More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

April – May 2022

Contents

- Tax Season 2022

By Lincoln Rice - Keep it Simple – Stop Killing By Chrissy Kirchhoefer

- Counseling Notes: Tax Day is Monday, April 18 • IRS Making Progress and Receives Some Relief • Passport Renewal and a Payment Plan • Passports and the Supreme Court

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- War Tax Resistance News Conscience Matters (by William Ruhaak) • Podcast “Tax Chats” Features War Tax Resistance • New England War Tax Resistance Online Panel

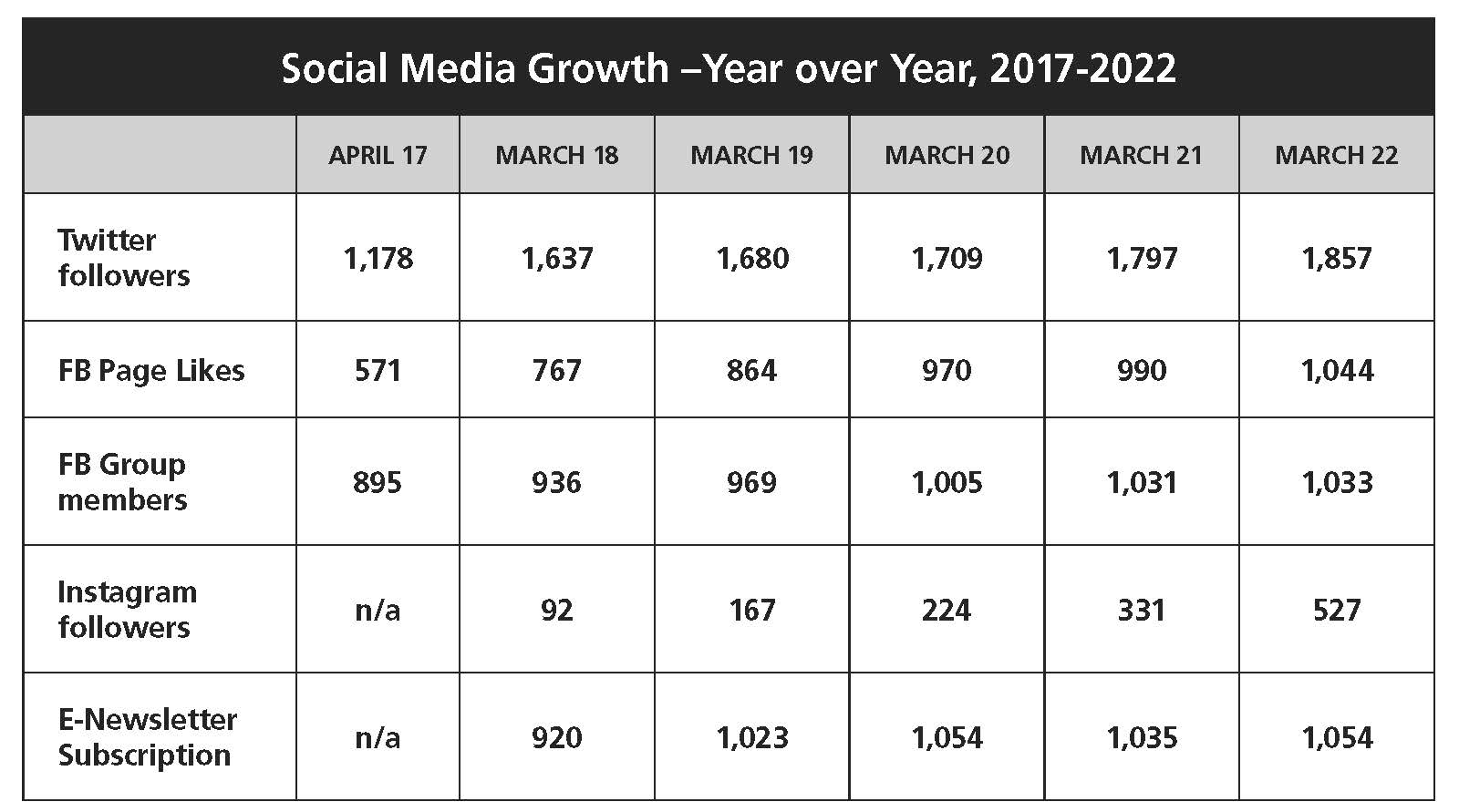

- NWTRCC Upcoming Events and News: NWTRCC National Conference: Organizing for Systemic Peace (April 29 – May 1, 2022) • Social Media Growth – Year over Year, 2017-2022

- Profile I am a “Symbolic Resister”

By Shirley Whiteside

Click here to download a PDF of the April/May issue

Tax Season 2022

By Lincoln Rice

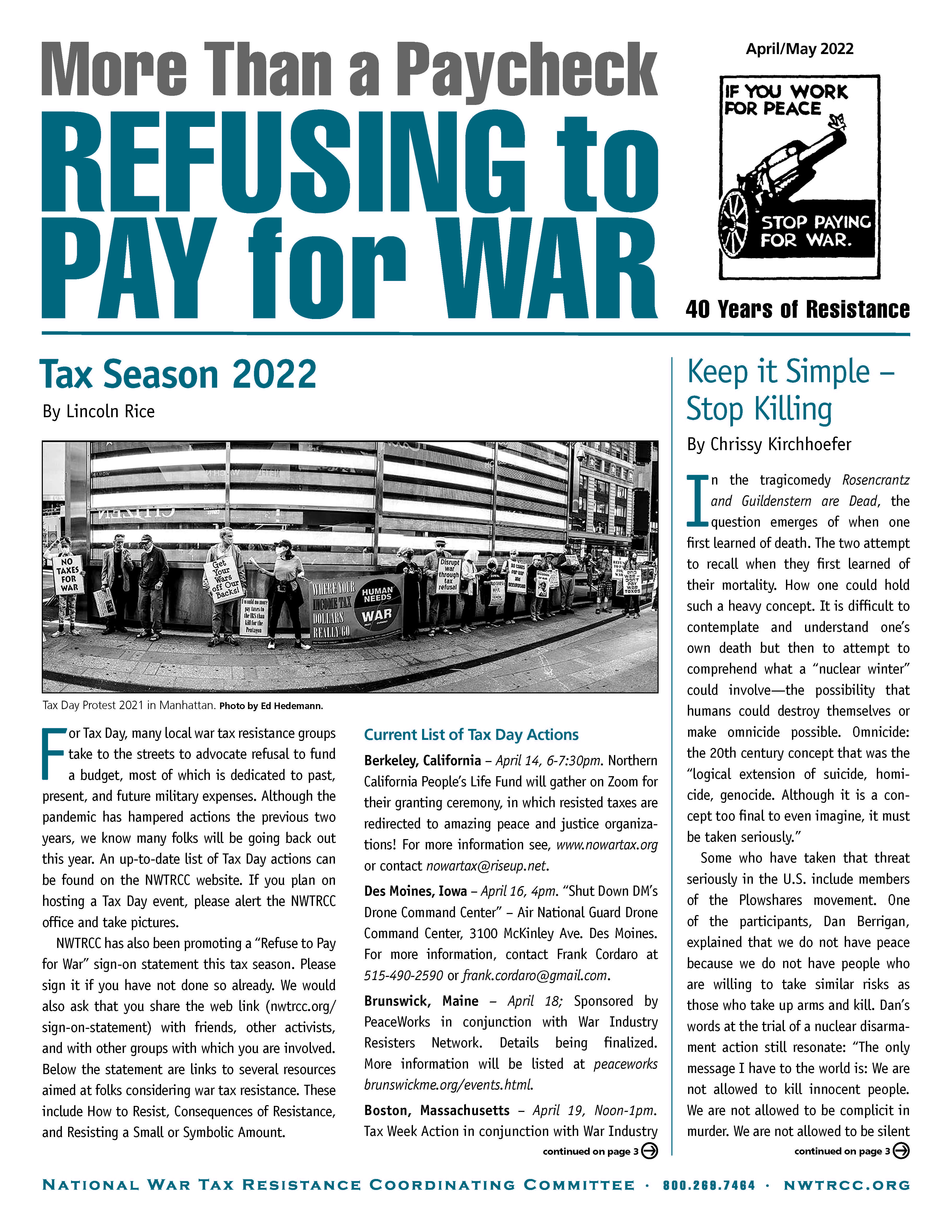

Tax Day Protest 2021 in Manhattan. Photo by Ed Hedemann

For Tax Day, many local war tax resistance groups take to the streets to advocate refusal to fund a budget, most of which is dedicated to past, present, and future military expenses. Although the pandemic has hampered actions the previous two years, we know many folks will be going back out this year. An up-to-date list of Tax Day actions can be found on the NWTRCC website. If you plan on hosting a Tax Day event, please alert the NWTRCC office and take pictures.

NWTRCC has also been promoting a “Refuse to Pay for War” sign-on statement this tax season. Please sign it if you have not done so already. We would also ask that you share the web link (nwtrcc.org/sign-on-statement) with friends, other activists, and with other groups with which you are involved. Below the statement are links to several resources aimed at folks considering war tax resistance. These include How to Resist, Consequences of Resistance, and Resisting a Small or Symbolic Amount.

Current List of Tax Day Actions

Berkeley, California – April 14, 6-7:30pm. Northern California People’s Life Fund will gather on Zoom for their granting ceremony, in which resisted taxes are redirected to amazing peace and justice organizations! For more information see, www.nowartax.org or contact nowartax@riseup.net.

Des Moines, Iowa – April 16, 4pm. “Shut Down DM’s Drone Command Center” – Air National Guard Drone Command Center, 3100 McKinley Ave. Des Moines. For more information, contact Frank Cordaro at 515-490-2590 or frank.cordaro@gmail.com.

Brunswick, Maine – April 18; Sponsored by PeaceWorks in conjunction with War Industry Resisters Network. Details being finalized. More information will be listed at peaceworks.brunswickme.org/events.html.

Boston, Massachusetts – April 19, Noon-1pm. Tax Week Action in conjunction with War Industry Resisters Network. Place to be determined. Sponsored by Massachusetts Peace Action. For more information, Massachusetts Peace Action at (617)354-2169, info@masspeaceaction.org or masspeaceaction.org/events/.

Manhattan, New York – April 18, Noon-1:30pm. Vigil at IRS office on Wall Street. Details being finalized as this goes to press. Sponsored by NYC War Resisters League [www.nycwarresisters.org/demonstrations or (718) 768-7306]. Other sponsors will be added.

Corvallis, Oregon – April 16, Noon. “Let’s Use Our Taxes for a Better World” rally at Howland Plaza, 1st & Madison; featuring music, speakers, networking, prioritizing, and coalition building. Sponsored by Veterans for Peace & Linus Pauling Chapter-Mid-Valley, Oregon. For more info, contact Court Smith at 541.753.3335 or crtsmth@comcast.net.

Philadelphia, Pennsylvania – April 15, Noon. “Stations of Justice, Nonviolence, Peace, and the Love of Humanity…” At Lockheed Martin: Mall & Goddard Boulevards, King of Prussia (behind King of Prussia Mall). Sponsored by Brandywine Peace Community. For more info, call 215-843-4827.

Brattleboro, Vermont – April 18, 10am-5pm. WTR Information Tabling outside of the Brattleboro Food Coop, 2 Main Street. Sponsored by Taxes for Peace New England. For more info, contact Daniel Sicken at 802-387-2798 or dhsicken@yahoo.com.

Milwaukee, Wisconsin – April 9, Noon-1pm. Vigil to protest federal tax dollars for war and environmental harm, U.S. Army Reserve, 5130 W. Silver Spring Dr. Sponsored by Milwaukee War Tax Resistance, Casa Maria Catholic Worker, & Peace Action of Wisconsin. For more info, contact Lincoln, Casa Maria at usury_sucks@hotmail.com or(414) 344-5745.

Check out another website for Tax Day actions:

The War Industry Resisters Network is a new coalition of groups opposing their local war companies, joined together to focus on corporate control over U.S. foreign policy. Groups in their coalition are planning protests during Tax Week all over the country. Find a list of all their actions at veteransforpeace.org/take-action/war-industry-resisters-network/events.

Keep it Simple – Stop Killing

By Chrissy Kirchhoefer

In the tragicomedy Rosencrantz and Guildenstern are Dead, the question emerges of when one first learned of death. The two attempt to recall when they first learned of their mortality. How one could hold such a heavy concept. It is difficult to contemplate and understand one’s own death but then to attempt to comprehend what a “nuclear winter” could involve—the possibility that humans could destroy themselves or make omnicide possible. Omnicide: the 20th century concept that was the “logical extension of suicide, homicide, genocide. Although it is a concept too final to even imagine, it must be taken seriously.”

Some who have taken that threat seriously in the U.S. include members of the Plowshares movement. One of the participants, Dan Berrigan, explained that we do not have peace because we do not have people who are willing to take similar risks as those who take up arms and kill. Dan’s words at the trial of a nuclear disarmament action still resonate: “The only message I have to the world is: We are not allowed to kill innocent people. We are not allowed to be complicit in murder. We are not allowed to be silent while preparations for mass murder proceed in our name, with our money, secretly. It’s terrible for me to live in a time where I have nothing to say to human beings except ‘Stop Killing.’ There are other beautiful things that I would love to be saying to people.”

The word for “Peace” is the same in Russian and Ukrainian

War devalues all life. It attempts to make some lives seem dispensable and others elevated. It has been challenging to witness images coming out of Ukraine and Russia and not feel one’s own life cheapened. Or to wonder about bombings elsewhere in the world that are not given attention. While it has long been said that truth is the first casualty in war, it is difficult to get reliable information especially with social media and the possibility of misinformation.

In recent years and with the rise of social media there has emerged the notion of the attention economy. It looks at what we can perceive and what actions we can take; sometimes “a wealth of information creates a poverty of attention.” The stories that we tell have great power and those in positions of power know that. The big lie that underlies war is the myth of scarcity — that people must compete.

One of the images that stood out over the past week was of Ukrainian men who were at a train station. The men were prevented from leaving, only women and children were allowed on the train. There was so much desperation and weariness expressed in the faces. They were informed they must remain and take up arms that were largely provided by U.S. taxpayer money.

Sometimes it is necessary to simplify the message in order to take action. The definition of economy simply means care of our home. It is about being responsible with the resources in our care. Some call into question the right of nuclear weapons to exist let alone to build a newer generation of more usable nuclear weapons. We have not even figured out how to clean up the first generation of the nuclear weapons waste.

I was thinking about war tax resisters who attempt to live in a world of their deepest imaginings. Those who realize that insatiable is not sustainable and who state that war is a racket and nuclear weapons are insane—trying to create the world in which we want to live and not allow the devaluing of life. People who realize what was expressed in the last line in the movie Don’t Look Up: “We really had everything, didn’t we?”

Counseling Notes:

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click on “Local Contacts & Counselors”).This training is usually offered once a year and the next training will be online in early 2022. If you would be interested in attending one of these trainings, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

Tax Day is Monday April 18

As of now, it seems unlikely that the IRS will extend its deadline for the filing and payment of federal income taxes.

IRS Making Progress & Receives Some Relief

IRS Commissioner Chuck Rettig stated in late March that the IRS should be completely caught up with processing tax returns by January 2023. In other words, just before the IRS needs to start processing next year’s tax returns, they should be finishing up tax returns for tax year 2022.

On March 15, President Joe Biden signed a $1.5 trillion omnibus spending bill that included a 6% increase to the IRS’s budget, $675 million more than allocated for fiscal year 2021. IRS Commissioner Rettig was glad to receive this funding, but reiterated that the IRS has been underfunded for decades and “needs help.” The original funding proposal in the spending bill would have given the IRS a IRS increase and Biden’s original Build Back Better bill would have provided the IRS $80 billion over the next decade. So the 6% funding increase is a very minor victory for the IRS.

Passport Renewal and a Payment Plan

As has been repeatedly noted in this column, when a U.S. citizen has a tax debt of $54,000 or more, the IRS is supposed alert the State Department that that citizen cannot receive a new passport. Though people on a payment plan should be able to receive a new passport.

In February, someone in our network had their passport renewal application revoked who met the debt criteria, but they also had a payment agreement with the IRS for which they were up to date with payments. This person sent proof of their payment plan to the passport application center and explained the situation in a letter. Within three weeks of sending the paperwork, they received their passport in the mail.

Passports and the Supreme Court

In this column, we have previously noted several circuit and appellate court cases in which people contested the loss of their ability to receive a new passport based on a “seriously delinquent tax debt.” In all these cases, the courts ruled against the plaintiff. One of these cases was appealed to the U.S. Supreme Court, which on February 22 denied a petition for review from Jeffrey T. Maehr (Maehr v. U.S. State Department). So for now, the Supreme Court is staying out of this issue.

Many Thanks

Thanks to everyone who donate to NWTRCC! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

We are very grateful to these WTR groups and alternative funds for their redirections

and Affiliate dues:

New England War Tax Resistance; War Resisters League

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. Thank you!

War Tax Resistance News

Conscience Matters

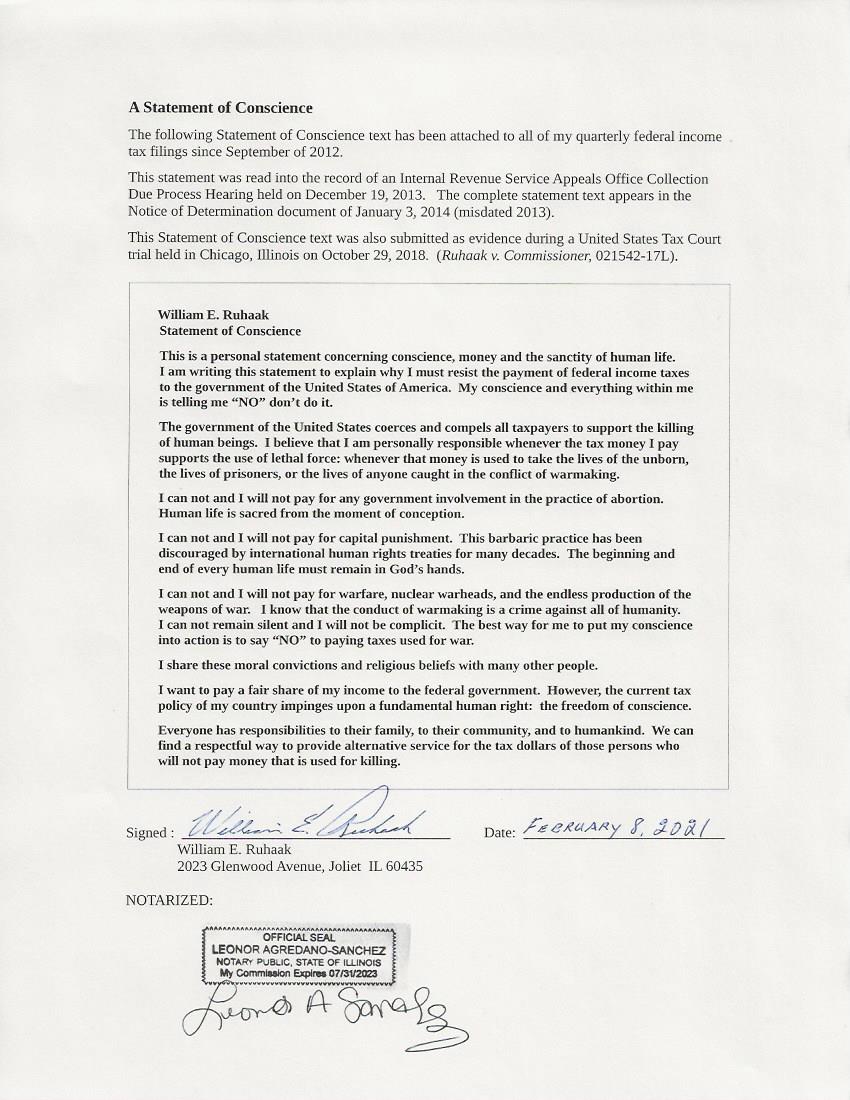

By William E. Ruhaak

Bill Ruhaak

I have been a war tax resister for many years. I withhold half of my income tax from the federal government and donate that amount to support the victims of war: refugees and veterans. I include a personal “statement of conscience” that explains my beliefs along with each tax payment. The federal government uses tax revenue to destroy human beings, which I consider an act of murder.

A copy of my “statement of conscience” appears below. Please take a moment to read it.

I have used IRS appeals procedures to communicate my reasons for withholding money from the government. And I have appealed several of the resulting IRS determinations into the federal courts. According to statute, “…[IRS] appeal procedures do not extend to cases because of moral, religious, political, constitutional, conscientious or similar grounds” (See: 26 CFR Section 601.106 (b)). I understand that a statement of conscience is considered “frivolous” for government taxing purposes. However, my actual statement has never been included in an IRS appeals determination document. And I am also aware that such personal statements of belief are not usually quoted in their entirety in various war tax resister court case rulings.

I pursued a simple objective in recent years: to ensure that my complete statement of conscience is included in an IRS appeals determination or in a federal court ruling. If my beliefs are automatically categorized as “frivolous” by the government, then my full written statement should be provided “on the record” and therefore available for anyone to see.

I was able to appeal an IRS determination into the U.S. Tax Court because of some technical ambiguities. Eventually there was a hearing and a trial in Chicago, Illinois. My day in court was a marvelous experience. A number of friends were with me for support wearing pins stating: “CONSCIENCE MATTERS.” Lincoln Rice, the NWTRCC coordinator, came by train from Wisconsin. It is such a blessing to know that I am not alone.

During the trial, the judge seemed to acknowledge that excluding my “statement of conscience” from the case record was an unnecessary violation of my first amendment right to freedom of expression. He allowed my complete written statement to be submitted as evidence. I would like to thank the court for treating me with respect, and I appreciate the work that was done by Judge Joseph H. Gale. Judge Gale’s decision can be found here: nwtrcc.org/PDFs/Ruhaak Tax Court Opinion.pdf

What is at stake here? The fundamental human right to publicly express an opinion or belief. And also the right to have a written expression of that belief included in government documentation for future reference.

If you are aware of other examples of similar statements that were included in IRS appeals determinations, or that were officially incorporated into court records, then I would like to know about them.

And if you have a personal “statement of conscience” concerning the payment of taxes that are used for war, and would like to make that statement public, then please contact me through NWTRCC. I am part of a group project that will bring many such written statements to the attention of international human rights review organizations.

Podcast “Tax Chats” Features War Tax Resistance

In early February, NWTRCC Coordinator Lincoln Rice was the featured guest on the podcast “Tax Chats.” The podcast is hosted by two university accounting professors, Scott Dyreng (Duke) and Jeff Hoopes (University of North Carolina). The episode focused on what it means to be a war tax resister, discussing the risks associated with not paying taxes and how the tax system is used by some as a tool for voicing opposition to government policies. The episode aired on 2 February 2022.

New England War Tax Resistance Online Panel

In the lead up to Tax Day, on Sunday March 27, New England War Tax Resistance (NEWTR) featured an online panel on war tax resistance. The panel included NEWTR members Mandy Carter, Mary Regan, and Larry Rosenwald as well as NWTRCC Coordinator Lincoln Rice. Lincoln began with sharing some background on war tax resistance and information about common methods practiced by resisters. The remainder of the panel then shared their individual war tax resistance stories and reasons for resisting. A Q&A followed in which some attendees asked technical questions and others shared their own war tax resistance stories. The session was attended by 25 people. A recording of the session can be found on NWTRCC’s YouTube page: youtube.com/nwtrcc.

NWTRCC Upcoming Events and News

NWTRCC National Conference:

Organizing for Systemic Peace

(29 April – 1 May 2022)

NWTRCC’s spring national conference will once again be online. The theme for the conference is “Organizing for Systemic Peace.” The conference will begin with a Friday evening social hour where participants will spend time in breakout rooms. Saturday will feature a “Panel on Vibrant Local WTR Groups,” speaking to starting a local war tax resistance group or keeping one active. There will also be a “Panel on WTR Outreach with Younger Activists,” who will share their thoughts on war tax resistance and outreach to younger folks. Both panel sessions will include plenty of time for discussion. The final time slot on Saturday will feature concurrent sessions of WTR 101 & 201.

On Sunday morning we will hold our business meeting, which is open to all. If you have a proposal you would like discussed at the business meeting, please send it to the NWTRCC office before April 15. Go to the NWTRCC website (www.nwtrcc.org) for full schedule and registration information.

Are you organizing an action, training, or gathering? Got a good photo of your war tax resister community in action? Keep us in the loop:

We’re all about building the community of resisters. We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (our Outreach Consultant): outreach@nwtrcc.org // Follow the journey + join us on all social media Instagram + Twitter:@wartaxresister // Facebook: National War Tax Resistance Coordinating Committee (NWTRCC)

Profile

I am a “Symbolic Resister”

By Shirley Whiteside

Shirley Whiteside

Back in December 2021, I wrote a letter to my 2 U.S. Senators — with no expectation — just a need to vent. I had written to both about U.S. Rep. Ilhan Omar and Sen. Rand Paul’s joint resolution that would have stopped the arms sale to Saudi Arabia for use in its war on Yemen. I never expect much but I thought this particular issue might have penetrating potential due to the objections by Democrats when President Trump brokered the deal. Of course, my senators both voted to carry on with the arms sale (now brokered by President Biden) and sent replies to me with no reference to the issue at all.

I know that in politics we don’t always get what we want. Politics is a dance of compromise and I’m a pretty good sport. But as I wrote to my not-forward-thinking Senators:

From my perspective those we have elected to Congress are owned by the military industrial complex. Otherwise why would “we the people” continue to promote wars and genocide in nations all over the world? So Raytheon (et al) gets what it wants… But our climate, and the refugee crisis, and the human crisis at home continue to deteriorate due to massive funding of the military industrial complex. It’s sick and I’m sorry you, undoubtedly a good person, have bought into this elephant in the room crisis.

So what are we, ordinary peace-loving citizens of the Empire to do? We have to stop paying for it. In my formative years I was a non-filer for many years. Some of that time I earned money that was under the table. When I had jobs with W-4’s I claimed a lot of withholding allowances and continued not to file. I would religiously figure out what I “owed,” donate it to a few worthy causes, and send everyone I knew a letter explaining why I was doing this. At two work places I learned from former co-workers that the IRS had come to seize funds after I had already left those workplaces. I never wanted to fight with the IRS, I just didn’t want to pay for war.

But at some point my lifestyle was a little less “Catholic Worker” and a little more “middle class.” I married, we owned a home. I reconciled that I wasn’t a good enough person to be a full-resister. The Empire was giving me a lifestyle not afforded to anyone else in the world. My personal solution was to begin to file a joint return with my partner, do W4 resistance so that less tax was withheld from my paycheck, and “pay under protest” while withholding a “symbolic” amount. Withholding $100, for us, meant we were throwing a little gravel in the machine—maybe more than $100 was spent sending out the letters and collection processes to mean at least that much wasn’t going to fund war, until the money is seized from us. Eventually, the IRS got that money. Once they just took it out of the 2008 stimulus payment; once my partner began receiving Social Security they seized it from his payment, once they’d gone through the process of sending letters and liens and adding interest and penalties. On $100 that’s not a lot.

I have never wanted to spend energy fighting with the IRS. The energy I have is about the evil that I am complicit in when planes and bombs stamped “Made in the USA” fly over other lands. I remember a Catholic nun community that used to have a button that said “I have family in Iraq” during one of the wars waged on Iraq. I remember friends visiting in El Salvador during the “civil war” and witnessing pieces of exploded ordinance stamped “Made in USAUSA.” U.S.-made cluster bombs—banned by international convention—dropped on people in Yemen. Love letters from our country.

I’m grateful for the resistance of those who feel the only way to resist the war machine is to not pay. I feel very positive about the years I spent as a non-filer. I am inspired by war resisters in other countries who pay high penalties with their very lives. But I’m not sure the movement can afford the “all or nothing” approach to WTR. I always appreciated the “$10.40 resistance” idea that I don’t think ever took off, but if everyone who is against this mindless endless war philosophy held back $10.40 from their taxes owed couldn’t the ship slowly sink? It’s completely do-able, and empowering.

Does symbolic resistance matter? It does to me. When it’s time to send the tax day letter, just the act of saying we’re still here and we still believe there has to be a way to peace matters.

Whiteside is also a committee member for the War Tax Resisters Penalty Fund, which offers to pay the interest and penalties of people who are collected on for war tax resistance. The fund does not pay the taxes, (the IRS just takes them) but it does provide for the interest and penalties seized from a war tax resister. A tax-filing citizen who’s able to ward off collection for more than 10 years has gotten what they want, they haven’t paid for war. A person who is collected on at least has this community of supporters to help make up the risk of their act of resistance. Together we are stronger. Go to nwtrcc.org/wtrpf/ for more information.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org