More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

August – September 2022

Contents

- Celebrating 40 years of NWTRCC

By Lincoln Rice - “Problems Were Encountered” By Ruth Benn

- Counseling Notes: Purpose of this section • IRS Files Lein in Wrong County • IRS Backlog of Paper Returns Not Improving • IRS Officials Laud Early Success of Voice Bots

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- War Tax Resistance News Spanish WTRs Open Local Offices • Spanish WTRs Participate in Civil Resistance • Minnesota WTRs Participate in anti-NATO Protests • 1040 for Peace Discusses Tax Day Actions • Peace Week: Introduction to WTR Webinar – 29 September 2022 • NWTRCC Lit Circulated at Poor People’s DC Event • Update from Nelson Legacy Project

- Current Issues Racism and Federal Taxes

By Lincoln Rice - Network News and Events: NWTRCC Raffle Winners • Local WTR Contacts and Counselors

- Personal Stories Finding Peace in a Constant State of Uncertainty? By Lindsey Britt

Click here to download a PDF of the August/September issue

Celebrating 40 years of NWTRCC

By Lincoln Rice

September 2022 marks forty years since NWTRCC was founded at the National Action Conference in Washington, DC. That original meeting was attended by over sixty people from 17 states. NWTRCC is organizing several ways to celebrate its fortieth.

Commemorative Newsletter

As you may have noticed on the cover of this issue, we are soliciting ads for our next newsletter, which will be a commemorative issue celebrating NWTRCC’s 40th anniversary. If you would like to sponsor an ad, please contact the NWTRCC office. Also, if you know of another person or group that may want to congratulate NWTRCC with an ad, please contact the NWTRCC office or reach out on our behalf.

Photo from first NWTRCC meeting by Ed Hedemann

The October newsletter will also be publishing several stories and memories from our network. We have set up a special webpage to collect stories from you. If you go to NWTRCC’s homepage (nwtrcc.org), you will see a link for collecting stories on the right side of the page. Depending on the number of submissions we receive, we may need to edit some stories and save others for future editions of the newsletter.

November Conference Celebration

This special anniversary conference is scheduled for 4-6 November 2022. We will begin Friday evening with some anecdotes from NWTRCC’s previous coordinators, including our original coordinator Kathy Levine, who now goes by Kathy Voss. We will then open the floor to let others share their own memories from the past forty years.

On Saturday, our first session, “The Living History of NWTRCC,” will feature a panel that will highlight moments from each decade of NWTRCC’s history. Our second session will remember NWTRCC members who have passed on. It will begin with a slide show and allow time afterward for attendees to share memories. We are currently building a list of folks to remember. Send the information of people you would like remembered to Lincoln at nwtrcc@nwtrcc.org.

Saturday afternoon will include NWTRCC trivia. Everyone will be placed a team to ponder fun NWTRCC trivia. There will be ample time to converse with your random teammates. Saturday will conclude by looking at NWTRCC’s next forty years. Attendees will be placed in breakout rooms to discuss how NWTRCC can best continue its purpose in a country that continues to militarize. We will then report back to the larger group.

As always, our business meeting will be held on Sunday morning. You can find registration information on the NWTRCC homepage (nwtrcc.org.

“Problems Were Encountered”

By Ruth Benn

Photo by Kindel Media on Pexels.

It will take 16 more weeks to overcome a “problem encountered” by the IRS in processing my 2020 tax return, which they received 14 months ago. IRS reports indicate I didn’t file a 2020 return. Without that my social security statement does not include my income or social security payments for that year.

Today I gathered my patience and decided to try calling the IRS again. I can get pretty frustrated being on hold for minutes on end, so I try to remember that IRS employees are not the enemy but end up being the fall guys for governmental dysfunction. As war tax resisters (at least those of us who file) it is also frustrating that we feel our message gets stuck at the IRS, but the topic did not come up in this call. I just wanted to know what happened to my return, and I know others in our network have similar questions.

After an hour+ on hold (as they warned in the initial recording) a human actually answered. She was friendly, and I explained the basic problem. “Can I put you on hold 5 – 7 minutes while I review the account?” She did return, probably after the full 7 minutes, but didn’t know much more. She asked if I e-filed and I said no, so “Can I put you on hold 5 – 7 minutes while I review the account again?” I desperately asked if I could get hold of her if I got cut off. Nope, you have to call the same general number again and basically start over.

Probably the full 7 minutes later she came back, and finally I had an answer!

“Problems were encountered, and it will be 16 weeks before your return posts.” Her response seemed to imply that it was a problem with my return, so I said I assume these problems are due to the IRS backlog. She affirmed my suspicion and said they had begun to work on my return July 11, but “don’t expect it to post before the 16 weeks are up.”

I broached one more question with her about my misapplied estimated payments, but she said I’d have to call Collections about that and gave me another number. I’ll have to wait until my patience reserves build up again before calling them.

The only relation to my resistance is that I continue to choose to file on paper so that I can enclose my annual letter and annoy “the system.” Now the system is so dysfunctional that my effort to annoy may be biting me in the butt. I’m not sure there’s a way around this except to tap into greater patience reserves than I normally have.

Counseling Notes:

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click on “Local Contacts & Counselors”). The next counselor training will be online in early 2023. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

IRS Filed Lien in Wrong County

A court ruled that an IRS lien filed against a debtor’s personal property was ineffective for purposes of securing a tax claim in bankruptcy because the lien was not filed in the county where the debtor resided.

The IRS objected to the debtor’s confirmed plan, which treated the agency’s claim as a general unsecured claim. The IRS asserted that part of its tax claim was secured by a lien it filed in a different county because the address the debtor claimed as her home address on her tax return was in that county. The court agreed with the debtor, who asserted that the IRS’ claim was not secured because the Notice of Federal Tax Lien was not filed in her county of residence and, therefore, failed to attach to her property.

The court acknowledged that a federal tax lien is created in favor of the IRS upon the assessment against the taxpayer even without recording a Notice of Federal Tax Lien. However, under federal law the lien does not attach to personal property for purposes of securing a bankruptcy claim until it is properly filed with the county where the debtor actually resides.

IRS Backlog of Paper Returns is not Improving

A recent U.S. Taxpayer Advocate report to Congress disputes claims by the IRS that they will solve the back-log of paper tax returns by next tax season. At its current rate, the IRS will process about 10.7 million paper tax returns each 52 weeks. Last tax season, the IRS received 17 million paper tax returns. At the end of May 2022, the backlog stood at over 21 million paper tax returns.

IRS Officials Laud Early Success of Voice Bots

The IRS introduced voice bots in January 2022. Currently, the voice bots — with their touted artificial intelligence — are able to set up or modify payment plans. Understaffed call centers have been able to answer only a fraction of the millions of calls that come in each year.

The voice-bot system has answered close to 4 million calls this year, which represents about 30% of calls to the IRS. By year end, more functions will be added to the bots, enabling requests of account and return transcripts, payment history summaries, and current account balances.

Many Thanks

Thanks to each of you who donated for the May appeal and participated in the reffle! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It is never too late to make a contribution to our work.

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. Thank you!

War Tax Resistance News

Spanish WTRs Open Local Offices

Spanish war tax resisters have been ramping up their activity as the Ukraine war prompts more military spending in Europe. In the Basque Country, for example, activists have set up war tax resistance offices in Donostia, Gasteiz, and Bilbao to help people through the process of resistance and redirection.

A spokesperson noted that the campaign was organized by different groups working together on “complementary paths for anti-militarism, environmentalism, feminism, and other struggles.”

[Thank you to David Gross for alerting NWTRCC of this story.]

Spanish WTRs Participate in Civil Resistance

In addition to their war tax resistance, our friends with Grup Antimilitarista Tortuga were among the 28 arrested for converting an Army War School sign in Madrid into a “School of Peace” sign using paint.

The action on June 28, 2022 was done in collaboration with other anti-war activists, trade unionists, and climate activists. The action was in response to Spain’s military support of the war in Ukraine and to condemn the murder of 37 migrants at the Morocco-Spain border a few days earlier.

Minnesota WTRs Participate in Anti-NATO Protests

On June 28, members of Minnesota War Tax Resistance participated with a coalition of anti-war groups and climate activists to protest against the NATO Summit in Madrid, where world leaders discussed NATO expansion. The 60+ protesters gathered outside of Senator Amy Klobuchar’s Minneapolis office and chanted, “No war with Russia! Disband NATO now!”

1040 for Peace Discusses Tax Day Actions

On July 12, local NWTRCC affiliate 1040 for Peace (Akron, Pennsylvania) hosted NWTRCC Outreach Consultant Chrissy Kirchhoefer on Zoom to share how different groups promoted war tax resistance on Tax Day this year. The discussion then shifted to outreach beyond those folks who typically make up war tax resisters.

Peace Week: Introduction to WTR Webinar –

29 September 2022

As part of Pace e Bene’s Peace Week (September 21–October 2, 2022), NWTRCC will host an online WTR workshop on Thursday September 29 at 8:30p Eastern / 5:30p Pacific. The session will be an introduction to the whys and hows of war tax resistance, with a discussion of potential consequences and resource referral. This session is for people new to war tax resistance or just getting started. Facilitated by Lincoln Rice (NWTRCC Coordinator) & Chrissy Kirchhoefer (NWTRCC Outreach Consultant). Please invite anyone who you think might be interested to participate. A link to the registration page can be found under the “NWTRCC News” section on NWTRCC’s homepage.

NWTRCC Lit Circulated at Poor People’s DC Event

As the Poor People’s group started marching from Freedom Plaza to Pennsylvania Avenue on their way to the Main Stage, I stood at the edge of the march with leaflets in hand and addressed the marchers, “Federal taxes pay for everything we oppose. Don’t give money to the federal government; give it to the poor instead.” As I spoke, I offered the literature which was enthusiastically received. The packet of literature was gone within a 1/2 hour. [The packet from NWTRCC included palm cards, newsletters, and WRL pie charts.]

— Report by Kathy Boylan of the Dorothy Day Catholic Worker in Washington DC

Update from Nelson Legacy Project

[Editor’s Note: In June, Betsy Corner of the Nelson Legacy Project sent an email to supporters. This project is named for Wally and Juanita Nelson, two of the founders of the modern WTR movement. Here is a slightly shortened version that we wanted to share with our readers.]

Violence infuses every aspect of our lives — economic exploitation, racism and misogyny, environmental devastation, a perpetual state of conflict in the world. Now, as always, this reality calls for a response that disrupts violence at every level.

Wally and Juanita Nelson understood this need. Throughout their long lives, they developed a philosophy and a practice of nonviolence as a way of life, a directional compass they strived to manifest in every aspect of their lives. For the Nelsons, the ideals and daily practice of community building, economic justice, simple living — and nonviolent direct action when called for — were paramount.

The Nelson Legacy Project came into being in 2021 following the renovation of the Nelson house in Deerfield, Massachusetts, at Woolman Hill, where Wally and Juanita lived for 37 years. The aim of the project is to make the Nelsons’ ideas, beliefs, commitments, ways of relating to people, and ways of being in the world — that is, their legacy — accessible and available to future generations.

Here is an outline of our current endeavors:

Archive Project: Since Wally left us in 2002 and Juanita in 2015, there are fewer and fewer people who knew them personally. We have begun collecting dozens of oral testimonies about the Nelsons from people who knew them well.

You can listen now to the Nelson Legacy teaser, “You Don’t Gotta,” on our website (www.nelsonhomestead.org). In addition, researcher and archivist, Louis Battalen, of Ashfield, Massachusetts, is creating an anthology of Juanita’s writings under the working title From Rags to Rags.

Educational Outreach and Tours: We recently conducted our first tour of the Nelson Homestead with undergraduates in the Civic Engagement and Service-Learning program at UMass Amherst. We continue to build relationships with area undergraduate programs, local middle and high schools, camps and community organizations, as we plan for more tours.

Website: Our website (www.nelsonhomestead.org) contains a wealth of information about the Nelsons, including archival footage, audio recordings, and writings by the Nelsons, as well as reflections by others.

We welcome your contribution to sustain their legacy. To contribute, please make your check out to Nelson Legacy Project. If you would like your gift to be tax-deductible, make the check out to Creative Thought & Action, our fiscal sponsor — noting it is for the Nelson Legacy Project. Mail your contribution to Betsy Corner, Nelson Legacy Project, 107 Main St, Shelburne Falls, MA 01370.

Current Events

Racism & Federal Taxes

By Lincoln Rice

I recently came across two articles on federal income taxes and racism. The first was in Thomson Reuters by tax journalist Joseph Boris, who reported on the issue of racial disparity pertaining to federal income taxes. The article focused on Steven Dean, who teaches at Brooklyn Law School.

Dean noted examples of racial bias in law, education, and tax enforcement that resulted in worse outcomes for Black taxpayers. Dean had previously published an article, “Filing While Black: The Casual Racism of the Tax Law,” where he documented the court case of a Black man who was denied the ability to deduct certain legal fees, though white defendants in similar cases had received positive rulings.

Dean also recounted how in 2000, the U.S. threatened sanctions against the African country of Liberia for being a tax haven, though Switzerland has never been targeted.

A second article was published by the American Bar Association last year, “ABA Webinar Explores How the Tax System Plays Favorites.” In this article, Donnie Charleston, director of Public Policy & Advocacy for E Pluribus Unum shared that it is “a basic conclusion that there is arguably, even if it’s not by design, de facto discrimination built into the tax code by virtue of the racially differential impacts on different racial groups in America.”

Charleston observed the difficulty in exploring race and federal taxes because the IRS does not have data on who pays taxes by race. He would like to see tax forms ask for one’s race.

Although this action would help track how our current tax laws affect different racial groups, I wonder if it would lead to more people of color facing penalties by the IRS. If the IRS had race information, it would probably include race in its formula for flagging tax returns. And once a revenue officer is assigned a case, knowing a person’s race could negatively affect the outcome for non-white households.

One area of enforcement that Charleston knows is unfairly treated is the disproportionately of audits faced by African Americans in states such as Alabama, Georgia, and Tennessee, which focus on earned income tax credit claims. He knows that underreported income from farms and royalties, which are the largest categories of underreported income in the country and include more white households, are targeted less frequently.

Network News & Events

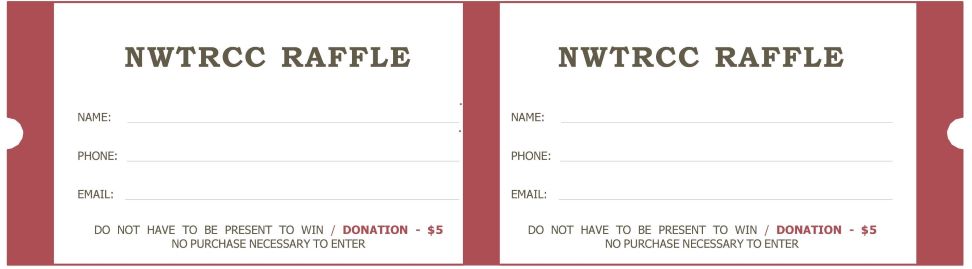

NWTRCC Raffle Winners!

This spring, NWTRCC held a raffle concurrently with its spring appeal. Donations definitely increased during May and June, but not all who donated to NWTRCC sent in raffle tickets. So it is difficult to determine to what extent the raffle led to increased donations. Nevertheless, the increase in spring appeal donations was significant enough that we plan on hosting a raffle again next spring.

Thank you to all you donated during our spring appeal!!! Here is a list of our raffle winners:

Top Prizes

- 2 Nights near Nelson Homestead (Deerfield, Massachusetts): Andy McKenna (Texas)

- 2 Nights at Celo Inn (Burnsville, North Carolina): Rita Furman (Georgia)

Additional Prizes

- Swag from the NWTRCC Café Press Store (up to $50): Craig Simpson (Massachusetts)

- Vintage War Resister League Posters (1980s); Designed & Donated by Rick Bickhart: Blanche Crandall (Massachusetts)

- Integrative Bodywork Session for pain, tension, and/or simply wanting to feel better (In Person in Berkeley or Online). Donated by Sara, www.sarasunstein.com: Ellen Barfield (Maryland)

- Spring Roll – Making Workshop with NWTRCC Outreach Consultant Chrissy Kirchhoefer: Sarah Weber (Kansas)

- Kombucha – Making Workshop with NWTRCC Coordinator Lincoln Rice: Rick & Carolyn Yoder

- Free Copy of book, 99 Tactics of Successful Tax Resistance Campaigns – Donated & Signed by Author David Gross: Aaron Albrecht (Illinois)

- Free Copy of book, A Persistent Voice: Marian Franz and Conscientious Objection to Military Taxation: Dolores Howard (California)

- Free Copy of book, A Persistent Voice: Marian Franz and Conscientious Objection to Military Taxation: Rita Furman (Georgia)

Local WTR Contacts & Counselors

NWTRCC keeps an updated list of NWTRCC affiliates, local contacts, and war tax resistance counselors by state on its website. Just go to the “About Us” tab and click on “Local Contacts & Counselors.” This list is regularly updated. For example, within the last two months we had a local contact move from Colorado to Iowa and another move from New York State to Montana. We have contacts for most states, but not all. Especially, if you are in the one of the following states and willing to be an area contact, please contact Lincoln at the NWTRCC office: Alaska, Arkansas, Hawaii, Idaho, Mississippi, Nebraska, New Hampshire, North Dakota, Rhode Island, Utah, West Virginia, and Wyoming.

Personal Stories

Finding Peace in a Constant State of Uncertainty?

By Lindsey Britt

Photo by Lindsey Britt

Uncertainty. Unknowns. Confusion. These aren’t my favorite feelings or states of being. After talking and interacting for nearly four decades with other humans, I feel confident saying a lot of people share my dislike for those feelings. In my experience, practicing war tax resistance by filing taxes and refusing to pay or being a non-filer are both activities which can be accurately described as uncertain, full of unknowns, and confusing. So given many people’s dislike for those feelings, this poses a real problem for WTR as a movement. How do you convince people to not only resist paying for war, but also accept uncertainty and confusion?

This problem isn’t totally unique to war tax resistance, other movements have it, too. I think what makes the situation different with WTR is the length of time a person lives with the state of uncertainty if they’ve chosen to willfully not pay all or a portion of their taxes. Refusing to pay—especially if done year after year—means living in a constant state of of uncertainty. That isn’t appealing to most people. Life is already so full of unknowns that it isn’t surprising that people—even those who are activists in other ways—don’t want to add more uncertainty to their lives.

There are those who are able to embrace confusion and maybe see accepting the unknowns that come with refusing to pay as part of a life practice of being at peace with their inability to control the world. There are probably others that fight through their dislike of the unknown because they put the cause ahead of their own comfort. Either way, resisting the payment of taxes the government thinks a person owes requires a lot of a person over a lengthy period of time. Even if a person acquiesces after a few months, that’s not nothing; those months might’ve felt very difficult.

This is all part of why I’ve gravitated towards consciously reducing my tax burden through simple living. For me, it’s easier. Living simply aligns with so many of my other values that it’s an obvious choice. My guess would be that a lot of other people who hate war and violence would be attracted to simple living as a way to refuse to pay for war, but that refusing to pay calculated taxes would be a bridge too far for them.

I wonder if this is where NWTRCC should be putting more of its energy: attracting people who are sympathetic to simple living as a way to live their lives in agreement with their values. Maybe this could be the avenue for getting people to resist paying for war, but without having to accept so much uncertainty. Not that living with less money is all a bed of roses (and certainly some people through no choice of their own struggle to survive, let alone thrive, on too little and that’s a national shame), but I’ve found that when it’s in service to many of my deeply held values—not just WTR, but sustainability, leaving enough resources for others, etc.—that living simply is easier to take on, almost a natural progression.

I know this path of war tax resistance may not feel aggressive enough to some people. Indeed it felt quite bold to refuse to pay the IRS what it said I owed whereas reducing my income has felt quieter. But I think there’s something to be said for having more people identify as activists for peace in whatever way they’re able, including earning less money to reduce their tax burden. I think what we as war tax resisters want (or at least this is what I’ve heard from folks during the several years I’ve been involved with NWTRCC) is less violence and more people who say “no” to war and militarization.

If that’s the case then, I’d suggest we think seriously about emphasizing simple living as a way to advocate for peace and resist war while we look for ways to network with groups that also promote simple living for other reasons (the health of the Earth, having more time for family, etc.). It would be wonderful to hear and see war tax resistance consistently mentioned in conversations about simple living that are happening outside the WTR sphere. I’d love to hear what others think!

NWTRCC 40 Years of Resistance

Celebrate NWTRCC…

Honor a war tax resister…

…Highlight a great moment in war tax resistance history…

…with an ad in our October/November anniversary issue!

Ad Rates for the Special Anniversary Issue

Ad Rates for the Special Anniversary Issue

$300 · Full page (7.75″ w x 9.75″ h)

$150 · Half page (Horizontal, 7.75″ w x 4.75″h; Vertical, 3.75″ w x 9.75″ h)

$75 · Quarter page (3.75″ w x 4.75″ h)

$35 · Business card (3.75″ w x 2.25″ h)

$20 · Listing – Up to 125 characters (incl. spaces)

Please send a high resolution, black and white, JPG or PDF. We are happy to design your ad for you, just send high resolution artwork and text. Ads will be printed on inside pages only and will appear in the PDF version on our website.

Deadline: September 14, 2022

Send your ad or copy to nwtrcc@nwtrcc.org

Payment can be made using PayPal or Credit Cards on NWTRCC’s donation page. Checks made out to NWTRCC should be mailed to the office: PO Box 5616, Milwaukee, WI 53205

Email or call with questions, (800) 269-7464

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org