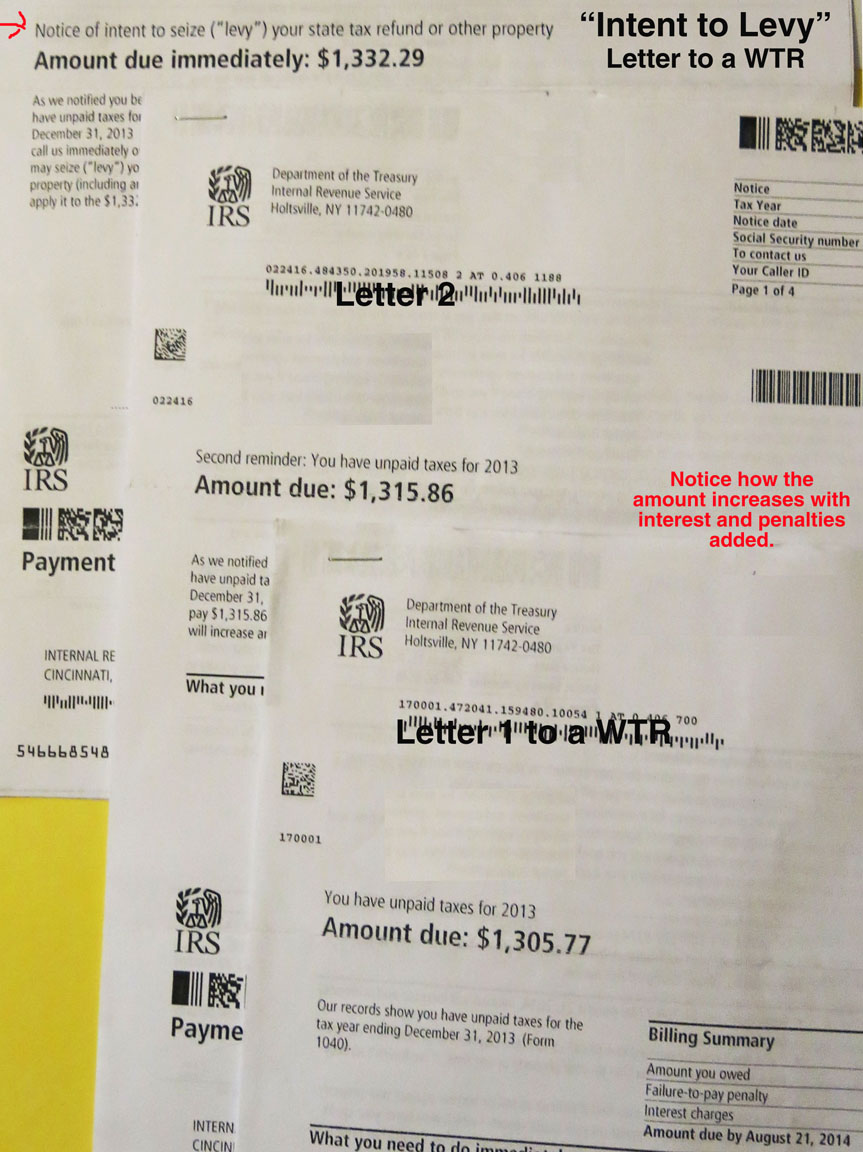

In a previous blog post, we reported the experience of one war tax resister that the IRS typically sends two letters before sending the Notice of Intent to Levy (see picture to the left for an example). This year, however, a few resisters have reported getting only one letter before the Notice of Intent. One resister usually gets three letters before the Notice of Intent, and this year only got one.

In a previous blog post, we reported the experience of one war tax resister that the IRS typically sends two letters before sending the Notice of Intent to Levy (see picture to the left for an example). This year, however, a few resisters have reported getting only one letter before the Notice of Intent. One resister usually gets three letters before the Notice of Intent, and this year only got one.

By sending fewer letters before the Notice of Intent, the IRS gives itself the opportunity to seize money from your bank accounts or wages sooner. But often, nothing happens regardless. If you have gotten fewer (or the same, or more) letters about your 2016 tax bill so far this year, let us know in the comments!

Many resisters also get annual letters from the IRS for each of the past 10 years that they didn’t pay. Again, it’s not clear why some resisters get these letters and others don’t. Receiving them isn’t a clear sign of whether you’ll face more collection action.

If you’re curious or concerned about IRS letters, check out:

David Gross also brought to our attention a recent article in the New York Times, which highlights illegal tactics from the private collection agencies the IRS has hired to go after folks owing back taxes. In some cases, the agencies are urging people to go into personal debt to pay off back taxes, or even raid retirement accounts. The IRS itself does not engage in these types of tactics.

Private agencies have no power to seize money from any accounts or wages you have. They can pretty much only send you letters and call you on the phone, trying to persuade you to pay voluntarily. Some resisters like to talk with collection agents, private or IRS agents alike – so if you get a call or letter and respond, please tell us about it! Our recent Counseling Note in the June/July 2017 newsletter states:

Four companies — CBE Group, Conserve, Performant, and Pioneer — have begun collection work for the government. The program is starting slowly, but will build over the year. Private collectors are given cases in which the taxpayer has years-old unpaid taxes and the IRS has stopped trying to actively collect. Take note of the company names to distinguish them from the ubiquitous scam callers, and note these requirements:

- The IRS will give taxpayers written notice of accounts being transferred to a private collection agency. The agencies will send a separate letter to the taxpayer confirming this transfer. The initial contact will not be by telephone.

- Private collection agencies will identify themselves as contractors of the IRS and must follow the Fair Debt Collection Practices Act.

- Payment is made directly to IRS by check or at irs.gov, not to the private agencies.

- If you do not wish to work with the assigned private collection agency, you must submit

a request in writing to that collection agency.

(Note: IRS phone call scams have become more common over the last few years. Be cautious about what information you give to anyone purporting to call about your tax debt!)

***

Having said all that, focusing too much on the potential consequences can be toxic to our ongoing resistance. Take a deep breath and read this great reflection from Thad Crouch on handling his own concerns about going public as a resister, and dealing with an IRS levy.

Post by Erica

Let me venture one guess about the variations on a theme we are experiencing from the IRS. I had begun to think in this age of computers that the IRS had become so computerized that it just automatically did the same thing when equivalent circumstances arose. In my experience in the 1980s you often had an opportunity to deal with a human being at the IRS. That doesn’t happen anymore. Now you are dealing with an automaton that just cranks you through the system with a repetitious regularity. But could the irregularities we are observing in the system suggest that an actual human being is involved? Or is the only human being a computer programmer tweaking the program?