If every visitor to this website donated $2, we could easily fund our work each year.

Who We Are

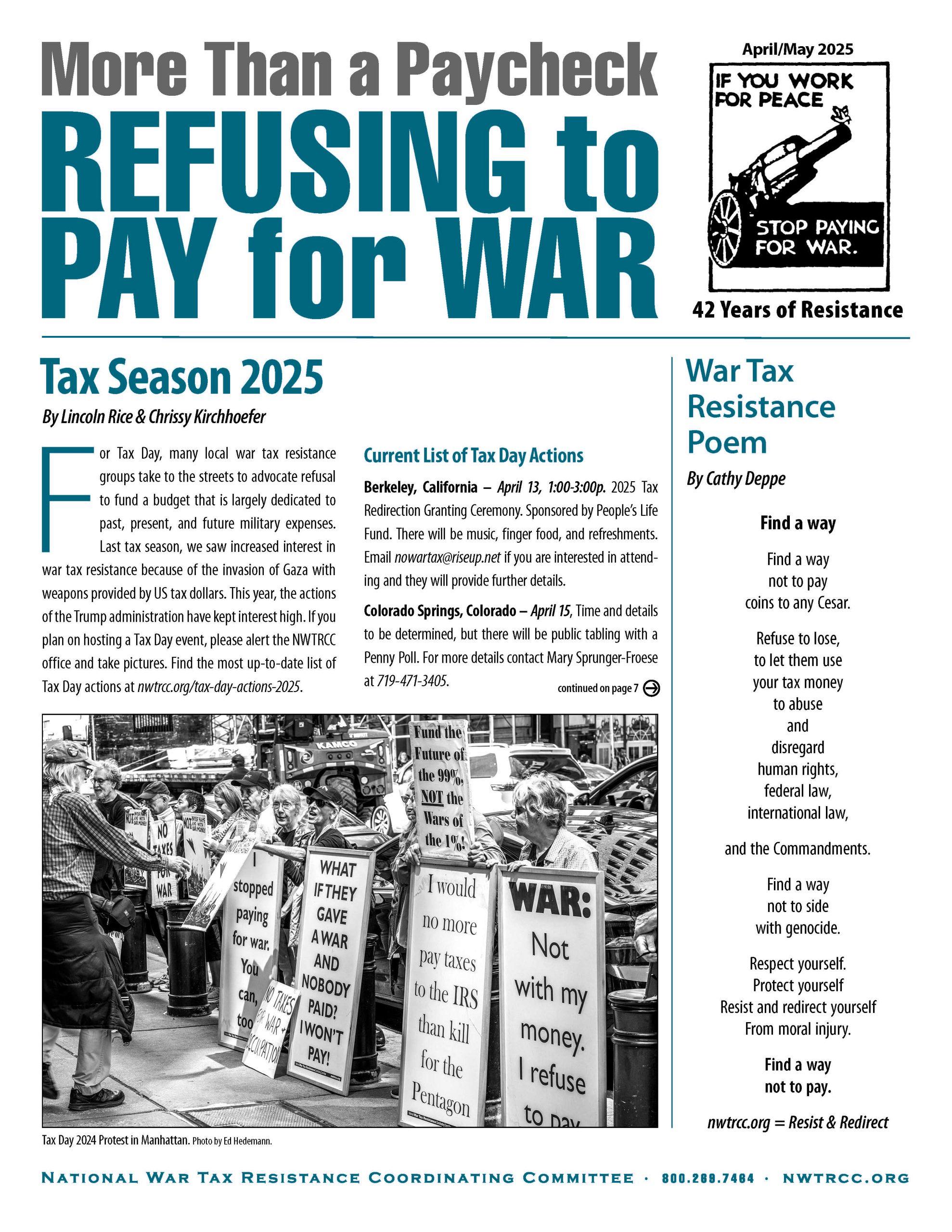

The National War Tax Resistance Coordinating Committee is a coalition of local, regional, and national groups and individuals from across the United States. For everyone interested in or actively refusing to pay taxes for war, NWTRCC offers information, referral, support, resources, publicity, campaign sponsorship, and connection to an international network of conscientious objectors to war taxes.

Recent Blog Posts

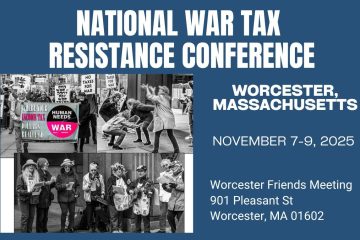

War Tax Resistance Conference in Worcester

For the first time in two years, we held our twice-yearly war tax resistance conference in person. We are very thankful to Patricia Kirkpatrick, an AdComm member in Worcester, who was a local organizer and hosted several attendees in her...Continue reading→

My Pleasant Dilemma

By Betty Winkler I received a big surprise in early July of this year. A former professor of mine who followed my careers and with whom I maintained contact for fifty years, left me a modest “Inherited IRA” as one...Continue reading→

Current Questions: Digital W-4, Private Collection Agencies

W-4 in the Digital Age and Private Collection Letters Adjusting a W-4 form through an online portal was a new WTR counseling question for me. Many of us longtime WTR counselors still rely on printed materials, so thanks to the...Continue reading→

America’s New Nuclear Spending Spree

Editors Note this piece was writen by Paul Popinchalk and first appeared in The Catholic Radical, January 2025 a publication of the Worcester Catholic Worker that will be helping host the NWTRCC November 7-9 Conference. Paul will be speaking on...Continue reading→

Upcoming Events

Register here for our Social Hour on Zoom at 6p Eastern (Sun August 17, 2025)

WTR 101 with General Strike U.S., Thur. July 24 at 7p Eastern. Click here to join when the event begins.

For full list of WTR events, including upcoming local in-person workshops, click here.

New Resources

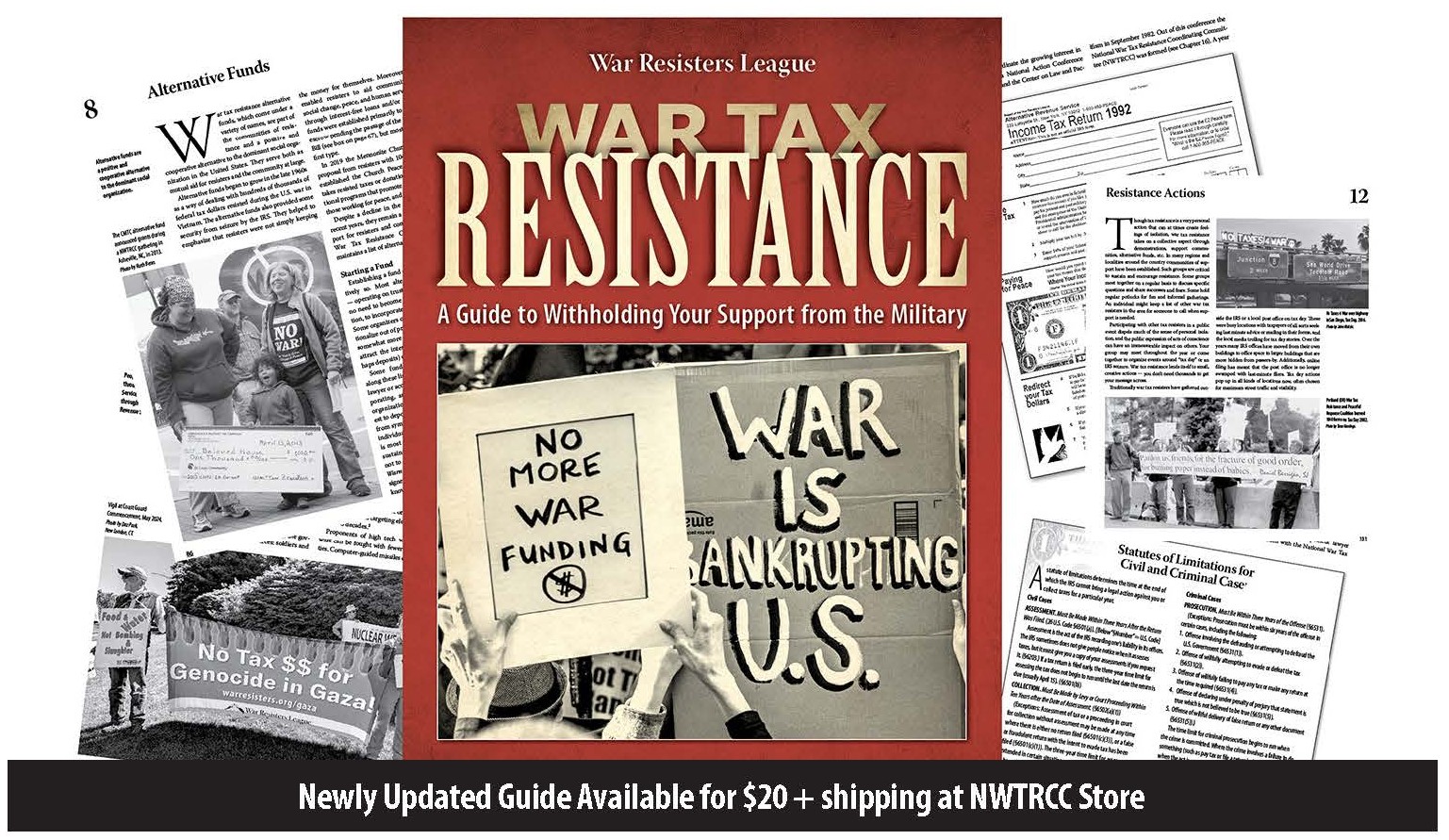

The new War Tax Resistance Guidebook was published in March 2025. Order your copy here!

National Tax Strike launched by Choose Democracy

Free E-Book, Tax Strike Tactics by David Gross

Anyone can file the Peace Tax Return — whether you are low income, high income, protesting, resisting, or refusing.

Contact NWTRCC

National War Tax Resistance Coordinating Committee (NWTRCC)

P.O. Box 5616

Milwaukee, WI 53205

(262) 399-8217

(800) 269-7464

National Affiliates

Community Peacemaker Teams, Center on Conscience & War, Choose Democracy, Episcopal Peace Fellowship, Fellowship of Reconciliation, Mennonite Central Committee, National Campaign for a Peace Tax Fund, M.K. Gandhi Institute for Nonviolence, Nonviolence International, Sojourners, War Resisters League, War Tax Resisters Penalty Fund