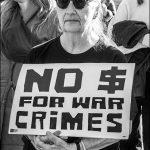

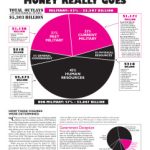

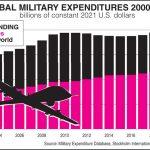

I got all tangled up trying to write a blog about producing the WRL pie chart in light of the federal budget process chaos currently discombobulating Washington. As so often happens with new administrations, there was no Trump budget proposal to analyze in time for our tax day flyer, just lots of bluster from the… Continue reading