More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

December 2021 – January 2022

Contents

- NWTRCC November 2021 Conference

had an International Flavor

By Lincoln Rice - We Can All Say “No!” By Ruth Benn

- Counseling Notes: Stricter Reporting Requirement for 1099-K Beginning in 2022 • Potential $80 Billion Funding Package for IRS • Possible Bill would Require Banks to Report on Gross Annual Transactions of $10,000 or More

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- In Memoriam: Bob Meola

- War Tax Resistance News Students in Myanmar Promote Tax Resistance

- Network News: NWTRCC Funding Concerns

- Social Media: Viral Post on Twitter

By Lincoln Rice

Click here to download a PDF of the December/January issue

NWTRCC November 2021 Conference

had an International Flavor

By Lincoln Rice

NWTRCC held its fourth online conference the weekend of 5 – 7 November 2021. About 50 people attended some portion of the conference, which began the evening of Friday November 5 with a social hour. For the social hour, we broke out twice into random groups of five or six people for 23 minutes. It was chance for old friends to chat, but also to meet new friends.

Panel on Tax Resistance with Money Rebellion and Grup Antimilitarista Tortuga

For this conference, we really took advantage of its online nature by hosting a Saturday morning panel with tax resisters from Europe. The first session was a “Panel on Tax Resistance with Money Rebellion and Grup Antimilitarista Tortuga,” with author Jane Rogers and biologist Alex Penson of Extinction RebellionUK, and Cuti of Grup Antimilitarista Tortuga in Spain.

Cuti spoke first and explained how their war tax resistance group grew from a movement of folks protesting compulsory military service in the 1990s. Grup Antimilitarista Tortuga collaborates with environmentalists and labor groups in Spain and also with War Resisters International. Their war tax resistance campaign is called, “Fiscal Objection to Military Spending,” and they object to 1,000 per person each year being dedicated from Spain’s federal budget to military spending, which is roughly 40% of their federal budget. Their study of Spain’s federal budget has revealed that Spain’s actual military spending is four times greater than the government admits in its summary of the budget.

Their analysis of the Spanish budget is similar to the pie chart created by the War Resisters League in the U.S., which reveal how much the U.S. actually dedicates to military spending. Although many collectives support their war tax resistance campaign, the actual number of resisters is about 400 people, who redirect about 25,000 each year to over 100 social projects.

Jane Rogers spoke next, sharing the beginnings of Extinction Rebellion and its Money Rebellion campaign. Extinction Rebellion (XR) began as a nonviolent direct action movement on 31 October 2018 as a response to the climate crisis. They have three demands: (1) the government should declare a climate emergency, (2) zero carbon emissions by 2025, and (3) the creation of a citizen’s assembly to direct climate policy.

Money Rebellion began earlier this year to address the massive financial resources being poured into the fossil-fuel industry. Money Rebellion targets “dirty banks” and advocates withholding 3% of one’s income tax and council tax. They are promoting the withholding of 3% because this percentage of England’s budget is used to subsidize the fossil-fuel industry. The funds will be redirected to a climate charity if the XR‘s demands are not met. Jane explained that despite their efforts to promote income tax resistance, only about 100 people are participating in the campaign. Their tax campaign has been partially hampered because only self-employed individuals can participate. Employees cannot control their tax withholding in the U.K. So far, income tax resisters have only received letters.

Biologist Alex Penson spoke last. He joined us from the Global Day of Action protest on the streets of the Glasgow, Scotland, where the COP26 U.N. Climate Conference was happening. He explained that the multi-pronged approach of Money Rebellion was intended to allow everyone a role in the campaign. If someone cannot resist their taxes, they can put pressure on banks such as J.P. Morgan. Actions have ranged from putting information stickers on ATMs to breaking bank windows. He also explained that the council tax is very similar to the property tax in the United States. Though Money Rebellion has recommended resisting 3% of the council tax, some have resisted the entire amount, facing repossession of their property and risking future imprisonment.

Session with Attorney Peter Goldberger

Attorney Peter Goldberger (left) speaks during the second session on Saturday.

Longtime NWTRCC legal consultant Peter Goldberger joined us for our second session on Saturday. This session was a sequel of sorts to Peter’s discussion on the Hobby Lobby case at NWTRCC’s Earlham conference in 2014. Since the previous talk, there has been an “upsurge” of Supreme Court cases dealing with freedom of religion from a First Amendment perspective, which was different from Hobby Lobby’s focus on the Religious Freedom and Restoration Act. Especially in the last couple years with COVID-19 court cases, the Supreme Court “has been very actively reviving its application of this equal treatment, or at least equal to secular reasons, doctrine under the Free Exercise Clause [of the First Amendment] If even-handedly applied,” Peter believes this updated view of the Supreme Court could benefit war tax resisters.

Saturday finished with concurrent WTR 101 and 201 sessions.

Sunday Business Meeting

The Sunday business meeting began with reports from both NWTRCC consultants (Coordinator & Outreach consultant), a biennial review of our consultants, the setting of our objectives for 2022, and the approval of our 2022 budget. (Minutes for this meeting are not available yet, but will be sent out to the network in the near future. The agenda and supporting documents for the meeting can be found here: www.nwtrcc.org/november-2021-cc-meeting/)

There were two proposals on our agenda. The first was to make three amendments to NWTRCC’s statement of purpose, which had been updated at our May 2021 meeting. The decision was made to reject all three amendments and leave the statement as is.

The second proposal was for a sign-on statement, which will be part of an outreach campaign for the coming tax season. The statement and plan for this campaign were approved as is, though NWTRCC’s Outreach Committee was given leeway to amend the statement and campaign as needed. You will see more about this campaign in early January.

Overall, it was a wonderful conference and we were very pleased to even welcome an attendee from Switzerland, who has attended several international meetings on war tax resistance. It was also great to host such great speakers with several speakers joining us from abroad. It would be better meeting in person, but I am glad we were able to make the best of what technology has to offer.

NWTRCC’s Statement of Purpose

[Editor’s Note: This is NWTRCC’s updated statement of purpose, which was approved at our May 2021 business meeting.]

The National War Tax Resistance Coordinating Committee (NWTRCC) is a coalition of groups and individuals across the U.S. working to maintain and build a national movement of resisters to military taxes. NWTRCC opposes militarism and war; we refuse to be complicit in paying taxes for such violence.

War tax resistance methods include refusing to pay federal income taxes, redirecting tax money to community needs, supporting peace tax fund legislation, and living in ways that eliminate tax liability.

We acknowledge the deep links between militarism and the social ills of poverty, racism, sexism, xenophobia, homophobia, transphobia, economic exploitation, environmental destruction, and militarized law enforcement. We believe war tax resistance can help build a world of justice, community, harmony with nature, and peace. We seek collaboration with others working for a non-militarized society.

We Can All Say “No!”

By Ruth Benn

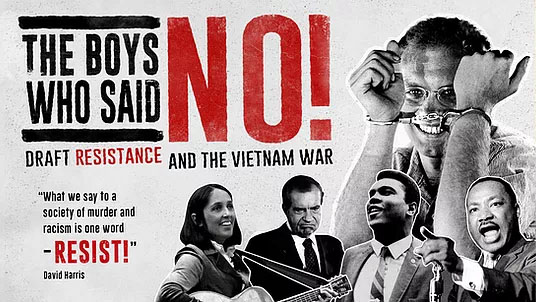

“What we say to a society of murder and racism is a very simple no. What we say to our brothers across this country and around the world is a very simple word. That word is RESIST!”

— David Harris, at a 1960s antiwar protest

David Harris is one of the featured draft resisters and organizers in the recently released film, The Boys Who Said No: Draft Resistance and the Vietnam War, directed by Oscar-nominated filmmaker Judith Ehrlich. The film gives an overview of the draft resistance movement from 1965 – 1975 through the eyes of those who participated and those who were influenced by the resistance, with an emphasis on The Resistance founded by Harris and others in California. It honors a movement that helped inspire a wider antiwar movement, grew to include resistance within the military, and was a key factor in bringing an end to the war.

For those of us of the Vietnam generation the film is both nostalgic and educational and full of amazing people we know or were inspired by. It’s a reminder of how horrific and wrong that war was — and how horrific and wrong war still is. It’s an incentive to press on with our protests of militarism and war. Although tax resistance is not mentioned in the film, two in our network, Randy Kehler in Massachusetts and Joe Maizlish in Los Angeles, are featured. Like many draft resisters, they went to prison for their refusal, but once that was over they realized they also didn’t want to pay for others to go to war. Their draft resistance was behind them but war tax resistance became part of a lifetime of war resistance.

The Connections between the Civil Rights Movement and War Resistance

The Boys Who Said No does an excellent job of showing the connections between the civil rights movement of the time and war resistance. Many of the draft resisters — both Black and White — had already been involved in voting rights demonstrations in the south. The famous refusal of Mohammad Ali to go “10,000 miles from home to help murder and burn another poor nation simply to continue the domination of white slave masters” is a moving highlight. I had not remembered that when the Student Nonviolent Coordinating Committee took a position against the war it caused an uproar from the civil rights leadership or about the Vietnam comic book that was created to outreach to young men in the Black community.

Draft Resistance as a Model for Today

Although it took longer to end the war than any activist at the time hoped, the filmmakers want viewers to see the success of the draft resistance movement as a relevant model today. The film demonstrates how that personal and individual act of refusal — burning a draft card or refusing to step over the line at the induction center — inspired the Berrigans and others to burn draft files; Dr. Benjamin Spock to speak out in support of resisters and face a federal conspiracy charge; Daniel Ellsberg to release the Pentagon papers; and eventually massive actions in cities across the country, like the October 1969 Moratorium. A soldier in Vietnam represents the growing resistance within the military: “The Woodstock generation came to Vietnam. Killing for peace just doesn’t make sense.”

The effectiveness of the movement is also described in numbers, as prosecutions and imprisonments of draft resisters dropped over the decade, because the court system was overwhelmed, many judges were sympathetic, and public opinion had turned against the war.

Inspiring Stories of Individual Resistance

One of my favorite stories in the film is told by Geoff Fishman who remembers getting his induction notice and heading to his appointment with no intention of refusing. At the induction center doors his bus full of young men was met by draft protesters holding signs and handing out leaflets. He took a leaflet and went in, but when it came time to cross the line and join the army he surprised himself by not taking the step. After that he found a welcoming community of support for his act of conscience. Harris says, “The longer we kept doing stuff, the more people kept joining us. The more that happened, the more people were able to stand up.”

War Tax Resister Randy Kehler Speaking in the Documentary

The Boys Who Said No is packed with great quotes that I find especially relevant to encouraging individual resistance, like refusing war taxes. Randy Kehler, who spent two years in prison for his draft resistance, talks about his decision to send his draft card back with his refusal; he hesitates before letting it drop into the mailbox asking himself, “Is this what I want to do?” How many war tax resisters have hesitated as they mailed their tax return with no check and their “I refuse to pay for war” letter?

For so many of these draft resisters, the risk of going to prison was real, but those interviewed expressed again and again that time in prison was worth it if it helped bring an end to killing. In the film, Christopher Jones reads his statement to the court which ended, “Stop the war. End the draft. I refuse to register with glad heart.”

See the film and let it inspire your continued — or new or renewed — resistance to war. See the film with an organizer’s eye and consider how as war tax resisters we can take some lessons learned and build on them today.

[A list of current screenings and a page where you can inquire about holding a screening in your community can be found here: www.boyswhosaidno.com. Chrissy Kirchhoefer recently shared WTR info at a screening in St. Louis and some folks in the Bay Area plan on handing out NWTRCC palm cards at a December screening.]

Counseling Notes:

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click on “Local Contacts & Counselors”).This training is usually offered once a year and the next training will be online in early 2022. If you would be interested in attending one of these trainings, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

Stricter Reporting Requirement for 1099-K Beginning in 2022

Currently, depending on the situation, gig workers receive a 1099-NEC if they earn more than $600 and a 1099-K if they have total sales of at least $20,000 and total transactions of 200 or more in a tax year. Gig workers who do not receive the 1099-NEC (e.g., sellers on eBay) have not had income reported to the IRS unless it hit the $20,000/200 threshold for the 1099-K. A provision in the $1.9 trillion COVID relief bill that President Biden signed into law last March amends the IRS code to require reporting for gross sales of $600 or more using the 1099-K form. This change will go into effect for tax year 2022.

A 1099-K form does not necessarily denote net income. If you sell a bike on eBay for $700 that you originally bought new for $1,000, there is no net income and no tax debt is due. But when PayPal sends out a 1099-K using the $600 rule for the above bike situation and for roommates that reimburse each other for rent and utilities using PayPal or Venmo, how the IRS will differentiate business income from reimbursements has not been clarified.

Potential $80 Billion Funding Package for IRS

After months of negotiations, the House passed the Build Back Better Bill the Friday before Thanksgiving. The $1.75 trillion social spending bill now heads to the Senate, where it is expected to undergo changes before a vote is taken. The bill contains a number of provisions, one of which is a proposal to strengthen the IRS through roughly $80 billion in additional funding over the next 10 years.

If the Senate passes the bill with the IRS funding provision, Biden is sure to sign it. Whether the Senate will include the IRS funding is far from certain. But it is a provision that is desperately desired by the IRS. IRS Commissioner Rettig, in a November 11 op-ed published in the Washington Post, encouraged Congress to approve the funding proposal.

As Rettig writes in the piece, the IRS’s workforce “is the same size as in 1970.” The shortage of auditors has resulted in a 60% drop in audits of taxpayers with over $1 million in annual income over the past decade. The IRS also lacks the means to adequately hold wealthy individuals and large corporations accountable. An estimated 15% of taxes “are uncollected each year,” largely because of personnel and technological gaps.

Rettig has made a point of emphasizing that the funds would be used to go after wealthy individuals, but the bill would obviously also affect war tax resisters and others of more moderate means. If the IRS funding were passed as is, this would be the breakdown:

- $1,931,500,000 for filing, education, account, and other taxpayer services;

- $44,887,500,000 for enforcement, investigative, litigative, and digital asset monitoring and compliance activities;

- $27,376,300,000 for supporting internal operations and expenses;

- $4,750,700,000 for the agency’s business systems modernization program designed to improve communications with customers; and

- $15,000,000 for the development of a free “direct efile” tax return system.

Possible Bill would Require Banks to Report on Gross Annual Transactions of $10,000 or More

A provision that was pulled out of the House’s Build Back Better bill was a requirement for banks and credit unions to report yearly gross transactions of $10,000 or more. Direct deposit amounts from paychecks would be excluded from deposit amounts, but anyone who removes $10,000 or more from an account during the year would have their total deposits and withdrawals reported to the IRS.

The stated purpose of this provision to catch individuals who are hiding income from the IRS. If it appears someone’s bank habits indicate more income than reported, these individuals would be flagged for an audit.

Although Biden would really like this bill to pass, it faces a steep-uphill battle from Republicans and the banking industry. If the bill were to pass, keeping one’s funds in a non-interest bearing account may no longer be sufficient to prevent the IRS from knowing where war tax resisters keeps their funds. We’ll keep you updated on this bill.

Many Thanks

Thanks to everyone who donate to NWTRCC! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

We are very grateful to these WTR groups and alternative funds for their redirections

and Affiliate dues payments from: Fools for Peace (Asheville, NC)

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. Thank you!

War Tax Resistance News

Students in Myanmar Promote Tax Resistance

Students from Mandalar University Protest Military Dictatorship in Myanmar. Photo by CI for Myanmar Now

In an October 31, 2021 Joint Statement signed by 246 student groups in Myanmar, the students decry the military coup that occurred in Myanmar earlier this year. The statement notes that two days earlier, the military “set fire to the town of Htantalan in Chin State, burning down 164 houses, including churches.”

The students document internal resistance to funding the military government as follows: “Even before the unlawful military coup, the people, who do not wish to be oppressed, have strived to refrain from using products of military-owned businesses and, accordingly, to stop the income of the military. And now, after the coup of the fascist military, the movements have become more rigorous, boycotting not only military-owned businesses but also those associated with the fascist State Administrative Council and those providing income for the illegitimate government.”

The students lament that they cannot stop those outside of the country from funding the military: “We have learned that the fascist military is going to have bullets funded by billions of dollars provided by international oil enterprises. Providing taxes to the fascist military, who are actively committing genocides, equates to funding for, and thus, committing the genocides ourselves.”

In response, the students are asking international oil companies and other governments “to temporarily reserve taxes that are to be paid to Myanmar’s government, in a bank (or escrow account) until democracy is restored and the people’s government is in power.”

(Thanks to Dave Gross for making NWTRCC aware of this statement.)

In Memoriam: Bob Meola

Bob Meola is in the center with the beard during a gathering to celebrate the War Resisters League 90th Anniversary. Photo provided by Jim Haber

By Jeff Paterson

Bob was well known throughout the San Francisco Bay Area for his lifelong commitment to anti-militarism efforts. Bob learned this past August that he had pancreatic cancer. He died Wednesday afternoon, November 17th, with his wife Sue and daughter Sofia by his side, following complications from a surgery the day before.

For years, Bob served as a War Resisters League (WRL) National Committee Member and the public contact for WRL-West. In 2009, he played a key role in the adoption by WRL of its current position statement in support of all forms of resistance to conscription and militarism. Bob was a founder of Southern California War Resisters’ League and Southern California War Tax Resistance.

He was well known locally for his 16 years on the City of Berkeley’s Peace and Justice Commission, serving as chairperson from 2008 to 2010. After helping pass a city resolution against military recruiting in 2008 that garnered national attention, he appeared on the “Daily Show with Jon Stewart”–something strangers on the street would recognize him for years later, which he found amusing.

On the Commission, Bob championed many human rights issues, police accountability, support for whistleblowers, the closure of Guantanamo Bay prison camp, and for Berkeley to become a “No Drone Zone.” One of the last events he was able to attend in person was a rally for Julian Assange of WikiLeaks who faces extradition to the U.S. for publishing classified documents pertaining to the wars in Iraq and Afghanistan.

Bob received a Juris Doctor degree from the New College of California School of Law, San Francisco, in 1989. He graduated from James Madison College at Michigan State University with a B.A. degree in Justice, Morality, and Constitutional Democracy in 1972. Over the last ten years, Bob became a scholar of the Spanish Civil War and was a primary participant in the Movement for an Anarchist Society, a study group that focused on the writings of 19th Century thinkers. On social media, Bob proclaimed, “The empire will fall. Work now to build a nonviolent anarchist-communist revolution. Long live Anarchy! Love, peace, anarchy.”

A friend of nearly 50 years, Steve Leeds remembers, “Bob was deeply caring about family, friends, community, and building a more peaceful and just world. I still remember our first conversation and Bob’s infectious laugh.”

Bob identified as a “HinJew” based on his practice of both Hinduism and Judaism. He found strong connection with Indian spiritual leaders Shirdi Sai Baba and Ammachi, as well as with the Bay Area Jewish community. Bob was also a co-founding minister of the religious humanist Objector Church in 2018.

Since 2007, Bob organized the Annual Berkeley Conscientious Objectors’ and War Resisters’ Day. Sponsored by the City of Berkeley Peace and Justice Commission, the gatherings are held at the flagpoles in front of City Hall in honor of International Conscientious Objectors’ Day.

[Editor’s Note: Reprinted with the permission of the author from the Courage to Resist website. There were minor edits for reasons of length. The full obituary and information about upcoming memorial services can be found at: www.couragetoresist.org/bob-meola-1952-2021/]

Jim Haber Remembers Bob Meola

Even though Bob and I both lived in the Bay Area, most of the time I spent with Bob Meola was in New York for War Resisters League national committee meetings or events. We would be home and happily run into each other at a demonstration or occasionally socialize for fun, but most of our great discussions were on the other side of the country. You could always count on Bob to show up. He represented steady movement solidarity to me. I aspire to his level of consistency and good humor.

Bob and I were also both war tax resisters, but we didn’t talk about it much. It just seemed consistent and a given, not to pay for what we’re working against. Bob’s memory represents walking your talk in such a straightforward way as war tax resistance. Bob was a regular participant in Northern California War Tax Resistance street actions as well as the annual People’s Life Fund war tax redirection ceremonies.

Network News

NWTRCC Funding Concerns

At NWTRCC’s business meeting at the beginning of November, we passed our annual budget for 2022. This budget anticipates taking $18,700 from our reserves during 2022. Thankfully, because of generous donations earlier in the 2021, we do not anticipate needing to dip into our reserves this year as long as donations in December mirror previous years.

We were able to build up these reserves because of a generous grant that we had been receiving from the Craigslist Charitable Fund each year from 2014 through 2018. Not only did this grant allow NWTRCC to build some reserves, but it permitted us to hire additional part-time staff.

NWTRCC did not receive the grant in 2019 and at this point it seems unlikely that NWTRCC will receive this grant again in the future. Since NWTRCC has always been very frugal, cuts to our 2022 budget were limited. Beginning in 2023, NWTRCC will be eligible once again for a grant from the James & Mary Jane Barrett Foundation, but we are still in needs of new funding sources, otherwise, NWTRCC will be forced to make more drastic cuts to future budgets.

If you know of funding sources willing to support NWTRCC, please contact us at nwtrcc@nwtrcc.org or call us at (800) 269-7464. In addition, any extra you can donate at this time would be appreciated.

Please consider making a pledge to donate to NWTRCC on a monthly or quarterly basis. This can be done by writing checks or setting up a monthly donation via PayPal (www.nwtrcc.org/about-nwtrcc/donations/).

Consider making a bequest to NWTRCC by putting us in your will. More information about making a bequest to NWTRCC can be found on our “Donations” webpage.

SOCIAL MEDIA

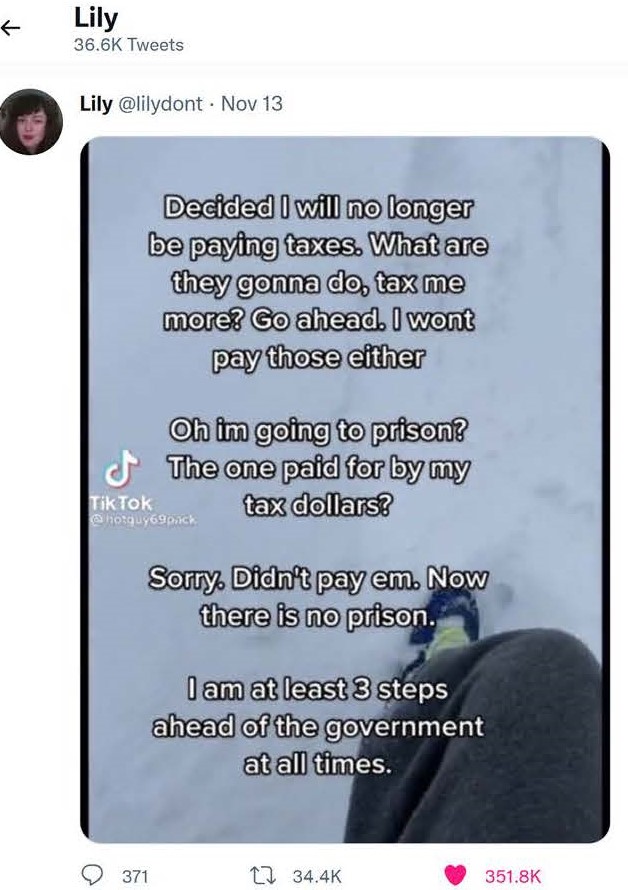

Viral Post on Twitter

By Lincoln Rice

Outreach Consultant Chrissy Kirchhoefer and myself often post items on Facebook, Instagram, and Twitter with the hope that it may go viral. On the rare chance when something we post gets anywhere near 50 likes and 10 reposts, we are pretty happy.

On November 13, a person on Twitter using the screen name @lilydont tweeted a pic about resisting taxes. Her profile identifies her as a leftist and a digital artist and she has about 4,900 followers on Twitter. I noticed her tweet two days after she posted it. And that point, it already had 371 comments, 34,000 retweets, and 352,000 likes. As this goes to press at the end of November, the tweet had reached 453 comments, 41,500 retweets, and 417,600 likes.

This tweet obviously resonated with quite a few folks online. If you use use social media, please share your own thoughts on war tax resistance from time to time. You can post your original thoughts or repost something from NWTRCC’s Facebook, Twitter, or Instagram feeds. If you are not already following NWTRCC on social meeting, you can find links to our social media accounts at the top of our main website(www.nwtrcc.org). You never know when something you post on social media about war tax resistance will connect with someone.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org