More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

December 2020 – January 2021

Contents

- Money Rebellion Hosts WTR David Gross

By Lincoln Rice - Comradery & Strategy at the Latest NWTRCC Conference

- Counseling Notes: Warning about Sending a Letter with your Tax Forms • QR Codes on Past Due Notices • U.S. Circuit Court of Appeals Affirms that Couple could not Discharge Tax Debt for Bankruptcy Chapter 7 • Gig Economy Correction Notice

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- All or Nothing Syndrome By Ruth Benn

- NWTRCC News: NWTRCC Funding Concerns

- Peace Tax Fund Director Named Peacemaker of the Year

- Profile: War Tax Resistance, Self-Employment, and Health Insurance By Ilene Roizman

Click here to download a PDF of the December/January issue

Money Rebellion Hosts

WTR David Gross

By Lincoln Rice

Logo for the Money Rebellion Event with David Gross

Over the last couple years, Extinction Rebellion (XR) has grabbed headlines as a climate activist group willing to practice nonviolent civil disobedience to compel government action. During the summer of 2019, they even advocated that their members in London withhold 22% of their council tax to protest London’s support of projects not compatible with the U.K. achieving carbon neutrality by 2025.

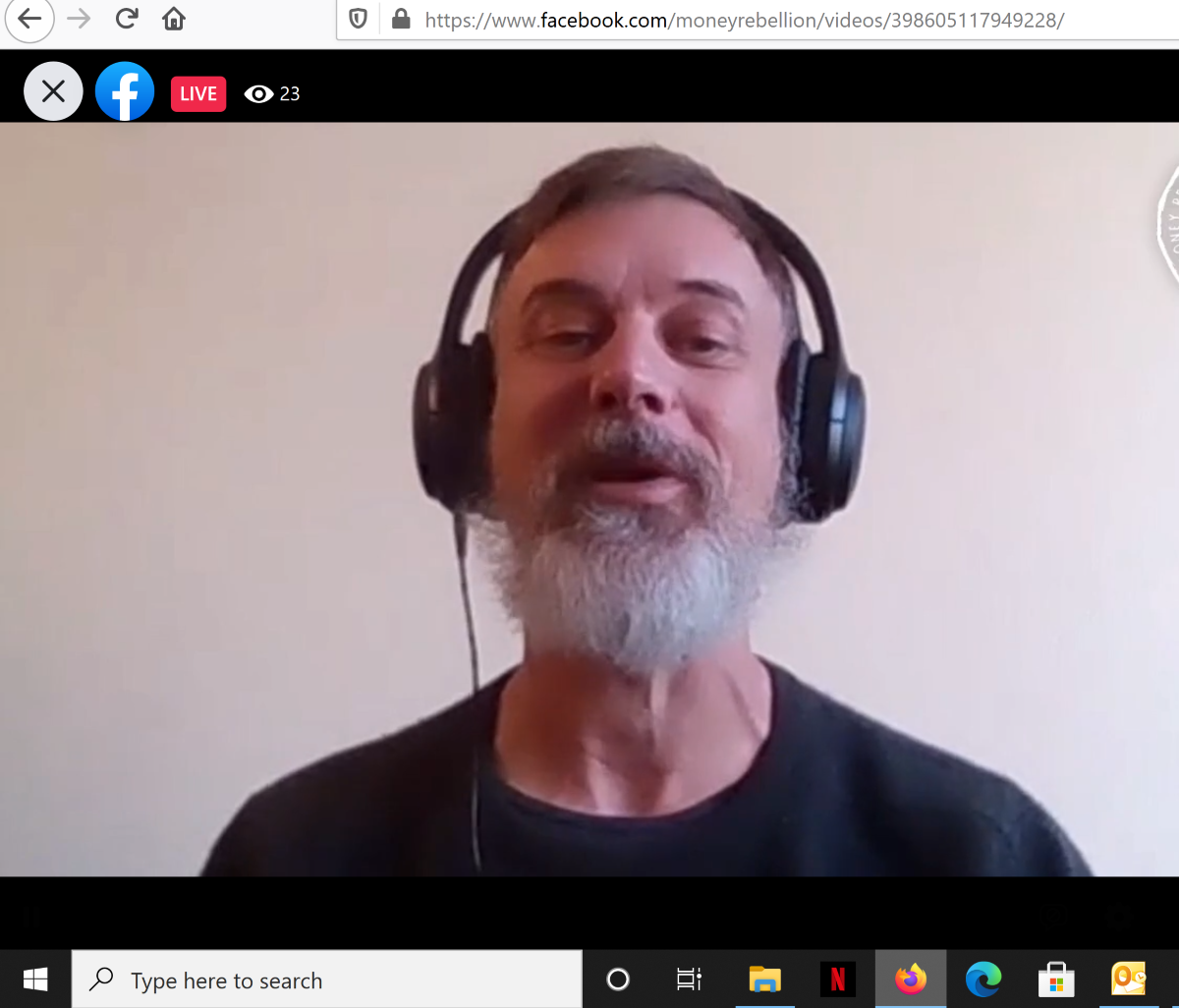

In late November 2020, XR launched a new campaign: Money Rebellion. This campaign is planning various measures to change an economy that has fostered the climate crisis, including a tax resistance component. To kick off this campaign, they held a Facebook Live event called “Building the Tactics of a Successful Tax Resistance Campaign” with American war tax resister David Gross on Wednesday November 25 at 4:30p London time. David is a WTR counselor in the NWTRCC network who has served on NWTRCC’s Administrative Committee and hosts a blog on war tax resistance (https://sniggle.net/TPL/). How did David Gross become involved in this event?!

As David explains, “The various automated keyword searches that patrol the internet for me started showing me hints that XR was thinking of expanding into tax resistance a few months ago. I learned about a planning meeting some of the insiders were holding on Zoom and decided to attend as a spectator. When they asked me who the heck I was, I gave a brief introduction, and Gail Bradbrook, who is spearheading the Money Rebellion campaign, held up her copy of my We Won’t Pay! book. From then on, it was all grins. They reached out to me on pretty short notice to come up with this talk for the Money Rebellion launch, but I was able to meet the deadline by partially repurposing the slides from the talk I’d given at the international war tax resistance conference that NWTRCC sent me to in Colombia a while back.” [Editor’s note: David’s books are available on his blogsite, https://sniggle.net/TPL/]

Gail Bradbrook, who held up a copy of David’s book, is a founding member of XR. Gail interviewed David for the Facebook Live event. She was at home and at one point she had to ask her children to get off the internet so that she would have enough bandwidth to continue the interview. (These are the issues of modern activists!)

Gail Bradbrook, who held up a copy of David’s book, is a founding member of XR. Gail interviewed David for the Facebook Live event. She was at home and at one point she had to ask her children to get off the internet so that she would have enough bandwidth to continue the interview. (These are the issues of modern activists!)

David Gross provided a broad history of war tax resistance in its various iterations so that Money Rebellion would have as many examples as possible to inspire them in their coming campaign. One example shared by David that stuck out to me was the public shaming that occurred in colonial Quaker communities if a member was not practicing war tax resistance.

If the member did not mend their ways, they would be banned from the community. Reflecting on this example further, David imagined that there might be a time in the future where a climate activist would not be respected if they paid their federal taxes, which in the United States supports the Pentagon — the number one institutional user of oil in the world.

Near the end of the interview, David stated that he would gladly be available as a resource, but as Money Rebellion is a climate campaign in the United Kingdom, he would also be “student” and rooting for their success. In response to some questions on Facebook about the practicality of tax resistance for climate activists, Gail Bradbrook responded that it is not always about whether an action will definitely lead to change, sometimes it’s a matter of “integrity” and “knowing that you did the right thing.”

You can follow @money_rebellion on Twitter. And you can follow NWTRCC News: NWTRCC @WarTaxResister on Twitter.

Comradery & Strategy at the Latest

NWTRCC Conference

Our November 2020 conference was originally going to take place in Colorado Springs. With the COVID-19 pandemic, we made the decision to meet online using Zoom instead. (Though we would like to thank Mary Sprunger-Froese and Rick Bickhart, who had put time and energy into the original planning of the conference.) If we had been able to meet in person, we might have seen some beautiful vistas. As it was, almost everyone had wonderful weather while we met online and some folks took their computers outside during our conference.

NWTRCC’s second online conference was a success. (Though to be clear, NWTRCC has had an online component to its conferences that has allowed folks who were offsite to join us for quite a few years now.) About 50 folks signed up for the conference and 42 attended at least some portion of the conference. We had folks joining us from Seattle to Georgia, from San Diego to Houston, and even folks from both Portlands (Oregon and Maine).

Friday Night Social Hour & Saturday Conference Sessions

Picture by Alexandra Koch from Pixabay

The conference began on Friday evening (November 6) with a “Social Hour.” This was an opportunity for folks to catch up with old friends and meet new ones. We used Zoom’s “breakout room” feature to form random groups of five for thirty minutes. After the thirty minutes was over, we broke out into random groups of five a second time.

On Saturday morning (November 7), we began the day with concurrent sessions of War Tax Resistance 101 & War Tax Resistance 201. We had six folks at our WTR 101 session and 25 folks at our WTR 201 session. [For people who are willing to be war tax resistance counselors, we will be offering a war tax resistance counselors training in early 2021. If you would like to attend, please contact the NWTRCC office.]

In the early afternoon, we held a strategizing session, in which attendees broke out into groups to discuss the relevant role of war tax resistance in the following four areas: (1) four years of a Biden presidency that has no plans to curb military spending, (2) Defund the Police, (3) COVID-19, and (4) the climate crisis.

The ideas generated from this session have already been discussed at our monthly Outreach Committee meeting. The thought at the moment is to incorporate some of these ideas into a war tax resistance campaign leading up to Tax Day 2021. More details to come…

For the final session, resisters from Colorado Springs shared their stories of resistance. Currently, military installations border the north, south, and east of the city. The militarization of Colorado Springs only began during World War II and afterward.

Sunday Business Meeting

The conference finished on Sunday morning with our business meeting. (The business meeting minutes will be posted within the next few weeks.) At this meeting, we approved our 2021 budget and objectives. We also passed “standing endorsements” for School of the Americas Watch and Witness Against Torture. (A standing endorsement means that the Coordinator does not need to receive future network approval to endorse the actions and events of a group.) Lastly, proposals regarding the updating of our logo and statement of purpose were discussed, though no consensus was reached. A few folks volunteered to work on reworked proposals for our next meeting.

Our Next Conference…

Our next conference will be April 30 to May 2, 2021. Our current plan is that this conference will once again be fully online with the hope of returning to a physical site for our November 2021 conference. We’ll keep you updated. Thanks to everyone who attended the conference and made it such a success.

Counseling Notes:

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click on “Local Contacts & Counselors”).This training is usually offered once a year and the next training will be online in early 2021. If you would be interested in attending one of these trainings, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

Warning about Sending a Letter with your Tax Forms

In late 2019, two war tax resisters were threatened with $5,000 frivolous fines if they did not refile their tax returns in thirty days. Although the IRS did not state that either filer received the threat because they included a letter with their tax return, it was the one thing the filers shared in common. Neither fine was enforced, but it was a hassle for each filer.

In mid-November 2020, a WTR filer in our network received a letter and phone call from her state’s health insurance marketplace provider. She was informed that she was being denied Obama-care premium tax credits because she had not filed her taxes for tax year 2019. She vehemently stated that she had, the person on the phone believed her, and her tax credits were reinstated.

She had previously created an online account with the IRS, so she logged into her account. Although she had filed in March 2020, her tax return had not been processed. She had sent a letter with her return. She had also sent a check to pay part of her taxes, which had been cashed. What is probable is that the IRS is planning to harass this WTR by threatening a $5,000 frivolous fine if she does not refile her tax return. The NWTRCC office had previously learned that during the frivolous fine warning process, the tax return is not processed by the IRS. Normally, that may not be a big deal for a WTR except that it delays the start of the 10-year statute of limitations on the tax debt. But with this example, we can see that this process could also cause problems with a resister’s heath care premium tax credits.

QR Codes on Past-Due Notices

In October 2020, the IRS began adding QR Codes to its past-due notices. QR codes are those boxes containing a jumble of square dots that you can scan with your phone to reveal information such as a web site address. In this case, you can scan the code to be taken to an irs.gov site at which you can check your account, make payments, etc.

There is a potential security issue here. If the QR codes are customized per-recipient or per-notice (though we do not yet know if this is case), then by visiting the website revealed by the code, you reveal that you have received the past-due notice. This in itself is not an issue for most of us, but if you are trying to keep a very low profile or convince the IRS you’ve disappeared, you may want to think twice about scanning such a code.

In addition, if you visit the web address revealed by the code — depending on what browser you use and how you have set it up — you may inadvertently give the IRS additional information such as: what kind of smartphone or computer you own, internet provider, or your location. The IRS could potentially use this information to track down your assets. For example, they could ask your phone company or internet provider for info about the bank you use to pay your bills. This is unlikely, but you should be aware of the potential for unwittingly sharing information with the IRS. (Thanks to David Gross for this note!)

U.S. Circuit Court of Appeals Affirms that Couple could not Discharge Tax Debt for Bankruptcy Chapter 7

A non-WTR couple filed for Chapter 7 bankruptcy to receive a general discharge (“fresh start rule”) from all debts that arose before they filed a bankruptcy petition. This “fresh start” is available to the “honest but unfortunate debtor.” To ensure that only the honest but unfortunate debtor receives the benefits of discharge, Congress has enumerated several exceptions to the fresh start rule. For example, there is no discharge “for a tax with respect to which the debtor… willfully attempted in any manner to evade or defeat such tax” (11 USC §523(a)(1)(C)). To prove that a tax is not dischargeable, the IRS must show that the debtor “attempted in any manner to evade or defeat [a] tax,” and the attempt was done “willfully.”

The appeals court agreed with the original court determination that years of excessive discretionary spending and a lavish lifestyle, while avoiding payment of their mounting tax debts, supported the bankruptcy court’s finding that they willfully attempted to evade their tax debt. Since most war tax refusers openly state their refusal or have previously sent letters to the IRS about their “willful” refusal to pay federal income taxes, this court case affirms that Chapter 7 bankruptcy would not be an option for war tax resisters who are trying to eliminate their tax debt.

Gig Economy Correction Notice

In the April 2019 issue of this newsletter, there was a counseling note that related how Treasury Regulations do not require certain gig economy businesses to issue Form 1099-K unless workers earn at least $20,000 AND engage in at least 200 transactions annually. This part of the notice was correct. (Gig economy business include Uber, Etsy, and Airbnb, where the worker is considered self-employed.) That notice incorrectly stated that gig economy workers do not normally receive a 1099-Misc form if they earn at least $600. In fact, gig economy workers do normally receive a 1099-Misc form if they make at least $600. Starting in 2021 the form will be labeled 1099-NEC, not 1099-MISC. Depending on their circumstances, a gig economy worker could receive a 1099-K & a 1099-Misc/1099-NEC for the same income.

Many Thanks

Thanks to each of you who has responded to our November appeal—and in advance to each of you who is about to send that check! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

Special thanks for Affiliate dues payments from:

Taxes for Peace Not War (Eugene, Oregon);

Milwaukee War Tax Resistance/Casa Maria Catholic Worker

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

All or Nothing Syndrome

By Ruth Benn

Over these decades of doing war tax resistance, being in meetings about war tax resistance, counseling current or new resisters, etc., I’ve tried to argue against something I will call the “all or nothing syndrome.”

“We’re having a baby so I have to stop resisting.”

“I’m applying for a loan so I have to stop resisting.”

“The IRS just took my bank account so I have to stop resisting.”

“I like the idea but I can’t risk my job by becoming a war tax resister.”

I don’t want to be snooty and judgmental about it. People hit a wall and feel there is no way around it for all kinds of reasons. But I do feel there is this “all or nothing” attitude that needs to be confronted. People see the risks before they consider all the options.

The all or nothing argument always makes me think of an old video clip of an interview with NYC resister Betty Winkler, who in her quiet way questioned why not “one fucking dollar?”

Somehow that always makes me laugh, because she is a rather quiet person, so her insistence on this point is a bit surprising.

My partner in resistance, Ed Hedemann, often brings up in workshops that he’d rather 1,000 people were resisting, for example, $10 each than a single person resisting $10,000, though the amount of money is the same, the impact is much greater. “It’s the act of resistance that the IRS hates, not so much the amount resisted.”

I often point out that many of us who are resisting, as best we can, 100% of federal income taxes owed started at a low level. We often dipped our toes in with telephone tax resistance** or some percentage of what was owed. As we felt stronger in our resistance (or began to earn more money), we began to feel we could not send anything to the government — or we began to figure out how to live without reported income or below the taxable level. And as Betty also says in that interview “Everybody who has done and everybody who is doing it for the first time, I think, would feel a renewed sense or a new sense of self-empowerment.”

For myself I know that over the years being a war tax resister has strengthened my non-cooperation and made me less afraid to “question authority.”

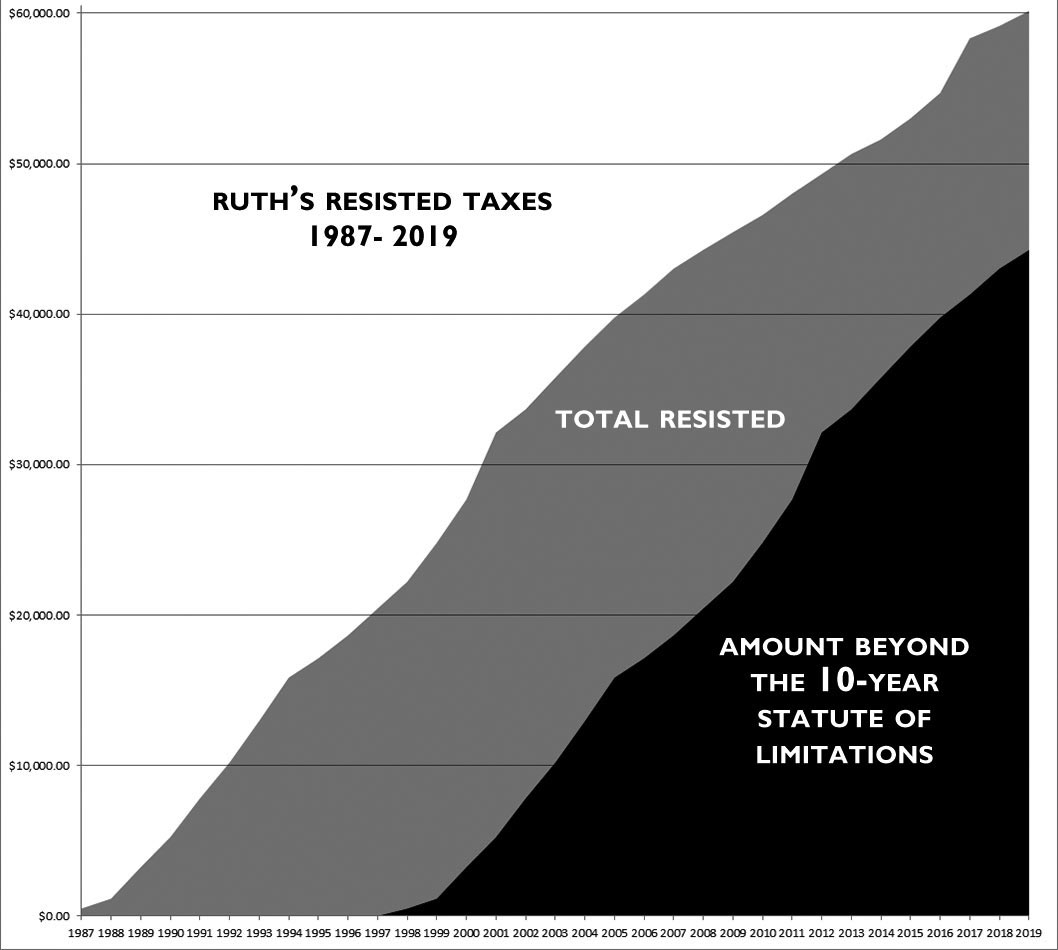

In the end I don’t believe that war tax resistance is about the amount. If I look at my own resistance since 1987, the numbers add up to not buying about fifty M16 rifles by Pentagon standards (but with many organizations benefiting from my redirected taxes).

Bottom line for me, it’s the protest, the resistance — that’s what the government does not want you to do. They don’t want anyone to think about refusing $5. It might encourage 100 others to refuse $5, and then those 100 might encourage…

Well, I can dream anyway.

— Post by Ruth Benn

**Federal excise tax is now only on local landline calls, so fewer people have a tax to resist. In its heyday there was federal tax on all long distance and local calls, but with the advent of flat rate services and cell phones the feds were forced to drop the tax.

Peace Tax Fund Director Named Peacemaker of the Year

In early November 2020, Malachy Kilbride was honored with the Peacemaker of the Year Award from Pax Christi Metro DC-Baltimore in an online ceremony. In addition to his role as the director of the National Campaign for a Peace Tax Fund, Malachy has also been working many years for peace in a leadership role as part of National Campaign for Nonviolent Resistance. He has organized and participated in over 40 actions, and has been arrested on numerous occasions. Peace activist Joy First eloquently states that he has brought “so much dedication, creativity, and strength to the work we have done together in speaking out against U.S. militarism.”

NWTRCC News

NWTRCC Funding Concerns

At NWTRCC’s business meeting at the beginning of November, we passed our annual budget for 2021. This budget anticipates taking $16,000 from our reserves. NWTRCC will also be dipping into its reserves for 2020.

We were able to build up these reserves because of a generous grant that we had been receiving from the Craigslist Charitable Fund each year from 2014 through 2018. Not only did this grant allow NWTRCC to build some reserves, but it permitted us to hire additional part-time staff.

NWTRCC did not receive the grant in 2019 and it is uncertain if the grant will ever resume. Since NWTRCC has always been very frugal, cuts to our 2020 budget will be limited. But without finding a new funding source to replace this shortfall, NWTRCC will be forced to make drastic cuts to its budget in 2022.

Therefore, NWTRCC is seeking new funding sources and needs your help. If you know of funding sources willing to support NWTRCC, please contact us at nwtrcc@nwtrcc.org or call us at (800) 269-7464. In addition, any extra you can donate at this time would be appreciated. Please consider making a pledge to donate to NWTRCC on a monthly or quarterly basis. This can be done by writing checks or setting up a monthly donation via PayPal (https://nwtrcc.org/about-nwtrcc/donations/). Consider making a bequest to NWTRCC by putting us in your will. More information about making a bequest to NWTRCC can be found on our “Donations” webpage.

If you are reading this, you know what a great resource NWTRCC has been in your life for supporting your war tax resistance. Any way you can support NWTRCC to be vibrant resource for a future generation of war tax resisters is appreciated.

PROFILE

War Tax Resistance, Self-Employment,

and Health Insurance

By Ilene Roizman

Decisions, Decisions

Photo courtesy of Pixabay

It’s a thorny problem when the complications of obtaining health insurance intersect with the desire to remain a nonfiling tax resister. This is exactly where I found myself when my luck ran out on the premium tax credit. As a self-employed freelancer, I have to purchase my own health insurance. For the past few years I was able to prove to the state’s insurance marketplace that my income was low enough to qualify by sending copies of my properly filled out but not filed tax forms. I knew it was a risky move when I started, and after the first year I thought I was in the clear. But now they’ve caught up with me and it’s not enough. Unless I file the tax forms, I can’t get the credit. What to do?

Option One

One option is to give up resisting and come clean with the IRS. I’m sure this is not the first thought that diehard resisters would have, but that’s where my mind went. I had to at least explore the idea, in terms of both logistics and my conscience. I had to push myself to the edge and test my conviction.

After brooding in despair for a while and entertaining the thought of running away to a Buddhist monastery, I called a friend who’s a longtime peace activist. She was a tax resister years ago, for about 10 years, but then chose to stop because she was in a situation where she felt she would be at risk of losing her property. She also said she didn’t have (and wasn’t aware of) the kind of support I’m getting. I called another friend whose perspective I value, and after analyzing the situation, we got philosophical. Her recommendation was to take the path of least resistance. Ordinarily I like that idea, but here, the whole point is resistance.

Reaching Out

I reached out to the NWTRCC community for advice. Some people who saw my messages on the listserv had discussed my situation, and Lincoln Rice emailed me with further questions and useful information, including NWTRCC Practical #7 on Health Care & Income Security, and suggested that I call a counselor, specifically Becky Pierce in the Boston area. I read the booklet and felt even more confused than before. Then Ruth Benn wrote a blog post about “all or nothing syndrome” that I knew was inspired, at least in part, by my admission that I was considering giving up. I knew she didn’t mean it personally, and I took it as a challenge. [Editor’s Note: Ruth’s blog post has also been printed as an article in this newsletter.] The more I agonized over it, the more I realized I didn’t want to surrender. I wanted to keep resisting. So how could I find the path of least resistance within the resistance?

Option Two

Option two would be to go ahead and file, but still not pay. But my income fluctuates — plus, as of this July, it’s considerably higher since I started receiving a portion of my ex-husband’s generous pension. Over the past few years I’ve had to change plans a couple of times due to changing income, and it’s likely I won’t qualify for the tax credit next year and would have to change plans again anyway. Besides, I’d like to stay off the IRS’s radar as much as possible. (Although I am aware that the pension is being reported on the other end.)

Communal Input

Speaking with Becky, I came to the conclusion that I could avoid the whole insurance problem by taking the tax money and redirecting it to my health care. I’ve gone without insurance before, when the precursor to the current ACA came into being in Massachusetts. At that time, there was no federal tax credit, and the insurance premiums were supposedly low enough for people to afford. But they weren’t really, and I was able to get the penalty waived by writing a letter detailing my income and expenses. (I should note that I was still filing taxes at the time.) Even with an emergency room visit one year, my health care costs were significantly lower than if I had been paying a monthly premium.

Becky was very supportive of the idea and helped me find the justification in redirecting the funds to myself under a government that doesn’t take care of its citizens’ health care. But the landscape has changed, and as I dug further I realized that going without health insurance wasn’t going to be an option. It’s financially risky, not just because of penalties, but because there’s no cap on out-of-pocket expenses without coverage. People go bankrupt this way. Even if you have to get a bad policy, or even if you have to pay more than you’d like, you’re much worse off if you don’t have any at all. Plus I’m getting older, I have a creaky knee, and who knows what might happen.

Taking Time to Take it All In

So I reread the NWTRCC health care booklet a few more times, mainly this piece of advice from Robert Randall:

“If the amount of premium tax credit you get but have not used equals or exceeds the amount of income tax you owe, then when you file your tax return you will not owe any income tax and may actually be owed a refund. The way to make that happen is to pay enough of your premium directly to the insurance company, instead of having the feds do it, so that you are owed a sufficient amount back to offset the income tax. In this case you will have redirected your money from the general fund to some insurance company—not the best recipient but much better than the war machine. The caveat, of course, is that most WTRs of low to modest income won’t be able to afford the high premiums monthly. But if WTRs have been setting aside, for redirection, the amount not being withheld from their pay, then it’s a wash. Now they are paying for insurance with it instead.”

Tax Confusion—You are not Alone

It’s hard to follow the intricacies of the tax code, so this didn’t make sense to me even after several readings, but after a lot of mental gyrations and many moments of utter despair, I finally got it. My situation is different because I’m self-employed, so taxes aren’t taken out of my pay. I’m the one who pays. So in my situation, if the amount of tax credit I would get is close enough to the amount of tax I would owe, and if I put aside the tax money for redirection, I could use that money to pay for health insurance instead. I can still be a nonfiler, and I wouldn’t have to worry about proving whether I qualify for the tax credit and having the government all up in my business.

I’ve already been denied the credit for 2021, so I don’t know how much it would have been. But looking at the tax credit and tax due from last year, the two amounts are only three dollars apart. So all the money I put aside for taxes, which up until now I’ve been redirecting to local community organizations, I can use for a basic health insurance policy. I’d rather give it to the community, but as Ruth says, it’s not only about the amount of money the IRS doesn’t get, it’s more about the act of resistance itself.

Finding a Workable Solution

Except I won’t be able to match the policy I had. The tax credit allowed me to purchase a mid-level policy rather than the cheapest one. I will have to pay more, either in premiums or in actual medical costs. So the question is, does it make more sense to shell out more per month for better coverage or to face higher co-pays and potentially large bills if I have a serious illness or an accident?

Either way, I’m going to have to keep using the health insurance marketplace. In Massachusetts, it’s the Health Connector—a poorly run, unhelpful, inconsistent system with overly complicated and unclear communication and a hard-to-navigate website. But it’s the only option that’s even close to affordable. Buying health insurance directly on the open market is outrageously expensive. Using a broker won’t make a difference; they only provide what one broker I contacted called “concierge service” for folks who don’t want to deal directly with the marketplace.

Getting a Hand to Get Out of a Corner

This is all rather overwhelming, a moving target with intersecting bureaucracies and lots of room for confusion, triggering anxiety and fear. It took a lot of anguish to get to this point. It hasn’t been an entirely outward-facing resistance against the government. I’ve felt inward resistance, in my head, in my psyche. Mostly the whole thing is aggravating. I resent having to struggle with this balancing act to meet an essential need while maintaining my values; I resent the intrusion into details of my personal business.

Ultimately, bolstered by the wisdom and support of this inspirational community, dealing with all of this has deepened my commitment to tax resistance. Pushed into a metaphorical corner, for my health, my peace of mind, and my conscience, I’m not going to give in.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org