If every visitor to this website donated $2, we could easily fund our work each year.

Who We Are

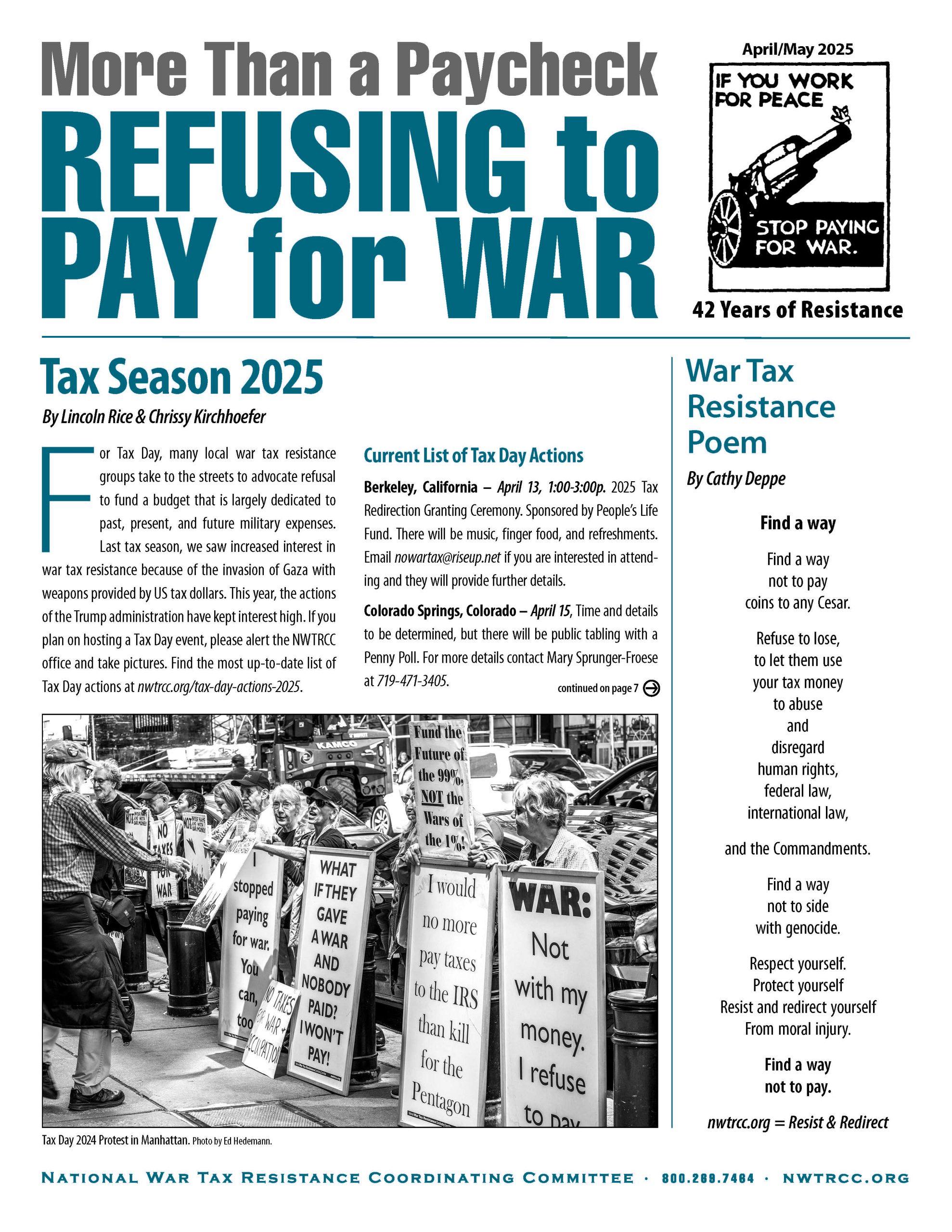

The National War Tax Resistance Coordinating Committee is a coalition of local, regional, and national groups and individuals from across the United States. For everyone interested in or actively refusing to pay taxes for war, NWTRCC offers information, referral, support, resources, publicity, campaign sponsorship, and connection to an international network of conscientious objectors to war taxes.

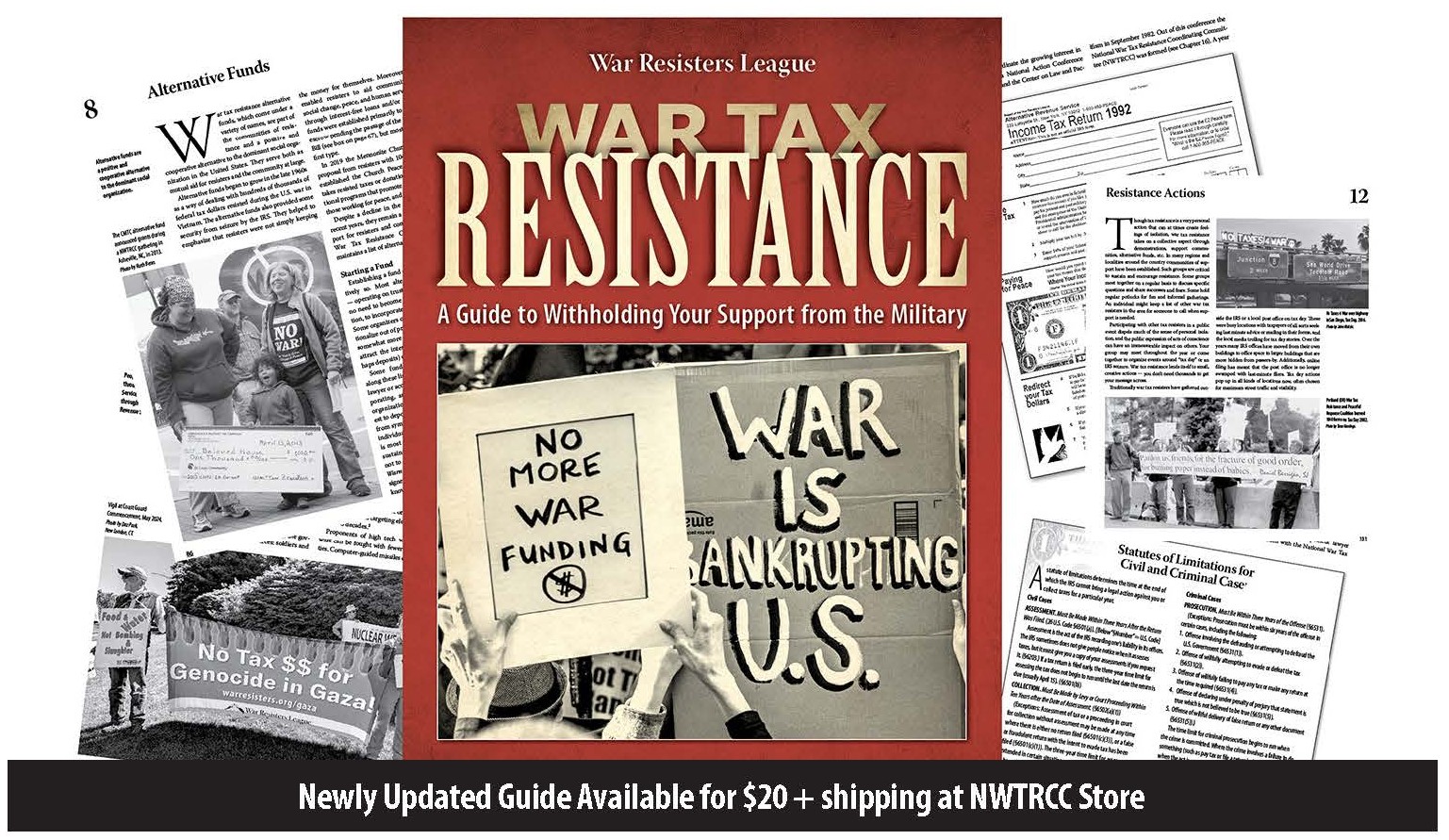

New Resources

The new War Tax Resistance Guidebook was published in March 2025. Order your copy here!

National Tax Strike launched by Choose Democracy

Free E-Book, Tax Strike Tactics by David Gross

Anyone can file the Peace Tax Return — whether you are low income, high income, protesting, resisting, or refusing.

Recent Blog Posts

Opposing nuclear weapons at Lawrence Livermore Lab

by Cathy Deppe Last August was the 70th anniversary of the U.S. atomic bombings of Japan. As members of the international peace group Global Network, Alex and I were fortunate to participate in commemoration services in both Hiroshima and Nagasaki. ...Continue reading→

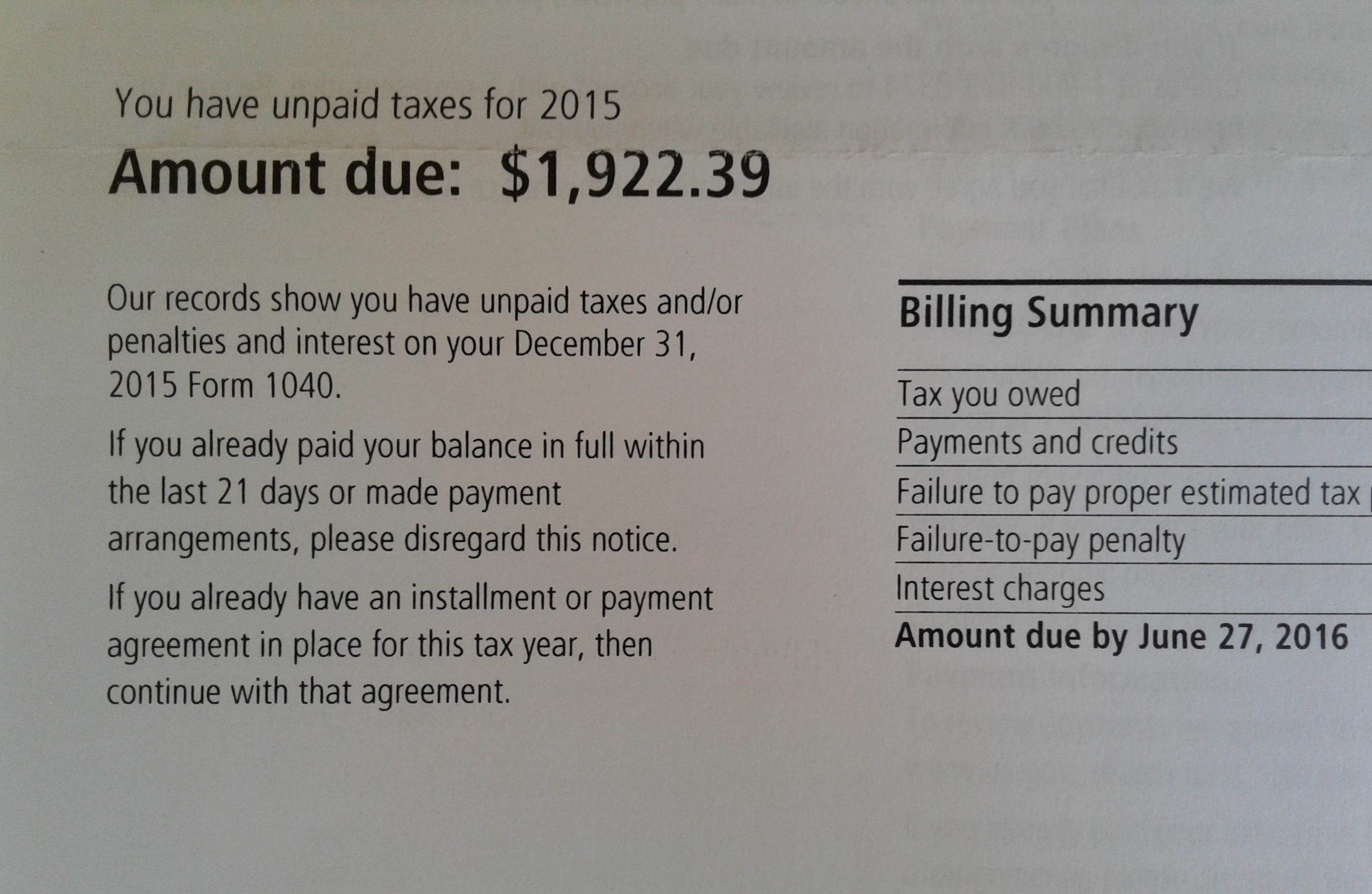

Understanding common IRS collection letters

Most war tax resisters who refuse federal income taxes will eventually (or quickly) get a letter from the IRS. Here I describe some of the most common letters one tax-return-filing resister has gotten over the past few years. Resisters who...Continue reading→

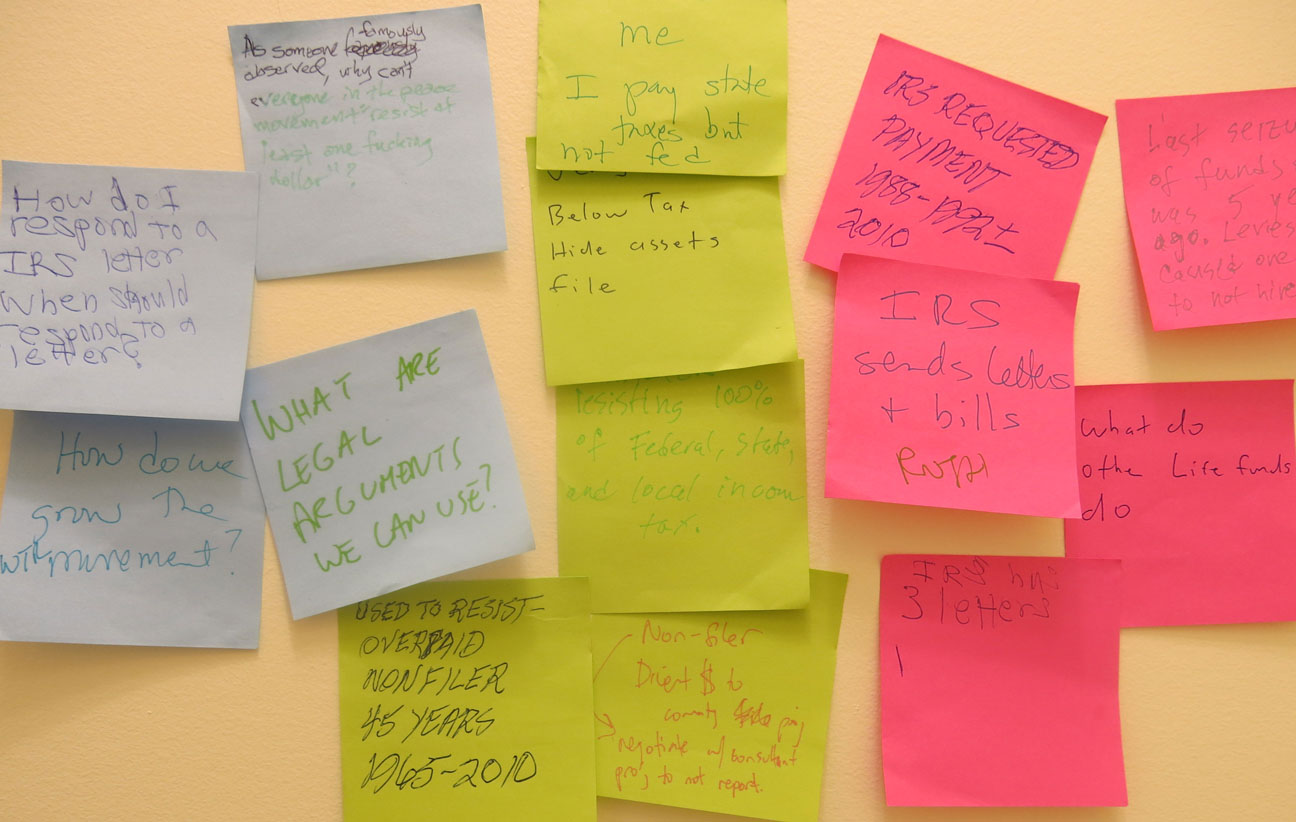

Fits and Starts with WTR Organizing

Here in New York City there are a lot of war tax resisters and people who support war tax resistance. It should be a big, active community, but over the years and from experience, we’ve found it exceedingly hard to...Continue reading→

Expanding war and nuclear programs

Foreign Policy just released another episode of its Editor’s Roundtable podcast, called “What does the expanding definition of war mean for the US military?” The panelists discuss Rosa Brooks’ new book, How Everything Became War and the Military Became Everything,...Continue reading→