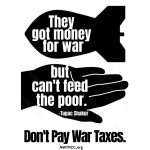

The headlines seem hard to navigate these days; change not just day to day but within the day. It has been difficult to keep track of all the different agencies getting cut, Health and Human Services this week, Education last week and FEMA while witnessing a new catastrophe weekly as a result of the climate… Continue reading