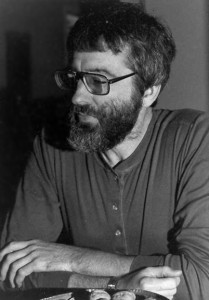

In 1985, the IRS took war tax resister and NWTRCC staff member Larry Bassett to court. Bassett had refused to pay any income taxes since 1980, and had refused the federal excise tax on telephone service since the early 1970s. The IRS wanted to compel him to give up information about his financial accounts so the agency could collect his refused income taxes.

In 1985, the IRS took war tax resister and NWTRCC staff member Larry Bassett to court. Bassett had refused to pay any income taxes since 1980, and had refused the federal excise tax on telephone service since the early 1970s. The IRS wanted to compel him to give up information about his financial accounts so the agency could collect his refused income taxes.

The case began very quickly, with a January 21 Order to Show Cause, requiring Bassett to appear for a January 31 court date. He wrote to the judge on January 22, stating his intent to appear as ordered, and noting:

“I am not opposing taxation; I have paid the self-employment tax to support the Social Security system….

“I have not benefited financially from my war tax resistance. I have redirected all of my resisted war taxes to groups working for peace, justice and to organizations meeting basic human needs. I have shared this information with the IRS and other public officials.

“Since I have refused to voluntarily pay my federal income tax money because more of taxes would go to support militarism than everything else combined, I will not cooperate by giving information that will allow forcible collection.”

(In 1981, 63% of every income tax dollar, or $431 billion, went to the military. Although the percentage of the total budget is much lower in 2017, with 44% of every dollar, now $1,357 billion goes to the military.)

After the January 31 appearance, Bassett and the other NWTRCC staff member at the time, Kathy Levine, assembled a legal team (including, at various times over the course of his case, Harry Kresky, Cora Glasser, Jay Rosner, Peter Goldberger, Vicki Metcalf, and Mitchell Gittin) and a legal defense fund. On March 5, US District Judge Jack Weinstein ordered Bassett to comply with the IRS and provide financial information. He would face potential jail time on contempt of court if he did not comply. Bassett noted, in a letter to supporters, that the legal attention he was receiving is unusual for war tax resisters:

“I want to emphasize to those of you who are thinking about becoming war tax resisters or who are war tax resisters that it is most unlikely that you will ever reach a situation as a war tax resister where jail is possible unless you want it to be possible. [emphasis in original] Jail or even court is extremely unusual in war tax resistance.”

After a few more months of legal wrangling, continuing to refuse to give financial information even at the risk of jail time, Bassett appeared in court on June 5. His legal team argued that,

“I should not be compelled to assist government collection of conscientiously resisted federal income taxes…

“We are not challenging the right of the government to tax but asserting that the government must accommodate the conscientious beliefs of citizens…

“We are also arguing that I should be ‘protected by a valid privilege under the Fifth Amendment Self-Incrimination Clause.’ I have been asked to give the government information which could eventually be used to criminally prosecute me.”

On June 14, Judge Weinstein dismissed the US government’s case against Larry Bassett on Fifth Amendment grounds (before the legal team was able to additionally argue the case on the basis of international law). Before and since Bassett’s case, other war tax resisters have won their cases due to the Fifth Amendment, including Robin Harper, Margaret Haworth, and Ed Hedemann. In a few other cases, the IRS withdrew the Order to Show Cause once the resister cited Fifth Amendment rights.

This case was an important victory for Bassett and raised the profile of war tax resistance and the National War Tax Resistance Coordinating Committee (just a couple of years after its founding in September 1982). To learn more about the progress of the case and the support and publicity Bassett received for taking a stand for peace, read these collected primary sources in two parts, with additional letters of support (courtesy of Larry Bassett).

Post by Erica

It seems clear that I was targeted by the IRS in this case because I was very visible with my resistance and a national WTR organizer. The action was taken several years after the tax filing and the amount of federal income taxes owed was $46. The government clearly wanted to send a message that would maintain its image of relentless enforcement.

One of the seldom told stories of this case is this one: Kathy and I lived in the small Long Island town of Bellport. We were relatively well-known in the town banks because we had previously worked for the CMTC which had a WTR escrow account with tens of thousands of dollars. There were three banks in town. We learned that IRS agents went from bank to bank to see if I had an account they could seize. The irony or maybe I should say the officia The irony or maybe I should say the inefficiency of the IRS was on display as they went to two of the three banks, skipping the bank where I had an account.

As an individual I was prepared to make my statements of conscientious resistance in court and go to jail. However the collective decision of the WTR movement was that it would not be good for an organizer to go to jail. Many thought it would have a chilling affect on other potential resisters. So with an abundance of dedicated legal support and a legal defense fund with donations from many non-resisters, legal arguments based on constitutional issues were developed.

Regrettably we were unable to pursue most of the constitutional issues because Judge Weinstein fairly quickly ruled in my favor based on the Fifth Amendment.

Some people in civil disobedience cases have intentionally declined to claim Fifth Amendment protections prefering to attempt to force courts into ruling on other amendments. However the Fifth has led to some success In WTR cases and the IRS has very likely declined to pursue many collection cases knowing this plea stops their cases.

Great work, Larry. Thanks for your stamina in this precedent-setting case and thanks for sharing the story behind it. It is a terrific help to WTR counselors!

This isn’t a comment on the current post. I’d just like to find out whether my comment that mentions Richard Wolff was published or ever will be. Thank you.

Dana, I looked through our comments moderation queue, as well as spam and trash, and I don’t have anything from you. It looks like it just didn’t go through originally. Sorry!

So far, since 1975 — when Robin Harper first used the Fifth Amendment in Federal District Court to successfully prevent the IRS from forcing him to turn over records — all war tax resisters using the Fifth in court have succeeded in stopping prosecution initiated with an “order to show cause.”

Keep in mind that this has only worked in courts. Writing “Fifth Amendment” on your 1040 form will not work and very likely get you saddled with a $5,000 “frivolous” fine from the IRS.

Though it might seem to many of us that the First Amendment should also work, to my knowledge, it never has for war tax resisters in federal court.

Thanks, Larry Bassett, for your readiness to invest yourself in the crucial efforts to witness against the folly of paying for military preparedness. As Howard Zinn expressed it: “To be hopeful in bad times is not just foolishly romantic. It is based on the fact that human history is a history not only of cruelty, but of compassion. Sacrifice, courage, kindness. What we choose to emphasize in this complex history will determine our lives. If we see only the worst, it destroys our capacity to do something. If we remember those times and places . . . where people have behaved magnificently, this gives us the energy to act. . . . And if we do act, in however small a way, we don’t have to wait for some grand utopian future. The future is an infinite succession of presents, and to live now as we think human beings should live, in defiance of all that is bad around us, is a marvelous victory.”

In response to your separate comment: We moderate all comments on the blog so that’s why your comment didn’t post right away!

I have happily just passed the nine-month mark of my first year of massive resistance. I mark this new beginning of my life on June 11 with the death of my father and with my commitment to redirect as much of my inheritance to make a better world. Dad left me $1 million with instructions to distribute about half of it to grandchildren and great grandchildren and special others. I did that and set to work on my half. My commitment to civil disobedience in honor of my mother who became a criminal for peace in her later years is acted out in my case with war tax resistance. I will resist the $128,005 I owe in federal income tax next month. I will have donated more than that amount to meet human needs internationally and nationally and locally.

To honor my father and mother I am trying to do as they did many times in their lives in trying to directly help the less fortunate. They were brave and compassionate by giving money and offering a place to stay in their home and loaning other personal goods. They found that helping others was not always free of risk. People who were ill and without resources sometimes took advantage of them. But my parents knew that they had much and others had little. Since I live in the Internet age I have had a much broader range of people in need. While I have given to many charities I have also tried in a very small way to help some individuals in Haiti and Kenya and Uganda who had little compared to me who had been left with so much by my father. My effort with individuals has taught me a lot about the desperation of poverty. I have often remembered my first job out of college working with the poor in Pontiac Michigan. Back then I came to the conclusion that what the poor need most is money. So when I found the international charity GiveDirectly that gives cash to the extremely impoverished in East Africa, I knew I had found an Organization that I wanted to support significantly.

My mother once spent 30 days in jail for merely “crossing the line” at a plant in Michigan that produced a part of a missile. What she learned from that experience was that the women who shared her jail cell were poor and black. She learned that the justice system needed reform. The government learned and continues to learn that the biggest result of putting peace and justice people in jail is that they are creating people who diligently work to change the system.

I do not know what the justice system will do when I refuse to pay my federal taxes in April. I am a little bit scared of what they might do just as I was scared in 1985 when they took me to court. But sometimes as my parents knew and as they taught me by their example you have to do what you have to do.

Larry Bassett

Lynchburg Virginia