National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

June – July 2024

Contents

- Tax Day 2024 Reports

By Lincoln Rice & Chrissy Kirchhoefer - War Tax Resistance Gathering

on Zoom By Lincoln Rice - Counseling Notes Large Income Nonfilers Given Notice • Improved IRS Phone Service

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Living Simply in a New Way: An Interview with Robin Greenfield – Part 2

By Erica Leigh - NWTRCC News and WTR News: Mark your Calendars!!! National War Tax Resistance Gathering & Coordinating Committee Meeting November 8-10, 2024 • Peace Walk 2024 • Conscience & Peace Tax International Conference October 4-6, 2024 near Lubeck, Germany • Oregon Community of War Tax Resisters’ 7 Year Nap • First-Time Resister’s Letter to the IRS • Donate by Venmo • Raffle Fundraiser for NWTRCC

Click here to download a PDF of the June/July issue

Tax Day 2024 Reports

By Lincoln Rice & Chrissy Kirchhoefer

Tax Day was Monday April 15, 2024 and people throughout the US gathered around this date to raise awareness that nearly half of federal income taxes are directed toward war. They also encouraged others to resist paying taxes and redirect those funds to community needs. This was a great year for people mailing in NWTRCC’s Peace Tax Return and letting us know that they were redirecting their federal income taxes. We heard back from forty-five individuals and three groups that redirected $136,073.20 to community needs.

Captain “A” stopping for a photo along his western Wisconsin trip. Photo courtesy of the Madison Chapter of the World Beyond War

Here is a slightly abbreviated account of Tax Day 2024 actions from our network. A link to the complete account with more photos can be found on our website. Go to the “Programs” tab and click on “Tax Day.” If you would like to see media coverage that occurred around Tax Day, go to the “Media” tab, and click on “Articles” and “TV and Radio Interviews.”

Arcata, California – We conducted the annual Penny Poll at the Arcata Farmers Market. We had previously been in front of the US post office, but in this electronic age, people rarely mail their tax returns anymore. About 165 people voted by distributing ten pennies among ten containers labeled to represent major government programs. By choosing where they want their federal tax dollars to go, they also inform the community about their priorities.

– Dave Meserve

Oakland, California – The People’s Life Fund held a granting ceremony where it redirected $67,000 to community organizations. We offer grants to groups that are providing essential day-to-day human services which the government is not adequately furnishing, and/or addressing the root causes of a problem by engaging in education or action, in the spirit of nonviolence, aimed at social, economic, or political change. Grantees included the Arab Film and Media Institute, Graduate Students for Justice in Palestine at UC Berkeley, Indigenous Peoples Day Committee, Regional Tenant Organizing Network, Rogers and Rosewater Soup Kitchen, and Support for Intertribal Gatherings.

– People’s Life Fund.

Chico, California – On Tax Day, volunteers from the Chico Peace Alliance leafleted with the WRL tax pie chart for four hours. Our Penny Poll had only twenty participants this year. Results were: 45.9% Human Resources; 22.3% Physical Resources; 13.1% Past Military; 12.3% General Government; 6.2% Current Military.

– Chris Nelson

Colorado Springs, Colorado – We had thirty-five “takers” for the Penny Poll, more for the pie chart leaflets. Poll results: Education 24%, Environment 19%, Housing 17%, Healthcare 15%, Military 11%, Infrastructure 7 %, Arts 6%. Guess it shows we’re a city with big military presence—five bases and oodles of contractors… but hey, human needs still won.

– Mary Sprunger-Froese

Gainesville, Florida – I handed out pie charts on Tax Day at a Democratic Women’s Club luncheon, 104 members in attendance as well as Gainesville Mayor and our Sheriff. I gave a short speech about how so much of our tax dollars goes to the military. True defense is a well-educated, healthy citizenry that is proud of their country. When I mentioned over 700 US military bases around the world, people shook their heads, not in a good way!

– Jackie Betz.

Brunswick, Maine – We gathered in front of the local post office with handouts from National Priorities Project… showing the federal budget priorities and showing that the Pentagon budget is higher than the next 10 nations. We also used some handouts from the US Campaign for Palestinian Rights showing Biden’s 2025 discretionary budget numbers. We always have great conversations with passersby.

– Rosalie Paul

Worcester, Massachusetts – We had a very successful picket. Sixteen people showed up, lots of engaging signage (including several lent to us by the Muslim-led Community Alliance for Peace and Justice) and an uplifting report from the folks leafleting inside the post office. Apparently those coming and going were open-minded, receptive to flyers, and generally seemed supportive of our message.

– Patricia Kirkpatrick

Ithaca, New York – We had the biggest turnout in years, due to the fact that folks concerned about Gaza “hitched” onto our war tax resistance event. We had about 25 folks, which is a lot for us.

– Mary Loehr

Tax Day Vigil in Manhattan. Photo by Ed Hedeman

Manhattan, New York – Our annual tax day presence at the IRS was a lively affair thanks to the musical accompaniment of the Raging Grannies and Filthy Rotten System, and an array of passers-by who offered support or challenged our message—some more politely than others.

The surge in interest in war tax resistance has been heartening, but we know we have a long way to go to turn the policies of this country around. Refusing to pay for war is really every-day resistance as taxes accompany most employment and the IRS can come calling any time. Here in New York City we plan to offer a series of informal get-togethers to keep answering questions and offering support to new (and ongoing) resisters.

– Ruth Benn

Eugene, Oregon – Planet vs Pentagon, Taxes for Peace Not War, and Extinction Rebellion flyered, tabled, and held up banners and signs outside the Eugene Public Library on Tax Day. We conducted a Penny Poll, and as always, Eugene people wanted very little going to the military and more going to human services and the environment. Over $3,000 was resisted locally and given away to local groups helping people without homes and the environment and to groups helping Palestinians.

Also, on Saturday March 23, about twenty people attended a WTR workshop and they decided to start a group called $29 for Palestine to resist 29 dollars, what someone figured out is about how much of our tax dollars are going to the genocide in Gaza.

Portland, Oregon – We had a Tax day program on April 13th at St. Andrews church and showed NWTRCC’s documentary “Death and Taxes.” Interesting to note that the documentary mentioned that even if you’re being harassed by the IRS, we still have it better than “the women in Gaza.” Paul Maresh was there with his Penny Poll, and many people participated. If only it were as easy with how we ACTUALLY want our tax dollars spent!

Our guest speaker, and recipient of some of our redirected tax dollars was Shawn Bargouti with the American Council for Palestine (ACP). He is an American Palestinian who has made Portland his home since 1989 and is extremely knowledgeable about the history and politics of the Palestinian/Israeli conflict. Shawn gave an eye-opening and informative slideshow presentation that included the history of Palestine for the last 100 years.

On the morning commute on April 15th, two groups were on the bridges holding signs. We received lots of positive responses of thumbs up and peace signs, but also a few one finger salutes. I’m sure those people must have been from out of town! Overall a great day!

– Kima Garrison

Lancaster, Pennsylvania – Over the noon hour on Saturday in Lancaster’s square, I operated a Penny Poll with a couple Peace Action Network of Lancaster colleagues. We gave passersby opportunities to vote on how they would like their federal tax dollars spent by putting 10 pennies into any of ten categories. Eighty-four passersby participated.

– H. A. Penner

Brattleboro, Vermont – Tax Day at the Brattleboro Food Coop was a beautiful, sunny wind-free day that my WTR friend Lindsey Britt of Taxes for Peace New England and myself thoroughly enjoyed, in coming out of a cold Vermont winter. Although stoppers-by did not take very much of the extensive WTR literature that was available, we were engaged in many interesting conversations and our presence during the seven hours was well-advertised via signs facing in every direction. The way I see it, “being there” is what really counts, since it basically says, “No More Business as Usual. There is another path available other than paying for war.”

– Daniel Sicken

Harrisonburg, Virginia – About forty people gathered beside the Harrisonburg Farmers Market at noon on Saturday for our 3rd annual Taxes for Peace event. Over thirty members of Shenandoah Taxes for Peace donated a total of $6,188 to organizations doing peace, relief and development work locally and around the world. Of this amount, $1,766 came from resisted war taxes, and the remainder came from donations in solidarity with the war tax resisters in our group.

– Tim Godshall

Tax Day Vigil in front of the Army Reserve in Milwaukee. Photo courtesy of Peace Action Wisconsin

Milwaukee, Wisconsin – On Saturday, Casa Maria Catholic Worker, Milwaukee War Tax Resisters, and Peace Action Wisconsin held a vigil outside US Army Reserve to protest federal tax dollars for war and genocide. There was a lot of car traffic and the response to our message was more positive than in previous years.

– Lincoln Rice

Southwestern Wisconsin – Captain “A” is an antiwar activist from Lone Rock, Wisconsin. He did a bike ride in costume on Tax Day weekend, April 13 – 14 from Lone Rock to Madison and back. In a fun way, he brought attention to the obscene amount of our tax money that goes to war and militarism. He stopped at many towns along the way, and he invited people to ride with him.

– Madison chapter of World Beyond War

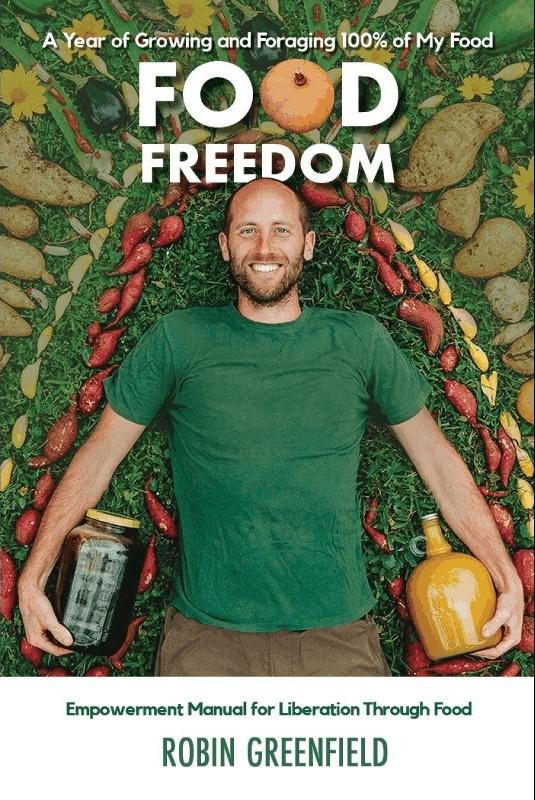

War Tax Resistance Gathering on Zoom

By Lincoln Rice

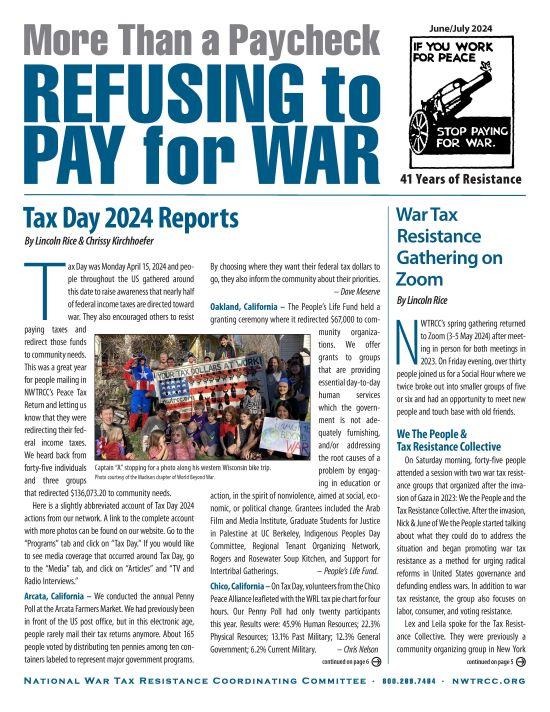

NWTRCC’s spring gathering returned to Zoom (3-5 May 2024) after meeting in person for both meetings in 2023. On Friday evening, over thirty people joined us for a Social Hour where we twice broke out into smaller groups of five or six and had an opportunity to meet new people and touch base with old friends.

We The People & Tax Resistance Collective

On Saturday morning, forty-five people attended a session with two war tax resistance groups that organized after the invasion of Gaza in 2023: We the People and the Tax Resistance Collective. After the invasion, Nick & June of We the People started talking about what they could do to address the situation and began promoting war tax resistance as a method for urging radical reforms in United States governance and defunding endless wars. In addition to war tax resistance, the group also focuses on labor, consumer, and voting resistance.

Lex and Leila spoke for the Tax Resistance Collective. They were previously a community organizing group in New York before they also started promoting war tax resistance. In addition to helping to organize local mutual aid programs, they promote war tax resistance as a method of divesting from the state. Their goal is the abolition of the United States and US imperialism.

Simple Living

In the early afternoon, forty people joined us for a session on Simple Living. The session was led by Mary Sprunger-Froese, a long-time war tax resister from Colorado Springs and Daniel Woodham, a long-time war tax resister in Kingston, New York. Mary emphasized the importance of relationships in living a more simple life. Without “community in some form,” she does not believe she could have lived so simply. She also shared that simple living is not simple. It requires planning and flexibility.

Daniel spoke about the relationship we have with money. He also spoke of how his simple living looked different as a young single man compared to being older with a partner and a child. At different points in his life, he has dumpster dived, hitch hiked, bartered, and used alternative currencies. One of the reasons that Daniel eventually started farming was to have access to good food.

Thinking about Retirement

After another short break, thirty-five people joined us for a session on retirement. This session featured two war tax resisters who have taken different paths on saving for retirement: Peter Smith from South Bend, Indiana and Clare Hanrahan of Asheville, North Carolina. Peter shared strategies about saving for retirement while at the same time lowering one’s tax debt. During his working life, Peter and his spouse always owed taxes and were collected on from time to time. He employed many of the strategies he shared to lower his taxable income. He discussed various retirement contribution options, health savings accounts, and Obama-care as methods to lower one’s taxable income.

Clare was radicalized against war after losing family in Vietnam. She shared how she grew up in involuntary poverty, but later chose to live simply as an enriching though arduous path. Simple living was a way to divest from our oppressive state, though she also realizes that this is never fully possible. In the end, mutual aid and frugal living have been her savings account.

WTR 101 and 201

In the early evening, we ended the day with concurrent War Tax Resistance 101 & 201 sessions. Over ten people joined NWTRCC Outreach Consultant Chrissy Kirchhoefer for an overview of war tax resistance that led to a fruitful discernment among attendees about what methods they wanted to explore. The 201 session was attended by seventeen people. NWTRCC Coordinator Lincoln Rice facilitated the session, noting current IRS trends and addressing concerns from those in attendance.

Sunday Business Meeting

On Sunday morning, we had our obligatory Sunday business meeting. NWTRCC’s consultants provided their reports and we also went over finances. With the conclusion of that meeting, Erica Leigh & Lindsey Britt finished their three-year terms on NWTRCC’s Administrative Committee and we welcomed Nick Lancellotti and Patricia Kirkpatrick to that committee. The minutes for the meeting can be found at nwtrcc.org/nwtrcc-business. Recordings for a couple of the sessions can be found at youtube.com/nwtrcc.

This was a wonderful online conference where we were able to hear voices that we would not have been able to hear if we had met in person. Though by meeting online, we missed out on those wonderful conversations that happen between sessions and over meals. Between all the different sessions, about seventy-five people attended some portion of the conference. Mark your calendars! Our next conference will be the weekend after the election, November 8-10, 2024. It will probably be on Zoom unless we receive an invitation from a local group in the near future.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2024. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org.

Large Income Nonfilers Given Notice

The IRS was given an influx of cash as part of the Inflation Reduction Act of 2022. At that time, the IRS stated that new enforcement funds would be primarily used to address those with incomes of at least $400,000. In late February, IRS Commissioner Danny Werfel stated that the IRS will begin issuing notices to high-income earners who have not filed federal tax returns in recent years despite ample financial activity based on third-party reporting information.

According to the commissioner, 125,000 cases have been identified where households making at least $400,000 have not filed their taxes since 2017. The IRS plans to send 20,000 to 40,000 notices every week. The IRS conservatively estimates that “hundreds of millions of dollars of unpaid taxes are involved in these cases.” Only one couple in our network, who are high earners, contacted the office to confirm that they had received such a letter (Notice numbers 2269C and 725B). They have decided to file for the years requested. According to the IRS, ignoring these letters will result in a substitute return being filed followed by the beginning of the civil collection process. Criminal prosecution is not being threatened for those ignoring these letters.

We do not expect this to affect most war tax resisters in our network, but if you do receive such a notice, please contact the NWTRCC office. So far, the IRS seems to be sticking to its promise not to focus on lower-income earners.

Improved IRS Phone Service

This past tax season, the IRS added 5,000 new telephone assistors. Supposedly, this has led to answering 88% of phone calls, up substantially from just 15% in 2022. Callers waited just over three minutes for help on the IRS main phone lines, down from twenty-eight minutes in filing season 2022. If you do need to call the IRS for some reason, now might be a good time.

Many Thanks

Thanks to everyone who donated for the May Appeal 2024 and sent in raffle tickets! There is still time to send in tickets! Remember, you can also donate online through PayPal and Venmo (not tax deductible), or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

We are very grateful to these WTR groups and affiliates for their redirection and affiliate dues: People’s Life Fund of Northern California; New England War Tax Resistance; War Resisters League; War Tax Resisters Penalty Fund

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loop

We’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.org

Living Simply in a New Way: An Interview with Robin Greenfield – Part 2

By Erica Leigh

[Editor’s Note: This is the second part of a two-part interview that was published in this newsletter. The first part of this interview was published in our April 2024 newsletter. Robin Greenfield has been challenging people to think about their environmental impacts, their relationship to other animals and plants, and their enmeshment in economic systems for over a decade. Through YouTube videos, TV appearances, books, articles, public speaking, and other cultural work, he shares personal challenges he sets for himself and how he accomplishes them. Since 2015, he has been a war tax resister, earning less than the federal taxable income level.

Food Freedom, a book by Robin Greenfield.

Former NWTRCC consultant Erica Leigh spoke to Greenfield in November 2023 about his work, which she’s been following for several years. This interview has been edited for readability and length.]

Erica Leigh: Have you ever had discussions with people in your life or with people that you’ve met about war tax resistance, and what kinds of questions or responses do you tend to get from people?

Robin Greenfield: Most people haven’t looked that far into the truth behind our taxes. Or just in general the truth behind our monetary system. So when they hear of me doing that, it’s generally like, why? And of course, why for me, it’s not just war of course. It’s all the ways in which our money is going into systems of destruction, systems of oppression and exploitation. So that includes war, the military-industrial complex, police brutality, the prison-industrial complex and the school-to-prison pipeline. And also just generally the disproportionate distribution of taxes, where the communities with the least get the least and the communities with the most get the most.

And so for me it’s real simple. I’m not saying I don’t want to contribute. I’m saying I want to contribute more… If the government isn’t going to proportionally distribute the money, then I’m going to proportionally distribute the money. I’m simply going to give my money to the organizations that represent the people that are not represented by our government.

…Seventy percent of all money that comes through me in any way, shape, or form is distributed back to the people in an equitable manner. That’s more than the government is asking for, saying that we need to.

My main method of this more equitable distribution is that I’ve committed to life to donating 100% of my media income directly to the people.

And so when I did a TV show for Discovery Channel, it was $30,000 that would have gone to me. And instead in the contract, it said no money is paid to Robin whatsoever, and the money is directly donated to these organizations.

Erica: For your living expenses otherwise, the money that you do need, where does that income come from?

Robin: Public speaking. I speak about being the change I wish to see in the world and how others can as well. I charge universities or corporations for me to speak to make the little bit of money that I need, which for the last, well, since 2015, has been less than $10,000 a year.

And then this year I actually taught foraging schools… This year I made $9,900… Ideally I would rather not have charged for that…

At this point what I’ve found is that I feel comfortable with charging some people who have money, who want to give, it’s their way of exchanging and sharing their gratitude. And then just offering so much of what I provide for free, and continuously offering scholarships.

Erica: I have had people say about certain choices I have made about war tax resistance, that there’s no personal purity. “You can’t fully extract yourself from the system. You can’t extract yourself from complicity.” People are seeing it as trying to be pure or the most unplugged from the system. Have you heard that sort of critique and how would you respond?

Robin: There’s definitely a lot of people who say it’s impossible to be pure. I agree! Okay – is that going to stop me from doing the best that I can? No! Anything that we’re doing in life, we’ll never be perfect at it, whether it’s sports, musical instruments, our education, being a parent or a lover. None of us believe that we have to be pure in any of this. So why would we have to be pure in our resistance to oppression and exploitation? …It’s a way of deflecting from the fact that they could be doing something, and having constructive conversations about what we can be doing.

So, am I on a quest for purity? In a sense, yes. But only with the very large asterisk that I will never achieve it. But I’m going to pursue it. I’m going to pursue removing myself from oppression and exploitation, and replacing that with systems of equity, justice, and regeneration to my best ability, and be transparent about where I’m not able to be successful in that. And I’m transparent with myself, first and foremost, honest with myself, and honest with others at the same time. And I think that’s important. And I think potentially one area where we as resisters could do better is being more honest with ourselves and being more honest and open about it with others, because maybe others would meet us with less resistance if we were able to do that… It can be challenging to talk about our weaknesses because it’s very possible that the dominator then focuses on that weakness. But the truth is that the strongest thing we can do is know our weaknesses, understand them, and be able to discuss them openly and transparently.

Erica: Is there anything you want to say or share or add?

Robin: One area where we have an incredible movement in the United States is with defunding the police, with resistance to police brutality. And I think that’s an incredible window for tax resistance. I don’t know if a lot of those people have made that connection that by paying taxes that they are contributing to police brutality through their money.

Learn more about Robin Greenfield at robingreenfield.org. He recently wrote a piece about his war tax resistance at robingreenfield.org/tax.

NWTRCC News and WTR News

Mark your Calendars!!! National War Tax Resistance Gathering and Coordinating Committee Meeting November 8-10, 2024

As of this printing, our next conference will be the weekend after the presidential election and it will probably be online. If you are interested in hosting a future NWTRCC meeting and have the resources to allow easy integration of online participants using Zoom, please contact the NWTRCC office.

Peace Walk 2024

By Shirley Whiteside

Peace Walkers in Dexter Park, Providence, Rhode Island. Photo courtesy of Peace Walk 2024.

NWTRCC is an endorser of Peace Walk 2024, a 700-mile walk from Maine to Washington, DC, initiated by Veterans for Peace (VfP) and devoted to peace, planet, justice, and democracy. As VfP states in their material about the walk:

Many veterans have seen war up close or have been trained for war.

But everyone, veteran or not, is affected adversely by war and the industry that profits from war. Besides the terrible human cost of war, our precious environment and climate are impacted most negatively.

When the walk set off from Ogunquit, Maine, Penobscot tribal leader Sherri Mitchell marked the send- off with a message about the sacredness of a pilgrimage:

So as you get ready to head off, I want to encourage you to mindfully bring the sacred back into your journey. Keep it the heart of what you’re doing; not the anger over those who are causing harm, but for the love of those who you seek to protect. And our deep reverence for the sacredness of all life.

Along the route of Peace Walk 2024 the group has met outside the Seabrook New Hampshire nuclear plant with the director of Seacoast Anti-Pollution League to discuss problems of nuclear waste storage, drummed at a US Rep office in Boston, vigiled to stop war on Gaza with the Rhode Island Anti War Committee at the state capitol, and at the General Dynamics Electric Boat facility in New London, Connecticut, where war tax resister Joanne Sheehan educated the pilgrims about the nuclear subs built there.

NWTRCC members and friends on the East Coast are urged to check the route near you as this group continues its path through New York, New Jersey, Pennsylvania, Delaware, Maryland, and expecting to arrive in Washington, DC on July 5. Peace groups or individuals are urged to walk along as possible, or plan local events for these vets to carry their powerful message. Current information on the march can be obtained at peacewalk2024.org.

Conscience & Peace Tax International Conference October 4-6, 2024 near Lubeck, Germany

The Seventeenth International Conference of War Tax Resisters and Peace Tax Campaigns will be hosted by Netzwerk Friedenssteuer at the Naturfreundehaus Priwall near Lubeck, Germany. There are no more details at the moment, but future details will be posted at cpti.ws.

Oregon Community of War Tax Resisters’ 7 Year Nap

By Paul Stretch

Rip Van OCWTR (Oregon Community of War Tax Resisters) was in bed sawing logs. His slumber disturbed he looked outside. Thousands of twenty somethings shouting, “Free Palestine!” were passing his window.

“Twenty some years and it’s still going on,” he cried! “Enough is enough, cut off the funds.” “But how can we?” asked the crowd. “Time for some WTR 101 classes,” said Rip.

Late February the first class was held at Multnomah County’s Hollywood Library. It had forty students. Approximately two weeks later, in early March, a second WTR 101 class of twenty attendees and four experienced WTRs, was in the same venue.

Sunday March 17th at St. Andrew Catholic Church a third class with twenty-five students was held. It was in a room named after Salvadoran Archbishop Oscar Romero, who was assassinated by military forces propped up by the US.

The brief class was conducted by OCWTR members Kima Garrison, Paul Stretch, Paul Maresh, and included the Penny Poll. The instructors gave their “how and why WTR histories.” Meanwhile the Penny Poll re-enforced the attendees’ opinions on tax allocation.

In the past few decades, presentations on WTR have drawn a handful of people. Lately our talks were filled with dozens seeking to reconcile their political and moral beliefs with where their tax dollars go.

First-Time Resister’s Letter to the IRS

To Whom It May Concern,

Marie Oliverio. Photo courtesy of Marie Oliverio.

Enclosed is the 1040 form for tax year 2023.

I, in sound mind, aligned spirit and in resistance to centuries of capitalist-fueled violence, am resisting war taxes and withholding $560, in loving honor of and fierce comradeship with the over 30,035 people killed in the US-funded attack on Palestine. I refuse to be complicit in the United States empire’s militarism, funding of genocides and oppression, on this land and in Palestine, Sudan, Congo, Ukraine, and in the war crimes committed in Afghanistan and Iraq during my childhood. The myths of freedom in this country are held up, shakily, by the theft of land and liberation of peoples the world over, including those it claims as “citizens.”

My anger and pain are justified, righteous, spiritual and are not solely my own; my small resistance of withholding the money I earned within this system is representative of a collective trauma, and in turn a collective resistance, that the IRS, the United States military, and the corrupt values that uphold oppression will not scare out of us any longer. I am divesting from militarism, from war, and investing in community, healing, and true liberation.

Free Palestine, free us all.

Marie Oliverio.

Donate by Venmo

Donate by Venmo

NWTRCC now accepts donations by Venmo! We still accept donations by check, PayPal, and credit/debit card using PayPal. Also, tax deductible donations can be made by check or credit/debit card using one of our fiscal sponsors. For more information on all the ways you can donate to NWTRCC, go to nwtrcc.org/donate.

Raffle Fundraiser for NWTRCC

Image by Eulaine McIntosh from Pixabay

We received a very positive response to our first two raffles that were combined with our May appeals. Therefore, NWTRCC’s Fundraising Committee has organized another raffle. No donation is required to participate in the raffle, but we would appreciate your financial support. NWTRCC is only able to continue because of every donation it receives—both large and small.

To be entered in the raffle, simply fill out the raffle tickets and mail them back to NWTRCC …hopefully with a donation. If you normally donate online using PayPal, Resist, or Venmo, simply print out a sheet of tickets, fill them out, and mail them in. A sheet of raffle tickets with a full list of prizes can be found at nwtrcc.org/raffle. Feel free to make copies of the tickets and hand them out to friends. Tickets need to be received by the time the drawing occurs on July 6.

We are very thankful to all those folks who donated something for the raffle. Our top prize is a 2-night stay in a cabin at Woolman Hill, which hosts the Nelson Homestead. Even if you do not win the top prize, making a pilgrimage to the Nelson Homestead might be something to consider at some point. The powerful peacemaking witness of Wally and Juanita—cofounders of the modern war tax resistance movement—is wonderfully displayed at their homestead. You can also take a virtual tour at nelsonhomestead.org. Other prizes include a 2-night stay at the Celo Inn in the Blue Ridge Mountains of North Carolina, NWTRCC swag, an integrative bodywork session, copies of the upcoming new edition of the WTR Guidebook, a brand-new hammock, and more.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org