More Than a Paycheck,

REFUSING to PAY for WAR

August–September 2018

Contents

“What Is It Today? Arrest A Granny Day?” by Anne Barron

“What Is It Today? Arrest A Granny Day?” by Anne Barron- “Please Get After Him” By David Gross

- Counseling Notes Private Debt Collectors Update • Scams • Schedule C Business Expenses

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network List Updates

- A Movement Without Stars By Larry Bassett

- War Tax Resistance Ideas and Actions Weapons Free Funds • Rebutting Arguments against War Tax Resistance • Hunger for Nuclear Disarmament • International Outreach Opportunities: Canada and Mexico • Citizen Truth at NWTRCC’s May Conference

- Resources War Tax Resistance at a Glance • Death and Taxes

- NWTRCC News Affiliate Support Fund • In Memoriam: Bruce Huntwork • In Memoriam: Raymond Hunthausen, retired archbishop of Seattle • See you in Cleveland!!!

- PROFILE Celebrating a Triumph over the IRS By David Gross

Click here to download a PDF of the August/September issue

“What Is It Today? Arrest A Granny Day?”

By Anne Barron

It was about 3 AM on May 30 in the Sacramento Jail holding cell. The young woman arrested during the early morning hours asked confusedly as she was pushed into our cell, “What is it today? Arrest A Granny Day?”

Twenty of us “elders,” equally groggy, were being processed by Sacramento’s “finest.” We had been arrested the day before for disrupting the California Assembly. And it was striking—the age gap between those who were arrested at the Capitol were more than twice the age of all but one of others arrested elsewhere. We just laughed, said “the Poor People’s Campaign” and “retirees,” then we sang.

We were arrested twice during the Poor People’s Campaign’s third week, focusing on The War Economy: Militarism and the Proliferation of Gun Violence.

This t-shirt expressed a dream shared by many in the crowd at the War Economy protest on May 29, 2018.

Photo by Anne Barron.

We disrupted the California Assembly to call attention to the immoral war economy of California. We read the 17 demands and called out the names of people killed by the “war economy”—veterans who committed suicide, people gunned down by militarized police, those murdered by Border Patrol, and victims of gun violence. Members of Veterans For Peace, Military Families Speak Out, war tax resistance groups, congregations, and peace groups used their bodies and their voices to stop the status quo. “Escorted” from the Assembly by state police, we signed “certificates of detention” during our first arrest. Released, we promptly returned to block access to the Assembly. We were arrested again and turned over to very surly Sacramento police.

While the plan was to disrupt, it was not about “getting arrested” (although everyone needs to spend at least one night in jail). The Campaign demands were the message; direct action the method. How successful was it? We will see if the fire is ignited.

I was proud that some San Diegans began a “PPC occupation” of San Diego City Hall within days after the War Economy action to counter police harassment of homeless people. Campaign organizers promise more direct action to counter the skewed priorities of local government.

“Please Get After Him”

By David Gross

The primary tactic of war tax resisters in the U.S. during World War I was to refuse to buy the “Liberty Bonds” funding the war. However, the government and vigilante groups frequently used coercive tactics to try to force people into purchases or to retaliate against people who had not contributed. A signature tactic of these vigilante groups was to paint the vehicles, homes, businesses, and bodies of “bond slackers” yellow. To commemorate these resisters, NWTRCC is printing our newsletter on yellow paper throughout 2018.

Vigilante mob actions against resisters continued into the Fall of 1918. For example, a mob visited Joseph Buechtel’s farm and painted his house, barn, outbuildings, car, and machinery with yellow paint, “German war crosses,” and messages denouncing him for his refusal to contribute to the war effort.

The Gloversville Morning Herald printed a clippable form that people could use to inform on their “bond slacker” neighbors. It read: “I wish to inform you _______, _______ street, who never has bought a Liberty Bond and who says he never will. He is a moneyed man. We wish him to help his country. Please get after him. Say nothing about this notice.”

David Gross, author of 99 Tactics of Successful Tax Resistance Campaigns among other books, will be adding historical notes in this column through the year. For more you can also see his blog at sniggle.net/TPL.

Counseling Notes:

Private Debt Collectors Update

Last issue we provided information about what private debt collector agencies can and cannot do. We also provided information on how to have them removed from your case. One of the two WTR people that we know have been assigned a private debt collector reported that they received a phone call from the agency (which they let go to voicemail) and that a roommate was contacted at their workplace. Please notify the NWTRCC office if the IRS assigns a private debt collector to your case. And remember, you will always receive notice of this from the IRS before the private agency tries to contact you.

Scams

Between October 2013 and March 2018, the IRS has logged more than 2.2 million reports from taxpayers who received telephone calls from individuals claiming to be IRS employees. The impersonators told the victims they owed additional tax and that if they did not pay immediately, they would be arrested, lose their driver’s license, or face other adverse consequences. More than 13,162 victims reported they had paid the impersonators a total of more than $65.6 million.

IRS employees may call taxpayers to set up appointments or discuss audits, but not without first attempting to notify taxpayers by mail. Letters are also sent before IRS representatives arrive in person, even if it’s an unannounced visit. IRS representatives will always have their official credentials, called a pocket commission and a HSPD-12 card. The HSPD-12 card is a government-wide standard form of identification for federal employees and contractors. Taxpayers and resisters have a right to see these credentials.

Schedule C Business Expenses

Just a reminder that self-employed WTRs who file the Schedule C should be careful about taking illegitimate deductions. Filing the Schedule C (whether a WTR or not) already makes you a more likely target for an audit. Taking large or creative deductions, without providing proper back up, further increases your chances.

Although NWTRCC cannot offer advice on what expenses can be deducted, we can inform you that deductions for illegal activities are not allowed. In a recent court case, the judge confirmed that a marijuana dispensary could only deduct the cost of purchasing the product to be sold, but not other ordinary expenses that most other business are allowed to deduct, such rent, utilities, and advertising.

Many Thanks

We are grateful to everyone who has responded or will respond to our June fund appeal with a donation of any size. Thank you!

We are very grateful to these alternative funds and WTR groups for their redirections and affiliate dues:

Philadelphia War Tax Resistance/War Resisters League

Northern California War Tax Resistance

National Campaign for a Peace Tax Fund

Christian Peacemaker Teams!

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC. Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

A Movement Without Stars?

By Larry Bassett

I recently watched the NWTRCC video “Death and Taxes“ for the first time in quite a while. And then I watched “An Act of Conscience” about the Corner-Kehler house seizure. I was swamped with feelings from seeing a lot of familiar faces and from hearing a lot of moving words. Both videos are filled with names and faces that are familiar to me. You might even say that Randy and Betsy and Wally and Juanita are stars in the war tax resistance movement. But I think it is very likely that even these well known people would deny their stardom. They were given ample opportunities to shine personally, but almost always opted to be spokespeople and dedicated servants of a greater cause.

Larry Bassett in a scene from the opening documentary The Pacifist. Find this and other videos at facebook.com/thepacifistfilm.

There are many people in the WTR movement who have had their moment in the spotlight and have handled that moment with sincerity and dignity. The U.S. government has found over and over that conscientious war tax resisters are not a good target. Even when the government may seem to win, they usually lose the public relations battle. People taking a moral stand against war and killing are not good targets.

As a young person I knew that I would not cooperate when I was faced with being drafted into the military. And shortly after that it became clear to me that paying into a system that sent others off to be killed and kill was not something that I would willingly participate in. I have tried in my lifetime to distance myself from that system in a variety of ways. I have not always been able to succeed in my effort but have always done the best that I could. I chose a variety of jobs in my lifetime but always with the goal of doing work that made the world a better place in some way. I have never had a job where I made a lot of money so I paid very little in income taxes. Over the years I tried to limit my financial support of militarism including war tax resistance when possible.

I have had two opportunities to be in the spotlight separated by more than three decades. The first time was in 1985 when the IRS decided to aggressively pursue me. I worked for NWTRCC in its beginning years and was ready to go to jail. But cooler heads prevailed and decided that a court fight would be better for the movement. And we surprised ourselves by winning!

My second time in the spotlight began on June 11, 2016 when my father died and left me $1 million in taxable income. It was actually easy for me to decide that I was going to continue my resistance even in this extraordinarily large circumstance. And it also soon became evident that it was really the redirection that was going to make the difference as much as the refusal.

Right now I can sign into the IRS page that is tracking how much I owe them and the amount is $236,000 in taxes and penalties and interest. At the same time I have donated nearly $250,000 to people and organizations that make the world a better place. I don’t believe the IRS will ever be able to collect the amount that I owe within the ten year period that they have to collect. I do not have that much money in assets and never will. And no matter what they do in the future, they will never be able to erase the money that I have donated internationally and nationally and locally. They cannot erase the good that I have done in redirecting my federal income taxes. And I am reminded that one of my first instances of war tax redirection in the 1970s was $300 that I resisted and redirected to a summer feeding program for low income children that would not have happened without that money. So I knew immediately that even a small amount of money could make a big difference.

I was pretty sure the IRS would react to these record-breaking numbers. So far I have been absolutely wrong. They have sent the routine letters, including the Notice of Intent to Levy. I have done a few things to try to agitate them because I want the government to notice. I have been trying to “poke the bear,” in my non-pacifist terminology. At this point I am actually feeling somewhat uncollectible. If the IRS seized all of my assets, I would still owe them money. One unexpected consequence of my massive resistance and redirection has been that I attracted the attention of a local filmmaker. He saw the article in the local newspaper last year about my resistance and called me up to ask about maybe doing a film about it. And now a year later there is a 58 minute documentary titled The Pacifist that will be showing soon in film festivals and will hopefully eventually be more generally available.

Part of committing civil disobedience is an acceptance of the consequences. So far the biggest consequence for me has been a positive feeling that I have contributed to the betterment of the earth. And if in years to come, people seeing The Pacifist come away with something to think about that is the icing on the cake.

No matter what the IRS does in the future, they cannot change the positive redirection of hundreds of thousands of dollars.

War Tax Resistance Ideas and Actions

Weapons Free Funds

CODEPINK has begun promoting a new website called Weapons Free Funds as part of their Divest from the War Machine campaign. The site helps people and institutions identify whether they are investing in weapons manufacturers (or defense contractors?) through their mutual funds, identify mutual funds that do not invest in weapons, and develop plans to reach out to funds investing in weapons.

Data from this site also might be useful to WTRs seeking how their state or local institutions are invested in war. Visit weaponsfreefunds.org for more information.

Rebutting Arguments against War Tax Resistance

David Gross started an interesting discussion on the wtr-s email list about “Tax Resistance: A Form of Protest?”, a 1975 article by Carl M. Lehman in The Mennonite that refuted arguments for war tax resistance. (Find the complete article on the Internet Archive at archive.org/stream/mennonite197590unse#page/579/mode/1up).

David summarized Lehman’s arguments as follows (renumbered for ease of tracking the points below):

1. It’s an abuse of analogy to say that paying money to the government that it spends on war is like personally fighting in battle. The analogy between war tax resistance and conscientious objection to military service is flawed. Money is not people.

2. There really isn’t any such thing right now as a “war tax”.

2.1. Most taxes go into the general treasury and are spent on whatever is in the budget; the few trust fund tax exceptions don’t have anything to do with war.

2.2. Even the telephone excise tax, which Congress has sometimes billed as a defense tax, just goes into the general fund. The words Congress members used to drum up votes for the tax don’t change its non-war-tax nature.

2.3. Saying that a percentage of your taxes, equivalent to the percentage of the president’s budget that goes to war, are thereby “war taxes” is ultimately incoherent.

2.3.1. If you think by refusing to pay 60% of your taxes you are impeding the government’s means of warfare, why not go all the way and refuse 100% to impede it that much more?

2.3.2. (The president’s budget is only advisory anyway; Congress spends using appropriations bills in a more willy-nilly way.)

3. Federal spending has only a tenuous connection with tax income

3.1. Arguing with or writing letters to the IRS (or the phone company) as a protest against government policy is like “arguing with the janitor at the Chase Manhattan Bank about giving you a loan”

3.2. Bipartisan Congressional majorities overwhelmingly support military appropriations. So to the extent that your tax resistance does deprive the government of money, that either means they will borrow more to pay for those appropriations or they will take the money from programs with less support in Congress. At the margin, the spending affected by reduced government revenue will not be military spending.

Steve Olshewsky responded to point 1:

Not sure why it is analogous. The fact is that a person whose body is conscripted into military service, and who physically complies, involves themselves in the government’s war. It is a separate fact that a person whose money is conscripted into military service, and who physically complies, involves themselves in the government’s war. The words body and money are the only differences in the two previous sentences, not to indicate an analogy, but to define a pattern. If a person is called upon to express an opinion (or carry a sign) that serves some military end, and if they comply, they involve themselves in war. Again, I am not able to distinguish between pulling the trigger, paying for the trigger, or designing the trigger.

Joe Maizlish responded to 3.1:

This is an argument against arguing with the janitor or IRS agent about government policy, not an argument against WTR, which does not imply or require that one do that. There is such a thing as

explaining one’s actions and opinions without arguing, and that can be beneficial in many ways (I’d even say it is a major component of de-escalatory conduct of affairs and conflict, and an important component of peace-promoting action).

and to 3.2:

That’s a good argument for redirection of refused funds and the use of alternative funds (if the refuser has any available that they are willing to risk being collected) and more generally an argument for exemplifying and advocating for support of beneficial programs.

Thoreau said he removes obstructions from the highways and thus does his part. Good agitation against war (in the many meanings of the term) and for social-environmental well-being can create an atmosphere in which the Congressional majorities may limit military spending (I assume that they impose some limits even today, though as Frank Zappa put it, “politics is the entertainment division of the military-industrial complex”)…

The core point about WTR to which the argument is entirely unresponsive (and a point not usually made explicit by WTR advocates) is that it is a challenge to the claim to obedience of a government so heavily investing in destruction.

It’s not surprising that war tax resisters weren’t particularly receptive to Lehman’s arguments, but many of these arguments persist to this day. The discussion might be helpful to resisters developing their own responses to criticism of WTR. Read the whole thing over at lists.riseup.net/www/arc/wtr-s.

Hunger for Nuclear Disarmament

War tax resisters Kathy Kelly and Robert Randall recently participated in the five-day “Hunger for Nuclear Disarmament” event in Georgia, in support of ending the Trident nuclear program and freeing the four Kings Bay Plowshares activists still in jail. The witness included fasting by many participants and daily vigils.

Patrick O’Neill, a Kings Bay Plowshares activist and participant in the fast, reports, “Each day here for the fast included a public witness, three times at the Kings Bay naval base, once at the Glynn County jail, where four of my co-defendants are still being incarcerated and once at the Brunswick federal building where our trial will be held. We also painted “Peace rocks” and hid them in St. Marys for people to find.”

“…Our numbers may be few in this work to save the world from nuclear destruction, but our spirits are strong, our hearts are steadfast and love is our measure. Like all of you reading this reflection, I dream of a better, brighter, disarmed world in our future, a world where our children and grandchildren will not have to face the prospect of nuclear war. First we disarm our hearts and then we disarm our weapons, and finally, let’s disarm our world.”

Read more about Kings Bay Plowshares and the Hunger for Nuclear Disarmament action at kingsbayplowshares7.org.

International Outreach Opportunities: Canada and Mexico

World Beyond War is holding their first conference outside of the United States, in Toronto, Canada (September 21-22, 2018; Friday evening and all day Saturday—More info at worldbeyondwar.org/nowar2018/). They have invited Doug Hewitt-White, the president of Conscience Canada, to speak on Canadian WTR. Doug has agreed to make NWTRCC literature available at his session. If anyone connected to NWTRCC is thinking of going and is willing to share NWTRCC resources, please contact Lincoln at the NWTRCC office (nwtrcc@nwtrcc.org / (800) 269-7464).

NWTRCC is also interested in mobilizing people who are attending the School of the Americas Watch (SOAW) Border Encuentro, November 16-18, in Nogales, Arizona, and Nogales, Sonora, Mexico. NWTRCC has historically presented a workshop and/or tabled at this event. Contact Lincoln if you plan to attend and can help represent NWTRCC.

Citizen Truth at NWTRCC’s May Conference

Sue Barnhart explains to Citizen Truth why she started to refuse to pay war taxes

War tax resisters Lauren von Bernuth and Orane Sharpe, co-founders of the media website Citizen Truth (citizentruth.org), made a short video of their interviews with war tax resisters Gary Erb, Jay Sordean, and Sue Barnhart at our May meeting in Los Angeles. Check out the video at youtu.be/1v595sOHHC4.

War Tax Resistance At a Glance

A revised edition of NWTRCC’s War Tax Resistance At a Glance pamphlet is now available in online and print versions, with updated design and content. Describing WTR in an easy-to-digest, point-by-point format, this pamphlet is an ideal supplement to our more in-depth pamphlets and our basic brochures.

Please visit nwtrcc.org/war-tax-resistance-resources/pamphlets/ to download this and other NWTRCC pamphlets.

RESOURCES

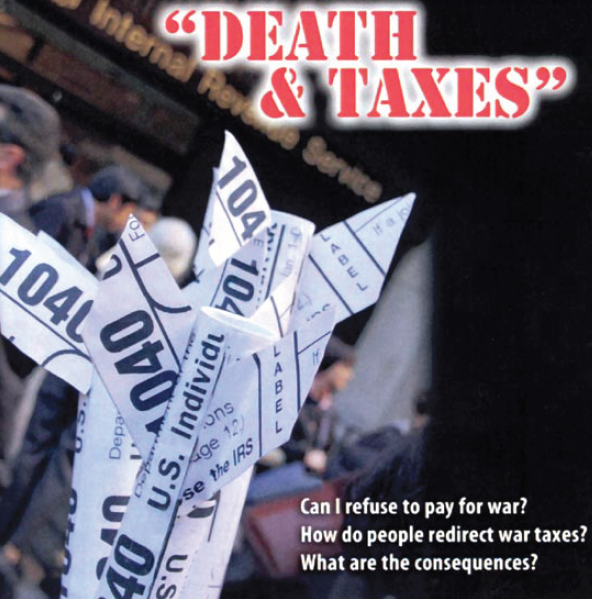

Death and Taxes

The Death and Taxes DVD is now available for just $2 per copy! Released in 2010 — timely until war ends!

Death and Taxes is NWTRCC’s 30-minute film covering why and how people refuse to pay for war, the risks, and the benefits. Includes music by Sharon Jones and the Dap-Kings and Antibalas, and interviews with 28 resisters.

Ask for a literature list from the office, 800-269-7464 or email nwtrcc@nwtrcc.org. To order war tax resistance literature see nwtrcc.org/store, or send a check to NWTRCC at our new address:

Ask for a literature list from the office, 800-269-7464 or email nwtrcc@nwtrcc.org. To order war tax resistance literature see nwtrcc.org/store, or send a check to NWTRCC at our new address:

P.O. Box 5616, Milwaukee,

NWTRCC News

Affiliate Support Fund

NWTRCC now has a complete Affiliate Support Fund application. The Coordinating Committee may choose to grant up to $2,000 per year altogether, budget permitting, to support affiliates. The amount of the next year’s grant fund is decided in November for the following year. We did not grant any of this fund in May, so money is still available to be granted in November.

Counselors, area contacts, and affiliates received an email in June with an attached form to submit requests for affiliate support money. Please contact the NWTRCC office if you need a form! Requests for funding are due September 21, 2018.

In Memoriam: Bruce Huntwork

NWTRCC network member Bruce Huntwork passed away on May 22, about eight months after the death of his wife Ann Huntwork. The Huntworks were members of the Oregon Community of War Tax Resisters and cofounders of the 18th Avenue Peace House in Portland, Oregon.

Bruce and Anne Huntwork on the show “‘H’ is for Humanitarian” in October 1991, discussing their health care work in Iraq and Iran.

Dan H. of Peace and Justice Works (PJW) in Portland wrote:

“Like Ann, Bruce was a long-time member of the PJW Iraq Affinity Group and brought his knowledge and curiosity to our meetings for many years before his memory began to fade. A brain surgeon at Kaiser whose brain lost its way, but who always had a smile on his face and a warm handshake.”

A memorial service was held on July 7, 2018 at the Peace House.

To watch a 1991 interview with Ann and Bruce about their healthcare work on the Iraq/Iran border, visit bit.ly/huntwork1991.

In Memoriam: Raymond Hunthausen, retired archbishop of Seattle

Long-time resisters and students of WTR history might recall retired Archbishop Raymond Hunthausen’s witness against nuclear proliferation in the 1980s, in which he refused and redirected war taxes. Hunthausen passed away at the age of 96 on July 22, 2018.

An obituary in the National Catholic Reporter notes that Hunthausen “acknowledged being influenced by the peace witness of Jim and Shelley Douglass and other members of the Ground Zero Center for Nonviolent Action aside the Trident base. Hunthausen embraced war tax resistance, and then proceeded to redirect 50 percent (the amount going to the military) of his own taxes to a peace fund [specifically, the Conscience and Military Tax Campaign, or CMTC].

“His stand against the morality of nuclear deterrence and his pastoral emphasis on church matters led to a sharp conservative Catholic backlash. That, in turn, led to a 1983 Vatican investigation that eventually concluded that Hunthausen had exercised ‘weak doctrinal leadership’ in a number of areas.’”

Find the full obituary at bit.ly/hunthausen.

See you in Cleveland!!!

NWTRCC Gathering and Meeting

Friday, November 2 – Sunday, November 4, 2018

The Mission House · 3606 Whitman, Cleveland, OH 44113

We would like to thank Maria Smith for reserving our meeting space in Cleveland. The Mission House can accommodate our housing needs, breakout sessions, and our Sunday business meeting. It is part of St. Patrick’s Parish on Bridge Ave. (There are two St. Patrick’s parishes in the metropolitan area.) The Mission House previously housed the Cleveland Catholic Worker and was recently renovated. It is in a neighborhood long connected to the solidarity and the anti-war movement. The offices of the InterReligious Task Force on Central America are located in another building of St. Patrick’s nearby.

Planning for the conference is still in the early stages, but information will be posted on the web in the near future (see nwtrcc.org/programs-events/gatherings-and-events/schedule). The NWTRCC business meeting is Sunday morning, November 4 (open to all). Note: Proposals regarding NWTRCC programs or finances for the November meeting must be submitted to the NWTRCC office by September 21, 2018.

PROFILE

Celebrating a Triumph over the IRS, with Redirection

By David Gross

For the first time this year one of my outstanding tax debts hit the ten-year statute of limitations for collection. During those ten years, the IRS sent me increasingly exasperated letters, threatened me with thousands of dollars of interest & penalties, and even seized $469 from my bank account once. But this year the remaining $3,226 I owed slipped permanently out of their reach, and the interest & penalties evaporated too.

I called their bluff, waited them out, and won (well, except for that $469).

(Note: this statute of limitations does not apply to people who refuse to file returns, or if the IRS can show that you did not file honestly, correctly, and completely. It only applies if you file but don’t pay.)

I didn’t make things easy for the IRS. I followed some of the advice in NWTRCC’s Practical War Tax Resistance pamphlet #3 (“How to Resist Collection, or Make the Most of Collection When It Occurs”). But I didn’t go to extraordinary lengths to hide my assets or drop into the underground economy. I’m certain the IRS knows of some things they could seize. I guess they’ve just been too busy to get around to it.

I Joined the Redirectors

This is also the first year I’ve redirected my taxes. In the past I’d been afraid that if I redirected my taxes and then the government also seized them from me that I’d go broke by paying double. (At least, thanks to the War Tax Resisters Penalty Fund (wtrpf.org), I don’t have to worry about going broke from the interest and penalties!) But this year, because I got away with it for the most part, I can redirect the successfully resisted money without concern.

I sent my $3,226 to the Prisoners Literature Project (prisonlit.org”), an all-volunteer group that sends free books to prisoners throughout the United States. My donation will pay for the postage on hundreds of packages, and for the purchase of dictionaries and other such high-demand books.

I made sure to let the Prisoners Literature Project know that the donation was coming from redirected taxes. And I informed our local war tax resisters’ alternative fund — the People’s Life Fund (nowar.tax) — about my donation so they can add it to their tally (they’ve already given away over $65,000 in resisted war taxes this year, joining several other such funds that coordinate war tax redirection).

And I Made Some Noise

“If I seem to boast more than is becoming, my excuse is that I brag for humanity rather than for myself.”

I also took some time to crow on social media about what I’d done so that news of my triumph over the IRS might spread. I hoped my example might encourage more people I know to consider resistance, and so I looked at the example of another war tax resister I respect who opted “to brag as lustily as Chanticleer in the morning, standing on his roost, if only to wake my neighbors up.”

It’s been a joy to join the redirectors. I’ve long been envious of that path of war tax resistance, and I’m delighted to finally feel able to participate.

More than a Paycheck

Editor Erica Leigh

Production Rick Bickhart

Printing and Mailing

Lakeside Printing Cooperative, Madison, Wisc.

Printed on Recycled Paper

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance

Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance

movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Subscriptions are $15 per year.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org