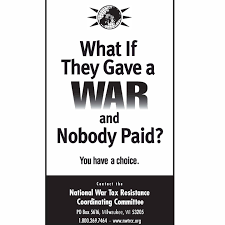

National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

February – March 2026

Contents

-

-

- Celebrate Pie Day!(and other Tax Season events)

By Lincoln Rice - Being Ungovernable

By Ruth Benn - Counseling Notes: 2026 IRS Standard Deduction and Taxable Income Level • $1,000 Charitable Deduction • Slight Change to IRS’s Annual Tax Debt Letters • 1099-NEC Reporting Requirements

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations

- Network Updates

- History Preserving and Using our Peace Histories

By Susan Van Haitsma - NWTRCC Network News and Events:

National NWTRCC Conference on Zoom: May 1 – 3, 2026 • Save the Date! National NWTRCC Conference in Las Vegas: November 6 – 8, 2026 • Help keep NWTRCC Strong and Growing! Nominations Open for NWTRCC’s Administrative Committee (AdComm) • Queer & Trans Wealth Offered Instagram Live with NWTRCC • Rochester Held WTR 101 in January - You Get What You Pay For—Take a Stand for Good

By Chrissy Kirchhoefer

Click here to download a PDF of the February/March issue

Celebrate Pie Day!(and other Tax Season events)

By Lincoln Rice

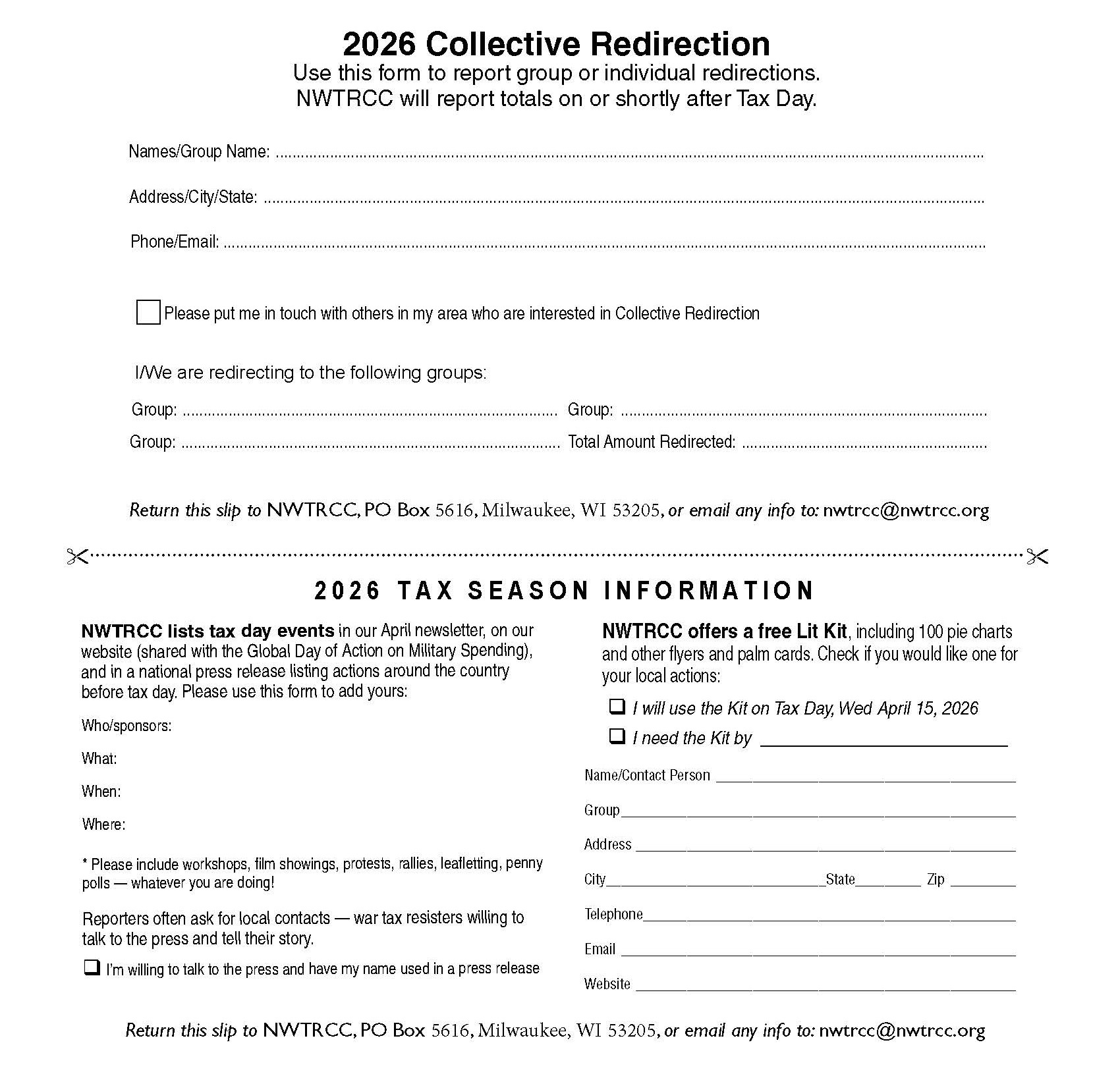

Normally, Tax Day in April is the pinnacle of the year for war tax resisters, with many going out to flyer or table. While we still plan on making a big deal of Tax Day this year, we would urge readers to consider holding an event on Pie Day, which is Saturday March 14th.

Many people already celebrate this day by getting together to eat pies, but with NWTRCC’s long tradition of promoting the War Resisters League pie chart, we thought this would also be a good opportunity to promote war tax resistance.

This idea came out of our brainstorming session for promoting war tax resistance at our November war tax resistance conference in Worcester, Massachusetts. In addition to piggybacking on the growing popularity of pie day, we also know that most people e-file their tax forms before Tax Day and never go to the post office to drop them off.

A WTR gathering in Prtland, Oregon, celebrates pies for peace. Photo by Paul Stretch

Pie Day could include traditional flyering, tabling, and penny polls, but it could also be more low key. A war tax resister could invite people to their homes, provide pie, and watch “Death and Taxes” or the War Tax Resistance 101 video—followed by discussion. Please let the NWTRCC office know if you plan on hosting a Pie Day event, especially if you would like us to promote it!

Tax Season Kick-Off 2026

NWTRCC began this tax season by holding a War Tax Resistance 101 on Zoom with Choose Democracy’s National Tax Strike (taxstrike.info). We specifically held it on the evening of Tuesday January 20th, the first anniversary of Trump’s inauguration. We had 497 people attend some portion of that session. And one of the “attendees” was the Biggest Little Action Group in Reno, Nevada, who hosted a watch party with thirty people in attendance. We held the event in a regular Zoom meeting, where anyone could unmute themselves at any time… and the event went very smoothly without a hitch.

Chrissy Kircchoefer and I led the WTR 101, and after fielding some questions, we handed it over to Christina Thompson, the Coordinator for the National Tax Strike (NTS). She explained how NTS formed and its current work of promoting tax resistance to disrupt the actions of the Trump administration. A lively Q&A continued afterward with people wanting to know how to become involved with NTS and others with further questions about war tax resistance.February Events

On February 5th at 1p Eastern (which might already have happened when you receive this), NWTRCC will hold a W-4 workshop on Zoom and also hold office hours for additional questions. Since one of the most common questions to the NWTRCC office is the filling out of the W-4, we believe this workshop will be popular. On February 24th at 8p Eastern, we will hold another War Tax Resistance 101. We plan on holding additional events during March and April, but we don’t have dates for those events, yet. If you plan on holding any local events, please let the NWTRCC office know so that we can promote them.

Being Ungovernable

By Ruth Benn

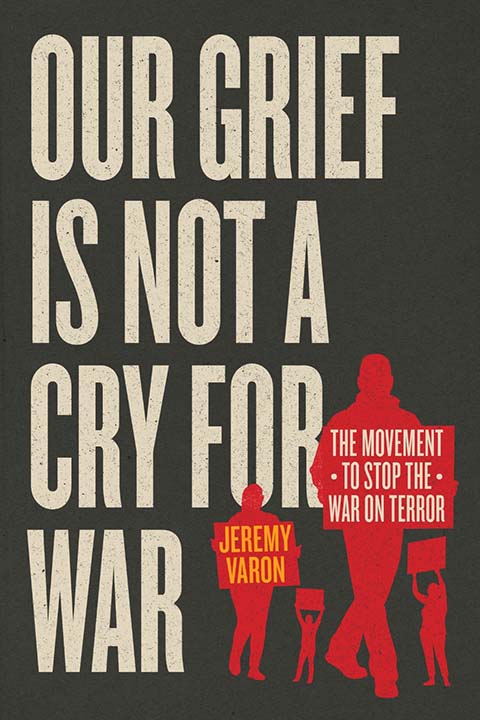

The word “ungovernable” stuck in my mind after reading a review by Frida Berrigan of activist/historian Jeremy Varon’s recent book Our Grief Is Not a Cry for War. The book is a history of the movement to stop the war on terror, from right after the 9-11-2001 attacks on the US to the invasion of Iraq in 2003. Varon covers the groups, individuals, and collective actions by the peace/antiwar movement as a whole with an emphasis on the value of the efforts even though the wars went on for more than 20 years with ongoing repercussions today.

The book and review include a quote from writer and activist Starhawk that “what finally may contain the war-mongers is the possibility that the people will be ungovernable — if the government continues to disregard its will.”

Frida added, “We were not ungovernable.”

That word, “ungovernable,” and Frida’s admonition, have stayed with me. Were we too polite in our protests to create true change? Millions turned out worldwide against the invasion of Iraq in February 2003, but the US launched the attack anyway and too many went back to their daily lives. Are we at a point now where we really have to figure out how to be ungovernable and how to sustain it…at the same time we need to pay rent, buy food, raise children, take care of aging parents, deal with medical issues, etc. etc.

Trump’s election in 2016 inspired Jackson, Mississippi activist Kali Akuno and others with the Malcolm X Grassroots Movement to put out a call that still resounds: “We cannot and should not legitimize the transfer of authority to a right-wing populist who has neo-fascist orientations. We shouldn’t legitimize that rule in any form or fashion. We need to build a program of being ungovernable.”

Today our focus — not to mention gratitude — is on Minneapolis and the neighbors and activists pouring into the streets with creative actions to stop “Trump’s Gestapo,” the masked ICE agents acting with impunity there and in cities and towns and rural areas around the country. “ICE Out of MN” (iceoutnowmn.com) called for “No Work. No School. No Shopping.” on Friday, January 23rd, to protest ICE activities and advocate for immigrant rights.

In a similar vein, the Women’s March recently called for Walk Outs with the slogan, “In the face of fascism, we will be ungovernable.” The call added, “It’s time to rise up and refuse to comply with this injustice — our ancestors showed us time and again that we can prevail when we, the people, stand up and refuse to comply.”

Growing participation may begin to unite these scattered calls toward a general strike nationwide. Strikes are an obvious element of ungovernability, which led me to look for more specifics of how to be ungovernable. Handily, Waging Nonviolence just posted an article by Rivera Sun, “10 Rules of Resistance for #ICEOut” with lessons from an anti-Nazi leaflet “10 Commandments for Danes.”

Sun’s list is good, but cutting off the funding needs to be added to the list if we are to deny ICE what it needs to function. We can lobby elected officials to do this, but to be ungovernable we need to do it individually as tax resisters — making our resistance loud and public. Despite the fact that most of these wider calls do not list tax resistance, thousands are finding the NWTRCC network and at least considering this form of resistance. How fortuitous that this anarchistic and decentralized network has managed to carry on and be ready for this moment with trainings, resources, and counseling!

At the same time, we work toward this ungovernability we find ourselves horrified that there are so many people, ok, mostly men, who will treat other humans as ICE is (not to forget the horrors of war and violent oppression around the world). There are materials we can use to hand to ICE agents and military members and anyone thinking of signing up for those jobs calling on them to refuse fascist orders. @DoNotTurnOnUs has leaflets and links to other resources here: https://linktr.ee/donotturnonus

Even as I struggle with the specifics of making myself ungovernable and pondering exactly what risks I’m willing to take, people mobilizing for change both here and abroad are cause for hope and courage. If we are able to sustain and build our resistance to the current regime(s) despite the growing militarism, we might come out of this era in a better place than the world has seen in a long time.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2025. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org.

2026 IRS Standard Deduction and Taxable Income Level

As a reminder, Trump’s tax overhaul bill eliminated the personal exemption in 2018. Now there is only the Standard Deduction figure that sets the taxable income level.

Category Standard Deduction Single $16,100 Married, Filing Jointly $32,200 Married, Filing Separately $16,100 Head of Household $24,150 For each married taxpayer who is at least 65 years old, an additional $1,650 standard deduction may be claimed for a total of $3,300 if both are over 65. If the taxpayer is single, the additional standard deduction amount is $2,050. If the taxpayer is blind, the additional amount is $1,650.

A single person can earn up to $16,100 and owe no federal income tax. You may be able to make significantly more than the amounts indicated above and owe no income taxes. NWTRCC’s Practical #5, Low Income/Simple Living as War Tax Resistance, includes information on legal ways to reduce taxable income and owe no federal income taxes ($1.50 for a hard copy from the NWTRCC office; read it free online at nwtrcc.org).

Payroll taxes for Social Security and Medicare begin to apply at a lower income level than one’s standard deduction. If you are self-employed and do not file or pay estimated taxes, you may be liable for Social Security taxes. If you are an employee, these payroll taxes are automatically withheld as a percentage and you cannot resist those taxes.

$1,000 Charitable Deduction

For tax year 2026, the Big Terrible Bill allows a charitable deduction for non-itemizers. (Non-itemizers are those who take the standard deduction and do not use Schedule A.) Only about 10% of filers itemize their deductions and take advantage of the regular charitable income tax deduction. 90% of taxpayers use the standard deduction, but now in 2026, the non-itemizers can take a tax deduction for charitable gifts. Up to $1,000 on single returns, up to $2,000 on married joint returns. To qualify for the non-itemizer charitable deduction, you have to make a cash gift – check or credit card. Donating items like clothing, cars, books, etc. will not qualify. Also, with this deduction you can deduct 100% of the donation from your taxable income. For example, if you donate $1,000 in cash to a 501(c)3, you will be able to lower your taxable income by $1,000.

Slight Change to IRS’s Annual Tax Debt Letters

Though not everyone receives them, most filing war tax resisters receive yearly letters for each previous year for which they have refused to pay federal income taxes. Someone in our network noticed that their latest batch of these letters were all IRS notice CP71C, which is the IRS’s “new improved” variation on CP71A. The previous version used much smaller regular (not bold) print with the headline “Annual reminder of balance due.” Unlike CP71A, the CP71C headlines in large bold type “Urgent Notice: You still owe a balance due for tax year…” preceded by an exclamation point in a black triangle. The front page also has more threatening language about things that need to be done “immediately” and “consequences.” These changes have no practical effect, except to be more intimidating for the recipient.

1099-NEC Reporting Requirements

As part of the Big Terrible Bill, reporting requirements for self-employed people receiving income from businesses will change in 2026. Previously, businesses were required to report payments of $600 or more during a calendar year to self-employed people. In tax year 2026, this threshold will rise to $2,000 and go up each year with inflation. This rule is expected to reduce by 30% of the amount of 1099-NECs that are issued.

Many Thanks

Thanks to each of you who has responded to our winter appeal! Remember, you can also donate online through PayPal and Venmo (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

Special thanks for Affiliate dues payments from:

War Resisters League; WRL New England; Boulder War Tax Info Project; Casa Maria Catholic Worker (Milwaukee)

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram •

or join our discussion listserve.

Click on the icons at nwtrcc.orgAdvertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loopWe’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.orgDonate by Venmo

NWTRCC now accepts donations by Venmo! We still accept donations by check, PayPal, and credit/debit card using PayPal. Also, tax deductible donations can be made by check or credit/debit card using one of our fiscal sponsors. For more information on all the ways you can donate to NWTRCC, go to nwtrcc.org/donate.

History

Preserving and Using our Peace Histories

Susan Van Haitsma at a No Kings rallyin Austin Photo by Jeff Webster

By Susan Van Haitsma

A number of us NWTRCC folks began doing war tax resistance in the 1980s in response to Reagan-era escalation of military spending, nuclear weapons proliferation, and US military intervention in Central America. Many of us were then in our 30s, and now we are in our “retirement years,” even as we continue to be as active as possible in the urgency of now.

Part of today’s urgency is a need to document our histories of peace activism in the face of a current climate of revisionism and falsification of US history. In Austin, our small group with the long name, Austin Conscientious Objectors to Military Taxation (ACOMT), was most active from about 1986 – 2008, and my file drawers have been a repository for papers associated with our local actions as well as NWTRCC organizing. That history has value, and I believe it will be of interest to future generations, so I’ve begun compiling the files into an archive. Because NWTRCC already has an established archive at the Swarthmore Peace Collection located in the McCabe Library of Swarthmore College in Pennsylvania, I contacted Sahr Conway-Lanz, Curator of the Peace Collection, to ask about sending our Austin papers there.

An “Archival” photo from the ACOMT files Photo by Susan Van Haitsma

Sahr responded affirmatively while also suggesting that I consider local possibilities. Often, Sahr explained, an archive is best placed locally, and I had found that to be true while organizing the papers of another peace group with which I had been active, CodePink Austin. That archive is now housed at the Austin History Center, where some of it was submitted as “born digital,” so it can be accessed online as well as researched in person. Several Tax Day actions in Austin were collaborations between ACOMT, CodePink, and other groups.

As I looked through my ACOMT files, there were more connections with NWTRCC than to local organizations, however, so joining the ACOMT files with the NWTRCC collection at Swarthmore, where interested persons might find it easier to see records of multiple NWTRCC affiliates in one place, seemed the best choice. Sahr offered recommendations for organizing the materials: NWTRCC newsletters need not be included, as those are already in the archive; writing a synopsis of our group’s history would be helpful, as that could be easily uploaded and viewable online.

Thus far, the NWTRCC collection at Swarthmore comprises twenty-five file boxes of materials documenting NWTRCC history since its founding in 1982, including newsletters, literature, business reports, and correspondence. Most of the materials were delivered to Swarthmore by NWTRCC coordinators over the years. Lincoln Rice also organized and added the files saved by longtime war tax resister Robert Randall, who had attended so many NWTRCC meetings and kept meticulous notes.

Most of the NWTRCC archive is stored off-site and is catalogued but not digitized, so general categories such as “Press Coverage” are noted online but not described in more detail. Research mostly happens through reading the papers in person, allowing two weeks’ notice so that materials can be retrieved from storage and brought to the library.

NWTRCC-related history is also found in the personal archives of longtime war tax resisters like Randy Kehler and Wally and Juanita Nelson. Randy’s archive is located at UMass Amherst, while the Nelsons have their own archive at Swarthmore. Materials in the NWTRCC files also include information about Randy, Juanita, and other war tax resisters who have archives elsewhere, so overlap and cross-referencing are part of the archival challenge—but also part of what makes research interesting.

As I’ve been reading through my ACOMT and NWTRCC files, I’ve especially appreciated revisiting the hand-written letters that were once a more common way of communicating about NWTRCC business. There are delightful notes from Juanita, for example—some written on the reverse sides of action fliers.

Former NWTRCC Coordinator Ruth Benn, who has been doing much historical work with the War Resisters League, put me in touch with Louis Battalen, a friend of the Nelsons who, since before Juanita died in 2015, has been writing her biography. Now close to finishing his first draft, Louis has made six visits to Swarthmore from his farm in Massachusetts to research the Nelsons’ papers – some of which he had a hand in rescuing from the kindling box during visits with the Nelsons at Woolman Hill years ago.

Louis has also done research in four other archives that include Juanita’s writings related to her civil rights activities. Louis and I have noted how special it is to see Juanita’s handwriting and her typed notes—her wit and wisdom so evident. Future generations may not be able to read her cursive handwriting, however, and some of the ink has faded, so Louis’s book will be a valuable resource as well as a treasured history of one of our movement’s most revered mentors.

This fall, I had the opportunity to tour the Swarthmore Peace Collection. Sahr brought out a special artifact: the Nobel Peace Prize awarded to Jane Addams in 1931 for her roles as co-founder of Hull House in Chicago and the Women’s International League for Peace and Freedom (WILPF). The Swarthmore Peace Collection originated through acquiring the WILPF archive and Jane Addams’s papers, which then attracted the archives of other peace groups and grew to what is now the largest collection of its kind in the US.I think about the through-line from Jane Addams to Juanita Nelson, great women who, in the midst of war and ingrained inequality, made the vital connections between social justice, feminism, freedom and peace, acting with creative, courageous nonviolence at every level. The Peace Collections that contain the valuable histories of Juanita Nelson, Jane Addams, and the multitude of people and movements in between, including us, are ready resources we can use now.

NWTRCC Upcoming Events & News

Mark Your Calendars! National NWTRCC Conference on Zoom: May 1 – 3, 2026

Our first conference in 2026 will be on Zoom. Registration is currently open on the website. The schedule for the conference is in the early stages of being formed. The NWTRCC business meeting will be Sunday morning, May 3 (open to all). Note: Proposals for the May meeting must be submitted to the NWTRCC office by April 15, 2026.

Save the Date! National NWTRCC Conference in Las Vegas: November 6 – 8, 2026

The Las Vegas Catholic Worker has agreed to host our fall gathering. Registration for this meeting will not open until after the May online conference but reserve this weekend in your calendar!

Help keep NWTRCC Strong and Growing!

Nominations Open for NWTRCC’s Administrative Committee (AdComm)

The AdComm provides oversight for business operations, helps plan two gatherings each year, keeps in touch with consultants between meetings, and meets face-to-face at the May and November gatherings (and by Zoom in February and August). We need to fill two seats, and new members will be selected from the nominees at the May 2026 meeting. They serve as alternates for one year and full members for two years (three years total). Travel to meetings is paid for full members and alternates filling in for full members who cannot attend. Each nominee will receive a nomination letter from the NWTRCC office with more details about what is involved as a member of this important committee.

Call, email, or mail your nomination(s) to

NWTRCC, PO Box 5616

Milwaukee, WI 53205

800-269-7464 or nwtrcc@nwtrcc.org

Deadline: March 15, 2026Queer & Trans Wealth Offered Instagram Live with NWTRCC

@queerandtranswealth, which offers anti-capitalist personal finance, has also been promoting war tax resistance for a while now. On January 27, they had NWTRCC

Coordinator Lincoln Rice join them on an Instagram Live session to discuss war tax resistance and answer questions. It was a lively session with quite a few questions on resisting as a business owner. A recording of the session can be found under “reels” on the Instagram pages for NWTRCC (@wartaxresister) or Queer & Trans Wealth.

Coordinator Lincoln Rice join them on an Instagram Live session to discuss war tax resistance and answer questions. It was a lively session with quite a few questions on resisting as a business owner. A recording of the session can be found under “reels” on the Instagram pages for NWTRCC (@wartaxresister) or Queer & Trans Wealth.Rochester Held WTR 101 in January

NWTRCC and the Pace e Bene Tax Resistance Affinity Group convened an introduction to war tax resistance (WTR</abbr) in upstate New York over Zoom. The invitation was shared with the Greater Rochester Council of Churches and the Interfaith Action Network. Members of Spiritus Christi church community hosted the online session. We began our time together by breaking into small groups to discuss why it was important to be together learning about war tax resistance.

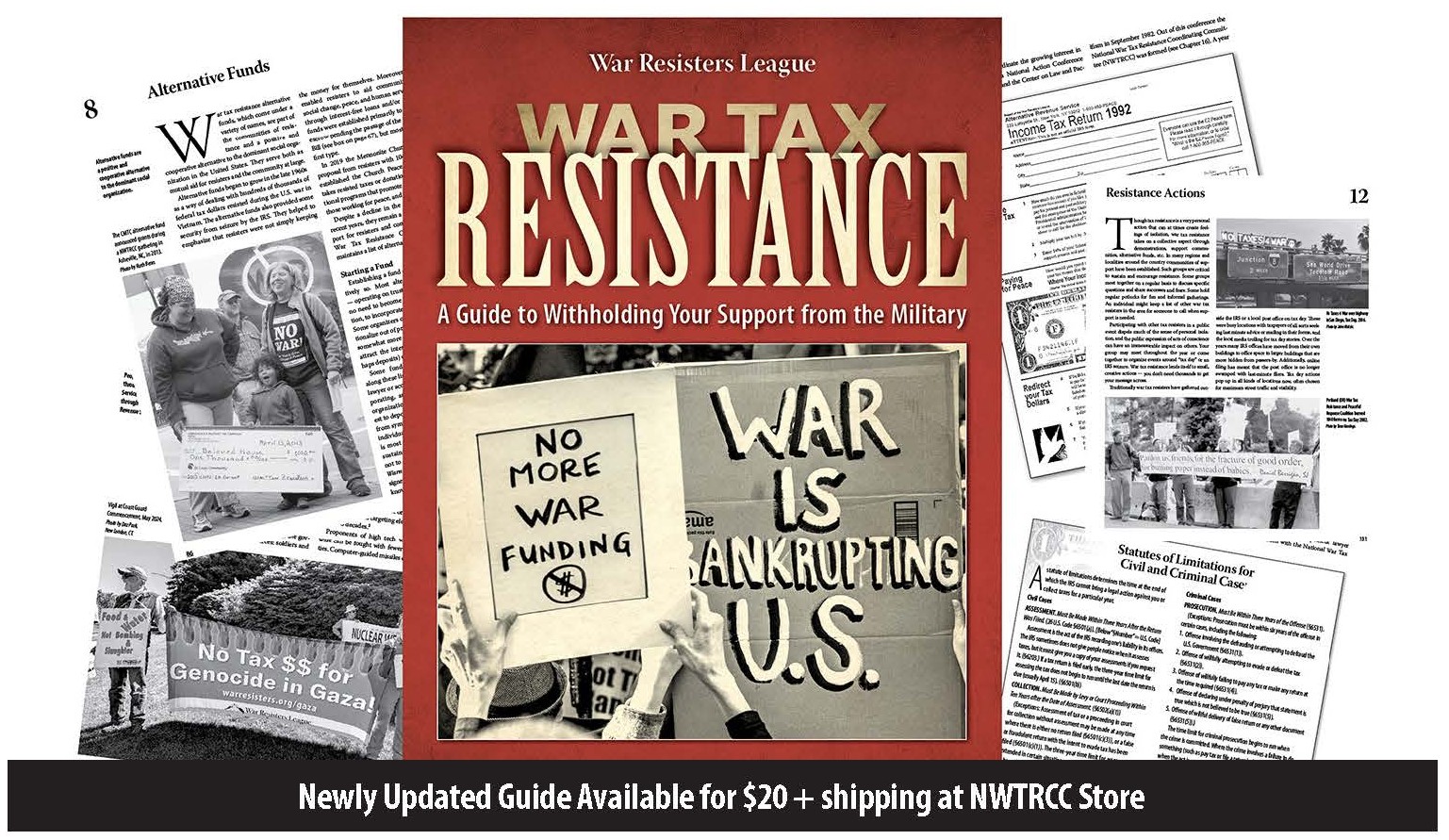

The presenters provided an overview of war tax refusal by highlighting some of the principles: that there are a variety of ways to practice that may change over time, that there is a community of support to share their experiences, and the history of NWTRCC and those refusing to pay for war in the US. Sharing from the new War Resisters League Guidebook, David Miller discussed the five myths about WTR. Cathy Deppe brought some levity to the conversation by sharing some of her many interactions with the IRS over the years in a segment that addressed getting real about the IRS.

Kit and David Miller shared their dance with WTRver the years and their redirection efforts locally in Rochester as well as internationally to those impacted by wars that are only possible with US taxpayer money. Lyle Jenks informed the group of the escrow account that Quakers in upstate New York have established but is not limited to Quakers, the Farmington-Scipio Regional Friends Escrow Account. Let NWTRCC know if you would like to host an introduction to WTR in your community and ways we can support you in that endeavor.

– Report by Chrissy Kirchhoefer

You Get What You Pay For—Take a Stand for Good

By Chrissy Kirchhoefer

Even though the drumbeat for war in Venezuela had become louder and louder, the news on the morning of January 3rd came as a surprise to many. For months news was emerging about US troops amassing in the Caribbean and airstrikes on Venezuelan oil tankers. To date there have been 36 strikes with at least 117 dead. US warships were also amassing near Venezuela and first bombed the country in late December.

That was not the only bombing carried out in late December. While many people throughout the world were gathering with friends and family on Christmas, the US bombed Nigeria. This was the first time that US taxpayer money dropped bombs on the most populated African nation. Previously, the US provided military aid and training to the nation with the largest oil reserves in the continent. Donald Trump stated that it was a “Christmas present”— one of the places targeted by the Tomahawk missiles was a mosque.

While there was mention in the news of the bombing in Nigeria, little notice was given to the bombing on Christmas in Somalia. Just twelve days into the second Trump administration, the military began bombing the country. There were at least 111 reported bombings in Somalia in 2025, more than the last 3 presidents combined. In less than a year, the current administration has carried out at least 626 airstrikes, including airstrikes in Iraq, Yemen, Iran, and Syria.

In the early morning hours of January 3rd just days into the New Year and after Trump declared that “Peace on Earth” was his resolution for 2026, the US military abducted the president of Venezuela and his wife. Over 150 aircraft including bombers, fighter jets, and drones were used with 15,000 troops on hand on numerous war crafts and operating out of twenty military bases—many of them in Puerto Rico. The Central Intelligence Agency (CIA), National Security Agency (NSA), and National Geospatial- Intelligence Agency (NGA) were all involved as well as SpaceCom and CyberCom which conducted a cyberattack to cut off electricity to the capital Caracas.

All of this was to showcase the vast military stockpiles of the US for what the White House has been referring to as a “law enforcement action” as a way of rationalizing not needing Congressional approval. While planning had been in place for some time, Trump reached out to oil executives a month before Operation Absolute Resolve and then after the regime change had taken place.

During the press conference that followed at Mar a Lago, the aims of the operation were clearly expressed when Trump stated, “We are going to run the country [and] get back the oil they stole from us.” Secretary of War Pete Hegseth stated, “Welcome to 2026, and under President Trump, America is back.” That American dominance in the Western Hemisphere would not be questioned was the stated intention. Warnings were also issued to Mexico, Denmark, Iran, Nigeria, Colombia, and Venezuela.

The war has been coming home in recent days with the departments overseeing immigration policy killing Renee Nicole Good, shooting unarmed civilians, and growing awareness of deaths of thirty-two people in Immigration and Customs Enforcement (ICE) custody in 2025. These tragedies are increasing and slowly information is coming out about additional deaths by ICE. The current budget for the Department of Homeland Security (DHS), Customs Border Patrol (Abbr title=”Customs Border Patrol”>CBP), and ICE is $170 billion over four years, making it by far the largest federal law enforcement agency. The Big Terrible Bill has further increased the militarization of law enforcement creating what some have called the “Deportation-Industrial Complex.”

This playbook has been going on for far too long. The cost that is being paid by ordinary people is increasing worldwide. In the US people are making the connections with their tax money paying for all the bombings and expressing their fury at the lack of basic services. We get what we pay for. What if we stop paying for war? Donald Trump recently has proposed a $1.5 trillion military budget which would be a 50% increase and a recipe for more waste, fraud, and abuse.

As people are beginning to get their earning statements this month and concretely see how much of their wages the government has been taking to pay for genocide, illegal bombings of sovereign nations, and the tanks within our streets, we would encourage people to double up their outreach on war tax resistance. Share your experiences, the many resources of NWTRCC, and our collective knowledge of refusing to pay for war. Share word about our upcoming War Tax Resistance 101 session on Zoom. (You can find the latest list on our homepage under “Upcoming Events.”)

As we gear up toward Tax Day, we wanted to take on different focuses each month. In January we shared knowledge about some of the practical steps of resisting taxes to pay for war and militarization, and to build community that centers humane values. We need each other for inspiration. As the great pacifist Albert Einstein said, “Imagination is more important than knowledge. Knowledge is limited. Imagination encircles the world.”

Editor Lincoln Rice

Production Rick BickhartMore Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org - Celebrate Pie Day!(and other Tax Season events)

-