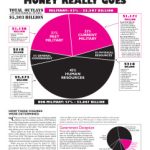

[Editor’s Note: Ed Hedemann created this post for a portion of NWTRCC’s website in 2015 that no longer exists. With it being the 100th anniversary of War Resisters League this year, it seemed appropriate to re-post it.] Had the War Resisters League been founded a few years earlier than 1923 and was producing its annual… Continue reading