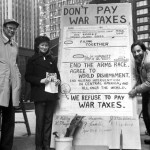

It’s hard to concentrate on day-to-day tasks of late. What with the weather, projects piling up around the house, worrying about the present and future, worrying I’m not doing enough, worrying that whatever I do is so minor in the face of it all… I’ve been to the U.S. Mission to the UN a few… Continue reading