If every visitor to this website donated $2, we could easily fund our work each year.

Who We Are

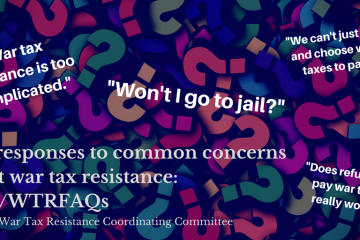

The National War Tax Resistance Coordinating Committee is a coalition of local, regional, and national groups and individuals from across the United States. For everyone interested in or actively refusing to pay taxes for war, NWTRCC offers information, referral, support, resources, publicity, campaign sponsorship, and connection to an international network of conscientious objectors to war taxes.

Recent Blog Posts

Q & A: “Office Hours” are Open

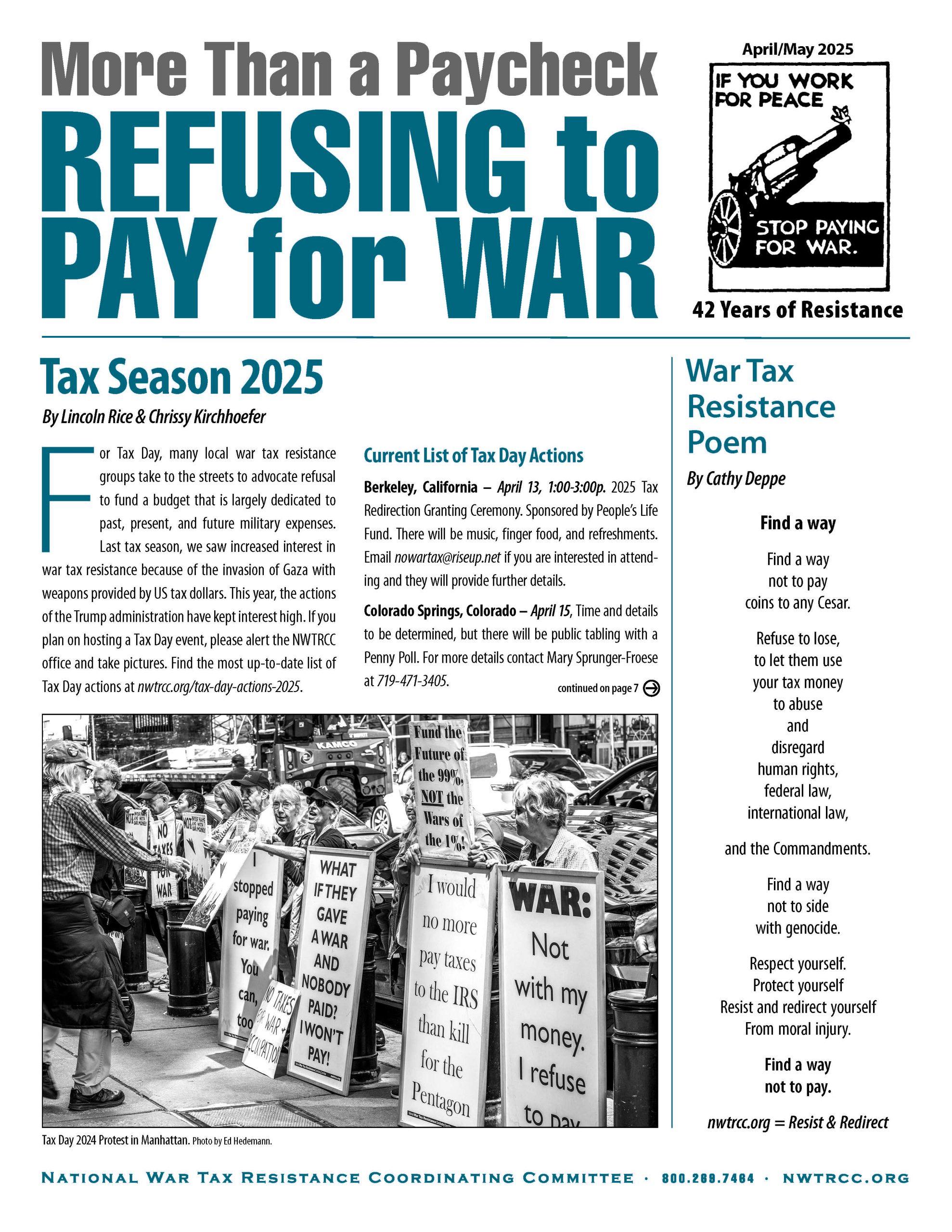

On Thursday February 5th (1pm Eastern/ 10am Pacific), NWTRCC will host an introduction to W-4 resistance. This new online session will address one of the most frequently asked questions of war tax resisters (WTR) by both those new and experienced...Continue reading→

Being Ungovernable

The word “ungovernable” stuck in my mind after reading a review by Frida Berrigan of activist/historian Jeremy Varon’s recent book Our Grief Is Not a Cry for War. The book is a history of the movement to stop the war...Continue reading→

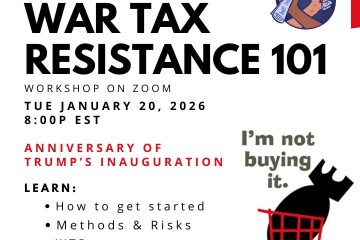

Upcoming War Tax Resistance 101 to Commemorate Trump’s 1st Anniversary

To commemorate the first anniversary of Trump’s inauguration, we will host a War Tax Resistance 101 on Zoom on Tuesday January 20th at 8p Eastern / 5p Pacific. Choose Democracy’s National Tax Strike will also be joining us for this...Continue reading→

You Get What You Pay For- Take a Stand for Good

Even though the drumbeat for war in Venezuela had become louder and louder, the news on the morning of January 3rd came as a surprise to many. For months news was emerging about US troops amassing in the Caribbean and...Continue reading→

Upcoming Events

Register here for our Social Hour on Zoom at 6p Eastern (Sun August 17, 2025)

WTR 101 with General Strike U.S., Thur. July 24 at 7p Eastern. Click here to join when the event begins.

For full list of WTR events, including upcoming local in-person workshops, click here.

New Resources

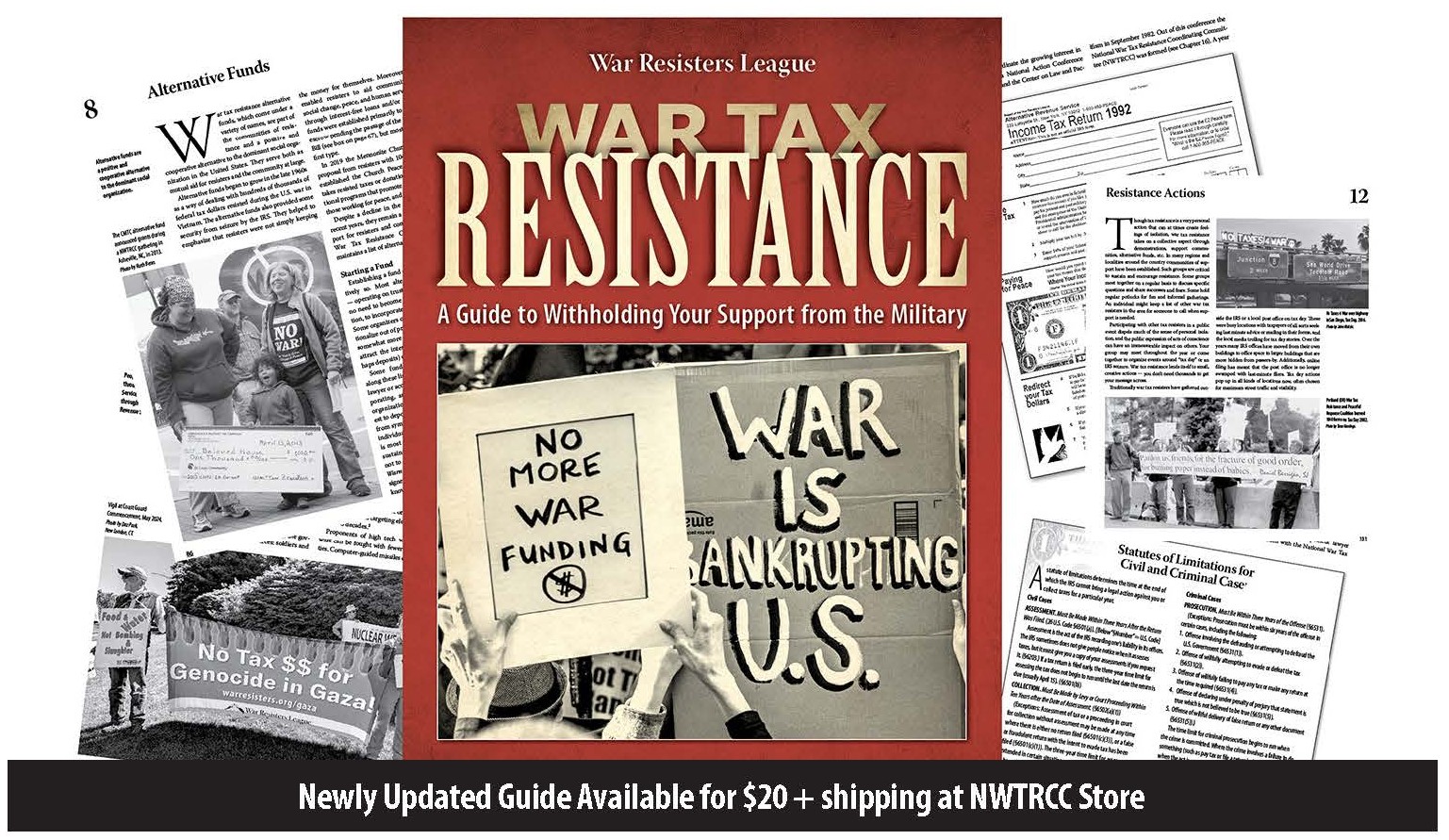

The new War Tax Resistance Guidebook was published in March 2025. Order your copy here!

National Tax Strike launched by Choose Democracy

Free E-Book, Tax Strike Tactics by David Gross

Anyone can file the Peace Tax Return — whether you are low income, high income, protesting, resisting, or refusing.

Contact NWTRCC

National War Tax Resistance Coordinating Committee (NWTRCC)

P.O. Box 5616

Milwaukee, WI 53205

(262) 399-8217

(800) 269-7464

National Affiliates

Community Peacemaker Teams, Center on Conscience & War, Choose Democracy, Episcopal Peace Fellowship, Fellowship of Reconciliation, Mennonite Central Committee, National Campaign for a Peace Tax Fund, M.K. Gandhi Institute for Nonviolence, Nonviolence International, Sojourners, War Resisters League, War Tax Resisters Penalty Fund