More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

April – May 2021

Contents

- Tax Season & The May 2021 NWTRCC Conference

By Lincoln Rice - Your Rights: Use ‘Em or Lose ‘Em By Ruth Benn

- Counseling Notes: Tax Day Moved to 17 May 2021 • Stricter Reporting Requirement for 1099-K • COVID-19 & Restriction on IRS Levies • IRS Mistakenly Sent Non-Filing Notices; Hasn’t Processed all 2019 Returns • Another Backlog of Mail for Some IRS Offices

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Tax Resistance Ideas and Actions Mennonite Church USA Sponsors “Cost of War: Learn Pray Join” • 1040 for Peace (Pennsylvania) Hosts a Zoom Session on WTR with Dr. Richard Yoder • Longtime WTRs Juanita & Wally Nelson are Focus of Radio Interview • Tax Day Actions!

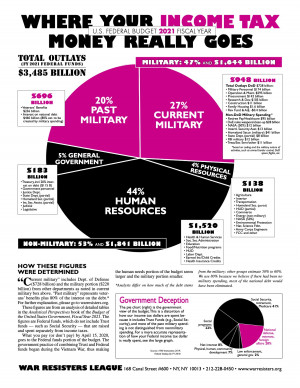

- RESOURCES New WRL Pie Chart • Revised Peace Tax Return • Revised Earth Palm Card

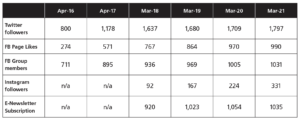

- NWTRCC News: Social Media Growth–Year over Year, 2016-2021

- Profile: Questioning the Need for Truthfulness in Resisting War Taxes By Anonymous

Click here to download a PDF of the April/May issue

Tax Season & The May 2021 NWTRCC Conference

By Lincoln Rice

For Tax Day, many local war tax resistance groups take to the streets to advocate refusal to fund a budget, 50% of which is dedicated to past, present, and future military expenses. Although vaccines are being administered, the pandemic may limit the extent to which people protest in groups and hand out flyers. With this in mind, the National War Tax Resistance Coordinating Committee (NWTRCC) began providing more online resources as part of a Tax Season 2021 campaign that began in January.

On Sunday January 24, the campaign launched when NWTRCC hosted a panel of war tax resisters on Facebook Live. The panel featured five longtime war tax resisters: Kathy Kelly (Chicago), Sam Yergler (Eugene, Oregon), Erica Leigh (Seattle), as well as Charlie Hurst and Maria Smith (Cleveland). They shared their original motivations for becoming war tax resisters and why they will continue to be war tax resisters during the Biden administration. (This video can be found at youtube.com/nwtrcc.)

In February, NWTRCC launched a new webpage connecting police militarization and war tax resistance (nwtrcc.org/police). This page underscores the consequences of U.S. militarism on police departments that are already mired in practices of systemic racism. For example, only $27 million of military equipment had been transferred to police departments before 9/11 under the 1033 Program. But after 9/11, the threat of terrorism was employed as an excuse to transfer over $1.6 billion of military equipment to police departments.

In March, we highlighted the misplaced priorities of the federal government with regard to health care, which have left so many Americans suffering during the COVID-19 pandemic. Despite the federal government’s dismal response to the pandemic, payments to weapons manufacturers have not skipped a beat. In addition to blog posts on the topic, we also featured an interview with family physician Paula Rogge whose commitment to war tax resistance has only been confirmed by the U.S. response to the pandemic. (This video can be found at youtube.com/nwtrcc.)

Tax Day Protest 2019 in Chico, CA. Photo Courtesy of Chris Nelson

With April featuring both Tax Day and Earth Day, we plan on highlighting the devastating impact of the U.S. military on the environment, with the Pentagon being the largest institutional user of oil in the world. The pandemic has slowed much of the planning that often goes into Tax Day for local war tax resistance groups, but a current list of actions can be found on page 5 of this newsletter. (With Tax Day being delayed until May 17, you will see actions set for both April and May.) If you plan on hosting a Tax Day event, please alert the NWTRCC office and we will add it to our list. Find the most up-to-date list of Tax Day actions at nwtrcc.org/tax-day-actions-2021.

NWTRCC National Conference: Organizing for Systemic Peace

(30 April – 2 May 2021)

NWTRCC’s spring national conference will once again be online. The theme for the conference is “Organizing for Systemic Peace.” The conference will begin with a Friday evening social hour where participants will spend time in break out rooms. Saturday will feature a panel of younger war tax resisters, speaking to how they became involved in war tax resistance and ideas on reaching out to younger activists. There will also be a panel of antinuclear activists speaking about their work in light of the new U.N. treaty on the prohibition of nuclear weapons.

Our Sunday business meeting will feature a discussion of a new NWTRCC logo as we enter our 40th year. We need to update our logo before we can complete our website upgrade. One major drawback with our current logo is that the dove on the howitzer is indiscernible when people are looking at our website on their phones. (Also, many folks don’t know what a howitzer is.) Go to the NWTRCC website (www.nwtrcc.org) for a full schedule and registration information.

Your Rights: Use ‘Em or Lose ‘Em

By Ruth Benn

Who wants to hassle with the IRS. Of course it’s a pain in the behind dealing with an agency that ranges from bullying to inefficient to inconsistent in following their own procedures. But, if we want to make a statement about refusing to pay for war, hassles come with the territory and are actually the least of the risks that a resister could face. So I was distressed to read the warning in the last issue of NWTRCC’s newsletter about sending a letter with tax forms which might lead to hassles with the IRS. In a rare success for this form of resistance, we won for the right to send those letters expressing our beliefs, complaints, and reasons for refusal.

Let’s not give up our rights of protest! In the fall of 2011, this information was submitted as a “systemic problem” through a form on the Taxpayer Advocate Service Systemic Advocacy Management System (SAMS):

Submission From: Taxpayer

Location: NY

Email Address: rbenn…

Issue Summary: improper frivolous penalties

Issue Detail Description:

The IRS Campus at Ogden, Utah, is incorrectly assessing $5,000 frivolous return penalties. The $5,000 penalty has been assessed on more than one individual when the IRS has accepted their calculations on the filed return as correct. The fine is being used to infringe on the free speech rights of individual taxpayers who are not attempting to evade taxes but who send a letter of protest about how the money is spent. The tax code on frivolous submissions does not cover a letter enclosed with a tax return when the return itself is filled out correctly for that individual with no extra messages written on the form and no reason to question the numbers on the return.

An analyst in the Taxpayer Advocate’s office took up the issue and pursued an investigation over the course of more than a year. She was referred to war tax resisters in the NWTRCC network who had received a $5,000 frivolous penalty, including some who had paid it or had the money seized from their bank accounts.

In April 2013 we received word that the Office of the Chief Counsel at the IRS would issue a memo and order for retraining of the Utah-based staff to prevent issuing frivolous penalties because a letter is enclosed with a tax return. The memo was released officially in August 2013 concluding:

When the taxpayer timely files a correct and complete return, the section 6702 penalty should not be assessed based solely on the fact that the taxpayer enclosed a letter with the return explaining why the taxpayer is not paying the self-assessed tax due. If a penalty has been assessed, it should be abated.

This rare success for WTRs even resulted in the return of the seized penalties for those resisters!

I am sympathetic to the recent cases of resisters who had to hassle with the IRS for months or years before the issue was cleared in their favor, but I am also grateful to them for fighting the IRS. We have the right to send our letters to a government agency, and we need to make sure that the IRS workers are reminded that we can do that without penalty. NWTRCC has a webpage on the Frivolous Fine that includes this history and tips for responding to the IRS. (nwtrcc.org/resist/frequently-asked-questions/frivolous-filing/)

At the moment I can’t help thinking beyond these bureaucratic hassles to the protests against the coup in Burma. I’m just in awe of the ongoing civil disobedience actions in the face of sweeping arrests and shoot-to-kill orders. It is humbling. I ask myself, “What would I do in that situation?” Even the worst-case-scenario risk of my tax refusal seems minor (if stressful) in comparison.

Counseling Notes:

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click on “Local Contacts & Counselors”).This training is usually offered once a year and the next training will be online in early 2021. If you would be interested in attending one of these trainings, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

Tax Day Moved to 17 May 2021

In case you did not hear, the IRS extended its deadline for the filing and payment of federal income taxes to May 17. Of course, you can always file earlier if you are a filer.

Stricter Reporting Requirement for 1099-K

Currently, some gig workers receive a 1099-NEC if they earn more than $600 and a 1099-K if they have total sales of at least $20,000 and/or total transactions of 200 or more in a tax year. Gig workers who do not receive the 1099-NEC (e.g., sellers on eBay) do not have income reported to the IRS unless it hits the $20,000/200 threshold for the 1099-K. A provision in the $1.9 trillion COVID relief bill that President Joe Biden signed into law amends Section 6050W of the IRS code to require reporting when total sales reach $600 or more through a 1099-K form. This change will go into effect for tax year 2022.

This change has been advocated by some in Congress for years because people are more likely to pay their taxes if they know the income is being reported. Therefore, this is a way for the federal government to increase tax revenue without increasing taxes.

A 1099-K form does not necessarily denote net income. If you sell a bike on eBay for $700 that you originally bought new for $1,000, there is no net income and no tax debt is due. It is unclear to what extent people will be expected to justify not claiming income listed on their 1099-K form when there is no net income. Here is another example that is sure to cause headaches: What if PayPal sends out a 1099-K using the $600 rule for roommates who reimburse each other for rent and utilities using PayPal? How will PayPal or the IRS determine what is income from a business and what are regular reimbursements among friends? These questions are not answered in the legislation. We will keep you updated.

COVID-19 & Restriction on IRS Levies

In recognition of the continuing economic hardship caused by the COVID-19 pandemic, the IRS is easing its collection activities to avoid the seizure of bank accounts containing either Economic Impact Payments (EIP) or Paycheck Protection Program (PPP) loan proceeds. In a guidance memorandum issued to all collection employees, the IRS has directed that before issuing a bank levy, employees should contact the taxpayer in question to determine if they received a PPP loan, and if so, where the funds were deposited. Employees are further directed that they should not levy on a bank account that contains PPP funds received within the prior 24 weeks. If PPP funds are inadvertently levied, the IRS must release the levy unless there are exigent circumstances, such as the expiration of a statute of limitations or an indication that the taxpayer intends to dissipate assets.

In a separate guidance memorandum, collection employees are directed to contact taxpayers in advance of a bank levy to determine if the taxpayer received an EIP, and if so, where the funds were deposited. Collection personal are directed that they must not levy on a bank account known to contain such funds received within the prior 8 weeks. If EIP funds are levied inadvertently, the IRS must release the levy unless exigent circumstances exist.

IRS Mistakenly Sent Non-Filing Notices; Hasn’t Processed all 2019 Returns

The IRS posted a statement on its website acknowledging that it mistakenly sent non-filer notices to approximately 260,000 taxpayers regarding their 2019 returns (“CP59 notices”). The IRS shouldn’t have sent the notices because it hasn’t finished processing all the 2019 returns that were filed.

At the beginning of the COVID-19 pandemic, the IRS scaled back its operations to focus on mission-critical activities, including accepting returns and sending refunds. The IRS shut down all its Taxpayer Assistance Centers (TACs) and reduced its mail processing operations. The reduction in mail processing caused a significant backlog, which the IRS is still dealing with.

The IRS stated that taxpayers who filed their 2019 tax return, but still received a CP59 notice, can disregard the notice and do not need to take any action. There is no need to call or respond to the CP59 notice.

Another Backlog of Mail for Some IRS Offices

An IRS official stated on March 3 that three of the IRS’s service centers are facing new mail backlogs due to winter storms and quarterly return filings. The official couldn’t estimate how long it would take the IRS to process its incoming mail.

The IRS is processing payments received immediately, but they are also prioritizing 2020 tax returns that are claiming refunds. As of early March, the IRS’s Austin, TX, Kansas City, MO, and Ogden, UT service centers were a couple of weeks behind in opening mail due to a combination of closures due to winter storms (Austin) and taxpayers filing quarterly business returns that were due at the end of January (Kansas City and Ogden).

Many Thanks

Thanks to each of you who has donated in early 2021! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

We are very grateful to these WTR groups and affiliates for their redirections

and Affiliate dues:

War Resisters League; New England War Tax Resistance; War Resisters League New England; Southern California War Tax Alternative Fund

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. Thank you!

Tax Resistance Ideas and Actions

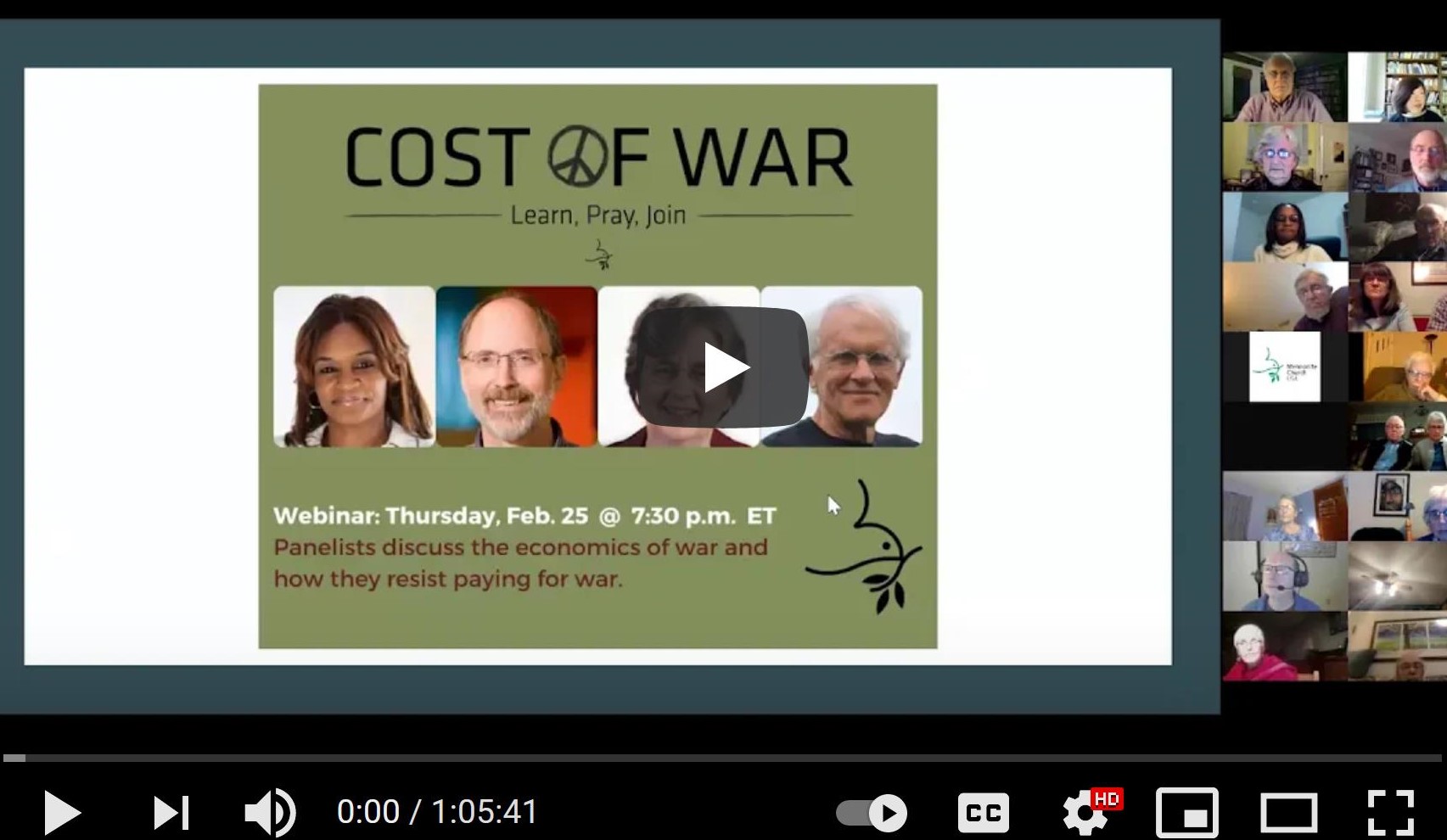

Mennonite Church USA Sponsors “Cost of War: Learn Pray Join”

Mennonite Church USA Sponsors “Cost of War: Learn Pray Join”

On February 25, the Mennonite Church USA sponsored a Zoom session on the cost of war and invited a panel of four Mennonites to share how they are creating a more peaceful world. The four speakers were Linda Gehman Peachey, Cyneatha Millsaps, Weldon Nisly, and Rick Yoder. Three of panelists shared about their war tax resistance to the 120 attendees. Attendees asked the panelists several questions about war tax resistance, including “Is paying for war the new form of conscription?” “How did you become a war tax resister?”

A Zoom recording of the session can be found on NWTRCC’s YouTube page: youtube.com/nwtrcc.

— Lincoln Rice

1040 for Peace (Pennsylvania) Hosts a Zoom Session on WTR with

Dr. Richard Yoder

The March monthly meeting of 1040 for Peace (https://1040forpeace.org) welcomed the input of Dr. Richard Yoder, Professor Emeritus of Business and Economics at Eastern Mennonite University at Harrisonburg, Virginia, reporting on his convictions and experiences with war tax resistance. Rick addressed three questions: 1) how he became a war tax resister, 2) how his faith has shaped his response to militarism, and 3) whether paying for war is the new conscription.

Rick affirmed his local congregation, the Mennonite Church USA, and the many friends who have supported him in making “good trouble,” as former Representative John Lewis encouraged us to do. Anabaptist faith teachings in his home include the pictures and stories in the Martyrs Mirror book and Jesus’s Sermon on the Mount, and the witnesses of Dietrich Bonhoeffer and Martin Luther King, Jr.

Regarding whether paying for war is the new conscription, Rick stated that it’s now our monies, some 48% of our federal taxes according to the War Resisters League, rather than our bodies that the U.S. government wants to fight wars. Given recent Supreme Court rulings regarding religious freedom, might it be possible to petition the government to allow conscientious objection to paying war taxes? Could our concerns be taken through the court system? Is it true that as long as the government can collect our resisted funds, there is no opportunity to develop a case that could go through the court as a lawsuit against the government because the taxpayer refused to pay? How did conscientious objectors obtain the right to refuse the draft in the 1940s? How do we now put our words into action?

A recording of the session can be found on NWTRCC’s YouTube page: youtube.com/nwtrcc.

— H. A. Penner

Juanita (far left) & Wally (far right) in front of IRS on Tax Day 1980.

Longtime WTRs Juanita & Wally Nelson are Focus of Radio Interview

Longtime WTR Bob Bady was interviewed by radio host Chris Nelson out of Chico, California on February 26. Bob Bady shared stories about Juanita and Wally Nelson, who passed away in 2015 and 2002 respectively. Bady was eighteen years old when he met the Nelsons, who were then in their 40s. He was immediately struck by their humility. They told him that they were “trying” to be nonviolent. He also recalled Wally’s simple mantra in response to folks who felt compelled to pay their war taxes: “You don’t gotta.”

The entire interview can be found at www.kzfr.org/broadcasts/24681.

— Lincoln Rice

Tax Day Actions!

Tax Day 2019. Penny Poll in Colorado Springs, CO. Photo by Donna Johnson

Because of COVID-19 and the deadline for federal taxes being moved to May 17, many local groups are still in flux concerning their Tax Day 2021 plans. See below for the confirmed actions as of this writing, but go to nwtrcc.org/tax-day-actions-2021/ for an up-to-date list of actions. If you are participating in a Tax Day action, please take photos and videos and send them to the NWTRCC office.

San Diego, California — Thursday, April 15

“Tax Day Action at the Border: Move our Money from Death to Life.” A tax day vigil to mourn deaths, pain, and suffering caused by U.S. policies at the U.S.-Mexico border. This event will take place at the San Diego-Tijuana Border. Sponsored by the Peace Resource Center of San Diego and the American Friends Service Committee. For more information, contact Anne at the Peace Resource Center at anne@prcsd.org.

Manhattan, New York — Thursday, April 15, Noon-1pm

Vigil and leafleting outside the IRS office, 290 Broadway at Duane Street, across from the Federal Building. War tax redirections may be announced. Info: Sponsored by NYC War Resisters League, NYC Catholic Worker, Kairos Community, Peace Action NYS, Brooklyn For Peace, Veterans for Peace/Chapter 34, CodePink NYC, Raging Grannies, Pax Christi Metro New York, Granny Peace Brigade, Peace Action Bay Ridge, Bronx Peace Action, Samidoun: Palestinian Prisoner Solidarity Network, NYC Democratic Socialists of America Anti-War Working Group, World Can’t Wait. For more information: www.nycwarresisters.org/demonstrations or call (718) 768-7306.

Cleveland, Ohio — Saturday, April 10, 7:00pm Eastern (Zoom)

War Tax Resister Frida Berrigan will discuss Dr. King’s words about racism, militarism, and excessive materialism. This event is cosponsored by the Cleveland Nonviolence Network, Cleveland Peace Action, Northeast Ohio Sierra Club, and the Inter Religious Task Force on Central America and Colombia. Information about the event, including registration information can be found here: www.facebook.com/events/3007265722933910/

Portland, Oregon — Thursday, April 15, 7:30-9am

Sign-holding on Portland bridges (Burma Shave Style). Meet at E. Burnside and MLK Jr. Blvd. Sponsored by War Resisters League – Portland. For more information, email: jgrueschow@comcast.net.

Akron, Pennsylvania — Wednesday, April 14, 7:30pm Eastern (Zoom)

“Service of Lament & Dedication.” Participants will lament the portion of federal taxes that support the military and dedicate to God letters of dissent to the U.S. government as well as conscientious objector contributions to peacebuilding organizations (perhaps in lieu of paying that portion, or symbolic amount, of the current federal tax levy that underwrites war and militarism). Zoom info: https://us02web.zoom.us/j/85245131803?pwd=UTdibTNtckV3SmpUNUpqTW5WUHBoUT09 Meeting ID: 852 4513 1803; Passcode: 758202; Zoom by Phone: (929) 205-6099. (Clickable hyperlinks for every event listed in this section can be found on NWTRCC’s Tax Day Action page.)

Brattleboro, Vermont — Monday, May 17, 10am-6pm

WTR information table outside the Brattleboro Food Coop, 2 Main Street. Sponsored by Pioneer Valley War Tax Resistance. For more information, contact Daniel Sicken at 802-387-2798 or dhsicken@yahoo.com.

Milwaukee, Wisconsin — Saturday, April 17, Noon-1pm

Vigil to protest federal tax dollars for war and environmental harm, U.S. Army Reserve, 5130 W. Silver Spring Dr. Sponsored by Milwaukee War Tax Resistance, Casa Maria Catholic Worker, & Peace Action of Wisconsin. For more info, contact Lincoln or Mikel, Casa Maria at usury_sucks@hotmail.com or (414) 344-5745.

Check out another website for Tax Day actions:

The Global Days of Action on Military Spending (GDAMS) are taking place again this year, April 13 – May 9, organized around the slogan, “Demilitarize: Invest in People’s Needs!” Find a list of all the actions at www.demilitarize.org

RESOURCES

New WRL Pie Chart

War Resisters League has released their fiscal year 2022 pie chart, “Where Your Income Tax Really Goes https://www.warresisters.org/sites/default/files/docs/fy2022piechart_b.pdf.” You can order amounts of 100 or less from NWTRCC at www.nwtrcc.org/store or 800-269-7464, or larger amounts from WRL (https://www.warresisters.org/store/).

Revised Peace Tax Return

We recently updated the Peace Tax Return. Just as the IRS has simplified its tax forms, NWTRCC has revised its Peace Tax Form so that it can be printed on a standard sheet of paper (11″×8½”). It now connects federal incomes taxes more closely with environmental harm, U.S. border patrol, and the militarization of police.

Revised Earth Palm Card

Revised Earth Palm Card

The revised Earth Palm Card includes a backside that connects military spending and environmental degradation. Download the card at www.nwtrcc.org or order cards from NWTRCCNWTRCC for 10 cents each.

NWTRCC Upcoming Events & News

Social Media Growth–Year over Year, 2016-2021

Are you organizing an action, training, or gathering? Got a good photo of your war tax resister community in action? Keep us in the loop: We’re all about building the community of resisters. We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (our Outreach Consultant):

outreach@nwtrcc.org // Follow the journey + join us on all social media Instagram + Twitter: @wartaxresister // Facebook: National War Tax Resistance

Coordinating Committee (NWTRCC).

PROFILE

Questioning the Need for Truthfulness in Resisting War Taxes

By Anonymous

I once lived in a small village; our neighbors separated by modest yards. My sister and I: about grades 4-5. Little Billy, about 4 years old, lived next door with his mother Betty. One afternoon he ran into our yard, running from his mother. Maybe more of a lark than running for his life. We either hid him out or let him go through the house to another yard. When Betty came looking for Billy, we denied everything. Somehow our Mom found out what we did; maybe Billy fessed up under pressure. Our only spankings, and not much of ones at that.

Image by OpenClipart-Vectors from Pixabay.

Years ago Wally Nelson attended a gathering of people interested in war tax resistance. Wally, from the simple living, rural homestead he and Juanita cared for. Several participants, from large urban areas. One topic: how to get along without a bank account. Difficulties of such a way were identified. Wally: “Look, I got money. But I’m not going to tell you where it is.”

Many readers of this newsletter know the biting words from Edna St. Vincent Millay’s poem “Conscientious Objector.” Millay makes it clear she will not divulge the location of the “black boy hiding in the swamp.” And likewise, “the whereabouts of my friends.”

If you were hiding out someone on the run—let’s say a runaway slave or someone hiding from the Nazis—would you be truthful if confronted about your activity?

Does the reason why the person is hiding, and from whom, make a big difference in what you do?

Is it possible to live above the taxable income limit and keep all your war tax money away from the government? I don’t think so.

I’ve driven a car for about 50 years, guessing an average of 12,000 miles a year. With a federal gas tax currently at 18 cents a gallon (the same since 1993), and averaging 20 miles a gallon, a guestimate of the money I have contributed to the gov’t by way of the gas tax is about $4,500—a goodly amount.

What is the value in someone living above the taxable income level, getting taxed, refusing to pay a portion, or all of, the taxes; having wages garnished or a bank account seized, and then considerate support people reimburse the money that went to the government?

Is integrity—as in telling the truth—a notch above keeping funds away from the government?

Not telling the truth can cover a long stretch of turf: the little “white lie;” crossing your fingers behind your back; making false statements on documents, from a little fudge to outright untruths. And in discerning the balance between keeping funds away from the government’s war-making efforts and one’s integrity, we can find ourselves weighing choices and options.

Cornell West talks about the change in residents at the White House as a “change in management of the empire.”

A perspective of more than fifty years leads me to conclude this empire has been despicably evil for far more than these past fifty years. “How bad?” That’s for you to say.

“Resist!”

As a “movement,” war tax resistance may not grow large. Perhaps a support network for people of conscience. Personal acts of conscience occupy a significant place in resisting empires. And so do the less than open and public acts of nonviolent resistance.

Perhaps a support network for people of conscience is “better” than becoming a haven for those who don’t tell the truth about their taxes. But then again . . . (This article is finishing up on the 50-year anniversary of the raid on the offices in Media, Pennsylvania.)

It’s been said “money is an extension of ourselves.” As a draft resister—of the open, “here I stand” variety—I did not shy away from being truthful; I publicly took personal responsibility for not engaging in learning how to kill on command whomever the government points to and says “Kill!” But I don’t think the same way about efforts over many years to keep blood money away from the empire.

[Editor’s Note: The author of this article brings up the possibility of falsifying tax forms without endorsing it. NWTRCC does not recommend that resisters falsify their tax forms. Falsifying tax forms is an offense for which the IRS will use its limited resources to charge a resister criminally with the intent of sending them to jail. Nevertheless, we like to present a myriad of views in our newsletter and we know war tax resisters take varying stances on how public to be in their resistance. If you would be willing to share your own war tax resistance story, please contact Lincoln at 262-399-8217 or nwtrcc@nwtrcc.org.]

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org