National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

October – November 2024

Contents

- NWTRCC Gathering on Zoom

November 8-10, 2024

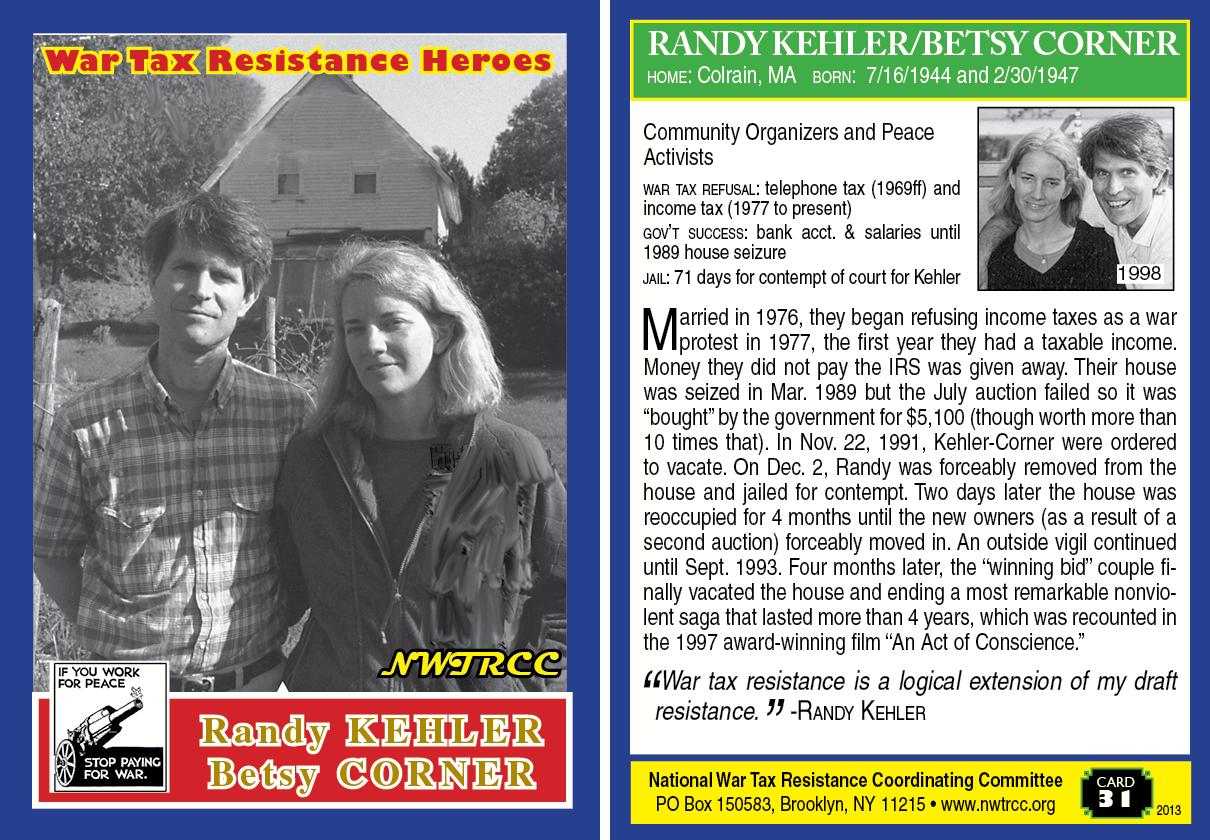

By Lincoln Rice - Remembering Randy Kehler:

A True Radical and Person of Conscience

By Aaron Falbel - Counseling Notes: Warning of Future Levy Letters • Warning of Future Lock-In Letter • Notice LT40 – The IRS Intends to Contact Others…

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Network News and Outreach Reports: Pax Christi Hosts WTR Session • WTR 101 at Midwest Catholic Worker Gathering • Mike Levinson spreading War Tax Resistance

- Good Grief? By Chrissy Kirchhoeffer

- Randy Kehler, 1944-2024

By Ed Hedemann - In Memoriam – Rod Nippert

- Profile: My Letter to the IRS

By Lorin Peters

Click here to download a PDF of the October/November issue

NWTRCC Gathering on Zoom November 8-10, 2024

Attending a NWTRCC Conference on Zoom provides flexibility. Photo by Ed Hedemann

By Lincoln Rice

NWTRCC’s November 2024 conference will be on Zoom the weekend after the election. We often meet the first weekend in November, but we know that many of our members will be canvassing and and doing other pre-election activities.

Friday Night Social

Mary Sprunger-Froese of Colorado Springs will gather us together with three songs having a war tax resistance / anti-war theme. Then, there will be two separate 25-minute breakout sessions. In each breakout session, participants will be randomly placed in groups of five people. Each group will be given a set of questions aimed toward folks getting a chance to know one another, share resistance stories, and share thoughts on future resistance based on the results of the November election. This session provides an opportunity for participants to chat with one another, something that is often missing in large online gatherings.

Saturday Sessions

Saturday morning will begin with a “Memorial & Future Meetings Discussion.” We will reserve the first half hour of this session to remember those war tax resisters who have recently passed away. During the last hour of the session, we will discuss different options for future NWTRCC gatherings. For most of NWTRCC’s history, local groups hosted meetings. Even though we have seen a recent resurgence in war tax resistance, this has not led to a resurgence of local groups. Some recent NWTRCC gatherings have been on Zoom simply because we could not find an in-person host.

Saturday morning will begin with a “Memorial & Future Meetings Discussion.” We will reserve the first half hour of this session to remember those war tax resisters who have recently passed away. During the last hour of the session, we will discuss different options for future NWTRCC gatherings. For most of NWTRCC’s history, local groups hosted meetings. Even though we have seen a recent resurgence in war tax resistance, this has not led to a resurgence of local groups. Some recent NWTRCC gatherings have been on Zoom simply because we could not find an in-person host.

Our second session will be “Creative Outreach,” and feature a panel who have incorporated creative forms of WTR and social justice outreach in their communities and on college campuses. Please bring your own stories of creative outreach to share.

After a short break, Paula Rogge will be leading a one-hour session on “Outreach to Peace Churches.” This session is geared toward members of Peace Churches to discuss garnering support (financial and otherwise) for war tax resistance.

We will then have our concurrent WTR 101 and 201 sessions. Lastly, we will then close the day with “Organizing a War Tax Resistance 101 Session.” This session will be very helpful for those interested in hosting a WTR 101 in their area. If you are already comfortable hosting a WTR 101, you can share your own thoughts in addition to hearing those of others. The panel will feature our friends in New York City and Portland, Oregon, who regularly host WTR 101s.

Sunday Business Meeting

As always, we will hold our business meeting on Sunday morning (11-2p Eastern / 8-11a Pacific). At this meeting, NWTRCC will discuss and reach consensus on its objectives and budget for 2025. We will also discuss any proposals from the larger network. If you have a proposal that you would like to have considered at this meeting, please send it to the NWTRCCC office before October 21st. This will give ample time for the proposal to be discussed online by people that may not be able to attend in person.

Logistics

To register for the conference, go to nwtrcc.org and you will see a link to our registration page. To help offset NWTRCC expenses, we are requesting a $10 registration fee, but no one will be turned away.

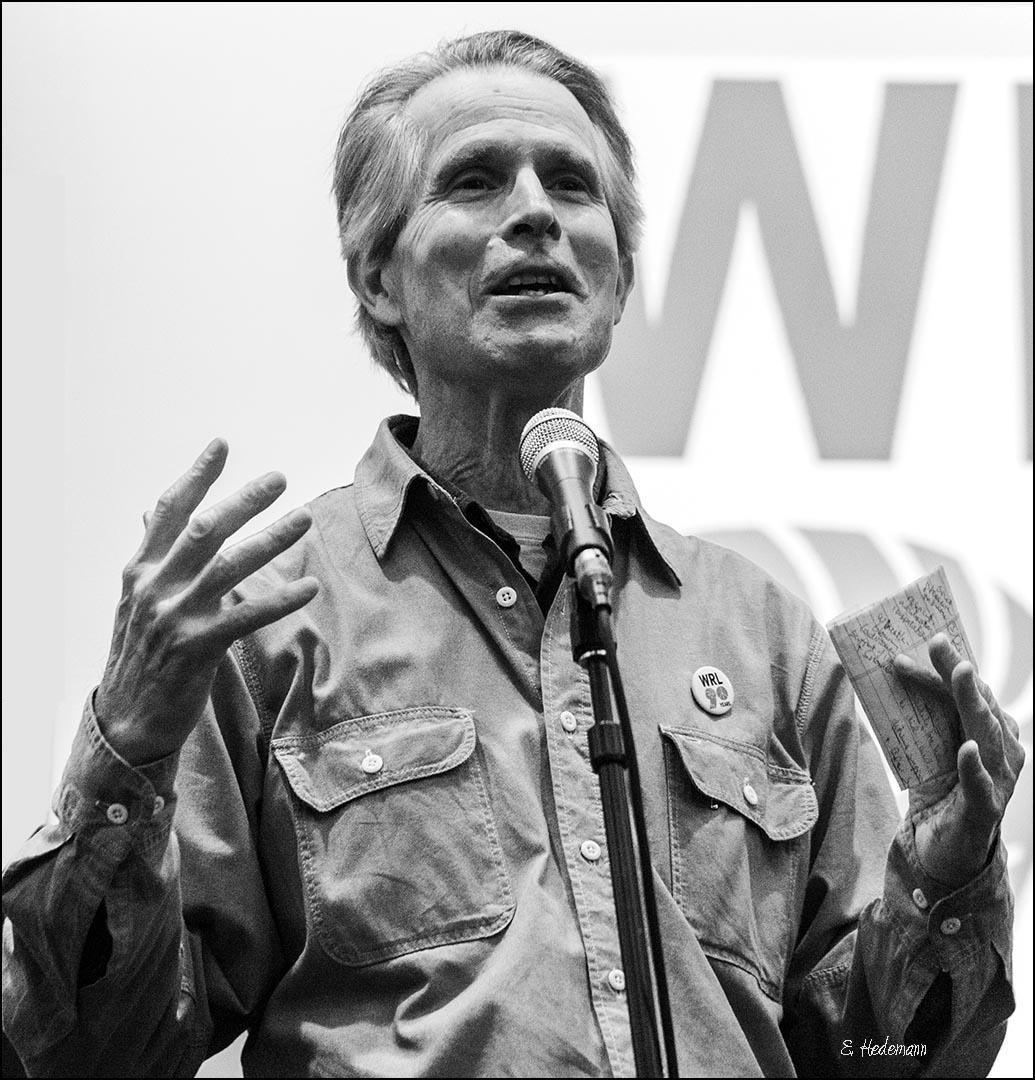

Remembering Randy Kehler: A True Radical and Person of Conscience

By Aaron Falbel

[Editor’s Note: This article was first published in the Greenfield Recorder on July 27, 2024.]

Randy speaking in 2013. Photo courtesy of Ed Hedemann

Randy Kehler was one of the most compassionate, kind, caring, and decent human beings I have ever known. Even those who disagreed with his politics — and there were many — could not help but like him personally. He was a person who radiated goodness, honesty, respectfulness, and integrity.

Some might say that he achieved few concrete results during his long career as an organizer and activist. We still live in a militaristic society that too frequently sees war as the answer, and we continue to be the world’s largest arms merchant. We still are armed to the teeth with nuclear weapons, and the Doomsday Clock ticks ever closer to midnight. We still do not have clean and fair elections, and things got worse after the infamous Citizens United decision. At times, Randy described himself as a Don Quixote figure, tilting at windmills and dreaming the impossible dream.

But that is not the whole story. Randy might not have achieved the concrete results he was after, but his actions had enormous ripple effects that penetrated far and wide. More than once, those ripples changed the course of history. Whistleblower Daniel Ellsberg famously asserted: “No Randy Kehler, no Pentagon Papers.” Randy’s organizing around the nuclear weapons freeze, which included the largest political demonstration in this country’s history, on June 12, 1982, had ripple effects that penetrated the Reagan White House, and Reagan’s nuclear saber-rattling noticeably softened during his second term — a major shift. This paved the way for several landmark nuclear arms reduction agreements with the Soviets. It is not out of place to say, “No Randy Kehler, no INF or START treaties.” We were brought back from the brink.

Randy would have been the first one to admit that his life was not about achieving results. It was about taking a stand. He derived much comfort from this quote by Thomas Merton: “Do not depend on the hope of results. You may have to face the fact that your work will be apparently worthless and even achieve no result at all, if not perhaps results opposite to what you expect. As you get used to this idea, you start more and more to concentrate not on the results, but on the value, the rightness, the truth of the work itself. You gradually struggle less and less for an idea and more and more for specific people. In the end, it is the reality of personal relationships that saves everything.”

I ask myself, why was it that he had these huge ripple effects? I think it was because of the type of person he was. He was a true radical, in the sense of someone who goes to the root of things. He was a person of conscience, a person who listened to that inner voice that told him what was right and wrong. That integrity, that sincerity earned him a certain respect and dignity that was impossible to ignore. It was palpable. It affected Ellsberg profoundly and obviously many others. It affected me. Aware of his own ripple effects, he often said to people, especially to young activists, “Don’t ever, ever assume that anything you do, particularly if it’s an act of conscience, won’t make a difference.” One never knows who might be listening or watching.

He also possessed a keen intelligence that kept him focused on what really mattered. He went straight to the heart of the matter, wherever he trained his attention. I have been in many meetings together with Randy, and one could always count on him to say something truly profound, insightful, and brilliant. He saw things so clearly. His moral compass was finely tuned and always on the mark.

Randy was the main person who brought the legendary peace and civil rights activists Wally & Juanita Nelson here to western Mass. (One could say, “No Randy Kehler, no Nelsons on Woolman Hill.”) They remained lifelong friends, but they also had their disagreements, especially during the seizure of Randy & Betsy’s house in Colrain by the IRS as a consequence of their refusal to pay taxes for war. The Nelsons espoused uncompromising noncooperation, for which they were famous, but Randy saw things somewhat differently, with more nuance. He once wrote a short statement called “Nonviolence is also…” that was meant as a coda to Wally’s own statement on nonviolence, with which Randy totally agreed, but he felt there was more to be said. That additional statement, that “also,” is simply beautiful and is what I call “compassionate nonviolence.”

Compassion was his middle name. Randy had a unique ability to stand by his principles yet also place himself in the shoes of his adversaries, to understand that they also had “a piece of the truth.” It’s so easy for activists, whether nonviolent or not, to say, I know I’m right and you’re wrong, so to hell with you! That’s not who Randy Kehler was. He strived to “listen with the ear of his heart,” to listen compassionately and with humility. This is so important, especially in these polarized times, and I will carry this lesson with me to the end of my days.

It sounds somewhat trite to say so, but Randy was one of my heroes. He was someone I would always look up to, yet at the same time he was very down-to-earth. He took an interest in you, a genuine interest that was not fake. He was the best friend a person could ask for, and he was a person who had many, many best friends.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2025. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org.

Warning of Future Levy Letters

Throughout the summer, we regularly heard from long-time resisters that they have been receiving the IRS’ Notice of Intent to Levy, Notice CP504, which is normally sent by certified mail and requires a signature to receive it. This letter is the final notice before the IRS may take enforcement action, such as levying bank accounts or garnishing wages. It does not mean that a levy will happen, it simply gives the IRS the option to levy at some point in the future. Legally, the IRS cannot levy for a tax year before sending out this letter.

Some resisters have received this notice for years before COVID and others have received it for more recent tax years, including tax year 2023. Thus far, none of these recent CP504 letters have resulted in levies or garnishments for the indicated tax years. If you receive one of these letters or are levied, please contact the NWTRCC office and let us know.

Warning of Future Lock-In Letter

Lock-in letters are correspondence from the IRS to one’s employer that adjusts one’s federal income tax withholding from one’s paycheck. This is different from a levy or garnishment in that its purpose is not to collect unpaid taxes from a previous tax year, but to withhold the correct amount of federal income tax during that current year so that no tax is due at year’s end.

The last time anyone in our network received a lock-in letter was in 2018 when the previous W-4 form was still in use. In mid-September, someone in our network let us know that they had received IRS letter 2802C. In this letter, the IRS asks you to voluntarily adjust your W-4 form. If you do not, the IRS may send your employer a lock-in letter to increase your federal tax withholding at some point (a couple months, a year, or never). If your employer receives a lock-in letter at some point, you will be given a short period of time to justify legitimate deductions to prevent over-withholding.

Lastly, the resister who received this warning letter was a nonfiler. To the best of this person’s knowledge, the IRS has not filed on their behalf for any previous tax years. Before being able to garnish wages or levy a bank account, the IRS would first have to determine the amount of tax owed by filing for the nonfiler. Sending a lock-in letter is a type of work around since it is not a garnishment, but simply a correction to someone’s W-4 form to collect the correct amount of tax for the current year.

Notice LT40 – The IRS Intends to Contact Others…

In August and September, a couple longtime war tax resisters let us know they received IRS Notice LT40, which states the IRS intends to contact other people about their tax debt. This could include employers, friends, family, neighbors, etc. The mailing of this notice gives the IRS permission to contact others about your case for up to one year from the date of the notice, though nothing prevents the IRS from sending you another Notice LT40 in the future. If they do contact a third party, the IRS is supposed to send you a list of who they contacted once each year. If you do not receive a list, they probably did not contact anyone. At the end of the day, the IRS is hoping to either embarrass the resister into paying or determine possible targets for garnishment or levy. Please let NWTRCC know if you receive such a notice and if they actually follow up with contacting anyone.

Many Thanks

Thanks to each of you who donate to NWTRCC! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loop

We’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.org

Donate by Venmo

NWTRCC now accepts donations by Venmo! We still accept donations by check, PayPal, and credit/debit card using PayPal. Also, tax deductible donations can be made by check or credit/debit card using one of our fiscal sponsors. For more information on all the ways you can donate to NWTRCC, go to nwtrcc.org/donate.

Network News and Outreach Reports

Pax Christi Hosts WTR Session

Pax Christi USA held their annual meeting on Zoom the first weekend of September 2024 and their Nuclear Disarmament Working Group hosted a session on war tax resistance. NWTRCC Coordinator Lincoln Rice joined them to share the nuts and bolts of war tax resistance. Before Lincoln spoke, longtime war tax resisters and Pax Christi members Judith Kelly and Lorin Peters shared about their motivations and experiences at war tax resisters. In addition to sharing that she began resisting taxes in 2000, Judith shared many of her other peacemaking activities, including spending three months in prison for protesting at the School of the Americas. Lorin’s father was recruited to the Manhattan Project in the 1940s, so his personal history had a strong connection to the working group’s theme. (Lorin’s letter to the IRS is featured on page 8 of this newsletter.) Sixteen people attended the working group’s session and the attendees were very interactive with great questions and comments.

Pax Christi USA held their annual meeting on Zoom the first weekend of September 2024 and their Nuclear Disarmament Working Group hosted a session on war tax resistance. NWTRCC Coordinator Lincoln Rice joined them to share the nuts and bolts of war tax resistance. Before Lincoln spoke, longtime war tax resisters and Pax Christi members Judith Kelly and Lorin Peters shared about their motivations and experiences at war tax resisters. In addition to sharing that she began resisting taxes in 2000, Judith shared many of her other peacemaking activities, including spending three months in prison for protesting at the School of the Americas. Lorin’s father was recruited to the Manhattan Project in the 1940s, so his personal history had a strong connection to the working group’s theme. (Lorin’s letter to the IRS is featured on page 8 of this newsletter.) Sixteen people attended the working group’s session and the attendees were very interactive with great questions and comments.

WTR 101 at Midwest Catholic Worker Gathering

14 September 2024 – NWTRCC consultants Lincoln Rice and Chrissy Kirchhoefer led a WTR session at the Midwest Catholic Worker Gathering outside Preston, Iowa. There were nine of us at the session, including longtime war tax resister Karl Meyer of Nashville Greenlands. Most of the attendees were newer to war tax resistance. Throughout the weekend, Lincoln and Chrissy also had conversations with others who had previously attended a WTR session and had follow-up questions and concerns as their individual situations had changed.

— Report from Lincoln Rice & Chrissy Kirchhoefer

Mike Levinson spreading War Tax Resistance

Mike Levinson at a recent protest. Photo by Andrew Courtney

I brought the message of the War Resisters League to our weekly peace vigil in downtown Hastings on Hudson, New York on Saturday August 17, 2024, hosted by Concerned Families of Westchester. “One of the most effective ways to stop war is to deprive the war makers and politicians of the guns and money they need to wage war!”

— Mike Levinson

Good Grief?

By Chrissy Kirchhoefer

Seventy-nine years ago, the US unleashed the most powerful weapon known to humankind. The devastation of “Little Boy,” a uranium bomb rained down on Hiroshima killing an estimated 140,000 people, mostly civilians. Three days later the US dropped the second bomb “Fat Man” made of plutonium which was ten times more powerful and took the lives of 70,000. The US War Department wanted to test the different design to see which was more effective. Part of the lower casualties may have been a result of evacuations of Nagasaki after the US dropped pamphlets throughout Japan stating:

We are in possession of the most destructive explosive ever devised by man. A single one of our newly developed atomic bombs is actually the equivalent in explosive power to what 2,000 of our giant B-29s can carry on a single mission. This awful fact is one for you to ponder and we solemnly assure you it is grimly accurate.

There were many conscientious objectors (COs) to World War II worldwide. One was Franz Jagerstatter, whose father was killed in World War I. Franz was executed on August 9, 1943 in Germany after refusing to kill for the Nazis. There were also many COs who were imprisoned in the US. One was James Otsuka who was previously interned in a War Relocation Center. Prior to being sentenced to three years in prison he stated:

As a general rule I obey the law. I feel that it is my duty to violate the law when it involves my conscience, such as a law requiring racial segregation, or commanding me to enter the armed forces and kill human beings. When I refuse to obey the law I do not do so lightly or casually. It takes all of my faith and courage.

Upon their release from prisons, many continued their resistance to war especially with their refusal to pay for war and the preparations for war. The advent of the nuclear age had a cascading effect upon peace movements and opposition to future wars. NWTRCC often mentions in its introduction to war tax refusal (WTR 101) that the modern WTR movement was grounded in resistance to World War II. The personal tales of those who took risks inspired others.

The story of Franz Jagertatter in the book In Solitary Witness influenced Daniel Ellsberg who released the Pentagon Papers which helped bring the Vietnam War to a close. He was also deeply influenced by war tax resister, Randy Kehler. Daniel had heard Randy speak prior to going to jail as a CO to the Vietnam War and in hearing Randy’s personal tale felt compelled to share with the nation and the world the preparations for war that the US was engaged in.

The story of Franz Jagertatter in the book In Solitary Witness influenced Daniel Ellsberg who released the Pentagon Papers which helped bring the Vietnam War to a close. He was also deeply influenced by war tax resister, Randy Kehler. Daniel had heard Randy speak prior to going to jail as a CO to the Vietnam War and in hearing Randy’s personal tale felt compelled to share with the nation and the world the preparations for war that the US was engaged in.

August 9th also marks ten years since the killing of Michael Brown Jr. His body lay in the streets of Ferguson, Missouri for over four hours while police from various municipalities tried to contain the public outrage with trained dogs, reminiscent of the civil rights era. Soon thereafter the streets of Ferguson were occupied by militarized weapons intended for war zones. US militarism was witnessed worldwide in this movement for justice.

Many learned of the 1033 and 1122 programs that allow surplus military equipment to flow into police departments throughout the US. We know that our movements are interconnected and that peace can only occur when it is rooted in justice for all. We also know that we do not do this work alone. We are not solitary witnesses; our actions influence others.

In the recent Washington Post obituary for Randy Kehler he reminded us:

“Don’t ever, ever assume that anything you do, particularly if it’s an act of conscience, won’t make a difference.”

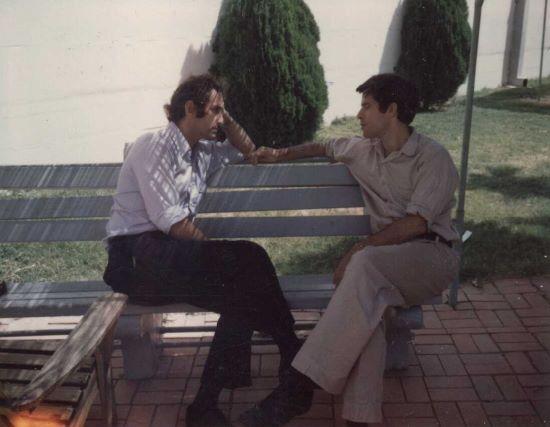

Randy Kehler, 1944-2024

By Ed Hedemann

Just after turning 80 this summer, longtime friend Randy Kehler died Sunday following a long series of illnesses, exacerbated most recently by a debilitating fall.

Randy — with his looming imprisonment for draft resistance in 1969 — is perhaps best known for inspiring Daniel Ellsberg to release the Pentagon Papers. But in his over 60-plus years of pacifist and social justice activism, he along with Betsy Corner have had many instances of principled nonviolent resistance, such as not paying taxes for war, even to the extent of “inspiring” the IRS to seize their western Massachusetts home in 1989, as documented in the film An Act of Conscience.

A bit less well known was Randy and Betsy’s 1975 critical role in bringing back to the US antinuclear movement the news of West German antinuclear activists using the new tactic of nonviolent occupation to disrupt the construction of the Wyhl nuclear power plant. This idea in turn helped lead to the Clamshell Alliance’s 1976 occupation of the Seabrook, New Hampshire, power plant, also under construction. The tactic quickly spread to other nuclear power plants across the US in the late ‘70s and early ‘80s.

My first intersection with Randy came in 1969 after I received a not very polite notice from my Bay Area draft board ordering me to report for induction. As a relatively apolitical University of Texas astronomy graduate student who knew nothing about pacifism and little about my options – army? prison? what? — I visited Austin’s draft counseling center and discovered a whole range of groups I had never heard of, fortuitously including the War Resisters League with its San Francisco branch. So, naturally I wrote them and immediately came into contact with two very helpful staffers, Judy Penhiter and Randy Kehler.

In addition to supportive discussions, Randy mentioned that later in the year he would be reporting to prison for resisting the draft. He also encouraged me to get to Haverford, Pennsylvania, which would be hosting a Triennial conference of the War Resisters’ International in late August, in celebration of the 100th anniversary of Gandhi’s birth.

Aside from the distance involved, not to mention my graduate studies and work, I was heading in the diametrically opposite direction to Oakland, California, on August 6th to refuse — rather than report for — induction. But given subsequent history, I’m sorry I didn’t make it to that historic WRI conference.

But I am not sorry to have known Randy all these decades. Kind, smart, and the sort of person whose infectious enthusiasm makes our almost Sisyphean efforts against war seem reassuringly possible and certainly worth the risks of struggle.

Randy, I am really going to miss you! You left way too soon as there is much work left to be done.

In Memoriam – Rod Nippert

[Editor’s Note: Rod Nippert passed away suddenly on Earth Day 2024. The following is a profile article he wrote for the April 2011 edition of this newsletter.]

Linda and Rob Nipper

I am 61 years young. I live in an intentional community in southeastern Ohio. I have been a war tax resister since the early 1970s. I believe being a WTRer has profoundly affected my adult life.

I do not feel that I am in any way uniquely suited to be a tax resister. I grew up in a small conservative farming community in central Ohio in a farming family. I was in high school as the Vietnam War was unfolding. I also grew up as a member of the Church of the Brethren. I think these circumstances greatly influenced the road I took.

I am a pacifist and attribute this to the influence of the Church of the Brethren. The Vietnam War made the military draft significant in my life. I was a conscientious objector and eventually turned in my draft card.

As soon as I started making enough money to pay taxes I could see the glaring contradiction of working to end war, being a pacifist, and paying federal taxes—especially since more than half of those taxes went for military expenditures.

About this time I became involved in a national group, Peacemakers, which strongly supported WTR. I believe that having a support group, whether local or national, is critical to having a positive experience with resisting taxes. It certainly has been for me. Being a war tax resister is not widely accepted or admired so having like-minded people as support is good.

I was married to Linda in 1970. We have always discussed and shared in the decisions around our (my) tax resistance. We were both war tax resisters until the mid-‘80s when Linda stopped, so I just speak for myself in the article.

Once I decided to not pay war taxes I had other decisions to make; what percentage to pay or not pay and whether it was important to actually keep the government from getting this tax money.

Once I decided to not pay war taxes I had other decisions to make; what percentage to pay or not pay and whether it was important to actually keep the government from getting this tax money.

It was clear that over half of any taxes I paid would go for military expenditures, so I determined not to pay any. It also became clear, after much talking, thinking, and reading, that it was important to actively work to keep the IRS from collecting any of this tax money. I had no idea how profoundly this decision would influence my life.

I decided not to file tax returns. I reasoned this would make it harder to track me down and harder for them to make an assessment of what I owed. I realized this would extend the time of liability and increase the amount the IRS might collect, but deciding to become a WTR does have possible consequences both positive and negative. I did not want my wages garnished so I decided I needed to be self-employed. The IRS could levy bank accounts or auction off property. I opened a business account, with a friend as the primary signer and was then able to get a credit card, which has been very helpful. I reduced the amount of property I owned and put my truck in my wife’s name after she stopped resisting.

I have been a fruit picker, woodworker, builder, stained glass craftsperson, and organic farmer. I presently raise organic red raspberries for fresh sell and make stained glass with the owner of a small stained glass shop.

I am now living a much simpler lifestyle than I would ever have imagined as a young adult. I attribute this largely to my decision to not pay my federal taxes and to work hard to not let the IRS collect this tax money. I have always donated that tax money to helping change the world and to relieving suffering. I live in the woods and hills of southern Ohio in an owner-built home, heated with wood, and energized by solar panels and the healing vibes of mother nature.

The IRS has not collected any money from me in all these years. I attribute this to three factors: not filing federal tax returns, earning money in ways that make it hard for the IRS to collect, and not having bank accounts and property that is very accessible. I am a nonfiler because I didn’t want to announce myself on their terms with their forms. I am very public about my resistance and have been active on and off for all these years in WTR issues.

The IRS has come and gone throughout this journey. They tried to collect early on but we were actually living below the taxable level. I have had an IRS lien for many years. This is mainly a problem if you borrow money or want to set up accounts. I have been getting letters from the IRS for the last two or three years. I ignore correspondence from them.

Being a WTRer has been an overwhelmingly positive experience—not that it isn’t a pain in the butt sometimes. I love the WTR community; local, national, and international. I am very happy with the way resisting has directed my life and in ways I couldn’t see when this journey started. I invite you to jump on board if you aren’t on board already.

Profile:

My Letter to the IRS

By Lorin Peters

Dear IRS Friends,

Lorin Peters

I was not born or raised this way. But when I received a death threat, in 1968, and was planning a gunfight, a prophet/angel appeared in a dream, taking me to talk with the man who wanted to kill me. I know now that Jesus’ “love your enemy” actually works better than violence.

When St Francis of Assisi tried it during the 5th Crusade, his enemy, Sultan al-Malik of Egypt, saved the Crusader army from starvation, and eventually gave Jerusalem back to the Christian world. Gandhi tried it with the British colonial government, which eventually freed all its colonies. The Danish people tried it during WWII, and saved 90% of their Jews.

Eventually I became a Conscientious Objector. I object also to our political leaders abusing our soldiers, using them to impose our corporate empire instead of to defend our country. I personally have been witnessing this abuse since Vietnam. In 1966 a boy from Tennessee, who had unintentionally killed an old woman in Vietnam, wept in my arms. The “moral injury” to our own soldiers of killing other human beings is still the primary cause of our 4,000 extra veteran suicides, year after year (“Veterans Administration 2012 Suicide Data Report”)

For seven summers with Christian Peacemakers Teams (CPT), I personally witnessed our support of Israel’s apartheid occupation of Palestine. This year we are now encouraging the people of Ukraine to kill Russians, in spite of the fact that when Russia invaded Czechoslovakia in 1968, the Czech people defeated the Russians without killing them (”Prague Spring”). “All who take the sword will perish by the sword” (Gospel of Matthew, 26:52). Does every empire not sow the seeds of its own downfall?

I have been teaching Gandhian nonviolence since Vietnam. I object specifically to paying someone else to kill in my name. As you can see, I still owe $1,836. According to the War Resisters League, 37% of this goes to our military. So I have paid this 37% (679$) to CPT (copy of check enclosed). My non-military balance, $1,157, is enclosed with my tax return.

Thank you for reading my many thoughts. I hope my resistance does not create extra work for you.

Peace and all good,

Lorin Peters

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org