More Than a Paycheck,

REFUSING to PAY for WAR

February-March 2018

Contents

Divest from War This Tax Day by Erica Weiland

Divest from War This Tax Day by Erica Weiland- Tribute in Yellow to “Slackers” By David Gross

- Counseling Notes Tax Overhaul Bill Brings Some Changes • 2018 IRS Standard Deduction and Taxable Income Level • W-4 Resistance 2018 • Schedule A Itemizing vs. Standard Deduction • Passport Policy to Kick In

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network List Updates

- Inspiration for Tax Season 2018 Actions

- War Tax Resistance Ideas and Actions Korea Peace Pledge • Poor Peoples Campaign • Global Day of Action on Military Spending • Start a WTR Affinity Group

- Resources Literature Revisions • Police Militarization • War Tax Talk – The Podcast

- NWTRCC News Celebrate Cinco de Mayo in Los Angeles! • Job Opening at NWTRCC • Meet our New Social Media Consultant • Participate!

- PROFILE Sixty Years with the Catholic Worker and Fifty-Eight Years of Effective War Tax Refusal By Karl Meyer

Click here to download a PDF of the February/March issue

Divest from War This Tax Day

By Erica Weiland

Amazingly, Tax Day is fast approaching. 2018 is looking like another important year for civil disobedience and resistance!

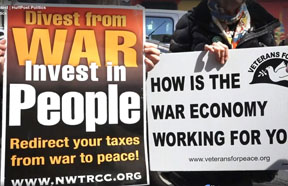

Outside the IRS in New York City, Tax day 2017. Photo: Facebook videos posted by HuffPost Politics

As always, please send your Tax Day and tax season plans, including any photos or event details, to the NWTRCC office. We’ll post them on our website, and if you have plans ready by March 9, we might also put them in the newsletter. Use the form enclosed or email details of your plans to nwtrcc@nwtrcc.org. Use the NWTRCC and our new divestment websites for ideas and materials to help you think about this tax season and reach out to your communities!

At the November meeting in Amherst, the Coordinating Committee (CC) approved the creation of a separate website with a unique design to highlight our “Divest from War, Invest in People” campaign, first introduced as “Divest from the Pentagon, Invest in People” for Tax Day 2016.

Over the past two years, NWTRCC consultants and network members have developed a variety of literature on the divestment theme, and divestment continues to be a popular theme among many other social movements.

For example, CODEPINK has just launched a “Divest from the War Machine” campaign that encourages people to work for institutional divestment from the military-industrial complex (NWTRCC is a sponsor).

The Movement for Black Lives’ Vision for Black Lives (also endorsed by the CC in November 2017) includes an Invest-Divest platform that calls for a 50% reduction in the military budget and redirection of that money. This vision was part of the inspiration for our ongoing Collective Redirection program of redirecting taxes to black, brown, and indigenous-led groups.

The Movement for Black Lives’ Vision for Black Lives (also endorsed by the CC in November 2017) includes an Invest-Divest platform that calls for a 50% reduction in the military budget and redirection of that money. This vision was part of the inspiration for our ongoing Collective Redirection program of redirecting taxes to black, brown, and indigenous-led groups.

The fossil fuel divestment movement picked up new steam with the Standing Rock resistance to the Dakota Access Pipeline. The recent solidarity protests against banks invested in the Dakota Access Pipeline called for people to divest personally from those banks and to pressure local governments and universities to also divest from those banks. In addition, during the Standing Rock resistance, a Sicangu Lakota spiritual leader, Leonard Crow Dog, called on people assembled at a veterans’ apology ceremony to refuse to pay taxes until the treaties are honored.

I’m also hopeful about our ability to reach folks in the BDS movement (Boycott, Divestment, Sanctions) against Israeli apartheid. Activists in this network are already aware of the harm that U.S. tax dollars do when given to the Israeli government as military aid, and civil disobedience is no stranger to this movement.

Another strength of our divestment is the call for reinvestment in communities. Divesting from war taxes means this investment can happen as soon as we’re ready. We don’t need to wait for an institution to make the decision for us, or be concerned that they will reinvest the money in other causes we don’t support. War tax reinvestment can mean meeting basic needs, people power, working against white supremacy, solidarity, reparations, repairing the earth, and more.

More about wartaxdivestment.org

Our new Divest from War, Invest in People website is modern-looking and geared specifically toward the theme of divestment. This tool will help our outreach to other people and groups interested in divestment.

With the support of the Outreach Committee, I’ve been working on this project for about two months, and we have just launched the website, which you can see at wartaxdivestment.org.

The content is a rewrite of material already available in our organizing guide. The website is an introduction to the concept of divesting from war taxes, as well as a portal for folks to sign up as a war tax resister, get connected to our network, and ask for more information.

We will replace the sign-up form for the War Tax Boycott with a very similar form on the Divest from War, Invest in People website.

In addition to the website, we will redesign the Peace Tax Return to fit into the Divest campaign. Other literature and palm cards created as part of this campaign will be reformatted as time and budget allow.

As I transition into my new work as NWTRCC’s communications consultant, please keep in touch if you have ideas for the divestment website. I’d like to keep it relatively simple, but over time it will be useful to change things up or add new content!

Erica Weiland developed NWTRCC’s social media outreach since becoming a part-time consultant in 2013. This spring she takes over editing this newsletter and other communications tasks for the organization.

Tribute in Yellow to “Slackers”

By David Gross

The United States funded its participation in World War I through the sale of “Liberty Bonds” to citizens. Refusal to buy these bonds was the primary tactic of war tax resisters in the U.S. at that time. It was ostensibly not obligatory to buy such bonds, but the government and vigilante groups frequently used coercive tactics to try to force people into purchases or to retaliate against people who had not contributed. A signature tactic of these vigilante groups was to paint the vehicles, homes, businesses, and bodies of “bond slackers” yellow. The persecution of Americans who refused to buy war bonds mostly took place in 1918, and to commemorate these resisters, NWTRCC is printing our newsletter on yellow paper throughout 2018.

When the Liberty Bond, or Liberty Loan, program was first being rolled out, there was already some opposition. The U.S. Treasury Department told the press that this was the work of “pro-German agents” who were conspiring to stir up resistance to buying the bonds.

Police officers would sometimes go door-to-door to sell bonds, taking down the names of those who refused and turning those names over to the newspaper to be published in a list of “bond slackers.” If the refusal was accompanied by remarks interpreted as “disloyal,” the refuser might also be prosecuted under the Espionage Act or state sedition laws.

In March, 1918, Mary S. McDowell, a Quaker high school teacher, was fired for refusing to encourage her students to participate in the Liberty Loan. She would later become part of the Peacemakers movement, helping to kickstart the modern war tax resistance movement in the years after World War II.

David Gross, author of 99 Tactics of Successful Tax Resistance Campaigns among other books, will be adding historical notes in this column through the year. For more you can also see his blog at sniggle.net/TPL.

Counseling Notes:

Tax Overhaul Bill Brings Some Changes

The tax overhaul bill passed by Congress and signed by the president late in 2017 mainly affects war tax resisters who file. For nonfilers and those living below taxable income, the bigger effects have to do with the expanding income gap that will probably be exacerbated by this bill favoring the rich. The allowance for drilling for oil in the Arctic National Refuge tucked into the legislation is bound to affect us all in the long run also.

The repeal of the individual mandate connected to the Affordable Care Act takes effect in 2019; nonfilers who began filing because of health care may change their plans in 2019. Those who were being penalized for not having health care will see that penalty lifted in 2019. The penalty still applies for 2017 and 2018 at the same level: $695 per adult or 2.5% of household income in excess of tax filing thresholds, whichever is higher. For the 2017 tax filing season (starting now), the IRS says they will reject tax returns that do not include health insurance information.

2018 IRS Standard Deduction and Taxable Income Level

The tax overhaul bill eliminated the personal exemption. Now there is only the Standard Deduction figure that sets the taxable income level.

| Category | Standard Deduction |

|---|---|

| Single | $12,000 |

| Married, Filing jointly | $24,000 |

| Married, filing separately | $12,000 |

| Head of Household | $18,000 |

For each married taxpayer who is at least 65 years old or blind, an additional $1,300 standard deduction may be claimed. If the taxpayer is single, the additional standard deduction amount is $1,600.

A single person can earn up to $12,000 and owe no federal income tax. You may be able to make significantly more than the amounts indicated above and owe no income taxes. NWTRCC’s Practical #5, Low Income/Simple Living as War Tax Resistance, includes information on legal ways to reduce taxable income and owe no federal income taxes ($1 from the NWTRCC office; read it free at nwtrcc.org). We suggest that nonfilers fill out the forms and keep their receipts for reference in case their circumstances change or the IRS comes calling.

Payroll taxes, for Social Security and Medicare, apply at a lower rate, so beware that if you do not file or pay estimated taxes you may be liable for Social Security taxes if the payments to you are reported. If you are on salary payroll taxes are automatically withheld as a percentage, and you cannot resist those taxes.

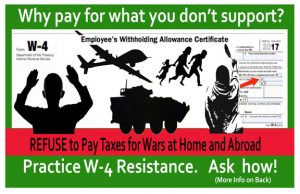

W-4 Resistance 2018

If you are a salaried employee and a war tax resister (or wanna-be war tax resister), adjusting allowances on the W-4 is the method required to reduce federal income tax withholding and owe taxes at the end of the year, thus being able to resist at your chosen level. Read NWTRCC’s Practical #1, Controlling Federal Tax Withholding, or see the W-4 flyer on our website under “Downloadable Flyers” for information about consequences and potential penalties.

California Bay Area war tax resisters in created this banner for tax marches in 2017.

For 2018, the IRS has adjusted withholding allowances in a way that suggests individuals do not have to change their W-4; withholding should look about the same as in 2017. Employers are to begin making withholding adjustments now, so monitor your paystubs to see what is being withheld and ask to change your W-4 as needed. NWTRCC has a formula in Practical #1 and on the flyer that can help you calculate allowances. Publication 15, Employer’s Tax Guide from the IRS is being updated now and will include handy charts to help you figure your allowances also.

The IRS itself notes that most employees are over-withheld, meaning too much is taken out of paychecks, forcing the IRS to process too many and too much in refunds. Most of you considering resistance but fearing repercussions should take at least another couple allowances and reduce or eliminate the refund. It’s not really a savings account — it’s an interest-free loan to a government that is doing a lot of things you don’t like.

Schedule A Itemizing vs. Standard Deduction

For those who itemize and try to bring down their taxable income, you may face more changes. The bill eliminates a lot of those itemized deduction categories on Schedule A, at least at levels that moderate income people have used to their advantage. With the standard deduction at $12,000, your itemized deductions would have to total more than that to be advantageous. This seems to be the major change toward simplifying the income tax system: eliminating deductions and getting more people to take the standard deduction. (For self-employed resisters, there don’t seem to be significant changes to Schedule C.)

So, even though the bill keeps deductions for charitable contributions, retirement savings, and student loan interest, with the standard deduction at $12,000 in 2018, you may no longer find itemizing useful. One article points out that this may hurt smaller nonprofits who receive tax deductible small donations from many people. If taxpayers are not getting their charitable deduction, they may cut back on their giving. (Since NWTRCC is not a 501c3 anyway, feel free to keep giving to us directly!).

Passport Policy To Kick In

Readers may remember that late in 2015 Congress passed a big transportation bill that slipped in a policy related to tax debt and passports. The bill requires the State Department to deny an individual’s passport application and allows them to revoke or limit an individual’s passport if the IRS has certified the individual as having a seriously delinquent tax debt. The Taxpayer Advocate’s recent 2017 Annual Report to Congress states that the IRS plans to start sending its list of taxpayers with more than $50,000 in tax debt to the State Department this month for passport-denial purposes. The IRS expects to certify 2,700 taxpayers when it initially implements the program, and they will continue with certifications in phases throughout the year. If you have a tax debt in excess of $50,000, you may want to file an expedited request to renew your passport as soon as possible. The State Department may renew your passport before the IRS gets around to sending in your name and may not get around to filing a revocation recommendation any time soon. If you wait, however, you may find it difficult to renew your passport when it expires. (See also sniggle.net/TPL/index5.php?entry=10Jan18.)

Many Thanks

Thanks to each of you who has responded to our November appeal or gave a year-end donation. Remember, you can also donate online through Paypal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

Special thanks for Affiliate dues payments from:

- Milwaukee War Tax Resisters

- Fools of Conscience, Asheville, NC

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or 1-800-269-7464), if you would like a printed list by mail.

Click on the icons at nwtrcc.org to find us on

Facebook • Twitter • YouTube • Instagram

and to join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC. Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

Inspiration for Tax Season 2018 Actions

War Tax Resistance Ideas and Actions

Korea Peace Pledge

Hun and other members of the People’s Democracy Party from South Corea held a 60-hour hunger strike and vigil across from the White House in September 2017/ Photo courtesy of People’s Democratic Party

Michael Goldstein of Oakland, California, asked NWTRCC to help bring attention to a petition and pledge he started recently. The Pledge Not to Fund Nuclear War in Korea is circulating online and states:

“We, the undersigned, pledge to use every non-fraudulent means to withhold our federal income tax payments … until the United States officially repudiates its threats of resumed war against North Korea and enters into the Korean Peninsula disarmament negotiations supported by every other country in the region. We are, however, committed to act on this pledge only after being notified that 250,000 people have signed it.”

Within the NWTRCC network we have not found it easy to reach a few hundred signers let alone a couple hundred thousand — but we’d love to see it happen!

The pledge and more information is at facebook.com/KoreaPeacePledge with links to the sign-on at change.org/p/pledge-not-to-fund-nuclear-war-in-korea.

Poor Peoples Campaign

Late in 2017 a coalition of faith and social  justice organizations launched a revival of Martin Luther King Jr.’s Poor People’s Campaign with a focus on what King described as the “triple evils” of racism, poverty and militarism, and, additionally, ecological devastation. Rev. William Barber II, who led the Moral Mondays movement in North Carolina, is a key activist behind this “National Call for Moral Revival.” The coalition is planning 40 days of coordinated action in the spring of 2018 at statehouses across the country, and the campaign Facebook page keeps an active list of current events around the country.

justice organizations launched a revival of Martin Luther King Jr.’s Poor People’s Campaign with a focus on what King described as the “triple evils” of racism, poverty and militarism, and, additionally, ecological devastation. Rev. William Barber II, who led the Moral Mondays movement in North Carolina, is a key activist behind this “National Call for Moral Revival.” The coalition is planning 40 days of coordinated action in the spring of 2018 at statehouses across the country, and the campaign Facebook page keeps an active list of current events around the country.

The Institute for Policy Studies in Washington, DC, is working on an in-depth “audit” of the U.S. for the campaign called The Souls of Poor Folk: Auditing America 50 Years After the Poor People’s Campaign Challenged Systemic Racism, Poverty, the War Economy/Militarism, Ecological Devastation and Our National Morality. A preliminary report is available now on the campaign website. “This analysis will feed into the process the 2018 Poor People’s Campaign will be undertaking to advance structural solutions to the multiple crises that people and communities are experiencing in our nation and the world,” states the summary.

NWTRCC as an organization endorses the effort and will link to the campaign’s plans and resources. We also hope that those of you involved at the local level will keep us posted on actions in your communities and will use war tax resistance literature where you can.

The campaign website is poorpeoplescampaign.org. Individuals can sign on to join the campaign there also.

Global Day of Action on Military Spending

For the 7th year this international campaign coincides with Tax Day in the U.S. and with the release of the Stockholm International Peace Research Institute (SIPRI) annual report on world military expenditures. While tax day 2018 in the U.S. is Tuesday, April 17, the actions will encompass the weekend before and run from April 15 to May 2 when the SIPRI report is released. NWTRCC shares tax day resources and action lists with GDAMS, which posts an international list on their website, demilitarize.org

For the 7th year this international campaign coincides with Tax Day in the U.S. and with the release of the Stockholm International Peace Research Institute (SIPRI) annual report on world military expenditures. While tax day 2018 in the U.S. is Tuesday, April 17, the actions will encompass the weekend before and run from April 15 to May 2 when the SIPRI report is released. NWTRCC shares tax day resources and action lists with GDAMS, which posts an international list on their website, demilitarize.org

. You can find flyers, infographics, analysis and facts and figure on their site, and you can also post photos from your actions there.

Start a WTR Affinity Group

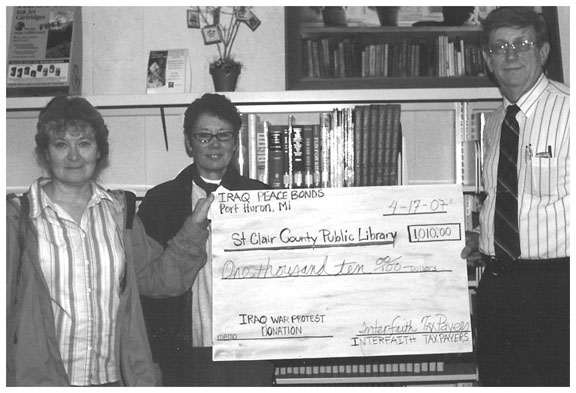

One example of an affinity group type action, the “Interfaith Group for Good Local Community Education Instead of a Bad War in Iraq” presented a check of resisted and redirected war tax to their public library in northern Michigan. Photo by Michael McCarthy, 2007

At the November war tax resistance gathering in Massachusetts, and in response to some of the bigger ideas for national campaigns, longtime resister Randy Kehler suggested, “Keep it local. Find six people who will do it with you; a group that really supports each other. 1,000 small groups around the country would be great development. Create WTR affinity groups.”

This idea took hold in the discussion, and we encourage readers and new resisters who are not ready to act alone to try it during this tax season. Creating an affinity group for direct action is not a new idea, but it is not a model that has been promoted much among war tax resisters.

There are lots of resources about forming affinity groups on the internet and you can find the links in our January 18, 2018, blog on our website. If you would like printed versions, please contact the NWTRCC office, 800-269-7464, and we’ll send you copies. The NWTRCC office will offer support as needed and put you in touch with others in your area who might be interested in forming such group.

Some things you could do together include:

- Watch a War Tax Resistance 101 webinar on NWTRCC’s YouTube channel to help you get started.

- Meet for coffee or a meal and talk out fears of refusing taxes.

- Agree to pool together resisted taxes and make a plan to redirect them together.

- Sign a letter-to-the-editor together about your resistance.

- Take out an ad in local publications or on popular websites announcing your protest and sign it together.

- When IRS letters arrive, open and read them together; talk out fears and responses.

Resources

Literature Revisions

As it becomes clearer how the changes in tax law affect war tax resistance, we will continue to update our website and literature. At this point we’ve made some updates to these pieces. If you have older versions, please look online or contact the office for print replacements:

W-4 Resistance flyer — see nwtrcc.org/war-tax-resistance-resources/flyers

Practical #1, Controlling Federal Income Tax Withholding — updates online; available in print soon

Practical #5, Low Income, Simple Living — updates online; available in print soon

Practical #6, Organizational War Tax Resistance, Employers, Contractors, and Financial Institutions — updated in October 2017

Practical #7, Health Care and Income Security — updated Oct. 2017; we will continue to update with coming changes to the Affordable Care Act

The Practical series is available in print from the NWTRCC office, PO Box 150553, Brooklyn, NY 11215. Single copies #1-3 75¢ ea.; #4-8 $1.00 ea.; call the office for bulk rates, 800-269-7464.

Please keep NWTRCC informed of changes that you notice in your own life as a result of the new legislation.

Police Militarization

War Resisters’ International (WRI) has a growing resource section on their website that draws together information about the militarization of police around the world. Activists throughout WRI’s worldwide

War Resisters’ International (WRI) has a growing resource section on their website that draws together information about the militarization of police around the world. Activists throughout WRI’s worldwide

network have been reporting on how their internal security forces were looking and acting more like domestic armies. “The idea to create an online resource on the militarization of policing was born from a desire to join the dots between what is happening in individual countries and paint a clearer picture of the wider global trend.” The site includes stories of resistance from communities across the globe. See wri-irg.org/en/story/2018/resisting-police-militarisation.

War Tax Talk — The Podcast

The newest podcast posted on our website under the “Media” buttons is #7: Why and How I Became a War Tax Resister. This podcast, created by Erica Weiland, features a series of interviews with people who started their war tax resistance in the year after the 2016 election, including Caitlin in Seattle who won’t pay for Trump’s border wall plan; Sarah Mueller, who wants to redirect taxes toward community organizing led by people of color; and Lauren von Bernuth and Orane Sharpe from the independent media website Citizen Truth.

Previous podcasts include:

#6: From the Military to WTR, a talk by former State Department official and Marine Corps officer Matthew Hoh at the May 2017 NWTRCC gathering in St. Louis.

#5: War Tax Resisters Abroad, featuring two war tax resisters who traveled overseas to work with other war resisters and learn more about the real impacts of U.S. warmongering. Jason Rawn visited Okinawa in Japan and Jeju Island in Korea, and Dana Visalli, denied a visa for Syria, spent time in Lebanon with Syrian refugees.

#4: Talking with Shane Claiborne, Christian author and speaker, founder of the Simple Way community, and war tax resister.

#3: Reflections of Experienced War Tax Resisters, a collection of interviews of longtime resisters who share their histories of and motivations for taking this path.

#2: Beyond the Rally, with presenters from NWTRCC, Center on Conscience and War, and National Campaign for a Peace Tax Fund.

#1: War Tax Resistance for a Better World, with 20-something resisters Ari, Katherine, and Shaolida who discuss why and how they refuse to pay for the war machine

Subscribe to the podcast feed in your RSS reader or podcast application by inputting feeds.feedburner.com/WarTaxTalkPodcast. You can also find us on iTunes by searching for War Tax Talk.

NWTRCC News

Celebrate Cinco de Mayo in Los Angeles!

War Tax Resistance Gathering and Coordinating Committee Meeting

May 4-6, 2018

CPUSA Worker Center, 1251 S. St. Andrews Place, Los Angeles, California 90019

Hosted by members of Southern California War Tax Resistance and Alternative Fund and co-sponsored by Veterans for Peace LA Chapter, LA Catholic Worker, and NWTRCC.

Join us the first weekend in May for “Divest from War, Invest in People.” The mini-conference on Friday evening and Saturday includes discussions and strategizing with activists from various divestment campaigns; introductory war tax resistance workshop and update sessions for current resisters; reports from tax season organizing and individual and group redirections; good company, plus great meals courtesy of Food Not Bombs! We hope to participate in Cinco de Mayo celebrations on Saturday evening and visit the Arlington West tribute to victims of war on the beach in Santa Monica on Sunday afternoon. Arrival and registration begin at 3 pm on Friday.

Details and a registration form will be on the NWTRCC website by the end of February, or call the office for a brochure later in February.

Job Opening at NWTRCC

The National War Tax Resistance Coordinating Committee (NWTRCC) is looking for applicants for its Coordinator position, to start about May 2018. The Coordinator is the primary administrator for NWTRCC responsible for office management, financial management, coordination with volunteers and other consultants, preparation for meetings, and fundraising. Other responsibilities are field organizing, counseling, and public relations. A successful applicant has strong administrative and managerial talents, is skilled at working independently, enjoys working with a wide variety of personalities, has demonstrated fundraising skills, and has experience in and commitment to war tax resistance.

Please ask for the applicant’s packet before applying. Call the NWTRCC office (800-269-7464) or email hiring@nwtrcc.org. The application deadline is February 15.

Meet Our New Social Media Consultant

Welcome to Sarah Mueller, who will step into a 5-hour per week position as Social Media Consultant as Erica Weiland shifts to Communications Consultant and focuses on this newsletter, the website, blog and literature updates. Sarah was profiled in this newsletter in June/July 2017, and told of growing up Brethren and hearing people around her say, “We are opposed to war and militarization, therefore we will not pay for it!” With that seed planted and her more recent awareness of the correlation between Washington’s war machine and the over-policing and the killing of black and brown people in our city streets, she realized it was time to stop paying. Sarah has met with other Philadelphia war tax resisters and hosted a house meeting with Sam Koplinka-Loehr. Along with activism, she is a freelance worker and uses Instagram, Facebook, and Twitter doing social media for a local restaurant and for the organization that she started, cineSPEAK: alternative cinema. We look forward to working with Sarah!

Participate!

Administrative Committee meeting in St. Louis, May 2017. Starting at far left, clockwise: Ruth Benn, Jason Rawn, Sam Koplinka-Loehr, Bill Glassmire, Erica leigh, Cathy Deppe, Coleman Smith, Chrissy Kirchhoefer. Photo by Clare Hanrahan.

Let us know you care about NWTRCC. Nominations are open for two seats on NWTRCC’s Administrative Committee (AdComm), which provides oversight to business operations, helps plan two gatherings each year, keeps in touch with consultants between meetings, and meets face-to-face at the May and November gatherings and by phone in February and August. New members will be selected from nominees at the May 2018 meeting. Contact the NWTRCC office for more details or get nominee names and contact information to NWTRCC, PO Box 150553, Brooklyn, New York 11215, 800-269-7464 or nwtrcc@nwtrcc.org. Self-nominations welcome. Deadline: March 15, 2018

PROFILE

Sixty Years with The Catholic Worker And

Fifty-Eight Years of Effective War Tax Refusal

By Karl Meyer

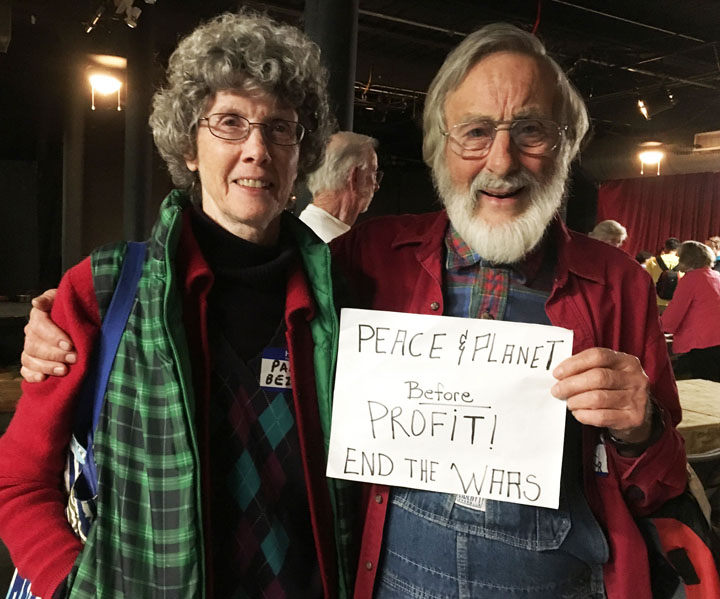

Pam Beziat and Karl Meyer at the Keep Space for Peace conference in Huntsville, Alabama, April 2017. Photo by Clare Hanrahan

July 12, 2017 marked my anniversary for 60 years of active engagement with Catholic Worker communities. On that day in 1957, at lunch hour, I hurried out from my job as a stock clerk at Barnes and Noble in New York City, raced to the Catholic Worker House on Chrystie Street, and, for the first time met Dorothy Day, Ammon Hennacy, and a handful of others gathered there. We went out and sat on benches in the park across the street, in open non-cooperation with a State law requiring everybody to take shelter in buildings when air raid sirens sounded, supposedly training to protect ourselves in case of a massive attack by Soviet nuclear weapons. To us it seemed an exercise in delusional propaganda and social folly aimed at conditioning Americans to the prospect of worldwide nuclear war.

Twelve of us were arrested. That night I slept beside Ammon Hennacy on the concrete floor of a holding cell at the “Tombs” city jail in lower Manhattan. The ideas he expounded deeply influenced me toward war tax refusal. In court the next day we were all sentenced to 30 days in jail. At age 20, as the only “juvenile,” I served my time at the notorious Rikers Island prison for youth offenders. So began a lifetime commitment as a recidivist Catholic Worker agitator.

A year later, in the summer of 1958, after graduating from the University of Chicago, I started a little storefront “house of hospitality” in a northside slum tenement two blocks away from the Cabrini-Green public housing project. That house ended up abandoned while I was imprisoned in 1971-72 for organizing war tax refusal during the Vietnam War.

On January 26, 1960, in Chicago, Eroseanna Robinson, a radical friend of Juanita and Wally Nelson, was carried into Federal Court by U.S. Marshals and ordered to provide information about war taxes she had not paid. She refused, began fasting from both food and water, and refused any cooperation with the process of imprisonment. She was cited for civil contempt, jailed, and, when she continued noncompliance, was sentenced to a year in prison for criminal contempt. I organized a continuous picketing vigil by supporters outside the courthouse for 20 days and nights, and when she was transferred to Alderson Federal Prison in Virginia, I began a series of “jail-in” solidarity actions handing out leaflets at the IRS office, leading to jail terms of three days, 15 days, 30 days jailed for psychiatric examination, and then 20 days. After 108 days of total fasting and noncooperation, Eroseanna was released from prison and I was freed from jail the next day.

Deeply moved by the example of this strong and beautiful woman (who was incidentally women’s high jump champion of the United States), I promised myself then that I would never pay federal income taxes again. I began claiming extra allowances on the W-4 Form to prevent withholding of income taxes from my wages, a method I introduced to thousands of Vietnam War tax refusers, through writings in WIN Magazine and the Catholic Worker in 1968-69. I have kept true to my promise for 58 years, and the IRS has succeeded in collecting less than $1,300 from me, by seizure of assets, across all of these years.

In 1974 several war resister friends started Francis of Assisi House, a next generation CW community in Chicago. Volunteering in this work I met and married Kathy Kelly, today one of our country’s most outstanding peace activists and a staunch advocate for war tax refusal.

In 1997 I settled on urban land in a neglected neighborhood near the center of Nashville, Tennessee. I restored a vacant house and began intensive fruit and vegetable gardening in my yards and the unused lot next door. Our “Nashville Greenlands” community has grown gradually around this first house. Using community effort guided by my skills as a carpenter, we’ve financed restoration of six more vacant houses in our neighborhood, and assembled our current network of seven affiliated houses, with 26 residents. A significant part of the resources to finance our community houses has come from the war tax refusal savings of myself and my current partner, Pam Beziat. We don’t do much direct hospitality for homeless people, but most of our young residents work as staff or organizers for small nonprofits. They do outreach and support services for the most vulnerable homeless people; they gather, process, and distribute surplus food to poor people; they organize mutual support among vulnerable immigrant workers; they organize on environmental, climate change, police accountability, and world peace issues.

A warm and grateful tribute to Ammon Hennacy, Dorothy Day, Juanita and Wally Nelson, Marion and Ernest Bromley, and Eroseanna Robinson, those wonderful exemplars of war tax refusal and right livelihood who led me down this revolutionary path.

I hope to report to you again at the 68th anniversary of my war tax refusal commitment, and I surely do not expect to pay war taxes when my ashes fertilize the gardens at Nashville Greenlands. In the meantime, I want to visit some communities and readers with a radically condensed version of my 600-page memoir published two years ago, and with a mini “Peace Van,” which I am currently fixing up for limited educational travel. These are two projects I hope to complete in this, my 81st year within our mother Earth.

A version of this article first appeared in The Catholic Worker in June/July 2017. Contact Karl at Nashville Greenlands, 2407 Heiman Street, Nashville, TN 37208, 615-322-9523.