More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

February – March 2021

Contents

- Tax Season 2021 Campaign

By Lincoln Rice - Hindsight, Looking Forward with 2020 Vision By Chrissy Kirchhoefer

- Counseling Notes: 2021 IRS Standard Deduction and Taxable Income Level • Self-Employed to Receive Different 1099 Form • Warning about Sending a Letter with your Tax Forms • IRS Commissioner: We’ve Cleared Unopened Mail Backlog • Private Debt Collectors for the IRS Not Very Successful • Old Computers at the IRS & Low Staffing are Causing Problems

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- NWTRCC Outreach WTR 101 as World Beyond War Fundraiser • War Tax Resistance Discussed at Chicago School of Complexes

- NWTRCC Upcoming Events & News: National NWTRCC Conference April 30 – May 2, 2021 • WTR Counselor Training on Zoom • NWTRCC Bequest Campaign • Ask your Church to Support NWTRCC • Nominations Open for NWTRCC’s Administrative Committee (AdComm)

- Profile: Letter to IRS: Former State Department Worker Refuses to Pay for Killing Civilians By Fred Burks

Click here to download a PDF of the February/March issue

Tax Season 2021 Campaign

By Lincoln Rice

Panelists from Facebook Live Stream: Top Row: Moderator Lincoln Rice, Charlie Hurst, Maria Smith and Sam Yergler. Bottom Row: Kathy Kelly and Erica Leigh

April 15, 2020 was not a normal Tax Day. The COVID-19 pandemic cancelled or radically changed the plans of many local groups. There was the additional oddity that Tax Day was then delayed until July 15, 2020.

As of this writing, Tax Day this year is still set for April 15, 2021. Although vaccines are being administered, how things will look this year on April 15 is a big question mark. With this in mind, NWTRCC is working to provide online resources as part of a Tax Season 2021 campaign that began in January.

On Sunday January 24, the campaign launched when NWTRCC hosted a panel of war tax resisters on Facebook Live. The panel featured five longtime war tax resisters: Kathy Kelly (Chicago), Sam Yergler (Eugene, Oregon), Erica Leigh (Seattle), as well as Charlie Hurst and Maria Smith (Cleveland). They shared their original motivations for becoming war tax resisters and why they will continue to be war tax resisters during the Biden administration. After each panelist spoke for about ten minutes, they answered questions that people asked via Facebook’s comment section.

One watcher of the live stream asked how public the panelists are in their war tax resistance. The responses given by our panelists raised important concerns about how well we communicate not only the reasons for promoting war tax resistance, but the possible risks and consequences. The full 90-minute panel can be found on our Facebook page (www.facebook.com/nwtrcc) or on our YouTube channel (www.youtube.com/nwtrcc). Feel free to check out the video and share it on your own social media platforms.

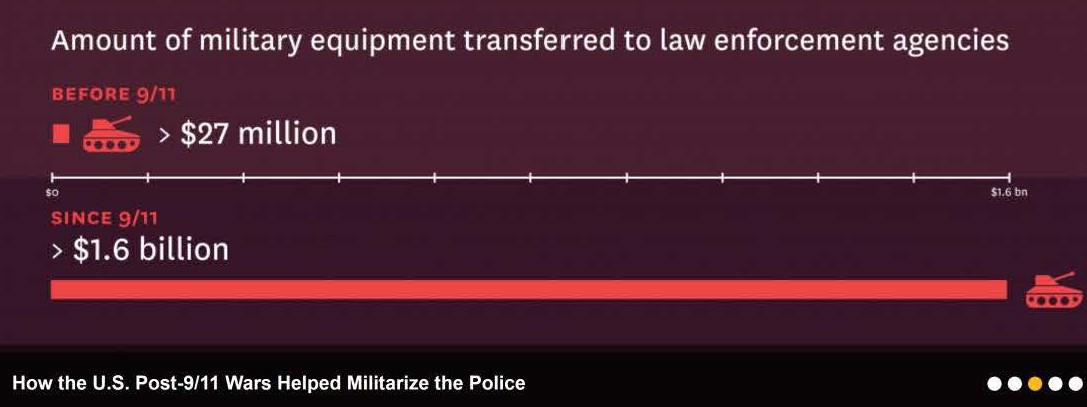

In February, we will be launching a new webpage that will connect police militarization and war tax resistance. The page will be active by the time you are reading this. The web address for the page is as follows: nwtrcc.org/police/. There will also be a link to this new page highlighted on the NWTRCC homepage. This page will underscore the consequences from U.S. militarization on police departments that are already mired in practices of systemic racism. For example, the new webpage will highlight the dramatic increase in the transfer of military equipment to local police departments after 9/11.

In March we plan on highlighting the misplaced priorities of the federal government in regards to health care, which have left so many Americans suffering during the COVID-19 pandemic. Despite the federal government’s dismal response to the pandemic, payments to weapons manufacturers have not skipped a beat. And in April we will feature the devastating impact of the U.S. military on the environment, with the Pentagon being the largest institutional user of oil in the world.

We also plan on releasing short videos with war tax resisters who are either experts in the fields of health care or climate, or whose motivations for war tax resistance are deeply grounded these areas. If you would be willing to make a short video for NWTRCC, please contact the office. Even if you do not have previous experience making videos, we can help you through the process.

This campaign is in flux, so if you have any ideas for resources or are willing to provide resources for NWTRCC to share that are related to war tax resistance, please contact the NWTRCC office.

Hindsight, Looking Forward with 2020 Vision

By Chrissy Kirchhoefer

With 2020 behind us, it seemed like a good time to look back to where we have been and have clear eyes about where we are headed in order to forge a new path. On January 15th, 2021, 5,000 U.S. troops remained in Iraq and Afghanistan. This is welcome news to the longest ongoing war in U.S. history (19 years), where at its height 170,000 troops were in Iraq and 100,000 troops were in Afghanistan. In the New York Times, “Two Costly Wars and a Legacy of Shame,” a former Marine captain wrote that the U.S. Defense Department alone spent $6 trillion dollars “costing each American taxpayer… more than $7,000” on the wars in Iraq and Afghanistan. With the increased use of drone attacks, the Obama and Biden administration seemed to prove that troops on the ground are not an essential part of warfare anymore.

Brown University’s Costs of War project published the report “Afghanistan’s Rising Civilian Death Toll Due to Airstrikes 2017-2019.” The study reports that from the end of the Obama administration to the last year that information is available from the Trump administration, the number of civilians killed by U.S. led airstrikes increased by 330%. After the Trump administration relaxed the rules of engagement with regard to airstrikes, 3,800 Afghan civilians were killed in 2018 alone. That time period also saw an increase in military spending from $580 billion in 2016 to $713 billion in 2020.

In “Trump’s Pernicious Military Legacy,” (article in Common Dreams) Michael Klare writes that Trump inherited the Global War on Terror, a seemingly endless war throughout the globe while Biden will inherit a shift that some refer to as the “Great Power Competition.” Klare writes, “The posture he’s bequeathing to Joe Biden is almost entirely focused on defeating China and Russia in future ‘high-end’ conflicts waged directly against those two countries—fighting that would undoubtedly involve high-tech conventional weapons on a staggering scale and could easily trigger nuclear war.”

While the path ahead may appear to position the U.S. against China and Russia, the reliance on covert operations will increasingly be a larger part of U.S. military strategy as evidenced by spending. Just this past month the Army Times wrote, “Congress plans to raise funding by 50 percent for the obscure authorities used by U.S. special operations forces to counter adversaries in foreign countries through irregular warfare, according to the defense bill approved by both the U.S. House and Senate, but still pending the president’s approval.” These programs use U.S. Special Operational Forces in “grey zones” outside of traditional armed conflicts like island developments in the South China Sea and differs from a similar program that uses surrogate forces in places like Africa that has seen increased funding in the past decade.

In These Times, Sarah Lazare wrote a timely article “Congress is Deadlocked on Covid Relief But Came Together To Fund the Pentagon for $740 Billion: There is Always Money for War.” She states, “The so-called ’War on Terror’ has turned the whole planet into a U.S. battlefield, and now the United States is planning to intensify its militarization of the Asia-Pacific region in order to escalate against China, which the current National Defense Authorization Act reflects, with bipartisan support. That we can find the money for war but not for coronavirus relief exposes the moral rot at the center of U.S. politics, a rot that must be dug out and expunged if we are to get through this crisis.”

Jeremy Scahill wrote an article about the Biden administration’s appointments and what they seem to indicate for the incoming president in “Biden is the Perfect Figure for the National Security Establishment” (article in the Intercept). “There is a consensus among the old establishment Democrats and Republicans that militarism and the myths of American exceptionalism are eternal, nonpartisan truths. In their eyes, a team of rivals doesn’t include leftists. It is a tactical or strategic rivalry among a handful of camps within the same war party about how best to conduct imperial policy.”

Money and War by withayou on Flickr

Many are looking towards putting pressure on the Biden administration by focusing on his first 100 days in office. The Poor People’s Campaign has created 14 Priorities to Heal the Nation. #13 states “Redirect the Bloated Pentagon Budget toward these Priorities as a Matter of National Security.”

Counseling Notes:

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click on “Local Contacts & Counselors”).This training is usually offered once a year and the next training will be online in early 2021. If you would be interested in attending one of these trainings, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

2021 IRS Standard Deduction and Taxable Income Level

The tax overhaul bill eliminated the personal exemption. Now there is only the Standard Deduction figure that sets the taxable income level.

| Category | Standard Deduction |

|---|---|

| Single | $12,550 |

| Married, Filing jointly | $25,100 |

| Married, filing separately | 12,550 |

| Head of Household | $18,800 |

For each married taxpayer who is at least 65 years old or blind, an additional $1,350 standard deduction may be claimed. If the taxpayer is single, the additional standard deduction amount is $1,700.

A single person can earn up to $12,550 and owe no federal income tax. You may be able to make significantly more than the amounts indicated above and owe no income taxes. NWTRCC’s Practical #5, Low Income/Simple Living as War Tax Resistance, includes information on legal ways to reduce taxable income and owe no federal income taxes ($1 from the NWTRCC office; read it free at nwtrcc.org). We suggest that nonfilers fill out the forms and keep their receipts for reference in case their circumstances change or the IRS comes calling.

Payroll taxes for Social Security and Medicare begin to apply at a lower income level than one’s standard deduction. If you do not file or pay estimated taxes, you may be liable for Social Security taxes. If you are an employee, these payroll taxes are automatically withheld as a percentage and you cannot resist those taxes.

Self-Employed to Receive Different 1099 Form

For many years, if you were self-employed and earned at least $600 by working for a business, that business was required by law to issue you a 1099-MISC. They would also furnish a copy of the 1099 to the IRS so that the IRS would be alerted to your income. The only change to this practice for tax year 2020 is that instead of receiving a 1099-MISC, you will receive a 1099-NEC. NEC stands for “non-employee compensation.” The 1099-MISC will still be used for other types of miscellaneous income, just not for reporting income to self-employed contractors. The IRS had previously used the 1099-NEC for reporting payments to contractors, but discontinued the form in favor of the 1099-MISC about 30 years ago.

Warning about Sending a Letter with your Tax Forms

In late 2019, two war tax resisters were threatened with $5,000 frivolous fines if they did not refile their tax returns in thirty days. Although the IRS did not state that either filer received the threat because they included a letter with their tax return, it was the one thing the filers shared in common. Neither fine was enforced, but it was a hassle for each filer.

In mid-November 2020, a WTR filer in our network received a letter and phone call from her state’s health insurance marketplace provider. She was informed that she was being denied Obamacare premium tax credits because she had not filed for tax year 2019. She vehemently stated that she had, the person on the phone believed her, and her tax credits were reinstated. At first it seemed probable that her tax forms had not been processed by the IRS because she sent a letter with her forms. (Tax returns are not processed if they are considered frivolous.) But in January 2021, this WTR filer received her tax return in the mail. She had signed her letter to the IRS, but had forgotten to sign the tax form. She had originally filed in April 2020 and it had taken the IRS eight months to return her form. She has since signed her tax form and returned it to the IRS.

In any case, war tax resisters may want to be careful about sending a letter with their tax forms this year if you do not want to be wrongly threatened with a $5,000 frivolous fine, which could delay the processing of your taxes and potentially cause problems with a resister’s heath care premium tax credits.

IRS Commissioner: We’ve Cleared Unopened Mail Backlog

In mid-January, IRS Commissioner Charles Rettig stated that the IRS had finally cleared its backlog of unopened paper mail. The COVID-19 pandemic had forced the temporary closing of many IRS offices, which helped create a backlog of unopened mail. Rettig also noted that there was initially a backlog of over 23 million pieces of mail in spring 2020. As of mid-January 2021, millions of tax returns filed in 2020 are still pending but the agency is now processing all of those it has received.

As of December 25, the IRS still had to process about 40% (or about 6.9 million) of last year’s paper tax returns. This backlog of tax returns from last year has led the IRS to delay the day when it will start accepting tax returns in 2021 from late January to February 12. The IRS would prefer that people file electronically. Many war tax resisters are happy to defy this request.

Private Debt Collectors for the IRS Not Very Successful

The Treasury Inspector General for Tax Administration has released another report on the federal government’s use of private debt collection companies to pursue unpaid taxes. The report states that the companies recovered a mere 1.79% of the unpaid taxes they were assigned, and that more than a third of the money collected went to cover costs and profit for the private companies, with the remainder going to the Treasury. [Thanks to David Gross of the Picket Line blog for highlighting this report.] As stated in previous issues, private debt collectors for the IRS do not have the power to garnish wages or levy bank accounts; they can only bother you with phone calls and letters.

Old Computers at the IRS & Low Staffing are Causing Problems

The National Taxpayer Advocate recently released a report highlighting some of the many problems the IRS had to cope with during the year of pandemic shutdowns and greater-than-usual government dysfunction. For example, taxpayers received misleading tax notices that included deadlines to respond that had already passed by the time the notice was sent. People who tried to call the IRS were able to get through to an agency employee less than 25% of the time. Taxpayer records are processed on “the oldest major IT systems in the federal government,” but Congress has appropriated only about 8% of the estimated cost of updating them. [Thanks to David Gross of the Picket Line blog for highlighting this report.]

Many Thanks

Thanks to each of you who donated to our November appeal! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

We are very grateful to these alternative funds and WTR groups for their redirections

and Affiliate dues:

Birmingham War Tax Objectors; Agape Community (Ware, Massachusetts);

St. Lawrence Catholic Worker (Kansas City, Kansas); War Resisters League

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. Thank you!

NWTRCC Outreach

WTR 101 as World Beyond War Fundraiser

In the latter half of 2020, World Beyond War solicited groups and individuals to offer online skill share sessions to fundraise money for World Beyond War. All the skill share options were posted on their website. NWTRCC offered a WTR 101 session for $10. Normally, NWTRCC does not charge for WTR 101 sessions, but this was to raise money for World Beyond War. In the end, four people signed up for the session, which was led by Lincoln Rice and Chrissy Kirchhoefer via Zoom. Most of the participants were previously familiar with war tax resistance, but wanted to more seriously consider war tax resistance as a practice in their own lives after seeing the session advertised on the World Beyond War skill share website.

War Tax Resistance Discussed at Chicago School of Complexes

On January 16, 2021, NWTRCC Coordinator Lincoln Rice spoke via Zoom at Chicago’s School of Complexes. This group has met over 3,500 times since 1951 to discuss a whole range of topics. Lincoln shared a brief history of war tax resistance in the United States as well as the basics of war tax resistance. The audience was provided time for rebuttals and the speaker was given the last word. About twenty folks attended, with some being war tax resisters themselves and others professing staunch support for current U.S. military policies. Words used to describe war tax resisters ranged from “love them” to “deluded.” It was an animated evening.

NWTRCC Upcoming Events & News

Mark Your Calendars!

National NWTRCC Conference:

April 30 – May 2, 2021

Mark your calendars for our next national gathering, April 30 – May 2, 2021. Unfortunately, we have will still have to meet on Zoom. Hopefully, we can return to in-person meetings for November. Information for the May meeting will be posted on the web in the near future (see nwtrcc.org/programs-events/ or call 262-399-8217). The NWTRCC business meeting is Sunday morning, May 2 (open to all). Note: Proposals for the May meeting must be submitted to the NWTRCC office by April 7, 2021.

WTR Counselor Training on Zoom

The next WTR Counselor Training is scheduled for Saturday February 20 (11a-4:45pm Eastern/ 8a-1:45p Pacific) on Zoom. Counselors are war tax resisters who volunteer to support existing and potential resisters by helping them to understand the motivations and methods of war tax protest, resistance, refusal, and redirection, and to understand the consequences of the choices they make. More information about being a counselor can be found at nwtrcc.org/about-nwtrcc/join-us/. If you are interested in becoming a WTR counselor or local contact for your area, contact the NWTRCC office.

NWTRCC Bequest Campaign

NWTRCC launched its bequest campaign in October 2020. We launched a new webpage (nwtrcc.org/bequests/) and reached out to some folks to consider making a bequest to NWTRCC. We took a short break in reaching out to folks during the holiday season, but will be reaching out to folks again in late February and March. If you are interested in learning more about making a bequest to NWTRCC, please contact Lincoln at the NWTRCC office (262-399-8217 or nwtrcc@nwtrcc.org).

Ask your Church to Support NWTRCC

If you are connected to a church or religious congregation that you think would be open to supportingNWTRCC financially, NWTRCC has just launched a new webpage with resources on how to reach out to your religious group. The address for the webpage is . The webpage has a sample letter as well as links to NWTRCC’s annual reports, which a religious congregation might find helpful in deciding whether to make a donation to NWTRCC. Even if your church denies the request, it is an opportunity to raise awareness about war tax resistance. If you would like any help in formulating a request to your church, feel free to contact Lincoln at the NWTRCC office.

Help keep NWTRCC Strong and Growing!

Nominations Open for NWTRCC’s

Administrative Committee (AdComm)

The AdComm gives oversight to business operations, helps plan two gatherings each year, keeps in touch with consultants between meetings, and meets face-to-face at the May and November gatherings (and by phone in February and August). We need to fill two seats, and new members will be selected from nominees at the May 2021 meeting. They serve as alternates for one year and full members for two years; travel to meetings is paid for full members and alternates filling in for full members who cannot attend. Each nominee will receive a nomination letter from the NWTRCC office with more details about what’s involved as a member of this important committee.

Call, email, or mail your nomination(s) to

NWTRCC, PO Box 5616

Milwaukee, WI 53205

800-269-7464 or nwtrcc@nwtrcc.org

Deadline: March 15, 2021

PROFILE

Letter to IRS: Former State Department Worker Refuses to Pay for Killing Civilians

Fred Burks Photo Courtesy of Fred Burks

Dear friends at the IRS,

I am withholding 20% of my taxes this year as I cannot morally or legally support the U.S. military’s indiscriminate killing of many thousands of innocent civilians, including several U.S. citizens, in recent years. The intentional killing of U.S. civilians (three in Yemen in Sept. 2011) “without due process of law” is a clear violation of the U.S. Constitution’s Fifth Amendment. If another country’s military were to kill innocent U.S. civilians, there would be a huge uproar. Yet our military kills civilians of other countries with impunity, listing them as “collateral damage.” Besides being immoral, this is clearly turning family and friends of those killed against the United States and creating more terrorists.

A further, important reason I am withholding this portion of my taxes is that the amount of corruption in the U.S. military is inexcusable. A CNBC/Reuters article dated Aug. 19, 2016 stated, “The United States Army’s finances are so jumbled it had to make trillions of dollars of improper accounting adjustments to create an illusion that its books are balanced.” The small nonprofit I manage is held accountable for every dollar spent, while the U.S. military has not been held to account for trillions of U.S. taxpayers dollars.

The fact that the Pentagon has been ordered by U.S. courts to get its finances under control for over a decade, yet it has continually failed to do so, suggests a massive level of corruption that I don’t think any American should support. By not undertaking any comprehensive audit in recent decades until 2018 (when it miserably failed its first-ever comprehensive audit and has failed again in 2019 and 2020), our military has clearly violated the U.S. Constitution Article I Section 9 Clause 7.

Additionally, the U.S. government and military repeatedly commit illegal acts by carrying out wars that have never been declared by Congress, violating Article I Section 8 Clause 11 of the U.S. Constitution.

If our military stops killing civilians as collateral damage and brings the rampant corruption in its ranks under control, I will repay these taxes. I have put the amount I’ve withheld in a separate account which I will turn over to the IRS should the killing and corruption stop. If after 10 years nothing has changed, I will turn these funds over to organizations dedicated to stopping both corruption and the killing of civilians by our military. As my federal income tax this year was $4,469, I am withholding $894.

I chose the number 20% as, according to official government statistics, 15% ($600 billion) of the U.S. budget is spent directly on the military, while hundreds of billions more of our tax dollars are funneled into discretionary funds used to support the Pentagon‘s unjust and illegal wars. As you likely know, the term “national security” is being used as a cover for all manner of corruption and political manipulation. It’s time for all caring citizens to join in the call for greater integrity in our military.

I support our tax system. I deeply appreciate how it finances our roads, schools, infrastructure, and much more. Yet integrity in finances, as in all matters, is of the highest importance to me. I would be out of integrity to continue to support the indiscriminate killing and massive corruption in the U.S. military.

I gladly welcome a response and welcome this message being shared with any who cares about the integrity of our country.

With best wishes for ever more humanity and integrity in government,

Frederick B. Burks

January 24, 2021

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org