National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

December 2024 – January 2025

Contents

- Jail-phobia and War Tax Resistance

By Ruth Benn - NWTRCC Conference Attracts Largest Numbers for Online Gathering by Chrissy Kirchhoefer and Lincoln Rice

- Counseling Notes: Letters, Letters, and More Letters • Future of Inflation Reduction Act

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- War Tax Resistance News A Victory Over Verizon! By Ellen Barfield • Temporary Relief

By CML Bishop • Peace Week WTR 101 • Lewis University Peace Teach-In • 17th International Conscience and Peace Tax International Conference - NWTRCC Network News Coordinating Committee Meeting (10 November 2024) • Flood Gallery Fine Art Center Rebuilding in Asheville

- Book Review Max Sandin’s Memoir

Click here to download a PDF of the December/January issue

Jail-phobia and War Tax Resistance

By Ruth Benn

Hundreds of people risk arrest in direct actions pretty much every day. Protests about the war on Gaza might top the list with thousands of arrests in the US since Israel’s genocide began. Last July, Nuclear Resister tallied 9,000 arrests, but that number could have doubled by now.

Thousands have been arrested in Black Lives Matter demonstrations. Arrests during climate actions, including against tar sands and pipelines, continue every day. Nuclear Resister publicizes anti-nuclear arrests, with five here, eight there, a dozen somewhere else. Of all these arrests, most are released quickly with a future court date, but some activists knowingly risk years in prison; others are surprised by a long sentence.

With all that I’m always a little surprised that fear of jail is a top concern for so many potential war tax resisters. This came up in recent counseling conversations and workshops, even from people who have seen the short list of war tax resisters jailed since World War II.

So what is it about war tax resistance that makes jail such a fear?

It seems there is a term for fear of the IRS and taxes: Forosophobia. I’m not sure if it’s made the dictionary yet, but apparently someone at Psychology Today coined it a few years ago, combining the Greek term for taxes, “foros,” and the one for fear. One CPA writing about fear of the IRS (at cpapracticeadvisor.com) sees himself as “acting as both a CPA and an unlicensed therapist for my clients.”

At workshops we like to show a clip from an old “Boston Legal” episode. One of the staff members, angry about the war in Iraq, is arrested in her office for filing a blank 1040 form with a protest note attached. (After the ads, the arrest is a few minutes into this episode.) To potential resisters we can easily say “that’s not going to happen,” particularly because the federal agents arrive at her office with handcuffs the day after she mailed in her form. The IRS would not even have received the mail at that point, let alone open the envelope.

Even after the IRS notes your refusal to pay some or all of your tax due, there are multiple steps the authorities still have to take before hauling you off to prison. In the war tax resistance network, the last person to receive a court order was Cindy Sheehan in 2012. She was not jailed (for her tax refusal anyway) and eventually the case was dropped.

I was reminded recently of Chris Coverdale, a war tax resister in England, who spent 42 days in jail in 2015 for refusing to pay his local council taxes because he believes the government could allocate those funds to war-related activities. It was his third jail term but he’s still not cooperating with Britain’s Inland Revenue. In correspondence with another UK resister about that case he said:

In Britain war tax resisters don’t get thrown into prison by the government any more. They have cannily realized that this just raises publicity for the issue. There is also the current crisis with prison overcrowding which makes it even more unlikely. Stop Oil protesters get harsher treatment.

That sounds similar to the situation here. (Nothing like what it must be to refuse war taxes in Russia, Israel, and so many other countries.)

I expect the fear of jail over tax resistance has a lot to do with the individual nature of this form of direct action. It’s not like getting arrested with dozens or hundreds of others who can share the experience. Personally, I find the idea of standing in court and trying to explain my refusal to pay taxes with no hand to hold quite intimidating. But I’ve watched others do it, felt proud of their stance, and was there for support before, during, and after. Our network is strong enough to be there for you should this rare opportunity arise.

In light of all this I often come back to a quote from Bill Ramsey in NWTRCC’s Death and Taxes film:

The IRS has a huge collection process that lasts for years and at every stage of that collection process, the war tax resister has a choice about what to do. So that’s why I believe that it’s really a one step at a time kind of thing, and that imagining the worst possible consequences before you even begin the process is paralyzing. And it doesn’t let your conscience struggle with doubts one by one.

NWTRCC Conference Attracts Largest Numbers for Online Gathering

By Chrissy Kirchhoefer & Lincoln Rice

NWTRCC returned to Zoom for its fall conference (November 8-10, 2024). We had 200 registrations for the weekend and 80 households attend some part of the conference.

Friday Evening

Friday evening began with music from long-time war tax resister Mary Sprunger-Froese in Colorado Springs. She led us in a sing-a-long of Fred Small’s “Love’s Gonna Carry Us,” Charlie King’s “Don’t Pay Taxes,” and “We Arm the Word,” which she wrote with local members of the First Strike Theatre. The final song follows the tune of “We are the World.”

We then broke out into smaller groups of five or six people on two occasions to continue our social hour with seeing old friends and making new ones.

Saturday Sessions

Many attendees cited hearing about Captain A’s bike ride in southwestern Wisconsin around Tax Day as the highlight of our Zoom gathering.

On Saturday morning, 35 people joined us for an extended session that began with a memorial to remember those who had recently passed away followed by a discussion about how NWTRCC should organize future gatherings. There was no consensus on what path to take going forward with future gatherings (online vs in-person gatherings). One idea that kept reemerging was to hold monthly social hours on Zoom. We plan on trying this in the near future. Watch for details…

The next session attracted 40 people and focused on creative forms of resistance. Captain A in southwestern Wisconsin shared about raising a family and being isolated in a rural area. Last April, he decided to ride his bike to Madison while wearing a Captain America outfit and hauling a large billboard promoting war tax resistance.

Sue Barnhart of Eugene, Oregon shared her experience incorporating crafts and street theater into her resistance. She showed her large flat topped hat which contained a homemade War Resisters League pie chart as well as large scrolling banner that shows the federal budget in color-coded format. This banner takes four or five people to hold it because of its length. Captain A and Sue’s sharing led others to share about other creative acts of resistance.

Mid-afternoon, Paula Rogge and H. A. Penner led a short session on the roots of war tax resistance in the Quaker and Mennonite traditions and laid the groundwork for future discussions about how to encourage the historical peace churches to support war tax resistance. The 30 people in attendance agreed to continue this discussion over the winter on Zoom.

Our very busy Saturday continued with concurrent WTR 101 & 201 sessions. 25 people joined Lincoln for the WTR 201 to discuss current trends. Over 40 people attended the WTR 101 session with a couple watch parties. The 101 session included many people new to attending NWTRCC events, though a few were already refusing taxes for war and had attended previous WTR 101s. Cathy Deppe, Kima Garrison, and Shirley Whiteside joined Outreach Consultant Chrissy Kirchhoefer to co-facilitate the session.

Some shared that they were interested in hosting WTR 101 sessions in their communities. This was a perfect segue to our final Saturday session on organizing WTR 101s. This session began with Kima Garrison and Paul Stretch in Portland, Oregon as well as Ruth Been in Brooklyn sharing how they organize, advertise, and present at local in-person sessions. About 20 people attended this final session.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2025. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org.

Letters, Letters, and More Letters

As reported in previous issues, the IRS has been very busy sending out letters to seasoned and new resisters since this summer and this trend has not relented. Many folks who resisted taxes and filed for tax year 2023 received IRS Notice CP14, which is the first threatening letter people receive indicating a tax debt. For tax years 2023 and earlier, many are receiving IRS Notice CP504 Notice of Intent to Levy or Seize. The latter letter simply gives the IRS the option of taking those types of actions in the future. It does not mean collection in imminent.

Since our last newsletter, someone also received IRS Notice LT19, in which the IRS asks the resister to contact them as they may be eligible for a payment plan. And another resister received IRS Notice 3174-A, which the IRS sends if they are given a new address for you and have already sent a CP504 to your old address. In that sense, it is like CP504, but they never send out CP504 twice for the same tax year. If you receive a letter from the IRS, please let us know. We are trying to keep track of the different types of letters they are sending out and with what frequency. So far, these recent letters have not led to any collection.

Future of Inflation Reduction Act

The Inflation Reduction Act of 2022 provided the IRS with an additional $80 billion over ten years. Initially, we believed this might lead to more aggressive collection. This has not been the case so far with war tax resisters. Some of these funds were already cut in a compromise to increase the federal debt ceiling. Now that Republicans will control the White House, Senate, and House of Representatives in 2025, we can expect further cuts to IRS funding.

Many Thanks

Thanks to each of you who has responded to our November appeal! Remember, you can also donate online through PayPal and Venmo (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

Special thanks for Affiliate dues payments from: War Resisters League; Casa Maria Catholic Worker (Milwaukee); Fellowship of Reconciliation-Western Washington; Boulder War Tax Info Project

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loop

We’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.org

Donate by Venmo

NWTRCC now accepts donations by Venmo! We still accept donations by check, PayPal, and credit/debit card using PayPal. Also, tax deductible donations can be made by check or credit/debit card using one of our fiscal sponsors. For more information on all the ways you can donate to NWTRCC, go to nwtrcc.org/donate.

War Tax Resistance News

A Victory Over Verizon!

Ellen Barfield

By Ellen Barfield

I began refusing the federal excise tax (FET) on landline phone service, always a war tax, as soon as I heard of it in the late 1980s. I was learning all about resistance to war, living and working at The Peace Farm right across the highway from the Pantex Nuclear Weapons Plant, which is the final assembly point for every US warhead, outside Amarillo, Texas.

Back then The Farm got its phone service from a small local phone company who had no idea about this issue. They were open and easily taught though, with NWTRCC info about the pertinent law, so they began crediting our FET every month.

Now, with few even using landlines, and cell phones taxed differently, phone tax resistance is becoming a lost art, with only us few Luddites hanging on. My landline connection here in Baltimore has been Verizon for the over 27 1/2 years. Verizon’s phone tax policy has shifted over the years, as has any understanding of the issue by Verizon staff, so contacting them can be long and arduous.

In July 2021, a Verizon staffer actually credited me for a year’s worth of the FET, and Verizon themselves deducted the $1.10 monthly for a year. After that, having gotten disinclined to call every month, when I also provide written notice every month with my payment and also to a separate address, I let the FET accumulate. In September 2024, I received a short and abrupt letter from Verizon’s “Executive Relations Team” (ERT), saying they could neither remove nor waive the tax, which is not what I was asking, and which verbiage indicated the ERT did not know about this issue. Since cell phones are taxed differently and since few still have landlines, that did not surprise me.

After that letter I spoke to various Verizon staff many times and requested being connected to the ERT. Some of the staffers seemed to be speaking with the ERT with me on hold, but I was unable to speak with the ERT myself. The staffers, though all very polite, said they could not credit me for the accumulated back FET and some late charges which had begun to be added.

I sent in my regular payment for my landline in later September, having deducted the accumulated FET and sent the notification slips both with my payment and to the other address.

Then on October 21st, my service was cut off without any warning, though I was told they would have e-mailed me if they had had my e-mail, which I did not particularly want them to have but finally gave them in hopes it might help resolve the cut off.

One afternoon, yet another staffer helped me figure out, without quite telling me, as she seemed constrained from doing, that my overdue amount had for one day, due to post office delay, risen over $50 which seems to be the automatic cutoff, to the level of $68.54 with the regular service amount which the post office finally delivered the very next day. But apparently the ERT office just keeps insisting on payment in full once the overdue bill goes over $50.

So I contacted the Federal Communications Commission with a detailed narrative similar to the above, but also making very clear I knew my legal rights. The very next day the ERT called me directly, finally. They credited me as they should have all along and restored my service within the hour.

Though this was quite the saga, and a hassle, I don’t regret it in the least. I do have a cellphone too, so I was not out of contact which of course would have been a bigger deal. But continuing to make noise opposing war always feel right!

[Ellen Barfield is on the National Committee of the War Resisters League, the national board of Veterans for Peace, the Center on Conscience and War board, the Disarmament Committee of Women’s International League for Peace and Freedom, Military Families Speak Out, and otherwise connected with many other social change and peace and justice organizations and projects.]

Temporary Relief

By CML Bishop

substack.com/@punchland

When single-sheet zines cease slinking from the printer, I stop biting my nails. With a little shuffle of feet and paper, I begin to fold and cut pages at my desk. Completing little 8-page booklets brings a small satisfaction on an otherwise unremarkable workday.

A coworker I trust stops to chat as he does every Wednesday. Among our pleasantries and jokes, I slip him a first copy of the War Tax Resistance Zine.

I’m hunched in the back corner of the library, the open layout tutoring center. Students speak in hushed foreign languages behind me. Library aids scurry between shelves. Kids in hoodies occupy plastic chairs with tired eyes and tablets.

Today, this position is a benefit. My job is little more than smiling and sharing tutor schedules. It’s easy to identify comrades and friends in the quiet hall. The first person my coworker tutors is a leader from the Climate Justice club, and I give him five copies to distribute to his board. He asks me more, eyes sparking at the possibility.

I start with 200 and leave my first shift 50 pages lighter. I don’t just wait for open hands: I drop intriguing white papers on vacant benches in the business school and art gallery on my way home. As well as I can, I avoid cameras, but other students and staff pay no mind. In fact, a few secretarial staff my age smile when I slip papers across their stations. Zine-dropping feels empowering—exciting, even!

A few months prior, War Tax Resistance was a new idea to me. First introduced as a footnote in a class on revolution, some quick research lit my heart (and wallet) on fire. Knowing that even my docile labor contributes to the war machine makes me sick. What is the medicine?

In my dorm tonight, I attend another WTR webinar with open eyes (and a VPN). As I watch the webinar, I include a zine as a gift in 35 carefully curated thank-you notes. Last month, I fundraised for a small trip to attend the Convergence to Stop Cop City. I asked my close friends and comrades for gas money, to join up with like minds in solidarity. We are learning firsthand the power of collective financial redistribution.

In the months before tax day, I’ll drop a few anywhere my daily life takes me: bathroom stalls, little free libraries, warm bus seats, gym locker rooms.

I’ll get awfully close to passing all 200 through this system of handoffs and mailing. But tonight, for a moment, I pause. I can’t help but feel overwhelmed by what I’m asking of people…

There’s little within my power to stop a war. I already don’t own a car or celebrate the fourth of July. I wear badly patched pants and a hat to cover my eyes. I eat free cafeteria meals with event coupons and spend my weekends working as a bouncer. I’m just one young person.

But, more than hopelessness, more than worthlessness, I’m compelled by responsibility—that all-too familiar sensation of needing to do something. I can’t stand by and watch my government sponsor genocide anymore. For me, the sheer intrigue of this idea outweighs the stress of repercussion.

If spreading literature is what I can do, it’s what I will do.

[Editor’s Note: You can find a copy of the zine here: tinyurl.com/28azbcnp]

Peace Week WTR 101

Sponsored by Pace e Bene Tax Resistance Affinity Group

Recently Campaign Nonviolence hosted Days of Action to elevate nonviolence in practice. NWTRCC and the Pace e Bene Tax Resistance Affinity Group hosted an introduction to war tax resistance. Over 25 people were in attendance. Many learned about the session from NWTRCC’s Instagram post.

While a few long-time war tax resisters who shared their experiences, quite a few attendees were already resisting taxes and redirecting those taxes to causes that they wanted to support (e.g., humanitarian efforts in Gaza).

One person was a tax preparer who wanted to be informed on how to educate their clients. Another raised the issue of reparations as the motivation for their war tax resistance to ongoing war and exploitation to peoples. For more information about the ongoing Tax Resistance Affinity Group with Pace e Bene, email me at outreach@nwtrcc.org.

— Report from Chrissy Kirchhoefer

Lewis University Peace Teach-In

War tax resister Bill Ruhaak persuaded Lewis University in Romeoville, Illinois to become the second Catholic college in the US to host memorial for conscientious objectors. Although the memorial is not yet completed, an event celebrating the coming memorial on October 23, 2024 was part of the university’s 2024 Peace Teach-In.

At the event, which boasted over fifty attendees, Bill first spoke about the significance of the coming memorial as well as his own journey to becoming a conscientious objector and a war tax resister. Afterward, NWTRCC Coordinator Lincoln Rice spoke on the basics of war tax resistance and as well as the strong historical connection between conscientious objection and war tax resistance. After some small group discussion, there was a lively question and answer period.

— Report from Lincoln Rice

17th International Conscience and Peace Tax International Conference

CPTI 2024 conference group photo at the seaside. Courtesy of Katharina Rottmayr-Czerny.

CPTI’s conference took place near Lübeck Germany the first weekend in October. On Friday evening, Lincoln Rice and Cathy Deppe were able to join the gathering on Zoom during the time reserved for country reports. Lincoln shared about growing war tax resistance interest in the US since the invasion of Gaza. A weak Zoom connection made it difficult to hear other reports, but it was clear that war tax resistance in Europe has not seen a similar increase.

On Saturday, Ralf Becker of the Rethinking Security spoke about the limitations of military intervention and emphasized the importance of cooperative crisis management. On Sunday, Derek Brett spoke about his role as CPTI’s representative at the United Nations and his work to maintain the organization’s visibility, especially given the limited opportunities to address the issue of conscientious objection to military taxation at the UN. NWTRCC is hoping to coordinate a Zoom panel with CPTI in February. Stay tuned…

— Report from Lincoln Rice

NWTRCC Network News

(10 November 2024)

23 people attended the NWTRCC’s business meeting, which began with reports from both consultants (Lincoln & Chrissy). Next, we set our objectives for 2025. Two additions were made to those from the previous year: to create a WTR 101 video with an American Sign Language interpreter and to translate our popular Peace Tax Return flyer into Spanish.

We also passed the 2025 budget, which was first composed by Lincoln, then received feedback from NWTRCC’s Fundraising Committee and Administrative Committee before being presented to the business meeting. Though we have seen an increase in donations this past year, we still expect to use some of our reserves to balance the budget in 2025.

The following proposal was submitted for discussion: “It should be a necessary qualification to be on AdComm that the person should have actually practiced War Tax Resistance in a meaningful way for a meaningful length of time.” After some heated debate, the proposal failed to achieve consensus with two people supporting, two people standing aside, and the remainder of coordinating committee blocking the measure.

The meeting finished with collecting some initial AdComm nominations for the May 2025 meeting and discussing some possible meeting locations for our next meeting (May 2-4, 2024). We received an invitation from Worcester, Massachusetts that seems very promising and a straw poll indicated strong support to hold our next meeting there. The NWTRCC office is currently exploring this option.

Minutes for this meeting can be found here: nwtrcc.org/nwtrcc-business/.

Flood Gallery Fine Art Center Rebuilding in Asheville

National news coverage showed the devastation of Hurrian Helene. Many of our friends in North Carolina were adversely affected. As long-time war tax resister and NWTRCC supporter Carlos Steward in Asheville reported, “The Flood Gallery Fine Art Center, and Black Mountain Press, which operated out of the gallery, have both been destroyed by Hurricane Helene. The Swannanoa River completely consumed it, causing the walls to collapse and our art to be sent downstream.” Carlos ran the gallery and the press.

National news coverage showed the devastation of Hurrian Helene. Many of our friends in North Carolina were adversely affected. As long-time war tax resister and NWTRCC supporter Carlos Steward in Asheville reported, “The Flood Gallery Fine Art Center, and Black Mountain Press, which operated out of the gallery, have both been destroyed by Hurricane Helene. The Swannanoa River completely consumed it, causing the walls to collapse and our art to be sent downstream.” Carlos ran the gallery and the press.

After raising some funds through a GoFundMe, Carlos is hoping to reopen in the gallery at a new location in the near future. For more information, go to facebook.com/FloodGallery.

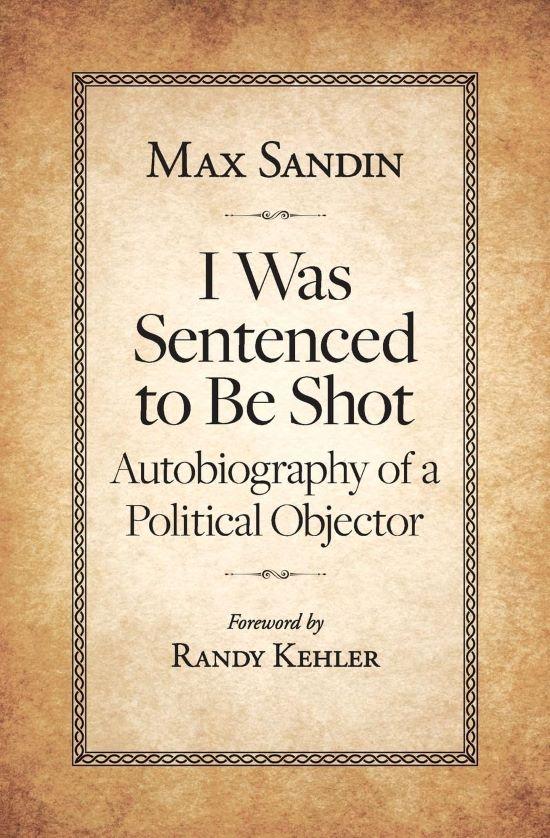

Book Review

Max Sandin’s Memoir

Max Sandin. Photo from publisher’s website.

Forward by Randy Kehler; Edited by Ed Hedemann & Ruth Benn; Published in May 2024 ($15)

By Lawrence Rosenwald

Max Sandin’s memoir begins with a story told by the late Randy Kehler, who met Sandin in 1963, in New York, on a bus taking them to the March on Washington. They talked the whole way. It was Kehler’s his first encounter with an ardent pacifist, and it made a big impact: “I often felt, consciously or unconsciously, that I was indeed, in my own way, following in – or at least trying to follow in – Max Sandin’s big footsteps in opposition to war and killing.”

We might read this encounter as a passing of the torch: the veteran pacifist hands pacifism on to the pacifist to be. Kehler then passes the torch to Daniel Ellsberg, and to all whom he inspired in his life and work. (As Bob Bady said at the memorial service for Kehler, “Randy sowed some seeds.”)

But the metaphor presumes that the torch itself, the pacifism itself, is unchanged. And that is not true. Though much in Sandin’s pacifism abides in Kehler’s, and in ours, much is transformed, something is lost, something is gained.

What abides? First the pacifism itself, fundamental and constant. For Sandin, I think for Kehler, for many of us, it is an intuition or revelation, not the result of reasoning. Then the willingness to see what pacifism implies: not just protests but draft resistance and war tax resistance. And the courage to live by pacifist principle. What Sandin and other World War I COs went through was appalling. They were tortured, there is no other word for it. (One of the book’s many virtues is its revelation of this history.) But few of them changed their views. They were pacifists, they were tortured, they were sentenced to death, they remained pacifists.

Kehler and others of his generation are in this tradition: a fundamental opposition to war, a conscientious sense of what that opposition entails, the courage to live in accord with what the conscience demands. Like Sandin, Kehler goes to jail for draft resistance, like Sandin he becomes a war tax resister. Sandin was stripped of his social security, Kehler was stripped of his house. Neither yielded.

Much abides, then. But much has changed too. Sandin was Jewish, for one thing. He translated his memoir into Yiddish. He was Jewishly literate and might have become a rabbi, as his parents wished. He was what many leftist Jews were in those days: socialist, communist, unionist, secularist. (He refused an offer from a Quaker meeting to pay his bail fee: “as an atheist I cannot accept help from a religious group” (165).)

I too am a Jew and a Yiddishist, and I sometimes feel the absence of the energies associated with these identities from the pacifist communities familiar to me. These energies are more combative, more unionist, funnier (though Sandin himself has no sense of humor), more cosmopolitan and polyglot, more irreverent than what I usually see. We have lost something in losing them.

But we have gained much too. A clearer sense of gender, for one thing. Sandin was stunningly indifferent to it. His marriage was amiable and long-lasting but patriarchal. He goes out to work, his wife takes care of the house and children, in particular their son Carl, diagnosed as “mentally retarded” (116); she spends four hours a day on street cars to get Carl to school and back. He is unmoved by the worries he is causing his wife and daughter. At one point he writes, unconscious of the irony, “because my family was upset about my stand, I decided to go west for a while” (155).

He is almost equally indifferent to questions of race. He makes occasional references to “Negroes,” he of course met Kehler on the way to the March on Washington, he met Wally and Juanita Nelson and Eroseanna Robinson, but he never wonders about what it was like to be an African American pacifist, cannot see racism as an American original sin, as pervasive and corrosive as the violence of war.

He was also strikingly un-Gandhian. He is not curious about his opponents, he does not regard them as conducting their own experiments with truth, he does not feel any bond of human sympathy with them. He is not like Gandhi, Barbara Deming, Bayard Rustin, Dorothy Day, Kehler. Our pacifism at its best is shaped by such figures, by their bridge-building curiosities and sympathies.

We have gone beyond Sandin’s pacifism; but his memoir is indispensable. It tells us where we come from, what we have retained, altered, lost, gained. All honor to Ruth Benn and Ed Hedemann for editing the manuscript so well, and may it find many readers.

[Editor’s Note: The book can be purchased from any online bookseller or ordered by your local bookstore.]

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org