National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

August – September 2025

Contents

-

- Defund the Trump Agenda by Members of the Nelson Legacy Project

- Rooted in Pacifism: Facing the Future from a Deep Tradition By Tim Godshall

- Counseling Notes: Correction to Last Newsletter • The Big Terrible Bill • Writing Messages on 1040 Form May Lead to $5,000 Fine

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- War Tax Resistance News Mennocon 2025 Promotes War Tax Resistance by Tim Godshall

- NWTRCC Fundraising and News: NWTRCC Raffle Winners! • Mark your Calendars for Next NWTRCC Conference

- War Tax Resistance: Two Complementary Visions By Karl Meyer

- Conference Report Tax Resistance at the 22nd Century Institute Conference by Christina Thompson, National Tax Strike Coordinator, and Pete Mousseaux, National Tax Strike Volunteer

Click here to download a PDF of the August/September issue

Defund the Trump Agenda

by Members of the Nelson Legacy Project

Juanita (far left) and Wally (far right) protesting in front of the IRS in Greenfield, Massachusetts in 1980

In a recent Boston Globe column (“Resisting Trump: The Revival of Tax Protest,” April 10), Alex Beam points to a time-honored way of resisting violence and war: refusing to pay for it. He highlights the activism of the Pioneer Valley in western Massachusetts, and central to that activism were Juanita and Wally Nelson, two peace and civil rights activists, subsistence farmers, advocates of simple living and local food. They were also war tax refusers, people who refused to pay for what they knew was wrong, what they opposed with every fiber of their being: war and killing. Wally and Juanita Nelson lived on Woolman Hill in Deerfield from 1974 until virtually the ends of their lives in 2002 and 2015, respectively. They were known for their integrity and for the extent to which they embraced a philosophy and lifestyle of nonviolence.

War tax refusal has usually meant a refusal to pay for war in the conventional sense: a shooting war with bombs, missiles, guns, chemical and biological agents, and (these days) drones—not to mention the maintenance of a nuclear arsenal, the most hideous form of violence we humans have created.

Today we are faced with a different type of war. The Trump administration has declared a domestic war on its political opponents, on virtually every progressive measure this country has ever enacted, from civil rights to voting rights to women’s rights to LGBTQIA rights to free speech… the list expands day by day. Most pernicious is the war against the natural environment. Trump has turned the Environmental Protection Agency into the Environmental Destruction Agency and is seeking to reverse every measure addressing climate change that previous administrations took pains to enact. Antisemitism has been weaponized to suppress free speech on college campuses. Words like diversity, equity, and inclusion have become dirty words. We are now apparently supposed to support its opposite – (white) monoculture, inequity, and exclusion—or face draconian funding cuts. Dr. King is surely rolling in his grave, along with many others who sacrificed their lives for racial and social justice in this country.

Not for the first time, the war has come home.The example of Wally and Juanita Nelson forces us to ask ourselves the question, “If you don’t support what the Trump administration is doing, why are you paying for it?” If we pay our federal taxes, we are supporting the Trump/Vance/Musk agenda, no matter how many protest rallies we attend. Wally was fond of carrying around a sign that simply said, “You Don’t Gotta.” What he meant was, you don’t have to be a sheep and follow the crowd. You don’t have to do what you don’t believe in. Sure, there will sometimes be consequences for following your conscience, especially if it involves some form of civil disobedience. But we are already living with the consequences of doing next to nothing, or as Alex Beam puts it, “sitting on our hands.” Trump’s policies and executive orders are already causing a lot of suffering.

The Nelsons insisted that the struggle of our times is that of freedom, and for them, freedom meant doing what you know is right, no matter the consequences. Wally famously said, “Freedom… You don’t vote for it. You don’t shoot for it. You don’t tell other people what to do about it. Freedom is something you do for yourself.” In other words, freedom is what you live. Juanita put it this way: “You don’t create change by doing something one day a month or one day a year. It has to be your whole life.” The change to which the Nelsons devoted much of their lives was divesting from the violent US economy.

The violence of our economy is what lies behind war and exploitation, and it is what lies behind Trumpism. Trump did not create this violence. It was long in the making. But Trump’s policies are its extreme manifestation and stem from the same sources: greed, profit, wealth, overconsumption, exploitation of vulnerable people, disdain for human rights and civil liberties, degradation of the natural environment… that’s how our economy works, that is its effect. The Nelsons saw that the American Dream was actually a Nightmare for so many people, both here and abroad, and especially for people in the Global South. And for the planet itself.

Complicity was an important word for the Nelsons. Toward the end of the 1960s, during the height of the Vietnam War and the struggles of the United Farm Workers, Wally and Juanita realized that they were part of the problem. In 1970, they gave up their urban lifestyle in Philadelphia to become subsistence farmers, first in Ojo Caliente, New Mexico, and then in Deerfield, Massachusetts, in an attempt to divest themselves—to some extent—from economic violence. They wanted to be neither the exploiter nor the exploited. Their guiding principle was nonviolence, which was both broader and deeper than the usual “tactical” definition of that term. For them, nonviolence was a way of life. It permeated everything they did, every choice or decision they made, everything they purchased (or didn’t purchase). And it governed the way they related to people, which included economic relationships.

For the Nelsons, tax refusal was a way of exercising freedom, of living one’s life according to one’s most deeply held beliefs. You, too, can choose your level of noncooperation with the Trump agenda. Most importantly, you can redirect your federal taxes to those organizations and causes that are being defunded by Trump at the direction of billionaire Elon Musk. You can fund climate change mitigations, DEI initiatives, independent media, aid to the homeless, protection for immigrants, Headstart, reparations for Indigenous people and African Americans, resources for LGBTQIA people, your local library… the list keeps getting longer. You don’t have to hope that your tax dollars will go to the right places. You can make sure that they do.

The Nelsons knew that any government can only function with the cooperation and consent of those governed. Once we withdraw our cooperation and consent, that government is finished. We can defund the Trump agenda if we dare to do so. There will likely be consequences for this, but as we said earlier, there are already consequences if we continue to fund what we abhor. Tax refusal is not for the timid or the meek, as Alex Beam confessed at the end of his opinion piece. Plus, it takes a certain amount of discipline and training to carry it through, as is true of any form of civil disobedience. You don’t have to go through it alone, however. There are people and organizations to provide help and support.

To find out more about Juanita and Wally Nelson, visit www.nelsonhomestead.org.

[Editor’s Note. The founding members of the Nelson Legacy Project who wrote this piece are: Bob Bady, Betsy Corner, Aaron Falbel, Mary Link, Jane McPhetres Johnson, Paula Rayman, and Joe Toritto.]

Rooted in Pacifism: Facing the Future from a Deep Tradition

By Tim Godshall

When I first learned of war tax resistance in my teenage years, I was smitten. Growing up in the Mennonite church, in which pacifism is a key part of church doctrine, I learned about our history of conscientious objectors who refused to fight in previous wars. Since the US military draft ended a few years before my birth, how would I practice my conscientious objection? War tax resistance, of course!

I’ve been a war tax resister for twenty-three years now – nearly half my life. The longer I’ve been involved, the more questions I have. One of those questions is why don’t more of my left-leaning Mennonite peers participate in WTR? I’ll address that question in a bit, but first, here’s a very brief summary of the Anabaptist movement, which started exactly 500 years ago in Europe, out of which present-day Mennonites and other denominations emerged.

The Anabaptist movement was a subset of the larger religious reformation that swept Europe in the sixteenth century. The Anabaptists rejected the practice of infant baptism and were thus named for their practice of re-baptizing each other as adults. While this doesn’t seem like such a big deal in today’s society, at that time, infant baptism was the bedrock of the church/state system. It was the official mechanism to create loyal subjects with the duty to pay taxes and fight wars. Anabaptists were severely persecuted for their actions, and many were killed for their refusal to participate in the system.

Out of this history, WTR would seem to be a pretty obvious practice for modern day Mennonites. While I don’t have any stats on this, I would be fairly confident that among US Mennonites, there is a much higher level of WTR than among the US population in general. Still, it is a very small number of people. For instance, in the very progressive Mennonite church in which I am one of roughly 250 members, there are five households who at times have practiced WTR in recent years.

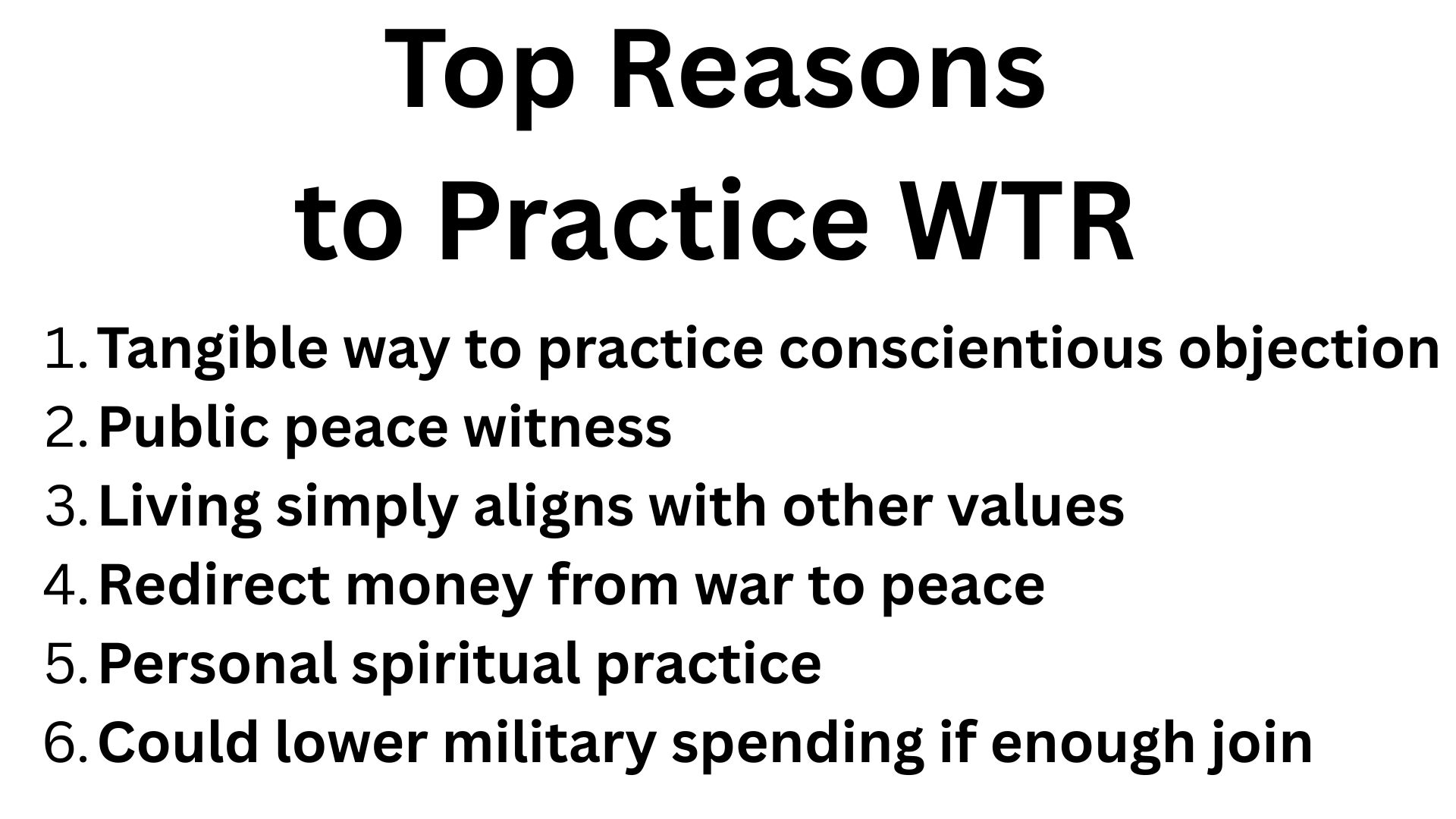

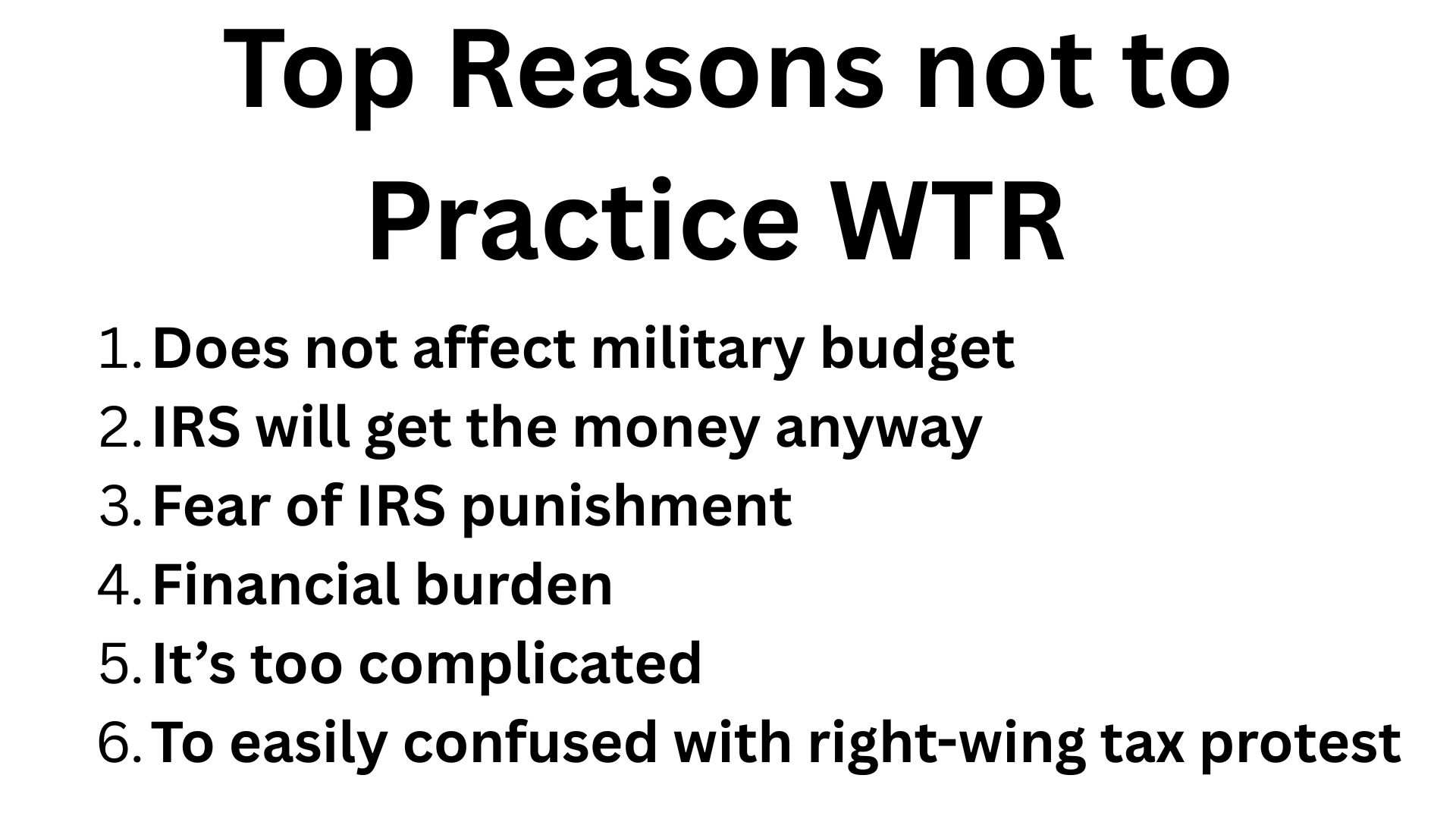

So, to answer my question, I put a survey in my church newsletter and emailed it around to my left-leaning Mennonite friends in other places. I got 41 responses – 19 from those who have at some point practiced WTR (whether living below taxable income or refusing payment) and 22 from those who have never done WTR. There is nothing scientifically rigorous about this, but here is how the responders to my survey listed their top three reasons to do WTR and their top 3 reasons NOT to do WTR.

I was not surprised that lack of effectiveness was high on the list of reasons against WTR, and that principled-based reasons were high on the list of reasons for WTR.It was interesting to me to see that there were a number of reasons that left-leaning Mennonites would, on principle, oppose WTR. We are living in a very different time than the Anabaptists of 1525. We have a bill of rights and a representative democracy in which we have other levers of power. We also see the many positive things that our taxes fund and we benefit greatly from many of these. And if we really dig deep into our thoughts, maybe we also take some comfort in knowing that we’ve got the world’s biggest military.

These questions challenge me and my idealism. On one hand I seek to engage these questions as valid challenges, and practice my WTR with humility. On the other, I must remember that even if my WTR isn’t changing the world, neither is it a meaningless act if it is done from a place of conscience. And maybe enough acts of conscience can eventually create some change.

-

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2025. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org.

Correction to Last Newsletter

In the last newsletter, we printed an article by David Gross that stated: “It’s an encouraging sign that the War Tax Resisters Penalty Fund mutual aid program now explicitly welcomes anti-Trumpery tax resisters as well as traditional war tax resisters.” This was an inaccurate statement based on a misunderstanding. The WTR Penalty Fund wants to make clear that their purpose is to aid war tax resisters.

The Big Terrible Bill

President Trump’s major budget and tax legislation was signed into law on July 4, 2025. There are several items in the bill that may interest war tax resisters. Some of the new tax laws affect 2025 taxes (filed in 2026), but most will start in 2026 or later.

Overtime Pay & Tips: Starting in tax year 2025, certain workers can claim a dollar-for-dollar deduction for a designated amount of overtime pay and tips. But there is a cap on both and the deduction excludes those filing Married Filing Separately.

1099-K: This column has been plagued with changes to the 1099-K, which reports payments from third-parties (eBay, PayPal, Venmo, Airbnb, Uber, etc.). The reporting requirements had been lowered in recent years from the original requirements of over $20,000 income and over 200 transactions. Beginning immediately in 2025, the 1099-K reporting requirements are reverting back to the original rule.

1099-NEC: Beginning in tax year 2026, the reporting requirements for self-employed people receiving income from businesses will change. Previously, businesses were required to report payments of $600 or more during a calendar year to self-employed people. In tax year 2026, this threshold will rise to $2,000 and go up each year with inflation. This rule is expected to reduce by 30% of the amount of 1099-NECs that are issued.

Charitable Deductions: Currently, charitable deductions can only be taken by people forgoing the Standard Deduction to itemize their deductions on Schedule A. Beginning in tax year 2026, single filers will be able to deduct up to $1,000 in cash donations even if they take the Standard Deduction. (Married-Jointly filers up to $2,000.) Property donations will not qualify.

Cuts to IRS: Between the Trump administration’s 20% cut to appropriated IRS funding and the reduction in supplemental funding under the Inflation Reduction Act, the IRS will face an overall 37% reduction. These cuts will make collection from war tax resisters more difficult.

Writing Messages on 1040 Form May Lead to $5,000 Fine

Writing messages on your 1040 form could lead to a $5,000 frivolous penalty. This does not apply to those who include a letter on a separate piece of paper. Nevertheless, Glen Milner in Washington State has written messages on his 1040 form since the early 1980s. Most often, he has written, “Some Taxes Withheld in Protest of Funds Appropriated for Illegal Military Purposes.”

For the first time in his filing history in June 2025, the IRS threatened Glen with the $5,000 penalty for writing a message on his 2023 tax return. The IRS letter gave him 30 days to file a corrected return; otherwise, the penalty would be assessed. After failing to connect with the IRS on the phone, he mailed in his same return without the message. We expect he will receive a letter stating that the situation is resolved. But with recent cuts to the IRS, he may have to wait up to a year, or even longer.

Many Thanks

Thanks to each of you who has donated for the May Appeal 2025 and participated in the raffle! Remember, you can also donate online through PayPal and Venmo (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

We are very grateful to these alternative funds and WTR groups for their redirections and Affiliate dues: War Tax Resisters Penalty Fund; Community Peacemaker Teams

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.orgAdvertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loopWe’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.orgDonate by Venmo

NWTRCC now accepts donations by Venmo! We still accept donations by check, PayPal, and credit/debit card using PayPal. Also, tax deductible donations can be made by check or credit/debit card using one of our fiscal sponsors. For more information on all the ways you can donate to NWTRCC, go to nwtrcc.org/donate.

War Tax Resistance News

MennoCon 2025 Promotes War Tax Resistance

By Tim Godshall

Pastor Jay Bergen advocating WTR as an act of evangelism. Photo by Tim Godshall.

On July 9, I was one of about sixty people who showed up for “War Tax Resistance as Public Witness,” a workshop at MennoCon ‘25, the biennial Mennonite Church USA convention held in Greensboro, North Carolina. Three presenters focused on taking WTR beyond a private moral choice and into the sphere of social change.

Jay Bergen, pastor of Germantown Mennonite Church in Philadelphia, started out by emphasizing the urgency of the time we are in with authoritarianism on the rise. Bergen made the case for public WTR as an act of evangelism connecting to Mennonites’ radical past of noncooperation with violent state structures.

H. A. Penner from Akron, Pennsylvania shared his perspective from decades of promoting WTR in Mennonite circles, going back to 1979 when 700 Mennonites attended a conference on WTR. Penner shared about Mennonite Church USA’s “Church Peace Tax Fund,” which operates as an alternative fund for resisted war tax dollars. He lamented that Mennonites pay more to the U.S. military than to our churches.

Jim Lichti shared about a new focus on WTR at First Mennonite Church in San Francisco. First Mennonite organized a forum last year to hear from longtime WTRs in their congregation and across the country. Out of that workshop emerged four working groups to focus on nuts and bolts details of WTR, national networking, education and outreach, and study and research. They are currently drafting a congregational statement of support for WTR, including the principles that provide the basis for such support and what concrete forms of support the congregation will provide. (For information about organizing at a congregational level, contact Jim at: lichtijames@gmail.com)

I appreciated a fresh insight from another workshop participant who challenged each of us to write down a personal statement on why we feel like we should not do war tax resistance. If we can’t do that with integrity, then it’s time to start resisting.

NWTRCC News

NWTRCC Raffle Winners!

Image from Eulaine McIntosh from Picabay.

This spring, NWTRCC News held a raffle concurrently with its spring appeal. Thank you to all who donated during our spring appeal and all who donated items for the raffle!!! Here is a list of our raffle winners:

Top Prize

- 2 Nights near Nelson Homestead (Deerfield, Massachusetts):

Michael K-L (New York)

Additional Prizes

- Swag from the NWTRCC Café Press Store (up to $50):

Kevel K (North Carolina) - Nuclear Resister T-Shirt & Button. Donated by the Nuclear Resister:

Sue B (Oregon) - Body Work Session (In Person or Online). Donated by sarasunstein.com: Andre R (Florida)

- $100 Gift Card for Better World Books (Donated by Rick Bickhart):

Jim F (Pennsylvania) - Bread & Puppet Theater Posters. Donated by Ruth Benn:

Cathy D (California) - 5 – WTR Guide Books (2025):

Jay S (California); Brianna S-P (Wisconsin); Boots W (Vermont);

Glen M (Washington); Steve L (California) - Book – A Persistent Voice: Marian Franz and Conscientious Objection to Military Taxation:

Jody I (California)

Mark Your Calendars for next NWTRCC’s Conference!!! November 7-9, 2025, Worcester, Massachusetts

NWTRCC will be meeting in person for the first time since November 2023. We are working on the agenda and would gladly accept any session proposals. Registration for those attending in person and online is already up on the website. Go to the “Programs” tab on the websiote and click on “Gatherings and Events.”

War Tax Resistance: Two Complementary Visions

By Karl Meyer

I see two alternative visions that I call War Tax Protest and Resistance and War Tax Refusal. I distinguish these two basic approaches by an analogy with the behavior of electrical energy. Copper is a material that allows, but resists, the passage of electric currents. The process of resistance generates heat and visible light radiating from wires. Porcelain, and other non-conductors, refuses the passage of electrical currents.

War Tax Resistance

Those following the Protest and Resistance approach typically file annual returns with the IRS, honestly reporting their income, but withholding payment of a token amount, or some percentage of the tax calculated. Often, they send a letter to the IRS explaining their reasons. Withholding any part of tax shown as due typically leads to a long succession of increasingly threatening letters demanding payment, plus a variety of penalties, assessment of a current 7% rate of interest, compounded daily, and eventual collection, or attempts at collection, by garnishment of income sources and seizure by levy on liquid assets in banks or stock accounts. By these methods the IRS may eventually collect much more money than the resister originally refused to pay.

War Tax Refusal

In the alternative approach, that I describe as War Tax Refusal, refusers may be very open and public in writing and speaking about their refusal, but they may typically file no returns with the IRS. They make no payments to the IRS of amounts that might be legally due. Instead, they distribute all such money, and often more, as donations to organizations and causes that they believe to be positively beneficial to others and for the common good of all people and our Mother Earth.

Should the IRS become actively aware of their refusal, calculate taxes allegedly due, and assess claims against them, refusers may typically take effective steps to protect their assets from discovery and seizure by the IRS. This approach works most effectively for refusers who are self-employed or paid through contractual arrangements in a variety of occupations where payments are not reported to the IRS by those making the payments.

I have used the complete refusal practice very effectively for 65 years since 1960, while being well known to the IRS in Chicago and nationally through my widely read writings about war tax refusal and widely publicized actions of public witness.

365 Daily Tax Protest Returns

The only exceptions to my practice of the complete refusal method was in 1984 when I filed a total of 365 daily tax protest returns to many different IRS offices around the country, in a public protest intended to mobilize wide resistance to the recently enacted “frivolous claims penalty,” at that time $500 for each claim. The IRS reacted by assessing a total of $140,000 in penalties, and sending me an accumulation of a whole file drawer of notices and demands for payment. They collected only $1,000 by auctioning a station wagon and trailer seized off the street from me. The cost to the IRS of this whole process exceeded by far the amount realized at auction. My action and the IRS response garnered publicity about war tax refusal in mass media around the US from Los Angeles to the Wall Street Journal in New York. The total of all other successful seizures from me across sixty-five years of refusal has amounted to less than $500. I have been self-employed as a carpenter since learning the trade in 1975.

Other War Tax Refusers

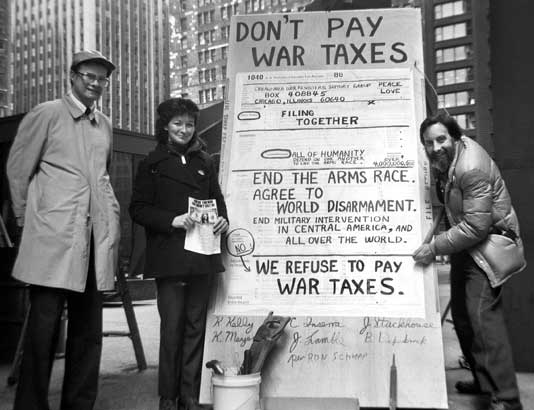

Brad Lyttle, Kathy Kelly, and Karl Meyer alongside a large sign reading “Don’t Pay War Taxes; End the arms race; agree to world disarmament; end military intervention in Central America and all over the world. We refuse to pay war taxes

For forty years my former wife, Kathy Kelly, one of the best-known pacifist activists and war tax refusers in the US, used the same methods of refusal. She began practicing war tax refusal in 1982 when we married. My recently deceased Nashville partner, Pamela Beziat, used the same methods, with no collections, since 1998 when we got together, as did our beloved World War II generation mentors, Wally and Juanita Nelson, Marion and Ernest Bromley, Rev Maurice McCrackin, and Eroseanna Robinson.

All war tax protesters, resisters, or refusers have the opportunity to make their own personal choices of methods and actions by the light of personal conscience.

Conference Report

Tax Resistance at the 22nd Century Institute Conference

By Christina Thompson, National Tax Strike Coordinator, and Pete Mousseaux, National Tax Strike Volunteer

This June, supporters of The National Tax Strike participated in the 22nd Century Institute’s second conference in Atlanta, Georgia. The conference brought together over a thousand pro-democracy advocates and organizations for four days filled with networking, skill sharing, and inspirational programming aimed at “forging a people-powered democracy.” We joined the conference to learn from the other amazing speakers and to present a strategy session introducing the National Tax Strike tactic. Christina and Pete share their experiences with presenting about the National Tax Strike and participating in an organic breakout session focused on Tax Resistance.

National Tax Strike Strategy Session | Christina Thompson

I was so excited to represent the National Tax Strike (NTS) as a speaker during the day focused on non-violent civil resistance. This day kicked off with an inspiring presentation from NTS supporter and long-time advocate, Daniel Hunter. Daniel encouraged the audience to think creatively and boldly about the kinds of non-violent non-cooperation activities organizers could pursue to fight creeping authoritarianism.

Our session, “Tax Resistance: Tackling the Pillar of Power We’re Afraid to Touch,” introduced the framework for a NTS as a tool for civil disobedience using the resources from NWTRCC. I shared the history and practice of tax resistance, outlined possible win conditions for a NTS, and covered the risks of participation in tax resistance based on the experiences of NWTRCC members.

As expected, when I polled attendees at the beginning of the session, they were not feeling good about paying federal income taxes to this administration. Attendees were dismayed that their tax dollars were being used to fund genocide in Gaza, build concentration camps in the US and abroad, and to support an administration violating people’s civil liberties. By the time I shared the moral and constitutional motivations behind a NTS, most participants were on board and ready to understand how to participate and learn what the risks were.

While there was widespread support in the audience for a tax strike, a small number of people shared concerns, including:

- the risks of striking (specifically that the risks experienced by War Tax Resisters didn’t match the higher level of risk experienced by non-resisters who experience tax issues)

- the impact of a NTS on vital public programs

- how a national strike could inadvertently support Libertarian/Sovereign Citizen beliefs about the role of government.

- The discussion highlighted opportunities to improve our messaging and areas for further research to strengthen our communications. Having stronger messaging about tax evasion versus tax resistance (and their punitive implications), having more data around the punitive experiences of non-resisters, and continually reinforcing the values of community care and mutual aid could strengthen future NTS messaging.

Attendee Breakout Session – Tax Resistance Edition | Pete Mousseaux

I was surprised to learn that the NTS crew wasn’t the only group at the conference thinking about tax resistance. After Daniel’s inspiring plenary, we were invited into small groups to explore specific resistance strategies to address hypothetical authoritarian scenarios playing out in the US.

Out of the many impactful breakout sessions, one impressed me the most — a strategic working session on tax resistance. I was elated. Here was proof that the cause I had been promoting was organically taking root.

Over 20 attendees brainstormed to formulate answers to the following prepared questions:

- How could we signal to tax agencies that people are beginning to get ready to withhold taxes?

- What barriers would we need to overcome for people to become ready for this idea?

- What is the best first step for a campaign like this?

- Map a cross-section of the pillar of taxpaying entities to show how you will move them to participate in forging a better future.

The mood was somber at first. Folks were overwhelmed. The working groups generated more questions than answers.

- How far were we willing to go — only legal methods or illegal as well?

- What about safety concerns — should we keep our activities hidden or was transparency required to get the message out?

- How much participation would make a meaningful dent?

I was impressed with how thoughtfully everyone approached the exercise. These were not accountants or lawyers or professional tax preparers. Yet they were willing to roll up their sleeves and wrestle with W-4 forms.

By the end of the session, the five groups had generated many creative yet pragmatic ideas to address the prepared questions we’d been given:

- Host a game night to popularize the idea of a tax strike and help people process the actions and consequences.

- Use participatory budgeting to show what we collectively spend money on using our taxes.

- Create a grassroots campaign targeting elected officials with the message that our current taxes are a joke!

- Organize a multi-state campaign to withhold federal income taxes

- Create a pledge to withhold taxes to create a broad base for escalating the tactic.

But what warmed my heart the most was a snippet of conversation I overheard as we were leaving: “Shit. When we started… I thought there was no way this could fly. But now I think it’s doable.”

Conclusion

Generally, when engaging with conference attendees formally and informally about the NTS, people understand the rationale, are supportive of the idea, and want to understand the risks and how to participate. Some attendees were understandably skeptical about the risks, and NTS advocates should be prepared to talk about risks within a larger societal context of tax-related punishments. Most importantly, the conference reflected a broader truth: people are independently thinking about tax resistance. NTS advocates should continue to find ways to be where these conversations are happening and be accessible to people looking to learn more.

Editor Lincoln Rice

Production Rick BickhartMore Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org

- 2 Nights near Nelson Homestead (Deerfield, Massachusetts):