National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

December 2025 – January 2026

Contents

-

-

- War Tax Resistance Conference in Worcester, Massachusetts

By Lincoln Rice - Current Questions: Digital W-4,

Private Collection Agencies

By Ruth Benn - Counseling Notes: IRS During the Shutdown • IRS Phasing Out Paper Check Payments and Refunds • IRS & ICE • CEO for the IRS

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations

- Network Updates

- War Tax Resistance News Peace Week WTR 101 Sponsored by Pace e Bene’s Tax Resistance Affinity Group • Social Influencer Promotes War Tax Resistance

- NWTRCC Network News – Coordinating Committee Meeting (9 November 2025)

Sunday Business Meeting • Taxpayers Against Genocide Update - Qualified Charitable Distributions: My Pleasant Dilemma

By Betty Winkler

Click here to download a PDF of the December/January issue

War Tax Resistance Conference in Worcester, Massachusetts

Christina from National Tax Strike brought M&Ms to our meeting with messages geared to our crowd. Photo by Lincoln Rice

By Lincoln Rice

For the first time in two years, we held our twice-yearly war tax resistance conference in person. We are very thankful to Patricia Kirkpatrick, an AdComm member in Worcester, who was a local organizer and hosted several attendees in her family’s home. Our conference events on Friday and Saturday were held at the Worcester Friends Meeting House. Most of the sessions were also streamed on Zoom.

Rep. Jim McGovern and Peace Tax Fund Legislation

Friday evening featured two different speakers. At 6:00 pm, US Representative Jim McGovern joined us. Since the passing of Representative John Lewis, McGovern has been the primary sponsor of the National Campaign for a Peace Tax Fund, which guarantees that federal tax monies paid by conscientious objectors would be diverted from military spending to other government programs. One of the reasons McGovern was able to join us was due to the government shutdown, which was still occurring when we met.

Much of what McGovern shared was Democratic rhetoric, but regarding the Peace Tax Fund, he shared he was planning on reintroducing that legislation and that he would let us know when a date is firmed up. He noted that the legislation would allow taxpayers to divert their tax monies from nuclear weapons and the genocide in Gaza. He continued that the legislation had an “uphill battle” with detractors on the right and left. For example, he also informed us that some progressive representatives opposed the bill for fear that it could be used by anti-abortion activists for their cause.

National Priorities Project

Lindsay Koshgarian, the Program Director for the National Priorities Project (nationalpriorities.org) offered critical information about the national budget and the budget-making process. National Priorities Project is the only nonprofit, non-partisan federal budget research organization in the nation with the mission of making the federal budget accessible to the American public.

Lindsay noted that when the numbers are adjusted for inflation, we have never returned to the high military expenditures of World War II, with the caveat that we are nearing that threshold and will likely pass it with the next federal budget. She also noted that the Big Terrible Bill passed in July included an additional $153 billion for military spending, including $24 billion for Trump’s missile defense system, which is just a small down payment. To help pay for all this, she noted several budget cuts, including drastic cuts to food stamps that will go into effect following the midterm elections in November 2026.Planning for Tax Resistance in Tax Season 2026

Lively Discussion during a break in the conference with Daniel Woodham (left), Virginia Cuello of The Black Response Cambridge (center), and Mary Regan of New England War Tax Resistance (right). Photo by Paula Rogge

On Saturday morning, NWTRCC Outreach Consultant Chrissy Kirchhoefer facilitated a workshop on planning for Tax Season 2026. After sharing several NWTRCC resources, we broke out into smaller groups to generate ideas to enhance war tax resistance outreach this coming tax season. Ideas included: bring NWTRCC flyers to protests, promote a spectrum of war tax resistance, host a monthly book study with the updated WTR guide book, post short videos with war tax resisters, include brass bands, puppets, and actual pies at Tax Day gatherings, incorporate local affected groups, promote slow tax resistance (filing paper, in-person payments, etc.), pass out War Resisters League pie charts on Pie Day (March 14), offer penny polls, create a Tax Day playlist to use at gatherings.

After lunch, we continued with a Resistance Panel. Virginia Cuello shared about the work of The Black Response Cambridge (theblackresponsecambridge.com). Claire Schaeffer-Duffy, the Program Director for the Center for Nonviolent Solutions (nonviolentsolutions.org) and a member of the Ss. Francis and Therese Catholic Worker, discussed the genocide in Palestine. Paul Popinchalk, a 350.org member and retired engineer with experience in facilities management and energy conservation, spoke to increasing concern of the federal budget’s impact on the environment during the Trump administration.

Trends in War Tax Resistance

The following session featured Ruth Benn, one of the authors of the recently updated book War Tax Resistance: A Guide to Withholding Your Support from the Military, and Christina Thompson, the Coordinator for the National Tax Strike (taxstrike.info). Ruth spoke to changes in the war tax resistance landscape since the publishing of the previous 2003 edition of the Guide. This included NWTRCC’s success in stopping the wrongly enforced $5,000 frivolous fine for some resisters who included a letter with their resistance as well as impact of the Tea Party in defunding the IRS.

Christina discussed how the National Tax Strike formed in the early days of the Trump Administration because of the “constitutional crisis.” She also stated that her organization formed as “a direct result of NWTRCC’s work.” Since then, they have hosted war tax resistance sessions with their own membership, as well as for other groups, such as Free DC.

We concluded the afternoon with concurrent War Tax Resistance 101 and 201 sessions. All the sessions on Friday and Saturday brought in twenty to twenty-five people in person and about fifteen to twenty people on Zoom. Saturday evening, the legendary folk singer Charlie King gave a concert with plenty of stories. It was the perfect way to cap off an energizing conference. To find out what happened at our Sunday business meeting, see the report on page 6.

- War Tax Resistance Conference in Worcester, Massachusetts

-

Charlie King gave a concert on Saturday evening. Photo by Lincoln Rice

-

Current Questions: Digital W-4, Private Collection Agencies

W-4 in the Digital Age and Private Collection Letters

By Ruth Benn

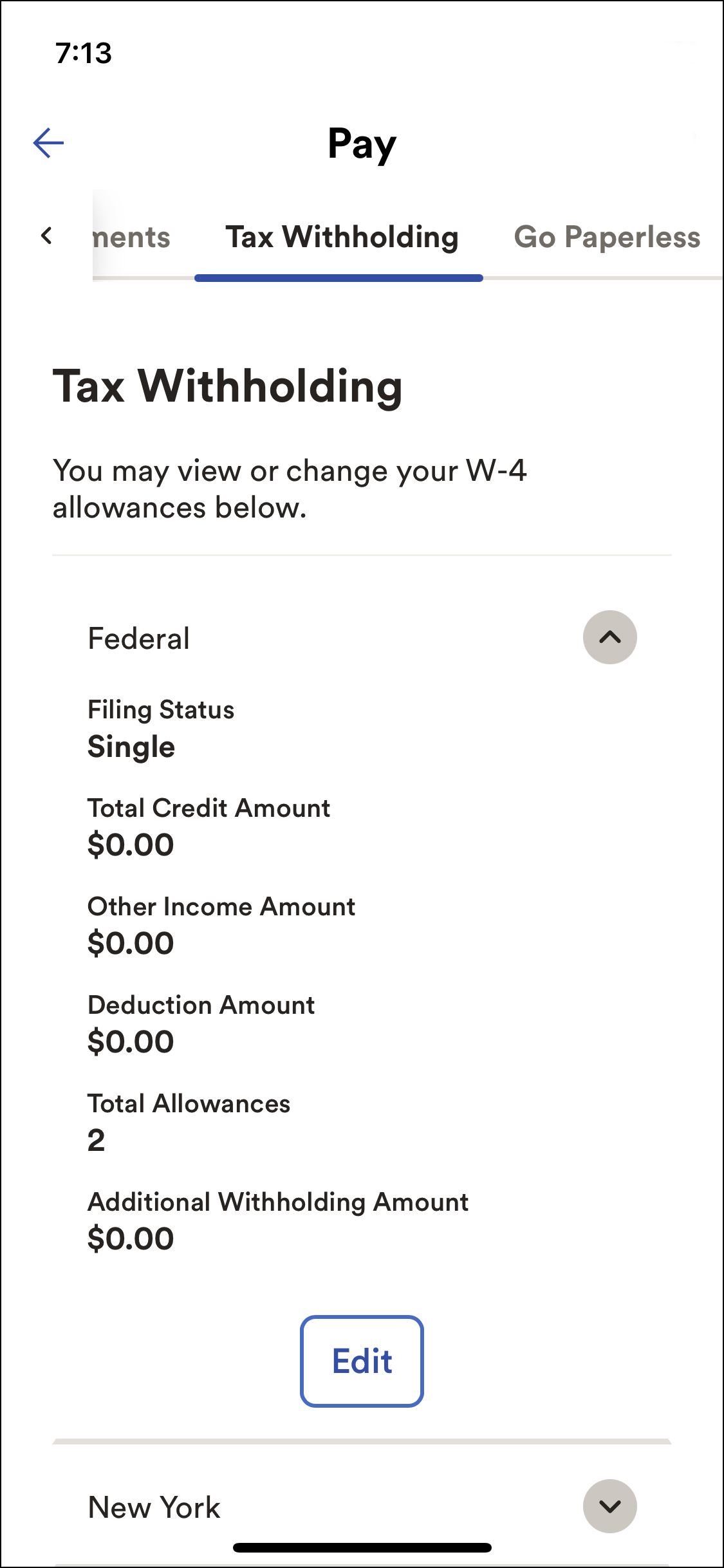

- Adjusting a W-4 form through an online portal was a new WTR counseling question for me. Many of us long-time WTR counselors still rely on printed materials, so thanks to the counselee who introduced me to the online ADP system, the payroll service their company uses. ADP and random accountant websites do have some tips about navigating the system. An human resources office could probably help with the basics too, but often workers have no in-person contact with that office.At first the counselee emailed me a printout of the form that you get on a phone after answering some other standard questions. Right off I was mystified by “allowances” near the bottom since the federal government changed the W-4 from the allowances system to “deductions” a few years ago. A tip from someone at the last NWTRCC gathering clued me in to the fact that “allowances” might be for state taxes (New York), and they were correct.I was also confused by all the zeros, especially on deductions, since the standard deduction should be taken into account on this person’s W-4. When I eventually saw the form live it became clear that the standard deduction (single = $15,750 in 2025) is factored in as soon as you enter your status.

As far as adjusting federal withholding, you can get an idea of what you want to do by using the formula under “Calculating Deductions” in NWTRCC’s Practical #1 on withholding. Or, use the IRS withholding calculator (apps.irs.gov/app/tax-withholding-estimator) to help clarify allowed credits and pre-tax contributions. At the end it shows if your withholding is too low or too high (per IRS standards, of course).

For the individual in question who had been getting a refund and wanted to be able to resist at least a small amount of taxes, the key was to add some amount to the “Deduction Amount” line. (The last line, “Additional Withholding Amount” has to do with having multiple jobs or filing jointly with a working spouse.) In this case, they made a rough guess and entered a few thousand dollars on the “deduction” line, but for some reason it would not save in the cell phone app.

Opening the account on a desktop computer turned out to be much easier, and the adjustment was easily made and saved (who knows why…just a tip in case this happens to you). A message came up that the change might be temporary covering only a couple paychecks. Could that be because we are near the end of the year? Perhaps the process needs to be repeated in the new year?

With the digital account it’s easy to look at the pay stub once the new deduction level kicks in and see if the federal tax withholding number has gone down. You can roughly calculate where you’ll be at the end of the year: will you owe taxes and resist; is it about even so that you won’t owe but won’t get a refund either; or, do you need to increase the deductions because you want to be sure you have taxes to resist? Once again, the IRS withholding calculator is a useful tool, and you are allowed to change your W-4 anytime. Be sure to read about potential consequences in NWTRCC’s Practical #1, Controlling Income Tax Withholding, in case the IRS decides your withholding is too low.

Private Debt Collection

Many resisters are contacting counselors about letters they’ve received from the IRS, which seems to be busy blasting them out. The staff may be decimated but the computers are still working. One letter that seems to be arriving more frequently is CP40, “We assigned your overdue tax account to a private collection agency.” I think this letter used to arrive in the mailboxes of long-time resisters who had an older tax debt (5+ years?), but perhaps with the severe staff cuts at the IRS there is more reliance on private companies. Just a guess.

Legislation back in 2015 forced the IRS to hire a few private collection agencies that began work in 2017. The main things to know are:

• The IRS will give taxpayers written notice of accounts being transferred to a private collection agency (PCA). The agencies will send a separate letter to the taxpayer confirming this transfer. The initial contact will not be by telephone.

• Private collection agencies will identify themselves as contractors of the IRS and must follow the Fair Debt Collection Practices Act. To be sure it’s not a scam, make sure the assignment is to one of these three IRS contractors: CBE, Waterloo, IA; Coast Professional, Inc., Geneseo, NY; ConServe, Fairport, NY.

• The PCAs have no power to collect money from you or levy salaries, bank accounts, etc. Their task is to convince you to clear your debt by sending $$ to the IRS. Whether the tactics are polite or border on harassment may depend on the individual collector.

• If you do not wish to work with the assigned PCA, you must put your request in writing to that agency. Then your case goes back to the IRS.When writing this I ran into a 2019 quote from an experienced resister: “And when they ‘assigned’ my case to a private collection agency, their ability to harass me or take my money decreased.” So I emailed him to ask if he stands by the quote today. He said: “I stand by that quote. I waited them out, and it was reassigned back to the IRS after a couple of years.”

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2025. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org.

IRS During the Shutdown

The IRS, like many US agencies, has been a roller coaster ride this year. When Trump took office in January, the IRS had 103,000 employees. Cuts to the IRS since Trump took office decreased their numbers to 74,000. During the government shutdown, only 40,000 employees continued working. All these factors have impeded the IRS with experts stating that we should expect slower processing of returns, refund claims, and correspondence.

IRS Phasing Out Paper Check Payments and Refunds

Executive Order 14247, signed in March 2025, requires all federal agencies to transition from paper checks to electronic payments for most transactions by September 30, 2025. This includes IRS refunds and payments to the IRS. Many self-employed war tax resisters pay for their Social Security and Medicare using post office money orders to avoid sharing banking information with the IRS. It’s unclear how this executive order will be implemented. Traditionally, there have been exceptions for unbanked households, Americans living abroad, those with religious constraints, victims of domestic violence, and those with disabilities. The executive order does not specify any exceptions but grants the Secretary of the Treasury the authority to approve “limited exceptions where electronic payment and collection methods are not feasible.” Thus far, we have not heard of the IRSIRS refusing any payments because they were made with a check or money order.

IRS & ICE

There has been no change on this front since the last newsletter. The US Court of Appeals for the DC Circuit is still hearing Centro de Trabajadores Unidos v. Bessent, No. 25-5181, in which the plaintiffs are challenging the legality of the IRS sharing certain information with ICE. Currently, the sharing has been paused. When we hear more information, we will share it here.

CEO for the IRS

In early October, Social Security Administration Commissioner Frank Bisignano was named CEO of the IRS, which is a newly created position at the behest of the White House. The IRS is still waiting to have a new commissioner approved by the Senate. The exact role of the IRS CEO and how they will interact with the IRS commissioner are unclear. At this time, Bisignano will run the day-to-day operations of the IRS while still maintaining his position with the SSA, even though it is a potential conflict of interest. As a newly created position, Bisignano did not need to be confirmed by the Senate, which raises the issue of accountability.

Many Thanks

Thanks to each of you who has responded to our November appeal! Remember, you can also donate online through PayPal and Venmo (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

Special thanks for Affiliate dues payments from:

War Resisters League; WRL New England; Boulder War Tax Info Project; Casa Maria Catholic Worker (Milwaukee)

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram •

or join our discussion listserve.

Click on the icons at nwtrcc.orgAdvertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loopWe’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.orgDonate by Venmo

NWTRCC now accepts donations by Venmo! We still accept donations by check, PayPal, and credit/debit card using PayPal. Also, tax deductible donations can be made by check or credit/debit card using one of our fiscal sponsors. For more information on all the ways you can donate to NWTRCC, go to nwtrcc.org/donate.

War Tax Resistance News

Peace Week WTR 101

Sponsored by Pace e Bene’s Tax Resistance Affinity GroupRecently NWTRCC and the Pace e Bene Tax Resistance Affinity Group hosted an introduction to war tax resistance as part of Campaign Nonviolence Days of Action. There were nearly forty people in attendance. The theme this year focused on nonviolence to self, others, world, and earth. All present shared what drew them to the online gathering, interest in war tax resistance, what they hoped to achieve, and questions moving forward. What anchored and motivated this session was the value of community and of doing this work together!

Some of the topics that the presenters discussed were the history of WTR/NWTRCC, getting real about the IRS (possibilities v. probabilities), 5 myths of WTR (taken from the new WTR Guidebook from WRL), and principles (there is no one right way of doing WTR, that it is an evolving journey over a lifetime and that there is a network of support every step of the way).

The space was a welcoming space for people to dip their toes into exploring and delving deeper into the WTR waters. NWTRCC is rich in collective knowledge as well as a strong network of people eager to share their vast experiences. That was communicated to those in attendance and reflected in their comments in the chat at the end which included “I am feeling energized! Thank you for sharing,” “Good to know there is a community for this out there,” “Many Thanks! This has been fabulous!”

Kit and David Miller also shared with the group some of the content of their letter to the IRS for tax season 2025:

“We are unwilling to contribute additional money to fund war and military expansion. Over the years, as a family we have given tens of thousands of dollars in taxes towards the US military empire. We cannot in good conscience continue to do so. We are haunted by the deaths and man-made famine in Gaza, in particular for which every US citizen bears tremendous responsibility.

“May God forgive us for the error of our ways.

“Thank you for reading this, and peace to you and to your family.”For more information about the ongoing Tax Resistance Affinity Group with Pace e Bene, email Chrissy at outreach@nwtrcc.org.

– Report from Chrissy Kirchhoefer

Social Influencer Promotes War Tax Resistance

Leeja Miller, an attorney and content creator with over 668,000 followers on YouTube, posted a video promoting war tax resistance in early November. Though she is clear that she is not advocating “breaking the law.” The video, “Is it Time to Stop Paying Taxes,” has over 244,000 views and 2,100 comments as this goes to print.

Leeja Miller’s YouTube thumbnail for the video

The video is very accurate for a non-NWTRCC resource and she correctly differentiates war tax resisters from tax protesters. Miller also provides a nice overview of the history of war tax resistance in the United States since World War II.

Miller’s explanation of legal and illegal forms of war tax resistance is very accurately portrayed and she regularly advertises the NWTRCC website. She even includes several excerpts from NWTRCC’s 2010 Death and Taxes film. Miller obviously did serious research on the NWTRCC website and her video is a great resource that could be employed by war tax resisters. Miller’s YouTube channel can be found here: youtube.com/@LeejaMiller.

– Report by Lincoln Rice

NWTRCC Network News

NWTRCC’s hybrid business meeting with Zoom participants projected on back wall

Coordinating Committee Meeting (9 November 2025)

Sunday Business MeetingWe had a full business meeting agenda, including setting our 2026 budget, confirming objectives for 2026, and holding the biennial review of the coordinator and outreach consultant. The minutes and materials for that meeting can be found here: nwtrcc.org/nwtrcc-business.

We also received requests to endorse two campaigns. The first was to endorse the Taxpayers Against Genocide campaign (taxpayersagainstgenocide.org). The preconference feedback on Loomio was almost completely positive and this endorsement passed without any discussion.

The second request was to endorse the General Strike US campaign (generalstrikeus.com). This request solicited much discussion, and the request was rejected. There were concerns about many aspects of the campaign, ranging from skepticism of their representation of millions of members and the role of endorsing organizations, to their plan for striking. Regarding the latter, it was felt that their demands were too broad and undefined. For example, how does war tax resistance jive with their demand to Tax the Rich? What does Gun Safety, Indigenous Rights, No Military for Genocide look like? What sort of military actions outside of genocide are permitted? There were also concerns about asking medical personnel to strike.

Nevertheless, it was an excellent gathering in Worcester and the business meeting accomplished a lot of important work for NWTRCC as an organization in its allotted three hours.

Taxpayers Against Genocide Update

As noted in NWTRCC’s business meeting update, NWTRCC has officially endorsed the Taxpayers Against Genocide (TAG) campaign. There are active TAG groups in California, Texas, Minnesota, New York, and New Jersey. Their campaign now includes more than 4,000 taxpayers who have joined TAG by signing onto the legal complaint filed with the Inter-American Commission on Human Rights (IACHR).Although the IACHR cannot criminally prosecute US officials, it can find the US government guilty of violating its international obligations under the American Declaration on the Rights and Duties of Man. This declaration established the jurisprudence of the Inter-American Commission on Human Rights and the binding human rights requirements to which member states must adhere, including the US government. A finding of guilt of the US government by the IACHR can be leveraged by human rights advocates in their other efforts to hold the US government accountable on an international level.

The complaint has been prepared and filed by a renowned team of attorneys with the National Lawyers Guild’s International Committee, including lead attorney Huwaida Arraf, who is also one of the founders of the Freedom Flotilla Coalition. For more information, go to taxpayersagainstgenocide.org.

Qualified Charitable Distributions

My Pleasant Dilemma

By Betty Winkler

Betty Winkler Photo by Betty Winkler

I received a big surprise in early July of this year. A former professor of mine who followed my careers and with whom I maintained contact for fifty years, left me a modest “Inherited IRA” as one of several beneficiaries. She passed on suddenly, at age eighty-nine. I am honored by this act of hers.

My first dilemma with Joann’s amazing gift: the money was in a traditional IRA in a financial firm that does not invest totally ethically, so I wanted it out. At first, I did not have access to any information, other than the firm’s name, and assumed it was not ethically invested. That was confirmed by the firm’s representative that first contacted me.

Next dilemma – it was a traditional IRA, which meant that if I removed any of it, federal tax would be owed, either upon withdrawal or with annual income tax. As a war tax resister of varying degrees, and especially now as the USturns into dictatorship, I could not do it. Simply could not.

Inherited IRAs have different rules than those owned and managed as one’s own IRA. Marriage or single status factors into several aspects of inherited IRA withdrawals. Being an inherited and traditional IRA, and my being single, it was not allowed to be rolled over into my own Roth IRA, which is in an ethical investment firm.

I know others may determine any investments in capitalist structure are unethical; that is not me. I look at selective investments as contributing to environmentally sound companies and contributing to communities while additionally investing in startups that otherwise would not have a chance to develop healthy, sustainable products. Also, I know tech companies are a large component of the investment firm I use, and that they supply digital infrastructure to myriad purposes, among them military. I do the best I can.

So, I couldn’t take it out and I couldn’t keep it in. I researched and quickly found QCD, Qualified Charitable Distribution. This is a direct contribution to a 501(c)(3) organization from the inherited IRA. I was lucky that I recently reached the required threshold of being 70 and one-half years old. Any younger and the QCD is not allowed to be used.

But I was the right age, I am lucky enough to be able to live without the inheritance, tax or no tax. (Not luck only, mostly simple living with a strong commitment to saving money.)

My next step was to see if I was reading the IRS publication correctly. I had already spoken with my financial institution which advised me to speak with an accountant. I didn’t have one, so I contacted friends, who made referrals. One of the two accountants was referred by Ruth Benn. The other referral, who spoke with me first, was from a friend who has a small arts business. Both accountants, one being a second opinion to the first, spent a few minutes with me on the phone, without charge. Both confirmed my understanding of the IRS rule – that I could make contributions without paying any tax and that these are a separate category from donations and therefore are not deductible on a 1040 IRS return.

QCDs are hidden within Publication 590-B (2024), regarding IRA Distributions (aka withdrawals); information is on page 13. The maximum annual exclusion for QCDs is $105,000. Any QCD in excess of the $105,000 exclusion limit is included in income as any other distribution. If you file a joint return, your spouse can also have a QCD. I think I read somewhere that there is also a lifetime maximum. [Editor’s Note: there is no lifetime limit on QCDs to charities. There is an annual limit of $108,000 for individuals, $216,000 for married couples for 2025.]

Before any beneficiary monies were released or known, I had to pay state taxes through a lawyer. I was told this was non-negotiable and it happened in a flurry; I am not sure why.

From first hearing of my being a beneficiary, without knowing initially if it was a Traditional or Roth IRA and not knowing about QCDs, I knew I would donate at least some of it. I drafted a short list of donor organizations. Once I had all the information, I expanded that list so that all the money would go to worthy organizations by way of QCDs.

The investment firm would have mailed the checks to the organizations directly without a cover letter. I wanted to include information about the person who means so much to me and who was the source of the money. The firm accommodated me. The checks, made out by the investment firm, were sent to me, and I then mailed them out to the organizations, with my cover letter and contact information. A couple of them received a follow-up email about my pleasant dilemma, the reason I wrote this piece.

[Editor’s Note: Qualified Charitable Distributions can be made to NWTRCC through our fiscal sponsor, Resources for Organizing and Social Change. (Their EIN is 01-0353747.) Ideally, the check would be mailed to NWTRCC, PO Box 5616, Milwaukee, WI 53205. Some investment companies will only mail checks directly to ROSC. If that is the case, please let us know. Otherwise, there is the possibility that ROSC might not notice it is earmarked for NWTRCC and may accept the donation for themselves.]

Editor Lincoln Rice

Production Rick BickhartMore Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org

-