Unpacking Pandora’s Box: The Tax Gift That Keeps On Giving

Recently there was a conversation about death and taxes on the radio. The conversation was in light of the recently released Pandora Papers, which exposed the hidden finances of the world’s wealthiest and most powerful people. In October, the International Consortium of Investigative Reporters (ICIJ) released over 12 million troves of documents revealing how heads… Continue reading

On the Brink

People are rising up and demanding action on climate change and a new vision for the world. Tremendous sustained pressure is building on politicians to reset policy and save the planet. World leaders are set to attend the COP-26 Conference in Glasgow this week. Our collective action can tip the balance. Protest in the streets,… Continue reading

We Can All Say “No!”

“What we say to a society of murder and racism is a very simple no. What we say to our brothers across this country and around the world is a very simple word. That word is RESIST!” — David Harris, at a 1960s antiwar protest David Harris is one of the featured draft resisters and… Continue reading

Beauty Will Save the World

The National War Tax Resistance Coordinating Committee’s November Conference will kick off with a social hour to connect with folks in the network on November 5th. The full schedule is here as well as information on how to register. Saturday will feature a panel discussion with tax resisters from Europe including speakers from Money Rebellion,… Continue reading

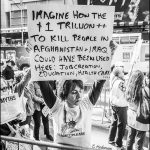

Billions, Billions & Billions…Who’s Counting?

On September 1st, the US House of Representatives Armed Services Committee backed a proposal to increase military spending for the Department of Defense by $25 Billion. That total was more than the Biden Administration had requested of $715 Billion. The vote was 42 to 17 which passed in the Senate. Many have been raising the… Continue reading

IRS Circumvents “Statute of Limitations”

Three letters arrived from the IRS within a week of each other. On the one hand this is rather exciting since the IRS has been quiet for the last few years, and I haven’t had much to report as far as consequences of refusal to pay. At the same time, it could take months of correspondence to sort out what they’ve done.

Website Refresh, Peace Week, & Extinction Rebellion

Moral Injury – It’s Not Just For Soldiers

“It’s been a hard week for Afghanistan veterans,” began an article on the front page of the local newspaper. While there has been a dizzying amount of every person turned pundit about the war; many of them are on the defense industry dole and would like to see the war continue into the third decade.

The Obvious Futility of War. What Can We Do?

“You don’t know if it’s going to last two days or two weeks or two months. It certainly isn’t going to last two years.” That was Secretary of War Donald Rumsfeld in September of 2002, almost a year after the invasion of Afghanistan and at the time the Bush Administration was building support for their… Continue reading

Righting the Ship

Part I Addressing the Harms in Our Neighborhoods Long time war tax resister Robert Randall introduced me to his hometown of Brunswick, Georgia by saying it was mostly known as a port town for automobile transportation; quickly followed by saying “not much happens there.” On April 4, 2018, 7 people entered the King’s Bay naval… Continue reading

Biden’s IRS Funding Proposal

In April, President Joe Biden began his push to provide an additional $80 billion to the IRS over the next decade to close the tax gap. The tax gap is the difference between what people owe the IRS and what it actually manages to collect in a given year. The estimated tax gap has been… Continue reading

Taxing Issues

The IRS has been so quiet lately that it’s been hard to find topics to write about — except for interesting historical notes or the horrors resulting from the massive U.S. military budget. But three people got in touch recently with three different issues. At a time when war tax resistance seems pretty quiet too,… Continue reading