More Than a Paycheck,

REFUSING to PAY for WAR

October–November 2018

Contents

Thirty-Eight Years of Refusal by Erica Leigh

Thirty-Eight Years of Refusal by Erica Leigh- Disloyalty to the War Machine By David Gross

- Counseling Notes Private Debt Collectors Update • Summons • Passport Renewals and Revocations • Notice on Levies

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network List Updates

- Colrain After 25 Years: Looking Back and Looking Forward

- War Tax Resistance Ideas and Actions Taking Back Our Tax Dollars from War Makers – Using Our Money for Our Priorities • Report Back: National Veterans for Peace Conference, St. Paul, Minnesota • In Memoriam: Ray Gingerich and Naomi Paz Greenberg

- NWTRCC News Stay Tuned for More NWTRCC Consultant Changes • See you in Cleveland!!! • Three Different Ways to Support NWTRCC

- PROFILE War Tax Resisters Penalty Fund By Shirley Whiteside

Click here to download a PDF of the October/November issue

The Conscience and Military Tax Campaign Escrow Account

Thirty-Eight Years of Refusal

By Erica Leigh

This year, after 38 years in operation, the operators of the Conscience and Military Tax Campaign (CMTC) Escrow Account decided to close the fund. They are in the process of moving its deposits to two other alternative funds: Depositors in the western half of the U.S. will now have their funds held at the Northern California People’s Life Fund, while depositors in the eastern half of the U.S. will now have their funds in the New England War Tax Resistance alternative fund.

CMTC has been a steady presence since 1979, since it first worked to pass what was called the World Peace Tax Fund Bill, the precursor to today’s Religious Freedom Peace Tax Fund Bill. CMTC founders Georgia and Ed Pearson started the escrow account for war tax resisters to hold their taxes pending the passage of such a fund. (Many other resisters who did not support the peace tax fund idea also deposited resisted taxes therein.)

For many years, CMTC also published a quarterly newsletter, Conscience. This newsletter was significantly larger than today’s NWTRCC newsletter and filled with a variety of interesting content. For a look back at some of the issues covered in CMTC’s long-running newsletter, Conscience, check out the ongoing Conscience and History series at nwtrcc.org/media/blog.

Below are some reflections from people who’ve worked on CMTC! If you have your own reflections on the impact of CMTC, please email them to Erica Leigh at wartaxresister@nwtrcc.org, and we’ll include some or all of them in the next issue of this newsletter!

Georgia Pearson, CMTC cofounder

During a Saturday silent vigil protesting the war in Vietnam in front of our Congressman Otis Pike’s home on Long Island my husband, Ed Pearson, thought that participating in war was not just fighting in war but it was also about paying for war. Conscientious objectors should be given the right to not fight or pay for war.

I contacted the Unitarian Senator from Alaska who had read part of the Pentagon Papers into the Congressional Record [Mike Gravel – ed.] and asked him if he would write a bill for conscientious objectors who objected to paying for war. He informed me that there already was a bill called the World Peace Tax Fund bill. Ed and I became involved with the passage of this bill. Congressional sponsors very slowly increased each year. A Riverside church minister, the Rev. Dr. William Sloane Coffin, Jr. suggested to Ed that if he wanted to succeed in supporting the right of Conscientious Objectors to not pay for war he should get 100,000 people to agree to withhold some of their taxes when the others all agreed.

Georgia and Ed Pearson picked up on this idea and started the Conscience and Military Tax Campaign (CMTC) in 1979 to support the WPTF bill. The CMTC created a resolution for Conscientious Objectors to withhold the military portion of their federal income tax when notified that there were 100,000 signed resolutions on file.

Many signers of the resolution did not want to wait to withhold their taxes and so an Escrow Account for the Peace Tax Fund was established. Some signers had small amounts from withholding the telephone tax which supported the war in Vietnam. By December 1981 there were 140 accounts holding $56,313.06. This was before the internet. It was hard to imagine that an organization in a garage office located in a small Long Island village would be able to have this much success.

Many signers of the resolution did not want to wait to withhold their taxes and so an Escrow Account for the Peace Tax Fund was established. Some signers had small amounts from withholding the telephone tax which supported the war in Vietnam. By December 1981 there were 140 accounts holding $56,313.06. This was before the internet. It was hard to imagine that an organization in a garage office located in a small Long Island village would be able to have this much success.

The mailing address for the escrow account was at our home about a mile from the CMTC office. Ed usually handled interactions with the IRS, but one day he wasn’t home and I was outside when a car pulled into the end of the driveway. Three tall men got out of the car and approached me. They wanted me to give them money from some escrow accounts. I said I couldn’t do that because they were earmarked for World Peace Tax Fund legislation. Then I looked at them, over a foot taller than me, and asked why there were three of them. They looked very sheepish, left, and did not return. Afterward I realized that some IRS agents had been fired upon when they came onto private property. I think that two of them were teaching the third one about what to do when entering private property. This was my first interaction with IRS agents and I felt very relaxed communicating my conscientious beliefs.

Larry Bassett (former CMTC and NWTRCC staff member)

Kathy Levine and I were living in the small Southern town of Christiansburg, Virginia when we traveled to Washington DC to go to a meeting of the National Campaign for a Peace Tax Fund, one of the few national piece groups that we knew about that was receptive to WTR action.

When we were there we met Ed Pearson. who had driven his Volkswagen van from Long Island and seemed like a similarly unusual person. I guess we impressed him as people who were willing to take a bit of a flying leap. Ed told us about this brand new organization that he and his wife Georgia had started on a shoestring, the Conscience and Military Tax Campaign. They wanted to hire someone to work for CMTC, and we ended up deciding to move.

Courtesy of Georgia Pearson

When we moved into the CMTC housing, I worked full-time and Kathy worked part time. We didn’t punch a clock because when you work for something you believe in and it’s the peace movement you just work your heart out. There is still a little of that attitude left these days.

The goal and purpose of the CMTC was to gather 100,000 pledges of people who agreed to resist taxes when that many people had agreed to act simultaneously to force passage of the World Peace Tax Fund (WPTF) bill [predecessor to the Religious Freedom Peace Tax Fund bill today]. So the CMTC was a project to try to get the WPTF passed in Congress. The relationship between the CMTC and the creator of the WPTF, the National Campaign for a Peace Tax Fund (NCPTF), was not without its complications. Ed and the people at the NCPTF were not always on the same page.

It fairly quickly became clear that many people were signing the pledge, but not waiting for the 99,999 others. Signing the pledge for many people was their overcoming the hesitancy to taking action as war tax resisters and in other ways.

The most positive thing about working at the CMTC was the volume of mail that came in every day. There were of course people regularly signing the pledge. The mail would come to Ed‘s house and he would do a preliminary sorting and then bring it over to the office usually each day. It was often a couple inches of mail and sometimes more. I think we surprised quite a few people at the beginning when we actually personally responded to correspondence, since most people expected to be dealing with nameless and faceless people even in the peace movement.

Kathy and I had almost nothing to do with the escrow account but the amount of money in the account became fairly substantial quite quickly. Ed handled the escrow account and the banking that was related to it. I think all of the accounts were held in local Bellport banks. Interest on the escrow account was part of what supported the CMTC.

Probably the greatest impact of the CMTC organization was the periodic newsletter that we put out. It eventually became a 20 or 30 page newsprint edition that was mailed out to thousands of people. A wide variety of information was included in the newsletter, including of course the progress on the pledge and other WTR information.

The four of us who put it together took a lot of pride in each issue. Georgia Pearson did the layout and some of her own personal art. It was a big job and the newsletter always looked good and because of Georgia it had something of its own personality. Usually on the inside cover there was a letter which was most often written by Ed but signed by KEGL, the initials of the four of us. I was amazed a few years after we left the organization that some people still actually remembered that name!

The CMTC was one of the organizations that participated in founding NWTRCC and Kathy Levine became the first NWTRCC coordinator. Shortly after that we left the CMTC and Ed and Georgia arranged to have the organization move out to Washington State. Someone else will have to take up the story from there!

Bill Ramsey (CMTC 2010-2018)

In July of 2010, while attending Salem Camp Meeting outside Covington, GA, I received a phone call from Carolyn Stevens, a board member of the Conscience and Military Tax Campaign (CMTC). Carolyn explained that the Nonviolent Action Community of Cascadia (NACC) in Seattle no longer had the staff capacity to administrate CMTC’s escrow account. She wanted to know if the St. Louis Covenant Community of War Tax Resisters (SLCCWTR) would take it on.

This was, most certainly, the first conversation concerning arrangements for war tax refusal and redirection that had ever taken place on Salem’s campground. Founded in 1828, by my Scottish Methodist ancestors, Salem is now a week-long gathering – part revival, part family reunion, and part business networking – all with conservative patriotic political underpinning. I told Carolyn that I would explore her proposal with others when I returned to St. Louis.

Thus began a new phase in CMTC’s history. By early February 2011, we had gathered a St. Louis CMTC oversight committee, received the depositors’ data base and the community development bank investment funds from NACC. We merged SLCCWTR’s alternative fund depositors into CMTC. When I left St. Louis in 2012, we moved the administration of CMTC to Asheville and added two new members to the oversight committee from Asheville and Black Mountain.

Over the past 8 years, we have expanded the geographical distribution of CMTC grants to include 72 recipient organizations in 22 states (Georgia, Missouri, Florida, New York, New Jersey, Kansas, Oregon, North Carolina, Illinois, Massachusetts, Colorado, California, Maine, Ohio, Texas, Virginia, Indiana, Minnesota, South Dakota, District of Columbia, Pennsylvania, and Arizona) and 13 countries (Haiti, Gaza and the West Bank in Palestine, Pakistan, Kenya, Colombia, Guatemala, Yemen Syria, Vietnam, Iraq, Costa Rica, South Sudan). In all, over $52,000 in interest and donated balances was redirected. We also transferred a portion of the CMTC escrow fund from investments in low-interest bearing domestic community development banks to micro-loan banks helping desperately impoverished women in Asia, Africa, and Latin America to create small enterprises.

This work was sustained by the CMTC oversight committee members Jim Alan, Hannah Allison, Hedy Epstein, Rich Howard-Wilms, Beth Keiser, and Larry Wilson. They reviewed scores of grant applications, endured long conference calls, making grant and investment decisions, and waded through annual financial reports. They supported the management of the fund, communicating with community development banks, signing checks and supporting my management with trust and encouragement.

We are grateful for those who founded CMTC on Long Island in the 70’s, NACC which sustained CMTC for nearly three decades and expanded the number of its depositors, and the hundreds of CMTC depositors across the country who have trusted us with the management of their resisted war taxes. We feel confident that this new arrangement, transferring CMTC’s remaining depositors and the escrowed funds to the New England War Tax Resistance alternative fund and the Northern California People Life Fund, is a sure and efficient way to maintain war tax redirection in the coming decades.

— Erica Leigh is NWTRCC’s communications consultant.

Disloyalty to the War Machine

By David Gross

The United States funded its participation in World War I by selling “Liberty Bonds” to Americans. The primary tactic of war tax resisters in the U.S. at that time was to refuse to buy these bonds, but the government and vigilante groups frequently used coercive tactics to try to force people into purchases or to retaliate against people who had not contributed. A signature tactic of these vigilante groups was to paint the vehicles, homes, businesses, and bodies of “bond slackers” yellow. To commemorate these resisters, NWTRCC is printing our newsletter on yellow paper throughout 2018.

In November, 1918, a mob captured Mennonite John Schrag, beat him, painted him yellow, and were on the verge of hanging him when the sheriff intervened and put him in jail. A later-repentant member of the mob remembered: “There was some kind of a glow come over his face and he just looked like Christ …. They’d slug him on the one side of the face and he’d turn his cheeks on the other. He exemplified the life of Christ more than any man I ever saw in my life.”

John Meintz, who had been tarred and feathered by a vigilante mob, tried to take his attackers to court. The jury acquitted all 32 of those who attacked him, and a band led a parade through town of the triumphant defendants. A newspaper report includes this detail: “Judge Wilbur F. Booth, in charging the jury, said that the evidence was overwhelming in support of the contention that Meintz was disloyal and that there was a strong feeling against him in the community.”

David Gross, author of 99 Tactics of Successful Tax Resistance Campaigns among other books, will be adding historical notes in this column through the year. For more you can also see his blog at sniggle.net/TPL.

Counseling Notes:

Private Debt Collectors Update

We now know of a third & fourth WTR who has been assigned private debt collectors. See the last two issues of MTAP for further info about private debt collectors.

Summons

A longtime WTR was issued a summons at the end of July. He had previously received notices from the IRS requesting a voluntary meeting, which he had ignored. (It should be noted that when WTRs in the past have attended voluntary meetings, many were still issued a summons after refusing to pay their debt at the voluntary meeting.) The WTR had also recently received a garnishment notice for his wages, but his income was low enough that nothing could be taken. We are not aware of anyone else who has recently received a summons or wage garnishment (not including Social Security). In early August, the WTR went to the IRS office for the summons, but was sent home when he told them he would be recording the conversation. The IRS told him that he needed to provide 10-day written notice to record the conversation. (The requirement to give 10-day notice dates back to 2009.) At this point, he has not received another summons. Please alert the NWTRCC office of any summons or garnishments so that we can ascertain if this is the beginning of a new pattern or an isolated incident.

Passport Renewals & Revocations

As previously noted, the IRS may inform the State Department not to renew passports for those with a tax debt over $51,000. Those in this situation may even have their passport revoked. At the end of July, a U.S. citizen living abroad contacted NWTRCC. He received a notice from the IRS that the IRS had notified the State Department not to renew his passport. As his passport does not need to be renewed for several years and since he did not receive notice of any impending revocation, he is taking the wait-and-see approach. I did not get the impression that he was a war tax resister (WTR), but his notice could be a forewarning of actions to come. It also informs us that the IRS will probably notify WTRs when the IRS alerts the State Department that someone’s passport should not be renewed.

Notice on Levies

A September 2018 report revealed that between 2012 and 2018 the number of levies to third parties dropped 80%, from 3 million to 590,000. This was an intentional decrease by IRS management. The issuance of a levy normally results in a phone call from the affected taxpayer, and the IRS did not believe its decreasing staff could handle the phone calls resulting from the levies. This coincides with the fact that no known WTRs are currently having their wages garnished.

Many Thanks

We are grateful to everyone who has responded or will respond to our June fund appeal with a donation of any size. Thank you!

We are very grateful to these alternative funds and WTR groups for their redirections and affiliate dues:

War Tax Resisters Penalty Fund

Voices for Creative Nonviolence

War Resisters League

Oregon Community Peace Fund

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is being updated this Fall. The latest list is online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC. Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

Colrain After 25 Years: Looking Back and Looking Forward

The 34th New England Regional Gathering of War Tax Resisters

November 16–18, 2018

Friday 6 pm – Sunday 1 pm

Woolman Hill Retreat Center

Deerfield, Massachusetts

Between 1989 and 1993, hundreds of people flocked to Colrain, MA, to voice their opposition to war and military spending by supporting the war tax resistance of the Corner-Kehler household. As this year marks 25 years since the end of the Colrain action, we are inviting as many of these participants (and interested others) as possible to gather at the Woolman Hill Retreat Center in Deerfield, MA, November 16–18, 2018, to revisit that experience.

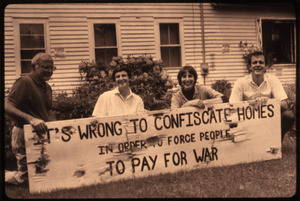

Supporters of war tax resisters Randy Kehler and Betsy Corner kneeling with sign. From the Randy Kehler Papers in the University of Massachusetts Amherst Libraries Special Collections.

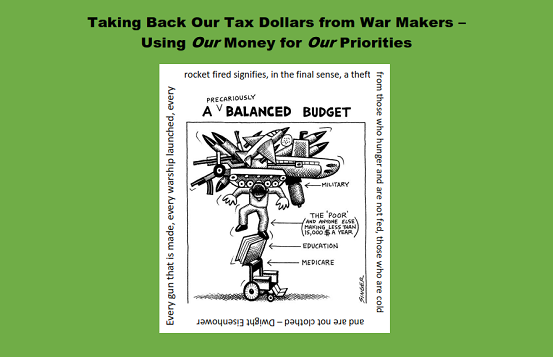

On Friday evening, we will take a close look at what lies at the heart of war tax resistance and the Colrain action: today’s exorbitant U.S. military budget and the wars and weapons it finances. President Eisenhower famously said in 1953, “Every gun that is made, every warship launched, every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed, those who are cold and are not clothed.” We will unpack that statement and look at where the money spent on the military is going and where it isn’t going. These policies have an enormous impact on practically every important issue facing us today as a society, but, for the most part, military spending remains a blind spot today for the population at large and even for many activists. We hope to shine some light on these very issues.

On Saturday, through panels, small group discussions, and informal conversations, participants in the Colrain action will revisit and explore what it meant to each of us personally, what we gained from it, as well as what we found difficult. We will review the timeline of the action and hear from a panel of Colrain activists addressing these questions. We will here from the principal players and organizers of the Colrain action, as well as from others who have different — even critical — perspectives. We will explore how the action was organized and how we handled decision-making as it related to strategy and tactics. We hope to cast as wide a net as possible and evaluate the Colrain experience from many points of view.

Tractor hauling a micro house from the Northern California War Tax Resistance in support of the Colrain action.

On Sunday, in what may well be the capstone of the Gathering, we will explore the legacy of the Colrain action and examine in what ways it has impacted the WTR movement and the larger peace movement generally. Twenty-five years ago, it seemed as if we were on the cusp of something revolutionary and that the Colrain action would provide a powerful model for expressing a conscientious nonviolent response to war and war preparations. This, alas, has not come to pass. We hope to ask — and try to answer — some difficult but important questions: How did the Colrain action impact the WTR movement and the broader peace and social justice movement? It clearly energized its own participants, but what about others? Did it inspire people, or did it scare them away? Why didn’t the Colrain experience catalyze similar actions across the country? Were we mistaken about WTR as an expression of political power and as a mode of resistance that could change the calculus of military spending and war-making? Why are we not seeing a resurgence of WTR now, in the Trump era? Why does it not seem relevant to most peace activists? Is there a way it can once again become relevant? We invite activists, both old and young, to help us explore these important questions — and not only for historical reasons. They are clearly important today.

Conference Logistics

Conference begins Friday at 6:00 pm and ends on Sunday at 1:00 pm. Cost for the entire weekend, which includes 6 meals: $60 per adult. Saturday only: $30. Cost with meals but without housing: $45. These amounts are suggestions. No one will be turned away for lack of funds.

For directions to Woolman Hill, see woolmanhill.org/directions.

Register online at bit.ly/colrain2018. Registration deadline: November 1st. No deposit necessary.

Questions/Ride Share/Airport pickup: Contact Bob Bady at bobbady@gmail.com or 802-258-7750, or call Aaron Falbel at 413-397-8976. •

War Tax Resistance Ideas and Actions

Taking Back Our Tax Dollars from War Makers – Using Our Money for Our Priorities

Ginny Schneider sent along this announcement for the 2018 Annual Maine War Tax Resistance Gathering, which will take place on Saturday, October 27, 2018 from noon to 4 PM (please BYO Lunch) at the University of Southern Maine – Luther Bonney Hall.

Workshops

Noon: Divest Yourself and Institutions from the Military Industrial Complex – Room 208

Noon: Support for Seasoned WTRs – Room 241

Panel

1:45 PM: Using Our Money for Our Priorities: Taking Back Our Tax Dollars from War Makers – Talbot Hall

This panel of Maine activists will discuss issues such as climate change, immigration, police violence, and corporate welfare and how these issues connect with war, the military budget, and resisting taxes for war.

Reportback: National Veterans for Peace Conference, St. Paul, Minnesota

“Members of Minnesota War Tax Resisters tabled at the national VFP conference (August 22-25). 328 people attended the conference, not counting the 100+ people who tabled for a wide variety of groups during the four-day event. We talked with previous war tax resisters, long time resisters, some who were considering it, and some who had not heard of it before. One person discussed his IRS adventure of paying his entire tax in pennies and having the IRS refuse his payment. (This was many years ago and the IRS has not returned to collect.) We hosted our popular “poster poll” (our version of the penny poll) and gave out a variety of NWTRCC literature.”

— DeCourcy Squire, Minneapolis War Tax Resistance

In Memoriam: Ray Gingerich and Naomi Paz Greenberg

We’d like to honor two members of the NWTRCC network who passed away in recent months. Ray Gingerich, the main organizer of NWTRCC’s May 2009 conference in Harrisonburg, Virginia, died on June 17, 2018. For his complete obituary, see bit.ly/raygingerich.

Naomi Paz Greenberg died on August 7, 2018. She was a member of Morningside Quaker Meeting and the main representative of Conscience and Peace Tax International at the United Nations. She attended several NWTRCC national gatherings and also represented NWTRCC at the 2015 Jewish Voice for Peace national gathering. You can read her report here: archives.nwtrcc.org/Gatherings/JVP_report_NPG.php. •

NWTRCC News

Stay Tuned For More NWTRCC Consultant Changes

After almost six years as NWTRCC’s social media consultant and now communication consultant, I’ve decided that it’s time to make a change! I’ll be leaving my consultant position at the end of December. This was such a hard decision for me, but I feel quite drawn to focus primarily on my hands-on local work instead of computer-based work. Lincoln and I will create a proposal for the November NWTRCC meeting for redistributing the work that I currently handle.

It’s been such a pleasure to work with Ruth, Sam, Sarah, and Lincoln over the years. I know I’m leaving this work in thoughtful, dedicated hands. I’ll continue to see you all at gatherings and to be a part of NWTRCC.

Thanks for all of your support over the years — I love this community!

— Erica Leigh

See you in Cleveland!!!

NWTRCC Gathering and Meeting

“The Science of Peace”

Friday, Nov. 2 – Sunday, Nov. 4, 20108

The Mission House, 3606 Whitman, Cleveland, OH 44113

“The Science of Peace” is the theme for our November meeting. The Great Lakes Science Center (in Cleveland) has been a strong supporter of the annual Labor Day Weekend Air Show, which promotes military propaganda. We will hear from friends who have been working to have a scientific exhibit on peace installed at the Science Center. There will also be sessions on racism, social media, and blueprints for creating a peace economy. The NWTRCC business meeting is Sunday morning, November 4 (open to all). Following the business meeting, there will be session on WTR Counseling Philosophies. Attendees are also invited to attend Annual Commemoration of the El Salvadoran Martyrs, which is sponsored by the InterReligious Task Force on Central America Sunday evening.

A tentative schedule with registration information can be found at nwtrcc.org/programs-events/gatherings-and-events/schedule.

Feel free to contact the NWTRCC office for more information (800-269-7464). •

Three Different Ways To Support NWTRCC

Advertising

Do you want to get the word out about your publications, small business, nonprofit group, or other activities to NWTRCC’s readers? Advertise in this newsletter! Rates are as follows:

price type dimensions

$35 business card 3.375″ × 2″

$75 quarter page 3.5″ × 4.875″

$150 half page horizontal only, 7.5″ × 5″

$300 full page 7.5″ × 10″

$0.50/word classified ads about 40 words/column inch

Rates for inserts, as well as additional information about advertising, can be found at nwtrcc.org/media/newsletters/advertising-rates. Please contact wartaxresister@nwtrcc.org</em to inquire about taking out an ad in this newsletter!

Religious Communities

NWTRCC’s Fundraising Committee asks for your help in fundraising for our peace and resistance work. If you are affiliated with a religious community or congregation, ask them if they will support you as a resister by contributing to NWTRCC.

You could also ask if you can take up a collection at a meeting for NWTRCC’s work.

We have a goal of raising $500 from religious funders this year, and have $100 so far — please help us meet this goal!

Pledges

When you make a monthly or quarterly pledge to NWTRCC, you help us establish a steady stream of income we can rely on to smooth our budgeting each year.

Consider converting your contribution to a periodic one. For example, if you normally give $100 once a year, consider if you could give $10 or $12 per month, which increases your donation at a minimal impact on monthly budgeting.

You can set up a periodic contribution by going to nwtrcc.org/about-nwtrcc/donations and setting up an automatic payment through PayPal or RESIST. We can also send you reminders to write us a regular check or send a contribution, if you contact the NWTRCC office (see address at bottom).

PROFILE

War Tax Resisters Penalty Fund

by Shirley Whiteside

Have you always wanted to be a war tax resister but don’t feel financially confident about the penalties involved?

Have you always wanted to be a war tax resister but don’t feel financially confident about the penalties involved?

Are you someone who feels you cannot personally resist war taxes at this time but want to support those who are called to this resistance?

If so, the War Tax Resisters Penalty Fund (WTRPF) is for you!

This fund was started in 1984 and reorganized in 2014. Interest and penalties for war tax resisters can incur over time, sometimes amounting to more than the taxes themselves. This happens easily with non-filers who are socked with penalties while avoiding collection undetected for long periods of time. For one contemplating resisting the massive war economy, knowing someone has your back for those penalties might make war tax resistance possible.

Let’s say you withhold 50% of your tax burden in order to protest war, and avoid collection for a period of time. Let’s say you put the funds wanted by the IRS into an escrow account designed for this purpose (see a current list at nwtrcc.org/resist/redirection). The IRS will send you a lot of mail reminding you to pay. Sometimes resisters avoid collection long enough that the IRS never gets the money and the statute of limitations on the tax debt expires.

But sometimes it doesn’t work that way, and the resister is penalized for this act of conscience. Eventually the IRS may levy you for those taxes and seize the money from your paycheck or bank account; they will also seize interest and penalties. That’s where the WTRPF comes in.

The Fund is a set of folks who know that collectively we are stronger. Three times a year the WTRPF committee reviews applications for assistance with interest and penalty requests — it does not reimburse the withheld war taxes themselves. Then we send a letter to all our subscribers to raise the money to reimburse the resister for their interest and penalties. Presently we have 163 active subscribers. We are committed not to request more than $30 from a subscriber in an appeal, and to send out no more than three appeals per year — if the need is greater than what is raised among subscribers, the remainder may be carried over to the next appeal.

The WTRPF is actively seeking both people who have been levied for this purpose, and those who want to share the burden of such an act of civil disobedience. More information about the WTRPF can be found on our website, wtrpf.org. Or by email at email webmaster@nwtrcc.org or call Peter at 574-532-3720. WTRPF c/o Peter Smith, 1036 N. Niles Ave, South Bend, IN 46617.

Shirley Whiteside is a member of the WTRPF steering committee along with Shulamith Eagle, Steve Leeds, Bill Ramsey, and Peter Smith.

More than a Paycheck

Editor Erica Leigh

Production Ruth Benn and Ed Hedemann

Printing and Mailing

Lakeside Printing Cooperative, Madison, Wisc.

Printed on Recycled Paper

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance

Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance

movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Subscriptions are $15 per year.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org