If every visitor to this website donated $2, we could easily fund our work each year.

Who We Are

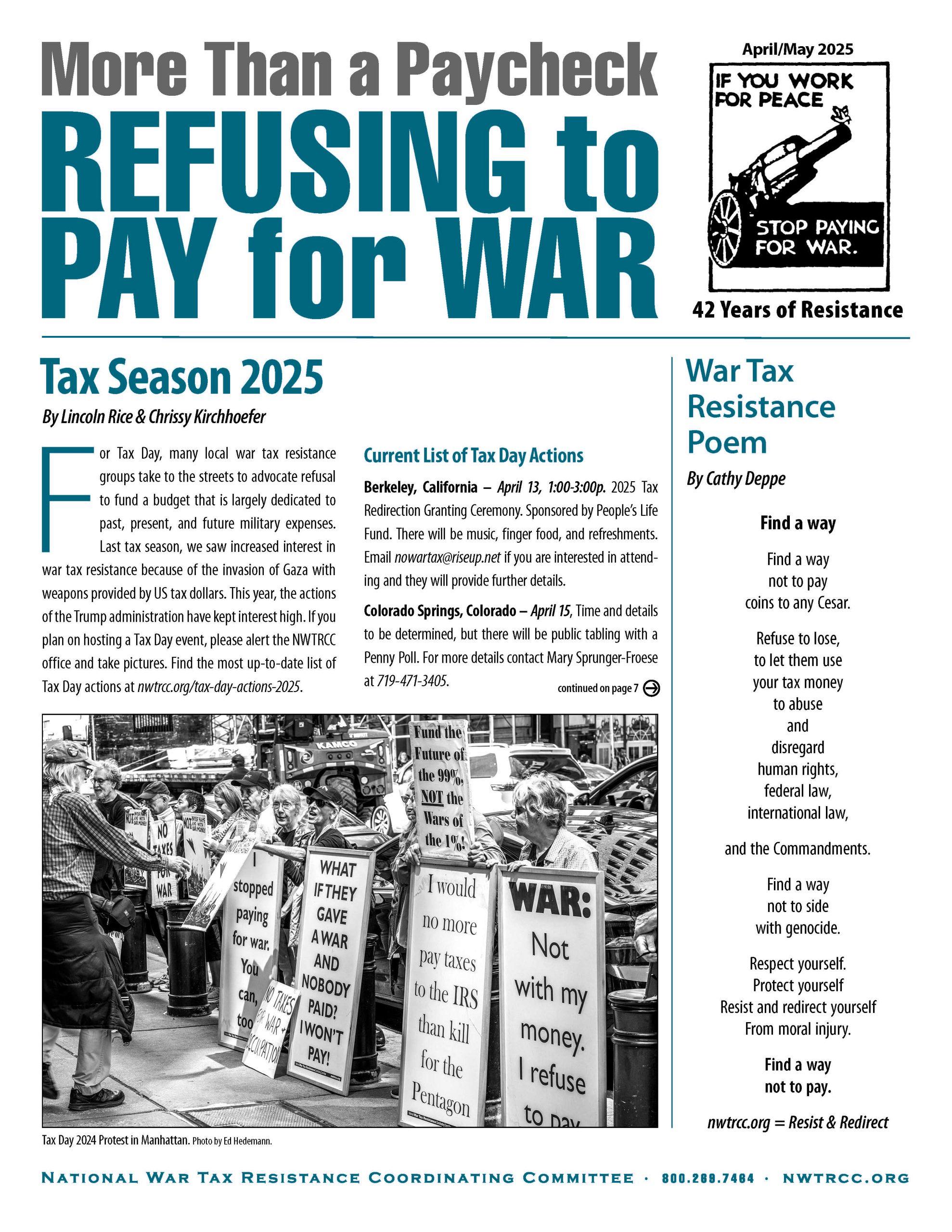

The National War Tax Resistance Coordinating Committee is a coalition of local, regional, and national groups and individuals from across the United States. For everyone interested in or actively refusing to pay taxes for war, NWTRCC offers information, referral, support, resources, publicity, campaign sponsorship, and connection to an international network of conscientious objectors to war taxes.

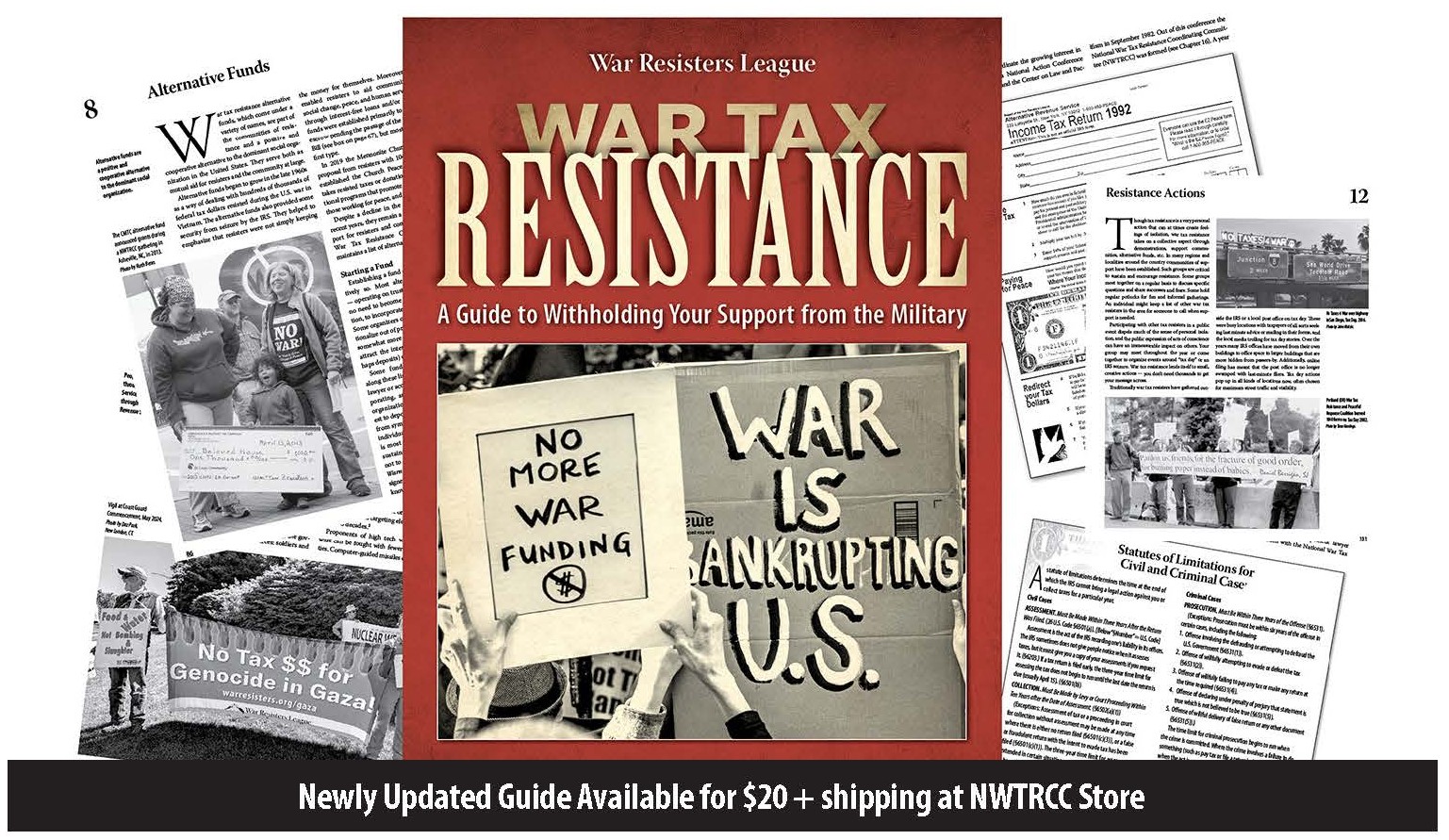

New Resources

The new War Tax Resistance Guidebook was published in March 2025. Order your copy here!

National Tax Strike launched by Choose Democracy

Free E-Book, Tax Strike Tactics by David Gross

Anyone can file the Peace Tax Return — whether you are low income, high income, protesting, resisting, or refusing.

Recent Blog Posts

U.S. Social Forum II – Philadelphia Musings

As Erica reported in the last post, NWTRCC was present at two sites of the 2015 U.S. Social Forum. She reported from San Jose. I was at the Philadelphia convergence, where our war tax resistance presence was somewhat limited by...Continue reading→

Inspiration for another world: the U.S. Social Forum in San Jose

This year NWTRCC made a big push to get war tax resisters to the U.S. Social Forum in Philadelphia and San Jose. Unlike the 2010 Social Forum in Detroit, which had 20,000 or more attendees, the forum in San Jose...Continue reading→

Video/audio from our last two conferences now available!

We recorded audio from two workshops during our May 2015 conference in Milwaukee. Patrick Kennelly’s workshop presentation on the Afghan Peace Volunteers. The first couple minutes are low volume, then it adjusts. mp3 file may take a little while to...Continue reading→

Find Us at the U.S. Social Forum, June 24-28!

NWTRCC is making a big push to get war tax resisters to the U.S. Social Forum sites in Philadelphia and San Jose for a weekend of workshops, People’s Movement Assemblies, organizing, getting to know people, and of course, spreading the...Continue reading→