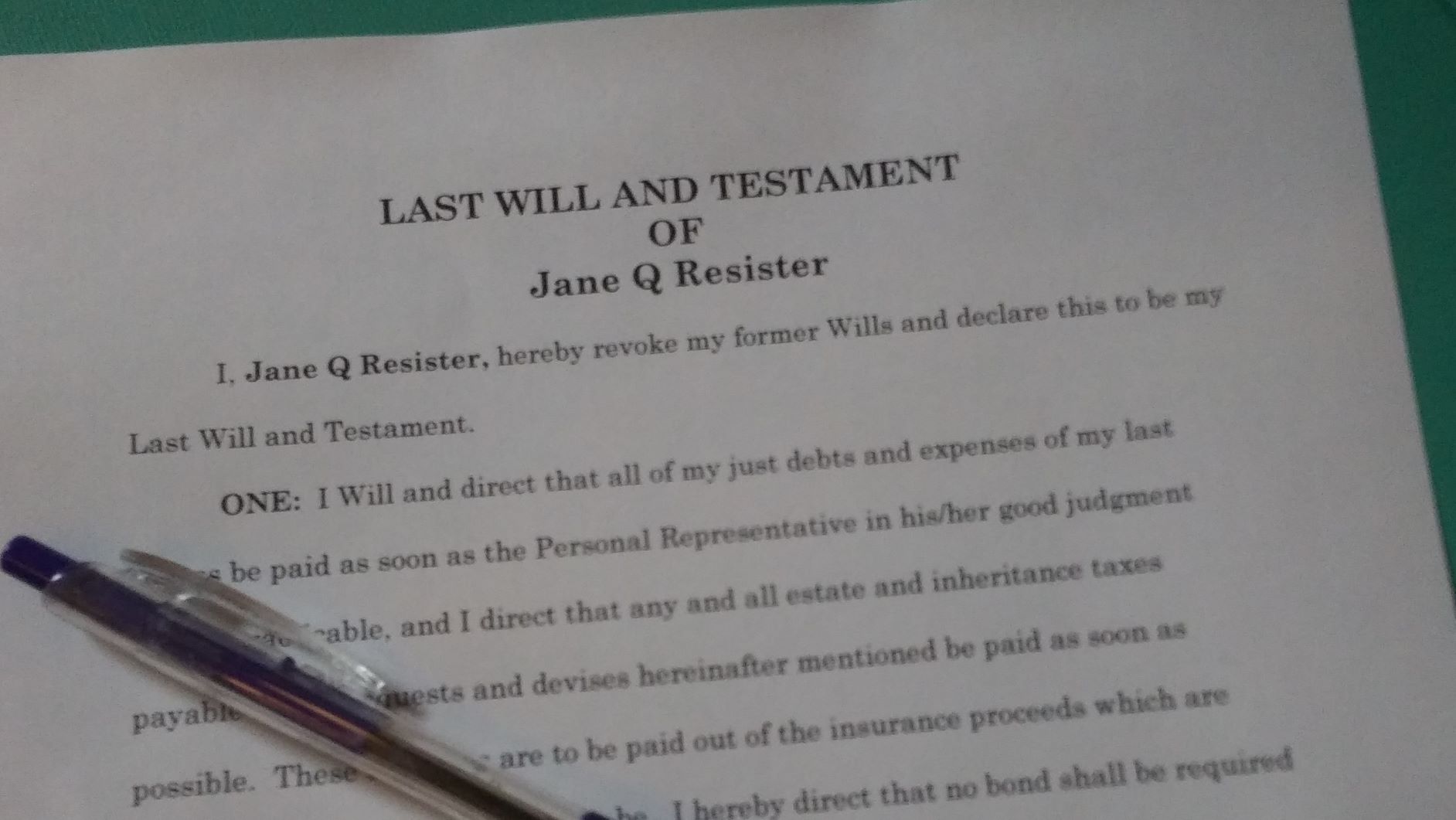

The Financial State of NWTRCC & Bequest Campaign

By Lincoln Rice

Photo Courtesy of Lincoln Rice

Unless you attend NWTRCC’s bi-annual business meeting or check out our annual reports, you might not be aware of NWTRCC’s financial situation. NWTRCC runs on a shoe-string budget. Our expenses last year were just over $58,000. Around 70% of our expenses—or about $42,000—were used to pay for NWTRCC’s two consultants. The remainder of the expenses were used to fund our biannual meetings, newsletter, website, and to keep our materials up-to-date. The website has definitely become our most highly utilized resource, with over 38,000 unique visitors checking out the NWTRCC site so far in 2020. (The average visitor looks at 9 different pages on our website.)

To help meet these expenses and make NWTRCC as helpful as possible to war tax resisters (WTRs), NWTRCC is embarking on a bequest campaign. Currently, more than half of our income ($35,500) is generated from the generous donations of folks in our network.

Because NWTRCC provides all of its resources and publications for free on our website, NWTRCC would not exist without the generosity of our donors. NWTRCC has received some grants, but most grantors shy away from NWTRCC because we promote breaking the law.

We realize that some folks find it difficult to regularly donate to NWTRCC. Many war tax resisters try to live simply or have limited budgets. Nevertheless, we hope that you may consider putting NWTRCC into your will. NWTRCC has recently created a web page dedicated solely to making a bequest (nwtrcc.org/bequests-estate-plan-gifts/). Some of the advantages of making a bequest include:

- A bequest costs nothing now, yet gives you the satisfaction of knowing you have provided for NWTRCC in the future.

- You retain control of and use of your assets during your lifetime.

- You may modify your bequest if your circumstances change.

- If you let NWTRCC know of your plans, we will be able to thank you now!

As part of our bequest campaign, a few of our NWTRCC members will be sending out personal invitations to folks in our network about making a bequest to NWTRCC. In most cases, we will send an email with an option to also discuss the topic over the phone.

Until recently, NWTRCC was receiving a sizable grant each year from the Craigslist Charitable Fund. Unfortunately, its funding priorities changed a couple years ago. Because NWTRCC has always been frugal, we had placed a large part of those grants into a reserve fund. We are still drawing from that reserve fund each year, but may need to make more drastic spending cuts in the near future if other sources of income are not found.

It is our hope that this bequest campaign will lead to an increase in funding that will ensure NWTRCC’s fiscal sustainability until the time comes when militarism ends and NWTRCC is no longer needed.

If you are interested in making a bequest to NWTRCC or have any questions, please contact the office at nwtrcc@nwtrcc.org or 262-399-8217.

Lincoln Rice is the Coordinator for NWTRCC and lives in Milwaukee, Wisconsin.

Loving the Hell out of People

By Marian Franz

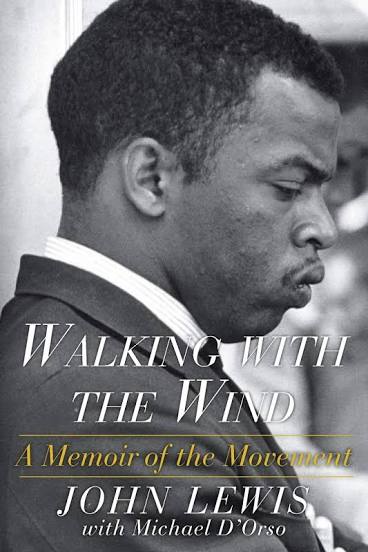

[Note from Ruth Benn, who edited this article: Congressman and peace, justice and civil rights activist John Lewis was a longtime sponsor in the House of the Religious Freedom Peace Tax Fund Bill. With his death on July 17, tributes abound and interviews with him can be found online. I was glad to find this essay by longtime Peace Tax Fund director Marian Franz. It was originally written for the organization’s newsletter in 1998 and is included in A Persistent Voice: Marian Franz and Conscientious Objection to Military Taxation, edited by David R. Bassett, Steve Ratzlaff & Tim Godshall (pp. 134-35).]

Walking with the Wind by U.S. Representative John Lewis (Simon and Schuster, 1998) is a riveting book, a must read. It recounts the author’s part in the nonviolent civil rights struggle that rocked this nation and forced it to face its conscience. The son of poor Alabama sharecroppers, who as a child preached to the chickens, Lewis now dines with the heads of state and is a member of the U.S. Congress.

You will be awed and grateful that Lewis, the main sponsor of the Religious Freedom Peace Tax Fund Bill in the U.S. House of Representatives, is this manner of person. From the freedom rides of 1961, during which Lewis was repeatedly brutalized and imprisoned, to the civil rights march on “Bloody Sunday” in Selma, Alabama, where he suffered a fractured skull during an attack by state troopers, he maintained a quiet dignity with intellect, faith, courage and perseverance. I warn you, this story will force you to take a measure of yourself, and in my case at least, to realize there is still much growing up to do.

Here are some of the book’s lessons:

- “Keep your eyes on the prize,” which John Lewis describes as a “more perfect union” and “a beloved community.”

- It is essential to endure pain and suffering. The tears, and the lives lost, make a redemptive difference in society.

- Suffering is not enough. As Lewis says, “It can be nothing more than a sad and sorry thing without the presence on the part of the sufferer of a graceful heart, a heart that holds no malice toward the inflictors of his or her suffering.

- Training is important, as indicated in the words of nonviolence instructor James Lawson. Lawson had filed for conscientious objector status during the Korean War rather than register for the draft, and

he spent fourteen months in jail for his refusal

to serve.

In training sessions, Lawson was tough. “When you can truly understand and feel, even as a person is cursing you to your face, even as he is spitting on you, or pushing a lit cigarette into your neck, or beating you with a truncheon—if you can understand and feel even in the midst of those critical and often physically painful moments that your attacker is as much a victim as you are, that he is a victim of the forces that have shaped and fed his anger and fury, then you are well on your way to the nonviolent life” (p.77).

John Lewis, visited by David Bassett, Bob Macfarlane, Jack Payden-Travers in March 2014 to discuss the Peace Tax Fund Legislation

“It was not enough, [Lawson] would say, simply to endure a beating. It was not enough to resist the urge to strike back at an assailant. ‘That urge can’t be there,’ he would tell us… ‘You have to have no desire to hit back. You have to love that person who’s hitting you. You’re going to love him’” (p.85).

Love is a way of life

This love is not simply a technique or strategy to be pulled out when needed. This is a way of life that permeates each moment from the monumental to the mundane. “This sense of love, this sense of peace, the capacity for compassion, is something you carry inside yourself every waking minute of the day. It shapes your response to a curt cashier or a driver cutting you off in traffic” (p.77). Ouch.

This is a more all-encompassing love than loving something that’s lovely to you. Says Lewis, this is “a love that accepts and embraces the hateful and the hurtful. It is a love that recognizes the spark of the divine in each of us, even in those who would raise their hand against us, those we might call our enemy. This love realizes that emotions of the moment and constantly shifting circumstances can cloud that divine spark. Pain, ugliness and fear can cover it over, turning a person toward anger and hate. It is the ability to see through those layers of ugliness, to see further into a person than perhaps that person can see into himself, that is essential to the practice of nonviolence” (p.77).

“Love the hell out of them,” Lewis remembers Martin Luther King, Jr., saying, “and he meant that literally. If there is hell in someone, if there is meanness and anger and hatred in him, we’ve got to love it out” (p.78).

Marian Franz was Executive Director of the National Campaign for a Peace Tax Fund from 1982 to 2005. She died of cancer in 2006.

Counseling Notes:

[This section of the newsletter serves as an important information hub for war tax resisters that want to be kept abreast of the kind of actions that the IRS is taking to collect federal tax debt.

It also aids WTR Counselors, who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals, options, and realistic consequences in regards to WTR. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click on “Local Contacts & Counselors”). Trainings are offered once year and the next training will be online. If you are interested in attending a training, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.]

IRS Working to Reduce Undeliverable Mail

The IRS has provided guidance (effect 28 July 2020) to its employees on how to research and update a taxpayer’s mailing address when correspondence sent to the taxpayer is returned by the United States Postal Service (USPS) as undeliverable with a yellow label that contains a more current address for the taxpayer.

Generally, to change a taxpayer’s “last known address” in its records, the IRS requires clear and concise notification that the taxpayer has a different address than the one in the IRS’s records, which the information received from the USPS National Change of Address (NCOA) database satisfies. IRS was already supposed to be doing this, but there has been a consistent issue with IRS employees destroying mail that is returned with a yellow updated address label before updating the address.

The term “last known address” is significant because the IRS is required to send various documents to a taxpayer’s “last known address.” When a notice or document is sent to a taxpayer’s last known address, it’s legally effective, even if the taxpayer never receives it.

IRS Rejects an Installment Plan

Though most WTRs never attempt to set up an installment plan, this note is included for WTRs who might consider it at some point. For example, some WTRs with tax debt larger than $52,000, who are not able to apply for or renew their passport, may consider this option in the future. After agreeing to an installment plan, one is permitted to apply for or renew one’s passport. Although if the taxpayer stops making payments, their new passport will be revoked.

In a recent non-WTR case, a tax court determined that an IRS Settlement Officer properly rejected a proposed installment agreement. A married couple was not entitled to an installment agreement because they had the ability to pay their tax debt in full without causing financial hardship. The couple disagreed, stating that payment in full would cause them financial hardship.

The couple in question had requested the installment plan after receiving a Notice of Intent to Levy. As WTRs know, this standard notice must go out if the IRS wishes to issue a levy in the future. The receipt of this notice does not indicate that the IRS has immediate plans to take collection action.

Stimulus Letters Sent to Non-Filers Who may be Eligible

The IRS is sending “Economic Impact Payments” (EIPs) to certain taxpayers. Eligibility for EIPs is generally dependent on a person’s 2018 or 2019 federal income tax return. The IRS created an on-line tool for taxpayers who were not required to file a 2018 or 2019 tax return. The IRS will begin mailing out notices to 9 million Americans who may be eligible for, but have not registered to claim, an EIP. The letter (IRS Notice 1444-A) will urge recipients to register with the Non-Filers tool by October 15 in order to receive their payment by the end of the year. Receiving the Notice 1444-A is not a guarantee of eligibility for an EIP. l

Many Thanks

Thanks to each of you who donated for the May/June Appeal 2020! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

We are very grateful t o these alternative funds and WTR groups for their redirections and affiliate dues:

Southern California War Tax Resistance Alternative Fund;

War Resisters League

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

Outreach Support and National News

4 Years Probation for American Anti-Abortion Activist

[Editor’s note: NWTRCC does not have an official stance on abortion, but includes this piece of news because it could have relevance for war tax resisters who may be taken to court in the future.]

Michael E. Bowman of Columbia City, Oregon is back in the news. Bowman was first targeted by the IRS because of his involvement in a tax protest scheme cooked up by Joseph Saladino. (Saladino promoted the idea that income taxes are unconstitutional and was later convicted of conspiring to defraud the IRS).

Bowman was charged with a misdemeanor in tax court for deliberating failing to file for tax years 2011 and 2014. His original defense was based the Religious Freedom Restoration Act (which is also a defense contemplated by some war tax resisters), and also putting forward the theory that since he got away with not filing returns for eighteen years, he had a reasonable belief that what he was doing was lawful. A twelve panel jury, made up of eight women and four men, could not come to a consensus after deliberating for nearly eleven hours over two days.

Shortly after the hung jury, the judge stated that he was mistaken in permitting Bowman to explain his religious objections and another trial occurred without a jury in which Bowman was found guilty. The district attorney wanted jail time for Bowman, but the judge stated that the obvious sincerity of Bowman’s beliefs led to a sentence without time in prison. Bowman was sentenced to four years of probation and $138,000 restitution. Bowman plans on appealing the case based on being denied the ability to introduce his religious objections and the Religious Freedom Restoration Act.

We’re All Field Organizers

Veterans for Peace National Conference

3 August 2020

A panel of war tax resisters presented at the Veterans for Peace national conference via Zoom to around 40 attendees. The panel consisted of NWTRCC Coordinator Lincoln Rice, NWTRCC Administrative Committee member Lida Shao, and longtime war tax resister Randy Kehler. Each began by sharing their personal stories and motivations for war tax resistance. The session then moved to an examination of methods and potential consequences with time at the end for questions and comments. Since Zoom was in “conference mode,” only the presenters could be seen. It was strange providing a WTR session and not being able to see one’s audience and their reactions.

Report from Lincoln Rice

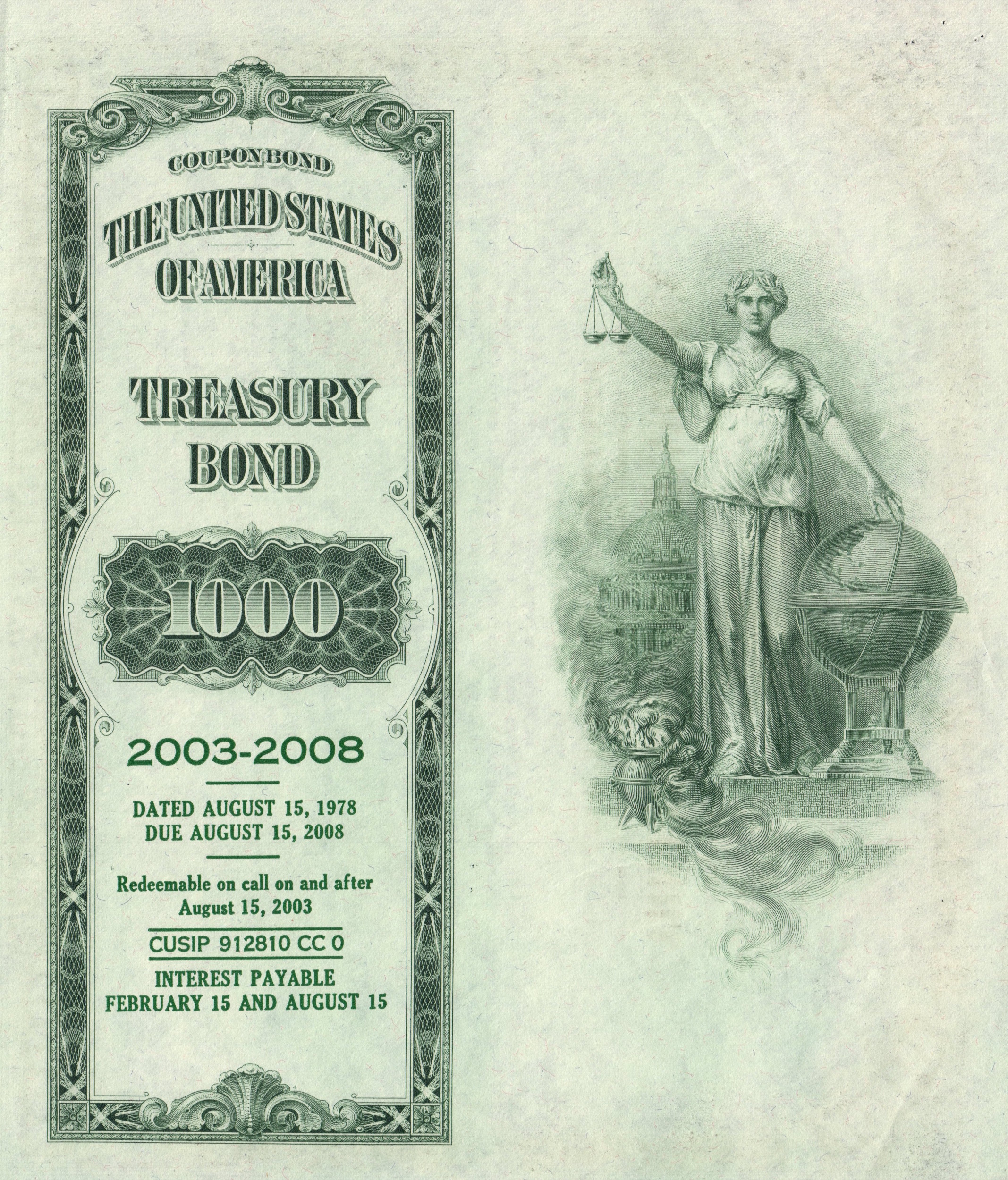

Can You Keep War Bonds Out of Your

Socially-Responsible Investments?

The U.S. government borrows money by selling Treasury bonds and other similar securities (“treasuries”). Much of the money it borrows in this way goes to the military, so people who do not want to help finance the military will want to avoid investing in such bonds.

Earlier this year, a war tax resister contacted me. She was concerned about avoiding such bonds in her retirement account and was having a hard time finding good places to put her money. Even the so-called “socially responsible” exchange-traded funds and mutual funds seemed to include such bonds in their holdings.

Some Overseas Funds Screen Out Treasuries

She also pointed me to this Bloomberg article: “ESG Hardliners Blacklist $16 Trillion U.S. Treasuries Market.” According to that article, some European companies that specialize in socially-responsible investments avoid investing in U.S. government debt because of U.S. policies. Excerpt:

“ESG-dedicated investors would usually avoid or question investments in U.S. Treasuries,” said Rupini Deepa Rajagopalan, head of the ESG office at Berenberg, which oversees about 36.7 billion euros. She cited the death penalty, nuclear weapons, and the U.S.’s non-participation in global environmental accords, such as the Kyoto Protocol.

(“ESG” stands for “Environmental, Social, and Corporate Governance” which is one of the ways socially-responsible investing is described.)

Many Funds Use Treasury Bonds by Default

But my correspondent was frustrated when she reached out to an investment advisor in the United States who specializes in socially-responsible investing. That advisor told her, “I have heard your concern before, but U.S. Treasury debt is unfortunately practically impossible to 100% divest from, as it is used as a default holding for many funds when they have available cash.”

He gave the example of the Calvert Green Bond Fund which, while its focus is on environmentally-responsible “green” bonds, “likely has some exposure to U.S. Treasury debt.”

Coincidentally, more than half of my own retirement savings was invested in that very fund, so I was surprised and upset: I thought I had investigated whether that fund holds Treasury bonds before I chose to invest there.

How Can You Find Out What a Fund Invests In?

You can use the “weaponfreefunds” search engine at As You Sow to search for equity funds that screen out military weapons manufacturers, but it does not screen out Treasury bonds.”

It’s something of a chore to find out what a fund invests in. If a socially-responsible fund has specific screening criteria that match what you care about, and you trust the fund managers to apply those criteria conscientiously, you can relax. But it is uncommon for U.S.-based socially-responsible funds to screen out U.S. Treasury debt. So if you want to make sure you are not inadvertently investing in treasuries, you may have to dig.

Every quarter, funds are supposed to issue a “Certified Shareholder Report” that lists the investments held by the fund at that time. This report is a public document, and if you are willing to battle the user interface at the Securities & Exchange Commission’s EDGAR tool, you can look it up on-line. Some of the reports are huge (I suffered a rare browser crash trying to look at one of them) but the data is there.

I skimmed some of these reports and found, for example, that the Vanguard FTSE Social Index Fund held about $1,240,000 in U.S. treasuries; the PIMCO Total Return ESG Fund about $282,931,000; the VALIC Company II U.S. Socially Responsible Fund another $2,394,279.

But there are limits to the usefulness of these reports. For one thing, they represent the investments of the fund only at a particular point in time. By the time you read the report, there have probably been some changes. Since funds often use Treasury bonds as temporary reservoirs for excess cash, just because a fund had no such investments listed in its report doesn’t mean they never invest that way.

How Treasury Bonds May Hide in a Fund’s Holdings

For another thing, a fund may invest in treasuries without investing in anything called “Treasury Bonds.” That’s how I overlooked the treasuries held by that Green Bond fund in my own retirement account. There were no Treasury bonds listed in the Certified Shareholder Report for that fund, but it did invest a significant amount of its assets in something called the “Calvert Cash Reserves Fund”—and as it turns out, that fund is chock-full of treasuries.

I found other examples like this, too: The Trillium ESG Global Equity Fund, for instance, invests three and a half million dollars in something called the “First American Government Obligations Fund,” which is government debt top-to-bottom. A number of funds I looked into also had on their books “Repurchase Agreements,” which were typically collateralized by U.S. bonds. There are probably other ways treasuries can hide, too, that I’m not clever enough to notice.

So to be really diligent, you have to start peeling the onion: looking not only at where a fund invests directly, but also at what additional funds it might invest in and what their investments look like. That’s a lot of work for an unsophisticated investor like me. I’d rather leave it to the professionals, at least if they’re already on the case.

Image by Steve Buissinne from Pixabay

I reached out to the press spokespeople for several U.S. companies that offer some of the most popular socially-responsible investment funds, to ask if any of their funds screen out investments in U.S. government debt or, if not, if they have any advice for investors who don’t want to see their money invested in that way.

Eventide Says It Avoids Treasuries in Its Funds

Many of the companies declined to answer. I did get an encouraging answer from Julie Jarrett of Eventide Funds, a faith-based socially-responsible investment company based in the U.S.:

Under normal circumstances, we avoid U.S. Treasuries in our funds because there are some activities of the government that we do not want to facilitate (e.g. offensive warfare, or funding to clinics providing abortions). Because Treasuries are general funding vehicles, an investor does not know which department of the government is an end recipient of the funds.

In addition, our income-focused products seek to screen out municipal bonds if the “use of proceeds” funds a state agency that participates in services that are contrary to our values-based screens.

However, when I looked up the EDGAR filings for Eventide funds, I found that most of them seemed to have indirect investments in treasuries: Their Gilead Fund is partially invested in the treasuries-heavy First American Government Obligations Fund; and their Global Opportunities Fund, Healthcare & Life Sciences Fund, and Multi-Asset Income Fund are each partially invested in Fidelity Investments Money Market Fund which is about half-treasuries. Of the funds I reviewed, only their Limited-Term Bond Fund seemed treasuries-free.

When I asked Jarrett about this, she replied:

In order to comply with the rules and regulations of the SEC, the mutual fund complex that Eventide is a part of has a list of securities to manage short term liquidity… When it comes to all other investments that Eventide has discretion over, we try to avoid treasuries under normal circumstances…

But Parnassus Believes U.S. Treasuries Are Socially-Responsible

Joe Sinha of Parnassus Investments (also U.S.-based), on the other hand, told me their ESG research team decided against screening out treasuries:

Parnassus believes it’s acceptable to buy treasuries because, on balance after various inputs are considered, the federal government is responsible for many good activities, like helping fund retirements (i.e. social security), providing medical care, revenue for education, and even recently helping to fund the search for a cure for COVID or supplying emergency aid.

“Investing with values, or ESG investing, means aligning someone’s personal values with how a Fund is managed,” Sinha told me. “So, it really depends on each person’s perspective.”

I asked him what advice he had for investors who were having a hard time finding a fund that matches their values. “Some investors chose to select individual bonds, like green bonds or social bonds, but these come with specific credit risks.” That is to say: you can always assemble your own custom-made fund by picking and choosing stocks and bonds that match your values, but then you lose the advantages of professional attention to the quality of your portfolio.

Conclusion

It’s harder than it ought to be to avoid loaning the Pentagon money with your investments. If you’re lucky, you may be able to find funds that match your preferred investment strategy and social responsibility criteria that also avoid treasuries. You could also do some careful research into funds that may just happen not to invest in treasuries, even if that is not an explicit screen they apply. If all else fails, and if you’re willing to put in the time, you can manually assemble an investment portfolio from individual stocks and bonds and other such investments that you have personally screened.

But unfortunately, you cannot assume that a “socially-responsible” mutual fund or exchange-traded fund—even one that explicitly screens out military contractors and weapons manufacturers—does not provide funding for war by extending credit to the Pentagon.

David Gross is the author of 99 Tactics of Successful Tax Resistance Campaigns. He blogs about tax resistance and related issues at The Picket Line.

War Tax Resistance Events

National War Tax Resistance Conference

“Defunding Militarism & Creating a New Normal”

November 6–8, 2020 Online!

Due to the pandemic, the fall NWTRCC National Gathering will be online once again. (It was originally going to be hosted by our friends in Colorado Springs.) The weekend will focus on how WTR fits in a culture that is questioning American priorities in the wake of Covid-19, Defund the Police, the Climate Crisis, and four years of an upcoming presidency that wants to keep the military budget at current levels. The conference will begin with a Friday evening social hour (8:00pm Eastern/ 5pm Pacific). On Saturday afternoon, the folks in Colorado Springs will lead a session on creating and sustaining a community of support in resistance work.

For the most recent information on the gathering, including registration information, go to nwtrcc.org/programs-events/gatherings-and-events/ or call the NWTRCC office.

PROFILE

Taxes, Relationships, and Competing Priorities

By Lindsey Britt

Lindsey Britt Photo Courtesy of Lindsey Britt

Since I began thinking about war tax resistance I’ve been struggling with the desire to reduce my income to avoid paying taxes for things I find abhorrent and, simultaneously, wanting to transfer more of my power (in the form of money) to organizations and individuals doing good. My mind keeps coming back these questions:

- Should I make less and give less money to good works/people, but also pay less into the war machine?

- Should I make more and give more money to good works/people and hope that my giving outweighs the increase in tax payments?

- If I can’t drastically reduce or eliminate my tax burden then is refusing to pay a portion of what I owe an option for me?

- If I put a bunch of money into a retirement fund that will mostly benefit me (which feels both practical and hoarder-ish) is that better than just paying the taxes on that money and giving it away?

- Am I just being greedy? Should I be able to make less money, give away just as much, and reduce my tax burden? This feels like the holy grail of my tax resistance.

Ethics, Morals, & War Tax Resistance

I love thinking about ethics and morals, but I have to say these ethical questions aren’t my favorites. I think a few factors combine to make these questions especially fraught. First, I’d rather not think about money. I grew up poor, now I have enough to get by, and I’d prefer not to think about money beyond knowing that I have enough and can give some away. Thinking about old age, in particular, brings out the scared money hoarder in me, which is an instinct I’m not happy with despite knowing it’s probably a natural one shared by lots of people. Second, my decisions about money and tax resistance necessarily involve my partner, so thinking about those questions listed above is complicated by being part of a relationship. Money and relationships are often sore points for people and then you put tax resistance on top of that and it seems like a recipe for unpleasantness. Third, the tax system is so hard to understand that I never feel confident when I make decisions. How do I answer my own questions when I’m not sure if I have the parameters right or that they won’t change tomorrow?

I thought resisting taxes wouldn’t be very different from being vegan, which is also part of my resistance to a world of violence. They are both sort of solitary pursuits with occasional opportunities for community and they are both forms of resistance that really seem to raise eyebrows, just a little too far outside the norm for most people’s comfort level. In reality I’ve found tax resistance to be much, much harder than being vegan. This seems strange to me because what I eat comes up as an issue with people way more often than whether I pay taxes. I think the difference is all those factors surrounding money that I discussed above. The first factor doesn’t apply at all: I’m happy to think about food. The second factor is somewhat relevant, because my food decisions do involve my partner, but he’s glad to eat what I cook so the relationship aspect becomes a non-issue. The third factor also doesn’t apply, because the concepts of veganism are way more straightforward than the tax system. Yes, there are nuances that people quibble over, but there isn’t a government body that can harass, fine, or jail you for disagreeing.

Not Having All the Answers

Returning to my initial questions, I don’t have the answers for most of them yet. This year I chose to refuse to pay a portion of my income taxes, but going forward my partner and I have decided that reducing income is the strategy that most works in our relationship. This was a tough compromise for me, because I’m okay with the potential consequences of refusing to pay (my partner isn’t) and refusing to pay seems easier to me than doing all the calculus around reducing my income tax burden. Ironically, my income went up this year. We bought a home, which feels like a good thing to have in these uncertain times, but it also came with the knowledge that we needed to transfer some of our wealth to those who have been historically excluded from land ownership and to those from whom this land was taken. It was difficult to say no to contract work that would allow us to pass money on to those communities.

So can I be at peace with paying more in taxes but also giving away more? In the long term my answer would be no, but for now my answer is that my resistance is a work in progress, but at least I’m doing the work. I became a pescatarian when I was 15 years old, then when I was in my early 30’s started moving towards veganism and finally several years later I went completely vegan. When I start moving in a direction it is usually deliberate and for the long run, so I’m confident it will be the same with war tax resistance. I feel the urgency of this form of resistance—2020 has made it clear beyond a shadow of a doubt that the militarization of the police and climate change are both at crisis points thanks in part to our tax dollars—and I think that will carry me forward. I always tell people considering veganism to be kind to themselves, so I’ll keep my own words in mind as I struggle with how to best practice tax resistance.

Lindsey Britt is a non-profit administrator, traveler, and amateur ethicist whose activist work is focused in the climate justice and animal rights movements.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Subscriptions are $15 per year.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org