More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

June – July 2022

Contents

- Tax Day 2022 Reports

By Lincoln Rice and Chrissy Kirchhoefer - Pentagon Spending: Efficient at Destroying but Inoperable for Healing Our World By Chrissy Kirchhoefer

- Counseling Notes: Gig Workers Should Keep Track of Expenses • IRS Destroys “Information Return Documents” • Avoid Those Pretending to be the IRS

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- NWTRCC and WTR News: Report from NWTRCC’s May 2022 Conference • Young Activists Impress at NWTRCC’s May Conference • Teen Vogue Features War Tax Resistance • Our Next National War Tax Resistance Gathering & Coordinating Committee Meeting • 16th International Conference of War Tax Resistance and Peace Tax Campaigns

- In Memoriam — Joe Maizlish (1942 – 2022)

By Ed Hedemann” - Raffle Fundraiser for NWTRCC

Click here to download a PDF of the June/July issue

Tax Day 2022 Reports

By Lincoln Rice & Chrissy Kirchoefer

Tax Day was Monday April 18, 2022 and folks throughout the U.S. gathered around this date to raise awareness that close to half of federal income taxes are employed for war. They encouraged others to resist paying taxes and redirect money to community needs.

This tax season, NWTRCC also sponsored a “Refuse to Pay for War” Statement, which was signed by 74 people. Of those signers, 36 redirected a combined total of $80,150 to life-giving organizations. This amount does not include the tens of thousands of dollars redirected by the Northern California People’s Life Fund and the New England War Tax Resistance Alternative Fund. Although we would have liked more people to have signed the statement, it provided an avenue for many new people to come into contact with NWTRCC, some of whom joined local groups for Tax Day activities and some of whom we put in contact with local war tax resistance counselors.

Here is a slightly abbreviated account of Tax Day 2022 actions from our network. A link to the complete account with more pictures can be found at nwtrcc.org.

Berkeley, California

The People’s Life Fund redirected grants of $2,000-$5,000 each to fifteen exceptional Bay Area groups offering critical services in Northern California communities. They also hosted a virtual Granting Ceremony, where a spokesperson from each of these groups shared about their mission and work.

Those of us who challenge our national spending priorities lament the fact that the health, housing, and social services so desperately needed in this time of global crisis have been depleted over the years because so much of our taxes are devoted to militarism and war. As we struggle to address the magnitude of the Coronavirus epidemic, along with so many other health disparities here and around the world. We also know that the crisis of climate chaos deepens every day, and urgently needs to be addressed. The U.S. military is the single largest driver of climate change.

–People’s Life Fund

San Diego Bake Sale with prison activist Cheryl Canson and WTR Anne Barron. Photo Courtesy of Anne Barron.

San Diego, California

This Tax Day, the Peace Resource Center offered President Biden a way to pay for his huge war budget — a Bake Sale for the Air Force!

Local tax resister Anne Barron redirected her war taxes directly to support the work of prison activist Cheryl Canson. Canson’s work on prison reform is tightly connected to the escalating militarization of our society – our police, our schools, and our prisons.

–Anne Barron

Santa Rosa, California

A Tax Day vigil was held on Saturday April 9 in downtown Santa Rosa to expose the gross amount of federal funding dedicated to military spending and pass out pamphlets on war tax resistance. The response was mixed with multiple people driving by who yelled, “War is the answer!”

–Anita LaFollette

Colorado Springs, Colorado

At a busy downtown intersection over the noon hour on Tax Day, we had five folks hosting a penny poll, holding signs, and leafletting. We had a good response to our penny poll.

–Mary Sprunger-Froese

South Bend, Indiana

Michiana War Tax Refusers gathered from 4:30p to 5:30p across from the Federal Building on Monday, April 18. There were four of us, all war tax resisters. A reporter from the local paper came and did some in-depth interviews with several of us. I think that he understood why and how we engaged in war tax resistance and redirection. His story never made it into the paper, however. We had “Honk for Justice” signs on stands that we call surrogate vigilers. A number of cars honked when they went by. This is a high-traffic area during the time we are there. I brought copies of the War Resisters League pie chart leaflet but other than the reporter there was no foot traffic.

–Peter Smith

Brunswick, Maine

PeaceWorks held an annual Tax Day rally at the local post office with handouts speaking to federal budget priorities and to the connection between militarism and the climate crisis. We typically have conversations with a dozen or more people. We also participated with other groups at Bath Iron Works in the last of the Lenten Vigils there which fell on Tax Day. The intention was to raise awareness of the devastation that militarism causes our climate.

–Rosalie Paul of PeaceWorks

Boston, Massachusetts

Invest in Life not Death: A Tax Day March – On April 20th the Raytheon Antiwar Campaign and allies led a march through Boston’s Financial District to highlight the connection between big banks and their dealings with companies that profit from war and companies that profit from destroying the environment. First, the crowd met at the statue of Samuel Adams, Founding Father and Boston’s most famous tax protester! From there they marched to Blackrock, an investment company that owns 6.5% of Raytheon and 6% of Exxon/Mobil, blowing whistles and doing a little street theater. From there they participated in a die-in at JP Morgan Chase, a bank that loaned $6.5 billion to Raytheon Tech. and is the world’s largest lender to fossil fuel companies. After that the group went on to State Street Bank, the largest shareholder in Raytheon (9.4%), who also holds $121 billion in fossil fuel stock.

–Brian Garvey

Santa Fe, New Mexico

Two of us tabled at the Montañita Food Coop on Friday April 15 from 10am-1:45pm. Three people engaged enough to add their names to a mailing list. We also distributed quite a few recent and past newsletters, and other materials provided by NWTRCC. Unfortunately, I learned the day of the tabling that the coop does not allow tablers to approach individuals outside the coop, so future tabling will occur where we can approach people to let them know about WTR.

–Ginny Schneider

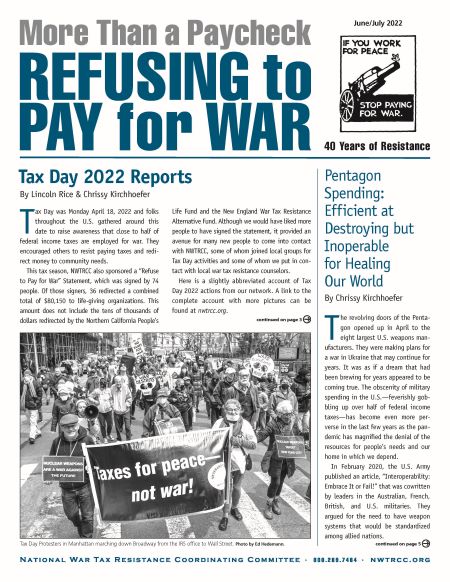

Tax Day Protesters in Manhattan marching down Broadway from the IRS office to Wall Street. Photo by Ed Hedemann

Manhattan, New York

The NYC Tax Day action this year grew into a bigger event than previous years. NYC War Resisters League, which includes many war tax resisters, traditionally holds a vigil at the IRS with other peace groups. This year we decided to add a march down to Wall Street to protest against war profiteers, and the coalition broadened to include Extinction Rebellion NYC (XR NYC) and other climate action groups. Tax Day fell within XR’s Spring Uprising week of actions when they were planning a series of direct actions, so Wall Street was a perfect target for them, too. About 80 activists came out for the rally with speakers and a performance by a new street theatre group, Rising Together Guerilla Theater. Then we took to the street for a lively march down Broadway, chanting “Money for Education Not for War,” etc., and holding up traffic for about 45 minutes until we reached the Charging Bull statue where XR activists were blocking the road with tripods featuring “NO WAR” and “NO WARMING” banners. Nine arrests took place downtown, but the police let us alone for the march down Broadway. Hopefully, we can broaden this coalition even more next year.

–Ruth Benn

Corvallis, Oregon

Veterans for Peace and Linus Pauling Chapter, Mid-Valley, Oregon held a Tax Day event. We asked the question, “The U.S. will spend $800 billion this year on militarism. How would you spend $800 billion to make the world better?” Twelve speakers and over 40 participants attended. Answers to this question fell into three major areas. First, three fourths of respondents emphasized one or more basic needs. Most noted were health care and housing. These were followed by education, food, child care, and student debt. Righting injustices was the next theme with just over one third of respondents wanting to help the needy, pay reparations to indigenous and black people, plus supporting refugees and world peace. Just under a third had environmental concerns about renewable energy, stopping the use of fossil fuels, and developing better infrastructure for electricity and transportation. Many volunteered to work on future actions to reduce taxes that support militarism.

–Bart Bolger

Eugene, Oregon

Our Tax Day event was fun! We held signs at a busy street corner in front of the federal building that has the local IRS office. It was a rainy day, but it did not rain during the event. It was great to see some folks we hadn’t seen since the pandemic started and we all enjoyed being together. Passersby honked and waved. It was a festive hour of activism.

On Earth Day, April 22nd, the last day of Passover, Jews and allies in Eugene, Oregon gathered in front of Chase Bank, the world’s largest banker of fossil fuels and one of the top financiers of Tar Sands oil, Arctic oil and gas, and fracking. Passover is a celebration of freedom.

We mourned the war in Ukraine and the loss of life, and we recognized how fossil fuels are funding the invasion of Ukraine (and how renewable energy can make us all safer). We delivered a letter to the bank manager and asked her to share the letter with Chase bank international to end their investments not just in Russian oil and gas, but in all fossil fuels. Our events were organized in collaboration with Dayenu and 350 Eugene.

–Sue Barnhart

Portland, Oregon

On April 15th, we held signs with a “burma shave” style rolling message on two of Portland’s busiest bridges for the benefit of morning commuters. The messages were about bloated military spending and the runaway military budget. A total of 11 volunteers participated, including folks from the War Resisters League—Portland and the Portland Raging Grannies.

–John Grueschow

King of Prussia, Pennsylvania

On Good Friday, retired United Church of Christ pastor Ken Trauger and H.A. Penner of Akron, Pennsylvania went to King of Prussia to witness along with others from the Brandywine Peace Community in front of Lockheed Martin, the world’s largest nuclear weapons contractor and war profiteer. Ken and H.A. held a banner saying “You Pay; Lockheed Martin Profits $” around the corner from the entrance to the plant where at least a dozen local police and security guards were stationed apparently to address whatever “good trouble” we might cause.

At that gathering of some 15 protesters, H.A. read the letter that he and his wife included with their 2021 federal income tax return indicating that they are redirecting 47% of what they owe to the peacebuilding activities of the Penner’s church. Several present risked arrest by temporarily blocking Lockheed Martin’s entrance. Eventually three moved forward onto Lockheed Martin property in an attempt to deliver a copy of the U.N. Treaty on the Prohibition of Nuclear Weapons to Lockheed Martin officials. They were stopped by Lockheed Martin security and the Upper Merion Township Police.

–H. A. Penner

Lancaster, Pennsylvania

Over the noon hour on Saturday April 16 in Lancaster’s square, I operated a Penny Poll with a couple of Peace Action Network of Lancaster colleagues. In anticipation of Tax Day, we gave passersby opportunities to vote on how they would like their federal tax dollars spent by putting 10 pennies into any of ten categories. Thirty-nine folks participated.

–H. A. Penner

Austin, Texas

A group called Nonviolent Austin, which is part of the Nonviolent Cities project of Pace e Bene, meets weekly in front of our capitol for a vigil. So we turned our Friday April 15 vigil into a Tax Day vigil and created a special banner for the occasion.

–Susan Van Haitsma

Brattleboro, Vermont

On Tax Day, members of Taxes for Peace New England tabled at the Brattleboro Food Co-op from 10am to 6pm. We were lucky to have good weather and many people visited the table to take brochures, ask questions, and engage in conversation. A couple people were particularly interested in how to resist if they held jobs where taxes were taken from the paychecks automatically. We also tabled at 350Brattleboro’s Earth Day Festival (4/22) where we focused our handouts on how war negatively impacts the climate.

–Lindsey Britt

Harrisonburg, Virginia

Several people from Community Mennonite and Shalom Mennonite organized a public War Tax Resistance/Redirection vigil at Love Park next to the Harrisonburg Farmer’s Market. At the vigil, some people literally or symbolically gave their redirected money to representatives from those organizations. Some read the letters they enclosed with their federal tax returns stating what they are doing and why—or just spoke from their heart of personal experiences. Others distributed pie chart leaflets showing the percentage of federal outlays going to military spending for 2022—about 48 percent.

Since these are times that try hearts and minds, we promoted war tax redirection and non-violent civil resistance as a better method of dealing with conflict, recognizing that we are not the first in history to experience such dilemmas. We also distributed half-page leaflets listing many examples and resources for people to explore if they so choose. It was good to have been part of this.

–Rick Yoder

Milwaukee, Wisconsin

Casa Maria Catholic Worker and Milwaukee War Tax Resisters held a vigil to protest federal tax dollars for war and environmental harm the two Saturdays before Tax Day. On April 9th, we vigiled outside the U.S. Army Reserve and on April 16th we vigiled on the corners of North Avenue and MLK Jr. Drive.

–Lincoln Rice

Pentagon Spending: Efficient at Destroying but Inoperable for Healing Our World

By Chrissy Kirchhoefer

The revolving doors of the Pentagon opened up in April to the eight largest U.S. weapons manufacturers. They were making plans for a war in Ukraine that may continue for years. It was as if a dream that had been brewing for years appeared to be coming true. The obscenity of military spending in the U.S.—feverishly gobbling up over half of federal income taxes—has become even more perverse in the last few years as the pandemic has magnified the denial of the resources for people’s needs and our home in which we depend.

In February 2020, the U.S. Army published an article, “Interoperability: Embrace It or Fail!” that was cowritten by leaders in the Australian, French, British, and U.S. militaries. They argued for the need to have weapon systems that would be standardized among allied nations.

Image of NATO protest in Chicago from Steve Rhodes on Flickr

Another part of the document spoke of gauging levels of ambition: “Interoperability requires nations to spend money, take risk and cede sovereignty in order to increase legitimacy, cohesion, mass and agility.” That seemed to have been the previous U.S. presidential administration’s continued refrain to NATO members that they needed to pay more of their GDP towards defense spending.

Following World War II, many western European countries’ military budgets invested more of their taxes or collective resources toward the needs of their populations and less on military spending. The world has witnessed a dramatic reversal of that trend with Germany making a jump from #7 in military spending to #3 as well as reversing its ban on exporting weapons. In the article “Waltzing to Armageddon,” Chris Hedges notes how U.S. military spending will help recruit Eastern European nations to join NATO and will fast track conversion to NATO weapons and technology. Long standing neutral nations of Sweden and Finland are considering joining NATO—adding additional impetus for a global war.

While some may have notions of U.S. exports being McDonalds and Levis, the number 1 export of the U.S. has long been weapons. Now it appears as if we are attempting to convince our allies to adopt the McDonaldization of our militaries and create standard systems, munitions, and fuels. The only country to use nuclear weapons is calling for new standardization and efficiencies of delivering death.

Some have questioned the increasing amounts of our collective resources going toward the Pentagon, especially with the removal of troops in Afghanistan after 20 years and the lack of resources during the pandemic. Nevertheless, war fever has been catching and spreading the world over, trying to rob us of our money, the lives of “others,” and our collective imaginations. Know that every day is a great day to speak out about military spending and that there is a vast worldwide network of others who share your concerns!

Counseling Notes:

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click on “Local Contacts & Counselors”). The next counselor training will be online in early 2023. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

Gig Workers Should Keep Track of Expenses

Previously, some gig workers only received a 1099-K if they had total sales of at least $20,000 and/or more than 200 transactions in a tax year. Gig workers who do not receive the 1099-NEC (e.g., sellers on eBay) did not have income reported to the IRS unless it hit the $20,000/200 threshold for the 1099-K. This tax year, gig workers will receive a 1099-K if they earned $600 or more.

A Treasury Inspector General for Tax Administration audit found that nearly 104,000 nonfilers had income totaling $3 billion in Form 1099-K income that was not reported to the IRS under the old rule. The new rule will help the IRS identity many of these individuals and increase tax revenue without increasing taxes. A 1099-K form does not necessarily denote net income. The amount on the 1099-K form represents gross income and reimbursements. Only net income is taxable.

IRS Destroys “Information Return Documents”

The IRS intentionally destroyed thirty million “information return documents” in March 2021. Information return documents include W-2s and 1099s that report amounts and sources of income. The agency relies on such documents to verify the accuracy of tax returns and to determine the need for an audit. This could also make it harder for the IRS to file garnishments and liens if they destroyed information regarding sources of income and the names of financial institutions where money is kept.

Avoid Those Pretending to be the IRS

First contact by the IRS for a tax debt is almost always by mail to one’s last known address. In certain instances, IRS revenue officers may make unannounced visits to one’s home or work, but they will only request payments be made to the U.S. Treasury.

The IRS will never: (1) Send text messages or contact people through social media. (2) Demand immediate payment using a prepaid debit card, gift card, or wire transfer. (3) Threaten to immediately bring in local police or other law enforcement groups to have you arrested for not paying. (4) Demand that taxes be paid without giving taxpayers the opportunity to question or appeal the amount owed. (5) Call unexpectedly about a tax refund.

Many Thanks

Thanks to everyone who donate to NWTRCC! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

We are very grateful to these WTR groups and alternative funds for their redirections

and affiliate dues:

People’s Life Fund of Northern California; Boulder War Tax Info Project

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. Thank you!

NWTRCC and WTR News

Report from NWTRCC’s May 2022 Conference

NWTRCC held its fifth online conference April 29 to May 1, 2022. About 40 people attended the conference, which began on Friday evening with a social hour.

There were two panels on Saturday. The first was a “Panel on Vibrant Local WTR Groups,” featuring H. A. Penner of 1040 for Peace in Pennsylvania, Ginny Schneider who has been an active WTR organizer in Maine and New Mexico, and Kathy Labriola of Northern California War Tax Resistance / People’s Life Fund. A recording of this panel can be found on NWTRCC’s YouTube page (www.youtube.com/nwtrcc).

The panel on vibrant local WTR groups included Kathy Labriola of California (top left), H. A. Penner of Pennsylvania (top right), and Ginny Schneider of New Mexico (bottom left).

The second was a “Panel on WTR Outreach with Younger Activists,” which is featured in the next article. Saturday concluded with concurrent WTR 101 & 201 sessions.

The Sunday business meeting began with reports from both NWTRCC consultants (Coordinator & Outreach consultant) and a financial update (which included news about NWTRCC’s first fundraising raffle. (See the last article of the newsletter for more information.)

Next, we unanimously approved the nominations of Shirley Whiteside (Colorado) and Travis Christian (Oregon) to begin serving three-year terms on NWTRCC’s Administrative Committee. (A huge thank you to both Sue Barnhart and Jerry Maynard, who finished their three-year terms!)

The conference included attendees from Vancouver BC Canada and Geneva as well as folks from all over the United States. It was great to host such great panels with panelists from all over the country. It would be better meeting in person, but I am glad we were able to make the best of what technology has to offer.

Young Activists Impress at NWTRCC’s May Conference

One of the panels at our May conference featured two young activists who had participated in NWTRCC’s focus group sessions a couple years ago. Their presentations sparked a lot of conversation. Here is some of the feedback the panelists provided about how NWTRCC currently performs outreach and areas for growth.

One theme that came forward was that war tax resistance should be promoted as a tactic rather than as an ethical or moral responsibility. The former can empower while the latter can bring shame. They also emphasized the importance of social media, especially Twitter, Instagram, and TikTok. NWTRCC uses Twitter and Instagram, but not TikTok, which they promoted as an avenue to reach younger activists by sharing short stories to allay fears and inspire resistance.

Lastly, they stressed the importance of anti-racism training for our network. They noted that these trainings provide a language that is used by younger activists. Even if one does not agree with all the concepts and ideas taught at a training, it is important to know the language used by younger activists today.

Teen Vogue Features War Tax Resistance

Teen Vogue Features War Tax Resistance

In mid-May Jacqui Germain penned an article entitled, “Economic Disobedience: What Is It and How Does It Work?” for Teen Vogue. It concluded with a few paragraphs on war tax resistance and included a link to NWTRCC’s website. You can find the article by searching the title online.

Mark your Calendars!!!

Our Next National War Tax Resistance Gathering & Coordinating Committee Meeting

As of this printing, our next national conference will be online November 4-6, 2022. Meeting in person is definitely preferred, but we also want to ensure that our next meeting does not put anyone in harm’s way. During our Sunday business meeting, concerns were raised about traveling safely and affordable sleeping arrangements that allowed for social distancing. If you are interested in hosting the May 2023 NWTRCC meeting, let us know!

16th International Conference of War Tax Resistance and Peace Tax Campaigns

Organized by Conscience and Peace Tax International, this conference will take place in Geneva from Friday 16th to Sunday 18th September 2022. This conference has been planned to coincide with the UN Human Rights Council session at which we expect a resolution on conscientious objection to military service. (Both the resolution and the conference were postponed from September 2021). There will be a possibility before and after the conference to attend the sessions. For more information, go to peacetaxinternational.org/conf/2022.

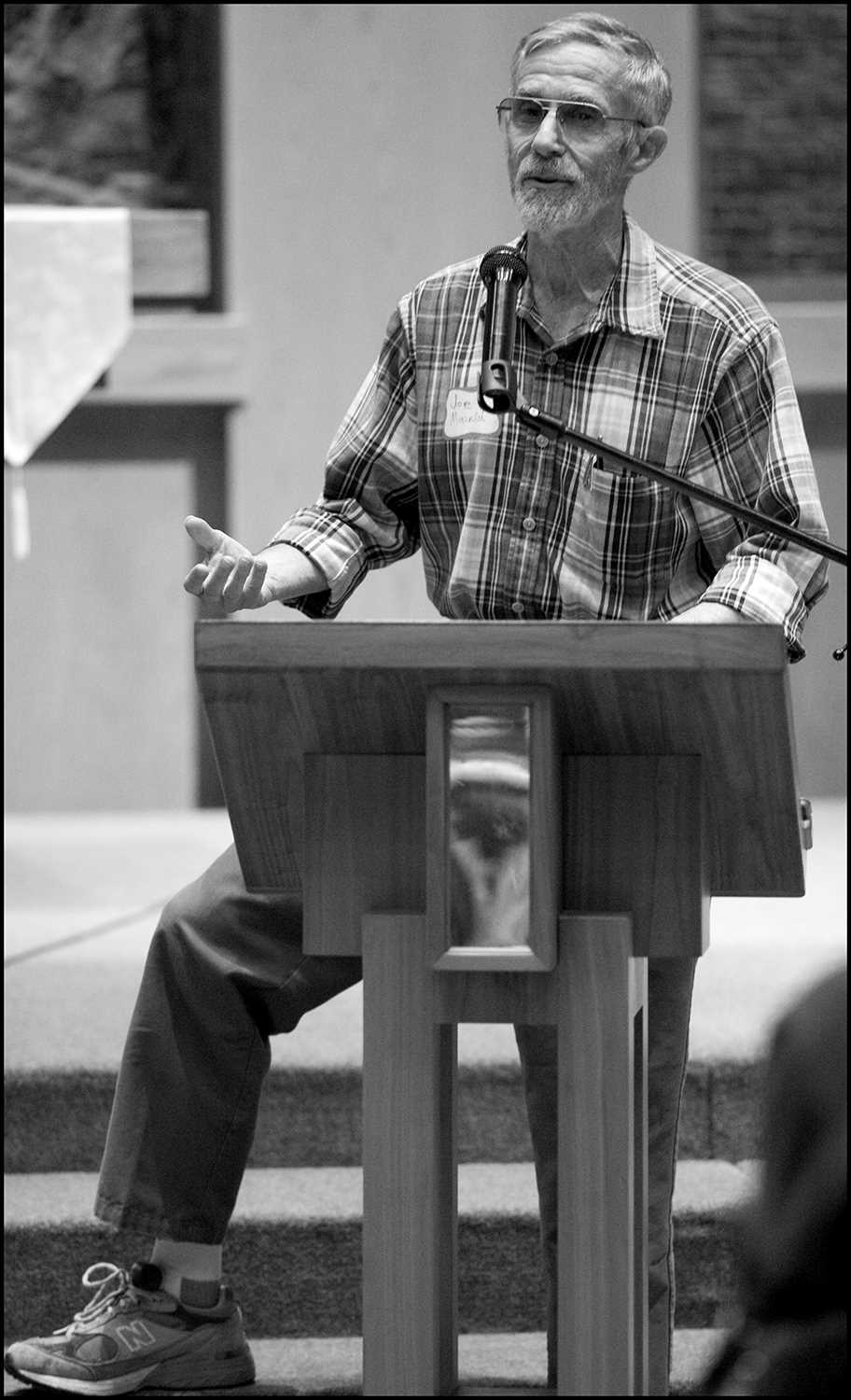

In Memoriam — Joe Maizlish (1942 – 2022)

By Ed Hedemann

Long-time war tax resister Joe Maizlish died from pancreatic cancer in Los Angeles on March 16—two weeks short of his 80th birthday.

A marriage and family therapist by profession (often dealing with prisoner issues), Joe was a thoughtful, analytical, intense, and deeply committed pacifist and nonviolent activist. “My way has been to study what makes people vulnerable to being swept away by the war panic, or by fears, in a way that results in belligerence, or division. That’s what moved me to study psychology—to look for the underlying problems which keep sprouting the surface ones.”

Besides openly refusing taxes for war, beginning in 1966 with the telephone tax, he resisted the draft. In 1962, Joe met David McReynolds of the War Resisters League (WRL) who was in Los Angeles for a speaking engagement. Three years later, Joe became an antiwar activist following the Gulf of Tonkin incident and U.S. bombings of north Vietnam. Joe finally realized he could never participate in the war and needed to undertake direct action, so in 1967 he became a “draft criminal” by giving up his student deferment and returning his draft card to the Selective Service System. A few months later in 1968, he refused induction, was indicted, convicted, and sentenced to three years in prison, serving two and a half.

He recounts the story of his resistance in the recently released The Boys Who Said NO! Following a panel discussion after the film’s premiere, Joe commented in an email, “I heard Daniel [Ellsberg] and David [Harris] wondering/talking about whether future wars could be stopped/prevented. But U.S. wars are being waged (and raged) all the time, usually by proxy, and there’s also the social atrocities being done in the U.S. I think they are working with a very narrow definition of ‘war.’ WRL broadened its understanding long ago.”

He was also a local organizer for WRL, co-founding the Los Angeles (later Southern California) WRL chapter in 1976 and remaining its contact through the 2010s. During this period, Joe went out of his way to highlight accomplishments of other WRL local activists, such as Franklin Zahn who, in 1951, became the first telephone war tax resister when he refused the 15% federal excise tax on phone service because of the U.S. war in Korea.

In 2020, Joe suggested on a WTR-listserv post that rather than cut military spending, “How about just keep on paying [Pentagon employees]… on condition the people don’t do the military work, the military adventures, invasions, occupations, production, and that they keep passing along what they’re paid by spending it as they have been, and use their time figuring out what work their communities need done and get busy with that… Unwieldy you say? Yes, it is, but no more unwieldy than the deadly unwieldiness of the current uses of [military] spending.”

Following his diagnosis, Joe was remarkably stoic and analytical, commenting last October, “I’ve decided to call my encounters with cancer (I’ve had a couple earlier ones) ‘conversing’ with cancer, rather than the conventional warlike ‘battling cancer.’ A resistance friend says ‘cancer, we hate it.’ I agree, and I believe that even if we’re at times ‘battling,’ there ought to be alongside that the negotiation aspect.”

And in a late December email, “I’m a little worried by the number of people who have said they will pray for me. I accept and feel supported by the good will they are expressing in their way, odd as their way seems. I’m ‘worse’ than an atheist in their terms; I’m what I call an ‘apatheist,’ meaning I don’t care!”

Joe lived in Los Angeles and is survived by wife Sarah Forth, who, for the seven weeks until his death, frequently updated family and friends about his condition with posts on CaringBridge.

Raffle Fundraiser for NWTRCC

Wally and Juanita Nelson in front of their cabin, The top raffle prize is a stay at a Woolman Hill cabin, which is less than 100 yards away.

To make the May 2022 appeal a bit more fun and interesting, NWTRCC’s Fundraising Committee has organized a raffle. No donation is required to participate in the raffle, but we would appreciate your financial support. NWTRCC is only able to continue because of every donation it receives—both large and small.

To be entered in the raffle, simply fill out the raffle tickets and mail them back to NWTRCC… hopefully with a donation. If you normally donate online using PayPal or Resist, just email the office (at nwtrcc@nwtrcc.org) letting us know you would like to be entered into the auction, and we will fill out a sheet of tickets for you. A sheet of raffle tickets with a full list of prizes can be found at nwtrcc.org. Feel free to make copies of the tickets and hand them out to friends. Tickets need to be received by the time the drawing occurs on June 30.

We are very thankful to all those folks who donated something for the raffle. Our top prize is a 2-night stay in a cabin at Woolman Hill, which hosts the Nelson Homestead. Even if you do not win the top prize, making a pilgrimage to the Nelson Homestead might be something to consider at some point. The powerful peacemaking witness of Wally and Juanita — cofounders of the modern war tax resistance movement — is wonderfully displayed at their homestead. You can also take a virtual tour at nelsonhomestead.org. Other prizes include a 2-night stay at the Celo Inn in the Blue Ridge Mountains of North Carolina, NWTRCC swag, one-on-one skill shares, an integrative body work session, and more.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org