I eagerly await my next letter from the IRS. I just got a letter from them “correcting” my 1040 for tax year 2020, filed on tax day, May 17, 2021. This latest letter came “right on time”; when I called in July 2022 the IRS employee told me it would be 16 weeks before my return is posted. According to my calculations this letter arrived at 16 weeks to the day.

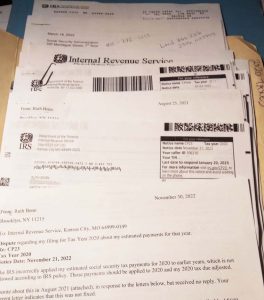

My 2020 tax folder is piling up with letters back and forth.

However, I had to write back a dispute because they did not correct their original error. The IRS took my estimated and final payments for 2020 self-employment/Social Security taxes and applied them to my income tax debts for 2011 and 2012. This is against IRS regulations. I wrote them about this is August 2021 but got no reply, so last week I copied that text and sent it back to them with my corrected calculations.

I have a feeling this is going to go on for a while. By my original calculations my resisted income tax for 2020 was $1,216. Since the IRS misapplied my 2020 payments, they say I owe $4,431, including interest and penalties and a credit I had overlooked for one of those stimulus checks I didn’t receive.

My dispute letter repeats my calculations but includes the credit. If the IRS accepts it and returns my payments to the proper year, the down side for me is that I may end up with an overpayment for 2020. In addition, all this delay has also messed up the real amount I should be getting in my Social Security payments. That and the fact that the IRS needs to apply estimated tax payments properly and follow their own regulations are reasons to carry on this correspondence.

NYC City Council member Carlina Rivera announces the Move the Money resolution on December 7 at City Hall. Photo by Ruth Benn. More photos by Ted Reich here.

Meanwhile, I did have a better time at a press conference for the NYC Move the Money campaign. City Council Member Carlina Rivera hosted the press conference on the steps of City Hall to announce the introduction of a “Move the Money” resolution in the NYC City Council. If passed, Res. 0423-2022 puts the city on record calling on Congress and the President to cut the military budget and fund social services. City officials who spoke at the press conference spoke eloquently and with passion about the importance of moving the money.

As with most such resolutions it is symbolic, but the campaign itself is a worthy one for peace groups as far as public education goes and the opportunity to work with a broader coalition. The NYC Move the Money coalition itself is made up of 60 labor, peace, community, clergy, environmental and racial justice organizations — and growing. Many of those groups are demanding the mayor fund social services (or at least avoid cuts), but they don’t talk about the obvious source of revenue to fund these programs. Move the Money makes the connection and opens the door for more dialogue and cooperation.

— Post by Ruth Benn

Ruth, Thanks for the update of your ongoing engagement with the IRS. Interesting that they were able to respond in 16 weeks as they perceived. What great photos of the Move the Money campaign & great messaging of books not bombs!