More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

April–May 2020

Contents

- COVID-19, Tax Day Actions, and the Chicago NWTRCC Conference

By Lincoln Rice - Report on the International Conference for War Tax Resistance and Peace Tax Campaigns in Edinburgh, Scotland

By Erica Leigh - Counseling Notes Tax Day is July 15 • $5,000 Frivolous Fine Sending a Letter with your Tax Forms • Passport Revocation Declared Constitutional • IRS Increases Focus on Nonfilers • IRS to Add over 800 Phone Line Tax Collection Employees

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Tax Resistance Ideas and Actions Celebrate Tax Day Online!

- Penny Poll by a Bank by Lincoln Rice

- NWTRCC News Charity Online Fundraiser for NWTRCC • Social Media Growth – Year over Year, 2015-2020

- Resources New WRL Pie Chart • Revised Peace Tax Return • Revised Earth Palm Card

- Profile A Freelancer’s Quandary by Ruth Benn

Click here to download a PDF of the April/May issue

COVID-19, Tax Day Actions, and

the Chicago NWTRCC Conference

By Lincoln Rice

Photo by Bongkarn Thanjakij from Pexels

By the time you read this, COVID-19 will have changed your life in any number of ways. Hopefully, you have not been too adversely affected. I am sorry to announce that NWTRCC has cancelled our next conference in Chicago (1-3 May 2020). Instead, we will have a virtual conference (via computer) on Saturday May 2nd, and have a virtual business meeting on Sunday May 3rd. For information about times, registration, and how to attend, visit the NWTRCC website (nwtrcc.org).

This pandemic has even caused the IRS to extend its deadline for the filing and payment of federal income taxes to July 15. It has been a tradition in previous years for the April newsletter to list Tax Day actions. Unfortunately, COVID-19 has caused a bit of chaos for local groups trying to organize local tax day events. The most up-to-date list of Tax Day events can be found here: nwtrcc.org/programs-events/tax-day/

Assuming that folks will not be able to go out in groups to flyer on tax day, we are asking folks to take a picture of themselves with their Tax Day signs and to post these images on social media on April 15. When posting on social media, please include the hashtags #NWTRCC and #NoTaxes4War, and let folks know that they can go to www.nwtrcc.org for more information about war tax resistance.

Over $1.5 trillion in military-related spending is slated for fiscal year 2020, and the drums of war are beating loudly across the world. Whether your local group is able to organize an April 15 Tax Day event on the streets or not, NWTRCC is asking war tax resisters to make their presence felt online.

Check out another website for Tax Day actions:

The Global Days of Action on Military Spending (GDAMS) are taking place again this year, April 10– May 9, organized around the slogan, “Demilitarize: Invest in People’s Needs!” Find a list of all the actions at www.demilitarize.org.

Report on the International Conference for

War Tax Resistance and Peace Tax Campaigns in Edinburgh, Scotland

By Erica Leigh

I arrived in Edinburgh on November 28, 2019, just hours before the opening dinner and discussion at the International Conference on War Tax Resistance and Peace Campaigns. Although I was running on zero sleep after 14 hours of travel, I managed to pull through and meet the group at the Quaker Meeting! We were treated to an excellent bagpipe performance, dinner, and a social evening.

First Night in Scotland. Photo by Erica Leigh.

About twenty people attended the first night, including the staff of our hosts, Conscience: Taxes for Peace Not War (Fay Solichou, Jonathan Maunders, and Karen Robinson) — most of the attendees were from around the UK, Germany, and Switzerland.

Vijay Mehta, author of How Not to Go to War, was the featured speaker on the first evening, advocating for the creation of departments or ministries for peace within national governments. I’m afraid I don’t remember much about his talk though — I went back to my hostel to sleep soon afterward.

Aside from the Thursday evening session with higher attendance (around 20), the weekend consisted of about 15 people. A few were from Edinburgh, a few from Germany and Switzerland, a few UKers from other organizations or those who were board members of Conscience. I was surprised to find that I was the only US representative and the only person without existing connections to Europe-based organizations. Folks from several other countries who had originally registered were not able to attend.

As many readers no doubt know, war tax resistance is difficult to accomplish in countries that automatically withhold taxes from all employees’ pay, rather than an amount that can be determined by the worker. UK resisters are largely self-employed or low-income. Some campaigners from other countries discussed paying under protest.

Here are some examples of the ways in which attendees of the conference have been refusing taxes for war:

Robin Brookes, of Conscience’s Executive Committee, was part of the Peace Tax Seven (petitioning the European Court of Human Rights to recognize conscientious objection to the payment of taxes for military purposes). He was integral in organizing the conference.

Anne McCullagh-D’Lyske, also on the Executive Committee, spoke passionately about the choice she made to live below the taxable level to avoid war taxes. She wrote in her delegate description: “I’m Anne. I don’t pay for war. I won’t ever pay for war. Ever.”

Christophe Barbey wrote, “I do not hand over the part of my taxes going to the Swiss military budget. I symbolically let them peacefully take it at the counter, though specifying it is laundering blood money.”

Wilhelmina Hoogendoorn has been living and protesting full-time at Faslane Peace Camp for the past two years.

A lot happened over the weekend, so I’ll focus on some of the highlights, people, and information that I think you all might be most interested in.

One excellent opportunity to learn about international anti-war work came from Ahmad Shahidov, who is the director of the Azerbaijan Institute for Democracy and Human Rights. This organization has worked to protect the rights of refugees in Azerbaijan, to call on Armenia and Azerbaijan to exchange hostages, and to achieve peace between the two countries. He spoke about this work, which is complicated by larger geopolitical forces and by war profiteering. You can see more about his work at http://shahidov.com/en/.

I also met Symon Hill, a staffer with the Peace Pledge Union, an 85-year-old British peace organization that seems to be experiencing a bit of a resurgence. PPU is “the oldest secular pacifist organisation in Britain. Since 1934 it has been campaigning for a warless world. From anti bombing campaigns during WW2 to protest at the remote controlled military drone assassinations of today. Campaigning against the militarisation of Armistice Day in the 30s to the militarisation of society today.” Symon told me that the PPU is growing, and even forming new student groups across the UK — very inspiring. Members take a pledge to not support war, and work on a variety of campaigns. For example, in their “No Pride in War” campaign, they have gone to pride parades and even disrupted parades that have been led or sponsored by weapons manufacturers.

Watching the documentary “War Schools” and speaking to UK residents taught me how militarized UK society has become. Only about 10 years ago, the government instituted an Armed Forces Day, celebrated with numerous military parades that include armed active duty soldiers marching in formation. The events also feature military equipment and encourage children to familiarize themselves with weapons of war.

Several Veterans for Peace UK veterans are featured in the film, some recounting harrowing wartime experiences, killings they participated in, murders they witnessed, and other atrocities. They are traumatized by their participation in this system, but also continue to show up to promote peace.

Erica at the Faslane Peace Camp. Photo by Erica Leigh

During the conference, there was also time for presentations about what each group and country is doing. I gave an oral report on activism within NWTRCC to the group, as well as my impressions on peace tax campaign organizing. A collection of conference proceedings and notes will be available soon.

A highlight of the weekend was our Sunday bus trip to Faslane, where the Faslane Peace Camp is located near the Clyde Trident nuclear submarine base. Although we attracted significant police attention, fortunately, there was no incident. I wrote about this trip previously in the NWTRCC blog (nwtrcc.org/2019/12/20/opposing-trident-with-faslane-peace-camp-37-years-of-resistance/).

Another big event of the weekend was the official CPTI board meeting. The day-to-day operations of CPTI (https://www.cpti.ws/) have continued at a skeleton level—Christophe Barbey of Switzerland is CPTI’s UN representative, filing reports and other documents through the Human Rights Council. CPTI’s annual expenditures are in the range of £2-3,000, primarily, as far as I could tell, to maintain their legal status and pay Christoph’s expenses for the UN work. They are actively seeking new members (especially those who can become board members), people who want to do work or participate in the UN reports and filings, and new sources of funding. If you are energized by fundraising for CPTI, or other ways to support their work at the UN, please contact them! It’s my impression that CPTI is just barely hanging together. As I think other NWTRCC visitors to the international conferences have found, overall, our European counterparts seem to have a greater trust in the UN as an institution, believing that conscientious objectors need to be present there.

Derek Brett of Switzerland had some great stories about his international conscientious objection work. Through the UN status of the International Fellowship of Reconciliation (IFOR) and other organizations, and some hard work, he has participated in helping free conscientious objectors from prison in South Korea, and in many other projects on behalf of COs. Here’s an article which, while it uses a lot of UN jargon and references to proceedings that you may not be familiar with, says a bit more about this work: wri-irg.org/en/story/2018/ifor-statement-delivered-human-rights-council-following-constitutional-court-decision

I also met an American living in Scotland, Brian Fellowes of the Edinburgh Peace and Justice Centre, who sends his greetings to the US! The center has been planning a beautiful Opposing War Memorial in Edinburgh, with the talented design and creation help of artist Kate Ive. Each aspect of the memorial is so carefully thought out and has meaning behind it. I was really quite impressed with it!

My overall impression from the weekend is that the international movement against taxes for war is struggling even more than NWTRCC. Our twice-annual conferences attract at least 15 people, and our November meeting in Oregon attracted a great crowd of 40-50! It was unfortunate that more people could not make it to the UK.

So, at the risk of sounding immodest, and even though our own movement has shrunk over time, we are doing extremely well, comparatively, for an organization focusing on war tax resistance. I attribute a lot of this unity and strength to the fact that war tax resisters are putting a lot more on the line and have a greater need for community and solidarity based on those risks. But I also noted the important work that peace organizations are doing on other issues, including the work of Conscience, Edinburgh Peace and Justice Centre, Peace Pledge Union, and Veterans for Peace UK.

A huge thanks to Conscience for organizing this conference and making space for international gatherings against taxes for war!

And to the NWTRCC network: Thank you for giving me the opportunity to represent NWTRCC in Edinburgh! I had a fantastic time and was also able to use some vacation time to see friends and family in England after the conference. I happened to leave England on the day of their general election, December 12, so I also got a glimpse into how media coverage of elections works there (much the same as here, unfortunately!).

You can watch some videos from the conference, including some videos I’m in, at www.facebook.com/pg/taxesforpeacenotwar/videos/ ?ref=page_internal.

Counseling Notes:

Tax Day is July 15

In case you did not hear, the IRS extended its deadline for the filing and payment of federal income taxes to July 15. Of course, you can always file earlier if you are a filer.

$5,000 Frivolous Fine & Sending a Letter with your Tax Forms

Two war tax resisters since late summer 2019 have been threatened with the $5,000 frivolous fine if they did not refile their taxes. What both of these resisters share in common is that they sent a letter explaining their war tax resistance with their tax forms. The first person was given a different reason for the threatened fine and the second person has not yet received an official reason, but it seems likely that the true reason for the threatened fine was to cause grief for the filer for including a letter with their tax forms. The threatened fine has been dropped for the first person and we expect the same result for the second person.

If you would like to avoid the possibility of this harassment, NWTRCC recommends not sending an explanatory letter with your tax forms, but rather sending a letter directly to the IRS, separate from your tax forms: Office of the Commissioner, IRS, 1111 Constitution Ave. NW, Washington, DC 20224.

Passport Revocation Declared Constitutional

On 28 February 2020, the United States District Court for the District Court of Colorado declared the IRS’s action to revoke a person’s passport because of a seriously delinquent tax debt (more than $52,000) was constitutional because it bears a rational relation to a legitimate government interest, to wit, the collection of delinquent tax debts.

The person who brought the case to court alleged that the law infringed on his constitutional right to travel. The court declared it is only a fundamental right to travel within the United States, not beyond its borders.

Unfortunately, the court decision did not explain why the person had their passport revoked, instead of only not being able to renew his passport. (For more on the reasons why a passport could be revoked, and why it would be extremely unlikely for a WTR to have their passport revoked, see the October 2019 issue of More Than a Paycheck.) Hopefully, this will be the first of many court cases challenging the validity of this law.

(Maehr v. United States, No. 18-cv-02948-PAB-NRN (D. Colo. Feb. 28, 2020)

IRS Increases Focus on Nonfilers

In an Information Release in February 2020, the IRS has announced that it is increasing the use of data analytics, research, and new compliance strategies, including personal visits, to reach taxpayers and tax return preparers who have not filed federal tax returns.

If a revenue officer would visit, they should provide two forms of official identification or credentials, that include a serial number and photo of the revenue officer. Taxpayers have the right to see both of these credentials.

During the visit, the revenue officer will interview the taxpayer to gather financial information, and tell the taxpayer what he or she needs to do to become and remain compliant with the tax laws. The revenue officer will request payment, but will provide a range of payment options, including payment by check made out to the U.S. Treasury. A legitimate revenue officer will not make threats or demand some unusual form of payment (such as payment by iTunes card) for a tax liability.

If a revenue officer calls on you by surprise, be prepared to say, “Now is not an acceptable time for me to talk. Let’s make an appointment for some other time in the (distant) future.” The officer should honor your request.

IRS to Add over 800 Phone Line Tax Collection Employees

Despite its overall shrinking workforce, the commissioner of the IRS’s Small Business/Self-Employed Division announced that it will be hiring over 800 new employees to provide phone “assistance” to taxpayers who have past-due tax liabilities. The new employees were supposed to start in March (with COVID-19, who knows if this plan is still being implemented in a timely manner) and will be located in 19 locations around the country. These added phone lines cannot be used to answer general filing questions during the 2020 tax season.

—Lincoln Rice

Many Thanks

Thanks to each of you who has donated in early 2020! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.).

We are very grateful to these WTR groups and affiliates for their redirection and Affiliate dues:

War Resisters League; New England War Tax Resistance; Voices for Creative Nonviolence

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Tax Resistance Ideas and Actions

Celebrate Tax Day Online!

Post this picture online for Tax Day (April 15)

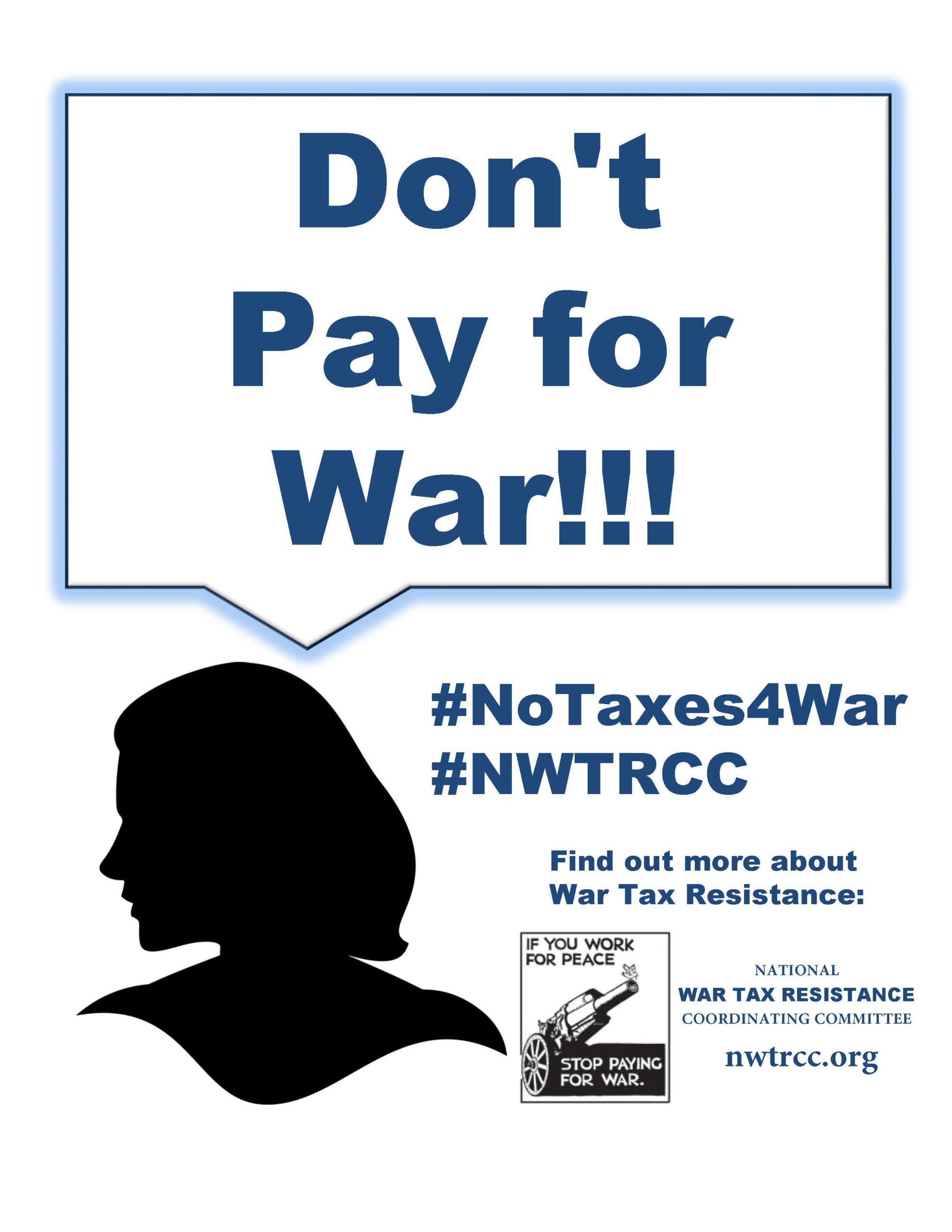

Or take a picture of yourself with a sign. Photo by Ed Hedemann

Tax Day 2020 will be very different because of COVID-19. Despite the Tax Day deadline being extended to July 15, 2020, we hope that folks will celebrate the April 15th Tax Day online, by posting a war tax resistance picture or home-made poster on their social media accounts. If you do this, please make sure to include a link to www.nwtrcc.org, so folks have a resource to find out more about war tax resistance. If you want to post a pre-made picture, go to nwtrcc.org/programs-events/tax-day/ to find the below picture, or feel free to make a homemade sign or graphic!

Penny Poll by a Bank

By Lincoln Rice

It is a common sight to see a penny poll at a Tax Day demonstration and it’s a good way to promote audience participation at a Tax Day event. But I must admit that I have always been suspicious of the results. My assumption is that the folks who are inclined to agree with us will be more willing to come and participate in the penny poll. (Though I could be wrong about this.)

A financial institution emailed me last month to let me know about an online poll that they performed. They noticed our website and thought we might be interested in promoting their information. I was very leery at first, because this is obviously a way for them to promote themselves, but I did find the results startling. So please be warned, while this article is sharing information from GoBankRates.org, this is not an endorsement of their services.

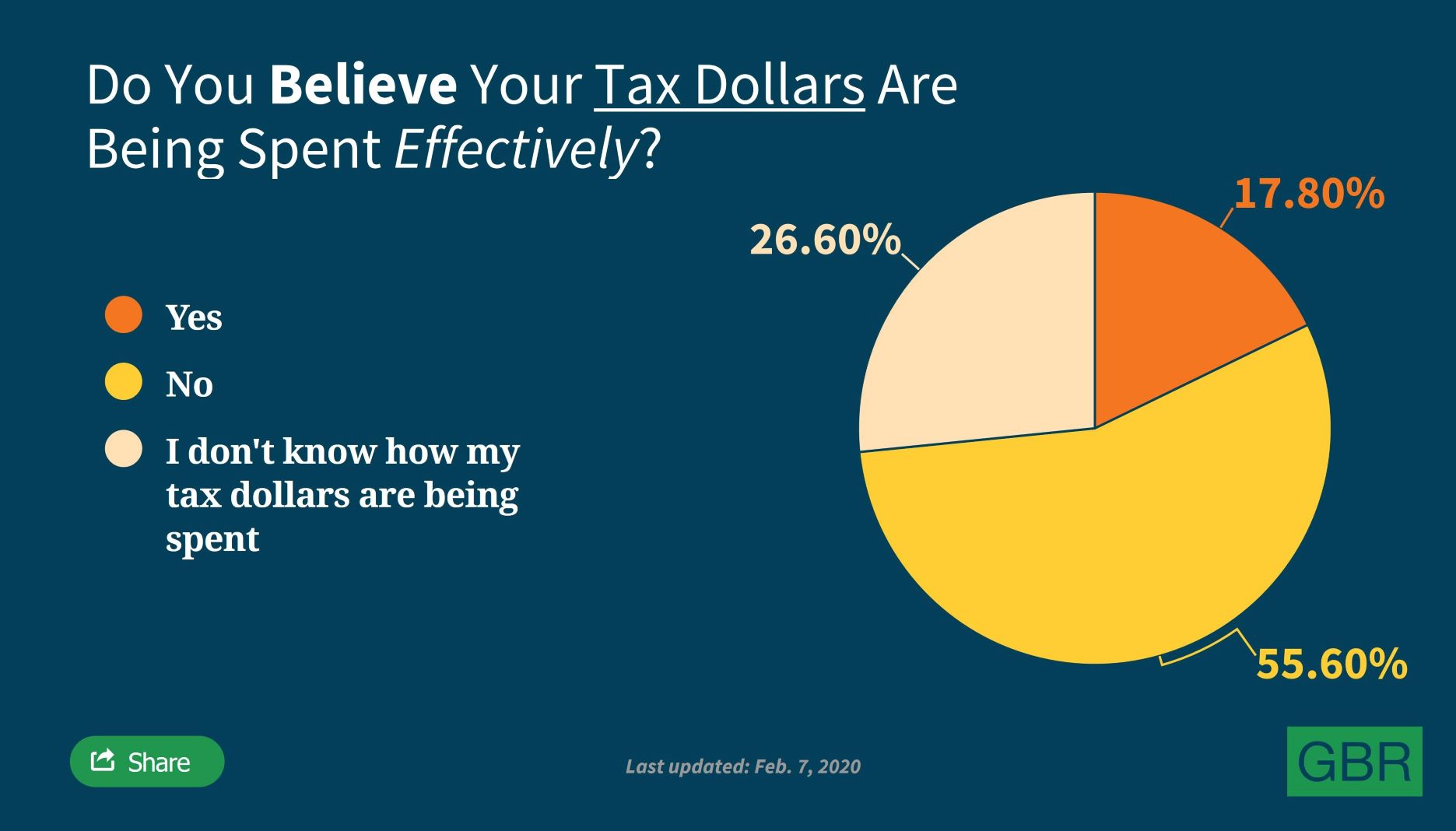

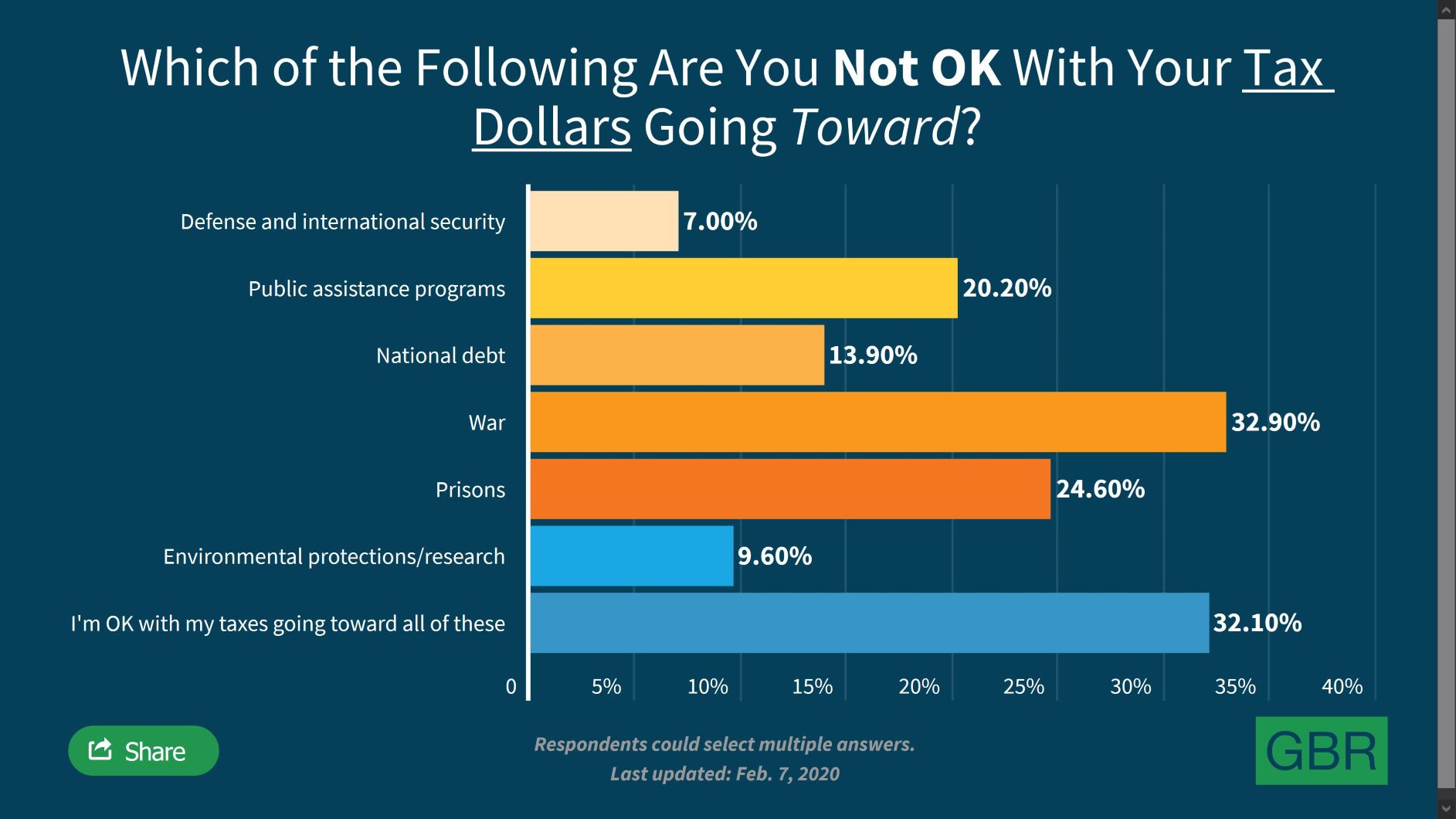

Graphic courtesy of GoBankingRates.com

Graphic courtesy of GoBankingRates.com

My assumption is that folks filling out a survey for banking services are not mainly of hippies or peaceniks. One could argue that they might have more money and be more likely to support war-making to protect their financial interests. The bank polled 1,000 adults, and for someone to participate in the survey, they had to state they would be filing federal income tax forms this year.

The Survey Results

In surveying 1,000 adults, this group found that 56% of respondents did not think their tax dollars were being spent appropriately, 18% believed they were being spent correctly, and 27% did not know how they were being spent. I have a feeling that more than 27% did not know how their tax dollars were being spent, but that’s another story.

When asked what should be the top priority for taxes, 53% responded social insurance programs like Social Security and Medicare. It should be noted that among 18 to 24 year olds, 71% stated that education should be the top priority.

The main reason I decided to share this survey was because of this next question: Which of the following are you NOT OK with your tax dollars going toward? The top answer was war.

War was the top answer with 32.9% of respondents voting for it. But “Defense & International Security” was also an option for respondents, with 7% choosing that option. When we combine these two answers, 39.9% of respondents stated they were not okay with tax dollars being used for war or international security.

With close to 40% of respondents stating they are not okay with tax dollars being spent on the military or war, I am more optimistic that war tax resisters have a message that is relevant for a lot of people, we just need to reach them. Even if only a small portion of the people who are against war taxes became war tax resisters, we would see our movement grow substantially.

The survey can be found online at www.gobankingrates.com/taxes/tax-laws/americans-believe-tax-dollars-spent-right-way/.

RESOURCES

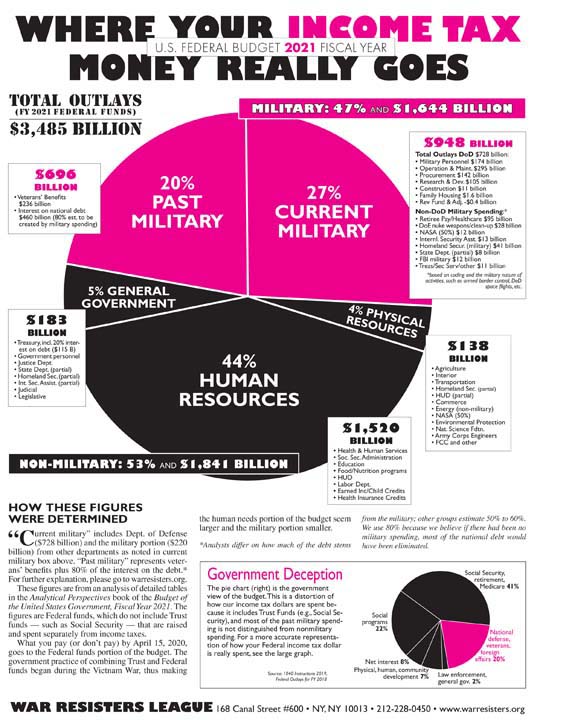

New WRL Pie Chart

War Resisters League has released their fiscal year 2021 pie chart, “Where Your Income Tax Really Goes.” A copy is included in this newsletter. You can order amounts of 200 or less from NWTRCC at www.nwtrcc.org/store or 800-269-7464, or larger amounts from WRL (www.warresisters.org/store/).

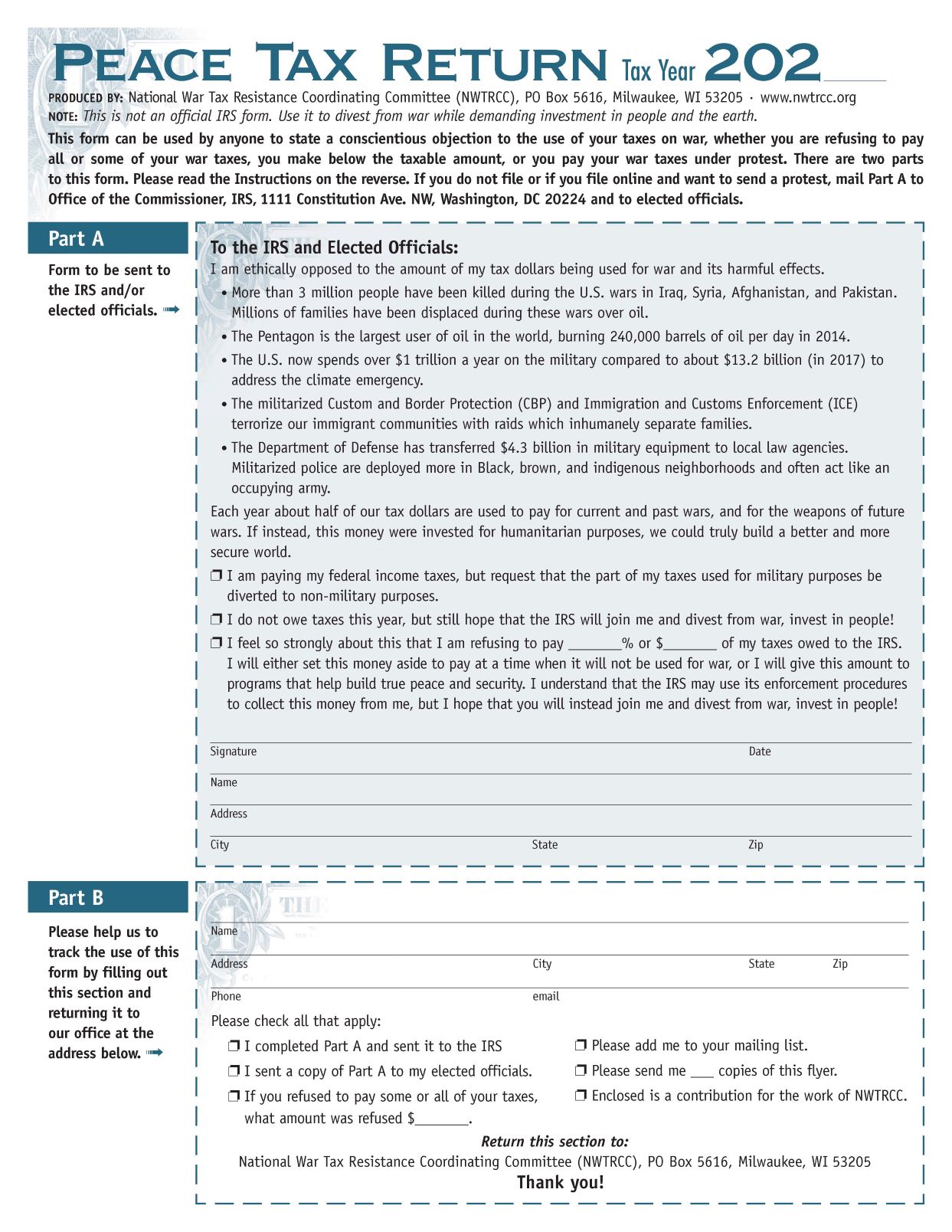

Revised Peace Tax Return

We have also updated the Peace Tax Return. Just as the IRS has simplified its tax forms, NWTRCC has revised its Peace Tax Form so that it can be printed on a standard sheet of paper (11″×8½”). It now connects federal incomes taxes more closely with environmental harm, U.S. border patrol, and the militarization of police.

Revised Earth Palm Card

Revised Earth Palm Card

The revised Earth Palm Card includes a backside that connects military spending and environmental degradation. Download the card at www.

nwtrcc.org or order cards from NWTRCC for 10 cents each.

NWTRCC News

Charity Online Fundraiser for NWTRCC

Carlos Steward and Jim Stockwell of North Carolina are organizing a charity auction for NWTRCC in collaboration with the NWTRCC Fundraising Committee. All the items online will also be on display at Flood Gallery Fine Art Center (www.floodgallery.org/) in Black Mountain, North Carolina.

A link to the Auction is on the NWTRCC Homepage (www.nwtrcc.org). Please go and check out some art and let your friends know! If you willing to donate an item, please contact Carlos Steward at 828.273.3332 or carlos@floodgallery.org. We are collecting not only art items, but also anything that would be termed collectible. All proceeds benefit NWTRCC. The auction will continue through mid-May 2020.

Social Media Growth – Year over Year, 2015-2020

| 9-Apr-15 | 1-Apr-16 | 1-Apr-17 | 6-Mar-18 | 3-Mar-19 | 20-Mar-20 | |

|---|---|---|---|---|---|---|

| Twitter followers |

648 | 800 | 1,178 | 1,637 | 1,680 | 1,709 |

| FB Page Likes | 170 | 274 | 571 | 767 | 864 | 970 |

| FB Group members |

619 | 711 | 895 | 936 | 969 | 1005 |

| Instagram followers |

n/a | n/a | n/a | 92 | 167 | 224 |

| E-Newsletter Subscription |

n/a | n/a | n/a | 920 | 1,023 | 1,054 |

Are you organizing an action, training, or gathering? Got a good photo of your war tax resister community in action? Keep us in the loop: We’re all about building the community of resisters. We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (our Outreach Consultant): outreach@nwtrcc.org // Follow the journey + join us on all social media Instagram + Twitter:

@wartaxresister // Facebook: National War Tax Resistance Coordinating Committee (NWTRCC)

PROFILE

A Freelancer’s Quandary

By Ruth Benn

Ruth at her computer. Pets are particularly happy to have work-at-home freelancing caretakers. Photo by Ed Hedemann

Who doesn’t want to protect workers against uncaring, exploitative, profit-hungry employers? But…. there’s always a but…. I’m just waking up to the fact that a wave of state laws intending to protect workers may also slam the door on freelance opportunities. The California law AB5 that just took effect pushes employers to categorize more workers as W-2 employees. Freelancers are scrambling, and articles indicate that many have lost good, paying work.

Now I see a similar law is proposed in New York, where I live. There’s a Freelancers New York campaign against it, and their website announces, “Freelancers in New York watched in horror as AB5 passed hastily in California, destroying the livelihoods of thousands of independent contractors in one vague, sweeping bill.” Maybe that’s a bit of an exaggeration as far as horror goes (there are plenty of horrors these days), but it is worrisome.

As part of our war tax resistance counseling in the NWTRCC network, we have long pointed out that working as an independent contractor (subject to 1099 tax reporting unless off-the-books) gives individuals the freedom to decide whether and how much they are going to pay to the IRS. NWTRCC’s Practical War Tax Resistance #4, Self Employment: An Effective Path for War Tax Refusal is all about this. The key thing is that 1099-MISC workers do not have withholding like W-2 employees, something the IRS has long been lobbying to change. Now it seems the states are going to help with that shift, along with, apparently, knocking a lot of people out of their paying freelance work.

Hopefully other freelancers will share their experiences with NWTRCC, especially those in California who may be feeling the effects of the new law. I see in the Freelancers New York FAQs that 33 states already have enacted the “ABC test,” the controversial change that California AB5 enacts. Personally, I do not completely understand the nuances of the ABC test compared to the current IRS regulations defined in the Employer’s Tax Guide (chapter 2, “Who Are Employees”). It seems one major problem with the ABC test is that it is vague, and employers are scared to hire freelancers because it will be hard to prove their independence if tax or labor enforcers come calling.

I think the quandary that I have felt over the past decade or so with the rise of the gig economy is that I’m all for freelancing — it’s great to set your own rate and hours and choose where you work — but watching companies like Uber and Lyft rake in profits off the labor of underpaid, no-benefits workers is another story. Of course, small employers exploit workers in many fields too, whether restaurant work, construction, house cleaning, etc.

In part, the quandary comes down to: some of us are quite happy to be choosing our own hours, where we work — and whether we are going to give the feds money for war. We know we are sacrificing some protections like health and unemployment insurance, employer’s share of FICA or workers comp. Others definitely need protection.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Subscriptions are $15 per year.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org