The Blog this week is an Opinion published by In Depth News and written by Lincoln Rice

MILWAUKEE, USA, 17 April 2023 (IDN) — Since the beginning of 2022, the US has dedicated over $30 billion of military aid for war in Ukraine. Most of these funds will be used by the Department of Defense to replenish the military equipment and weapons that have been sent to Ukraine. Essentially, the funds are being used to enrich US weapons manufacturers.

MILWAUKEE, USA, 17 April 2023 (IDN) — Since the beginning of 2022, the US has dedicated over $30 billion of military aid for war in Ukraine. Most of these funds will be used by the Department of Defense to replenish the military equipment and weapons that have been sent to Ukraine. Essentially, the funds are being used to enrich US weapons manufacturers.

Although not as well publicized, the United States’ endless war on terror continues with drone warfare in places like Afghanistan, Syria, and Yemen. In addition, the US continues its global military presence with over 800 military bases overseas. The recently signed National Defense Authorization Act approved $45 billion more in military funding for fiscal year 2023 than President Biden requested. After removing Social Security and Medicare—which are dedicated Trust funds raised and spent separately from income taxes—the National Priorities Project asserts that military spending consumes 47% of federal expenditures.

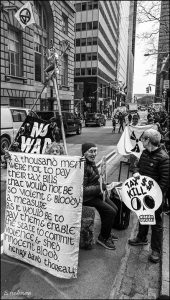

Since the US military-industrial complex only continues to grow without any hint of slowing down, war tax resisters in the United States are divesting from war by refusing to pay the federal tax dollars that fund it. War tax resistance is another form of conscientious objection. If we would refuse to participate in military service, how can we in good conscience fund war. Some will refuse all or a portion of their tax debt while others choose to live below the taxable income level. We invite everyone to join us in this public campaign of civil disobedience to war and war funding.

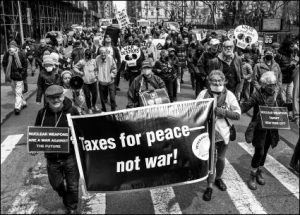

On and around Tax Day (April 18) this year, thousands of people across the United States—from Chico, California to Manhattan—will protest the US military budget. They will promote war tax resistance and highlight the deep flaws of our current budget.

Last Saturday (April 15), there was a “Back Sale for the Military Victims” in front of Milwaukee’s Army Reserve. They raised funds for the Ukrainian Red Cross Society. There will be “Burma Shave” sign displays on Tax Day during rush hour in Portland, Oregon. On the morning of Tax Day, there will be a vigil outside Raytheon Missile Systems in Tucson, Arizona. Part numbers on shrapnel recovered at the scene confirmed that a laser-guided “smart” bomb made at Tucson’s Raytheon plant killed 23 people attending a wedding in northern Yemen in April 2018. The majority of casualties were women and children.

Since 1983, these Tax Day actions have been planned in coordination with the National War Tax Resistance Coordinating Committee (NWTRCC). NWTRCC is a coalition of local, regional, and national groups providing information and support to people who are conscientious objectors to paying taxes for war. NWTRCC partners with the Global Days of Action on Military Spending coordinated from Barcelona, Spain, to join protests of war spending with a demand for global disarmament and a shift in priorities to sustainable development.

To be clear, war tax resistance is not about avoiding one’s fiscal responsibility to one’s community. War tax resisters who refuse to pay federal income taxes redirect those funds to underfunded organizations. Often this redirection is done individually, but it is also performed communally. For example, Shenandoah Valley Taxes for Peace in Harrisonburg, Virginia has organized an annual “Redirection Vigil” at LOVE Park next to the Harrisonburg Farmer’s Market. They publicly redirect resisted war taxes to peace and justice organizations.

XR tripod-sitter blocking road in NYC financial district. Tax day 2022. Photo by Ed Hedemann

The US military is the largest institutional user of oil in the world. At top speed, an F-35A jet ignites more fuel in a single hour than the average US car owner consumes in two years. In addition, climate accords, like the Paris Agreement (2015), exempt military compliance. Highlighting the connection between the US military and environmental harm, New York City War Resisters League will continue its collaboration with Extinction Rebellion NYC and other climate action groups. Their event will include picketing, street theater, and music in front of the IRS on April 18th.

Although it is a criminal act to willfully refuse payment of one’s federal income taxes, unless a resister submits a fraudulent tax return, the most common response is automated letters with the possibility of a bank levy or wage garnishment. If a resister is collected on, there are those in our network who will pass the hat to reimburse the resister for any fines and penalties collected as a result of the levy. To find more information about war tax resisters, visit the NWTRCC website. All our resources are available for free.

*Lincoln Rice has been the Coordinator of NWTRCC since 2018 and a war tax resister since 1998. He earned his PhD in Christian Ethics in 2013 from Marquette University. He has published books and articles in the areas of social ethics and racial justice. [IDN-InDepthNews]

Photo Credit: Ed Hedemann

IDN is the flagship agency of the Non-profit International Press Syndicate.

Visit us on Facebook and Twitter.

You can find a link to the article on In Depth News here

Republished under Creative Commons Attribution 4.0 International

How do you “redirect” war taxes to peace and justice organizations? That would be great, but how do you do it??

On NWTRCC’s website we try to tackle these question. Hopefully this link is helpful https://nwtrcc.org/resist/redirection/

Lincoln Can you just send this without all the clutter around it so I can print out a 1 page flyer. I am not good at that kind of stuff and I want to take it to the Democratic dinner on Wed nite.