National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

August – September 2023

Contents

- IRS Should Embrace Race Data

By Lincoln Rice - Join us in West Harrison, New York

for our November Gathering! - Counseling Notes IRS May Respond to Correspondence… You Did Not Send • IRS Will Drastically Cut Back Surprise Visits to Homes and Offices • IRS Eliminated Backlog of Paper Tax Returns

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Memoriam: Lonnie Valentine and Martha Fuchs Ferger

- Network News: Reflections on Antimilitarist Roots: War Resisters’ International June 2023 Conference By Theo Kayser

- NWTRCC News: Tax Day: Tucson, Arizona • Peace History Society Conference will Feature WTR • Next WTR Counselors Call – October 24, 2023 • Legacy of Witness: MennoCon 23 By Chrissy Kirchhoefer • Juanita Nelson’s 100th Birthday Celebration

- NWTRCC Fundraising NWTRCC Raffle Winners!

- Stories Positive Responses to War Tax Resistance by Ruth Benn

Click here to download a PDF of the August/September issue

IRS Should Embrace Race Data

By Lincoln Rice

Photo by Brett Sayles on Pixels.

Earlier this year, Professor Leslie Book of the Villanova University Law School stated, “The IRS has yet to fully acknowledge its role as one of the most important federal agencies in terms of delivering benefits.” According to the Government Accountability Office (GAO), from April 2020 through the end of 2021, the IRS distributed $837.5 billion in total Economic Impact Payments and $93.5 billion in advance child tax credit payments.

Although the IRS is a social benefit provider, it maintains a policy of race neutrality in its data collection. In addition, since the IRS does not collect racial data, it is difficult to ascertain if the IRS treats people of color fairly in its interpersonal interactions and structural policies. Essentially, the IRS has a “color-blind” approach that it believes protects it from being racist. In reality, this approach simply makes it difficult to know how its actions affect communities of color.

Interpersonal interactions for which it would be very important for the IRS to track race data include referrals to the Department of Justice for criminal investigation, civil penalty assessments, settlement amounts, and denial of innocent spouse relief. Although NWTRCC has not witnessed racial disparity in how war tax resisters are treated by the IRS, our sample size is too small. It would be helpful to have the big picture data to determine if being a war tax resister carries a greater risk for people of color.

In drafting structural policies, Book stated that the IRS needs to consider the following: (1) will a policy promote racial equity; (2) how will a policy affect historically unfairly treated communities; and (3) will a policy perpetuate or exacerbate racial inequity.

One thing that we do know is that extremely wealthy white men have a significant voice in forming the tax code. Pro Publica has reported how billionaires influenced the Trump-era tax cuts. (This was reported in an August 2021 article entitled, “Secret IRS Files Reveal How Much the Ultrawealthy Gained by Shaping Trump’s ‘Big, Beautiful Tax Cut.’” The most vulnerable do not have a direct phone line they can use to influence tax policy.

[The main source for this article was Tim Shaw, “Law Professor: IRS Should Embrace Race Data to Promote Equity,” at tax.thomsonreuters.com.]

Join us in West Harrison, New York

for our November Gathering!

The lingering effect of the pandemic on our first in-person conference in May was palpable. Only eleven folks travelled from outside the area to attend the conference and about ten people joined us for various sessions online. Nevertheless, the meeting was energizing and the general thought at the Sunday morning business meeting was the need to meet again in person very soon.

Image by Sabrina Ripke from Pixabay

Thanks to Lucia van Diepen (one of the energized in-person attendees at the May gathering) the Purchase Quaker Meeting in West Harrison, New York has agreed to host our next gathering the weekend of November 3-5, 2023. The schedule is being planned as of this writing. A schedule with registration will be up on the website before the end of August.

The Meeting House will be able to accommodate about fifteen people with sleeping bags and we are hoping to find a few local folks to provide some beds. The meeting house has superb internet, so we will also be providing an online option for joining the meeting.

The location is good for travel. The meeting house abuts the Westchester County Airport, which is served by American Airlines, Delta, and a few others. Also, the meeting house is situated thirty miles north of New York City. Check out the website at the end of August for more information.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). The next counselor training will be online in early 2024. If you are interested in attending, please contact the NWTRCC office.

IRS May Respond to Correspondence… You Did Not Send

Last year I (Lincoln) received several letters from the IRS stating that they had received my correspondence and would respond to it within sixty days. After sixty days, they sent another letter to the same affect. And then another. Eventually, they sent me a letter stating that the matter was resolved and I never heard anything more.

What made these letters from the IRS so strange was that I never sent them any correspondence and I had not sent a letter with my tax forms that year. I figured that it was a random computer malfunction since the letter was automated and their computer system has been sorely in need of an upgrade for over a decade.

I did not previously mention this news here because I believed it was an isolated event. But in July 2023, a longtime war tax resister in New England received a similar letter about correspondence he did not send. The letter begins by referring to his “correspondence of July 11, 2023.” If anyone else has received this type of correspondence, please contact the NWTRCC office. These letters seem harmless, but it would be good to know how common they are.

IRS Will Drastically Cut Back Surprise Visits to Homes and Offices

At the end of July 2023, the IRS announced that it will end most surprise visits to homes and offices. In the latter half of the twentieth century, this was a common way for revenue officers to collect information to aid in the collection process, but it has been a relatively rare experience for those in our network during the last two decades. The IRS will only continue this practice for seizing assets or issuing of summonses and subpoenas.

The IRS gave two reasons for the change: (1) the safety of their revenue officers and (2) to deter the practice of scammers acting as IRS employees. Those with a tax debt may still receive a letter from the IRS offering the option to meet with revenue officers. This did recently happen to one of our war tax resisters in Wisconsin who invited them to her home to discuss her resistance (see the December 2019 issue of this newsletter, page 8).

IRS Eliminated Backlog of Paper Tax Returns

According to the National Taxpayer Advocate, the IRS has finally closed its backlog of paper tax returns for both individuals and businesses, though there are still delays in processing amended tax returns and taxpayer correspondence.

At the end of May 2022, the backlog of regular paper returns stood at over 21 million paper tax returns. The IRS eliminated this backlog by a combination of allocating more resources to processing paper returns and a precipitous drop in the number of paper returns filed this past spring.

Many Thanks

Thanks to each of you who donated for the May 2023 Appeal and participated in the raffle! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

We are very grateful to these alternative funds and WTR groups for their redirections and affiliate dues: Las Vegas Catholic Worker; Michiana War Tax Refusers; Taxes for Peace Not War (Eugene, Oregon); War Resisters League; War Tax Resistance Penalty Fund

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. (Please let the NWTRCC office know if you use Resist.) Thank you!

Network News

Reflections on Antimilitarist Roots: War Resisters’ International June 2023 Conference

By Theo Kayser

[Catholic Worker Theo Kayser was in Europe for the recent European Catholic Worker Gathering. He decided to stay in Europe a little longer and also attended the recent WRI gathering, which was attended by some of our friends with the War Resisters League. Thank you to Theo for providing this firsthand account of the conference.]

After attending this year’s War Resisters’ International conference (the first since the pandemic for this international cohort of which the US’s War Resisters League is a member) I’ve been asked by friends in the peace movement, “What did you learn? What were your takeaways?” And even now as I put these words down I don’t know that I have a great answer to these questions.

Sure I attended a workshop on the tactics Wage Peace is using in Australia to combat the arms trade/manufacturing there. (Rather than write articles they livestream low risk actions such as interrupting meals at hotels where arms traders are congregating and read facts/convey stories they’d otherwise put in an article.) I did hear more about the need to support conscientious objectors all over the world. (The plenary speaker from Belarus but living in exile in Lithuania shared that COs from her country who had fled not wanting to participate in Russia’s invasion of Ukraine were being pushed by host countries to serve in Ukraine’s military instead.) And I even learned from friends in Colombia about the need to counter “militarized masculinities” (a.k.a. views of manhood being tied to domination or “protecting” women and children with violence and war).

But even more than concrete tactics that we can use to make a just peace, I left with a sense of awe and inspiration and renewed energy from my fellow attendees.

Sometimes it can feel like the peace movement is tiny, that our efforts are small and insignificant when faced with the immense apparatus of the war machine and the seeming apathy by so many other normal folks out there.

Maybe there is in fact some truth to that, but my experience at the WRI conference was a reminder that there are people on our side all over the world, people acknowledging that “war is a crime against humanity” and working to end militarization and its causes.

While I block the entrance to a nuclear weapons plant in the US, folks in Montenegro occupy a mountain and brave the elements to prevent NATO forces from using it as a training ground and in Nepal there are efforts to build a pan-Asian network resisting the arms trade. While activists in South Korea dance on top of tanks, in Germany they are comically changing military recruitment advertisements and in Colombia indigenous people are fighting for their rights to live on their land in peace.

I don’t know if all this makes for a good article. My paltry effort at recounting the energy and inspiration is no substitute for being in the room. Maybe that’s all the more reason for you to put a bit of those withheld war taxes to try to make it to WRI’s next gathering in 3 years (or some other congregation of like-minded folks).

Group Photo of WRI from their website

It might be a difficult road ahead of us and for every two steps forward it might feel like there is a step back, but we aren’t alone in these anti-war efforts and as one Israeli CO shared with the gathering, “I believe in the end we will win. We have won before and it is only a matter of time.”

Memoriam — Lonnie Valentine

Lonnie Valentine speaking at NWTRCC‘s November 2014 Gathering. Photo by Ruth Benn

By April Vanlonden (ESR Class of ’04) Joint Seminaries Registrar – Earlham School of Religion

With hearts broken that carry an abiding sense of gratitude, the Earlham School of Religion (ESR) community shares the passing of Professor Emeritus of Peace and Justice Studies, Lonnie Valentine, on June 19, 2023, during treatment for Primary Cerebral Lymphoma. Lonnie retired from ESR at the close of the 2021‐22 academic school year.

Lonnie earned a B.A. from Raymond College, University of the Pacific in 1970, a B.A. in Philosophy and Religion, University of California, Irvine in 1975, an M.S. from Loyola College, an M.A. in Religion from Earlham School of Religion in 1983, and a PhD in Constructive Theology from Emory University in 1989.

Lonnie returned to teach at ESR in 1989. His broad training and experience enabled him to teach Ethics, Interfaith Dialogue, Moral and Faith Development, Spirituality and Peacemaking, Liberation and Process Theologies, and Biblical Violence and Non‐Violence.

Lonnie was known for his personal history of tax resistance and other justice actions, leading students on trips to protest the School of the Americas and accompanying groups of students to Friends Committee on Legislation Annual Conferences. A strong advocate for the student, Lonnie led educational trips to India and shepherded the numerous international students who came to study at ESR.

Widely published, Lonnie’s works are in The Oxford Handbook of Quaker Studies, Quaker Religious Thought, Friends Association of Higher Education, among others. Always willing to pitch in, Lonnie offered countless presentations at National Peace conferences, Yearly Meeting annual sessions, Church of the Brethren gatherings, American Academy of Religion, Friends World Committee for Consultation, the National War Tax Resistance Coordinating Committee, individual monthly meetings, churches, and to anyone willing to join with him in the pursuit of peace.

An accomplished academic and sought‐after presenter, Lonnie was loved by the hundreds of students he taught at ESR and Bethany Theological Seminary and as well as those throughout the wider Quaker community. After Lonnie’s passing, messages flooded in, relating stories of the impact Lonnie had on the students of ESR and Bethany, and how this impact guides their work throughout this world. Lonnie was a ready participant in student activities, gatherings, meals, and endeavors of ministry, willing to lend a hand if any called or simply join in the various celebrations of their lives.

Lonnie is survived by his wife, Genevieve Baird, daughter Cady, son Ben, grandson Sovann, and the countless who go forth in his ministry. As Lonnie would say, “Carry on.”

Memoriam — Martha Fuchs Ferger

Martha Fuchs Ferger

[Editor’s Note: The following are excerpts from her obituary.]

Martha Fuchs Ferger (born 1924) grew up in St. Louis, Missouri, and attended Swarthmore College where she met John Ferger. They married in 1946, and she earned her PhD in the new field of biochemistry in 1947.

Martha and John loved outdoor adventures and delighted in sharing them with others. They canoed on local streams, started downhill skiing before Greek Peak existed, and spent most Sunday afternoons hiking in the woods. They also shared a love of travel. They spent 2 years living in Bethel, Alaska and they led American Friends Service Committee work camps in rural Alaska while their family was still young. After their children were grown, they took trips to Nepal, Turkmenistan, Ethiopia and several other far-flung destinations, always sharing a slideshow of their adventures with friends and family on their return.

Martha had a deep and abiding commitment to human rights, peace and justice, and to local causes. She and John were war tax resisters, donating the portion of their federal income tax that would have gone to the military to the local Dryden school.

She founded and chaired the Unitarian Church’s Social Justice Committee, headed up the Friendship Center in Ithaca, helped found PARKIT (Prevent Alcohol Related Killings in Tompkins), worked to defeat a proposed nuclear power plant on Cayuga Lake, circulated nominating petitions for local and national Democratic candidates in every election, campaigned against fracking in New York State, and, at age 91, got arrested as part of the We Are Seneca Lake campaign to stop natural gas storage under Seneca Lake. Her work was local, collaborative, often unsung, and never ending. She led by example and was a role model to many.

Martha died at age 99 on June 24th following a fall and hip fracture. She is survived by Gladys (Mitchell) Howard, Carol (Bill) Klepack and Kathy Ferger; 6 grandchildren; and 3 great grandchildren. A memorial service in celebration of her life will be held at a later date.

NWTRCC Fundraising

NWTRCC Raffle Winners!

This spring, NWTRCC held a raffle concurrently with its spring appeal. Donations definitely increased during May and June, but not all who donated to NWTRCC sent in their raffle tickets. Therefore, it is difficult to determine with certainty to what extent the raffle increased donations. Nevertheless, the increase in the spring appeal donations was significant enough that we plan on having a raffle again next spring.

Thank you to all you donated during our spring appeal!!! Here is a list of our raffle winners:

Top Prizes

• 2 Nights near Nelson Homestead (Deerfield, Massachusetts): Scott Yoos (Washington State)

• 2 Nights at Celo Inn (Burnsville, North Carolina): Ruth Zalph (North Carolina)

Additional Prizes

• Swag from the NWTRCC Café Press Store (up to $50): Paul Stretch (Oregon)

• Nuclear Resister T-Shirt & Button. Donated by the Nuclear Resister: Rick Bickhart (Virginia)

• Body Work Session (In Person or Online). Donated by sarasunstein.com: Sue Barnhart (Oregon)

• Twin Oaks Rope Hammock. Donated by Rick Bickhart: Mark Looney (New York)

• Signed copy of Daniel Akst’s book: War By Other Means: Pacifists of the Greatest Generation Who Revolutionized Resistance. Donated by Ruth Benn: Dolores Howard (California)

• Book – Crossing the Line: Nonviolent Resisters Speak Out for Peace. Donated by author Rosalie Riegle: Karen Gruber (Colorado)

• Floral Print on Canvas donated by Larry Bassett: Lynne Lohr (Washington)

• Framed Print created by Larry Bassett: Thadeus Dziekonski (New York)

• Book – A Persistent Voice: Marian Franz and Conscientious Objection to Military Taxation: Sue Troyano (Louisiana)

NWTRCC News

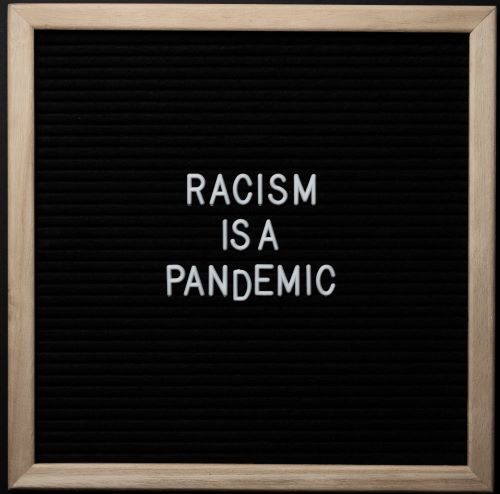

Tucson Tax Day. Photo by Felice Cohen-Joppa

Tax Day: Tucson, Arizona

[Editor’s Note: We have one last Tax Day report to add to our list from the previous newsletter.]

In the early morning of Tax Day, April 18, Tucson activists held signs and banners outside of Raytheon Missiles & Defense as workers arrived, in a protest to say, “Not in our name, Not with our tax dollars.”

At Tucson’s Raytheon plant, Standard Missiles, Star Wars “kill vehicles,” hypersonic glide bombs, AMRAAMs, Javelins, Mavericks, microwave crowd control beams, drones, cluster bombs, nuclear-armed cruise missiles, and more are made.

– Report from Felice Cohen-Joppa.

Peace History Society Conference will Feature WTR

The Peace History Society will hold its next conference at Gwynedd Mercy University, October 26 – 28, 2023. Saturday morning will feature a session celebrating the hundredth anniversary of the War Resisters League with Scott Bennett (moderator), Mandy Carter, Ed Hedemann, Matt Meyer, Joanne Sheehan. Saturday afternoon will feature a session entitled, “War Tax Resistance Beyond Thoreau.” That session will be moderated by Ed Hedemann and showcase the following panelists: Ruth Benn, Betsy Corner & Randy Kehler, and Lincoln Rice.

Founded in 1964, the Peace History Society encourages, supports, and coordinates scholarly research on peace, nonviolence, and social justice; it also communicates the findings of this scholarly work to the general public. More information about the conference can be found at peacehistorysociety.org.

Next WTR Counselors Call – October 24, 2023

For the last six years or so, NWTRCC has offered quarterly War Tax Resistance Counselors calls to aid our counselors in staying up to date with the latest information and provide a platform for discussing various topics. Normally, these Zoom calls occur at 8pm Eastern / 5pm Pacific on the last Tuesday of January, April, July, and October. Since the last Tuesday of October is Halloween, we will be meeting a week earlier on October 24th.

If you are not currently a counselor, but think you might want to consider it, check out the first paragraph of the Counselors Notes on page two of this newsletter.

Legacy of Witness: MennoCon 23

H. A. Penner and Chrissy Kirchhoefer speaking at MennoCon 23. Photo by Byron Clemens

By Chrissy Kirchhoefer

When the largest denomination of Mennonites in the US met in Kansas City for MennoCon 19, H. A. Penner, along with other Mennonite war tax resisters, had put together a proposal that the Mennonite Church USA renew its Church Peace Tax Fund. The historical peace church had previously established a war tax alternative fund in the 1980s to lend support to those refusing to fund violence. That workshop encompassed a lively discussion with many in agreement that the Mennonite Church USA should establish a new fund. A few months later the church leadership approved the proposal.

H. A. shared his hopes, “This fund is designed to provide the spiritual resources, human solidarity, and material aid necessary to support and equip those who, because of conscience, choose not to pay taxes that underwrite war and militarism.” In the few years since the Church Peace Tax Fund has been operating, tens of thousands of dollars have been put into the fund which provides resources for the peace education of future generations and underwrites justice programs like the emerging Peaceful Options for Training and Careers (POTC) program.

MennoCon returned to Kansas City in early July of this year with thousands of Mennonites gathered to attend workshops and worship services. Noticeable was a large contingent of youth. H. A. Penner invited me to join him in presenting at the workshop titled, “Enabling the Church to Do War Tax Redirection.”

H. A. compiled a comprehensive slideshow presentation exploring the long tradition and varied ways Mennonites refuse to participate in war. One story was about Joseph and Michael Hofer, whose refusal to participate in World War I led to a 20-year sentence of hard labor at Fort Alcatraz. They were tortured for their refusal to work and were sent to the disciplinary barracks at Fort Leavenworth.

They arrived eight days after the end of World War I; both were dead within three weeks. The conditions that the Hofer brothers and other conscientious objectors (COs) suffered motivated the traditional peace churches consisting of Mennonites, Quakers, and Brethren to advocate for alternative service and the Civilian Public Service camps that were established for COs during World War II.

Peppered throughout the presentation were questions posed to the audience about how to respond to the militarism so prevalent in our society and inquiring how paying and participating in war are connected. The discussion that ensued with the 30-plus people present was engaging!

Some people wanted to know the practicals of WTR, some shared specifics of how Chrissy and H. A. have gone about WTR over the years, and some spoke of supporting young people taking on WTR.

One of the most compelling questions asked was how to promote entire congregations taking part in WTR and sharing the Mennonite Church USA’s support of WTR to leverage more power and impact.

The group discussion made evident that the Church Peace Tax Fund was already a living reality. The solidarity was palpable; the strength and courage seemed to be expanding before my eyes. It was inspiring to be among a community engaged in effective peacemaking. It was great to share NWTRCC’s many resources with an enthusiastic and receptive crowd!

Juanita Nelson’s 100th Birthday Celebration

Juanita Nelson 1923-2015. Photo by Ed Hedemann

To remember Juanita Nelson, on what would have been her 100th birthday, the Nelson Legacy Project is planning three days of workshops, theater, trainings, music, and dancing. The event will be August 17-20, 2023 at the Woolman Hill Conference Center in Deerfield, Massachusetts. Go to the Nelson Legacy Project website (nelsonhomestead.org) for more information.

Stories

Positive Responses to War Tax Resistance

By Ruth Benn

This string came off the war tax resistance listserve, which you can sign up for by clicking the star icon on the upper right-hand corner of the website. Ask questions, start a discussion topic, like Angie did, or ask for feedback about an issue related to war tax resistance.

Angie got it started:

I’m starting this thread to see if anyone has any stories they’d like to share about positive responses, especially pleasantly surprising ones, that they’ve received regarding their war tax resistance. For instance, was there a time when you shared your war tax resistance activities or beliefs with a person or group and was met with more curiosity, support, or encouragement, than you expected? Is there anything specific in the way you handled it that you think may have led to that particular response?

I’m looking to gradually become much more open about my war tax resistance, and I think sharing things like this could be encouraging to all of us.

Larry:

Yes indeed. E.g., the time when I announced in the College newspaper that my salary had been levied, and several colleagues I wouldn’t have guessed would be sympathetic came up to me, not only to express sympathy, but also to ask me whether I needed financial support. E.g., and later, when the then President of the College, herself a Quaker, invited me to draft a letter she could send to the IRS, asking it to withdraw the then levy on the ground that freedom of conscience was a core value of the academy. No response from the IRS, and the levy went on apace, but I’m not aware of any other College President who sent such a letter.

Ginny:

Yes, my partner of 20 years was originally attracted to me due to the WTR.

Sue:

Over the years many people have told me how much they admire that I am a war tax resister and that I talk about it openly with friends, family and co-workers, and write a letter to the editor about it each spring. One person I know who I think of as fairly straight told me he saved one of those letters to the editor from the local paper from a long time ago and it’s still on his refrigerator door.

When I was adopting my daughter from India I had a lot of trouble with the INS, US Immigration. Many people kept thinking it was the IRS that was causing the issues and that being a WTR was somehow the reason I was having some issues, I just kept explaining that the IRS was not the problem, it was the INS!!

I met my two long-term partners due to being a peacenik and war tax resister. My first partner I met at a War Resisters League conference; my second partner I met tabling at an event. Both of them admired my war tax resistance. They have been great allies.

Mary:

When I was levied while working as a neighborhood organizer based in a shelter for homeless families, I wrote a letter to the board and staff explaining why I was being levied and asked that they consider not complying. Several staff members were formerly homeless women, and a couple asked me questions out of curiosity. They said that it made sense to not pay for war and instead fund human needs. One said something like, “I never knew you could do that — we all should do it!”

Some years later, when I worked organizing low-income tenants for a more radical small organization, the IRS visited my workplace and then levied me. I wrote a letter to the Steering Committee and gave them info on organizational tax resistance. They wrote the IRS saying basically that this was a matter between the IRS and our employee, we don’t want to get involved. After that, the IRS seemed to lay off — I didn’t hear from them except for the form letters they send out.

Dana:

I just finished up a 5-day kids camp and one of the other instructors said to me, “Dana, you are so radical.” I wasn’t sure what she meant, but then she went on, “You don’t pay taxes.” I was glad she thought of me as a radical (she’s pretty radical herself), but I thought, “That’s it, just because I don’t pay taxes? That’s not radical…” For one thing, I think I’m too old to have to pay taxes; I’m not sure how that works but in any case the IRS and I are not on speaking terms.

But, I was recently reminded about Trident submarines: one sub carriers 14 missiles, each missile has up to 14 warheads, 14×14 = up to 196 cities destroyed by one sub. Now that’s radical! And they think I’m radical because I resist paying for this slaughter? I think “they” are radical for doing what they are told to do when it is so evil, or ignorant, or both.

Eleanor:

“Radical” means that it goes to the root. A peace activist who refuses to pay for war is going to the root: if we don’t pay for this expensive foolery, it can’t be done. That doesn’t mean that there aren’t other ways to go to the root: not signing up to fight, or refusing to be drafted, but this is certainly one of them.

Ruth:

One of my favorites was doing an interview about WTR once with PressTV, which was an Iran media outlet in the US. There was a reporter and a camera person. The camera guy didn’t say anything during the interview, but as he was packing up to leave he stopped to say, “I have Thoreau’s ‘On the Duty of Civil Disobedience’ in my phone and read it almost every day when I’m waiting for something or traveling.”

Peter:

When I first started teaching at Saint Mary’s College 55 years ago, the IRS started levying my wages. The finance officer recommended that I be fired since I was a disgrace to the college. Fortunately, my department chair stood up for me and I continued to teach there for 35 years. When this finance officer retired, he wrote a nice letter to me saying how much he admired my principled stand.

Errol:

In 1994 my son was accepted to Cornell on scholarship but the school required a copy of my tax return. I told them I was a war tax resister, a conscientious Quaker, and argued that they should support my witness because the school’s founder was a Quaker. Eventually they gave him the scholarship with the caveat that if the feds audited my son’s account I’d be in trouble.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org