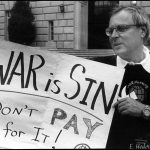

“…we cannot turn a blind eye to the people within our community whose basic needs go unmet, knowing that more will join their ranks with budget cuts. What if instead we insisted upon diverting $20,000 to 2,800 homeless households a month? What if, since no one is listening to our pleas of no intensified war… Continue reading