More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

June–July 2020

Contents

- Virtually Conflicted

By Ruth Benn - NWTRCC‘s First On-Line Conference

By Lincoln Rice - Counseling Notes IRS Cannot Levy the Descendants of a Deceased Taxpayer • IRS Practices During COVID-19 • Unemployment • Head of Household Fraud

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Tax Resistance Ideas and Actions Tax Day is July 15!!! • Host a War Tax Resistance 101 Session Online

- Grounded…or Flying by the Seat of our Pants by Chrissy Kirchhoefer

- War Tax Resistance News (Almost) Everyone is Getting Free Government Money • Mennonite Church Promotes Church Peace Tax Fund • War Tax Resistance Season in Spain • Agape Community Book Tour • New Booklet Highlights War Tax Resistance • Charity Online Fundraiser for NWTRCC • Mark your Calendars!!!

- Profile Bewildering Federal Budget by Shulamith Eagle

Click here to download a PDF of the June/July issue

Virtually Conflicted

By Ruth Benn

[Editor’s Note: Many local WTR groups moved to an online format for Tax Day this year. Around twenty different localities/groups posted WTR messages on Facebook and Twitter. Below is Ruth’s reflection on this online format for the New York City War Resisters League.]

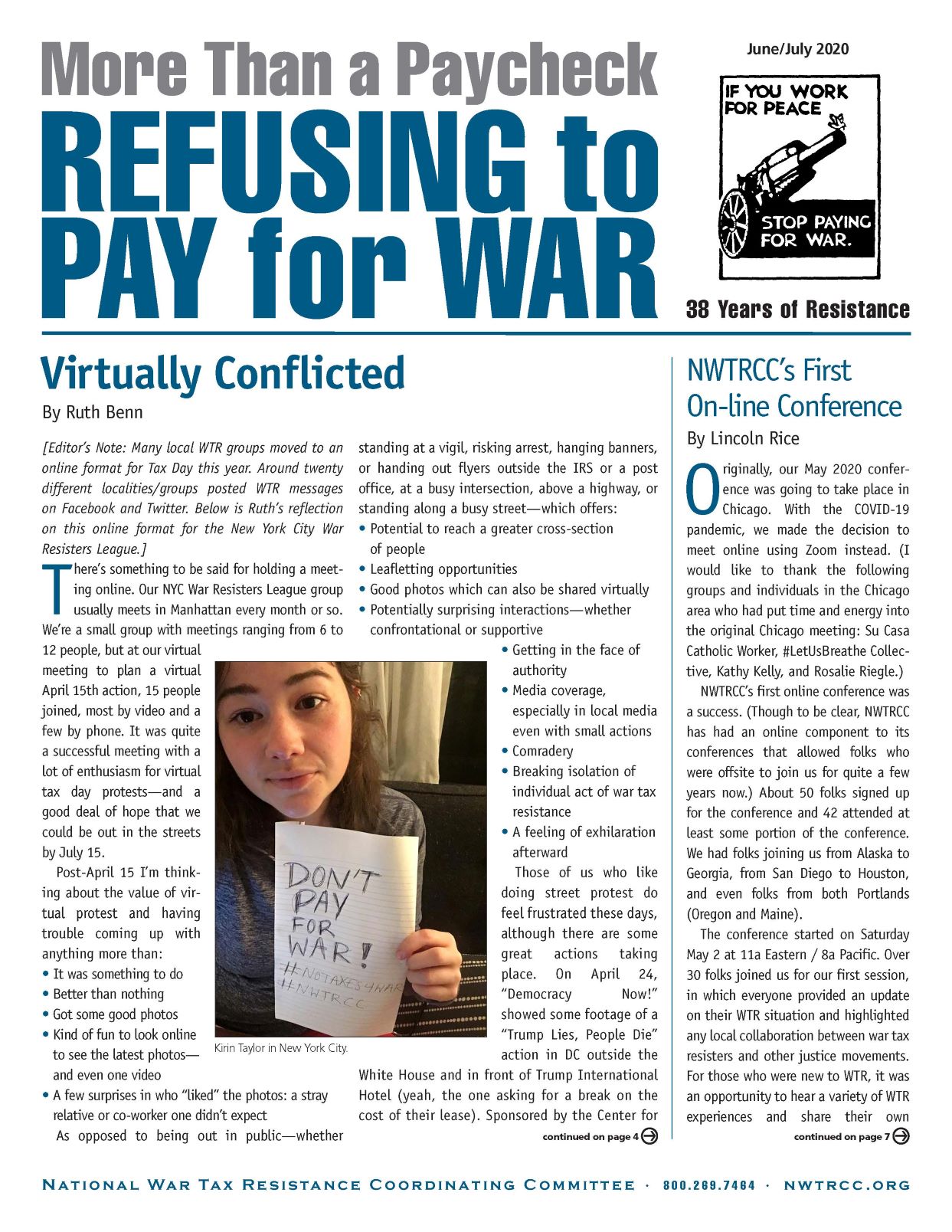

Kirin Taylor in New York City

There’s something to be said for holding a meeting online. Our NYC War Resisters League group usually meets in Manhattan every month or so. We’re a small group with meetings ranging from 6 to 12 people, but at our virtual meeting to plan a virtual April 15th action, 15 people joined, most by video and a few by phone. It was quite a successful meeting with a lot of enthusiasm for virtual tax day protests—and a good deal of hope that we could be out in the streets by July 15.

Post-April 15 I’m thinking about the value of virtual protest and having trouble coming up with anything more than:

- It was something to do

- Better than nothing

- Got some good photos

- Kind of fun to look online to see the latest photos—and even one video

- A few surprises in who “liked” the photos: a stray relative or co-worker one didn’t expect

As opposed to being out in public—whether standing at a vigil, risking arrest, hanging banners, or handing out flyers outside the IRS or a post office, at a busy intersection, above a highway, or standing along a busy street—which offers:

- Potential to reach a greater cross-section of people

- Leafletting opportunities

- Good photos which can also be shared virtually

- Potentially surprising interactions—whether confrontational or supportive

- Getting in the face of authority

- Media coverage, especially in local media even with small actions

- Comradery

- Breaking isolation of individual act of war tax resistance

- A feeling of exhilaration afterward

Ruth with Signs for Tax Day. Photo by Ed Hedemann.

Those of us who like doing street protest do feel frustrated these days, although there are some great actions taking place. On April 24, “Democracy Now!” showed some footage of a “Trump Lies, People Die” action in DC outside the White House and in front of Trump International Hotel (yeah, the one asking for a break on the cost of their lease). Sponsored by the Center for Popular Democracy, with signs on cars circling and others on the sidewalk, the group placed body bags in front of the hotel with a spokesperson demanding more PPE, more testing, and real leadership. Good action and kudos to them!

Still, I try to remind myself that we protest every day with our refusal to pay war taxes. Even if we aren’t in the street, we do get the government’s attention, if only by the fact that the IRS has us on their collection list.

As with any of these actions, if we had tens of thousands in our network, instead of the small numbers that we do, we would get more attention with any of our efforts. Reminds me of a favorite Thoreau quote, despite the narrow gender reference:

“If a thousand men were not to pay their tax bills this year, that would not be a violent and bloody measure, as it would be to pay them, and enable the State to commit violence and shed innocent blood.”

NWTRCC’s First On-line Conference

By Lincoln Rice

Image by Alexandra Koch from Pixaby

Originally, our May 2020 conference was going to take place in Chicago. With the COVID-19 pandemic, we made the decision to meet online using Zoom instead. (I would like to thank the following groups and individuals in the Chicago area who had put time and energy into the original Chicago meeting: Su Casa Catholic Worker, #LetUsBreathe Collective, Kathy Kelly, and Rosalie Riegle.)

NWTRCC’s first online conference was a success. (Though to be clear, NWTRCC has had an online component to its conferences that allowed folks who were offsite to join us for quite a few years now.) About 50 folks signed up for the conference and 42 attended at least some portion of the conference. We had folks joining us from Alaska to Georgia, from San Diego to Houston, and even folks from both Portlands (Oregon and Maine).

The conference started on Saturday May 2 at 11a Eastern / 8a Pacific. Over 30 folks joined us for our first session, in which everyone provided an update on their WTR situation and highlighted any local collaboration between war tax resisters and other justice movements. For those who were new to WTR, it was an opportunity to hear a variety of WTR experiences and share their own thoughts and concerns about WTR.

The first session was a natural lead-in to our WTR 101 session, which started one hour after the first session ended. Thirteen folks showed up for this session, though most were seasoned war tax resisters. (The fact that so many long-time WTRs joined us for 101 was a surprise. Normally, WTR 101 & 201 are concurrent, so folks have to choose one or the other.) The mix of interested and new folks with seasoned resisters led to the sharing of many perspectives and experiences.

After another hour break, we gathered again for WTR 201. This time about 25 folks joined, including some of the new folks from WTR 101. We covered the new W-4 form, home visits, passports, frivolous warning letters, IRS response to COVID-19 (suspension of most collection efforts until July 15), stimulus checks, deferred compensation and IRAs, unemployment (& the extra $600/week is taxable), and head of household fraud.

The conference finished on Sunday morning with our business meeting. The business meeting minutes will be posted shortly. I would like to especially thank Anne Barron and Justin Becker, who each finished a three-year term on NWTRCC’s Administrative Committee (AdComm) when the conference ended. I’d also like to welcome Lida Shao (New York, New York) and Joshua Wrolstad (Eugene, Oregon), who were selected to begin three-year terms.

With this being our first fully-online conference, we tried to keep it simple (which hopefully made the conference easier for participants and planners alike). Our next conference will be 6-8 November 2020. We have an invitation to meet in Colorado Springs, Colorado, but we will have to see what the state of the pandemic is at that point. The AdComm plans on making a decision by July 1. We’ll keep you updated. Thanks to everyone who attended the conference and made it such a success. It really was a delight to see so many new faces with faces I had not seen in a while.

Counseling Notes:

IRS Cannot Levy the Descendants of a Deceased War Tax Resister

Periodically, the NWTRCC office receives a call from a war tax resister who is concerned that the IRS may try to take the property of their children after they die. I always remind them that while the IRS may be able to put a lien against the assets of WTR’s estate, they cannot levy the property of their children. In other words, the IRS may levy property that they wish to pass on to their children, but WTRs should not be concerned that the property of their children is at risk.

There was a court case in March 2020 in Louisiana where the property belonging to the deceased taxpayer’s children was levied. (The deceased was not a WTR, but their case is relevant for WTRs.) The children sued the IRS and the court ruled that the IRS had improperly levied the property of the children. There were additional circumstances that led the IRS to believe that the property had been part of the father’s estate, but the IRS was mistaken. Fortunately, it is very rare for the IRS to wrongly take property belonging to the children of someone with a tax debt.

IRS Practices during COVID-19

The IRS has relaxed many of its collection practices during the COVID-19 pandemic. At least until July 15, most liens and levies are being suspended. There may be exceptions for people with large debts or debts that are about to expire. During the May 2020 NWTRCC conference, this practice was at least anecdotally confirmed by a woman during the WTR 201 session who mentioned that the 15% garnishment on her social security check did not occur in April.

The NWTRCC office has received many calls regarding the $1,200 stimulus check. Most U.S. citizens making less than $75,000 qualify. A tax debt (no matter the amount) does not disqualify someone from receiving these funds. If you are a filer or on Social Security, and the IRS knows where to send the check, either the check came already or will be coming. If you are non-filer who is not on Social Security, there is a website to submit your information so you can receive the funds, but the information will only be accepted if you are legally not supposed to file or if you fraudulently understate your income (which NWTRCC does not recommend). The added downside with providing your info online is that you are required to provide bank information to receive the funds by direct deposit. If you are nonfiler who is legally supposed to file, the only way to receive the stimulus check is to file your 2019 taxes by July 15, 2020.

Lastly, self-employed people can apply for a “loan” from the federal government which can be forgiven up to $10,000. This loan, even if forgiven, is not taxable. You can qualify for this “loan” program even as a WTR with a current tax debt. Assuming this program is still available when you read this, more information can be found at https://www.sba.gov/funding-programs/loans/coronavirus-relief-options.

Unemployment

If you are in the unfortunate position of filing for unemployment, this is a reminder that unemployment compensation and the $600 extra / week that is currently available during the COVID-19 pandemic are taxable. Please plan accordingly.

Head of Household Fraud

The NWTRCC office was recently contacted by a non-filing WTR, whose non-WTR spouse has been filing as Head of Household. This is a reminder that filing Head of Household when you are not legally entitled to do so is one of the most common types of middle-class tax fraud.

To qualify for this advantageous filing status if one is unmarried, the following conditions are necessary:

- Must have paid more than half of the cost of maintaining the home (or home for a dependent parent)

- One of the following must have lived with you for more than half the year:

- child or grandchild under age 19 (or 24 if in college) whether or not you can claim them as a dependent (the child can’t have provided more than half of their support)

- parent who is a dependent whether or not they lived with you

- blood relative whom you can claim as a dependent

A married person can qualify for Head of Household status if the following conditions are met:

- Must not have lived with spouse for the last 6 months of the year and this situation is expected to be permanent.

- Must file a separate return from the spouse

- Must have paid over half of the cost of keeping up the home

- Your child, stepchild, or foster child must live in your home for more than 6 months. (Grandchildren don’t count).

- Must claim this child as a dependent (unless the spouse gets to claim them under divorce decree).

More than one person living in the same dwelling unit can qualify as Head of Household if they would have qualified if they lived separately.

In addition to interest and penalties if one is caught, the IRS can also fine you up to $250,000 for fraud and up to 5 years in prison.

Many Thanks

Thanks to each of you who are donating for the Spring Appeal 2020! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.).

We are very grateful to these WTR groups and affiliates for their redirection and Affiliate dues:

War Resisters League; Northern California People’s Life Fund

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact NWTRCC for arrangements through one of our 501c3 fiscal sponsors: (800) 269-7464 or nwtrcc@nwtrcc.org.

Tax Resistance Ideas and Actions

Car Caravan Protest against local ICE detention facility in Birmingham. Photo courtesy of Birmingham Party for Socialism and Liberation.

Tax Day is July 15!!!

In 2020, there are two tax days! As of this writing, it is still too early to know what will be possible on July 15 for Tax Day demonstrations. But we would encourage local groups and individuals to be creative. For April 15, around twenty groups participated in online WTR actions (see Ruth Benn’s article on page one). We would ask folks to continue this practice on July 15, but also consider other actions. (Also, please submit your plans at nwtrcc.org/programs-events/tax-day/#form. Or feel free to email or call the NWTRCC office.)

If you will be holding an online demonstration, we are asking folks to take a picture of themselves with their Tax Day signs and to post these images on social media on July 15. When posting on social media, please include the hashtags #NWTRCC and #NoTaxes4War, and let folks know that they can go to www.nwtrcc.org for more information about war tax resistance.

Some groups have organized drive-by protests to make their point. For example, participants in a May Day 2020 parade in Portland, Oregon attached signs to their cars and circled city hall. They increased their visibility and received ample news coverage by having the person in the passenger seat play a musical instrument (drums and trumpets were common). Another example was an April protest by the Birmingham Party for Socialism and Liberation. They attached signs to their vehicles for a protest in front of their local ICE detention facility.

Depending on where you live, in-person demonstrations might be permitted, but please be careful and practice social distancing. This may not be a good year for handing out materials.

Host a War Tax Resistance 101 Session Online

Though it is not possible to host in-person WTR 101 sessions, consider hosting a session online. If you are intrigued by this idea, but it seems daunting, contact the NWTRCC office. We could discuss options and possibly co-host an online session with your local group.

Grounded…or Flying by the Seat of our Pants?

By Chrissy Kirchhoefer

An increased number of military planes have been flying over the US and targeting cities, often in clusters, to show appreciation to “front line workers.” The Pentagon cooked up the scheme of “Operation America Strong” to mobilize the military in what some refer to as the “war on the coronavirus.” The operation was to honor the sacrifices of health care workers who have faced new challenges in their profession in caring for those with COVID-19. The risks to their lives have increased as the availability of PPE (Personal Protection Equipment) has decreased.

The same weapons platforms that have bombed civilians across the world were sent to fly over hospitals in the US that cannot even provide health care workers with masks that should cost $1.27. The most expensive bomber was the nuclear-weapons capable B2 Stealth Bomber flying out of Whiteman Air Force base in Missouri at $122,311 per hour (in 2017 estimates). At top speed, a F-35A jet ignites more fuel in a single hour than the average car owner consumes in two years. It seems that no area of the U.S. has been spared these displays of affection with many of the targeted cities roped together just as would be the case with a nuclear bomb or a flying mission to destroy multiple targets.

While the military had stated in their press release that they wanted “to thank first responders, essential personnel, and military service members as we collectively battle the spread of COVID-19,” it seems more as a way of justifying that almost half of U.S. taxpayer monies go to warfare. The US military didn’t seem to get the memo or want to acknowledge that the current U.N. Ceasefire defines war as a non-essential activity. In March, U.N. Secretary General Antonio called for a worldwide end of armed conflict during the Covid-19 pandemic as well as an end to economic warfare. More than 70 nations signed onto the statement. The United States blocked the vote before the U.N.

Meanwhile the New York Times recently published a piece on homelessness, “America’s Cities Could House Everyone if They Chose To.” The article stated, “The nation’s homeless population could be housed for less than the price of one aircraft carrier.” That seems to bear repeating—for LESS than one military expenditure, all of the people living on the streets of the cities that the bomber jets are flying over could have homes. Imagine that $13 billion used to meet basic human needs.

Navy Jets Polluting the Environment. Photo by Dylan from Pexels.

Despite concerns over the coronavirus, there has been a proposal to replicate the “Salute to America” military parade on July 4th, 2020. This year that would be before Tax Day. Increasingly, people are becoming more aware of the catastrophic funding priorities in the US and the deadly consequences.

War Tax Resistance News

(Almost) Everyone is Getting Free Government Money

As mentioned in the Counselors’ Notes, having a tax debt does not exclude one from receiving the $1,200 stimulus check. The NWTRCC office has received several phone calls and emails from folks who were surprised when it showed up. In response to receiving his stimulus check, War Tax Resister Larry Bassett commented, “So I owe the IRS approximately $300,000, but today I received a paper check for $1,200 in the mail. This should answer a lot of questions from a lot of people in the WTR movement. I will be donating this check in a variety of ways that I have not yet determined completely. I have already sent small contributions to orphanages in Uganda that I have been in touch with since the massive redirection years. Some may go to local restaurants in the downtown area where I live that could be severely harmed in the current crisis. The fact that the Congress has appropriated trillions of dollars in two months is all the proof we need that the government could do whatever we could convince it to do to provide healthcare for all and decent living conditions for everyone.”

Another war tax resister recently signed over his entire check to NWTRCC and sent it to us in the mail. NWTRCC does not know how the current pandemic will affect donations. Please consider making a donation to NWTRCC if you benefit from superfluous funds during the pandemic. You can donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

Mennonite Church Promotes Church Peace Tax Fund

Spurred on by the wonderful efforts of WTRs H. A. Penner and John Stoner, the Mennonite Church USA has reworked its defunct War Tax Alternative Fund that began in 1983 and created a Church Peace Tax Fund. Glen Guyton, executive director of MC USA, who left the military under a conscientious objector discharge, states, “This Church Peace Tax Fund provides individuals with a tangible way to support the church’s ongoing peace mission, while symbolically protesting government spending on war and militarism.”

This new fund serves the purpose of furthering the Mennonite Church USA’s peace programming. Although it is not an alternative fund, it will “provide grant opportunities to support war-tax resisters through already established alternative funds.”

Additionally, the fund will provide funding for educational programs that address militarism and promote living out ways of peace, and allocate a $100 annual grant to Mennonite youth (ages 16-25) who are actively engaged in resisting war and promoting peace in their congregation and community.

As H. A. Penner notes, “The church peace tax fund provides the spiritual resources, human solidarity, and material support to enable U.S. Mennonites and others to follow the prompting of their Spirit-led consciences and publicly object to paying taxes used for killing and militarism.”

More information about this fund can be found at: http://mennoworld.org/2020/05/18/news/mc%E2%80%88usa-promotes-church-peace-tax-fund/

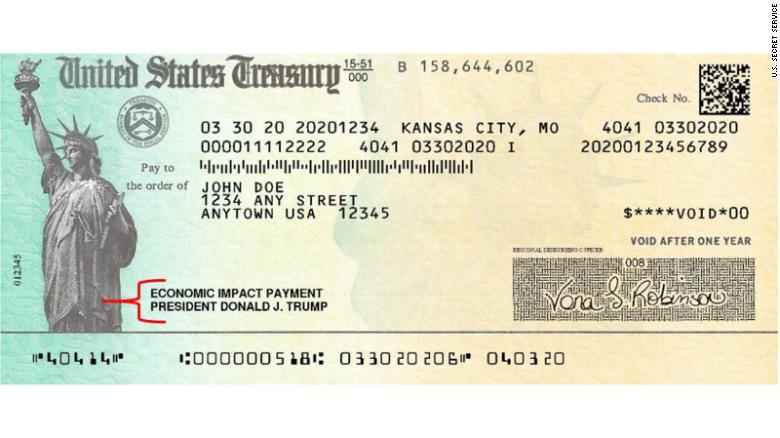

War Tax Resistance Season in Spain

Logo for 2020 WTR</abbr Season in Catelonia.

A Spanish NGO along with other solidarity movements in Lleida, Spain have launched their 10th annual war tax resistance campaign for the Spanish tax season. Their theme is “You Can’t Kill a Virus with Armaments.” From April 1 to June 30, they are offering support and advice for all those wanting to object to war taxes. For more information, go to http://www.coordinadora-ongd-lleida.cat/ca/noticies/per-10-any-consecutiu-la-coordinadora-dongd-i-ams-de-lleida-promou-lobjecci-

fiscal-a-la-despesa-militar-en-la-declaraci-de-la-renda/ (Be warned that the page is in Catalan. Thanks to David Gross for bringing this to NWTRCC’s attention.)

Agape Community Book Tour

Last year, Suzanne and Brayton Shanley published a book on the history of the intentional community that they founded: Loving Life on the Margins: The Story of the Agape Community. The book includes stories about their own war tax resistance. During this past winter and spring, they embarked on an East Coast book tour and always made sure to highlight their war tax resistance. The tour made stops at several venues in Massachusetts, Maryland, Washington, D.C., and North Carolina.

The Shanleys (center) with Pax Christi Staff in Washington, D.C.

New Booklet Highlights War Tax Resistance

WTR Howard Waitzkin has recently published a new booklet that includes a section on war tax resistance—“Rinky-Dink Revolution: Moving Beyond Capitalism by Withholding Consent, Creative Constructions, and Creative Destructions.”

Howard was featured in the profile section of the July 2019 issue of “More than a Paycheck.” His new booklet prominently features war tax resistance as a revolutionary strategy for someone to withdraw their consent from “brutal oppression” and offers NWTRCC as a vital resource. In the booklet, Howard states: “The greatest joy of war tax resistance isn’t about not paying taxes; it’s about redirecting the resisted taxes for creatively constructive purposes.” The work is available through the publisher at Daraja Press or on Amazon.

Charity Online Fundraiser for NWTRCC

Carlos Steward and Jim Stockwell of North Carolina are organizing a charity auction for NWTRCC in collaboration with the NWTRCC Fundraising Committee. A link to the Auction is on the NWTRCC Homepage ( www.nwtrcc.org</em<). Please go and check out some art and let your friends know! All proceeds benefit NWTRCC. The auction will continue through mid-June 2020.

Mark your Calendars!!!

Our next National War Tax Resistance Gathering

& Coordinating Committee Meeting

November 6-8, 2020

Although we have the dates for our next meeting, the setting is still being determined. The WTR folks in Colorado Springs, Colorado have graciously offered to host the November NWTRCC conference. Meeting in person is definitely preferred, but we also have to ensure that our next meeting does not recklessly put anyone in harm’s way. If we cannot meet in person, we will hold another online-only meeting. If this would occur, we would make sure to incorporate the most popular suggestion from the feedback gathered from of our May online meeting—a social hour (probably on Saturday evening). And even if we meet in Colorado Springs, every NWTRCC conference for over the past six years has included online options for folks that could not attend in person. So there is always the online option for folks that cannot travel.

A decision about the exact location of the November conference (Colorado Springs v. online) will be made by the NWTRCC AdComm around July 1. Watch the NWTRCC website or call the office for updates after July 1.

PROFILE

Bewildering Federal Budget

By Shulamith Eagle

I recently read a guest editorial in my local newspaper that noted the startling fact that there is a “$437 million budget for the military’s 130 marching bands.” Setting aside the question of why each band needs to cost over $3 million, this fact got me interested in taking a look at federal budget priorities compared to mine.

As a Quaker (we are known for our peace witness and works), I have long been aware that the U.S. budget is heavily tilted towards war. The War Resisters League pie chart shows that military and veterans’ services totaled 48% of the 2018 U.S. budget. The National Priorities Project shows the 2020 budget as allocating 55% for the military. For this budget, I will include expenditures for Social Security and Medicare, even though these are not part of the normal taxes dues on April 15. When these are included in the federal budget, the military portion of the budget drops to about 23%.

According to the Congressional Budget Office, the federal expenditures this year will total $4.6 trillion (including Social Security and Medicare).

If I compare this country’s budget to mine (major items only), it would look something like the following. To make it easy, let’s imagine I have an annual income of $50,000. (Utilities are omitted—trying to match up utilities with the national budget was too complicated to be accurate.)

| Federal Government | Home Budget | |

|---|---|---|

| Food | 5% | |

| Housing | 2% | $1,000 |

| Medical | 33% | $16,500 |

| Transportation | 0.5% | $250 |

| Interest on Debt | 3.5% | $1,750 |

| Allowance for Children/ Child Care/ Adults Unable to Work |

33% | $16,500 |

| Military | 23% | $11,500 |

Regarding the 23% for the military portion of the federal budget, that means I’ll spend $11,500 for:

- Training my teenagers and young adult children to murder people on the other side of town.

- Hiring people to find, force, or punish my children who try to refuse this training.

- Making or buying the murder weapons.

- Maintaining physical and mental hospitals for my children for the rest of their lives (after they return from the killing).

- Financial support for the spouses and kids of my children who get murdered themselves.

- Marching Bands to lift the spirits of the fighting children.

- Assassinations of troublemakers and leaders I don’t like. (Officially, I don’t do that.)

Image by Picdream from Pixabay.

Does this budget make sense to you? Does it match your values? Does it match the reality of your expenses (2% for housing, 5% for food, and 23% or more for security and fighting)? Shouldn’t our government share our priorities for using our money, since it is our money that “they” are spending?

Does this budget encourage the values you are trying to instill in your children? I don’t know about you, but I can’t afford to spend even one-quarter of my income on killing other people or dealing with the consequences of that. I don’t feel it makes me more secure. It makes me less secure, because when we threaten or harm others, they have the tendency to threaten and harm us in return.

“Do unto others” and “Thou shalt not kill” are universal concepts. Do we spend our money—earned with our energy, our time, our lives—in a way that reflects what we say we believe?

Look at what you spend most of your money on. What would our society be like if the numbers were switched around so the government prioritized housing, food, cradle-to-grave healthcare, and education?

How much of that $1.058 trillion military budget is actually making us safer? What might we do with even $1 billion dollars for peacemaking? Can we make a Department of Peace with equal funding as our combined departments for war?

Shall we dream big?

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Subscriptions are $15 per year.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org